Академический Документы

Профессиональный Документы

Культура Документы

2010 08 21 - 142723 - P11 2a

Загружено:

Jessica DragonIvyИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

2010 08 21 - 142723 - P11 2a

Загружено:

Jessica DragonIvyАвторское право:

Доступные форматы

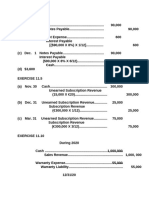

P11-2A. The following are selected transactions of Winsky Company.

Winsky prepares

financial statements quarterly. Jan. 2 Purchased merchandise on account from Yokum

Company, $30,000, terms 2/10, n/30. Feb. 1 Issued a 9%, 2-month, $30,000 note to

Yokum in payment of account. Mar. 31 Accrued interest for 2 months on Yokum note.

Apr. 1 Paid face value and interest on Yokum note. July 1 Purchased equipment from

Korsak Equipment paying $11,000 in cash and signing a 10%, 3-month, $40,000 note.

Sept. 30 Accrued interest for 3 months on Korsak note. Oct. 1 Paid face value and interest

on Korsak note. Dec. 1 Borrowed $15,000 from the Otago Bank by issuing a 3-month,

8% interest-bearing note with a face value of $15,000. Dec. 31 Recognized interest

expense for 1 month on Otago Bank note. Hint: Journalize and post note transactions;

show balance sheet presentation. (SO 2) Instructions (a) Prepare journal entries for the

above transactions and events. (b) Post to the accounts Notes Payable, Interest Payable,

and Interest Expense. (c) Show the balance sheet presentation of notes and interest

payable at December 31. (d) What is total interest expense for the year? (d) $1,550

(a) Jan. 2 Merchandise Inventory or

Purchases................................................................... 30,000

Accounts Payable................................................

30,000

Feb. 1 Accounts Payable.......................................................... 30,000

Notes Payable......................................................

30,000

Mar. 31 Interest Expense........................................................... 450

($30,000 X 9% X 2/12)

Interest Payable..................................................

450

Apr. 1 Notes Payable................................................................ 30,000

Interest Payable............................................................ 450

Cash.....................................................................

30,450

July 1 Equipment..................................................................... 51,000

Cash.....................................................................

11,000

Notes Payable......................................................

40,000

Sept. 30 Interest Expense........................................................... 1,000

($40,000 X 10% X 3/12)

Interest Payable..................................................

1,000

Oct. 1 Notes Payable................................................................ 40,000

Interest Payable............................................................ 1,000

Cash.....................................................................

41,000

Dec. 1 Cash ...................................................................15,000

Notes Payable......................................................

15,000

Dec. 31 Interest Expense........................................................... 100

($15,000 X 8% X 1/12)

Interest Payable..................................................

100

(b)

Notes Payable

4/1 30,000 2/1 30,000

10/1 40,000 7/1 40,000

12/1 15,000

12/31 Bal. 15,000

Interest Payable

4/1 450 3/31 450

10/1 1,000 9/30 1,000

12/31 100

12/31 Bal. 100

Interest Expense

3/31 450

9/30 1,000

12/31 100

12/31 Bal. 1,550

(c) Current liabilities

Notes payable......................................................................... $15,000

Interest payable..................................................................... 100

$15,100

(d) Total interest is $1,550.

Вам также может понравиться

- Allstate Declaration - 20221110 - 0001Документ4 страницыAllstate Declaration - 20221110 - 0001Shilyn KaufmanОценок пока нет

- Calculate Current Liability for Paid Vacation DaysДокумент6 страницCalculate Current Liability for Paid Vacation DaysfidelaluthfianaОценок пока нет

- Bab 14Документ4 страницыBab 14tutykaykay67% (3)

- Problem Ch.14Документ3 страницыProblem Ch.14kenny 322016048100% (1)

- FAC1601 Exam Pack & Solutions by Study UnitДокумент101 страницаFAC1601 Exam Pack & Solutions by Study UnitandreqwОценок пока нет

- E7 25Документ2 страницыE7 25Muhammad Syafiq RamadhanОценок пока нет

- Solutions To Problems Chapter 3Документ23 страницыSolutions To Problems Chapter 3Kayla Julian0% (1)

- Financial Accounting 11th Edition Harrison Solutions ManualДокумент11 страницFinancial Accounting 11th Edition Harrison Solutions Manualchitinprooticgp3x100% (15)

- Problem 4 6aДокумент13 страницProblem 4 6aMoamar Dalawis Ismula100% (1)

- 12th Book Keeping Board Papers PDFДокумент50 страниц12th Book Keeping Board Papers PDFRam IyerОценок пока нет

- Key Chapter 11Документ3 страницыKey Chapter 11JinAe NaОценок пока нет

- Optimize sales tax adjusting entriesДокумент6 страницOptimize sales tax adjusting entriesHuỳnh Thị Thu BaОценок пока нет

- Chapter 13 solutions 11e E13-2 and E13-3 journal entriesДокумент19 страницChapter 13 solutions 11e E13-2 and E13-3 journal entriessabrina danteОценок пока нет

- ACCT 100 - Principles of Financial Accounting Fall 2020, Section 6 Week 10 Chapter 10 - LiabilitiesДокумент2 страницыACCT 100 - Principles of Financial Accounting Fall 2020, Section 6 Week 10 Chapter 10 - LiabilitiesAli Zain ParharОценок пока нет

- Ch11 ExercisesДокумент17 страницCh11 Exercisesjamiahamdard001Оценок пока нет

- ACCT 551 Week2 PracticeQuestions SolutionsДокумент5 страницACCT 551 Week2 PracticeQuestions SolutionsMD SomratОценок пока нет

- Microsoft Word - WEY - SM.cp13.vpdfДокумент11 страницMicrosoft Word - WEY - SM.cp13.vpdfDa HorseОценок пока нет

- Fac1601 2015 Question Bank All Su'sДокумент125 страницFac1601 2015 Question Bank All Su'sLolita Berenice SoldaatОценок пока нет

- Fac1601 - Study - School - Question - Bank - 2014 Q &AДокумент99 страницFac1601 - Study - School - Question - Bank - 2014 Q &ALolita Berenice SoldaatОценок пока нет

- Solutions to Bond ExercisesДокумент31 страницаSolutions to Bond ExercisesMaha M. Al-MasriОценок пока нет

- Extra Applications - Lecture Week 2Документ5 страницExtra Applications - Lecture Week 2Muhammad HusseinОценок пока нет

- IF2 - Practice ProblemsДокумент320 страницIF2 - Practice ProblemssaikrishnavnОценок пока нет

- 193 15 13357 ACT AssignmentДокумент14 страниц193 15 13357 ACT AssignmentSaif UR RahmanОценок пока нет

- Liabilities Part 2 TutorialДокумент3 страницыLiabilities Part 2 TutorialSalma HazemОценок пока нет

- Calculate installment payments for car salesДокумент4 страницыCalculate installment payments for car salesAliezaОценок пока нет

- Nisha Nur Aini - 43219110183 - TM 01 - AKM IIДокумент11 страницNisha Nur Aini - 43219110183 - TM 01 - AKM IInisha nuraini100% (1)

- CH 10 - End of Chapter Exercises SolutionsДокумент57 страницCH 10 - End of Chapter Exercises SolutionssaraОценок пока нет

- 2009-12-06 064119 StarkeyДокумент5 страниц2009-12-06 064119 StarkeyAnne KatОценок пока нет

- 1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Документ11 страниц1621 Acct6174 Tabe TK1-W3-S4-R1 Team1Raisul Ma'arif100% (1)

- Exercise E9-3Документ7 страницExercise E9-3Kara Mhisyella AssadОценок пока нет

- Additional Practical Problems-19Документ1 страницаAdditional Practical Problems-19Danish DanishОценок пока нет

- CH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As FollowsДокумент9 страницCH 14: Long Term Liabilities: The Timelines of The Bonds Will Be As Followschesca marie penarandaОценок пока нет

- Financial Planning and Analysis: The Master Budget: Solutions To ExercisesДокумент12 страницFinancial Planning and Analysis: The Master Budget: Solutions To ExercisesBlackBunny103Оценок пока нет

- Accounting Warren 23rd Edition Solutions ManualДокумент54 страницыAccounting Warren 23rd Edition Solutions Manualbrennadrusillas7zОценок пока нет

- Practice Questions for BAAC 550 Property, Plant and EquipmentДокумент19 страницPractice Questions for BAAC 550 Property, Plant and EquipmentJasmine HuangОценок пока нет

- Final Practice ProblemsДокумент9 страницFinal Practice ProblemsQian ZhangОценок пока нет

- Ex.1 Transactions For The Mariam Company For The Month of October Are PresentedДокумент4 страницыEx.1 Transactions For The Mariam Company For The Month of October Are PresentedAA BB MMОценок пока нет

- Ex.1 Transactions For The Mariam Company For The Month of October Are PresentedДокумент4 страницыEx.1 Transactions For The Mariam Company For The Month of October Are PresentedAA BB MMОценок пока нет

- ACCT5001 S1 2010 Week 8 Self-Study SolutionsДокумент5 страницACCT5001 S1 2010 Week 8 Self-Study Solutionszhangsaen110Оценок пока нет

- Tugas Kas PiutangДокумент14 страницTugas Kas PiutangDeby Nailatun FitriyahОценок пока нет

- Harrison Fa Ifrs 11e Ch09 SMДокумент107 страницHarrison Fa Ifrs 11e Ch09 SMAshleyОценок пока нет

- Example 1: SolutionДокумент7 страницExample 1: SolutionalemayehuОценок пока нет

- Module 2 Homework Answer KeyДокумент5 страницModule 2 Homework Answer KeyMrinmay kunduОценок пока нет

- Tugas 4 - Mukhlasin S 142170091Документ10 страницTugas 4 - Mukhlasin S 142170091Mukhlasin SyaifullahОценок пока нет

- Assignment 1 - SolutionДокумент10 страницAssignment 1 - SolutionKhem Raj GyawaliОценок пока нет

- Jawaban AKM2Документ10 страницJawaban AKM2Jeaxell RieskyОценок пока нет

- ACCT1100 PA1 AssignmentSolutionManual 1Документ6 страницACCT1100 PA1 AssignmentSolutionManual 1Chi IuvianamoОценок пока нет

- Ch10 ExercisesДокумент15 страницCh10 Exercisesjamiahamdard001Оценок пока нет

- Week 11 CH 11 SolutionsДокумент5 страницWeek 11 CH 11 SolutionslizaОценок пока нет

- MUCHON FLYING EXPERIENCE LTD financial statementsДокумент3 страницыMUCHON FLYING EXPERIENCE LTD financial statements張芷綾Оценок пока нет

- Tugas Chapter 15Документ12 страницTugas Chapter 15Ach Junaidi Irham FauziОценок пока нет

- ITFA Solution June 2018 ExamДокумент7 страницITFA Solution June 2018 ExamF A Saffat RahmanОценок пока нет

- Trimo Tugas 2 IntermediteДокумент6 страницTrimo Tugas 2 Intermeditetrimo belitungОценок пока нет

- Assignment CHPT 10 (Liability)Документ2 страницыAssignment CHPT 10 (Liability)Sultan LimitОценок пока нет

- Sir Answer P 11-1A S.D 11-4AДокумент5 страницSir Answer P 11-1A S.D 11-4AInez ChristabelОценок пока нет

- Igcse Yr 10 Paper 2 Nov 2020 AssessmentДокумент9 страницIgcse Yr 10 Paper 2 Nov 2020 AssessmentVoon Chen WeiОценок пока нет

- Solution Tutorial 2Документ3 страницыSolution Tutorial 2KHANH Du NgocОценок пока нет

- Case 8 23Документ5 страницCase 8 23Thinh VuОценок пока нет

- NKLT - PR1-3B-GR8Документ1 страницаNKLT - PR1-3B-GR8kimphuc3819Оценок пока нет

- Selling Canadian Books in Australia: A Guide for Canadian Publishers, 2nd editionОт EverandSelling Canadian Books in Australia: A Guide for Canadian Publishers, 2nd editionОценок пока нет

- Cagayan Valley 3D2N TourДокумент2 страницыCagayan Valley 3D2N TourAym KyutОценок пока нет

- JN0-363 (224 Questions)Документ78 страницJN0-363 (224 Questions)Sadia Baig100% (1)

- Module 3 Nominal and Effective IRДокумент19 страницModule 3 Nominal and Effective IRRhonita Dea Andarini100% (1)

- Business ON - App-New Guideline-EnglishДокумент3 страницыBusiness ON - App-New Guideline-EnglishMuhammad UsmanОценок пока нет

- HDTS Highway Safety 1 and 2 With SolutionsДокумент23 страницыHDTS Highway Safety 1 and 2 With SolutionsCarl Harvey Saludes100% (1)

- Nike Sales & Distribution at RJ Corp: A Project StudyДокумент12 страницNike Sales & Distribution at RJ Corp: A Project StudyPriyanshu RanjanОценок пока нет

- Reservations & Bookings: I. Reservations A. Kinds of ReservationsДокумент3 страницыReservations & Bookings: I. Reservations A. Kinds of ReservationsHychell Mae Ramos DerepasОценок пока нет

- Airtel Bill AprilДокумент3 страницыAirtel Bill AprilHiten ChudasamaОценок пока нет

- E Bill ReceiptДокумент1 страницаE Bill Receiptshivg2213Оценок пока нет

- Changing Face of Indian BankingДокумент22 страницыChanging Face of Indian Bankinganon_356753627Оценок пока нет

- Service Provider Network Design and Architecture Perspective Book - 5ddf8620031b8Документ307 страницService Provider Network Design and Architecture Perspective Book - 5ddf8620031b8Omar ZeyadОценок пока нет

- Nagpur Pagal Khana Number - Google SearchДокумент1 страницаNagpur Pagal Khana Number - Google SearchL & C Tattoo StudioОценок пока нет

- HSBC Third Party Transfer Activate FormДокумент1 страницаHSBC Third Party Transfer Activate FormPankaj Batra100% (2)

- 0b8a014c0000001306696 ESTATEMENT 012023 0b8a014c00000013 PDFДокумент7 страниц0b8a014c0000001306696 ESTATEMENT 012023 0b8a014c00000013 PDFV TravelОценок пока нет

- Government of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryДокумент2 страницыGovernment of West Bengal GRIPS 2.0 Acknowledgement Receipt Payment SummaryPratik JainОценок пока нет

- New American ExpressДокумент27 страницNew American Expressamitliarliar100% (2)

- Bank Jan23Документ9 страницBank Jan23Diviyan MacОценок пока нет

- SC-2169-PE IP Phone User Manual Dec 26 2018Документ50 страницSC-2169-PE IP Phone User Manual Dec 26 2018Eko IndriatmokoОценок пока нет

- Rapides Parish Sheriff's Office Audit ReportДокумент55 страницRapides Parish Sheriff's Office Audit ReportThe Town TalkОценок пока нет

- Centre For Distance Education: AssignmentДокумент5 страницCentre For Distance Education: AssignmentCompany BrandОценок пока нет

- Karachi Institute of Power Engineering Fee DepositДокумент1 страницаKarachi Institute of Power Engineering Fee DepositRK DanishОценок пока нет

- DSMM 1Документ22 страницыDSMM 1kisam78442Оценок пока нет

- American Express Credit Cart ActivitysДокумент1 страницаAmerican Express Credit Cart ActivitysAbhijit RathiОценок пока нет

- PEMI - Redemption Order Form (ROF)Документ1 страницаPEMI - Redemption Order Form (ROF)ippon_osotoОценок пока нет

- Engleski Jezik 1-PrezentacijaДокумент20 страницEngleski Jezik 1-PrezentacijaJosip KapularОценок пока нет

- Letters of Credit ExplainedДокумент7 страницLetters of Credit ExplainedGelo MVОценок пока нет

- Borang TNB - Checklist Tutup AkaunДокумент1 страницаBorang TNB - Checklist Tutup Akaunazwarfahmi0725% (4)

- Wells Fargo SWOT Analysis Highlights Strengths and Weaknesses in Customer ServiceДокумент4 страницыWells Fargo SWOT Analysis Highlights Strengths and Weaknesses in Customer ServiceKatlene HortilanoОценок пока нет