Академический Документы

Профессиональный Документы

Культура Документы

BBS 1st Year Question

Загружено:

satya100%(1)100% нашли этот документ полезным (1 голос)

3K просмотров2 страницыBachelor 1st year sample model question

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документBachelor 1st year sample model question

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

100%(1)100% нашли этот документ полезным (1 голос)

3K просмотров2 страницыBBS 1st Year Question

Загружено:

satyaBachelor 1st year sample model question

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

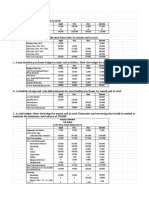

JANAK COLLEGE Additional information:-

Internal Examination – 2075 - Closing inventory is Rs. 60,000

Level: BBS 1st year Time: 1.5 Hour Full Marks: 50 - Depreciation 10% on Machinery and 15% on Furniture

Sub: Accounting for Financial analysis and planning Pass Marks: 18 - O/S salary is Rs 12,000 and Prepaid wages is 15,000

Required :- Work sheet statement

Brief answer questions: (5 x 2 = 10)

8. Lumbini Pvt. Ltd. provides income statement for the year ending 2006 is as follows:

Attempt ALL Questions:

1. State the importance of financial statements.

Particulars Amount Amount

2. What are the characteristics of Public limited company?

3. If Variable cost is 50% of Sales ,Fixed cost is Rs.1,50,000 and DOL is 4 times, Sales 4,00,000

Calculate Sales revenue of the company. Less: Cost of goods sold:

4. Calculate COSA from given information: Opening stock 30,000

Stock as on 1-1 Rs.20,000 Add: Purchase 2,00,000

Stock as on 31-12 Rs.30,000 Less: Closing stock (50,000) 1,80,000

Index at beginning of the year 50 and at the end of the year 100.

5. Calculate liquid ratio from given information, Gross profit 2,20,000

Total current assets Rs.2,00,000 (including inventory Rs.50,000) Less: Operating expenses 80,000

Current liabilities for the period Rs.1,00,000 Depreciation 20,000

Interest 10,000 1,10,000

Short answer questions: (9 x 3 = 27)

6. XYZ Ltd. Company with a paid up capital of 3,000 ‘A’ Equity shares of Rs.100 each Net profit before tax 1,10,000

but Rs.80 called and paid up went into voluntary liquidation. The company also had 1,000 , Less: Tax 20,000

10% Preference shares of Rs.100 each and 2,000 , 8% Debentures of Rs.100 each. Less: Dividend paid 30,000

The total creditors of the company including Rs.25,000 for Preferential creditors,

Rs.1,20,000 Secured creditors was Rs.2,50,000. The assets of the company realized for Retained earning 60,000

Rs.520,000. The liquidator was entitled to a commission of 2% on assets realized and 3% Add: Opening Retained earning 15,000

on amount distributed to unsecured creditors. There was Preference dividend in arrear for

one years and Liquidation expenses Rs.15,000. Closing Retained earning 75,000

Required: Liquidator’s final statement of account Additional information:

-COSA Rs.3,000

7. Trial balance of a company is given below : -Depreciation adjustment Rs.10,000

-Monetary working capital adjustment Rs.7,000

Particulars Dr. Particulars Cr. -Gearing ratio 20%

-Increased value in fixed assets Rs.4,000

Bank 70,000 Sales 6,50,000

-Increased value in inventory Rs.2,000

Cash 25,000 Share capital 5,00,000

Machinery 4,00,000 8% debenture 1,50,000 Required: (a) Current cost accounting reserve (b)CC income statement

Furniture 1,87,000 Creditors 1,10,000

Purchase 4,25,000

Debtors 1,50,000

Salaries 5,00,00

Wages 60,000

Discount 15,000

Interest 12,000

Electricity charge 16,000

Comprehensive Questions: (13 x 1 = 13)

9. The following balance sheet is taken from the books of H. Company and S. Company:

Balance sheet as on 31 Chaitra 2072

Capital & Liabilities H. com. S.com. Assets H.com. S.com.

Equity share capital 1,00,000 80,000 Fixed assets 1,00,000 90,000

General reserve 50,000 40,000 Debtors 40,000 20,000

P&L account 20,000 1,70,000 Investment 1,00,000 1,30,000

Creditors 1,00,000 50,000 Inventory 50,000 80,000

Bank loan 30,000 - Cash balance 10,000 20,000

3,00,000 3,40,000 3,00,000 3,40,000

- H. company invested Rs.1,00,000 for 75% shares in S. company on 1st Kartik 2072.

-On beginning of the year S. company’s General reserve had Rs.40,000 and P&L account

had credit balance of Rs.50,000.

-Creditors of S. company includes Rs.10,000 for goods supplied by H.company.

-50% of goods supplied by H.Com. are still in stock of S.Com. on which company made

profit 20% on sales.

Required: Capital profit, Revenue profit, Cost of control, Minority interest, B/S

Вам также может понравиться

- Tax Guide for Manufacturing CompanyДокумент10 страницTax Guide for Manufacturing CompanynikhilramaneОценок пока нет

- NAS 20 Government GrantsДокумент15 страницNAS 20 Government GrantsSushant MaskeyОценок пока нет

- Jaiib Accounting Module C and Module DДокумент340 страницJaiib Accounting Module C and Module DAkanksha MОценок пока нет

- Suggested Answer Paper CAP III Dec 2019Документ142 страницыSuggested Answer Paper CAP III Dec 2019Roshan PanditОценок пока нет

- 9 Partnership Question 21Документ11 страниц9 Partnership Question 21kautiОценок пока нет

- Chapter 7 Asset Investment Decisions and Capital RationingДокумент31 страницаChapter 7 Asset Investment Decisions and Capital RationingdperepolkinОценок пока нет

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationДокумент21 страницаACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadОценок пока нет

- Chapter-Six Accounting For General, Special Revenue and Capital Project FundsДокумент31 страницаChapter-Six Accounting For General, Special Revenue and Capital Project FundsMany Girma100% (1)

- Consolidated Financial StatementsДокумент41 страницаConsolidated Financial StatementsBethelhemОценок пока нет

- Ratio AnalysisДокумент42 страницыRatio AnalysiskanavОценок пока нет

- Consolidated Balance Sheet Group CompaniesДокумент1 страницаConsolidated Balance Sheet Group CompaniesBabu babuОценок пока нет

- Chapter# 5 Accounting Transaction CycleДокумент16 страницChapter# 5 Accounting Transaction CycleMuhammad IrshadОценок пока нет

- Week 13 SolutionsДокумент7 страницWeek 13 SolutionsStanley RobertОценок пока нет

- Chapter 10 - Fixed Assets and Intangible AssetsДокумент94 страницыChapter 10 - Fixed Assets and Intangible AssetsAsti RahmadaniaОценок пока нет

- E-14 AfrДокумент5 страницE-14 AfrInternational Iqbal ForumОценок пока нет

- Chapter - 4 Intermediate Term FinancingДокумент9 страницChapter - 4 Intermediate Term FinancingmuzgunniОценок пока нет

- Issue of SharesДокумент11 страницIssue of SharesRamesh KumarОценок пока нет

- Exercises Budgeting ACCT2105 3s2010Документ7 страницExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Inventory Management at Makerere University Business School and Its Impact On The Revenue Performance of Small and Medium EnterprisesДокумент16 страницInventory Management at Makerere University Business School and Its Impact On The Revenue Performance of Small and Medium EnterprisesKIU PUBLICATION AND EXTENSIONОценок пока нет

- Chapter 11 Partnership DissolutionДокумент19 страницChapter 11 Partnership DissolutionAira Nhaire Cortez MecateОценок пока нет

- Chapter # 8 Exercise & Problems - AnswersДокумент8 страницChapter # 8 Exercise & Problems - AnswersZia UddinОценок пока нет

- Inventory ManagementДокумент48 страницInventory ManagementSerhat ÇulhalıkОценок пока нет

- Brief Exercises For EPSДокумент4 страницыBrief Exercises For EPSanon_225460591Оценок пока нет

- IFM - Intro to Financial Accounting Tutorial QuestionsДокумент5 страницIFM - Intro to Financial Accounting Tutorial QuestionsPatric CletusОценок пока нет

- Summary of Ias 1Документ8 страницSummary of Ias 1g0025Оценок пока нет

- Key Accob3 Exercises On CVP and BeДокумент16 страницKey Accob3 Exercises On CVP and BeJanine Sabrina LimquecoОценок пока нет

- ACC121 FinalExamДокумент13 страницACC121 FinalExamTia1977Оценок пока нет

- Final Requirment (Case Study)Документ2 страницыFinal Requirment (Case Study)Gerry SajolОценок пока нет

- Lecture 4 - Cost Quality (Extra Notes) - With AnswerДокумент7 страницLecture 4 - Cost Quality (Extra Notes) - With AnswerHafizah Mat NawiОценок пока нет

- Advanced Accounts 1 PDFДокумент304 страницыAdvanced Accounts 1 PDFJohn Louie NunezОценок пока нет

- AIOU Financial Accounting ChecklistДокумент9 страницAIOU Financial Accounting ChecklistAhmad RazaОценок пока нет

- FRSA Practice Questions For AssignmentДокумент8 страницFRSA Practice Questions For AssignmentSrikar WuppalaОценок пока нет

- Case 8-31: April May June QuarterДокумент2 страницыCase 8-31: April May June QuarterileviejoieОценок пока нет

- 6 - Dividend - DividendPolicy - FM - Mahesh MeenaДокумент9 страниц6 - Dividend - DividendPolicy - FM - Mahesh MeenaIshvinder SinghОценок пока нет

- Fixed & Flexible BudgetsДокумент15 страницFixed & Flexible BudgetsAdilNzОценок пока нет

- Maximize Microcomputer Profits with LPДокумент12 страницMaximize Microcomputer Profits with LPbojaОценок пока нет

- Questionnaire and InterviewДокумент3 страницыQuestionnaire and Interviewአረጋዊ ሐይለማርያምОценок пока нет

- Practice With APC APS MPC MPS KEY PDFДокумент2 страницыPractice With APC APS MPC MPS KEY PDFFrancis SamaniegoОценок пока нет

- LPP - Problem Number 2Документ9 страницLPP - Problem Number 2CT SunilkumarОценок пока нет

- Multiple Choice Questions Conceptual FameworkДокумент4 страницыMultiple Choice Questions Conceptual FameworkUy Uy Choice100% (1)

- Chapter 10 Plant Assets, Natural Resources, and Intangible Assets (13 E)Документ18 страницChapter 10 Plant Assets, Natural Resources, and Intangible Assets (13 E)Raa100% (1)

- Day 1Документ11 страницDay 1Abdullah EjazОценок пока нет

- Accounting Lecture 10 Annotated 1114Документ10 страницAccounting Lecture 10 Annotated 1114KrisztiОценок пока нет

- CAF 1 IA Autumn 2020Документ5 страницCAF 1 IA Autumn 2020Qasim Hafeez KhokharОценок пока нет

- Adjusting journal entries for Campus TheaterДокумент17 страницAdjusting journal entries for Campus TheaterTayyabAdreesОценок пока нет

- Largey and Smalley consolidated accountsДокумент5 страницLargey and Smalley consolidated accountsKaren Yvonne R. BilonОценок пока нет

- Measuring Financial Position (Balance SheetДокумент2 страницыMeasuring Financial Position (Balance SheetjakelakerОценок пока нет

- Question Bank Paper: Cost Accounting McqsДокумент8 страницQuestion Bank Paper: Cost Accounting McqsNikhilОценок пока нет

- ch04.ppt - Income Statement and Related InformationДокумент68 страницch04.ppt - Income Statement and Related InformationAmir ContrerasОценок пока нет

- Working CapitalДокумент15 страницWorking CapitalAdeem AshrafiОценок пока нет

- 123 - AS Question Bank by Rahul MalkanДокумент182 страницы123 - AS Question Bank by Rahul MalkanPooja GuptaОценок пока нет

- Quiz 5 - QuesДокумент14 страницQuiz 5 - QuesPhán Tiêu TiềnОценок пока нет

- Scope of Public Finance and its Key ConceptsДокумент12 страницScope of Public Finance and its Key ConceptsshivaniОценок пока нет

- Value Chain Management Capability A Complete Guide - 2020 EditionОт EverandValue Chain Management Capability A Complete Guide - 2020 EditionОценок пока нет

- RATIO ANALYSIS Q 1 To 4Документ5 страницRATIO ANALYSIS Q 1 To 4gunjan0% (1)

- Account 1srsДокумент5 страницAccount 1srsNayan KcОценок пока нет

- Unit - II Module IIIДокумент7 страницUnit - II Module IIIpltОценок пока нет

- Tutorial On Ratio AnalysisДокумент4 страницыTutorial On Ratio AnalysisRajyaLakshmiОценок пока нет

- COMPARATIVE INCOME STATEMENTДокумент12 страницCOMPARATIVE INCOME STATEMENTBISHAL ROYОценок пока нет

- JanardanBaral2067BS Jalpariko SangharshaДокумент26 страницJanardanBaral2067BS Jalpariko SangharshasatyaОценок пока нет

- Alchhi TulkeДокумент16 страницAlchhi TulkesatyaОценок пока нет

- Cash Flow Statement AnalysisДокумент3 страницыCash Flow Statement AnalysissatyaОценок пока нет

- Class 12 Question Set 2Документ3 страницыClass 12 Question Set 2satyaОценок пока нет

- Enter transactions and prepare Trial BalanceДокумент1 страницаEnter transactions and prepare Trial Balancesatya100% (1)

- BBS 2nd Year English QuestionДокумент1 страницаBBS 2nd Year English QuestionsatyaОценок пока нет

- Some Examples of Journal EntriesДокумент5 страницSome Examples of Journal Entriessatya100% (4)

- Provision For Bad DebtsДокумент3 страницыProvision For Bad DebtssatyaОценок пока нет

- Accounting Process CW2Документ1 страницаAccounting Process CW2satyaОценок пока нет

- Cash Flow Statement QuestionДокумент5 страницCash Flow Statement QuestionsatyaОценок пока нет

- Income Tax CalculationДокумент3 страницыIncome Tax CalculationsatyaОценок пока нет

- Cash Flow Statement AnalysisДокумент3 страницыCash Flow Statement AnalysissatyaОценок пока нет

- Maths Worksheets Set 10Документ4 страницыMaths Worksheets Set 10satyaОценок пока нет

- Accounting For DebentureДокумент1 страницаAccounting For DebenturesatyaОценок пока нет

- Children'S Toys From Africa: Unesco PublicationДокумент30 страницChildren'S Toys From Africa: Unesco PublicationsatyaОценок пока нет

- 1st Terminal QuestionДокумент1 страница1st Terminal QuestionsatyaОценок пока нет

- TR - Basunlama2005 TraditionalBirthAttendanceДокумент18 страницTR - Basunlama2005 TraditionalBirthAttendancesatyaОценок пока нет

- Chapter 07 - Accounts and Notes Receivable. Chapter OutlineДокумент6 страницChapter 07 - Accounts and Notes Receivable. Chapter OutlinesatyaОценок пока нет

- TejPrakashShrestha2067BS HiuManchheДокумент67 страницTejPrakashShrestha2067BS HiuManchhesatyaОценок пока нет

- TejPrakashShrestha2067BS BhokaDamaruharuДокумент41 страницаTejPrakashShrestha2067BS BhokaDamaruharusatyaОценок пока нет

- SrijanaSharma2063BS ManachinteyJhholaДокумент35 страницSrijanaSharma2063BS ManachinteyJhholasatyaОценок пока нет

- TejPrakashShrestha2003 MingmarДокумент30 страницTejPrakashShrestha2003 MingmarsatyaОценок пока нет

- Asmita Goes To The Farm Asmita Goes To The Farm: By: Saurav Dev Bhatta By: Saurav Dev Bhatta 2009Документ16 страницAsmita Goes To The Farm Asmita Goes To The Farm: By: Saurav Dev Bhatta By: Saurav Dev Bhatta 2009satyaОценок пока нет

- Illustrator Promina Shrestha Author Tara Pun: Lzlift Afnaflnsfx¿Af6 G) LJZJDF KL/JT (GSF) Yfngl X'G5Документ26 страницIllustrator Promina Shrestha Author Tara Pun: Lzlift Afnaflnsfx¿Af6 G) LJZJDF KL/JT (GSF) Yfngl X'G5satyaОценок пока нет

- 'Snl-E'Snl: /FTF) Aënf LstfaДокумент20 страниц'Snl-E'Snl: /FTF) Aënf LstfasatyaОценок пока нет

- N) Vs LJ - Ml:6G:6F) G Lrqfígstf (Blks Uf) TD Dkfbs ZFGTBF DFGGWДокумент28 страницN) Vs LJ - Ml:6G:6F) G Lrqfígstf (Blks Uf) TD Dkfbs ZFGTBF DFGGWsatyaОценок пока нет

- SushmaJoshi2008 ArtMattersДокумент122 страницыSushmaJoshi2008 ArtMatterssatyaОценок пока нет

- Celebrating 50 Years of Nepal - Switzerland Development CooperationДокумент51 страницаCelebrating 50 Years of Nepal - Switzerland Development CooperationsatyaОценок пока нет

- RoomToRead2066BS ShankheRaPhatyangro PDFДокумент30 страницRoomToRead2066BS ShankheRaPhatyangro PDFsatyaОценок пока нет

- RoomToRead2066BS SattalSinghKoKatha PDFДокумент29 страницRoomToRead2066BS SattalSinghKoKatha PDFsatyaОценок пока нет

- s6 Econ (Public Finance and Fiscal Policy)Документ50 страницs6 Econ (Public Finance and Fiscal Policy)juniormugarura5Оценок пока нет

- Tangible Asset Value Per Share CalculationДокумент1 страницаTangible Asset Value Per Share Calculationimtehan_chowdhuryОценок пока нет

- FBL Annual Report 2019Документ130 страницFBL Annual Report 2019Fuaad DodooОценок пока нет

- Accounting For ReceivablesДокумент4 страницыAccounting For ReceivablesMega Pop Locker50% (2)

- MilmaДокумент50 страницMilmaPhilip G Geoji50% (2)

- B.A.Ll.B. Viii Semester: Subject: Drafting of Pleading & Conveyancing CODE: BL-805 Topic: Promissory Note & ReceiptДокумент4 страницыB.A.Ll.B. Viii Semester: Subject: Drafting of Pleading & Conveyancing CODE: BL-805 Topic: Promissory Note & ReceiptGaurav KumarОценок пока нет

- IPP Report PakistanДокумент296 страницIPP Report PakistanALI100% (1)

- Cashback Redemption FormДокумент1 страницаCashback Redemption FormPapuKaliyaОценок пока нет

- Service Marketing 3 - (Marketing Mix)Документ123 страницыService Marketing 3 - (Marketing Mix)Soumya Jyoti BhattacharyaОценок пока нет

- Regression Analysis Application in LitigationДокумент23 страницыRegression Analysis Application in Litigationkatie farrellОценок пока нет

- EY-IFRS-FS-20 - Part 2Документ50 страницEY-IFRS-FS-20 - Part 2Hung LeОценок пока нет

- Fertilizer - Urea Offtake Update - AHLДокумент3 страницыFertilizer - Urea Offtake Update - AHLmuddasir1980Оценок пока нет

- KOMALДокумент50 страницKOMALanand kumarОценок пока нет

- Credit Rating AgenciesДокумент40 страницCredit Rating AgenciesSmriti DurehaОценок пока нет

- Global Dis Trip Arks ProspectusДокумент250 страницGlobal Dis Trip Arks ProspectusSandeepan ChaudhuriОценок пока нет

- Canara - Epassbook - 2023-10-10 202024.654466Документ49 страницCanara - Epassbook - 2023-10-10 202024.654466Kamal Hossain MondalОценок пока нет

- What is Operations ResearchДокумент10 страницWhat is Operations ResearchSHILPA GOPINATHANОценок пока нет

- Thesis Writing FinalДокумент34 страницыThesis Writing FinalFriends Law ChamberОценок пока нет

- The MBA DecisionДокумент7 страницThe MBA DecisionFiry YuanditaОценок пока нет

- Palais Royal Vol-4 PDFДокумент100 страницPalais Royal Vol-4 PDFrahul kakapuriОценок пока нет

- Cash Flow Statements PDFДокумент101 страницаCash Flow Statements PDFSubbu ..100% (1)

- Delhi Rent Control Act, 1958Документ6 страницDelhi Rent Control Act, 1958a-468951Оценок пока нет

- Joint Venture in Insurance Company in IndiaДокумент37 страницJoint Venture in Insurance Company in IndiaSEMОценок пока нет

- Central Excise ScopeДокумент2 страницыCentral Excise Scopeapi-3822396100% (3)

- Merchant of Venice Act 2 Part 2Документ25 страницMerchant of Venice Act 2 Part 2Verna Santos-NafradaОценок пока нет

- Strategic Management of BisleriДокумент24 страницыStrategic Management of BisleriKareena ChaudharyОценок пока нет

- BPI's Opposition to Sarabia Manor's Rehabilitation PlanДокумент2 страницыBPI's Opposition to Sarabia Manor's Rehabilitation PlanJean Mary AutoОценок пока нет

- Research Proposal On Challenges of Local GovernmentДокумент26 страницResearch Proposal On Challenges of Local GovernmentNegash LelisaОценок пока нет

- Grant Thornton Dealtracker H1 2018Документ47 страницGrant Thornton Dealtracker H1 2018AninditaGoldarDuttaОценок пока нет