Академический Документы

Профессиональный Документы

Культура Документы

BBS 2nd Year Question

Загружено:

satyaАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BBS 2nd Year Question

Загружено:

satyaАвторское право:

Доступные форматы

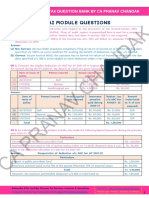

JANAK COLLEGE 8.

The following information were extracted from the books of ABC production house

Internal Examination – 2075 having two production department and one service department:

Rent Rs.10,000 Machine repair cost Rs.5,000

Level: BBS 2nd year Full Marks: 50 Indirect wages Rs.15,000 Depreciation Rs.20,000

Time: 1.5 Hours Sub: Cost and Management Accounting Pass Marks: 18 Power expenses Rs.16,000 Lighting expenses Rs.30,000

Other information related to the production house are:

Brief answer questions: (2 x 5 = 10)

1. Write down any two objectives of cost accounting. Particulars Production Dept. A Production Dept. B Service Dept. S

2. What do you mean by fixed and variable cost?

3. The production units and indirect wages cost for a manufacturing company is given Direct material (Rs.) 10,000 10,000 5,000

below:

Direct wages (Rs.) 4,000 6,000 5,000

Production units Indirect wages

Hp of Machine 1 3 4

3,000 22,000

8,000 42,000 Floor space (Meter) 800 500 700

Required: Segregation of variable and fixed cost by using High – Low method Cost of Machinery Rs.2,00,000 Rs.50,000 Rs.1,50,000

4. A company purchase a product for Rs.40,000 and sell on Rs.1,00,000 with profit

Rs.10,000. Calculate fixed cost for the period. Re-distribution from 40% 60% -

5. A Company annually needs 5,000 units of raw materials .The storing cost is 10% of service dept.

inventory price and procurement cost is Rs.40 per order. Machine Hours 7,000 3,000 1,000

Required: (a) Economic order quantity

Required: (a) Overhead distribution statement

Short answer questions: (9 x 3 = 27) (b) Overhead rate per machine hour

6. The following information were provided to you ;

Selling price per unit Rs.20 Comprehensive answer Questions: (1 3x 1 = 13)

Fixed cost for the period Rs.1,00,000 9.The following details are recorded from a company for the previous month:

Variable cost per unit Rs.15 Products A B C

Required: (a) Profit volume ratio (b) BE sales volume in units and Rs. (c) Sales Production units 3,000 units 2,000 units 5,000 units

amount to earn after tax profit Rs.50,000 with 20% tax rate (d) BEP in Rs. if selling price Labour hour per unit 4 1.5 1

is increased by 25% (e) What price should be charged to earn profit Rs.80,000 from Machine hour per unit 2 1 2

selling 40,000 units. Raw material cost per kg Rs.4 Rs.3 Rs.5

7. The following information were recorded while producing 19,000 units and selling Material in kg per unit 2 kg 3 kg 1kg

20,000 units. No. of set up 5 4 6

Direct material per unit Rs.4 The indirect overhead occurred during the month are as given below:

Direct labour cost Rs.2 Set - up related cost Rs.30,000 (No. of set – ups)

Variable selling overhead per unit Rs.2 Machine related cost Rs.18,000 (Machine hours)

Fixed manufacturing cost Rs.40,000 Production scheduling cost Rs.20,000 (No. of Production run)

Fixed office cost Rs.30,000 Packaging and dispatching cost Rs.34,000 (No. of dispatch)

Fixed selling expenses Rs.15,000 Additional informations:

Normal capacity 20,000 units *Output is realized in a production run of 1,000 units each.

Closing stock 2,000 units *Materials are dispatched in a lot of 500 kg each for each product.

Selling price per unit Rs.15 *Direct labour cost per hour is Rs.10

Required: (a) Income statement under variable costing Required: Calculate cost per unit under traditional costing using labour hour and under

ABC method.

Вам также может понравиться

- Cost SheetДокумент6 страницCost SheetAishwary Sakalle100% (1)

- Suggested Answer Paper CAP III Dec 2019Документ142 страницыSuggested Answer Paper CAP III Dec 2019Roshan PanditОценок пока нет

- Cost and Management Accouting PDFДокумент472 страницыCost and Management Accouting PDFMaxwell chanda100% (1)

- CMA Foundation (Accounts) by CA Mohit RohraДокумент341 страницаCMA Foundation (Accounts) by CA Mohit Rohramalltushar975Оценок пока нет

- Work Book Unit 2 Proforma Variation - SolvedДокумент12 страницWork Book Unit 2 Proforma Variation - SolvedZaheer SwatiОценок пока нет

- Basic of Accountng IcomДокумент731 страницаBasic of Accountng IcomZahid Butt100% (2)

- Measuring Business Income CH 3Документ37 страницMeasuring Business Income CH 3eater PeopleОценок пока нет

- GST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyОт EverandGST Tally ERP9 English: A Handbook for Understanding GST Implementation in TallyРейтинг: 5 из 5 звезд5/5 (1)

- 04 Activity Based Costing PDFДокумент11 страниц04 Activity Based Costing PDFPappu LalОценок пока нет

- Taxation of CompaniesДокумент10 страницTaxation of CompaniesnikhilramaneОценок пока нет

- 7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkДокумент25 страниц7 Deductions ICAI SM + PCA + Past RTPs + Past Exam Questions WatermarkSavya SachiОценок пока нет

- Double Entry SystemДокумент17 страницDouble Entry SystemDastaan Ali100% (1)

- Financial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay DhamijaДокумент23 страницыFinancial Accounting For Managers Author: Sanjay Dhamija Financial Accounting For Managers Author: Sanjay Dhamijashweta sarafОценок пока нет

- Principles of Accounting PDFДокумент2 страницыPrinciples of Accounting PDFfrank mutale0% (1)

- CPA 1 Financial Accounting-1Документ8 страницCPA 1 Financial Accounting-1LYNETTE NYAKAISIKIОценок пока нет

- Depreciation Question and Answers 2Документ2 страницыDepreciation Question and Answers 2AMIN BUHARI ABDUL KHADERОценок пока нет

- Cost AccountingДокумент43 страницыCost AccountingAmina QamarОценок пока нет

- CAF 1 IA Autumn 2020Документ5 страницCAF 1 IA Autumn 2020Qasim Hafeez KhokharОценок пока нет

- Financial Accounting 1 by HaroldДокумент421 страницаFinancial Accounting 1 by HaroldcyrusОценок пока нет

- Solutions To Text Book Exercises: Non-Trading ConcernsДокумент12 страницSolutions To Text Book Exercises: Non-Trading ConcernsM JEEVARATHNAM NAIDUОценок пока нет

- ManufacturingДокумент6 страницManufacturingapi-3034896990% (1)

- Chapter 3 & 4Документ78 страницChapter 3 & 4Viren DeshpandeОценок пока нет

- 42 42 Characteristics of Working CapitalДокумент22 страницы42 42 Characteristics of Working Capitalpradeepg8750% (2)

- 11th Accountancy Volume I Teachers ManualДокумент56 страниц11th Accountancy Volume I Teachers Manualnilofer shallyОценок пока нет

- Aafr Ias 12 Icap Past Paper With SolutionДокумент17 страницAafr Ias 12 Icap Past Paper With SolutionAqib Sheikh100% (1)

- Not For Profit Organisation: Basic ConceptsДокумент48 страницNot For Profit Organisation: Basic Conceptsmonudeep aggarwalОценок пока нет

- Std11 Acct EMДокумент159 страницStd11 Acct EMniaz1788100% (1)

- CA Inter Costing Practical Questions With SolutionsДокумент311 страницCA Inter Costing Practical Questions With SolutionsAnkit KumarОценок пока нет

- Final Exam BSC 2nd 2020Документ3 страницыFinal Exam BSC 2nd 2020NadeemОценок пока нет

- MTP1 May2022 - Paper 5 Advanced AccountingДокумент24 страницыMTP1 May2022 - Paper 5 Advanced AccountingYash YashwantОценок пока нет

- Past Papers For Single Entry and Incomplete RecordsДокумент2 страницыPast Papers For Single Entry and Incomplete RecordsMahreena IlyasОценок пока нет

- Cost ProblemsДокумент7 страницCost ProblemsMadanОценок пока нет

- Accounting Standard - 20 Earning Per Share Full NotesДокумент16 страницAccounting Standard - 20 Earning Per Share Full NotesKumar SwamyОценок пока нет

- 123 - AS Question Bank by Rahul MalkanДокумент182 страницы123 - AS Question Bank by Rahul MalkanPooja GuptaОценок пока нет

- 11th Accounts by CA, Cma Santosh Kumar SirДокумент206 страниц11th Accounts by CA, Cma Santosh Kumar SirMillat Afridi100% (1)

- Financial AccountingДокумент300 страницFinancial AccountingIPloboОценок пока нет

- Introduction To Final AccountsДокумент38 страницIntroduction To Final AccountsCA Deepak Ehn88% (8)

- UntitledДокумент482 страницыUntitlednanu miglaniОценок пока нет

- Key Notes IPCC Advanced AccountingДокумент119 страницKey Notes IPCC Advanced AccountingAnand Bhangariya100% (2)

- Financial Accounting For Islamic Banking Products: Learning ObjectivesДокумент21 страницаFinancial Accounting For Islamic Banking Products: Learning ObjectivesAbdelnasir HaiderОценок пока нет

- Tally Test No 1 Next LectureДокумент2 страницыTally Test No 1 Next Lecturesha_ash777Оценок пока нет

- Techniques of Capital Budgeting SumsДокумент15 страницTechniques of Capital Budgeting Sumshardika jadavОценок пока нет

- Chapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaДокумент14 страницChapter 1-Job and Batch Costing: Ref: Cost & Management Accounting by K.S.AdigaAR Ananth Rohith BhatОценок пока нет

- Cost Accounting 3Документ3 страницыCost Accounting 3sharu SKОценок пока нет

- TutorialActivity 3Документ7 страницTutorialActivity 3Adarsh AchoyburОценок пока нет

- Activity Based Costing SystemДокумент18 страницActivity Based Costing SystemMAXA FASHIONОценок пока нет

- Marginal & Absorption CostingДокумент9 страницMarginal & Absorption CostingRida JunejoОценок пока нет

- 4 2 Sma 2017Документ5 страниц4 2 Sma 2017Nawoda SamarasingheОценок пока нет

- MC1Документ3 страницыMC1deepalish88Оценок пока нет

- Cost & Management Accounting - MGT402 Power Point Slides LectureДокумент15 страницCost & Management Accounting - MGT402 Power Point Slides LectureMr. JalilОценок пока нет

- Unit IVДокумент14 страницUnit IVkuselvОценок пока нет

- Model Question For Account409792809472943360Документ8 страницModel Question For Account409792809472943360yugeshОценок пока нет

- Inter Cost 2Документ27 страницInter Cost 2Anirudha SatheОценок пока нет

- T I C A P: HE Nstitute of Hartered Ccountants of AkistanДокумент3 страницыT I C A P: HE Nstitute of Hartered Ccountants of AkistanShehrozSTОценок пока нет

- 1) May 2005 Cost ManagementДокумент60 страниц1) May 2005 Cost Managementshyammy foruОценок пока нет

- Marginal & Absorption Costing UpdatedДокумент6 страницMarginal & Absorption Costing UpdatedMUHAMMAD ZAID SIDDIQUI100% (2)

- Mcom NotesДокумент10 страницMcom Notesvkharish21Оценок пока нет

- Managerial Accounting (Acct 321) 3rd Trimester 2016Документ5 страницManagerial Accounting (Acct 321) 3rd Trimester 2016Nodeh Deh SpartaОценок пока нет

- Variance IQ FileДокумент34 страницыVariance IQ FileShehrozSTОценок пока нет

- BCOM 22031 Practice Question-Varaince AnalysisДокумент4 страницыBCOM 22031 Practice Question-Varaince Analysisajanthahn0% (1)

- Some Examples of Journal EntriesДокумент5 страницSome Examples of Journal Entriessatya100% (4)

- JanardanBaral2067BS Jalpariko SangharshaДокумент26 страницJanardanBaral2067BS Jalpariko SangharshasatyaОценок пока нет

- Accounting Process CW2Документ1 страницаAccounting Process CW2satyaОценок пока нет

- Provision For Bad DebtsДокумент3 страницыProvision For Bad DebtssatyaОценок пока нет

- Accounting Process HW1Документ1 страницаAccounting Process HW1satya100% (1)

- Alchhi TulkeДокумент16 страницAlchhi TulkesatyaОценок пока нет

- BBS 2nd Year English QuestionДокумент1 страницаBBS 2nd Year English QuestionsatyaОценок пока нет

- Cash Flow Statement FormateДокумент3 страницыCash Flow Statement FormatesatyaОценок пока нет

- Cash Flow Statement QuestionДокумент5 страницCash Flow Statement QuestionsatyaОценок пока нет

- Class 12 Question Set 2Документ3 страницыClass 12 Question Set 2satyaОценок пока нет

- Income From EmploymentFormatДокумент3 страницыIncome From EmploymentFormatsatyaОценок пока нет

- 'Snl-E'Snl: /FTF) Aënf LstfaДокумент20 страниц'Snl-E'Snl: /FTF) Aënf LstfasatyaОценок пока нет

- Cash Flow Statement FormateДокумент3 страницыCash Flow Statement FormatesatyaОценок пока нет

- Accounting For DebentureДокумент1 страницаAccounting For DebenturesatyaОценок пока нет

- TejPrakashShrestha2003 MingmarДокумент30 страницTejPrakashShrestha2003 MingmarsatyaОценок пока нет

- Chapter 07 - Accounts and Notes Receivable. Chapter OutlineДокумент6 страницChapter 07 - Accounts and Notes Receivable. Chapter OutlinesatyaОценок пока нет

- Maths Worksheets Set 10Документ4 страницыMaths Worksheets Set 10satyaОценок пока нет

- TejPrakashShrestha2067BS HiuManchheДокумент67 страницTejPrakashShrestha2067BS HiuManchhesatyaОценок пока нет

- TR - Basunlama2005 TraditionalBirthAttendanceДокумент18 страницTR - Basunlama2005 TraditionalBirthAttendancesatyaОценок пока нет

- Children'S Toys From Africa: Unesco PublicationДокумент30 страницChildren'S Toys From Africa: Unesco PublicationsatyaОценок пока нет

- Illustrator Promina Shrestha Author Tara Pun: Lzlift Afnaflnsfx¿Af6 G) LJZJDF KL/JT (GSF) Yfngl X'G5Документ26 страницIllustrator Promina Shrestha Author Tara Pun: Lzlift Afnaflnsfx¿Af6 G) LJZJDF KL/JT (GSF) Yfngl X'G5satyaОценок пока нет

- SushmaJoshi2008 ArtMattersДокумент122 страницыSushmaJoshi2008 ArtMatterssatyaОценок пока нет

- SrijanaSharma2063BS ManachinteyJhholaДокумент35 страницSrijanaSharma2063BS ManachinteyJhholasatyaОценок пока нет

- 1st Terminal QuestionДокумент1 страница1st Terminal QuestionsatyaОценок пока нет

- TejPrakashShrestha2067BS BhokaDamaruharuДокумент41 страницаTejPrakashShrestha2067BS BhokaDamaruharusatyaОценок пока нет

- Asmita Goes To The Farm Asmita Goes To The Farm: By: Saurav Dev Bhatta By: Saurav Dev Bhatta 2009Документ16 страницAsmita Goes To The Farm Asmita Goes To The Farm: By: Saurav Dev Bhatta By: Saurav Dev Bhatta 2009satyaОценок пока нет

- Celebrating 50 Years of Nepal - Switzerland Development CooperationДокумент51 страницаCelebrating 50 Years of Nepal - Switzerland Development CooperationsatyaОценок пока нет

- N) Vs LJ - Ml:6G:6F) G Lrqfígstf (Blks Uf) TD Dkfbs ZFGTBF DFGGWДокумент28 страницN) Vs LJ - Ml:6G:6F) G Lrqfígstf (Blks Uf) TD Dkfbs ZFGTBF DFGGWsatyaОценок пока нет

- RoomToRead2066BS ShankheRaPhatyangro PDFДокумент30 страницRoomToRead2066BS ShankheRaPhatyangro PDFsatyaОценок пока нет

- RoomToRead2066BS SattalSinghKoKatha PDFДокумент29 страницRoomToRead2066BS SattalSinghKoKatha PDFsatyaОценок пока нет

- MBA Course StructureДокумент2 страницыMBA Course StructureAnupama JampaniОценок пока нет

- Test 1 MCQДокумент3 страницыTest 1 MCQKarmen Thum50% (2)

- Amount of Investment Bonus Method: Than Investment Greater Than InvestmentДокумент14 страницAmount of Investment Bonus Method: Than Investment Greater Than InvestmentElla Mae Clavano NuicaОценок пока нет

- Share Holders Right To Participate in The Management of The CompanyДокумент3 страницыShare Holders Right To Participate in The Management of The CompanyVishnu PathakОценок пока нет

- Unit 4 The Hospitality Industry: Ntroduction To Tourism HMGTДокумент44 страницыUnit 4 The Hospitality Industry: Ntroduction To Tourism HMGTdilanocockburnОценок пока нет

- Business Plan On HIRING A MAIDДокумент21 страницаBusiness Plan On HIRING A MAIDharsha100% (1)

- 2017 Walters Global Salary SurveyДокумент428 страниц2017 Walters Global Salary SurveyDebbie CollettОценок пока нет

- Batman GuidesДокумент3 страницыBatman GuidesMarco MazzaiОценок пока нет

- BIR Form 1604cfДокумент3 страницыBIR Form 1604cfMaryjean PoquizОценок пока нет

- A Product Recall Doesn't Have To Create A Financial Burden You Can't OvercomeДокумент1 страницаA Product Recall Doesn't Have To Create A Financial Burden You Can't OvercomebiniamОценок пока нет

- Roles & Responsibilities of A Maintenance Engineer - LinkedInДокумент4 страницыRoles & Responsibilities of A Maintenance Engineer - LinkedInEslam MansourОценок пока нет

- List of SAP Status CodesДокумент19 страницList of SAP Status Codesmajid D71% (7)

- A Comparative Analysis On Fuel-Oil Distribution Companies of BangladeshДокумент15 страницA Comparative Analysis On Fuel-Oil Distribution Companies of BangladeshTanzir HasanОценок пока нет

- Curriculum ViateДокумент1 страницаCurriculum ViateOssaОценок пока нет

- Evaluasi Kinerja Angkutan Umum Di Kota Magelang (Studi Kasus Jalur 1 Dan Jalur 8)Документ10 страницEvaluasi Kinerja Angkutan Umum Di Kota Magelang (Studi Kasus Jalur 1 Dan Jalur 8)Bahar FaizinОценок пока нет

- Ax2012 Enus Deviv 05 PDFДокумент32 страницыAx2012 Enus Deviv 05 PDFBachtiar YanuariОценок пока нет

- Ker61035 Appd Case01Документ3 страницыKer61035 Appd Case01GeeSungОценок пока нет

- Comparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesДокумент9 страницComparing FTTH Access Networks Based On P2P and PMP Fibre TopologiesWewe SlmОценок пока нет

- 1 Zong Net Package PDFДокумент8 страниц1 Zong Net Package PDFHafiz Abid Malik0% (1)

- Competitors and CustomersДокумент2 страницыCompetitors and Customerslk de leonОценок пока нет

- Part One: Overture and Pageantry: TenderlyДокумент3 страницыPart One: Overture and Pageantry: TenderlyEneas Augusto100% (1)

- Case 15 Pacific Healthcare - B - Student - 6th EditionДокумент1 страницаCase 15 Pacific Healthcare - B - Student - 6th EditionAhmed MahmoudОценок пока нет

- Marketing IndividualДокумент2 страницыMarketing Individualsinyi0Оценок пока нет

- Pfrs 1Документ8 страницPfrs 1Jenne LeeОценок пока нет

- Products Services FCPO EnglishДокумент16 страницProducts Services FCPO EnglishKhairul AdhaОценок пока нет

- Creating Customer Value, Satisfaction and LoyaltyДокумент20 страницCreating Customer Value, Satisfaction and Loyaltymansi singhОценок пока нет

- Assin Bsos15-31 PDFДокумент69 страницAssin Bsos15-31 PDFAnonymous cPS4htyОценок пока нет

- Objectives For Chapter 9: Business Cycle, Inflation and UnemploymentДокумент19 страницObjectives For Chapter 9: Business Cycle, Inflation and UnemploymentAnonymous BBs1xxk96VОценок пока нет

- Laguna y Markklund PDFДокумент668 страницLaguna y Markklund PDFjuan carlos sanchezОценок пока нет

- From Good To Great: An Introduction To Servant Leadership Gemeco March 2018Документ33 страницыFrom Good To Great: An Introduction To Servant Leadership Gemeco March 2018Papa KingОценок пока нет