Академический Документы

Профессиональный Документы

Культура Документы

Accounting For Insurance Liabilities

Загружено:

DudenОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Accounting For Insurance Liabilities

Загружено:

DudenАвторское право:

Доступные форматы

Accounting for Insurance Liabilities:

IFRS 17 – Finally There!

Cardi van Capelle

IFRS and Solvency II Specialist

NN Group

Global Association of Risk Professionals

June 2017

The views expressed in the following material are the

author’s and do not necessarily represent the views of

the Global Association of Risk Professionals (GARP), its

Membership or its Management.

© 2016 Global Association of Risk Professionals. All rights reserved. (12.15.16)

Poll

Who is working for an EU listed insurer?

2 | © 2014 Global Association of Risk Professionals. All rights reserved. 2

IASB Insurance: a marathon project

3 | © 2014 Global Association of Risk Professionals. All rights reserved. 3

IFRS 17 has a long history……

• The project to have an international standard

on insurance accounting started in 1997

• The plan was to have it when IFRS was

implemented in Europe in 2005

as this was unsuccessful: temporary IFRS

• Initially the project was directed to

• implement full fair value accounting for insurance businesses

• achieve a joint outcome with the US (US GAAP)

• Along the way however:

• profit recognition for insurance moved away from fair value

• the US has take its own (different) approach

4 | © 2014 Global Association of Risk Professionals. All rights reserved. 4

……and we are not there yet

• IFRS 17 was issued final in May 2017

• Many elements of the standard will result

in discussions, interpretations and best practices

over the coming years:

• industry, auditors, regulators

• The IASB intends to establish a Transition Resource Group – a

forum to discuss implementation issues that may result in

interpretations or amendments to the standard

• The EU will now start its endorsement process – IFRS 17 is only

effective in the EU if and when endorsed

• endorsement process likely to continue for the full 2017 (or

longer…)

• EFRAG (the EU body that advises on endorsement) is under

significant pressure to first perform a complete impact assessment

5 | © 2014 Global Association of Risk Professionals. All rights reserved. 5

IFRS 9

Implementation of IFRS 17 will go together with IFRS 9 on assets

• IFRS 9 on Financial Assets is final

• Implementation for insurers (likely) together with IFRS 17

in 2021

• For non-insurers effective in 2018; for insurers certain

disclosures as of 2018

• Main changes:

⁻ More assets accounted for at fair value through P&L

⁻ Expected loss provisioning to replace current impairment model

• This presentation focusses on IFRS 17 only

6 | © 2014 Global Association of Risk Professionals. All rights reserved. 6

Why is it a big change?

“Temporary” IFRS since 2004

• No accounting standard for insurance contracts when IFRS was

implemented (2005)

• A temporary IFRS was issued that allowed continuation of pre-IFRS

accounting

• NN Group uses pre-IFRS “NN GAAP”:

- mostly fixed discount rate

- mostly mortality tables used for pricing the contract at inception

- NN Group’s RAT to test adequacy

- towards fair value for specific portfolios (Japan Closed Block VA)

• The final outcome of IFRS 17 reflects the long and difficult discussions:

complexity!

7 | © 2014 Global Association of Risk Professionals. All rights reserved. 7

The core measurement model (balance sheet)

The core measurement model is the Building Block Approach

(“BBA”)- general model

4th Building Block: Unearned profits (Contractual Service Margin)

CSM

3rd Building Block: Compensation for risk

Fulfilment Cash Flows

Risk adjustment

2nd Building Block: Discounting at current rate

Time value of money (discounting)

1st Building Block:

Expected value of the future cash flows

Best estimate of fulfillment cash flows

8 | © 2014 Global Association of Risk Professionals. All rights reserved. 8

Level of aggregation

1. A portfolio is a group of contracts subject to similar risks and managed

together.

2. Portfolio’s are further split into groups based on profitability:

1. Onerous at inception

2. Not onerous at inception and no significant risk of becoming

onerous

3. Other profitable contracts

3. Groups are set for maximum one year layers

If required for management reporting, a more detailed split is allowed.

Exception: if, and only if, a split in profitability is a result of specific

constraints in law or regulation to set price of benefit based on individual

policyholder characteristics.

9 | © 2014 Global Association of Risk Professionals. All rights reserved. 9

Measurement - summary

• profit at inception of the contract

(4) • avoids recognition of day-1 gain

• must be positive; any day-1 loss is recognised immediately in P&L

CSM

• compensation for the uncertainty about the amount and timing of future cash

(3) flows

Risk • equivalent to a Risk Margin in Solvency 2

adjustment • method not prescribed

• discounting against a market consistent yield, updated every reporting period

Total

(2) • top down rate (asset return adjusted for default) or bottom up (risk free plus

insurance

illiquidity) are both allowed

liability Discounting

• expected cash flows from premiums, claims, benefits, expenses, etc.

• includes acquisition costs (i.e. no DAC, but reflected in cash flows)

(1) • current estimates, i.e. updated every reporting period, using all available info

Cash Flows • on a “fulfillment” basis – i.e. not market value but entity-specific; however, must

be market consistent where possible

10 | © 2014 Global Association of Risk Professionals. All rights reserved. 10

Poll

IFRS 17 measurement will provide the same

numbers as measurement under Solvency II

11 | © 2014 Global Association of Risk Professionals. All rights reserved. 11

Some additional observations on

measurement

Similarities and differences with Solvency 2

• Blocks 1 to 3 (discounted cash flows plus a risk margin) are similar to

Solvency 2

• However, there are likely many detailed differences in each (scope of

cash flows in the best estimate liability, discount rate, risk

adjustment, level of aggregation)

• Especially for discount rate: differences with Solvency II to be

considered

• Therefore, the market value liability in the Solvency II balance sheet

will be different from the market value liability in the balance sheet

under IFRS 17

• The Contractual Service Margin (block 4) only exists in IFRS

12 | © 2014 Global Association of Risk Professionals. All rights reserved. 12

Changes in measurement

Beginning of the period End of the period

Interest

Absorbing

(4) Release for accretion (4)

changes in

CSM the period (locked in CSM

estimates

rate)

(3) (3)

Change in Release for

Risk future Risk

adjustment the period

estimate adjustment

Unwind for

(2) Change in Discounting the period (2)

Discounting discount rate (locked in) (locked in Discounting

rate)

Experience –

(1) Change in Change in actual vs (1)

Cashflows

financial non-financial expected

Cash Flows in/out Cash Flows

assumptions assumptions cashflows

Other Comprehensive Some changes are Profit and loss :

Income (OCI), i.e. absorbed in CSM - Underwriting result

“revaluation reserve" in - Investment result

13 | © 2014 Global Association equity or P&L All rights reserved.

of Risk Professionals. 13

Accounting model modified by type of

contract

BBA – General model Life & pension –

traditional

Non-

participating

BBA- general model Non-Life – car

or optional: PAA insurance

Insurance

contract

Direct BBA – Variable fee Unit Linked

Participating

BBA – General Model Profit sharing based

Indirect + limited modification on index or company

profit

14 | © 2014 Global Association of Risk Professionals. All rights reserved. 14

Poll

IFRS 17 will not have any impact on

my daily business

15 | © 2014 Global Association of Risk Professionals. All rights reserved. 15

Questions

16 | © 2014 Global Association of Risk Professionals. All rights reserved. 16

Creating a culture of risk awareness®

About GARP | The Global Association of Risk Professionals (GARP) is the leading globally recognized

association dedicated to the education and certification of risk professionals, connecting members in more than

190 countries and territories. GARP’s mission is to elevate the practice of risk management at all levels, setting

the industry standard through education, training, media, and events.

Main Office London Office

111 Town Square Place 2nd Floor

14th Floor Bengal Wing

garp.org Jersey City, New Jersey

07310, U.S.A.

9A Devonshire Square

London, EC2M 4YN, U.K.

© 2016 Global Association of Risk Professionals. All rights reserved. (12.20.16) +1 201.719.7210 +44 (0) 20 7397 9630

Вам также может понравиться

- Understanding IFRS Fundamentals: International Financial Reporting StandardsОт EverandUnderstanding IFRS Fundamentals: International Financial Reporting StandardsОценок пока нет

- Insurance AccountingДокумент16 страницInsurance Accountingssp2000Оценок пока нет

- Foundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsОт EverandFoundational Theories and Techniques for Risk Management, A Guide for Professional Risk Managers in Financial Services - Part II - Financial InstrumentsОценок пока нет

- 201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Документ6 страниц201.06 Accounting For Insurance Companies (IAS-1, IfRS-4)Biplob K. SannyasiОценок пока нет

- Accounting For Directors Loans Under FRS 102 FAQsДокумент7 страницAccounting For Directors Loans Under FRS 102 FAQswattersed1711Оценок пока нет

- IFRS 17 in South AfricaДокумент12 страницIFRS 17 in South AfricaDanielОценок пока нет

- IFRS 17 Ebook - AptitudeSoftwareДокумент40 страницIFRS 17 Ebook - AptitudeSoftwareAnton LimОценок пока нет

- Accounting of Life Insurance CompaniesДокумент4 страницыAccounting of Life Insurance CompaniesAnish ThomasОценок пока нет

- Advanced Accounting - BCOM 5 Sem Ebook and NotesДокумент98 страницAdvanced Accounting - BCOM 5 Sem Ebook and NotesNeha firdoseОценок пока нет

- The Private Insurance Industry: Financial Operations of InsurersДокумент11 страницThe Private Insurance Industry: Financial Operations of InsurersSunny SunnyОценок пока нет

- Sage Green Minimalist Business Proposal PresentationДокумент35 страницSage Green Minimalist Business Proposal PresentationMjane JamitoОценок пока нет

- Insurance Basics: Insurers Assume and Manage Risk in Return For A PremiumДокумент6 страницInsurance Basics: Insurers Assume and Manage Risk in Return For A Premiumgaggu747Оценок пока нет

- Financial Statements of Insurance Companies (PDFDrive)Документ106 страницFinancial Statements of Insurance Companies (PDFDrive)Putin PhyОценок пока нет

- Ifrs 9 Financial InstrumentsДокумент8 страницIfrs 9 Financial InstrumentsBella ChoiОценок пока нет

- 1 IFRS 9 - Financial InstrumentsДокумент31 страница1 IFRS 9 - Financial InstrumentsSharmaineMirandaОценок пока нет

- FIN 321 CH 11 QuizДокумент4 страницыFIN 321 CH 11 Quizspike100% (1)

- IFRS 4 Basis For ConclusionsДокумент87 страницIFRS 4 Basis For ConclusionsMariana Mirela0% (1)

- Insurance Accounting Entries and TypeДокумент4 страницыInsurance Accounting Entries and TypeimranОценок пока нет

- Whitepaper Ifrs17 Accounting Turning Theory Into PracticeДокумент10 страницWhitepaper Ifrs17 Accounting Turning Theory Into PracticeVarian CitrajayaОценок пока нет

- Control AccountДокумент6 страницControl AccountPranitha RaviОценок пока нет

- Financial FormationДокумент60 страницFinancial FormationSandeep Soni100% (1)

- IFRS 2 New WorkbookДокумент63 страницыIFRS 2 New WorkbooktparthasarathiОценок пока нет

- Asc 944Документ172 страницыAsc 944Babymetal LoОценок пока нет

- CH 06Документ18 страницCH 06harisadhaОценок пока нет

- PeopleSoft GL PointsДокумент14 страницPeopleSoft GL PointsVenkateswara Rao Balla100% (1)

- Partnership Final AccountsДокумент6 страницPartnership Final AccountsNila AОценок пока нет

- Financial Accounting ExercisesДокумент45 страницFinancial Accounting Exercisesskostic013Оценок пока нет

- FINANCE FOR MANAGER TERM PAPERxxxДокумент12 страницFINANCE FOR MANAGER TERM PAPERxxxFrank100% (1)

- Financial StatementsДокумент35 страницFinancial StatementsTapish GroverОценок пока нет

- Accounting For InsuranceДокумент14 страницAccounting For InsuranceJudith GabuteroОценок пока нет

- IFRS 16 Leases: You Might Want To Check That Out HereДокумент10 страницIFRS 16 Leases: You Might Want To Check That Out HerekoshkoshaОценок пока нет

- 2 Sem - Bcom - Advanced Financial AccountingДокумент39 страниц2 Sem - Bcom - Advanced Financial AccountingpradeepОценок пока нет

- Controlling With ExamplesДокумент39 страницControlling With ExamplesteuuuuОценок пока нет

- IFRS GUIDE Book PDFДокумент68 страницIFRS GUIDE Book PDFLeonard Berisha100% (1)

- Ifrs 10: Consolidated Financial InstrumentДокумент5 страницIfrs 10: Consolidated Financial InstrumentAira Nhaira Mecate100% (1)

- Presentation of FSДокумент2 страницыPresentation of FSTimmy KellyОценок пока нет

- Financial Reporting WДокумент345 страницFinancial Reporting Wgordonomond2022Оценок пока нет

- Consolidation or Business CombinationsДокумент17 страницConsolidation or Business CombinationsTimothy KawumaОценок пока нет

- Banking and InsuranceДокумент106 страницBanking and Insurancebeena antuОценок пока нет

- Lecture 1Документ44 страницыLecture 1Inzamam Ul HaqОценок пока нет

- Foundations of PlanningДокумент31 страницаFoundations of PlanningUYEN Pham Thuy PhuongОценок пока нет

- Noclar: Supplementary Material Related To Non-Compliance With Laws and Regulations (Noclar)Документ17 страницNoclar: Supplementary Material Related To Non-Compliance With Laws and Regulations (Noclar)Karlo Jude AcideraОценок пока нет

- SBR - Hedge AccountingДокумент13 страницSBR - Hedge AccountingMyo Naing100% (1)

- IFRS 4 Insurance Contracts Phase II: Preparing For ActionДокумент53 страницыIFRS 4 Insurance Contracts Phase II: Preparing For Actionsai madhavОценок пока нет

- Insurance Accounting TerminologiesДокумент16 страницInsurance Accounting Terminologieskumaryashwant1984Оценок пока нет

- Ias 12Документ38 страницIas 12lindsay boncodinОценок пока нет

- Ias 28 - Investments in AssociatesДокумент14 страницIas 28 - Investments in AssociatesJaaОценок пока нет

- IAS-12 BinderДокумент27 страницIAS-12 Binderzahid awanОценок пока нет

- ACCA F9 Lecture 2Документ37 страницACCA F9 Lecture 2Fathimath Azmath AliОценок пока нет

- Business Combinations - ASPEДокумент3 страницыBusiness Combinations - ASPEShariful HoqueОценок пока нет

- Financial Modelling PDFДокумент2 страницыFinancial Modelling PDFSilviana FassicaОценок пока нет

- MTP SJMДокумент340 страницMTP SJMhelen gugsaОценок пока нет

- Introduction To Consolidated Financial StatementsДокумент6 страницIntroduction To Consolidated Financial StatementsNirali MakwanaОценок пока нет

- 6 Dividend DecisionДокумент31 страница6 Dividend Decisionambikaantil4408Оценок пока нет

- Profit and Loss AccountДокумент15 страницProfit and Loss AccountLogesh Waran100% (1)

- International Financing Reporting Standards (Ifrs) International Financing Reporting Standards (Ifrs)Документ15 страницInternational Financing Reporting Standards (Ifrs) International Financing Reporting Standards (Ifrs)Sugufta ZehraОценок пока нет

- Ratio Analysis: Theory and ProblemsДокумент51 страницаRatio Analysis: Theory and ProblemsAnit Jacob Philip100% (1)

- IFRS 2 Share Based Payment Final Revision ChecklistДокумент17 страницIFRS 2 Share Based Payment Final Revision ChecklistEmezi Francis ObisikeОценок пока нет

- KPMG Prodegree EBrochureДокумент6 страницKPMG Prodegree EBrochurerajiv559Оценок пока нет

- Blockchains: Where We Are and How They Will Change Risk ManagementДокумент16 страницBlockchains: Where We Are and How They Will Change Risk ManagementDudenОценок пока нет

- Behavioural Risk ManagementДокумент20 страницBehavioural Risk ManagementDudenОценок пока нет

- FinTech Journey and The HurdlesДокумент22 страницыFinTech Journey and The HurdlesDudenОценок пока нет

- Financial MathematicsДокумент107 страницFinancial MathematicsDudenОценок пока нет

- Exchange Rates and Monetary Policy UncertaintyДокумент48 страницExchange Rates and Monetary Policy UncertaintyDudenОценок пока нет

- Alternative Approaches To Modelling Non Maturing DepositsДокумент23 страницыAlternative Approaches To Modelling Non Maturing DepositsDuden100% (1)

- Challenges To Implementing CECLДокумент20 страницChallenges To Implementing CECLDudenОценок пока нет

- Cybersecurity Is Your Disclosure Discovery SecureДокумент18 страницCybersecurity Is Your Disclosure Discovery SecureDudenОценок пока нет

- Post-Energy RiskДокумент23 страницыPost-Energy RiskDudenОценок пока нет

- P SyllabusДокумент5 страницP SyllabusDudenОценок пока нет

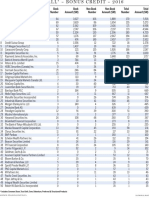

- Bonus Credit Equity FormsДокумент1 страницаBonus Credit Equity FormsDudenОценок пока нет

- Probability Measures in Financial MathematicsДокумент3 страницыProbability Measures in Financial MathematicsDudenОценок пока нет

- Investment & Financial Markets Exam-July 2019: Normal Distribution Calculator Prometric Web SiteДокумент12 страницInvestment & Financial Markets Exam-July 2019: Normal Distribution Calculator Prometric Web SiteDudenОценок пока нет

- Minority-Led Activist Hedge FundДокумент4 страницыMinority-Led Activist Hedge FundDudenОценок пока нет

- Bonus Credit Government DebtДокумент1 страницаBonus Credit Government DebtDudenОценок пока нет

- Bonus Credit Equity IpoДокумент1 страницаBonus Credit Equity IpoDudenОценок пока нет

- High Water Mark PieceДокумент2 страницыHigh Water Mark PiecedjdazedОценок пока нет

- Abb FZ LLC - Bangalore ItatДокумент23 страницыAbb FZ LLC - Bangalore Itatbharath289Оценок пока нет

- ACSI Travel Report 2018-2019: American Customer Satisfaction IndexДокумент14 страницACSI Travel Report 2018-2019: American Customer Satisfaction IndexJeet SinghОценок пока нет

- Full Download Solution Manual For Global Investments 6 e 6th Edition Bruno Solnik Dennis Mcleavey PDF Full ChapterДокумент36 страницFull Download Solution Manual For Global Investments 6 e 6th Edition Bruno Solnik Dennis Mcleavey PDF Full Chapterwaycotgareb5ewy100% (18)

- A Model of Balance-Of-Payments CrisesДокумент22 страницыA Model of Balance-Of-Payments CrisesyeganehfarОценок пока нет

- Delhi Chapter MembershipДокумент1 страницаDelhi Chapter Membershipgoten25Оценок пока нет

- Management Accounting Report BudgetДокумент42 страницыManagement Accounting Report BudgetBilly Maravillas Dela CruzОценок пока нет

- Chapter 1 Microeconomics For Managers Winter 2013Документ34 страницыChapter 1 Microeconomics For Managers Winter 2013Jessica Danforth GalvezОценок пока нет

- Test 3Документ7 страницTest 3info view0% (1)

- The Rotary Club of Payson: Today... September 18th Is..Документ2 страницыThe Rotary Club of Payson: Today... September 18th Is..api-35893633Оценок пока нет

- Pending Home SalesДокумент2 страницыPending Home SalesAmber TaufenОценок пока нет

- التحفيزات الجبائيةДокумент18 страницالتحفيزات الجبائيةbouamama bОценок пока нет

- Quantitative Easing Institution Name: Qe-AssignmentДокумент4 страницыQuantitative Easing Institution Name: Qe-AssignmentDaniel OdhiambpoОценок пока нет

- Vermisoks Case PDFДокумент16 страницVermisoks Case PDFTre CobbsОценок пока нет

- Contract I Reading ListДокумент11 страницContract I Reading ListBUYONGA RONALDОценок пока нет

- 50 Largest Hedge Funds in The WorldДокумент6 страниц50 Largest Hedge Funds in The Worldhttp://besthedgefund.blogspot.comОценок пока нет

- Welfare Economics of Amartya SenДокумент12 страницWelfare Economics of Amartya SenromypaulОценок пока нет

- SN Character List of Animal Farm by George OrwellДокумент3 страницыSN Character List of Animal Farm by George Orwell10nov1964Оценок пока нет

- Alternative Centres of PowerДокумент40 страницAlternative Centres of PowerJigyasa Atreya0% (2)

- BASFINE - Banks HomeworkДокумент5 страницBASFINE - Banks HomeworkDanaОценок пока нет

- 320 - 33 - Powerpoint-Slides - Chapter-10-Monopolistic-Competition-Oligopoly (Autosaved)Документ37 страниц320 - 33 - Powerpoint-Slides - Chapter-10-Monopolistic-Competition-Oligopoly (Autosaved)Ayush KumarОценок пока нет

- Industrialization WebquestДокумент4 страницыIndustrialization WebquestmrsorleckОценок пока нет

- How The American Dream Has Changed Over TimeДокумент3 страницыHow The American Dream Has Changed Over TimeKellie ClarkОценок пока нет

- ReportДокумент10 страницReportNeeraj KishoreОценок пока нет

- Property Acquisition and Cost RecoveryДокумент40 страницProperty Acquisition and Cost RecoveryMo ZhuОценок пока нет

- Report On Summer Training (July 2019) : Organization: Irrigation Department, Guwahati West Division, UlubariДокумент22 страницыReport On Summer Training (July 2019) : Organization: Irrigation Department, Guwahati West Division, UlubariKunal Das75% (4)

- 16 PDFДокумент3 страницы16 PDFLem MasangkayОценок пока нет

- Office Memorandum No - DGW/MAN/171 Issued by Authority of Director General of WorksДокумент2 страницыOffice Memorandum No - DGW/MAN/171 Issued by Authority of Director General of WorksDeep Prakash YadavОценок пока нет

- Intergovernmental Organizations (Igos) and Their Roles and Activities in Security, Economy, Health and EnvironmentДокумент9 страницIntergovernmental Organizations (Igos) and Their Roles and Activities in Security, Economy, Health and EnvironmentAMPONIN EUNICEОценок пока нет

- Gartner IT Key Metrics Data: 2011 Summary ReportДокумент12 страницGartner IT Key Metrics Data: 2011 Summary ReportVincent BoixОценок пока нет