Академический Документы

Профессиональный Документы

Культура Документы

Re I Property Analyzer

Загружено:

Ucok DedyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Re I Property Analyzer

Загружено:

Ucok DedyАвторское право:

Доступные форматы

QuickTime™ and a QuickTime™ and a

decompressor decompressor

are needed to see this picture.

are needed to see this picture.

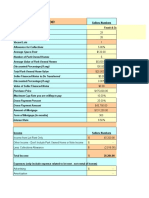

Property Cashflow Analyzer

Brought to you by: http://www.chandler-property.com and http://www.BiggerPockets.com

Purpose: The Property Analyzer is a tool to evaluate a property's cashflow characteristics. The areas highlighted in green

are for the user to enter data. The yellow highlighted cells are automatically calculated. Enter in the basic information of

the transaction and the spreadsheet will calculate several common ratios and profitability measures. Values are already

entered in certain cells to demonstrate how the spreadsheet works. Type over the green cells with new information to

analyze your transaction.

Property Information Cost Information (dalam Juta)

Property Name XYZ Property Building Cost Rp 1,500

Location Medan, IND Land Cost Rp 522

Type of Property Option A (RUKO LEBAR 4M) Cost Basis Rp 2,022

Size of Property 100.4 M2 X 3 UNIT Less Mortgages Rp -

Equals Initial Investment Rp 2,022

Amortization Period 0

Ratio Information

Loan to Value 0% Mortgage Information

Loan Amtz

Cashflow / Initial Investment #VALUE! Balance Payment Interest Term Period

Cashflow / Assets #VALUE! 1st Mtg Rp - #VALUE! ###

0% 0 0

CAP Rate 128%

Annual

# Description (All Figures are Annual) Amount Notes

1 POTENTIAL RENTAL INCOME Rp 3,033 Total Potential Income if rented 100%

2 Less: Vacancy Rp (450) Assumed 2% Vacancy Factor

3 EFFECTIVE RENTAL INCOME $ 2,583

4 Plus: Other Income $ - Other Fees, charges, etc

5 GROSS OPERATING INCOME $ 2,583 Total Revenue

OPERATING EXPENSES

6 Real Estate Taxes $ - Property Taxes

7 Personal Property Taxes $ -

8 Property Insurance $ -

9 Off Site Management $ -

10 Payroll $ -

11 Expenses/Benefits $ -

12 Taxes/Worker's Compensation $ -

13 Repairs and Maintenance $ -

14 Utilities $ -

15 Accounting and Legal $ -

16 Licenses/Permits $ -

17 Advertising $ -

18 Supplies $ -

19 Lawn and Grounds Keeping $ -

20 Miscellaneous $ -

21

22

23

24 TOTAL OPERATING EXPENSES $ - Sum of Line 6 thru 23

25 NET OPERATING INCOME $ 2,583

26 Less: Annual Debt Service #VALUE! Total Mortgage Payments

27 CASH FLOW BEFORE TAXES #VALUE!

28 Add Back: Principal Payments #VALUE! Principal Paid on Loan

29 - Depreciation #DIV/0! Tax Depreciation on Building

30 TAXABLE NET INCOME (LOSS) #VALUE!

Definitions

Loan to Value (LTV) = Loan / Property Value

LTV is a measurement of leverage. The higher the LTV, the more leveraged a property. Bank's use this to determine the

riskiness of a loan. Generally, banks do not loan above 85% LTV.

Net Operating Income (NOI)

Total Potential Income

- Vacancy

= Effective Gross Income

- Operating Expenses

= NOI

NOI measures the profitability of a property by excluding the cost of debt (mortgage). It essentially looks at the profitability of

the property if it were paid off.

Cap Rate - Net Operating income / Sales Price

The Cap Rate is common measurement tool used by real estate professionals to measure the attractiveness of a property.

Cap Rate measeures NOI as a percent of Sales Price. The higher the Cap Rate the better.

Indicates an area for the user to enter data.

Indicates an area that is automatically calculated.

NOTE: This spreadsheet provided is best used as a reference and should not be considered a substitute for proper property analysis and should be used at your own risk.

Вам также может понравиться

- 1099-r FREEДокумент11 страниц1099-r FREEItzFire2kОценок пока нет

- Box Truck Business PlanДокумент28 страницBox Truck Business PlanDee DawaneОценок пока нет

- Personal Financial StatementДокумент2 страницыPersonal Financial StatementDiane PilonОценок пока нет

- Venture Game RulesДокумент4 страницыVenture Game RulesTim MelkОценок пока нет

- Apartment Analyse FormДокумент5 страницApartment Analyse FormWillie Adams III100% (1)

- AXIS PD Report FormatДокумент7 страницAXIS PD Report Formatvishal kharva100% (1)

- 2011 Cash Flow EvaluatorДокумент42 страницы2011 Cash Flow EvaluatorEddie AyalaОценок пока нет

- Equity AnalysisДокумент17 страницEquity AnalysisVarsha SukhramaniОценок пока нет

- Constellation SoftwareДокумент11 страницConstellation SoftwaregalatimeОценок пока нет

- Food TruckДокумент23 страницыFood TruckMaria Salman85% (13)

- 7803 Stahelin - Performance ReportДокумент1 страница7803 Stahelin - Performance ReportBay Area Equity Group, LLCОценок пока нет

- Xypex Crystalline Repair System: Repair of Concrete Spalling and HoneycombingДокумент3 страницыXypex Crystalline Repair System: Repair of Concrete Spalling and HoneycombingUcok DedyОценок пока нет

- Dry Film Thickness Measurements How Many Are EnoughДокумент11 страницDry Film Thickness Measurements How Many Are EnoughSds Mani SОценок пока нет

- Question of The ReportДокумент8 страницQuestion of The ReportMushfika MuniaОценок пока нет

- Professional Engineers Board: Guidelines For Registration As A Professional EngineerДокумент12 страницProfessional Engineers Board: Guidelines For Registration As A Professional EngineerUcok DedyОценок пока нет

- Professional Engineers Board: Guidelines For Registration As A Professional EngineerДокумент12 страницProfessional Engineers Board: Guidelines For Registration As A Professional EngineerUcok DedyОценок пока нет

- No Broad Level Report Options Available For Report Execution Tcode in SAPДокумент48 страницNo Broad Level Report Options Available For Report Execution Tcode in SAPpankajsri68100% (1)

- NLIU's Guide to Corporate VeilДокумент22 страницыNLIU's Guide to Corporate Veilyash tyagiОценок пока нет

- Translation Agreement (ATA)Документ6 страницTranslation Agreement (ATA)Martin LsОценок пока нет

- Module 1 - Recording Business TransactionДокумент11 страницModule 1 - Recording Business Transactionem fabi100% (1)

- Hydraulic Calculation Submission For ABC Waters Design Features - Bioretention Basin (Rain Garden)Документ9 страницHydraulic Calculation Submission For ABC Waters Design Features - Bioretention Basin (Rain Garden)Ucok DedyОценок пока нет

- Classification of Industries Based on Various FactorsДокумент12 страницClassification of Industries Based on Various FactorsBhagyashree Dhimmar100% (2)

- Accounting For The IphoneДокумент9 страницAccounting For The IphoneFatihahZainalLim100% (1)

- Hydraulic Calculation Submission For ABC Waters Design Features - Vegetated SwalesДокумент9 страницHydraulic Calculation Submission For ABC Waters Design Features - Vegetated SwalesUcok DedyОценок пока нет

- Ud. Buana Trial Balance, Per 1 Desember 2018Документ68 страницUd. Buana Trial Balance, Per 1 Desember 2018M.desviandra Prasetiyo100% (2)

- Group 10 VivendiДокумент18 страницGroup 10 Vivendipkm84uch100% (1)

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageДокумент6 страницInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaОценок пока нет

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageДокумент6 страницInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaОценок пока нет

- Risk Rating Model - BlankДокумент23 страницыRisk Rating Model - BlankpaozinОценок пока нет

- Profit-And-Loss-Statement WELLS FARGOДокумент2 страницыProfit-And-Loss-Statement WELLS FARGOSamantha JahansouzshahiОценок пока нет

- Investment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageДокумент6 страницInvestment Property Analysis Sheet: Provided by Joe Massey of Castle & Cooke MortgageJoseph KingmaОценок пока нет

- Correct Unit Mix ApodДокумент2 страницыCorrect Unit Mix Apodassistant_sccОценок пока нет

- Sept Courtney DownsДокумент82 страницыSept Courtney DownsMarcyОценок пока нет

- Ellsworth - Performance ReportДокумент1 страницаEllsworth - Performance ReportBay Area Equity Group, LLCОценок пока нет

- FOP - Financial Plan Sample SImplified - Updated-1687937974250Документ15 страницFOP - Financial Plan Sample SImplified - Updated-1687937974250MUFTI HUDANI HUDANIОценок пока нет

- 81 Financial and Tax Tips For The Canadian Real Estate Investor Expert Money Saving Advice On Accounting and Tax Planning-33Документ1 страница81 Financial and Tax Tips For The Canadian Real Estate Investor Expert Money Saving Advice On Accounting and Tax Planning-33stumeritОценок пока нет

- Profit and Loss STДокумент3 страницыProfit and Loss STJemalОценок пока нет

- ACC 201 Company Accounting Workbook Template 2Документ20 страницACC 201 Company Accounting Workbook Template 2dee.ride.wit.meОценок пока нет

- Analyze Real Estate InvestmentДокумент1 страницаAnalyze Real Estate InvestmentHisExcellencyОценок пока нет

- Usa Courtney Downs Leaseco, LLC Key Variable Analysis: (Net Rental Income) / (Total Units Occupancy)Документ46 страницUsa Courtney Downs Leaseco, LLC Key Variable Analysis: (Net Rental Income) / (Total Units Occupancy)MarcyОценок пока нет

- Executive SummaryДокумент49 страницExecutive SummaryFikru TesefayeОценок пока нет

- MH Park Evaluation: Sellers NumbersДокумент9 страницMH Park Evaluation: Sellers NumbersRonald KahoraОценок пока нет

- 9941 Mansfield - Performance ReportДокумент1 страница9941 Mansfield - Performance ReportBay Area Equity Group, LLCОценок пока нет

- 2021 Redfin Investor Presentation - March FinalДокумент17 страниц2021 Redfin Investor Presentation - March FinalAbie KatzОценок пока нет

- How To Value Stocks - P - E or EV - EBIT - Kelvestor PDFДокумент4 страницыHow To Value Stocks - P - E or EV - EBIT - Kelvestor PDFPook Kei JinОценок пока нет

- Personal - Financial - Statement GOALДокумент1 страницаPersonal - Financial - Statement GOALberkayyakinnОценок пока нет

- American Valley MHPДокумент21 страницаAmerican Valley MHPDenise MathreОценок пока нет

- 3402 N Shadeland Ave Flex Proforma 10-23 Blacked outДокумент1 страница3402 N Shadeland Ave Flex Proforma 10-23 Blacked outJuan bastoОценок пока нет

- Business Plan Workbook: About This TemplateДокумент15 страницBusiness Plan Workbook: About This Templateavinashr139Оценок пока нет

- Written Apartmentl W Instructions - 0Документ6 страницWritten Apartmentl W Instructions - 0Estrada Pence HoseaОценок пока нет

- Abhishek Bhootna ACC ModelДокумент15 страницAbhishek Bhootna ACC Modelabhishek bhOoTnAОценок пока нет

- 7242 Montrose - Performance ReportДокумент1 страница7242 Montrose - Performance ReportBay Area Equity Group, LLCОценок пока нет

- 6693 Baldwin - Performance ReportДокумент1 страница6693 Baldwin - Performance ReportBay Area Equity Group, LLCОценок пока нет

- HALO BILLING STATEMENT SUMMARYДокумент1 страницаHALO BILLING STATEMENT SUMMARYTaufanОценок пока нет

- Kso TugasДокумент7 страницKso TugasRahmat Ramadhan RahmatОценок пока нет

- Project Benefit Calculation TemplateДокумент1 страницаProject Benefit Calculation Templateananth999Оценок пока нет

- WEALTH STATEMENTДокумент3 страницыWEALTH STATEMENTSaira KhalilОценок пока нет

- Rental Property Management Tracking Built by UpscaleДокумент49 страницRental Property Management Tracking Built by Upscaleemerald apartelОценок пока нет

- 4 EstrellasДокумент162 страницы4 EstrellasCarlos Mdo MonteroОценок пока нет

- 5790 Guilford - Performance ReportДокумент1 страница5790 Guilford - Performance ReportBay Area Equity Group, LLCОценок пока нет

- Financial Statement - Service CompanyДокумент4 страницыFinancial Statement - Service CompanySherly Amalia DewiОценок пока нет

- 2023 08Документ7 страниц2023 08Priyanka NarwalОценок пока нет

- Financial Profile Analysis of Ekos Pte LtdДокумент4 страницыFinancial Profile Analysis of Ekos Pte LtdAzliGhaniОценок пока нет

- Gooood Bank Info 1Документ1 страницаGooood Bank Info 1douglascouvillon241Оценок пока нет

- Voucher - November 2019Документ18 страницVoucher - November 2019Kirby ReyesОценок пока нет

- Adjusted Cash Flow Analysis for Business OwnersДокумент1 страницаAdjusted Cash Flow Analysis for Business Ownerssr9335Оценок пока нет

- Credit Analysis Worksheet FAC COMPLETEДокумент4 страницыCredit Analysis Worksheet FAC COMPLETEpaozinОценок пока нет

- (Bizform) Anggaran Biaya 1Документ1 страница(Bizform) Anggaran Biaya 1nusaibah taqiyyaОценок пока нет

- BRRRR v2Документ5 страницBRRRR v2SujitKGoudarОценок пока нет

- Balance Sheet Prepare and AnalyseДокумент9 страницBalance Sheet Prepare and AnalyseSatyarth GaurОценок пока нет

- Jubilant Ingrevia LTD Financial Results and PriceДокумент1 страницаJubilant Ingrevia LTD Financial Results and Pricerahul patelОценок пока нет

- Financial Feasibility SampleДокумент66 страницFinancial Feasibility SampleKimmyОценок пока нет

- US Internal Revenue Service: f8865sk1 - 2005Документ2 страницыUS Internal Revenue Service: f8865sk1 - 2005IRSОценок пока нет

- Project Benenefit Calculation Template Name Sign-Off Project NameДокумент1 страницаProject Benenefit Calculation Template Name Sign-Off Project NameSyed RaashidОценок пока нет

- Initial Documentation ChecklistДокумент3 страницыInitial Documentation ChecklistDarnell WoodardОценок пока нет

- Women in Banking 40m (Empty)Документ338 страницWomen in Banking 40m (Empty)El rincón de las 5 EL RINCÓN DE LAS 5Оценок пока нет

- Property Analyser CalculatorДокумент14 страницProperty Analyser Calculator3m4illistОценок пока нет

- Basic Financial Package Template (With COGS)Документ47 страницBasic Financial Package Template (With COGS)Rukundo PatrickОценок пока нет

- Knox Grammar School - Fees 2022Документ1 страницаKnox Grammar School - Fees 2022Ucok DedyОценок пока нет

- Ad-Structural Engineers 160822 (En) ITBДокумент1 страницаAd-Structural Engineers 160822 (En) ITBUcok DedyОценок пока нет

- Frame analysis report for Space Gass structureДокумент13 страницFrame analysis report for Space Gass structureUcok DedyОценок пока нет

- Vitrabond ManualДокумент20 страницVitrabond ManualUcok DedyОценок пока нет

- Seismic Structural Attachments: Tolco Fig. 69 - Beam Clamp Retaining StrapДокумент17 страницSeismic Structural Attachments: Tolco Fig. 69 - Beam Clamp Retaining StrapUcok DedyОценок пока нет

- The Arup Journal Issue 1 1967 CompДокумент20 страницThe Arup Journal Issue 1 1967 CompUcok DedyОценок пока нет

- Seismic C Knauf AMF en LayДокумент16 страницSeismic C Knauf AMF en LayUcok DedyОценок пока нет

- Seismic C Knauf AMF en LayДокумент16 страницSeismic C Knauf AMF en LayUcok DedyОценок пока нет

- Fig. 69 - Beam Clamp Retaining Strap: DimensionsДокумент1 страницаFig. 69 - Beam Clamp Retaining Strap: DimensionsUcok DedyОценок пока нет

- Timetable MSHS Term 3Документ17 страницTimetable MSHS Term 3Ucok DedyОценок пока нет

- Is It A Nonstructural Component or A Nonbuilding Structure PDFДокумент4 страницыIs It A Nonstructural Component or A Nonbuilding Structure PDFHyunkyoun JinОценок пока нет

- Standard Const. Joint Details - Non-Traffic Bearing Slab & WallsДокумент1 страницаStandard Const. Joint Details - Non-Traffic Bearing Slab & WallsUcok DedyОценок пока нет

- Detail Plan A and BДокумент2 страницыDetail Plan A and BUcok DedyОценок пока нет

- 1 Admix - Joint Details - Traffic BearingДокумент1 страница1 Admix - Joint Details - Traffic BearingUcok DedyОценок пока нет

- Takiguchi 2019 PDFДокумент14 страницTakiguchi 2019 PDFatrash_fouadОценок пока нет

- Kalsi Building Boards (A4-32p) - EBPI SmallДокумент32 страницыKalsi Building Boards (A4-32p) - EBPI SmallUcok DedyОценок пока нет

- Standard Const. Joint Details - Non-Traffic Bearing Slab & WallsДокумент1 страницаStandard Const. Joint Details - Non-Traffic Bearing Slab & WallsUcok DedyОценок пока нет

- Generator Gantry Elevation A, B & C (Without Kop)Документ1 страницаGenerator Gantry Elevation A, B & C (Without Kop)Ucok DedyОценок пока нет

- Lampiran Jawaban PertanyaanДокумент8 страницLampiran Jawaban PertanyaanUcok DedyОценок пока нет

- Dura-Gritz: High Strength & Corrosion ResistantДокумент12 страницDura-Gritz: High Strength & Corrosion ResistantUcok DedyОценок пока нет

- Xypex Crystalline Coating SystemДокумент3 страницыXypex Crystalline Coating SystemUcok DedyОценок пока нет

- Nippon Steel PDFДокумент50 страницNippon Steel PDFZULFIKAR AZANОценок пока нет

- Serambi Engineering PaperДокумент18 страницSerambi Engineering PaperUcok DedyОценок пока нет

- Mass Chiller SumДокумент10 страницMass Chiller SumUcok DedyОценок пока нет

- Equity Resurch ReportДокумент10 страницEquity Resurch ReportZatch Series UnlimitedОценок пока нет

- Balanced Scorecard & Advanced Analysis and Appraisal of Performance, Financial & Related InformationДокумент17 страницBalanced Scorecard & Advanced Analysis and Appraisal of Performance, Financial & Related InformationSasha 101Оценок пока нет

- Structural Rates 2015Документ3 страницыStructural Rates 2015Raghu Ram100% (1)

- Value of The Building Was $300,000. The Company Paid $200,000 Cash and Issued A Note Payable For The BalanceДокумент3 страницыValue of The Building Was $300,000. The Company Paid $200,000 Cash and Issued A Note Payable For The BalanceBushra NazОценок пока нет

- Bhavyansh Offer Letter - Showket RahmanДокумент2 страницыBhavyansh Offer Letter - Showket RahmanDar AijazОценок пока нет

- Hailu Worku - LuluДокумент112 страницHailu Worku - Luluhailu123Оценок пока нет

- SPCC Accounts Term 2 HomeworkДокумент2 страницыSPCC Accounts Term 2 HomeworkHarsh MishraОценок пока нет

- Tax II OutlineДокумент68 страницTax II OutlineEdmond MenchavezОценок пока нет

- Break Even Point ExplanationДокумент2 страницыBreak Even Point ExplanationEdgar IbarraОценок пока нет

- Section - A: Statutory Update: Part - I: Direct Tax LawsДокумент47 страницSection - A: Statutory Update: Part - I: Direct Tax LawsmdfkjadsjkОценок пока нет

- Foreign Tax Credit: Taxable Income or Loss From Sources Outside The United States (For Category Checked Above)Документ2 страницыForeign Tax Credit: Taxable Income or Loss From Sources Outside The United States (For Category Checked Above)Linda GardnerОценок пока нет

- Cost of Goods Sold Problems PDF 1 3Документ3 страницыCost of Goods Sold Problems PDF 1 3Janine padronesОценок пока нет

- PartnershipДокумент330 страницPartnershipAbby Sta Ana100% (2)

- NPI Introduction W Energy AdvisoryДокумент3 страницыNPI Introduction W Energy AdvisoryDev DuttОценок пока нет

- CFL's Financial Performance and Corporate Governance AnalysisДокумент11 страницCFL's Financial Performance and Corporate Governance AnalysisHugsОценок пока нет

- York, 15 Justice Frankfurter, After Referring To It As An 1, Unfortunate Remark Characterized It As "AДокумент20 страницYork, 15 Justice Frankfurter, After Referring To It As An 1, Unfortunate Remark Characterized It As "AShaiОценок пока нет

- Corporate Finance and ValueДокумент1 страницаCorporate Finance and Valueapi-3721037Оценок пока нет