Академический Документы

Профессиональный Документы

Культура Документы

Syllabus - GST Beginner

Загружено:

nayra khan0 оценок0% нашли этот документ полезным (0 голосов)

134 просмотров4 страницыSyllabus GST Beginner

Оригинальное название

Syllabus _ Gst Beginner

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документSyllabus GST Beginner

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

134 просмотров4 страницыSyllabus - GST Beginner

Загружено:

nayra khanSyllabus GST Beginner

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

DIPLOMA IN GOODS AND SERVICES TAX TM – BEGINNER COURSE

Course Code : GST-01

Class Room Training : 40 Hrs.

E-Learning Facility : One Year Free Login

Eligibility : 10+2 / Equivalent

Suitable for : Understanding Basics about GST

To pursue Higher GST Diploma Courses.

Certificate : GST CENTRE – Participation Certificate.

The Association of GST Professionals, India *

Students can appear Exam after completion of 40 Hours of Classroom Training.

SYLLABUS

This Course will cover highlights of the Goods & Services Tax which include 15 Chapters.

Chapter 1 Overview of Goods and Services Tax

Overview of GST

Implementation of GST

Liability of the Tax Payer

GST Network

GST Council

Self-Examination Questions

Chapter 2 Levy of an Exemption from Tax

Levy of GST – Introduction

Composition Scheme

Remission of Tax / Duty

Self-Examination Questions

Chapter 3 Registration

Introduction

Registration Procedure

Important Points

Special Persons

Amendments / Cancellation

Self-Examination Questions

DIPLOMA IN GOODS & SERVICES TAX (DGST) TM – BEGINNER www.gstcentre.in 1

Chapter 4 Meaning and Scope of Supply

Taxable Supply

Supply of Goods and Supply of Services

Course or Furtherance of Business

Special Transactions

Self-Examination Questions

Chapter 5 Time of Supply

Time of Supply - Goods

Time of Supply –Services

Other Points

Self-Examination Questions

Chapter 6 Valuation in GST

Transaction Value

Valuation Rules

Self-Examination Questions

Chapter 7 Payment of GST

Introduction

Time of GST Payment

How to make payment

Challan Generation & CPIN

TDS & TCS

Self-Examination Questions

Chapter 8 Electronic Commerce

Introduction

Tax Collected at Source (TCS)

Procedures for E-commerce Operator

Self-Examination Questions

Chapter 9 Job Work

Introduction

Part II

Self-Examination Questions

Chapter 10 Input Tax Credit

Introduction

Important Points

Job Worker

DIPLOMA IN GOODS & SERVICES TAX (DGST) TM – BEGINNER www.gstcentre.in 2

Case Studies – Part I

Case Studies – Part I

Self-Examination Questions

Chapter 11 Input Service Distributors

Concept of Input Service Distributor

Legal Formalities for an ISD

Distribution of Credit

Self-Examination Questions

Chapter 12 Matching of Input Tax Credit

Returns

GSTR-2

Other Taxable Persons

Annual Return

Self-Examination Questions

Chapter 13 Overview of the IGST Act

Overview

Other Provisions

Self-Examination Questions

Chapter 14 Place of Supply of Goods & Services

Introduction

Registered and Unregistered Persons

Case Studies – Part I

Case Studies – Part II

Self-Examination Questions

Chapter 15 GST Portal

Introduction

GST Eco-system

GST Suvidha Provider (GSP)

Uploading Invoices

Self-Examination Questions

Revised Model GST Law – Highlights

DIPLOMA IN GOODS & SERVICES TAX (DGST) TM – BEGINNER www.gstcentre.in 3

* Charges apply

DIPLOMA IN GOODS & SERVICES TAX (DGST) TM – BEGINNER www.gstcentre.in 4

Вам также может понравиться

- CA Final GST and Customs Flow Charts Nov 2018Документ173 страницыCA Final GST and Customs Flow Charts Nov 2018Amar ShahОценок пока нет

- Impact of GST On Warehousing and Supply ChainДокумент39 страницImpact of GST On Warehousing and Supply ChainSundaravaradhan Iyengar100% (6)

- GST in Banking SectorДокумент93 страницыGST in Banking SectorMOHD SALIMОценок пока нет

- Impact of GST On Stock MarketДокумент14 страницImpact of GST On Stock MarketSiddhartha0% (1)

- GST Question BankДокумент109 страницGST Question Bankneeraj goyalОценок пока нет

- GST STeps To File ReturnДокумент22 страницыGST STeps To File ReturnAnnu KashyapОценок пока нет

- ESOP and Sweat EquityДокумент7 страницESOP and Sweat EquityShehana RenjuОценок пока нет

- Indirect Impact of GST On Income TaxДокумент14 страницIndirect Impact of GST On Income TaxNAMAN KANSALОценок пока нет

- GST Registration PPT Ver6 28042017Документ46 страницGST Registration PPT Ver6 28042017Sonal AggarwalОценок пока нет

- Impact of GST On Agricultural Sector PDFДокумент3 страницыImpact of GST On Agricultural Sector PDFSiddardha Kumar NelapudiОценок пока нет

- Investigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorОт EverandInvestigation into the Adherence to Corporate Governance in Zimbabwe’s SME SectorОценок пока нет

- Ready Reckoner For Preparing GSTR-9Документ12 страницReady Reckoner For Preparing GSTR-9SATVINDER WALIAОценок пока нет

- TDSДокумент18 страницTDSPratik NaikОценок пока нет

- New Agreement UpdatedДокумент20 страницNew Agreement UpdatedDayalan AОценок пока нет

- PHD Research Bureau PHD Chamber of Commerce and IndustryДокумент33 страницыPHD Research Bureau PHD Chamber of Commerce and IndustrySUNIL PUJARIОценок пока нет

- AX Educted at Ource - I: KPPM & AssociatesДокумент67 страницAX Educted at Ource - I: KPPM & AssociatesSaksham JoshiОценок пока нет

- GST BookДокумент100 страницGST BookNaman ChopraОценок пока нет

- Impact of GST On Automobile IndustryДокумент3 страницыImpact of GST On Automobile Industrypvaibhav08Оценок пока нет

- Impact of GST On LogisticsДокумент18 страницImpact of GST On LogisticsSharath ReddyОценок пока нет

- E-Book On GST by CA. (DR.) G. S. Grewal - 2020Документ58 страницE-Book On GST by CA. (DR.) G. S. Grewal - 2020Aarav DhingraОценок пока нет

- Handbook On GST On Service SectorДокумент276 страницHandbook On GST On Service SectorABC 123100% (1)

- Fema Provisions: Hassle Free Compliance WithДокумент16 страницFema Provisions: Hassle Free Compliance WithjitmОценок пока нет

- Direct Tax Vs Indirect TaxДокумент44 страницыDirect Tax Vs Indirect TaxShuchi BhatiaОценок пока нет

- Life InsuranceДокумент9 страницLife InsuranceAKHLAK UR RASHID CHOWDHURYОценок пока нет

- E-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)Документ7 страницE-Filing of Income Tax Return: SUBMITTED BY: Nisha Ghodake Roll No: 17019. (Functional Project)NISHA GHODAKEОценок пока нет

- Transport Rules GSTДокумент19 страницTransport Rules GSTSudhir KumarОценок пока нет

- Aud 1 To Aud 12Документ12 страницAud 1 To Aud 12kishor kumarОценок пока нет

- Financial ServicesДокумент4 страницыFinancial ServicesAkhil B Kulkarni100% (1)

- TdsДокумент4 страницыTdsshanikaОценок пока нет

- Simplified Goods & Services Tax (GST) For Hotels & RestaurantsДокумент14 страницSimplified Goods & Services Tax (GST) For Hotels & Restaurantsvishaljain_caОценок пока нет

- GST GuideДокумент46 страницGST GuideVikasОценок пока нет

- TDS DocumentДокумент34 страницыTDS DocumentSaleem JavedОценок пока нет

- GST Registration Procedure Chapter 2Документ22 страницыGST Registration Procedure Chapter 2Amreen kousarОценок пока нет

- Handbook On Exempted Supplies Under GSTДокумент205 страницHandbook On Exempted Supplies Under GSTkaaryafacilitiesОценок пока нет

- New Partnership LetterДокумент3 страницыNew Partnership LetterDewang Chheda0% (1)

- Sbi Life InsuranceДокумент4 страницыSbi Life InsuranceJay KotkarОценок пока нет

- Topic: Page NoДокумент21 страницаTopic: Page NoAcchu BajajОценок пока нет

- GST Debit Note Format in ExcelДокумент4 страницыGST Debit Note Format in ExcelVivek PadoleОценок пока нет

- Format of Auditors CertificateДокумент5 страницFormat of Auditors CertificatejayantgeeОценок пока нет

- Goods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLAДокумент30 страницGoods and Services Tax (GST) in India: A Presentation by KRISHNA SHUKLAKrishna ShuklaОценок пока нет

- Unit III Personal Tax Planning Bcom HonsДокумент38 страницUnit III Personal Tax Planning Bcom Honshimanshi25gОценок пока нет

- Mahindra FinanaceДокумент14 страницMahindra FinanaceIshita BhagatОценок пока нет

- Indirect Tax and GSTДокумент124 страницыIndirect Tax and GSTPrasanna KumarОценок пока нет

- E Way Bill Under GST 1.2Документ43 страницыE Way Bill Under GST 1.2Kunal KapadiaОценок пока нет

- GST Flyers: Central Board of Excise & Customs New DelhiДокумент468 страницGST Flyers: Central Board of Excise & Customs New DelhiPrerna YadavОценок пока нет

- ICICI Housing LoansДокумент3 страницыICICI Housing LoansAdv Sheetal SaylekarОценок пока нет

- Statutory CompliancesДокумент4 страницыStatutory CompliancesPratibha ChopraОценок пока нет

- GST Return Business Process For GSTДокумент72 страницыGST Return Business Process For GSTAccounting & Taxation100% (1)

- IND AS 12 - Bhavik Chokshi - FR ShieldДокумент7 страницIND AS 12 - Bhavik Chokshi - FR ShieldSoham UpadhyayОценок пока нет

- Deduction Under Income TaxДокумент57 страницDeduction Under Income Taxmalayali100Оценок пока нет

- Draft Accounting Manual PDFДокумент71 страницаDraft Accounting Manual PDFkishore kumarОценок пока нет

- FEMA Compliance and Recent Policies On FDI - CA Manoj ShahДокумент58 страницFEMA Compliance and Recent Policies On FDI - CA Manoj ShahAbhinay KumarОценок пока нет

- Compendium of Opinions Vol. XXVI - EACДокумент304 страницыCompendium of Opinions Vol. XXVI - EACDarpan Gawade100% (1)

- Course File Income Tax JanuaryДокумент48 страницCourse File Income Tax JanuaryAzad Singh BajariaОценок пока нет

- Chargeble GSTДокумент87 страницChargeble GSTgopaljha84Оценок пока нет

- Compliance Calendar 2022Документ2 страницыCompliance Calendar 2022bhujabaliОценок пока нет

- 36 Useful Chart For Tax ComplianceДокумент45 страниц36 Useful Chart For Tax Compliancech_poddar100% (1)

- Paryant Agarwal SIP ReportДокумент59 страницParyant Agarwal SIP ReportjatinОценок пока нет

- Confidential Information Case Study2Документ3 страницыConfidential Information Case Study2SereneОценок пока нет

- ISBNApplicationДокумент2 страницыISBNApplicationnayra khanОценок пока нет

- Agri. Polytechnic SyllabiДокумент28 страницAgri. Polytechnic Syllabinayra khanОценок пока нет

- ISBNApplicationДокумент2 страницыISBNApplicationnayra khanОценок пока нет

- Agri. Polytechnic SyllabiДокумент28 страницAgri. Polytechnic Syllabinayra khanОценок пока нет

- Agri. Polytechnic SyllabiДокумент28 страницAgri. Polytechnic Syllabinayra khanОценок пока нет

- PGDHM SyllabusДокумент37 страницPGDHM Syllabusnayra khan0% (1)

- English Skill Questions BankДокумент42 страницыEnglish Skill Questions Banknayra khanОценок пока нет

- FitterДокумент144 страницыFitternayra khanОценок пока нет

- Retail Sales Associates UrduДокумент4 страницыRetail Sales Associates Urdunayra khanОценок пока нет

- Hospitality AssistantДокумент9 страницHospitality Assistantnayra khanОценок пока нет

- Warehouse Supervisor Cum Lesson PlannerДокумент56 страницWarehouse Supervisor Cum Lesson Plannernayra khan67% (3)

- Emergency Medical Training Plan Daily Basis 1Документ117 страницEmergency Medical Training Plan Daily Basis 1nayra khanОценок пока нет

- Emergency Medical Training Plan Daily Basis 1Документ12 страницEmergency Medical Training Plan Daily Basis 1nayra khanОценок пока нет

- Emergency Medical Training Plan Daily Basis 1Документ12 страницEmergency Medical Training Plan Daily Basis 1nayra khanОценок пока нет

- Time TableДокумент18 страницTime Tablenayra khanОценок пока нет

- QP THC Q3006 Multi Cuisine CookДокумент71 страницаQP THC Q3006 Multi Cuisine Cooknayra khanОценок пока нет

- Multi Skill Session PlanДокумент171 страницаMulti Skill Session Plannayra khanОценок пока нет

- Attendance SheetДокумент4 страницыAttendance Sheetnayra khanОценок пока нет

- Attendance SheetДокумент4 страницыAttendance Sheetnayra khanОценок пока нет

- Tax.3201-2 Classification of TaxesДокумент3 страницыTax.3201-2 Classification of TaxesMira Louise HernandezОценок пока нет

- Statutory Checklist-Tds OthersДокумент15 страницStatutory Checklist-Tds OthersGaurav KumarОценок пока нет

- Income Tax Ordinance, 2001 (Ordinance 2001) : Publication Date: 31 October 2020Документ21 страницаIncome Tax Ordinance, 2001 (Ordinance 2001) : Publication Date: 31 October 2020Irfan RazaОценок пока нет

- Configuration of Tax Calculation Procedure TAXINNДокумент8 страницConfiguration of Tax Calculation Procedure TAXINNdharmesh6363Оценок пока нет

- 1998 Revenue Memorandum OrdersДокумент9 страниц1998 Revenue Memorandum OrdersGilbert Jay Martin MarfilОценок пока нет

- Mauritius Revenue Authority: T: - F: - E: - WДокумент2 страницыMauritius Revenue Authority: T: - F: - E: - WAmrit ChutoorgoonОценок пока нет

- Final Sad S-131104 Cutting FatДокумент2 страницыFinal Sad S-131104 Cutting FatCAMILLE ANNE PROCESOОценок пока нет

- 1274 PDFДокумент1 страница1274 PDFAbhilashKrishnanОценок пока нет

- Discharge Voucher ULIP End V6.1 RevisedДокумент3 страницыDischarge Voucher ULIP End V6.1 Revisedsunny0908Оценок пока нет

- Of CM Cali QTN 27mar21Документ1 страницаOf CM Cali QTN 27mar21Chetan KaleОценок пока нет

- MCQ - Unit 2Документ15 страницMCQ - Unit 2Niraj PandeyОценок пока нет

- CS - EXE - Income Tax - Notes - Combined PDFДокумент437 страницCS - EXE - Income Tax - Notes - Combined PDFRam Iyer100% (1)

- CRS Form For Tax Residency Self CertificationДокумент2 страницыCRS Form For Tax Residency Self Certificationcoldbrizze2Оценок пока нет

- Revenue Memorandum Order 63-99Документ2 страницыRevenue Memorandum Order 63-99bedan100% (1)

- KGN Pub. Bill No. 16, Majencio Brand SolutionДокумент1 страницаKGN Pub. Bill No. 16, Majencio Brand Solutioncsingh081Оценок пока нет

- Past Paper Inspector Inland Revenue FBR IIR Jobs in FPSCДокумент4 страницыPast Paper Inspector Inland Revenue FBR IIR Jobs in FPSCRaJa71% (14)

- DRC 03Документ2 страницыDRC 03Sonu JainОценок пока нет

- Deposit Interest Certificate 40903908Документ2 страницыDeposit Interest Certificate 40903908adityaОценок пока нет

- 879 Eltron Energy PVT LTDДокумент1 страница879 Eltron Energy PVT LTDHaseeb TyzОценок пока нет

- Sample QP 2 Jan2020Документ23 страницыSample QP 2 Jan2020M Rafeeq100% (1)

- 16 17 PDFДокумент380 страниц16 17 PDFcakartikayОценок пока нет

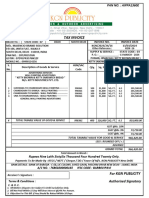

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Vibhor SinghОценок пока нет

- FACTS: Air Canada Is An Offline Air Carrier Selling Passage Tickets in The Philippines, Through A GeneralДокумент4 страницыFACTS: Air Canada Is An Offline Air Carrier Selling Passage Tickets in The Philippines, Through A GeneralHannah Tolentino-DomantayОценок пока нет

- Council Tax Single Person Discount ApplicationДокумент2 страницыCouncil Tax Single Person Discount ApplicationTerry SaundersОценок пока нет

- Profession Tax Challan - MaharashtraДокумент1 страницаProfession Tax Challan - MaharashtraPaymaster Services80% (5)

- 187 Lucky Hardware 23 24Документ1 страница187 Lucky Hardware 23 24REZAUL KARIMОценок пока нет

- Vijay - Redington LTDДокумент1 страницаVijay - Redington LTDBlk KabalaОценок пока нет

- June Current BillДокумент1 страницаJune Current Billsachith0017Оценок пока нет

- GST ChallanДокумент1 страницаGST ChallansouОценок пока нет

- View CertificateДокумент1 страницаView CertificateGopal PenjarlaОценок пока нет