Академический Документы

Профессиональный Документы

Культура Документы

Financial Statement Analysis Slides PDF

Загружено:

BradОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Financial Statement Analysis Slides PDF

Загружено:

BradАвторское право:

Доступные форматы

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Financial Statement

Analysis

6.1 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Examples of External Uses

of Statement Analysis

• Trade Creditors – Focus on the

liquidity of the firm.

• Bondholders – Focus on the

long-term cash flow of the firm.

• Shareholders – Focus on the

profitability and long-term health of

the firm.

6.2 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 1 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Examples of Internal Uses

of Statement Analysis

• Plan – Focus on assessing the current

financial position and evaluating

potential firm opportunities.

• Control – Focus on return on investment

for various assets and asset efficiency.

• Understand – Focus on understanding

how suppliers of funds analyze the firm.

6.3 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Global Accounting Standards

• Convergence of Accounting Standards: Aims to

narrow or remove differences so that investors can

better understand financial statements prepared under

different accounting frameworks

• IASB – International Accounting Standards Board has the

responsibility of IFRS

• IFRS – International Financial Reporting Standards (EU

countries adopted)

• US GAAP – US Generally Accepted Accounting Principles

determined by FASB

• FASB – Financial Accounting Standards Board determines

accounting standards for financial statements

6.4 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 2 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Primary Types of

Financial Statements

Balance Sheet

• A summary of a firm’s financial position on

a given date that shows total assets = total

liabilities + owners’ equity.

Income Statement

• A summary of a firm’s revenues and

expenses over a specified period, ending

with net income or loss for the period.

6.5 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

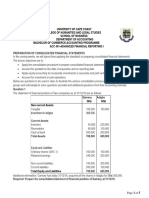

Basket Wonders’ Balance

Sheet (Asset Side)

Basket Wonders Balance Sheet (thousands) Dec. 31, 2007a

Cash $ 90 a. How the firm stands on

Acct. Rec.c 394 a specific date.

Inventories 696 b. What BW owned.

Prepaid Exp d 5 c. Amounts owed by

Accum Tax Prepay 10 customers.

e

Current Assets $1,195 d. Future expense items

Fixed Assets (@Cost)f 1030 already paid.

Less: Acc. Depr. g (329) e. Cash/likely convertible

Net Fix. Assets $ 701 to cash within 1 year.

Investment, LT 50 f. Original amount paid.

Other Assets, LT 223 g. Acc. deductions for

Total Assets b $2,169 wear and tear.

6.6 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 3 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Basket Wonders’ Balance

Sheet (Liability Side)

Basket Wonders Balance Sheet (thousands) Dec. 31, 2007

Notes Payable $ 290 a. Note, Assets =

Acct. Payablec 94 Liabilities + Equity.

Accrued Taxes d 16 b. What BW owed and

Other Accrued Liab. d 100 ownership position.

Current Liab. e $ 500 c. Owed to suppliers for

Long-Term Debt f 530 goods and services.

Shareholders’ Equity d. Unpaid wages,

Com. Stock ($1 par) g 200 salaries, etc.

Add Pd in Capital g 729 e. Debts payable < 1 year.

Retained Earnings h 210 f. Debts payable > 1 year.

Total Equity $1,139 g. Original investment.

Total Liab/Equitya,b $2,169 h. Earnings reinvested.

6.7 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Basket Wonders’

Income Statement

Basket Wonders Statement of Earnings (in thousands)

for Year Ending December 31, 2007a

Net Sales $ 2,211 a. Measures profitability

Cost of Goods Sold b 1,599 over a time period.

Gross Profit $ 612 b. Received, or receivable,

SG&A Expenses c 402 from customers.

EBIT d $ 210 c. Sales comm., adv.,

Interest Expensee 59 officers’ salaries, etc.

EBT f $ 151 d. Operating income.

Income Taxes 60 e. Cost of borrowed funds.

EAT g $ 91 f. Taxable income.

Cash Dividends 38 g. Amount earned for

Increase in RE $ 53 shareholders.

6.8 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 4 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Use of Financial Ratios

A Financial Ratio is Types of

an index that relates Comparisons

two accounting

numbers and is Internal

obtained by dividing Comparisons

one number by the External

other. Comparisons

6.9 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

External Comparisons and

Sources of Industry Ratios

This involves Examples:

comparing the ratios

Risk Management

of one firm with those

Association

of similar firms or with

industry averages. Dun & Bradstreet

Similarity is important Almanac of

as one should Business and

compare “apples to Industrial

apples.” Financial Ratios

6.10 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 5 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Liquidity Ratios

Balance Sheet Ratios Current

Current Assets

Liquidity Ratios Current Liabilities

Shows a firm’s

For Basket Wonders

ability to cover its December 31, 2007

current liabilities

with its current $1,195 = 2.39

assets. $500

6.11 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Liquidity Ratio

Comparisons

Current Ratio

Year BW Industry

2007 2.39 2.15

2006 2.26 2.09

2005 1.91 2.01

Ratio is stronger than the industry average.

6.12 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 6 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Liquidity Ratios

Balance Sheet Ratios Acid-Test (Quick)

Current Assets - Inv

Liquidity Ratios Current Liabilities

Shows a firm’s For Basket Wonders

ability to meet December 31, 2007

current liabilities

with its most liquid $1,195 – $696 = 1.00

assets. $500

6.13 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Liquidity Ratio

Comparisons

Acid-Test Ratio

Year BW Industry

2007 1.00 1.25

2006 1.04 1.23

2005 1.11 1.25

Ratio is weaker than the industry average.

6.14 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 7 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Summary of the Liquidity

Ratio Comparisons

Ratio BW Industry

Current 2.39 2.15

Acid-Test 1.00 1.25

• Strong current ratio and weak acid-test

ratio indicates a potential problem in the

inventories account.

• Note that this industry has a relatively

high level of inventories.

6.15 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Current Ratio – Trend

Analysis Comparison

Trend Analysis of Current Ratio

2.5

2.3

Ratio Value

2.1

BW

1.9 Industry

1.7

1.5

2005 2006 2007

Analysis Year

6.16 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 8 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Acid-Test Ratio – Trend

Analysis Comparison

Trend Analysis of Acid-Test Ratio

1.5

1.3

Ratio Value

1.0 BW

Industry

0.8

0.5

2005 2006 2007

Analysis Year

6.17 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Summary of the Liquidity

Trend Analyses

• The current ratio for BW has been rising

at the same time the acid-test ratio has

been declining.

• The current ratio for the industry has

been rising slowly at the same time the

acid-test ratio has been relatively stable.

• This indicates that inventories are a

significant problem for BW.

6.18 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 9 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Financial Leverage Ratios

Balance Sheet Ratios Debt-to-Equity

Total Debt

Financial Leverage Shareholders’ Equity

Ratios

For Basket Wonders

December 31, 2007

Shows the extent to

which the firm is $1,030 = 0.90

financed by debt. $1,139

6.19 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Financial Leverage

Ratio Comparisons

Debt-to-Equity Ratio

Year BW Industry

2007 0.90 0.90

2006 0.88 0.90

2005 0.81 0.89

BW has average debt utilization

relative to the industry average.

6.20 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 10 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Financial Leverage Ratios

Balance Sheet Ratios Debt-to-Total-Assets

Total Debt

Financial Leverage Total Assets

Ratios

For Basket Wonders

Shows the percentage December 31, 2007

of the firm’s assets

that are supported by $1,030 = 0.47

debt financing. $2,169

6.21 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Financial Leverage

Ratio Comparisons

Debt-to-Total-Asset Ratio

Year BW Industry

2007 0.47 0.47

2006 0.47 0.47

2005 0.45 0.47

BW has average debt utilization

relative to the industry average.

6.22 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 11 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Financial Leverage Ratios

Balance Sheet Ratios Total Capitalization

(i.e., LT-Debt + Equity)

Financial Leverage Total Debt

Ratios Total Capitalization

Shows the relative For Basket Wonders

importance of long-term December 31, 2007

debt to the long-term $1,030 = 0.62

financing of the firm. $1,669

6.23 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Financial Leverage

Ratio Comparisons

Total Capitalization Ratio

Year BW Industry

2007 0.62 0.60

2006 0.62 0.61

2005 0.67 0.62

BW has average long-term debt utilization

relative to the industry average.

6.24 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 12 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Coverage Ratios

Income Statement Interest Coverage

Ratios

EBIT

Interest Charges

Coverage Ratios

For Basket Wonders

Indicates a firm’s December 31, 2007

ability to cover

interest charges. $210 = 3.56

$59

6.25 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Coverage

Ratio Comparisons

Interest Coverage Ratio

Year BW Industry

2007 3.56 5.19

2006 4.35 5.02

2005 10.30 4.66

BW has below average interest coverage

relative to the industry average.

6.26 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 13 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Coverage Ratio – Trend

Analysis Comparison

Trend Analysis of Interest Coverage Ratio

11.0

9.0

Ratio Value

7.0 BW

Industry

5.0

3.0

2005 2006 2007

Analysis Year

6.27 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Summary of the Coverage

Trend Analysis

• The interest coverage ratio for BW has

been falling since 2005. It has been

below industry averages for the past

two years.

• This indicates that low earnings (EBIT)

may be a potential problem for BW.

• Note, we know that debt levels are in

line with the industry averages.

6.28 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 14 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Activity Ratios

Income Statement/ Receivable Turnover

(Assume all sales are credit sales.)

Balance Sheet

Ratios Annual Net Credit Sales

Receivables

Activity Ratios

For Basket Wonders

Indicates quality of December 31, 2007

receivables and how

successful the firm is in $2,211 = 5.61

its collections. $394

6.29 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Activity Ratios

Income Statement/ Avg Collection Period

Balance Sheet

Ratios Days in the Year

Receivable Turnover

Activity Ratios For Basket Wonders

December 31, 2007

Average number of days

that receivables are

outstanding. 365 = 65 days

(or RT in days) 5.61

6.30 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 15 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Activity

Ratio Comparisons

Average Collection Period

Year BW Industry

2007 65.0 65.7

2006 71.1 66.3

2005 83.6 69.2

BW has improved the average collection

period to that of the industry average.

6.31 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Activity Ratios

Income Statement/ Payable Turnover (PT)

(Assume annual credit

Balance Sheet purchases = $1,551.)

Ratios

Annual Credit Purchases

Accounts Payable

Activity Ratios

Indicates the For Basket Wonders

promptness of payment December 31, 2007

to suppliers by the firm. $1551

= 16.5

$94

6.32 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 16 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Activity Ratios

Income Statement/ PT in Days

Balance Sheet

Ratios Days in the Year

Payable Turnover

Activity Ratios

For Basket Wonders

December 31, 2007

Average number of days

that payables are 365

outstanding. = 22.1 days

16.5

6.33 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Activity

Ratio Comparisons

Payable Turnover in Days

Year BW Industry

2007 22.1 46.7

2006 25.4 51.1

2005 43.5 48.5

BW has improved the PT in Days.

Is this good?

6.34 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 17 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Activity Ratios

Income Statement/ Inventory Turnover

Balance Sheet

Ratios Cost of Goods Sold

Inventory

Activity Ratios

For Basket Wonders

Indicates the December 31, 2007

effectiveness of the

inventory management $1,599 = 2.30

practices of the firm. $696

6.35 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Activity

Ratio Comparisons

Inventory Turnover Ratio

Year BW Industry

2007 2.30 3.45

2006 2.44 3.76

2005 2.64 3.69

BW has a very poor inventory turnover ratio.

6.36 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 18 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Inventory Turnover Ratio –

Trend Analysis Comparison

Trend Analysis of Inventory Turnover Ratio

4.0

3.5

Ratio Value

3.0 BW

Industry

2.5

2.0

2005 2006 2007

Analysis Year

6.37 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Activity Ratios

Income Statement/ Total Asset Turnover

Balance Sheet

Ratios Net Sales

Total Assets

Activity Ratios

For Basket Wonders

Indicates the overall December 31, 2007

effectiveness of the firm

in utilizing its assets to $2,211 = 1.02

generate sales. $2,169

6.38 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 19 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Activity

Ratio Comparisons

Total Asset Turnover Ratio

Year BW Industry

2007 1.02 1.17

2006 1.03 1.14

2005 1.01 1.13

BW has a weak total asset turnover ratio.

Why is this ratio considered weak?

6.39 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Profitability Ratios

Income Statement/ Gross Profit Margin

Balance Sheet

Ratios Gross Profit

Net Sales

Profitability Ratios

For Basket Wonders

December 31, 2007

Indicates the efficiency

of operations and firm $612 = 0.277

pricing policies. $2,211

6.40 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 20 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Profitability

Ratio Comparisons

Gross Profit Margin

Year BW Industry

2007 27.7% 31.1%

2006 28.7 30.8

2005 31.3 27.6

BW has a weak Gross Profit Margin.

6.41 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Gross Profit Margin –

Trend Analysis Comparison

Trend Analysis of Gross Profit Margin

35.0

Ratio Value (%)

32.5

30.0 BW

Industry

27.5

25.0

2005 2006 2007

Analysis Year

6.42 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 21 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Profitability Ratios

Income Statement/ Net Profit Margin

Balance Sheet

Ratios Net Profit after Taxes

Net Sales

Profitability Ratios

For Basket Wonders

Indicates the firm’s December 31, 2007

profitability after taking

$91 = 0.041

account of all expenses

$2,211

and income taxes.

6.43 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Profitability

Ratio Comparisons

Net Profit Margin

Year BW Industry

2007 4.1% 8.2%

2006 4.9 8.1

2005 9.0 7.6

BW has a poor Net Profit Margin.

6.44 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 22 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Net Profit Margin –

Trend Analysis Comparison

Trend Analysis of Net Profit Margin

10

9

Ratio Value (%)

8

7 BW

Industry

6

5

4

2005 2006 2007

Analysis Year

6.45 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Profitability Ratios

Income Statement/ Return on Investment

Balance Sheet

Ratios Net Profit after Taxes

Total Assets

Profitability Ratios

For Basket Wonders

Indicates the December 31, 2007

profitability on the

assets of the firm (after $91 = 0.042

all expenses and taxes). $2,160

6.46 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 23 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Profitability

Ratio Comparisons

Return on Investment

Year BW Industry

2007 4.2% 9.6%

2006 5.0 9.1

2005 9.1 10.8

BW has a poor Return on Investment.

6.47 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Return on Investment –

Trend Analysis Comparison

Trend Analysis of Return on Investment

12

Ratio Value (%)

10

8 BW

Industry

6

4

2005 2006 2007

Analysis Year

6.48 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 24 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Profitability Ratios

Income Statement/ Return on Equity

Balance Sheet

Ratios Net Profit after Taxes

Shareholders’ Equity

Profitability Ratios

For Basket Wonders

Indicates the profitability December 31, 2007

to the shareholders of

the firm (after all $91 = 0.08

expenses and taxes). $1,139

6.49 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Profitability

Ratio Comparisons

Return on Equity

Year BW Industry

2007 8.0% 18.0%

2006 9.4 17.2

2005 16.6 20.4

BW has a poor Return on Equity.

6.50 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 25 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Return on Equity –

Trend Analysis Comparison

Trend Analysis of Return on Equity

21.0

Ratio Value (%)

17.5

14.0 BW

Industry

10.5

7.0

2005 2006 2007

Analysis Year

6.51 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Return on Investment and

the Du Pont Approach

Earning Power = Sales profitability ×

Asset efficiency

ROI = Net profit margin ×

Total asset turnover

ROI2007 = 0.041 × 1.02 = 0.042 or 4.2%

ROIIndustry = 0.082 × 1.17 = 0.096 or 9.6%

(Note: values are rounded)

6.52 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 26 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Return on Equity and

the Du Pont Approach

Return On Equity = Net profit margin X

Total asset turnover X

Equity Multiplier

Total Assets

Equity Multiplier =

Shareholders’ Equity

ROE2007 = 0.041 × 1.02 × 1.90 = 0.080

ROEIndustry = 0.082 × 1.17 × 1.88 = 0.180

(Note: values are rounded)

6.53 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Summary of the Profitability

Trend Analyses

• The profitability ratios for BW have ALL

been falling since 2005. Each has been

below the industry averages for the past

three years.

• This indicates that COGS and

administrative costs may both be too

high and a potential problem for BW.

• Note, this result is consistent with the low

interest coverage ratio.

6.54 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 27 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Summary of Ratio Analyses

• Inventories are too high.

• May be paying off creditors

(accounts payable) too soon.

• COGS may be too high.

• Selling, general, and

administrative costs may be too

high.

6.55 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Common-Size Analysis

An analysis of percentage

financial statements where all

balance sheet items are divided

by total assets and all income

statement items are divided by

net sales or revenues.

6.56 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 28 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Basket Wonders’ Common

Size Balance Sheets

Regular (thousands of $) Common-Size (%)

Assets 2005 2006 2007 2005 2006 2007

Cash 148 100 90 12.10 4.89 4.15

AR 283 410 394 23.14 20.06 18.17

Inv 322 616 696 26.33 30.14 32.09

Other CA 10 14 15 0.82 0.68 0.69

Tot CA 763 1,140 1,195 62.39 55.77 55.09

Net FA 349 631 701 28.54 30.87 32.32

LT Inv 0 50 50 0.00 2.45 2.31

Other LT 111 223 223 9.08 10.91 10.28

Tot Assets 1,223 2,044 2,169 100.0 100.0 100.0

6.57 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Basket Wonders’ Common-

Size Balance Sheets

Regular (thousands of $) Common-Size (%)

Liab+Equity 2005 2006 2007 2005 2006 2007

Note Pay 290 295 290 23.71 14.43 13.37

Acct Pay 81 94 94 6.62 4.60 4.33

Accr Tax 13 16 16 1.06 0.78 0.74

Other Accr 15 100 100 1.23 4.89 4.61

Tot CL 399 505 500 32.62 24.71 23.05

LT Debt 150 453 530 12.26 22.16 24.44

Equity 674 1,086 1,139 55.11 53.13 52.51

Tot L+E 1,223 2,044 2,169 100.0 100.0 100.0

6.58 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 29 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Basket Wonders’ Common-

Size Income Statements

Regular (thousands of $) Common-Size (%)

2005 2006 2007 2005 2006 2007

Net Sales 1,235 2,106 2,211 100.0 100.0 100.0

COGS 849 1,501 1,599 68.7 71.3 72.3

Gross Profit 386 605 612 31.3 28.7 27.7

Adm. 180 383 402 14.6 18.2 18.2

EBIT 206 222 210 16.7 10.5 9.5

Int Exp 20 51 59 1.6 2.4 2.7

EBT 186 171 151 15.1 8.1 6.8

EAT 112 103 91 9.1 4.9 4.1

Cash Div 50 50 50 4.0 2.4 2.3

6.59 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Index Analyses

An analysis of percentage financial

statements where all balance sheet

or income statement figures for a

base year equal 100.0 (percent) and

subsequent financial statement

items are expressed as percentages

of their values in the base year.

6.60 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 30 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Basket Wonders’

Indexed Balance Sheets

Regular (thousands of $) Indexed (%)

Assets 2005 2006 2007 2005 2006 2007

Cash 148 100 90 100.0 67.6 60.8

AR 283 410 394 100.0 144.9 139.2

Inv 322 616 696 100.0 191.3 216.1

Other CA 10 14 15 100.0 140.0 150.0

Tot CA 763 1,140 1,195 100.0 149.4 156.6

Net FA 349 631 701 100.0 180.8 200.9

LT Inv 0 50 50 100.0 inf. inf.

Other LT 111 223 223 100.0 200.9 200.9

Tot Assets 1,223 2,044 2,169 100.0 167.1 177.4

6.61 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Basket Wonders’

Indexed Balance Sheets

Regular (thousands of $) Indexed (%)

Liab+Equity 2005 2006 2007 2005 2006 2007

Note Pay 290 295 290 100.0 101.7 100.0

Acct Pay 81 94 94 100.0 116.0 116.0

Accr Tax 13 16 16 100.0 123.1 123.1

Other Accr 15 100 100 100.0 666.7 666.7

Tot CL 399 505 500 100.0 126.6 125.3

LT Debt 150 453 530 100.0 302.0 353.3

Equity 674 1,086 1,139 100.0 161.1 169.0

Tot L+E 1,223 2,044 2,169 100.0 167.1 177.4

6.62 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 31 Carroll University

Fundamentals of Financial Management, 13e

Chapter 6: Financial Statement Analysis

Basket Wonders’ Indexed

Income Statements

Regular (thousands of $) Indexed (%)

2005 2006 2007 2005 2006 2007

Net Sales 1,235 2,106 2,211 100.0 170.5 179.0

COGS 849 1,501 1,599 100.0 176.8 188.3

Gross Profit 386 605 612 100.0 156.7 158.5

Adm. 180 383 402 100.0 212.8 223.3

EBIT 206 222 210 100.0 107.8 101.9

Int Exp 20 51 59 100.0 255.0 295.0

EBT 186 171 151 100.0 91.9 81.2

EAT 112 103 91 100.0 92.0 81.3

Cash Div 50 50 50 100.0 100.0 100.0

6.63 Van Horne and Wachowicz, Fundamentals of Financial Management, 13th edition. © Pearson Education Limited 2009. Created by Gregory Kuhlemeyer.

Van Horne & Wachowicz, by Gregory A. Kuhlemeyer, Ph.D.,

© Pearson Education Limited 2009 VI - 32 Carroll University

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Week 7 - Business FinanceДокумент3 страницыWeek 7 - Business FinanceAries Gonzales CaraganОценок пока нет

- Attachment To State Tax Including Cpa Cert PDFДокумент4 страницыAttachment To State Tax Including Cpa Cert PDFBradОценок пока нет

- Operating and Financial Leverage Slides PDFДокумент27 страницOperating and Financial Leverage Slides PDFBradОценок пока нет

- Business Mathematics - Accounting and FinanceДокумент15 страницBusiness Mathematics - Accounting and Financesharmila100% (3)

- Problem 5: QuestionsДокумент6 страницProblem 5: QuestionsTk KimОценок пока нет

- Financial Management (FM) Question Pack: S. No ACCA Exam Paper Topics CoveredДокумент34 страницыFinancial Management (FM) Question Pack: S. No ACCA Exam Paper Topics CoveredKoketso Mogwe100% (1)

- Albrecht 4e Student CH 13 Pertemuan 5Документ10 страницAlbrecht 4e Student CH 13 Pertemuan 5eugeniaОценок пока нет

- 65874216Документ2 страницы65874216Allen CarlОценок пока нет

- Community Tax PDFДокумент11 страницCommunity Tax PDFBradОценок пока нет

- Risk and Return Slides PDFДокумент26 страницRisk and Return Slides PDFBradОценок пока нет

- Just-in-Time Production Slides PDFДокумент11 страницJust-in-Time Production Slides PDFBradОценок пока нет

- Gantt Chart PDFДокумент38 страницGantt Chart PDFBradОценок пока нет

- Cost of Capital Slides PDFДокумент10 страницCost of Capital Slides PDFBradОценок пока нет

- Capital BudgetingДокумент22 страницыCapital BudgetingBradОценок пока нет

- Gulane Cleaners Accounting WorksheetДокумент4 страницыGulane Cleaners Accounting WorksheetsanchezrowОценок пока нет

- Reconstruction InternalДокумент12 страницReconstruction InternalsviimaОценок пока нет

- Our Lady of Fatima University Quezon City Campus: ACCOUNTING 2B-Fundamentals of Accounting 2Документ7 страницOur Lady of Fatima University Quezon City Campus: ACCOUNTING 2B-Fundamentals of Accounting 2Its meh SushiОценок пока нет

- Acquisition Valuation: Aswath DamodaranДокумент49 страницAcquisition Valuation: Aswath DamodaranUdit AdhlakhaОценок пока нет

- Quiz 1&2 - IiДокумент29 страницQuiz 1&2 - IiJenz Crisha PazОценок пока нет

- WAC02 2017 Jan A2 QP PDFДокумент16 страницWAC02 2017 Jan A2 QP PDFvicky koni tofiОценок пока нет

- Daily Report 402 31-08-2021Документ125 страницDaily Report 402 31-08-2021jay ResearchОценок пока нет

- Textile Industry ProjectДокумент19 страницTextile Industry ProjectMohammad Ajmal AnsariОценок пока нет

- Chapter 13: Schedule VI: Rohit AgarwalДокумент3 страницыChapter 13: Schedule VI: Rohit Agarwalbcom0% (1)

- Conceptual Issues by CA. Naveen ND GuptaДокумент23 страницыConceptual Issues by CA. Naveen ND GuptaTapas PurwarОценок пока нет

- Marginal Costing PDFДокумент16 страницMarginal Costing PDFaditiОценок пока нет

- FinRep SummaryДокумент36 страницFinRep SummaryNikolaОценок пока нет

- Basic Concept FileДокумент97 страницBasic Concept FileArsalan AliОценок пока нет

- Excel Sheet Ratio AnalysisДокумент5 страницExcel Sheet Ratio AnalysisTajalli FatimaОценок пока нет

- Adms 2510 Winter 2007 Final ExaminationДокумент11 страницAdms 2510 Winter 2007 Final ExaminationMohsin Rehman0% (1)

- Assessment of Working CapitalДокумент23 страницыAssessment of Working Capital9019329249Оценок пока нет

- Aarti Industries LTDДокумент8 страницAarti Industries LTDAkash MathewsОценок пока нет

- IFRS 14 - Regulatory Deferral AccountsДокумент3 страницыIFRS 14 - Regulatory Deferral AccountsMarc Eric Redondo100% (1)

- SCM ProblemsДокумент9 страницSCM ProblemsErika Mae UmaliОценок пока нет

- Book 1Документ5 страницBook 1anitaОценок пока нет

- ACC401-Basic Conso-Basic QuestionsДокумент5 страницACC401-Basic Conso-Basic Questionsisaacbediako82Оценок пока нет

- FinManSemis3 UMALIДокумент6 страницFinManSemis3 UMALIJenny Shane UmaliОценок пока нет

- CASE 1: Considering M&A Deal Between Colour Group and Green/YellowДокумент7 страницCASE 1: Considering M&A Deal Between Colour Group and Green/YellowThủy Thiều Thị HồngОценок пока нет

- ACC CourseДокумент22 страницыACC Courseshah md musleminОценок пока нет