Академический Документы

Профессиональный Документы

Культура Документы

Cordon Isabela ES2018

Загружено:

MelvinBuyagawonИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Cordon Isabela ES2018

Загружено:

MelvinBuyagawonАвторское право:

Доступные форматы

EXECUTIVE SUMMARY

A. Introduction

By virtue of House Bill No. 804, The Municipality of Cordon came into existence on

July 1, 1939 sponsored by Hon. Mauro Versoza through Commonwealth Act No.

191.

Cordon is a third Class Municipality consisting of 26 barangays. It is under the

administration of Municipal Mayor, Honorable Lynn M. Zuniega with the assistance

of Vice Mayor, Honorable Charlita J. Mariano and the Sangguniang Bayan including

the ABC President.

The Municipality maintains separate books for General Fund, Special Education Fund

and Trust Fund.

Financial, compliance and value for money audits were conducted on the accounts

and operations of the Municipality of Cordon, Isabela for Calendar Year (CY) 2018.

The audit was conducted to ascertain the fairness of the presentation of the financial

statements and compliance of the Municipality with laws, rules and regulations, as

well as economical, efficient and effective utilization of resources.

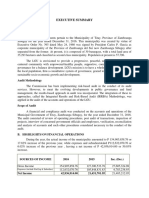

B. Financial Highlights

The total assets, liabilities, government equity, income and expenses for CY 2018

compared with that of the preceding year are as follows:

%

CY 2018 CY 2017

Increase/(Decrease)

Financial Condition

Total Assets 223,502,622.48 186,185,968.18 37,316,654.30 20%

Total Liabilities 72,201,375.87 71,514,434.41 686,941.46 1%

Total Government 32%

151,301,246.61 114,671,533.77 36,629,712.84

Equity

Results of Operation

Total Revenue 147,381,761.91 135,138,559.62 12,243,202.29 9%

Total Expenses 117,715,194.72 113,306,238.07 4,4008,956.65 4%

For CY 2018, the Municipality of Cordon generated a total revenue of

₱147,381,761.91 from local taxes, permits and licenses, service and business income

and internal revenue allotment. The revenue increased by ₱12.243 million or 9% as

compared with that in CY 2017.

C. Auditor’s Opinion on the Financial Statements

We rendered a modified opinion on the fairness of presentation of the Financial

statements as of December 31, 2018 for the reason that the validity, propriety and

existence of Property, Plant and Equipment (PPE) stated at ₱202.503 million or 90%

of total assets, as at December 31, 2018 could not be ascertained due to incomplete

inventory taking, unreconciled discrepancy of ₱0.505 million between accounting and

property records, inclusion of unserviceable properties totalling ₱12.599 million,

inadequacies of subsidiary records and accounting deficiencies, and non-recognition

of Road Networks account from its Registry of Public Infrastructure, which are not in

conformity with existing rules and regulations prescribed under Paragraph 2, Section

124, Volume I of Manual on the New Government Accounting System (MNGAS) for

Local Government Units (LGUs); Section 13, Volume II, of the MNGAS for LGUs;

Sections 58 and 79 of PD 1445; and COA Circular No. 2015-008 dated November 23,

2015.

D. Significant Audit Observations and Recommendations

Favorable Observations

Tax Compliance

The Municipality of Cordon complied with tax laws by withholding applicable

taxes on compensation, goods and services and regularly remits taxes withheld

from employees and suppliers/contractors.

However, in the course of audit, we noted the following significant observations,

together with our recommendations.

Financial and Compliance

1. The accuracy and reliability of Cash-in-Bank accounts totalling

₱32,898,909.72 as at December 31, 2018 could not be ascertained due

to (a) variance of ₱12,187,580.01 between the Accounting Records

and Treasury Records, (b) current and prior years’ book and bank

reconciling items were not immediately adjusted and/or remained

unadjusted; and (c) failure of the Municipal Accountant’s Office to

prepare and submit monthly Bank Reconciliation Statements (BRS)

together with the paid checks and original copies of debit/credit

memos within the prescribed period contrary to existing rules and

regulations as prescribed under Section 6.3 of COA Circular No. 97-

002 dated February 10, 1997 and Section 3.3 of COA Circular No. 96-

011 dated October 2, 1996.

We recommended that Management require the Municipal Accountant:

To reconcile with the Municipal Treasurer the Cash accounts records

on a quarterly basis to reflect an accurate and reliable balance at any

particular period in compliance to Section 6.3 of COA Circular No.

97-002 dated February 10, 1997;

To create an effective and efficient internal control system to avoid

future negative balances of cash in bank - accounts as prescribed in

Section 58 of PD 1445, and to present accurate and reliable reports

that are useful and not misleading to its users;

To give immediate attention and adjust in the books the reconciling

items that are duly supported with valid/complete documents, and

coordinate with the concerned depositary bank regarding the bank

reconciling items that need to be adjusted in the bank books in

conformity with Section 3.3 of COA Circular No. 96-011 dated

October 2, 1996;

To coordinate with LGU’s Depositary Banks for the prompt delivery of

monthly Bank Statements (BS), but in cases where the BS are not yet

available, secure snapshot copy of the bank transactions to facilitate

the timely reconciliation of its bank accounts in compliance with COA

Circular No. 96-011 dated October 2, 1996; and

To promptly prepare and submit Bank Reconciliation Statements on

all bank accounts, together with the paid checks and original copies of

debit/credit memo, pursuant to COA Circular 96-011 dated October 2,

1996 to facilitate the immediate preparation of the necessary

correction/adjusting entries for any discrepancies/errors or other

reconciling items requiring corrections in order to reflect the correct

balance of cash accounts in financial statements.

2. The account Due to Special Education Fund (SEF) totalling

₱17,374,389.57 were not automatically transferred/deposited to the

SEF account maintained contrary to Section 86, Volume I, New

Government Accounting System (NGAS) for LGUs.

We recommended that the Municipal Mayor require the Municipal

Treasurer to deposit directly all her collections accruing to Special

Education Fund (SEF) in the depository bank account maintained for SEF

to avoid possible misappropriation and to strictly adhere to the provisions

on collections pursuant to Section 86, Volume I of NGAS for LGUs.

3. Due to LGU totalling ₱4,348,767.09 were still not remitted by the

Municipality of Cordon contrary to Section 271 to 272 of Republic

Act No. 7160 (RA 7160) or the Local Government Code of 1991 and

Section 36 of COA Circular 92-382.

We recommended that Management promptly remit the shares of Province

of Isabela from collections of RPT and additional one (1) percent SEF Tax

in compliance to Section 271 to 272 of Republic Act No. 7160 (RA 7160)

or the Local Government Code of 1991 and Section 36 of COA Circular

92-382.

4. Cash advances amounting to ₱1,323,099.04 remained unliquidated as

at December 31, 2018 contrary to Section 5 items 7 and 8 of COA

Circular No. 97-002 resulting in possible misstatement of expenses

and government equity accounts in the Financial Statements.

We recommended that the Local Chief Executive adapt strict measures to

regulate the granting of cash advances in accordance with the provisions

of COA Circular 97-002 dated February 10, 1997 and adhere to Item 6.0

COA Circular 2012-004. Any unused or unspent cash advances should be

returned or refunded.

We further recommended that the Municipal Accountant strictly monitor

the settlement of unliquidated cash advances and discontinue granting

additional cash advances unless all outstanding cash advances have been

liquidated. Subsequently, officials and employees with outstanding cash

advances who get separated from the service should not be cleared from

money/property accountability unless liquidations are made. We also

recommended to stop the granting of cash advance to officers and

employees whose position/designation does not conforms to the definition

of accountable officer as stated in the aforementioned circular.

5. Unused balances from completed projects totalling ₱313,279.88 out of

fund transfers from different national government agencies were not

returned contrary to Sections 4.9 and 6.7 of COA Circular No. 94-013

dated December 13, 1994.

We recommended for the immediate return of the unused balances of

completed projects to the source agencies to comply with Sections 4.9 and

6.7 of COA Circular 94-013 dated December 13, 1994.

Value for Money Audit

6. The Municipality of Cordon was unable to utilize ₱6.995 million or

30.26% out of ₱23.120 million appropriations for 20 percent

Development Fund (DF), thus depriving the intended beneficiaries on

the consequential socio-economic and environmental benefits that

could have been derived therefrom.

We recommended that management meticulously and judiciously consider

projects before its inclusion in the Local Development Fund (LDF) and

Annual Investment Program and promptly implement

programs/project/activities embodied in the 20 percent LDF in order to

achieve the desirable socio-economic and environmental benefits as

prescribed under DILG & DBM Joint Memorandum Circular (JMC)

No. 2017-1 dated February 22, 2017.

E. Status of Audit Suspensions, Disallowances and Charges (SASDC)

For CY 2018, one (1) notice of disallowance was issued but has been settled

immediately. As at December 31, 2018, disallowances recorded in the books

amounting to ₱158,465.61 represents disallowances of previous years (prior to the

implementation of the Rules and Regulations on the Settlement of Accounts

contained under COA Circular No. 2009-006 dated September 15, 2009).

F. Status of Implementation of Prior Year’s Audit

Recommendations

Out of the thirteen (13) audit recommendations embodied in the CY 2017 Annual

Audit Report, four (4) were fully implemented, two (2) were partially

implemented and the remaining seven (7) were not implemented and being

reiterated in this report.

Вам также может понравиться

- AMI - Audit Engagement Letter 2018 (V2) PDFДокумент10 страницAMI - Audit Engagement Letter 2018 (V2) PDFSok Chann SocheathОценок пока нет

- Final Test - EY - Q - 3.19.2018Документ23 страницыFinal Test - EY - Q - 3.19.2018KHUÊ TRẦN ÁI100% (2)

- Magsaysay Executive Summary 2020Документ9 страницMagsaysay Executive Summary 2020Johanna Mae AutidaОценок пока нет

- Malabang Executive Summary 2018Документ5 страницMalabang Executive Summary 2018Evan LoirtОценок пока нет

- Cabanatuan City Executive Summary 2021Документ7 страницCabanatuan City Executive Summary 2021blazelayoutОценок пока нет

- Dasmariñas2020 Audit ReportДокумент228 страницDasmariñas2020 Audit ReportJuswa DanyelОценок пока нет

- Northern Kabuntalan Executive Summary 2018Документ4 страницыNorthern Kabuntalan Executive Summary 2018Angelo GuevarraОценок пока нет

- Mabalacat City Executive Summary 2022Документ6 страницMabalacat City Executive Summary 2022Emerson Floyd Quendan DimarucutОценок пока нет

- San Antonio Executive Summary 2019Документ6 страницSan Antonio Executive Summary 2019Jay AnnОценок пока нет

- Rizal Executive Summary 2021Документ8 страницRizal Executive Summary 2021Jean Monique TolentinoОценок пока нет

- SantiagoCity Isabela ES2018Документ7 страницSantiagoCity Isabela ES2018MelvinBuyagawonОценок пока нет

- Tanauan City Executive Summary 2021Документ13 страницTanauan City Executive Summary 2021Hannah Isabel ContiОценок пока нет

- Lugait Executive Summary 2018Документ4 страницыLugait Executive Summary 2018OZ La NB AnamiОценок пока нет

- Balabac Executive Summary 2022Документ5 страницBalabac Executive Summary 2022Gray XoxoОценок пока нет

- Santa Ignacia Executive Summary 2017Документ6 страницSanta Ignacia Executive Summary 2017Reyna YlenaОценок пока нет

- Santa Rosa Executive Summary 2018Документ5 страницSanta Rosa Executive Summary 2018Shmily MendozaОценок пока нет

- 03-DRT2019 Executive SummaryДокумент6 страниц03-DRT2019 Executive SummaryGiovanni MartinОценок пока нет

- Masantol Executive Summary 2019Документ5 страницMasantol Executive Summary 2019Juan Miguel NavarroОценок пока нет

- Meycauayan City Executive Summary 2019Документ8 страницMeycauayan City Executive Summary 2019Secret secretОценок пока нет

- Malimono SDN ES2018Документ10 страницMalimono SDN ES2018Joseph Raymund BautistaОценок пока нет

- San Fernando City Executive Summary 2017Документ7 страницSan Fernando City Executive Summary 2017Ryan De GuzmanОценок пока нет

- Silang Executive Summary 2018Документ6 страницSilang Executive Summary 2018Realie BorbeОценок пока нет

- 01-Angadanan2020 Transmittal LettersДокумент14 страниц01-Angadanan2020 Transmittal LettersAlicia NhsОценок пока нет

- Bislig City Executive Summary 2017Документ8 страницBislig City Executive Summary 2017liezeloragaОценок пока нет

- Bamban Executive Summary 2017Документ6 страницBamban Executive Summary 2017Reyna YlenaОценок пока нет

- Inbound 2597438685297588432Документ6 страницInbound 2597438685297588432RA MonillaОценок пока нет

- Morong Executive Summary 2016Документ6 страницMorong Executive Summary 2016Ed Drexel LizardoОценок пока нет

- Agency Background: Executive Summary A. IntroductionДокумент4 страницыAgency Background: Executive Summary A. IntroductionRObelyn Alwod BOta-angОценок пока нет

- OdionganДокумент7 страницOdionganJohn Claude TabanОценок пока нет

- Alegria Executive Summary 2019Документ6 страницAlegria Executive Summary 2019Ronel CadelinoОценок пока нет

- Iba Executive Summary 2022Документ8 страницIba Executive Summary 2022Lance LagundiОценок пока нет

- Motiong Executive Summary 2017Документ7 страницMotiong Executive Summary 2017Ronel CadelinoОценок пока нет

- Executive Summary: A. IntroductionДокумент5 страницExecutive Summary: A. IntroductionAlicia NhsОценок пока нет

- La Paz Executive Summary 2019Документ10 страницLa Paz Executive Summary 2019Rene BalloОценок пока нет

- San Agustin Executive Summary 2018Документ4 страницыSan Agustin Executive Summary 2018minds2magicОценок пока нет

- Quezon Executive Summary 2021 PDFДокумент4 страницыQuezon Executive Summary 2021 PDFEsnar de Castro Jr.Оценок пока нет

- Mayantoc Executive Summary 2022Документ8 страницMayantoc Executive Summary 2022John NicosОценок пока нет

- Conner Executive Summary 2019Документ8 страницConner Executive Summary 2019The ApprenticeОценок пока нет

- Executive Summary: A. IntroductionДокумент5 страницExecutive Summary: A. Introductionsandra bolokОценок пока нет

- Prosperidad ADS ES2016Документ66 страницProsperidad ADS ES2016J JaОценок пока нет

- Morong Executive Summary 2021Документ6 страницMorong Executive Summary 2021Marvelouz Kate AbarioОценок пока нет

- 03-Estancia2022 Executive SummaryДокумент4 страницы03-Estancia2022 Executive SummaryEi Mi SanОценок пока нет

- Oton Executive Summary 2017Документ5 страницOton Executive Summary 2017Franz FulhamОценок пока нет

- San Miguel Executive Summary 2011Документ12 страницSan Miguel Executive Summary 2011Justine CastilloОценок пока нет

- Taytay Water District Executive Summary 2018Документ6 страницTaytay Water District Executive Summary 2018Allan SobrepeñaОценок пока нет

- Sasmuan Pampanga ES2019Документ7 страницSasmuan Pampanga ES2019Wilmar AbriolОценок пока нет

- Dipaculao Aurora ES2017Документ6 страницDipaculao Aurora ES2017kim ann m. avenillaОценок пока нет

- TaclobanCity2017 Audit Report PDFДокумент170 страницTaclobanCity2017 Audit Report PDFJulPadayaoОценок пока нет

- Executive Summary: A. IntroductionДокумент6 страницExecutive Summary: A. IntroductionMarcoОценок пока нет

- Surallah Executive Summary 2020Документ5 страницSurallah Executive Summary 2020Kynard PatrickОценок пока нет

- Agusan Del Sur Executive Summary 2018Документ8 страницAgusan Del Sur Executive Summary 2018Sittie Fatma ReporsОценок пока нет

- Executive SummaryДокумент8 страницExecutive SummaryNathan Roy OngcarrancejaОценок пока нет

- Olongapo City Executive Summary 2022Документ9 страницOlongapo City Executive Summary 2022Mary Patricia Irma MoralesОценок пока нет

- Villaba Executive Summary 2021Документ5 страницVillaba Executive Summary 2021Johanna Mae AutidaОценок пока нет

- Kalayaan Executive Summary 2014Документ6 страницKalayaan Executive Summary 2014Aira Kathrina PerezОценок пока нет

- Santo Nino Executive Summary 2017Документ6 страницSanto Nino Executive Summary 2017Meranie FrancisqueteОценок пока нет

- Anda Executive Summary 2010Документ5 страницAnda Executive Summary 2010Henry AunzoОценок пока нет

- Titay ZS ES2016Документ5 страницTitay ZS ES2016J JaОценок пока нет

- Sta. Barbara Executive Summary 2021Документ4 страницыSta. Barbara Executive Summary 2021Jose MacaОценок пока нет

- Science City of Munoz Executive Summary 2020Документ4 страницыScience City of Munoz Executive Summary 2020Jane ButllerОценок пока нет

- San Felipe Executive Summary 2020Документ5 страницSan Felipe Executive Summary 2020Jay AnnОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- Category A B C D F: Assessment Rubric For Virtual PresentationДокумент1 страницаCategory A B C D F: Assessment Rubric For Virtual PresentationMelvinBuyagawonОценок пока нет

- IlaganCity Isabela ES2018Документ6 страницIlaganCity Isabela ES2018MelvinBuyagawonОценок пока нет

- SantiagoCity Isabela ES2018Документ7 страницSantiagoCity Isabela ES2018MelvinBuyagawonОценок пока нет

- Branches of ScienceДокумент13 страницBranches of ScienceMelvinBuyagawonОценок пока нет

- Invitation To Submit Offer To Purchase: Pampanga BranchДокумент12 страницInvitation To Submit Offer To Purchase: Pampanga BranchRoy Rowe Baldoza EscotonОценок пока нет

- Annual Report 2016 17annualДокумент218 страницAnnual Report 2016 17annualDhananjay pathareОценок пока нет

- Chapter7 Budgets and Preparing The MasteДокумент44 страницыChapter7 Budgets and Preparing The MasteAnthony Corneau100% (1)

- Bank SupervisionДокумент91 страницаBank Supervisionabdalla osmanОценок пока нет

- New Government Accounting SystemДокумент2 страницыNew Government Accounting SystemOwdray CiaОценок пока нет

- Chapter Three Basic Concepts of Audit PlanningДокумент20 страницChapter Three Basic Concepts of Audit PlanningNigussie BerhanuОценок пока нет

- Anki Reddy. N: Career ObjectiveДокумент3 страницыAnki Reddy. N: Career ObjectiveyashpalОценок пока нет

- Export Procedure in IndiaДокумент16 страницExport Procedure in IndiaRohan AroraОценок пока нет

- Questions Tracker (Q&A)Документ16 страницQuestions Tracker (Q&A)The Brain Dump PHОценок пока нет

- Risk Management Practices and Islamic Banks: An Empirical Investigation From PakistanДокумент9 страницRisk Management Practices and Islamic Banks: An Empirical Investigation From PakistanJoko SiwantonoОценок пока нет

- Vetas Tech ReportДокумент135 страницVetas Tech ReportDiego URibeОценок пока нет

- Asha Itr 4Документ11 страницAsha Itr 4Niraj JaiswalОценок пока нет

- Z003800101201740141305080572 448187Документ51 страницаZ003800101201740141305080572 448187Dian AnitaОценок пока нет

- Chapter 7 - AuditingДокумент33 страницыChapter 7 - AuditingUmar FarooqОценок пока нет

- 01 Sarbanes-Oxley - Preparing - For - Internal - Control - Reporting - EYДокумент40 страниц01 Sarbanes-Oxley - Preparing - For - Internal - Control - Reporting - EYJuan QuintanillaОценок пока нет

- Preweek Auditing Theory 2014Документ86 страницPreweek Auditing Theory 2014Angelica AllanicОценок пока нет

- Lecture 3 Handouts - PCFMДокумент18 страницLecture 3 Handouts - PCFMjaveria zahidОценок пока нет

- 19 Differences Between A Company and PartnershipДокумент11 страниц19 Differences Between A Company and PartnershipFazal MuezОценок пока нет

- P2int 2012 Dec QДокумент7 страницP2int 2012 Dec QMhamudul HasanОценок пока нет

- Skill Audit ProcessДокумент2 страницыSkill Audit ProcessthrinadОценок пока нет

- Lo 1Документ3 страницыLo 1Uzma SiddiquiОценок пока нет

- Laporan Keuangan PT - Sido Muncul NewДокумент7 страницLaporan Keuangan PT - Sido Muncul NewReni YulianiОценок пока нет

- Guide To The Assessment of IT Risk (GAIT) - Part 5Документ10 страницGuide To The Assessment of IT Risk (GAIT) - Part 5Ko ZawОценок пока нет

- Audit Quality ControlДокумент11 страницAudit Quality ControlChinee CastilloОценок пока нет

- Refer To The Second General Standard of Generally Accepted Auditing StandardsДокумент3 страницыRefer To The Second General Standard of Generally Accepted Auditing StandardsAgenttZeeroOutsiderОценок пока нет

- Sunrays Textile Report Final 2020-21Документ27 страницSunrays Textile Report Final 2020-21hhaiderОценок пока нет

- A Student's Guide To Cost-Benefit AnalysisДокумент2 страницыA Student's Guide To Cost-Benefit AnalysisAlbyziaОценок пока нет

- Root Cause Analysis Example Pipeline Weld FULLДокумент11 страницRoot Cause Analysis Example Pipeline Weld FULLjacm_zarОценок пока нет