Академический Документы

Профессиональный Документы

Культура Документы

Investments in Equity Securities: Control May Be Exercised in Some Instances Even If Holding Is Less Than 50%

Загружено:

Irah LouiseОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Investments in Equity Securities: Control May Be Exercised in Some Instances Even If Holding Is Less Than 50%

Загружено:

Irah LouiseАвторское право:

Доступные форматы

CHAPTER 4 Classifications of Equity Investments

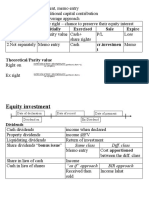

INVESTMENTS IN EQUITY SECURITIES A. Equity Investments at Fair Value

through Profit or Loss

Nature of Equity Securities Initial Recognition

Equity Securities – represent equity interest - Measured at initial recognition and each of

represented by certificate of share capital or potential the reporting date at fair value

share in other corporate entities. - Transaction Cost at initial recognition are

not part of initial cost and charge to expense

Reasons to by another enterprise to purchase a share To record the acquisition

capital: Equity Investments – FVPL xx

1. As temporary placements of excess cash and Broker’s Commission (if any) xx

held primarily for sale in near term to Cash xx

generate income in short term price To record the entry to appropriate bring the

fluctuations. investment at fair value

2. To obtain long term customer or supplier or Equity Investments – FVPL xx

creditor relationship to secure operating or Unrealized Gains on Equity Investments xx

financing arrangements with these

companies (Fair Value – Purchase Price)

3. To exercise significant influence or control

over the operating policies of another entity. To record the sold of share during the

subsequent year

Classifications of Equity Securities

Cash xx

Less than 20% Equity Investments – FVPL xx

Gain in Sale of Equity Investments xx

- Investors does not have significant influence

over the investee company *At reporting date, the investment shall be

- Equity investments = FAIR VALUE adjusted to fair value. Any change in fair value is

20% - 50% taken to income or loss in profit or loss

- Investors has significant influence over the B. Equity Investments at Fair Value

investee company through Other Comprehensive Income

- Investments in Associates or Joint Venture =

use EQUITY METHOD unless expected to Initial Recognition

be disposed within 12 months - Measured at purchase price plus directly

More than 50% attributable transaction cost

- Investors has control over the investee To record the acquisition

company Equity Investments – FVOCI xx

- Parent-Subsidiary Relationship Cash xx

- Consolidate Financial Statements unless To record the entry to appropriate bring the

falling under exemption in PAS/IAS 7 investment at fair value

Equity Investments – FVOCI xx

*Control may be exercised in some instances even if Unrealized Gains on Equity Investments xx

holding is less than 50%

(Fair Value – Initial Cost)

To record the sold of share during the Transactions Subsequent to Initial

subsequent year Recognition

Equity Investments – FVOCI xx Share Split (stock split) – reduction in the par or

Unrealized Gains on Equity Investments xx stated value of share capital accompanied by a

Cash xx proportionate increase in the number of shares

Equity Investments – FVPL xx outstanding.

- Does not affect the equity shareholder in

To record the transfer the cumulative balance of the issuing corporation

unrealized gains and losses to the retained

earnings The investors record the receipt of the additional

shares through a memorandum entry only

Unrealized Gains on Equity Investments xx indicating the change in the number of shares

Retained Earnings xx

(net selling price – initial cost) Dividends

- Corporate contributions to its shareholders

proportionate to the number of shares held

C. Investment in Associate or Investment in

by the latter

joint venture

Investment in Associate - Provides the holder the Cash Dividends – recognized as income

ability to participate but not to control the financial when received or receivable

and operating policy decisions of the investee

company To record the acquisition

Investment in joint venture – an investor that Cash xx

jointly controls the operation of another entity Dividend Revenue xx

through share capital ownership

The distributions of dividends involves 3

D. Investment in Subsidiaries significant dates:

- Gives the holder the power to govern the 1. Date of declaration

financial and operating of an entity so as to 2. Date of record

obtain benefits from its activities 3. Date of Payment

Note:

A shareholder selling his securities after the date

Trading Equity Securities – FVPL

of declaration but before the date of record, sell 2

Non-Trading Equity Securities – Day 1 irrevocable

types of financial assets:

choice of designating either at FVPL OR FVOCI

1. The investment in shares

2. Dividend Receivable

If the securities are for trading purposes = FVPL

If the securities are non-trading at initial recognition

Liquidating Dividends – return of the

= the enterprise shall make an irrevocable decision

investor’s cost of investment as the

investee’s earnings prior to the date of the

Recognition Principle for Financial Assets

acquisition is logically considered by the

original seller in setting the selling price of

When an entity becomes a party to the contractual

the shares

provisions of the instruments

- Dividends declared come from the balance

of contributed capital accounts of the issuing

The Financial Asset shall be recognized if the

corporation

entity becomes the holder of the financial

instrument

Bonds Issue or Share Dividend Impairment of Equity Investment measured at

- The investee company distributes as fair Value

dividends, shares in the same class held by

shareholders - No longer tested for impairment

- An investor receiving a bonus issue records

the transaction by making a memorandum

entry Investments in Associates and Joint Ventures

A bonus issue in the form of another class of

share capital also termed as special bonus issue,

is treated similar to property dividends

The share received as bonus issue is recognized

at fair value with a credit to dividend income

To record the receipt of shares

Equity Investments xx

Dividend Revenue xx

Property Dividends

- When dividends are distributable in the form

of the investee’s non cash assets, the

investor records the asset received as

dividend revenue at the asset’s fair value

To record the receipt of dividends

Equity Investments xx

Dividend Revenue xx

Share Rights

Pre-emptive Right – enables them to maintain

their ownership interest in the corporation.

Share Warrant – evidences a shareholder’s

right

Upon exercise of rights, the new shares acquired shall

be measured at the fair value of these shares

Theoretical Fair Value of Share Rights

In the absence of fair value...

TFV = fair value of share ex rights – subscription

price/ number of rights needed to buy one share

Financial Statements presentation

FVPL – current asset

FVOCI – non-current asset

above all hindi ko pinipigialng sumama ka.

Swear to God, alam ng Diyos nay un laang ang

dahilan ko.

Alam mo nandun man o wala, pumunta ka

nalang, Napapagod na din kase akong i-explain

sarili ko sayo, napapagod na akong ulit ulitin

sayo yung dahilan. Yung paulit ulit ko nalang

sinasabi na pano kung yung ex ko naman yung

kasmaa ko. Yung pinipilit kong malagay ka sa

pwesto ko para lang marealize mo kung bakit

ayaw ko. Naiintindihan ko naman kase kung

bakit nagaglit ka kase di mo naman narasanan

na maging magkaklase kami ni lem habang tayo.

Isipin mo kaya, kayanin mo kaya yon? Yung

lolokohin kami ni sir naldoza kahit meron na

akong ikaw? Nung panahong niloloko kayo ni

sir, oo nagalit ako natural ang sakit kaya nun

sakin, na hello meron ka ng ako pero bakit

ganun. Joke man yon pero syempre may sakit

sakin. Yun lang naman pakiusap ko eh at

pumayag ka naman non diga. Yun nga yong

bago mo ko balikan diba? Siguro mali na nagalit

agad ako, oo humihigi ako ng sorry don. Pero

hindi maling nagalit ako kase aminin man natin

ang laking issue satin ng mga ex nay an diba. O

eto papaalala ko na ulit yung ginawa ni aila ha,

partida hinarap lang saglit sa video call, anong

nangyari nun. Edi yon naghiwalay tayo. Kaya

sana maintindihan mo din ako. Hindi naman to

sa pananakal nalang eh, yun bang I respeto mo

din yung sakit nafeefeel ko pag usapang past

mo kase for sure naman kahit pa sabihing okay

kayo ni lem ay may ilang dyan at sakit dahil sa

pinag samahan namin diga. Kumbaga eh

respeto nalang din natin sa isa’t isa yon eh. Pero

Вам также может понравиться

- Intro To Financial Accounting Horngen 11e Chapter2 SolutionsДокумент41 страницаIntro To Financial Accounting Horngen 11e Chapter2 SolutionsArena Arena100% (7)

- Investment in Equity Securities 2Документ26 страницInvestment in Equity Securities 2Mhelka Tiodianco0% (1)

- FARAP 4406A Investment in Equity SecuritiesДокумент8 страницFARAP 4406A Investment in Equity SecuritiesLei PangilinanОценок пока нет

- CHSP Comprehensive Template by DOLEДокумент15 страницCHSP Comprehensive Template by DOLEkatherineОценок пока нет

- Alfred Cesar QuinsayДокумент3 страницыAlfred Cesar QuinsayIrah Louise67% (3)

- Chapter 4Документ4 страницыChapter 4Irah LouiseОценок пока нет

- Chapter 4 Investments in Equity SecuritiesДокумент25 страницChapter 4 Investments in Equity SecuritiesCarylle silveoОценок пока нет

- CHAPTER 22 Theory Financial Assets at Fair ValueДокумент3 страницыCHAPTER 22 Theory Financial Assets at Fair ValueRomel BucaloyОценок пока нет

- Investment in Equity and Debt SecuritiesДокумент3 страницыInvestment in Equity and Debt SecuritiesBryan ReyesОценок пока нет

- Investment in Equity Securities 2Документ6 страницInvestment in Equity Securities 2RomeОценок пока нет

- FAR-4207 (Investment in Equity Securities)Документ3 страницыFAR-4207 (Investment in Equity Securities)Jhonmel Christian AmoОценок пока нет

- FAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerДокумент12 страницFAR.111 - INVESTMENT IN EQUITY SECURITIES AND DEBT SECURITIES With AnswerMae100% (1)

- 06 Equity InvestmentsДокумент8 страниц06 Equity InvestmentsAllegria AlamoОценок пока нет

- FAR-Lecture 3Документ9 страницFAR-Lecture 3wingsenigma 00Оценок пока нет

- Chapter 5 Investments in Equity SecuritiesДокумент13 страницChapter 5 Investments in Equity SecuritiesKrissa Mae Longos100% (2)

- Chapter 12 - 220426 - 162131Документ47 страницChapter 12 - 220426 - 162131CY YangОценок пока нет

- Summary 217 229Документ5 страницSummary 217 229Love alexchelle ducutОценок пока нет

- Initially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Документ8 страницInitially Exercised Sale Expire: Market Value of Share Subscription Price No - of Rights Purchase 1 Share+1Bryan NatadОценок пока нет

- H.09 Accounting For InvestmentsДокумент14 страницH.09 Accounting For Investmentschen.abellar.swuОценок пока нет

- Actrev2 - InvestmentsДокумент19 страницActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- Chapter 4 - Investments in Equity SecuritiesДокумент51 страницаChapter 4 - Investments in Equity SecuritiesYel100% (2)

- Auditing&Assurance-Audit Of-Investment Divinagracia, Khyla A.Документ10 страницAuditing&Assurance-Audit Of-Investment Divinagracia, Khyla A.Khyla DivinagraciaОценок пока нет

- Stock Acquisition DOAДокумент9 страницStock Acquisition DOAShekinah Grace SantuaОценок пока нет

- Cfas PFRS 9 Pas 28Документ31 страницаCfas PFRS 9 Pas 28quintanamarfrancisОценок пока нет

- Notes FAR Investment in Associates Equity MethodДокумент4 страницыNotes FAR Investment in Associates Equity MethodKerwin Lester MandacОценок пока нет

- IAS 28 - IFRS 9 (Accounting For Associates and Financial Instruments)Документ29 страницIAS 28 - IFRS 9 (Accounting For Associates and Financial Instruments)Hiền MỹОценок пока нет

- Consolidated Comprehensive IncomeДокумент6 страницConsolidated Comprehensive IncomeNathalie G LuceroОценок пока нет

- Ia InvestmentsДокумент11 страницIa InvestmentsJhunnie LoriaОценок пока нет

- Seminar 1A - Group Reporting: (A) Power Over The InvesteeДокумент44 страницыSeminar 1A - Group Reporting: (A) Power Over The InvesteeJasmine TayОценок пока нет

- Business CombinationДокумент4 страницыBusiness CombinationNicole AutrizОценок пока нет

- Accounting For Investment in O/SДокумент4 страницыAccounting For Investment in O/SchinchangeОценок пока нет

- Notes - AFAR - Consolidated Financial Statements (PFRS 10)Документ5 страницNotes - AFAR - Consolidated Financial Statements (PFRS 10)Charles MateoОценок пока нет

- Intermediate Accounting - Investment in Associate (Pas 28)Документ3 страницыIntermediate Accounting - Investment in Associate (Pas 28)22100629Оценок пока нет

- Financial Asset at Fair ValueДокумент4 страницыFinancial Asset at Fair ValueDaren Dame Jodi RentasidaОценок пока нет

- Week 05 - 02 - Module 11 - Investment in Equity InstrumentsДокумент10 страницWeek 05 - 02 - Module 11 - Investment in Equity Instruments지마리Оценок пока нет

- Financial AssertsДокумент2 страницыFinancial AssertsromamikhaelalouisseОценок пока нет

- Horngren Ima15 Im 17Документ19 страницHorngren Ima15 Im 17Ahmed AlhawyОценок пока нет

- Financial Assets at Fair ValueДокумент2 страницыFinancial Assets at Fair ValueNicole Allyson AguantaОценок пока нет

- 2.3 Audit of InvestmentsДокумент2 страницы2.3 Audit of Investmentsantonette seradОценок пока нет

- Lesson 11Документ7 страницLesson 11Jamaica bunielОценок пока нет

- Lesson 13Документ9 страницLesson 13Jamaica bunielОценок пока нет

- InvestmentДокумент4 страницыInvestmentTupayb AgosОценок пока нет

- Philippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Документ13 страницPhilippine School of Business Administration: Integrated Review - Auditing BLD 2 Semester 2020-2021Thalia UyОценок пока нет

- AC7&8 Module 4 Investments in Equity SecuritiesДокумент28 страницAC7&8 Module 4 Investments in Equity SecuritiesCatherine JaramillaОценок пока нет

- PPE NotesДокумент4 страницыPPE Notesaldric taclanОценок пока нет

- Lecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794Документ18 страницLecture Financial Accounting (8 - E) - Appendix E - Robert Libby, Patricia A. Libby, Daniel G. Short - 1130794Đức DramaОценок пока нет

- Share Rights, Credit Investment in Shares (To Investment in Shares and Credit Cash. Measured atДокумент1 страницаShare Rights, Credit Investment in Shares (To Investment in Shares and Credit Cash. Measured atNicole Allyson AguantaОценок пока нет

- Investment NotesДокумент12 страницInvestment NotesLenrey CobachaОценок пока нет

- Intermediate Acc NotesДокумент24 страницыIntermediate Acc Notesyurineo losisОценок пока нет

- Notes Financial Asset ReviewerДокумент25 страницNotes Financial Asset ReviewerStephen Jay RioОценок пока нет

- Reviewer - IntaccДокумент36 страницReviewer - IntaccPixie CanaveralОценок пока нет

- Notes FAR 2Документ9 страницNotes FAR 2ALLYSA DENIELLE SAYATОценок пока нет

- FAR 2 Discussion Material - Shareholders' Equity PDFДокумент4 страницыFAR 2 Discussion Material - Shareholders' Equity PDFAisah ReemОценок пока нет

- Investment in Equity Securities - IA1Документ17 страницInvestment in Equity Securities - IA1dumpyforhimОценок пока нет

- Intacc Ass 1Документ5 страницIntacc Ass 1Pixie CanaveralОценок пока нет

- Audit of Investments: Investment PurposeДокумент11 страницAudit of Investments: Investment PurposeTracy Miranda BognotОценок пока нет

- IA1 Financial Assets at Fair ValueДокумент11 страницIA1 Financial Assets at Fair ValueSteffanie OlivarОценок пока нет

- Unit IV InvestmentsДокумент16 страницUnit IV InvestmentsJonnacel TañadaОценок пока нет

- InvestmentsДокумент7 страницInvestmentsNicole MoralesОценок пока нет

- Investments in Equity Securities and Debt Securities - LectureДокумент6 страницInvestments in Equity Securities and Debt Securities - LectureJazmine Arianne DalayОценок пока нет

- Preparation of Separate Financial StatementsДокумент29 страницPreparation of Separate Financial StatementschingОценок пока нет

- Obligations of Third Person To Restore - Circumstances Denominated As Badges (Mark or Sign) of FraudДокумент6 страницObligations of Third Person To Restore - Circumstances Denominated As Badges (Mark or Sign) of FraudIrah LouiseОценок пока нет

- DECISION: Produce 175 of Chickens and 25 of Turkeys To Maximize Profit of PHP 8250Документ3 страницыDECISION: Produce 175 of Chickens and 25 of Turkeys To Maximize Profit of PHP 8250Irah LouiseОценок пока нет

- ACTIVTIESДокумент3 страницыACTIVTIESIrah LouiseОценок пока нет

- Contracts 2Документ3 страницыContracts 2Irah LouiseОценок пока нет

- Of Financial PositionДокумент3 страницыOf Financial PositionIrah LouiseОценок пока нет

- Ka1 Ka102 A 3.02 en ProdДокумент1 страницаKa1 Ka102 A 3.02 en Prodirina_makedonijaОценок пока нет

- Group 7 Conceputal FrameworkДокумент8 страницGroup 7 Conceputal FrameworkIrah Louise100% (1)

- 02 Focus Group SolutionДокумент1 страница02 Focus Group SolutionIrah LouiseОценок пока нет

- Answers - V2Chapter 1 2012Документ10 страницAnswers - V2Chapter 1 2012Christopher Diaz0% (1)

- Chapter Objec0Ves: de La Salle Lipa Financial Accoun0Ng and Repor0Ng MspunayДокумент12 страницChapter Objec0Ves: de La Salle Lipa Financial Accoun0Ng and Repor0Ng MspunayAnonymous IKqZn7Оценок пока нет

- SosДокумент1 страницаSosIrah Louise25% (4)

- Daddy (Pioneers Baseball)Документ1 страницаDaddy (Pioneers Baseball)Irah LouiseОценок пока нет

- Lasallian Five Core Principles: de La Salle LipaДокумент5 страницLasallian Five Core Principles: de La Salle LipaIrah LouiseОценок пока нет

- History: Benzene RingДокумент3 страницыHistory: Benzene RingIrah LouiseОценок пока нет

- C5 Human Flourishing PDFДокумент10 страницC5 Human Flourishing PDFIrah LouiseОценок пока нет

- Di Ko Na Alam Sa Life KoДокумент3 страницыDi Ko Na Alam Sa Life KoIrah LouiseОценок пока нет

- 4.2 Measures of Correlation and RegressionДокумент17 страниц4.2 Measures of Correlation and RegressionJohn Amiel Dale MalgapoОценок пока нет

- Measures of Correlation and RegressionДокумент9 страницMeasures of Correlation and RegressionIrah LouiseОценок пока нет

- Costcon AnswersДокумент3 страницыCostcon AnswersIrah LouiseОценок пока нет

- 2018 FAR Module2-RecordingBusinessTransactionsДокумент4 страницы2018 FAR Module2-RecordingBusinessTransactionsIrah LouiseОценок пока нет

- Chapter Objec0Ves: de La Salle Lipa Financial Accoun0Ng and Repor0Ng MspunayДокумент12 страницChapter Objec0Ves: de La Salle Lipa Financial Accoun0Ng and Repor0Ng MspunayAnonymous IKqZn7Оценок пока нет

- Comparative Balance Sheet: MeaningДокумент64 страницыComparative Balance Sheet: MeaningRahit MitraОценок пока нет

- Fed Foreclosure PetitionДокумент80 страницFed Foreclosure PetitionudhayaisroОценок пока нет

- 2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookДокумент8 страниц2023 Grade 11 Provincial Examination Accounting P1 (English) November 2023 Answer BookChantelle IsaksОценок пока нет

- Recently Asked KYC Interview Questions and AnswersДокумент21 страницаRecently Asked KYC Interview Questions and AnswersChika Novita PutriОценок пока нет

- Lesson 29 - General AnnuitiesДокумент67 страницLesson 29 - General AnnuitiesAlfredo LabadorОценок пока нет

- 14 Excise Invoice FormatДокумент1 страница14 Excise Invoice FormatZahirabbas BhimaniОценок пока нет

- Report in BM 222Документ5 страницReport in BM 222Neil Dela Cruz AmmenОценок пока нет

- Credit Risk Modelling Literature ReviewДокумент5 страницCredit Risk Modelling Literature Reviewea3h1c1p100% (1)

- Cryptocurrencies and Its Contemporary Impact On The Preparation of The Financial StatementДокумент4 страницыCryptocurrencies and Its Contemporary Impact On The Preparation of The Financial StatementAziz Rajim BundaОценок пока нет

- Eco Sem6Документ8 страницEco Sem6smarttalksaurabhОценок пока нет

- National Income Accounting - 2020 - PrintДокумент31 страницаNational Income Accounting - 2020 - PrintAndrea RodriguezОценок пока нет

- Lesson 1 (RESPONSIBILITIES AND ACCOUNTABILITIES OF ENTREPRENEURS TO EMPLOYEES, GOVERNMENT, CREDITORS AND SUPPLIERS)Документ40 страницLesson 1 (RESPONSIBILITIES AND ACCOUNTABILITIES OF ENTREPRENEURS TO EMPLOYEES, GOVERNMENT, CREDITORS AND SUPPLIERS)kc.malimbanОценок пока нет

- Banking Theory, Law and PracticeДокумент51 страницаBanking Theory, Law and PracticePrem Kumar.DОценок пока нет

- 1557278181265Документ12 страниц1557278181265Hema VarmanОценок пока нет

- Quiz - QuestionsДокумент20 страницQuiz - QuestionsArturo ArbajeОценок пока нет

- CFTC Commitments of Traders Report - CME (Futures Only) 06082013Документ10 страницCFTC Commitments of Traders Report - CME (Futures Only) 06082013Md YusofОценок пока нет

- CFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameДокумент20 страницCFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameVaibhav SarinОценок пока нет

- Suggested Solutions/ Answers Fall 2016 Examinations 1 of 8: Business Taxation (G5) - Graduation LevelДокумент8 страницSuggested Solutions/ Answers Fall 2016 Examinations 1 of 8: Business Taxation (G5) - Graduation LevelQadirОценок пока нет

- 201FIN Tutorial 3 Financial Statements Analysis and RatiosДокумент3 страницы201FIN Tutorial 3 Financial Statements Analysis and RatiosAbdulaziz HОценок пока нет

- Banking Regulation Act 1949Документ4 страницыBanking Regulation Act 1949sunil_mishra04Оценок пока нет

- Part F - Additional QuestionsДокумент9 страницPart F - Additional QuestionsDesmond Grasie ZumankyereОценок пока нет

- Case Study On Panipat-Jalandhar Toll Road ProjectДокумент26 страницCase Study On Panipat-Jalandhar Toll Road ProjectNeeraj Kumar Ojha50% (2)

- Statute of Limitations For Collecting A DebtДокумент2 страницыStatute of Limitations For Collecting A DebtmikotanakaОценок пока нет

- Accounting Concepts and PrinciplesДокумент8 страницAccounting Concepts and PrinciplesNikki BalsinoОценок пока нет

- A Guide To Business PHD ApplicationsДокумент24 страницыA Guide To Business PHD ApplicationsSampad AcharyaОценок пока нет

- Closing America's Infrastructure Gap:: The Role of Public-Private PartnershДокумент42 страницыClosing America's Infrastructure Gap:: The Role of Public-Private PartnershrodrigobmmОценок пока нет

- Internship ReportДокумент33 страницыInternship ReportPriyanka A SОценок пока нет

- Why Investors Must Wring Out HIGH Beta From Portfolio?Документ4 страницыWhy Investors Must Wring Out HIGH Beta From Portfolio?Yogesh V GabaniОценок пока нет

- Tally Accounting Book by Ca MD ImranДокумент6 страницTally Accounting Book by Ca MD ImranMd ImranОценок пока нет