Академический Документы

Профессиональный Документы

Культура Документы

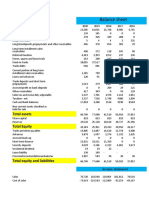

Balance Sheet: Particulars 2014 2015 Assets

Загружено:

Taiba SarmadОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Balance Sheet: Particulars 2014 2015 Assets

Загружено:

Taiba SarmadАвторское право:

Доступные форматы

Balance Sheet

Amounts i

Particulars 2014 2015

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 684,798,311 696,321,121

Intangible Assets 2,247,136 2,254,228

Biological Assets 9,341,334 8,795,333

Long term Recieveables 1,974,780 1,974,780

698,361,561 709,345,462

CURRENT ASSETS

Stores and spares 19,457,038 29,549,570

Stock-in-trade 405,756,555 313,067,277

Trade debts 96,601,581 109,963,834

Loans and advances, prepayments and other receivables 147,086,354 38,909,504

Income tax recoverable - 153,965,507

Cash and bank balances 34,314,031 13,216,209

703,215,559 658,671,901

TOTAL ASSETS 1,401,577,120 1,368,017,363

EQUITY AND LIABILITIES

SHARE CAPITAL AND RESERVES

Authorised Capital 20,000,000 20,000,000

Issued subscribed paid up capital 78,750,000 78,750,000

Reserves 9,635,878 9,635,878

Unappropriate Profit 490,527,386 484,201,186

TOTAL EQUITY 578,913,264 572,587,064

NON-CURRENT LIABILITIES

Deffered taxation - 52,492,282

Deferred Liabilities 157,033,057 105,277,960

Long term finance secured 149,333,333 106,666,665

306,366,390 264,436,907

CURRENT LIABILITIES

Current portion of long-term finance 10,666,667 42,666,668

Short term running finance 331,973,482 376,641,761

Creditors, accrued and other liabilities 164,653,092 105,114,723

Accrued finance cost on short term running finance 9,004,225 6,620,240

516,297,466 531,043,392

TOTAL LIABILITIES 822,663,856 795,480,299

CONTINGENCIES AND COMMITMENTS

TOTAL EQUITY AND LIABILITIES 1,401,577,120 1,368,067,363

Ratio Analysis

2014 2015

Liquidity

Current ratio 1.36 1.24

Quick (acid-test) ratio 0.58 0.65

Other liquidity ratios

Cash ratio 0.07 0.02

Net working capital to total assets 0.13 0.09

Interval measures 1,623.83 3,233.96

Asset Utilization Ratios

Inventory Turnover 3.51 4.13

Days' sale in inventory 104 88

Receivable turnover 20 15

Days' sales in receivables 18 24

Net working capital turnover 12.31 22.82

Fixed asset turnover 2.79 2.40

Total asset turnover 1.39 1.24

Long-term solvency, or financial leverage, ratios

Total debt ratio 0.59 0.58

Debt-equity ratio 1.42 1.39

Equity multiplier 2.42 2.39

Long- term debt ratio 0.21 0.16

Times interest earned ratio 4.10 1.53

Cash coverage ratio

Profitability ratio

Profit margin 0.0552 0.0160

Return on assets (ROA) 0.0767 0.0198

Return on equity (ROE) 0.1856 0.0473

Market value ratios

Price-earning ratio 0.7328 2.9091

PEG ratio

Price-sales ratio

Market to book ratio

Tobin's Q ratio

Enterprise vale- EBITDA

Balance Sheet

Amounts in Rupees

2016 2017 2018 2019 2020

668,991,855 769340633.25 884741728.2375 1017452987.473 1170070935.594

2,076,700 2388205 2746435.75 3158401.1125 3632161.279375

8,205,000 9435750 10851112.5 12478779.375 14350596.28125

1,974,780 2270997 2611646.55 3003393.5325 3453902.562375

681,248,335 783,435,585 900,950,923 1,036,093,561 1,191,507,596

26,879,437 30911352.55 35548055.4325 40880263.74738 47012303.30948

376,429,996 432894495.4 497828669.71 572502970.1665 658378415.6915

119,516,939 137444479.85 158061151.8275 181770324.6016 209035873.2919

30,636,203 35231633.45 40516378.4675 46593835.23763 53582910.52327

160,602,743 184693154.45 212397127.6175 244256696.7601 280895201.2741

19,686,493 22639466.95 26035386.9925 29940695.04138 34431799.29758

733,751,811 843,814,583 970,386,770 1,115,944,786 1,283,336,503

1,415,000,146 1,627,250,168 1,871,337,693 2,152,038,347 2,474,844,099

200,000,000 230000000 264500000 304175000 349801250

78,750,000 90562500 104146875 119768906.25 137734242.1875

9,635,878 11081259.7 12743448.655 14654965.95325 16853210.84624

452,535,627 520415971.05 598478366.7075 688250121.7136 791487639.9707

540,921,505 622,059,731 715,368,690 822,673,994 946,075,093

53,890,464 61974033.6 71270138.64 81960659.436 94254758.3514

95,129,885 109399367.75 125809272.9125 144680663.8494 166382763.4268

- - - - -

149,020,349 171,373,401 197,079,412 226,641,323 260,637,522

106,666,665 122666664.75 141066664.4625 162226664.1319 186560663.7517

486,101,770 559017035.5 642869590.825 739300029.4488 850195033.8661

126,610,548 145602130.2 167442449.73 192558817.1895 221442639.7679

5,679,309 6531205.35 7510886.1525 8637519.075375 9933146.936681

725,058,292 833,817,036 958,889,591 1,102,723,030 1,268,131,484

874,078,641 1,005,190,437 1,155,969,003 1,329,364,353 1,528,769,006

1,415,000,146 1,627,250,168 1,871,337,693 2,152,038,347 2,474,844,099

o Analysis

2016 2017 2018 2019 2020

1.01 1.01 1.01 1.01 1.01

0.49 0.49 0.49 0.49 0.49

0.03 0.03 0.03 0.03 0.03

0.01 0.01 0.01 0.01 0.01

5,949.76 5,949.76 5,949.76 5,949.76 5,949.76

3.42 3.42 3.42 3.42 3.42

107 107 107 107 107

14 14 14 14 14

26 26 26 26 26

37.31 37.31 37.31 37.31 37.31

2.47 2.47 2.47 2.47 2.47

1.19 1.19 1.19 1.19 1.19

0.62 0.62 0.62 0.62 0.62

1.62 1.62 1.62 1.62 1.62

2.62 2.62 2.62 2.62 2.62

- - - - -

1.05 1.05 1.05 1.05 1.05

(0.0072) (0.0072) (0.0072) (0.0072) (0.0072)

(0.0086) (0.0086) (0.0086) (0.0086) (0.0086)

(0.0224) (0.0224) (0.0224) (0.0224) (0.0224)

(6.5038) (5.6555) (4.9178) (4.2763) (3.7186)

Statement of Comprehensive Income

Amounts in Rupees

Particulars 2014 2015 2016 2017

Profit for the period 107,464,622 27,069,910 (12,108,364) (13,924,619)

Items that will not be reclassified to profit or

loss

Remeasurement of retirement benefit (1,221,639) 5,978,890 130,305 149,851

Items that may be reclassified subsquently to

profit or loss

Total comprehensive income for the year 106,242,983 33,048,800 (11,978,059) (13,774,768)

sive Income

ts in Rupees

2018 2019 2020

(16,013,311) (18,415,308) (21,177,604)

172,328 198,178 227,904

(15,840,983) (18,217,130) (20,949,700)

Profit and Loss Account

Amounts in Rupees

Particulars 2,014 2,015 2,016

Sales 1,945,126,430 1,696,332,638 1,679,461,946

Cost of sales (1,423,776,984) (1,292,628,532) (1,286,380,012)

Gross profit 521,349,446 403,704,106 393,081,934

Administrative expenses (95,153,037) (103,015,226) (103,908,093)

Distribution and marketing expenses (275,836,084) (240,215,552) (261,060,067)

Other operating expenses (9,397,863) (2,998,690) (2,167,460)

Other operating income 17,104,796 16,866,190 19,067,139

Profit from operations 158,067,258 74,340,828 45,013,453

Finance cost (38,590,614) (48,485,951) (42,919,936)

Profit before tax 119,476,644 25,854,877 2,093,517

Taxation (12,012,022) 1,215,033 (14,201,881)

(Loss) / profit for the year 107,464,622 27,069,910 (12,108,364)

(Loss) /earnings per share-basic and dilute 13.65 3.44 (1.54)

1,945,126,430

s Account

Amounts in Rupees

2,017 2,018 2,019 2,020

1,931,381,238 2,221,088,424 2,554,251,687 2,937,389,440

(1,479,337,014) (1,701,237,566) (1,956,423,201) (2,249,886,681)

452,044,224 519,850,858 597,828,486 687,502,759

(119,494,307) (137,418,453) (158,031,221) (181,735,904)

(300,219,077) (345,251,939) (397,039,729) (456,595,689)

(2,492,579) (2,866,466) (3,296,436) (3,790,901)

21,927,210 25,216,291 28,998,735 33,348,545

51,765,471 59,530,292 68,459,835 78,728,811

(49,357,926) (56,761,615) (65,275,858) (75,067,236)

2,407,545 2,768,676 3,183,978 3,661,574

(16,332,163) (18,781,988) (21,599,286) (24,839,179)

(13,924,619) (16,013,311) (18,415,308) (21,177,604)

(1.77) (2.03) (2.34) (2.69)

Statement of Cashflow

Amount in Rup

Particulars 2,014 2,015 2,016

Cash flow from operating activities

Cash generated from operation 75,683,606 143,876,211 86,427,999

Finance cost paid (31,071,532) (50,869,936) (43,860,867)

Net income tax paid (60,878,383) (26,103,584) (22,238,420)

Retirement benefits paid (5,496,243) (10,324,394) (25,060,565)

Net cash generated from/used in operating

activities (21,762,552) 56,578,297 (4,731,853)

Cash flows from investing activities

Fixed capital expenditure (337,548,934) (77,236,162) (42,523,562)

Purchase of intangible assets (1,606,150) (489,130) (277,950)

Purchase of Biological assets (1,236,440) (50,150) -

Net increase in long term security deposits (1,224,780) - -

Proceeds from sale of Biological assets 2,625,700 1,994,700 213,350

Prooceeds from sale of property plant and

equipment 9,592,326 4,291,727 4,535,828

Net cash used in investing activities (329,398,278) (71,489,015) (38,052,334)

Cashflows from financing activities

Dividend paid (47,196,454) (40,188,716) (19,459,020)

Long term loans(repaid)/acquired 160,000,000 (10,666,667) (42,666,668)

Net cash (used in)/generated from financing

activities 112,803,546 (50,855,383) (62,125,688)

Net (decrease) in cash and cash equivalents (238,357,284) (65,766,101) (102,989,725)

Cash and cash equivalents at the beginning of the

year (59,302,167) (297,659,451) (363,425,552)

Cash and cash equivalents at end of each year (297,659,451) (363,425,552) (466,415,277)

of Cashflow

Amount in Rupees

2,017 2,018 2,019 2,020

99,392,199 114,301,029 131,446,183 151,163,110

(50,439,997) (58,005,997) (66,706,896) (76,712,931)

(25,574,183) (29,410,310) (33,821,857) (38,895,136)

(28,819,650) (33,142,597) (38,113,987) (43,831,085)

(5,441,631) (6,257,876) (7,196,557) (8,276,040)

(48,902,096) (56,237,411) (64,673,022) (74,373,976)

(319,643) (367,589) (422,727) (486,136)

- - - -

- - - -

245,353 282,155 324,479 373,150

5,216,202 5,998,633 6,898,427 7,933,192

(43,760,184) (50,324,212) (57,872,843) (66,553,770)

(22,377,873) (25,734,554) (29,594,737) (34,033,948)

(49,066,668) (56,426,668) (64,890,669) (74,624,269)

(71,444,541) (82,161,222) (94,485,406) (108,658,217)

(102,989,725) (102,989,725) (102,989,725) (102,989,725)

(363,425,552) (363,425,552) (363,425,552) (363,425,552)

(466,415,277) (466,415,277) (466,415,277) (466,415,277)

Вам также может понравиться

- Beximco Pharmaceuticals LimitedДокумент4 страницыBeximco Pharmaceuticals Limitedsamia0akter-228864Оценок пока нет

- Ratio Analysis of Fuel Company-3Документ21 страницаRatio Analysis of Fuel Company-3Zakaria ShuvoОценок пока нет

- BF1 Package Ratios ForecastingДокумент16 страницBF1 Package Ratios ForecastingBilal Javed JafraniОценок пока нет

- Financial Report - ShyamДокумент14 страницFinancial Report - ShyamYaswanth MaripiОценок пока нет

- Balance Sheet Comparison 2017-2015Документ9 страницBalance Sheet Comparison 2017-2015sumeer shafiqОценок пока нет

- Ain 20201025074Документ8 страницAin 20201025074HAMMADHRОценок пока нет

- Atlas Honda: Analysis of Financial Statements Balance SheetДокумент4 страницыAtlas Honda: Analysis of Financial Statements Balance Sheetrouf786Оценок пока нет

- Kohinoor Chemicals Balance Sheet Analysis 2016-2019Документ37 страницKohinoor Chemicals Balance Sheet Analysis 2016-2019Sharif KhanОценок пока нет

- Confidence Cement sales growth and profit over timeДокумент20 страницConfidence Cement sales growth and profit over timeIftekar Hasan SajibОценок пока нет

- Cement Ratio AnalysisДокумент12 страницCement Ratio AnalysisAreeba SheikhОценок пока нет

- FIN254 Project NSU (Excel File)Документ6 страницFIN254 Project NSU (Excel File)Sirazum SaadОценок пока нет

- Agriauto industry financial ratios and trendsДокумент5 страницAgriauto industry financial ratios and trendsSader AzamОценок пока нет

- Balance Sheet: Total Assets Total EquityДокумент6 страницBalance Sheet: Total Assets Total EquityDeepak MatlaniОценок пока нет

- ViTrox's Income and Cash Flow Statements for 2016-2018Документ6 страницViTrox's Income and Cash Flow Statements for 2016-2018Hong JunОценок пока нет

- FMOD PROJECT WeefervДокумент13 страницFMOD PROJECT WeefervOmer CrestianiОценок пока нет

- M Saeed 20-26 ProjectДокумент30 страницM Saeed 20-26 ProjectMohammed Saeed 20-26Оценок пока нет

- Rak Ceramics: Income StatementДокумент27 страницRak Ceramics: Income StatementRafsan JahangirОценок пока нет

- Ratio Analysis of Engro Vs NestleДокумент24 страницыRatio Analysis of Engro Vs NestleMuhammad SalmanОценок пока нет

- DG Khan Cement Financial StatementsДокумент8 страницDG Khan Cement Financial StatementsAsad BumbiaОценок пока нет

- Analysis of Balance Sheet Trends 2017-2015Документ8 страницAnalysis of Balance Sheet Trends 2017-2015sumeer shafiqОценок пока нет

- Titan Company TemplateДокумент18 страницTitan Company Templatesejal aroraОценок пока нет

- Assessment WorkbookДокумент7 страницAssessment WorkbookMiguel Pacheco ChicaОценок пока нет

- Seema Ma'amДокумент14 страницSeema Ma'ampranav chauhanОценок пока нет

- Payment For Interest and Income Taxes Cash Payment For InterestДокумент5 страницPayment For Interest and Income Taxes Cash Payment For InterestsenОценок пока нет

- Excel File SuzukiДокумент18 страницExcel File SuzukiMahnoor AfzalОценок пока нет

- STD Balance Sheet 3Документ2 страницыSTD Balance Sheet 3AbhijeetBhiseОценок пока нет

- LDG - Financial TemplateДокумент20 страницLDG - Financial TemplateQuan LeОценок пока нет

- Pak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Документ14 страницPak Electron Limited: BALANCE SHEET - Vertical Analysis (Rupee in Million)Abdul RehmanОценок пока нет

- Credit Memo For Gas Authority of IndiaДокумент15 страницCredit Memo For Gas Authority of IndiaKrina ShahОценок пока нет

- Financial Statements Analysis: Arsalan FarooqueДокумент31 страницаFinancial Statements Analysis: Arsalan FarooqueMuhib NoharioОценок пока нет

- Minda Industries - Forecasted SpreadsheetДокумент47 страницMinda Industries - Forecasted SpreadsheetAmit Kumar SinghОценок пока нет

- Assets: Balance SheetДокумент4 страницыAssets: Balance SheetAsadvirkОценок пока нет

- SEFAM AJMC-RatiosДокумент26 страницSEFAM AJMC-RatiosShanzeh WaheedОценок пока нет

- "Dewan Cement": Income Statement 2008 2007 2006 2005 2004Документ30 страниц"Dewan Cement": Income Statement 2008 2007 2006 2005 2004Asfand Kamal0% (1)

- Analysis of Balance Sheet: AssetsДокумент7 страницAnalysis of Balance Sheet: AssetsMuhammad AshfaqОценок пока нет

- Sir Sarwar AFSДокумент41 страницаSir Sarwar AFSawaischeemaОценок пока нет

- Excel TopgloveДокумент21 страницаExcel Topglovearil azharОценок пока нет

- Total Shareholders Funds 12,797 13,195 10,206 10,505 10,485Документ6 страницTotal Shareholders Funds 12,797 13,195 10,206 10,505 10,485sayan duttaОценок пока нет

- Financial Statement AnalysisДокумент5 страницFinancial Statement AnalysisMohammad Abid MiahОценок пока нет

- Pran Company Ratio AnalysisДокумент6 страницPran Company Ratio AnalysisAhmed Afridi Bin FerdousОценок пока нет

- Alk SidoДокумент2 страницыAlk SidoRebertha HerwinОценок пока нет

- Ratio Analysis 2023Документ25 страницRatio Analysis 2023mishantlilareОценок пока нет

- Berger Paints Excel SheetДокумент27 страницBerger Paints Excel SheetHamza100% (1)

- Buxly Paint: Balance SheetДокумент33 страницыBuxly Paint: Balance SheetJarhan AzeemОценок пока нет

- Financial Model 3 Statement Model - Final - MotilalДокумент13 страницFinancial Model 3 Statement Model - Final - MotilalSouvik BardhanОценок пока нет

- Sap Id 35428Документ21 страницаSap Id 35428Muhammad TalhaОценок пока нет

- Sefam Financial Statement AnalysisДокумент25 страницSefam Financial Statement AnalysisShanzeh WaheedОценок пока нет

- HUBCO Financial Statements Analysis 2015-2020Документ97 страницHUBCO Financial Statements Analysis 2015-2020Omer CrestianiОценок пока нет

- Receivable Breakdown Type of Inventory Amount of Receivable Days Overdue RemarkДокумент6 страницReceivable Breakdown Type of Inventory Amount of Receivable Days Overdue RemarkYonatanОценок пока нет

- Finacial Position FINALДокумент4 страницыFinacial Position FINALLenard TaberdoОценок пока нет

- Rs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37Документ6 страницRs PPS 28.5 Crores # Shares 1025.93 Crores Market Cap 29,239.01 Crores Cash 5,245.61 Crores Debt 25,364.97 Crores EV 49,358.37priyanshu14Оценок пока нет

- BDlampДокумент59 страницBDlampSohel RanaОценок пока нет

- Vodafone Class 5Документ6 страницVodafone Class 5akashkr619Оценок пока нет

- Balance Sheet: AssetsДокумент19 страницBalance Sheet: Assetssumeer shafiqОценок пока нет

- Shell Pakistan: Total Non Current Assets Current AssetsДокумент17 страницShell Pakistan: Total Non Current Assets Current AssetsshamzanОценок пока нет

- Annual financial statement analysis of assets, equity and liabilities from 2019-2021Документ4 страницыAnnual financial statement analysis of assets, equity and liabilities from 2019-2021Muhammad AkmalОценок пока нет

- Engro FertilizerДокумент9 страницEngro FertilizerAbdullah Sohail100% (1)

- Balaji TelefilmsДокумент23 страницыBalaji TelefilmsShraddha TiwariОценок пока нет

- Financial Statements and Ratios Flashcards QuizletДокумент14 страницFinancial Statements and Ratios Flashcards QuizletDanish HameedОценок пока нет

- Solution Manual For Financial and Managerial Accounting 8th by WildДокумент45 страницSolution Manual For Financial and Managerial Accounting 8th by WildTiffanyFowlercftzi100% (41)

- Summit Bank Internship ReportДокумент72 страницыSummit Bank Internship ReportStranger BoyОценок пока нет

- CMA FormatДокумент21 страницаCMA Formatapi-377123878% (9)

- Chapter 2 Part 2Документ15 страницChapter 2 Part 2AliansОценок пока нет

- EXAMPLE 12.1 (Current Tax Liability)Документ8 страницEXAMPLE 12.1 (Current Tax Liability)KaiWenNgОценок пока нет

- Financial Statement Analysis of Microsoft Corporation (Revised)Документ7 страницFinancial Statement Analysis of Microsoft Corporation (Revised)Adhikansh SinghОценок пока нет

- Lanao del Sur Municipality Financial Statements Management ResponsibilityДокумент3 страницыLanao del Sur Municipality Financial Statements Management ResponsibilitymocsОценок пока нет

- InventoriesДокумент17 страницInventoriesYash AggarwalОценок пока нет

- Course: FINC6001 Effective Period: September2019: Managing Cash Flow, Sales Collection, Credit CollectionДокумент27 страницCourse: FINC6001 Effective Period: September2019: Managing Cash Flow, Sales Collection, Credit Collectionsalsabilla rpОценок пока нет

- Audit of Investments - Set AДокумент4 страницыAudit of Investments - Set AZyrah Mae SaezОценок пока нет

- Provisions of Buyback Under Section 68Документ5 страницProvisions of Buyback Under Section 68jinisha sharmaОценок пока нет

- Shareholder Primacy, ControllingДокумент23 страницыShareholder Primacy, ControllinganonymouseОценок пока нет

- CASH AND EQUIVALENTS SUMMARYДокумент30 страницCASH AND EQUIVALENTS SUMMARYCaballero, Charlotte MichaellaОценок пока нет

- SS 06 Financial Reporting and Analysis IntroductionДокумент22 страницыSS 06 Financial Reporting and Analysis IntroductionMayura KatariaОценок пока нет

- Pa-Note Nalang Pag May Babaguhin Kayong SagotДокумент26 страницPa-Note Nalang Pag May Babaguhin Kayong SagotErika Mae LegaspiОценок пока нет

- Class+8+ Chapter+8 +Practice+Questions+ ANSWERSДокумент4 страницыClass+8+ Chapter+8 +Practice+Questions+ ANSWERSMar JoОценок пока нет

- CorpFinance Cheat Sheet v2.2Документ2 страницыCorpFinance Cheat Sheet v2.2subtle69100% (4)

- CFA Level 1 Mock Exam 1 Morning PaperДокумент34 страницыCFA Level 1 Mock Exam 1 Morning PaperSiddharthaSaiKrishnaGonuguntla33% (3)

- Company CasesДокумент14 страницCompany CasesLynette Tang100% (1)

- Building A 3 Statement Financial Model: in ExcelДокумент85 страницBuilding A 3 Statement Financial Model: in ExcelSureshОценок пока нет

- ExamView - Homework CH 10Документ9 страницExamView - Homework CH 10Brooke LevertonОценок пока нет

- GR 51765 Rep Planters Bank Vs Enrique AganaДокумент4 страницыGR 51765 Rep Planters Bank Vs Enrique AganaNesrene Emy LlenoОценок пока нет

- FAC3702 Study GuideДокумент308 страницFAC3702 Study GuideLizelle MoutonОценок пока нет

- Policy On Related Party TransactionsДокумент9 страницPolicy On Related Party TransactionsUniinfo Telecom Services Ltd.Оценок пока нет

- 2017 01 10 - DEGROOF PETERCAM - Stefaan Genoe - Benelux Preference List Update PDFДокумент48 страниц2017 01 10 - DEGROOF PETERCAM - Stefaan Genoe - Benelux Preference List Update PDFTony KututoОценок пока нет

- Study of Corporate Governance in Bangladesh Through The Impact of Ownership Structure On Firms PerformanceДокумент32 страницыStudy of Corporate Governance in Bangladesh Through The Impact of Ownership Structure On Firms PerformanceEngineerKhandaker Abid Rahman80% (5)

- Corporate Governance Mock Test - Vskills Practice TestsДокумент9 страницCorporate Governance Mock Test - Vskills Practice TestsGaurav SonkeshariyaОценок пока нет

- 2018 Pag-IBIG Fund Corporate Annual Report (Posted 09 September 2019)Документ74 страницы2018 Pag-IBIG Fund Corporate Annual Report (Posted 09 September 2019)Freed WatchОценок пока нет

- MBA Electives Guide to Finance Area CoursesДокумент21 страницаMBA Electives Guide to Finance Area CoursesRizzy PopОценок пока нет

- Conceptual Framework: & Accounting Standards Lecture AidДокумент19 страницConceptual Framework: & Accounting Standards Lecture AidFuentes, Ferdelyn F.Оценок пока нет