Академический Документы

Профессиональный Документы

Культура Документы

Tax Exemption Determination

Загружено:

Ensemble 212Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tax Exemption Determination

Загружено:

Ensemble 212Авторское право:

Доступные форматы

INTERNAL REVENUE SERVICE DEPARTMENT OF THE TREASURY

P. O. BOX 2508

CINCINNATI, OH 45201

Employer Identification Number:

Date: 20-4858181

MAR 052001' DLN:

17053008023017

ENSEMBLE 212 INC Contact Person:

C/O YOON JAE LEE RENEE RAILEY NORTON ID# 31172

301 W 45TH ST STE 7J Contact Telephone Number:

NEW YORK, NY 10036-3828 (877) 829-5500

Accounting Period Ending:

MAY 31

Public Charity Status:

170 (b) (1) (A) (vi)

Form 990 Required:

YES

Effective Date of Exemption:

FEBRUARY 2, 2006

Contribution Deductibility:

YES

Advance Ruling Ending Date:

MAY 31, 2010

Dear Applicant:

We are pleased to inform you that upon review of your application for tax

exempt status we have determined that you are exempt from Federal income tax

under section 501(c) (3) of the Internal Revenue Code. Contributions to you are

deductible under section 170 of the Code. You are also qualified to receive

tax deductible bequests, devises, transfers or gifts under section 2055, 2106

or 2522 of the Code. Because this letter could help resolve any questions

regarding your exempt status, you should keep it in your permanent records.

Organizations exempt under section 501(c) (3) of the Code are further classified

as either public charities or private foundations. During your advance ruling

period, you will be treated as a public charity. Your advance ruling period

begins with the effective date of your exemption and ends with advance ruling

ending date shown in the heading of the letter.

Shortly before the end of your advance ruling period, we will send you Form

8734, Support Schedule for Advance Ruling Period. You will have 90 days after

the end of your advance ruling period to return the completed form. We will

then notify you, in writing, about your public charity status.

Please see enclosed Information for Exempt Organizations Under Section

501(c) (3) for some helpful information about your responsibilities as an exempt

organization.

Letter 1045 (DO/CG)

-2-

ENSEMBLE 212 INC

c::i;,erf ~

Lois G. Lerner

Director, Exempt Organizations

Rulings and Agreements

Enclosures: Information for Organizations Exempt Under Section 501 (c) (3)

Statute Extension

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- PD MishraДокумент479 страницPD MishraAnurag Kureel77% (52)

- Sample-Budget For ProductionДокумент4 страницыSample-Budget For ProductionsasavujisicОценок пока нет

- PayPal Complaint Feb 28Документ36 страницPayPal Complaint Feb 28jeff_roberts881100% (4)

- NCVO Business Plan Template For Charities and Voluntary OrganisationsДокумент10 страницNCVO Business Plan Template For Charities and Voluntary OrganisationsAEG EntertainmentОценок пока нет

- Making Music - Model Constitution and Guidance Notes - Oct 2021Документ17 страницMaking Music - Model Constitution and Guidance Notes - Oct 2021Kwame Victorious FrimmОценок пока нет

- Chapter No.18 Manual XVII: Under Clause 4 (B) (Xvii) of Chapter II of The Right To Information Act, 2005Документ75 страницChapter No.18 Manual XVII: Under Clause 4 (B) (Xvii) of Chapter II of The Right To Information Act, 2005Anonymous lfw4mfCmОценок пока нет

- Commissioner of Internal Revenue vs. ST Luke's Medical CenterДокумент14 страницCommissioner of Internal Revenue vs. ST Luke's Medical CenterRaquel DoqueniaОценок пока нет

- Section A: Respondent BackgroundДокумент4 страницыSection A: Respondent BackgroundVinithasri SubramaniamОценок пока нет

- Session 01 - Intodction To SEДокумент47 страницSession 01 - Intodction To SEVishwa NirmalaОценок пока нет

- Investment PolicyДокумент7 страницInvestment Policyapi-299221104Оценок пока нет

- Starting A Nonprofit Organization GuideДокумент38 страницStarting A Nonprofit Organization GuideJon Gollogly100% (3)

- ST Annes Trustees Report 31st December 2021Документ25 страницST Annes Trustees Report 31st December 2021api-254967909Оценок пока нет

- ESU Newsletter Aug 09Документ7 страницESU Newsletter Aug 09esumauritiusОценок пока нет

- دليل المستخدم في تسجيل الجمعيات في اثيوبياДокумент74 страницыدليل المستخدم في تسجيل الجمعيات في اثيوبياUber FoundationОценок пока нет

- IELTS Essay Questions - All TypesДокумент6 страницIELTS Essay Questions - All TypesAnkur SharmaОценок пока нет

- Thanks For EverythingДокумент17 страницThanks For Everythingnfpsynergy100% (4)

- Non StockДокумент2 страницыNon StockJamz LopezОценок пока нет

- Gambling Act 2005Документ248 страницGambling Act 2005Matthieu EscandeОценок пока нет

- Tax DigestsДокумент345 страницTax DigestsJohn Ralph TumaliuanОценок пока нет

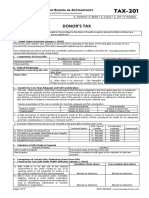

- TAX-201 (Donor's Tax)Документ7 страницTAX-201 (Donor's Tax)Edith DalidaОценок пока нет

- Seida KassimДокумент59 страницSeida KassimTewfic SeidОценок пока нет

- A Historical Perspective of The Social Work ProfessionДокумент14 страницA Historical Perspective of The Social Work ProfessionRahul KumarОценок пока нет

- The EFQM Excellence Model in ActionДокумент40 страницThe EFQM Excellence Model in Actionsheref_hamady33% (3)

- Gopal: Income of The TrustДокумент23 страницыGopal: Income of The TrustAshish ShahОценок пока нет

- Ipasset ManagementДокумент48 страницIpasset ManagementSiddharth GhorpadeОценок пока нет

- Tax Guide On Philippine Taxation - Bureau of Internal RevenueДокумент11 страницTax Guide On Philippine Taxation - Bureau of Internal RevenueRadh KamalОценок пока нет

- Charity Audit ChecklistДокумент14 страницCharity Audit ChecklistRay BrooksОценок пока нет

- Philanthropy 1Документ137 страницPhilanthropy 1Fatma100% (1)

- HISTORY OF SOCIAL WELFARE - Philosophical Evolution - CompleteДокумент21 страницаHISTORY OF SOCIAL WELFARE - Philosophical Evolution - CompleteMabaet Carl MiguelОценок пока нет