Академический Документы

Профессиональный Документы

Культура Документы

54543bos43717ipcc p3q PDF

Загружено:

Puneet Vyas0 оценок0% нашли этот документ полезным (0 голосов)

51 просмотров6 страницОригинальное название

54543bos43717ipcc-p3q.pdf

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

51 просмотров6 страниц54543bos43717ipcc p3q PDF

Загружено:

Puneet VyasАвторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 6

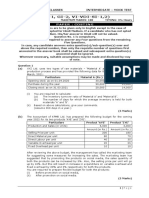

Test Series: March 2019

MOCK TEST PAPER

INTERMEDIATE (IPC): GROUP – I

PAPER – 3: COST ACCOUNTING AND FINANCIAL MANAGEMENT

Answers are to be given only in English except in the case of the candidates who have opted for Hindi medium. If a

candidate has not opted for Hindi medium his/ her answers in Hindi will not be valued.

Question No. 1 is compulsory.

Attempt any five questions from the remaining six questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours Maximum Marks – 100

1. Answer the following:

(a) M Ltd. has an annual fixed cost of Rs. 98,50,000. In the year 20X8-X9, sales amounted to

Rs.7,80,60,000 as compared to Rs.5,93,10,000 in the preceding year 20X7-X8. Profit in the year

20X8-X9 is Rs.37,50,000 more than that in 20X7-X8.

Required:

(i) Calculate Break-even sales of the company;

(ii) Determine profit/ loss on a forecasted sales volume of Rs.8,20,00,000.

(iii) If there is a reduction in selling price by 10% in the financial year 20X8-X9 and company

desires to earn the same amount of profit as in 20X7-X8, compute the required sales amount?

(b) Arnav Motors Ltd. manufactures pistons used in car engines. As per the study conducted by the

Auto Parts Manufacturers Association, there will be a demand of 80 million pistons in the coming

year. Arnav Motors Ltd. is expected to have a market share of 1.15% of the total market demand

of the pistons in the coming year. It is estimated that it costs Rs.1.50 as inventory holding cost per

piston per month and that the set-up cost per run of piston manufacture is Rs. 3,500.

(i) Determine the optimum run size for piston manufacturing?

(ii) Assuming that the company has a policy of manufacturing 40,000 pistons per run, compute

how much extra costs the company would be incurring as compared to the optimum run

suggested in (i) above?

(c) Mr. K has taken a personal loan from a commercial bank of Rs.3,00,000 for one year at 18% p.a.

It has to pay the loan amount in equal monthly installments (EMIs). Compute the EMI amount to

be paid per month and the total interest that would be paid upto the end of sixth month.

(d) Based on the following particulars show various assets and liabilities of T Ltd.

Fixed assets turnover ratio 8 times

Capital turnover ratio 2 times

Inventory Turnover 8 times

Receivable turnover 4 times

Payable turnover 6 times

GP Ratio 25%

Gross profit during the year amounts to Rs.8,00,000. There is no long-term loan or overdraft.

Reserve and surplus amount to Rs.2,00,000. Ending inventory of the year is Rs. 20,000 above the

beginning inventory. (4 × 5 = 20 Marks)

© The Institute of Chartered Accountants of India

2. (a) Aditya Agro Ltd. mixes powdered ingredients in two different processes to produce one product.

The output of Process- I becomes the input of Process-II and the output of Process-II is transferred

to the Packing department.

From the information given below, you are required to prepare accounts for Process-I, Process-II

and Abnormal loss/ gain A/c to record the transactions for the month of February 20X9.

Process-I

Input:

Material A 6,000 kilograms at Rs. 50 per kilogram

Material B 4,000 kilograms at Rs. 100 per kilogram

Labour 430 hours at Rs. 50 per hour

Normal loss 5% of inputs. Scrap are disposed off at Rs. 16 per

kilogram

Output 9,200 kilograms.

There is no work- in- process at the beginning or end of the month.

Process-II

Input:

Material C 6,600 kilograms at Rs. 125 per kilogram

Material D 4,200 kilograms at Rs. 75 per kilogram

Flavouring Essence Rs. 3,300

Labour 370 hours at Rs.50 per hour

Normal loss 5% of inputs with no disposal value

Output 18,000 kilograms.

There is no work-in-process at the beginning of the month but 1,000 kilograms in process at the

end of the month and estimated to be only 50% complete so far as labour and overhead were

concerned.

Overhead of Rs.92,000 incurred to be absorbed on the basis of labour hours. (8 Marks)

(b) XYZ Ltd. Is considering three financial plans for which the key information is as below:

(i) Total investment to be raised Rs.4,00,000.

(ii) Plans of Financing Proportion:

Plans Equity Debt Preference shares

A 100% - -

B 50% 50% -

C 50% - 50%

(iii) Cost of debt 8%

Cost of preference shares 8%

(iv) Tax Rate 50%

(v) Equity shares of the face value of Rs.10 each will be issued at a premium of Rs.10 per share.

(vi) Expected EBIT is Rs.1,60,000

© The Institute of Chartered Accountants of India

Determine for each plan:

(i) Earnings per share (EPS)

(ii) Financial break-even point.

(iii) EBIT range among the plans A and C for point of indifference. (8 Marks)

3. (a) The following standards have been set to manufacture a product:

Direct Materials: (Rs.)

2 units of X at Rs.40 per unit 80.00

3 units of Y at Rs. 30 per unit 90.00

15 units of Z at Rs.10 per unit 150.00

320.00

Direct labour 3 hours @ Rs. 55 per hour 165.00

Total standard prime cost 485.00

The company manufactured and sold 6,000 units of the product during the year 20X9.

Direct material costs were as follows:

12,500 units of X at Rs. 44 per unit.

18,000 units of Y at Rs. 28 per unit.

88,500 units of Z at Rs.12 per unit.

The company worked 17,500 direct labour hours during the year 20X9. For 2,500 of these hours

the company paid at Rs. 58 per hour while for the remaining hours the wages were paid at the

standard rate.

Required:

Compute the following variances:

Material Price, Material Usage, Material Mix, Material Yield, Labour Rate and Labour Efficiency.

(8 Marks)

(b) A newly formed company has applied to the commercial bank for the first time for financing its

working capital requirements. The following information is available about the projections for the

current year:

Estimated level of activity: 1,04,000 completed units of production plus 4,000 units of work-in-

progress. Based on the above activity, estimated cost per unit is:

Raw material Rs.80 per unit

Direct wages Rs.30 per unit

Overheads (exclusive of depreciation) Rs.60 per unit

Total cost Rs.170 per unit

Selling price Rs.200 per unit

Raw materials in stock: Average 4 weeks consumption, work-in-progress (assume 50% completion

stage in respect of conversion cost) (materials issued at the start of the processing).

Finished goods in stock 8,000 units

Credit allowed by suppliers Average 4 weeks

Credit allowed to debtors/receivables Average 8 weeks

© The Institute of Chartered Accountants of India

Lag in payment of wages 1

Average 1 weeks

2

Cash at banks (for smooth operation) is expected to be Rs.25,000

Assume that production is carried on evenly throughout the year (52 weeks) and wages and

overheads accrue similarly. All sales are on credit basis only.

Find out Net Working Capital required. (8 Marks)

4. (a) From the details furnished below you are required to compute a comprehensive machine-hour rate:

Original purchase price of the machine (subject to depreciation

at 10% per annum on original cost) Rs. 6,48,000

Normal working hours for the month (The machine works for only 200 hours

75% of normal capacity)

Wages to Machine-man Rs. 400 per day (of 8 hours)

Wages to Helper (machine attendant) Rs. 275 per day (of 8 hours)

Power cost for the month for the time worked Rs. 65,000

Supervision charges apportioned for the machine centre for the

month Rs. 18,000

Electricity & Lighting for the month Rs. 9,500

Repairs & maintenance (machine) including Consumable stores per Rs. 17,500

month

Insurance of Plant & Building (apportioned) for the year Rs. 18,250

Other general expense per annum Rs. 17,500

The workers are paid a fixed Dearness allowance of Rs. 4,575 per month. Production bonus

payable to workers in terms of an award is equal to 33.33% of basic wages and dearness

allowance. Add 10% of the basic wage and dearness allowance against leave wages and holidays

with pay to arrive at a comprehensive labour-wage for debit to production. (8 Marks)

(b) G Limited has the following capital structure, which it considers to be optimal:

Capital Structure Weightage (in percentage)

Debt 25

Preference Shares 15

Equity Shares 60

100

G Limited’s expected net income this year is Rs.34,285.72, its established dividend payout ratio is

30 per cent, its tax rate is 40 per cent, and investors expect earnings and dividends to grow at a

constant rate of 9 per cent in the future. It paid a dividend of Rs.3.60 per share last year, and its

shares are currently sold at a price of Rs.54 per share.

G Limited requires additional funds which it can obtain in the following ways:

• Preference Shares: New preference shares with a dividend of Rs.11 can be sold to the public

at a price of Rs.95 per share.

• Debt: Debt can be sold at an interest rate of 12 per cent.

You are required to:

(i) Determine the cost of each capital structure component; and

© The Institute of Chartered Accountants of India

(ii) Compute the weighted average cost of capital (WACC) of G Limited. (8 Marks)

5. (a) What is cost plus contract? State its advantages.

(b) How apportionment of joint costs upto the point of separation amongst the joint products using

market value at the point of separation and net realizable value method is done? Discuss.

(c) Define Modified Internal Rate of Return method.

(d) Discuss the advantages of raising funds by issue of equity shares. (4 x 4 =16 Marks)

6. (a) A transport company has a fleet of three trucks of 10 tonnes capacity each plying in different

directions for transport of customer's goods. The trucks run loaded with goods and return empty.

The distance travelled, number of trips made, and the load carried per day by each truck are as

under:

Truck No. One way No. of trips Load carried

Distance Km per day per trip / day tonnes

1 16 4 6

2 40 2 9

3 30 3 12

The analysis of maintenance cost and the total distance travelled during the last two years is as under:

Year Total distance travelled Maintenance Cost (Rs.)

1 1,60,200 46,050

2 1,56,700 45,175

The following are the details of expenses for the year under review:

Diesel Rs. 65 per litre. Each litre gives 4 km per litre of diesel on an

average.

Driver's salary Rs. 24,000 per month

Licence and taxes Rs. 25,000 per annum per truck

Insurance Rs. 45,000 per annum for all the three vehicles

Purchase Price per truck Rs. 30,00,000, Life 10 years. Scrap value at the end of life is Rs.

1,00,000.

Oil and sundries Rs. 250 per 100 km run.

General Overhead Rs. 1,15,600 per annum

The vehicles operate 24 days per month on an average.

On the basis of commercial tone-km, you are required to:

(i) Prepare an Annual Cost Statement covering the fleet of three vehicles.

(ii) Calculate the cost per km. run.

(iii) Determine the freight rate per tonne km. to yield a profit of 10% on freight. (8 Marks)

(b) You are a financial analyst for B Limited. The director of finance has asked you to analyse two

proposed capital investments, Projects X and Y. Each project has a cost of Rs. 10,00,000 and the

cost of capital for each project is 12 per cent. The project’s expected net cash flows are as follows:

Year Expected net cash flows

Project X (Rs.) Project Y (Rs.)

0 (10,00,000) (10,00,000)

5

© The Institute of Chartered Accountants of India

1 6,50,000 3,50,000

2 3,00,000 3,50,000

3 3,00,000 3,50,000

4 1,00,000 3,50,000

(i) Calculate each project’s payback period, net present value (NPV) and internal rate of return

(IRR).

(ii) State which project or projects should be accepted if they are independent? (8 Marks)

7. Answer any four of the following:

(a) Discuss the effect of overtime payment on productivity.

(b) “Is reconciliation of cost accounts and financial accounts necessary in case of integrated

accounting system? Discuss.”

(c) Explain the term ‘Ploughing back of Profits’.

(d) State the advantage of Electronic Cash Management System.

(e) Distinguish between controllable & uncontrollable costs? (4 x 4 =16 Marks)

© The Institute of Chartered Accountants of India

Вам также может понравиться

- Leveraging on India: Best Practices Related to Manufacturing, Engineering, and ItОт EverandLeveraging on India: Best Practices Related to Manufacturing, Engineering, and ItОценок пока нет

- Costing FM Mock Test May 2019Документ20 страницCosting FM Mock Test May 2019Roshinisai VuppalaОценок пока нет

- 51624bos41275inter QДокумент5 страниц51624bos41275inter QvarunОценок пока нет

- 3) CostingДокумент19 страниц3) CostingKrushna MateОценок пока нет

- C.FM QДокумент7 страницC.FM QcawinnersofficialОценок пока нет

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementДокумент34 страницыLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementSimon JosephОценок пока нет

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementДокумент3 страницыLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementvivekОценок пока нет

- Cost Management Accounting Full Test 1 Nov 2023 Test Paper 1689158389Документ17 страницCost Management Accounting Full Test 1 Nov 2023 Test Paper 1689158389ahanaghosal2022Оценок пока нет

- ECON F315 - FIN F315 - Compre QP PDFДокумент3 страницыECON F315 - FIN F315 - Compre QP PDFPrabhjeet Kalsi100% (1)

- 4 2 Sma 2018Документ5 страниц4 2 Sma 2018Nawoda SamarasingheОценок пока нет

- Cost Accounting and Financial Management: All Questions Are CompulsoryДокумент4 страницыCost Accounting and Financial Management: All Questions Are CompulsorySudist JhaОценок пока нет

- Caf 8 Cma Autumn 2015Документ4 страницыCaf 8 Cma Autumn 2015mary50% (2)

- Cost and Management AccountingДокумент4 страницыCost and Management AccountingRamzan AliОценок пока нет

- Costing English Question-01.09.2022Документ5 страницCosting English Question-01.09.2022Planet ZoomОценок пока нет

- Cost Accounting: T I C A PДокумент4 страницыCost Accounting: T I C A PShehrozSTОценок пока нет

- CA Pakistan - MAC Past PapersДокумент194 страницыCA Pakistan - MAC Past PapersAbdul Azeem100% (1)

- Cost Accounting: T I C A PДокумент4 страницыCost Accounting: T I C A PShehrozSTОценок пока нет

- Cost Accounting: The Institute of Chartered Accountants of PakistanДокумент4 страницыCost Accounting: The Institute of Chartered Accountants of PakistanShehrozSTОценок пока нет

- 68957Документ9 страниц68957Mehar WaliaОценок пока нет

- Cost Sheet: Particulars Job 101 Job 102Документ12 страницCost Sheet: Particulars Job 101 Job 102vishal soniОценок пока нет

- FFM Updated AnswersДокумент79 страницFFM Updated AnswersSrikrishnan SОценок пока нет

- Question Bank Paper: Cost Accounting McqsДокумент8 страницQuestion Bank Paper: Cost Accounting McqsDarmin Kaye PalayОценок пока нет

- Question Bank Paper: Cost Accounting McqsДокумент8 страницQuestion Bank Paper: Cost Accounting McqsNikhilОценок пока нет

- Costing QN PaperДокумент5 страницCosting QN PaperAJОценок пока нет

- Caf 8 Cma Spring 2019Документ5 страницCaf 8 Cma Spring 2019Jawad AzizОценок пока нет

- Gujarat Technological UniversityДокумент3 страницыGujarat Technological UniversityMehul VarmaОценок пока нет

- Assignment ProblemsДокумент5 страницAssignment ProblemsRamesh SigdelОценок пока нет

- 8) FM EcoДокумент19 страниц8) FM EcoKrushna MateОценок пока нет

- Sir Saud Tariq: 13 Important Revision Questions On Each TopicДокумент29 страницSir Saud Tariq: 13 Important Revision Questions On Each TopicShehrozST100% (1)

- Ca Inter May 2023 ImpДокумент23 страницыCa Inter May 2023 ImpAlok TiwariОценок пока нет

- Working Capital QuestionsДокумент10 страницWorking Capital QuestionsVaishnavi VenkatesanОценок пока нет

- Costing (New) MTP Question Paper Mar2021Документ8 страницCosting (New) MTP Question Paper Mar2021ADITYA JAINОценок пока нет

- Cost FM Old Syllabus Question PaperДокумент6 страницCost FM Old Syllabus Question PaperDhruvil PatelОценок пока нет

- First Time Login Guide MsДокумент6 страницFirst Time Login Guide MskonosubaОценок пока нет

- Mcom NotesДокумент10 страницMcom Notesvkharish21Оценок пока нет

- Cost and Management AccountingДокумент5 страницCost and Management AccountingZaib Khan0% (1)

- Set: A: Instructions For CandidatesДокумент10 страницSet: A: Instructions For CandidatessaurabhОценок пока нет

- Cost and Management Accounting Mid Term Exam: July, 2020 Time Allowed: 3 Hours & 15 MinutesДокумент10 страницCost and Management Accounting Mid Term Exam: July, 2020 Time Allowed: 3 Hours & 15 MinutesmaryОценок пока нет

- CAF 8 CMA Autumn 2019 PDFДокумент4 страницыCAF 8 CMA Autumn 2019 PDFbinuОценок пока нет

- Management Accounting 9mrQc9m4HBДокумент3 страницыManagement Accounting 9mrQc9m4HBMadhuram SharmaОценок пока нет

- MC&bepproblemsДокумент6 страницMC&bepproblemsNishanth PrabhakarОценок пока нет

- Marginal - Absorption Costing - Practice Questions With SolutionsДокумент11 страницMarginal - Absorption Costing - Practice Questions With Solutionsaishabadar88% (17)

- IV SEM - BA & BBA - Basics of Financial Management - 2021-22Документ3 страницыIV SEM - BA & BBA - Basics of Financial Management - 2021-22Aria MazeОценок пока нет

- Caf 8 Cma Autumn 2018Документ4 страницыCaf 8 Cma Autumn 2018Hassnain SardarОценок пока нет

- Standard Costing and Variance Analysis: Icap Cost Accounting & Management Accounting - Spring 2020 Q 1Документ8 страницStandard Costing and Variance Analysis: Icap Cost Accounting & Management Accounting - Spring 2020 Q 1maryОценок пока нет

- Winter Exam-2012: Management AccountingДокумент4 страницыWinter Exam-2012: Management AccountingSamina IrshadОценок пока нет

- Management Accounting: Final ExaminationsДокумент4 страницыManagement Accounting: Final ExaminationsAbdulAzeemОценок пока нет

- Advanced Management Accounting PDFДокумент4 страницыAdvanced Management Accounting PDFSmag SmagОценок пока нет

- 54540bos43716 p3q PDFДокумент6 страниц54540bos43716 p3q PDFPul pehlad pur 14 BadarpurОценок пока нет

- Material Exam Type Practice Question M.Com 2ndДокумент4 страницыMaterial Exam Type Practice Question M.Com 2ndJahanzaib ButtОценок пока нет

- Working cap-SEM IIIДокумент9 страницWorking cap-SEM IIIBhushan BhorkadeОценок пока нет

- Question Bank - B.COM (H) Semester - IV (2022-25)Документ19 страницQuestion Bank - B.COM (H) Semester - IV (2022-25)antarjot69Оценок пока нет

- Practice Session ThreeДокумент3 страницыPractice Session ThreeKUMAR ABHISHEKОценок пока нет

- CBE - Corporate Finance - SPJG - FinalДокумент16 страницCBE - Corporate Finance - SPJG - FinalNguyễn QuyênОценок пока нет

- Management Accounting: Final ExaminationДокумент3 страницыManagement Accounting: Final ExaminationAbdulAzeemОценок пока нет

- Cost Sheet - Pages 16Документ16 страницCost Sheet - Pages 16omikron omОценок пока нет

- GIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyДокумент36 страницGIFT - CAF 8 Master Questions With Solutions & Marks - Caf 8 Sir Saud Tariq ST AcademyShehrozSTОценок пока нет

- 3rd Sem Cost AccountingДокумент3 страницы3rd Sem Cost AccountingkapilchandanОценок пока нет

- Marginal Costing NumericalДокумент6 страницMarginal Costing Numericalswarnim chauhanОценок пока нет

- Marginal CostingДокумент2 страницыMarginal CostingOmkar DhamapurkarОценок пока нет

- CMF Day0 SY CMF-OESY-01 Ver1 PDFДокумент20 страницCMF Day0 SY CMF-OESY-01 Ver1 PDFRaj SharmaОценок пока нет

- 1 - Finance Spring - 2022 - JGLSДокумент7 страниц1 - Finance Spring - 2022 - JGLSIshika PatnaikОценок пока нет

- Financial LeveragesДокумент31 страницаFinancial LeveragesGaurav gusaiОценок пока нет

- SFM FinДокумент159 страницSFM FinAakashОценок пока нет

- Solution 6Документ11 страницSolution 6askdgasОценок пока нет

- TB - Chapter21 Mergers and AcquisitionsДокумент12 страницTB - Chapter21 Mergers and AcquisitionsPrincess EspirituОценок пока нет

- I Semester Financial Accounting - Bpz1A: Theory 15 Problems 60Документ28 страницI Semester Financial Accounting - Bpz1A: Theory 15 Problems 60Blaze MysticОценок пока нет

- Accountancy Paper III Advance Financial Management Final BookДокумент395 страницAccountancy Paper III Advance Financial Management Final Books.muthu100% (1)

- PLIMSOLДокумент4 страницыPLIMSOLAditya JandialОценок пока нет

- Review PKG1 PDFДокумент25 страницReview PKG1 PDFjennifer weiОценок пока нет

- Fundamentals of Financial Management Concise Edition 10th Edition Brigham Solutions ManualДокумент38 страницFundamentals of Financial Management Concise Edition 10th Edition Brigham Solutions Manualmanciplesoakerd4tt8100% (12)

- Capital Structure Decisions: ExtensionsДокумент42 страницыCapital Structure Decisions: ExtensionssidhanthaОценок пока нет

- Corporate Finance and Investment Decisions and Strategies 9Th Edition Full ChapterДокумент41 страницаCorporate Finance and Investment Decisions and Strategies 9Th Edition Full Chapterharriett.murphy498100% (24)

- 2017 L 3 & L4 Mini Assignments & Summary SolutionsДокумент9 страниц2017 L 3 & L4 Mini Assignments & Summary SolutionsZhiyang Zhou67% (3)

- Discounted Cash FlowДокумент50 страницDiscounted Cash Flowgangster91Оценок пока нет

- Tugas FM FuzzyTronicДокумент7 страницTugas FM FuzzyTronicAnggit Tut PinilihОценок пока нет

- Problems On Leverage AnalysisДокумент4 страницыProblems On Leverage AnalysisMandar SangleОценок пока нет

- Chapter 13 Capital Structure and LeverageДокумент64 страницыChapter 13 Capital Structure and LeverageSavita MalikОценок пока нет

- Capital StructureДокумент9 страницCapital Structurealokkuma050% (2)

- Capital Structure ZX8LJ0G23iДокумент7 страницCapital Structure ZX8LJ0G23iAravОценок пока нет

- Quiz 2 ReviewerДокумент4 страницыQuiz 2 ReviewerMariel Garra0% (1)

- EBIT - EPS QuestionsДокумент6 страницEBIT - EPS QuestionsTaliya ShaikhОценок пока нет

- MAS 2 - Optimal Capital StructureДокумент5 страницMAS 2 - Optimal Capital StructureNathallie CabalunaОценок пока нет

- Cheat Sheet Final FMV PDFДокумент3 страницыCheat Sheet Final FMV PDFQuy TranОценок пока нет

- Description AnanlysisДокумент76 страницDescription AnanlysiskaushalОценок пока нет

- Final - Research Methodology PDFДокумент34 страницыFinal - Research Methodology PDFDanveer Kaur Birdi100% (2)

- Elements of Corporate FinanceДокумент9 страницElements of Corporate FinanceReiki Channel Anuj Bhargava100% (1)

- Chapter 13 Dividend PolicyДокумент15 страницChapter 13 Dividend PolicyI Am Not Deterred100% (4)

- DcosДокумент4 страницыDcosAbhishek BharteОценок пока нет

- Cost of Capital: Dr. Μd. Sogir Hossain Khandoker Professor, Dept. of Finance, Jagannath University, DhakaДокумент47 страницCost of Capital: Dr. Μd. Sogir Hossain Khandoker Professor, Dept. of Finance, Jagannath University, DhakaKhandaker Tanvir AhmedОценок пока нет

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successОт EverandReady, Set, Growth hack:: A beginners guide to growth hacking successРейтинг: 4.5 из 5 звезд4.5/5 (93)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- John D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthОт EverandJohn D. Rockefeller on Making Money: Advice and Words of Wisdom on Building and Sharing WealthРейтинг: 4 из 5 звезд4/5 (20)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- These Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese Are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 3.5 из 5 звезд3.5/5 (8)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetОт EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetРейтинг: 5 из 5 звезд5/5 (2)

- Venture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistОт EverandVenture Deals, 4th Edition: Be Smarter than Your Lawyer and Venture CapitalistРейтинг: 4.5 из 5 звезд4.5/5 (73)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanОт EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanРейтинг: 4.5 из 5 звезд4.5/5 (79)

- Financial Risk Management: A Simple IntroductionОт EverandFinancial Risk Management: A Simple IntroductionРейтинг: 4.5 из 5 звезд4.5/5 (7)

- Private Equity and Venture Capital in Europe: Markets, Techniques, and DealsОт EverandPrivate Equity and Venture Capital in Europe: Markets, Techniques, and DealsРейтинг: 5 из 5 звезд5/5 (1)

- Applied Corporate Finance. What is a Company worth?От EverandApplied Corporate Finance. What is a Company worth?Рейтинг: 3 из 5 звезд3/5 (2)

- Creating Shareholder Value: A Guide For Managers And InvestorsОт EverandCreating Shareholder Value: A Guide For Managers And InvestorsРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Startup CEO: A Field Guide to Scaling Up Your Business (Techstars)От EverandStartup CEO: A Field Guide to Scaling Up Your Business (Techstars)Рейтинг: 4.5 из 5 звезд4.5/5 (4)

- Joy of Agility: How to Solve Problems and Succeed SoonerОт EverandJoy of Agility: How to Solve Problems and Succeed SoonerРейтинг: 4 из 5 звезд4/5 (1)

- Financial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityОт EverandFinancial Modeling and Valuation: A Practical Guide to Investment Banking and Private EquityРейтинг: 4.5 из 5 звезд4.5/5 (4)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (34)

- Value: The Four Cornerstones of Corporate FinanceОт EverandValue: The Four Cornerstones of Corporate FinanceРейтинг: 4.5 из 5 звезд4.5/5 (18)

- Corporate Finance Formulas: A Simple IntroductionОт EverandCorporate Finance Formulas: A Simple IntroductionРейтинг: 4 из 5 звезд4/5 (8)