Академический Документы

Профессиональный Документы

Культура Документы

Section Iv: Global Trade Finance

Загружено:

ripin6Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Section Iv: Global Trade Finance

Загружено:

ripin6Авторское право:

Доступные форматы

SECTION IV: GLOBAL TRADE FINANCE

Financing Arrangements

Bank Loan for lease of building property. The reason RHIM poutine would be leased is

in case of bankruptcy, failure of profitable revenues, problems that arise through local

environment, etc. This will help RHIM be able to pull out from the lease at the end of the

term, or lease it again based on positive outcomes. Loan will cover the payments made

to gather proper equipment, extra, ingredients tox make the poutine, etc. Most of the

common expenses are to be held for a long term such as employees and material. This

will help reduce the amount spent to cook the poutine allowing us to generate a higher

gross profit margin.

No need for delivery expenses because partnering up with Uber Eats can help save

cost of getting to a wider group of consumers. There is also little to no expense on

advertising because of free and useful marketing online via social media.

Cash made by RHIM will be reinvested within the company to generate a higher profit

turn around year after year. The cash will also be split into profits amongst all partners

involved with the help of sales of poutine.

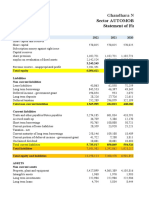

Cash Flows Estimations

There will not be intangible credit because the transactions made are on spot and cash

is always involved for short term. We have to keep in mind for credit purchases from

vendors and suppliers. Possible cash flow expectation could also depend on foreign

exchange due to high volumed tourists. The intake of cash is healthier for the company

because it is liquid asset and can help pay off many payments that decrease our cash

flow. There is a sunk cost in our cash flow because of the expenses on the equipment

each year as well as the lease of the property.

Products and Financial Risks

There are many risks when it comes to launching a product a completely new setting. At

first, the primary risk is that the product is unsuccessful. Thus resulting in all

investments to go down the drain and bankruptcy. However, despite the worst-case

scenario, many other risks come along with the process of launching. For instance,

there are risks when it comes to obtaining credit, investors, and equity. All these

potential scenarios can lead to serious dilemmas. Thus, it is essential that all aspects

are thoroughly revised and no precedent is disregarded.

Currency Exchange Rate Fluctuations

England uses the currency of Pound Sterling whereas Canada’s currency is known to

be in canadian Dollars. The current exchange rate shows that the Pound is rated at a

higher value: 1 Pound results in $1.74 Canadian. Nonetheless, the fluctuation rates

have been steadily stable throughout the past years. The only viable result in the

currency of Pounds to a rise in relation to the Canadian Dollar. This exchange rate is a

definite concern to trading companies, yet is it still an up and becoming issue on the

rise.

International Leasing and Joint Ventures

In order to bring poutine into England we plan to coincide with Butterfield Trust

(Guernsey) Limited. This trust company is known for developing relations with many

international clients to provide exceptional solutions and services. This company will be

a great asset to have in order to make our product successful within England.

Additionally, Butterfield Trust (Guernsey) Limited possess all the needed attributes to

assist in making financial decisions and various other banking operations.

Collection Procedures for International Debts

In order to obtain international debts, we will be in relations with Lovetts Solicitors, a

well renowned collections company located within the United Kingdom. This company

will help us in recovering monetary values that are owed to us. Lovetts Solicitors charge

no collection or recovery fees. They conduct specified and thorough research of the

debt and contractual agreements from which they contact the debtor company to settle

the situation. The funds are then initially transferred directly into our company bank.

This allows for little confusion and direct relations.

Commercial Disputes and Resolutions Options

Commercial disputes are the possibilities of disagreements or breaches that may occur

between partnering companies. These disputes can include, breach of contracts,

financial disputes, shareholder disagreements, etc. In order to resolve such occurrences

there are various resolution options of either negotiating the situation, going through

litigation, or mediation and arbitration. The primary resolution option will differ in regards

to the situation and intensity of the breach.

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Introduction To Financial Econometrics Chapter 4 Introduction To Portfolio TheoryДокумент19 страницIntroduction To Financial Econometrics Chapter 4 Introduction To Portfolio TheoryKalijorne MicheleОценок пока нет

- RR 5-76Документ8 страницRR 5-76matinikkiОценок пока нет

- The Mile Gully To Greenvale RoadДокумент32 страницыThe Mile Gully To Greenvale RoadShane KingОценок пока нет

- Test Your Knowledge - Ratio AnalysisДокумент29 страницTest Your Knowledge - Ratio AnalysisMukta JainОценок пока нет

- Valuation Report Ryanair ShortДокумент20 страницValuation Report Ryanair ShortJohn Sebastian Gil (CO)Оценок пока нет

- A STUDY ON DEPOSITORY SYSTEM - Docx NewДокумент19 страницA STUDY ON DEPOSITORY SYSTEM - Docx NewRajni WaswaniОценок пока нет

- Case Study Happy Nissan-Renault Marriage PDFДокумент21 страницаCase Study Happy Nissan-Renault Marriage PDFVivian Anto DОценок пока нет

- TEC Commercialization Process ModelДокумент7 страницTEC Commercialization Process ModelPandu PrawiraОценок пока нет

- Financial Management: Topic-Dividend PolicyДокумент10 страницFinancial Management: Topic-Dividend PolicyVibhuti SharmaОценок пока нет

- Heavy OilДокумент6 страницHeavy Oilsnikraftar1406Оценок пока нет

- The Prudential Regulations of State Bank PakistanДокумент33 страницыThe Prudential Regulations of State Bank PakistanSaad Bin Mehmood88% (17)

- World Class Motor MaintДокумент3 страницыWorld Class Motor MaintIshmael WoolooОценок пока нет

- Ghandhara NissanДокумент7 страницGhandhara NissanShamsuddin SoomroОценок пока нет

- Company Information: Dewan Sugar Mills LimitedДокумент14 страницCompany Information: Dewan Sugar Mills LimitedSyed Arif RazaОценок пока нет

- Meetings of CoMpanyДокумент18 страницMeetings of CoMpanyHeer ChaudharyОценок пока нет

- The Richard Branson Interview Part 1 - KeyДокумент6 страницThe Richard Branson Interview Part 1 - Keyelianasilva100% (1)

- Account Opening FormДокумент3 страницыAccount Opening FormJoseph VJОценок пока нет

- PYRAMIDДокумент5 страницPYRAMIDAdam AlexОценок пока нет

- Financial Analysis of Dewan Mushtaq GroupДокумент26 страницFinancial Analysis of Dewan Mushtaq Groupسید نیر سجاد البخاري100% (2)

- Ontario Budget 2017Документ330 страницOntario Budget 2017National PostОценок пока нет

- Alternate Revenue Sources For The Bank, Idbi Bank - MarketingДокумент36 страницAlternate Revenue Sources For The Bank, Idbi Bank - Marketingwelcome2jungle100% (2)

- Cumulative Deposit SchemeДокумент16 страницCumulative Deposit SchemearctickingОценок пока нет

- Ratio Analysis Tata MotorsДокумент8 страницRatio Analysis Tata Motorssadafkhan21Оценок пока нет

- UAFLLДокумент459 страницUAFLLmahesh malveОценок пока нет

- Finlatics Investment Banking Experience ProgramДокумент3 страницыFinlatics Investment Banking Experience ProgramShalaka PhatakОценок пока нет

- Rashtriya Krishi Vikas Yojana: Deepshikha Maheshwari Rohit KumarДокумент8 страницRashtriya Krishi Vikas Yojana: Deepshikha Maheshwari Rohit KumarRohit SachdevaОценок пока нет

- Cfas 19 Pas 41 Biological AssetsДокумент3 страницыCfas 19 Pas 41 Biological Assetsnash lastОценок пока нет

- Sample para JumblesДокумент9 страницSample para JumblessamdhathriОценок пока нет

- CourseworkДокумент6 страницCourseworkyonghuiОценок пока нет

- Elite HARP Open Access ReliefДокумент4 страницыElite HARP Open Access ReliefAccessLendingОценок пока нет