Академический Документы

Профессиональный Документы

Культура Документы

RBI Monetary Policy Review - April

Загружено:

mohitgaandhiОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

RBI Monetary Policy Review - April

Загружено:

mohitgaandhiАвторское право:

Доступные форматы

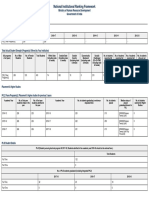

RBI Monetary Policy Review

Assessing the impact and reasons behind the recent monetary policy stance

RBI’s Monetary Policy Committee increased the reverse repo ra tes by 25 bps to 6.00% while

What keeping the repo-‐‑rate fixed at 6.25%. Marginal Standing Facility, on the other hand, has been

reduced by 25 bps to 6.5%

Rise in wholesale and retail inflation, Increasing upside inflation risks posed by Risk Factors

Why

and threat of missing Inflation Targets in the future disallowed any repo-‐‑rate cuts

Reverse repo-‐‑rate hike is expected to absorb surplus liquidity with the banks (pegged at INR 4

Impact

lakh crores, Mar’17) & is expected to align the dropping Overnight Rates with the repo rate

Rise Risk Factors Targets Overnight Rate

Wholesale inflation Upside risks to inflation are RBI expects inflation to It refers to the rate a t

rallied to a 39 months posed by volatility in global average at 4.5% for first which banks lend to each

high of 6.55% while crude oil prices, forthcoming half of FY18 and 5.0% other for short durations.

retail inflation inched at El-‐‑Nino, implementation of for second half of FY18. It witnessed a sharp

3.65% in February allowances of 7 th pay RBI targe ts an overall decline in last 6 months

indicating upward trend commission & uncertainty inflation rate of 4% with since Nov’16 due to

in future inflation (see related to GST an allowance of +/-‐‑ 2% surplus liquidity with the

graph below) implementation banks (see graph below)

Inflation Overnight Call Rates

Wholesale Inflation (%) Retail Inflation (%) Repo Rate (%) Overnight C all Rates (%)

7 6.60

6 6.50

5 6.40

4 6.30

3 6.20

2 6.10

1 6.00

0 5.90

A PR ' 16 JU N ' 1 6 A U G ' 16 O C T' 1 6 DEC' 16 F EB ' 17 A P R ' 1 6 JU N ' 1 6 A U G ' 1 6 O C T' 1 6 D E C ' 1 6 F E B ' 1 7

We believe the move to increase the reverse repo rate is in line with RBI’s neutral monetary policy

stance and does not present a hawkish move signaling any future rate hikes/ monetary policy

Our

tightening. Also, we believe other liquidity absorption moves would follow. RBI has already proposed

View the option of Standing Rate Fa cility by which banks can park their excess funds with RBI without

receiving any collateral.

Presented by The Economics and F inance Society, F MS

Вам также может понравиться

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Partitions and Permutations: Gordon RoyleДокумент45 страницPartitions and Permutations: Gordon RoylemohitgaandhiОценок пока нет

- Institute Name: Faculty of Management Studies (IR-M-N-34)Документ2 страницыInstitute Name: Faculty of Management Studies (IR-M-N-34)mohitgaandhiОценок пока нет

- Basic TermsДокумент4 страницыBasic TermsmohitgaandhiОценок пока нет

- Date SheetДокумент1 страницаDate SheetmohitgaandhiОценок пока нет

- Advertisement For Faculty Position Unreserved Category June 2019 1Документ2 страницыAdvertisement For Faculty Position Unreserved Category June 2019 1mohitgaandhiОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Quicken Loans Decision 03-09-17Документ52 страницыQuicken Loans Decision 03-09-17MLive.comОценок пока нет

- Accounting Comprehensive Degree Mock Exit Exam With Answer KeyДокумент15 страницAccounting Comprehensive Degree Mock Exit Exam With Answer Keyzelalem kebede96% (23)

- Security Analysis Portfolio Management AssignmentДокумент4 страницыSecurity Analysis Portfolio Management AssignmentNidhi ShahОценок пока нет

- Master License OringinalДокумент2 страницыMaster License OringinalKo Ko LwinОценок пока нет

- Chapter 7 Chap SevenДокумент11 страницChapter 7 Chap SevenRanShibasaki50% (2)

- Book Keeping and Accounts Level 2 Model Answers Series 4 2013Документ11 страницBook Keeping and Accounts Level 2 Model Answers Series 4 2013Angelina Papageorgiou100% (1)

- Resume Palepu Chapter 10Документ14 страницResume Palepu Chapter 10Fifi AiniОценок пока нет

- There Are 20 Questions in This Part. Please Choose ONE Answer For Each Question. Each Question Is Worth 0.2 PointsДокумент8 страницThere Are 20 Questions in This Part. Please Choose ONE Answer For Each Question. Each Question Is Worth 0.2 PointsThảo Như Trần NgọcОценок пока нет

- 11-Inventory Cost FlowДокумент28 страниц11-Inventory Cost FlowPatrick Jayson VillademosaОценок пока нет

- Aud 2Документ7 страницAud 2Raymundo EirahОценок пока нет

- VAT MathДокумент3 страницыVAT Mathtisha10rahman50% (4)

- Accounting Standard 15: It's Relevance To GRCДокумент6 страницAccounting Standard 15: It's Relevance To GRCTulika JeendgarОценок пока нет

- FIP 504 NAA Assignment 1Документ2 страницыFIP 504 NAA Assignment 1Srushti RajОценок пока нет

- Credit Card ProcessingДокумент58 страницCredit Card ProcessingDipanwita Bhuyan92% (13)

- Selected Banking Sector Data - Q4 2020Документ39 страницSelected Banking Sector Data - Q4 2020Nuriell OzОценок пока нет

- Cpa NotesДокумент16 страницCpa NotesRakesh KumarОценок пока нет

- Human Resource Financial Management: Anupa Chaudhary, and Sumit Prasad, Member, IEDRCДокумент3 страницыHuman Resource Financial Management: Anupa Chaudhary, and Sumit Prasad, Member, IEDRCSathish ARОценок пока нет

- NBFC NotesДокумент2 страницыNBFC NotesHemavathy Gunaseelan100% (1)

- Company Master Data: ChargesДокумент2 страницыCompany Master Data: ChargesNaresh KarmakarОценок пока нет

- Becoming Market SmithДокумент82 страницыBecoming Market SmithTu D.Оценок пока нет

- Change in Estimate and Error Correction Holtzman Company Is in PDFДокумент1 страницаChange in Estimate and Error Correction Holtzman Company Is in PDFAnbu jaromiaОценок пока нет

- SOA TemplateДокумент20 страницSOA TemplateNrkОценок пока нет

- CA FINAL - Question Bank - Nov 2019 KALPESH CLASSES PDFДокумент1 093 страницыCA FINAL - Question Bank - Nov 2019 KALPESH CLASSES PDFparameshwaraОценок пока нет

- Philippine Interpretations Committee (Pic) Questions and Answers (Q&As)Документ6 страницPhilippine Interpretations Committee (Pic) Questions and Answers (Q&As)Mary Jo Lariz OcliasoОценок пока нет

- Report Financial ManagementДокумент30 страницReport Financial ManagementRishelle Mae C. AcademíaОценок пока нет

- Depreciation, Impairments, and DepletionДокумент41 страницаDepreciation, Impairments, and DepletionJofandio AlamsyahОценок пока нет

- Master Server Vix Risk ChartДокумент2 страницыMaster Server Vix Risk ChartBibiana TarazonaОценок пока нет

- CHINAMART 1 - PresentationДокумент6 страницCHINAMART 1 - PresentationRetro GirlОценок пока нет

- Cac - Application Form With Declaration For SmeДокумент2 страницыCac - Application Form With Declaration For SmeAbuОценок пока нет

- One World Media - Publications - FacebookДокумент7 страницOne World Media - Publications - FacebookJMОценок пока нет