Академический Документы

Профессиональный Документы

Культура Документы

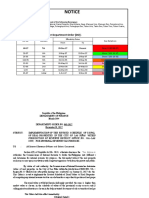

Annex C 0621-EA

Загружено:

MELLICENT LIANZAИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Annex C 0621-EA

Загружено:

MELLICENT LIANZAАвторское право:

Доступные форматы

For BIR BCS/

Republic of the Philippines

Department of Finance Annex “B”

Use Only Item: Bureau of Internal Revenue

BIR Form No.

Estate Tax Amnesty Return

2118-EA Pursuant to Republic Act No. 11213

May 2019 Enter all required information in CAPITAL LETTERS using BLACK ink. Mark all applicable boxes with an “X”.

Page 1 Two copies MUST be filed with the BIR and one to be held by the taxpayer. 2118-EA 05/19 P1

1 Date of Death (MM/DD/YYYY) 2 Amended Estate Tax Amnesty 3 Is there a Previously Filed Estate Tax 4 Alphanumeric Tax Code

Return? Return prior to Estate Tax Amnesty? (ATC)

Yes No Yes No MC320

Part I – Taxpayer Information

5 Taxpayer Identification Number (TIN) / / / 0 0 0 0 0 6 RDO Code

7 Taxpayer’s Name (ESTATE of Last Name, First Name, Middle Name)

ESTATE OF

8 Residence of Decedent at the time of death

9 Non-Resident Alien? Yes No

10 Name of Executor / Administrator (Last Name, First Name, Middle Name for Individuals OR Registered Name for Non-Individual)

11 TIN of Executor / 12 Contact

Administrator / / / Number

13 Email Address

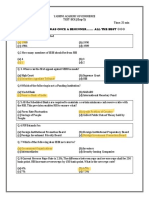

Part II – Total Tax Payable

Particulars A. Exclusive B. Conjugal/Communal C. Total

14 Real Properties excluding Family

Home (From Schedule 1)

●

15 Personal Properties (Total of

Schedule 2 and 3)

●

16 Family Home (From Schedule 1A) ●

17 Taxable Transfer (From Schedule 4) ●

18 GROSS ESTATE (Sum of Items 14

●

to 17)

19 Less: Ordinary Deductions

●

(From Schedule 5)

20 Estate after Deductions (Item 18 less

●

Item 19)

21 Less: Special Deductions

21A Family Home (if applicable) ●

21B Standard Deduction (if applicable) ●

21C Total Special Deductions (Sum of items 21A and 21B) ●

22 NET ESTATE (Item 20 less Item 21C) ●

23 Less: Share of Surviving Spouse (Net Conjugal Estate divided by 2) (if applicable) ●

24 NET TAXABLE ESTATE (Item 22 less Item 23) ●

25 Less: Net Taxable Estate per Previously Filed Estate Tax Return/Estate Tax Amnesty Return ●

(if applicable)

26 NET TAXABLE ESTATE FOR AMNESTY (Item 24 less Item 25) ●

27 Applicable Tax Rate 6 ● 0%

28 ESTATE TAX DUE (Item 26 Multiply by Item 27) ●

29 Minimum Amnesty Amount (if applicable) ●

30 Amnesty Estate Tax Payable ●

I/We declare under the penalties of perjury that this certificate has been made in good faith, verified by me/us, and to the best of my/our knowledge and belief, is true and correct, pursuant to the

provisions of the National Internal Revenue Code, as amended, and the regulations issued under authority thereof. Further, I/we give my/our consent to the processing of my/our information as contemplated

under the *Data Privacy Act of 2012 (R.A. No. 10173) for legitimate and lawful purposes. (If signed by an Authorized Representative, attach Special Power of Attorney)

Signature Over Printed Name of Executor/Administrator/Heir/Authorized Representative

(Indicate title/designation and TIN)

Tax Agent Accreditation No./ Date of Issue Date of Expiry

Attorney’s Roll No. (if applicable)

MCLE Compliance No.

(MM/DD/YYYY) (MM/DD/YYYY)

Part III – Details of Payment

Paid thru:

AAB (specify) __________________________________ Branch Location ________________ Date (MM/DD/YYYY) _______________

RCO (specify name) ________________________________________________________________ Date (MM/DD/YYYY) _______________

*NOTE: The BIR Data Privacy Policy is in the BIR website (www.bir.gov.ph)

BIR Form No.

2118-EA Estate Tax Amnesty Return

May 2019 Pursuant to Republic Act No. 11213

Page 2 2118-EA 05/19 P2

TIN Taxpayer’s Name

0 0 0 0 0

Part IV - Schedules

DETAILS OF PROPERTY

Schedule 1 – REAL PROPERTIES (Attach additional sheet/s if necessary)

OCT/ TCT/ Tax Declaration Zonal Value (ZV) Fair Market Value FMV whichever is higher

Location Class* Area

CCT No. (TD) No. (FMV per BIR) (FMV per TD) CONJUGAL EXCLUSIVE

TOTAL (To Part II Item 14)

Schedule 1A – Family Home

OCT/ TCT/ Tax Declaration Zonal Value (ZV) Fair Market Value FMV whichever is higher

Location Class* Area

CCT No. (TD) No. (FMV per BIR) (FMV per TD) CONJUGAL EXCLUSIVE

TOTAL (To Part II Item 16)

Schedule 2 – Personal Properties (SHARES OF STOCK) (Attach additional sheet/s if necessary)

No of Fair Market Value Total Fair Market Value

Name of Corporation Stock Cert. No.

Shares per Share CONJUGAL EXCLUSIVE

TOTAL (To Part II Item 15)

Schedule 3 – Other Personal Properties (Attach additional sheet/s if necessary)

Fair Market Value

Particulars

CONJUGAL EXCLUSIVE

TOTAL (To Part II Item 15)

Schedule 4 – Taxable Transfers (Attach additional sheet/s if necessary)

Fair Market Value

Particulars

CONJUGAL EXCLUSIVE

TOTAL (To Part II Item 17)

Schedule 5 – Ordinary Deductions (Whichever is applicable)

Fair Market Value

Particulars

CONJUGAL EXCLUSIVE

Actual or Allowable Funeral Expenses

Actual or Allowable Medical Expenses

Judicial Expenses of the Testamentary or Intestate Proceedings/Administration Expenses

Claims against the Estate

Claims against Insolvent Persons

Property Previously Taxed (Vanishing Deduction)

Transfers for Public Use

Others (specify) ________________________________________________________________

TOTAL (To Part II Item 19)

* RR-Residential Regular CR-Condominium Regular CL-Cemetery Lot GL-Government Lot A-Agricultural X-Institutional

RC-Residential Condominium CC-Commercial Condominium PS-Parking Slot GP-General Purpose I-Industrial APD-Area for Priority Development

Вам также может понравиться

- RDO No. 52 - Paranaque CityДокумент197 страницRDO No. 52 - Paranaque CityKarla KatigbakОценок пока нет

- RDO-Zarraga, IloiloДокумент823 страницыRDO-Zarraga, IloiloDoni June Almio100% (1)

- RDO No. 75 - Zarraga, IloiloДокумент1 133 страницыRDO No. 75 - Zarraga, IloiloAC PalmaresОценок пока нет

- RDO No. 80 - Mandaue City, CebuДокумент798 страницRDO No. 80 - Mandaue City, CebuCecil GubaОценок пока нет

- RDO No. 74 - Iloilo City, IloiloДокумент834 страницыRDO No. 74 - Iloilo City, IloiloRon NasupleОценок пока нет

- RDO No. 58 - Batangas CityДокумент377 страницRDO No. 58 - Batangas Cityattyjecky100% (2)

- PRLD - SRS.002-B.00 - Sworn Registration Statement (Single)Документ2 страницыPRLD - SRS.002-B.00 - Sworn Registration Statement (Single)KLASANTOS100% (1)

- Zonal RDO No. 46 - Cainta-TaytayДокумент299 страницZonal RDO No. 46 - Cainta-TaytayHershey Ramos SabinoОценок пока нет

- Estate Tax Description: BIR Form 1801Документ5 страницEstate Tax Description: BIR Form 1801Razz LimpiadaОценок пока нет

- Eastwest Foreclosed Properties For Sale April 14 2023Документ16 страницEastwest Foreclosed Properties For Sale April 14 2023Coleen Navarro-Rasmussen0% (1)

- RDO No. 103 - Butuan City, Agusan Del NorteДокумент703 страницыRDO No. 103 - Butuan City, Agusan Del Nortelovenia mantilla0% (1)

- 1701A Annual Income Tax ReturnДокумент2 страницы1701A Annual Income Tax ReturnJaneth Tamayo NavalesОценок пока нет

- RDO No. 21B - City of San Fernando, South PampangaДокумент519 страницRDO No. 21B - City of San Fernando, South PampangaAОценок пока нет

- E.S.A.P. Application Form (2019)Документ2 страницыE.S.A.P. Application Form (2019)Jigo Dacua100% (1)

- RDO No. 44 - Taguig-Pateros4850195872301349928Документ428 страницRDO No. 44 - Taguig-Pateros4850195872301349928Karla Katigbak100% (1)

- Deed of Donation - QCG To Albay (Generator Sets) 11.5.20Документ4 страницыDeed of Donation - QCG To Albay (Generator Sets) 11.5.20Francis BlaiseОценок пока нет

- RDO No. 54B - Bacoor City, West CaviteДокумент1 108 страницRDO No. 54B - Bacoor City, West CaviteCreative PlannersОценок пока нет

- Engr. Eduardo B. CedoДокумент1 страницаEngr. Eduardo B. CedoHoward UntalanОценок пока нет

- Special Power of Attorney (MULTIPLE)Документ2 страницыSpecial Power of Attorney (MULTIPLE)Har RizОценок пока нет

- RDO No. 72 - Roxas City All MunicipalitiesДокумент225 страницRDO No. 72 - Roxas City All MunicipalitiesPaul Pabilico PorrasОценок пока нет

- Telco Rental Commission AgreementДокумент1 страницаTelco Rental Commission AgreementmutedchildОценок пока нет

- Deed of Adjudication With Usufruct-Arturo I. ZonioДокумент2 страницыDeed of Adjudication With Usufruct-Arturo I. ZonioArnulfo CerezoОценок пока нет

- 10.25. Affidavit of Two Disinterested Persons (Aves)Документ1 страница10.25. Affidavit of Two Disinterested Persons (Aves)Dax MonteclarОценок пока нет

- RDO No. 84 - Tagbilaran CityДокумент296 страницRDO No. 84 - Tagbilaran CityBlu Kurakao100% (1)

- Bautista BTF Elcac Opcen EoДокумент2 страницыBautista BTF Elcac Opcen EojomarОценок пока нет

- Waiver of Rights Unregistered LandДокумент2 страницыWaiver of Rights Unregistered Landtig singkwentalangОценок пока нет

- Dar Clearance Form 1.0Документ1 страницаDar Clearance Form 1.0Colleen Rose GuanteroОценок пока нет

- Aff Transferro-Ree-1Документ2 страницыAff Transferro-Ree-1Anonymous kJPBOi0HОценок пока нет

- RDO No. 64 - Talisay, Camarines NorteДокумент483 страницыRDO No. 64 - Talisay, Camarines NortedebbeelawОценок пока нет

- Rmo15 03anxb3 PDFДокумент2 страницыRmo15 03anxb3 PDFNetty GaviolaОценок пока нет

- Deed of SaleДокумент4 страницыDeed of SaleBenna Arzaga CabutihanОценок пока нет

- ONETT For Sale of Real Property Classified As Ordinary AssetДокумент1 страницаONETT For Sale of Real Property Classified As Ordinary Assetd-fbuser-49417072Оценок пока нет

- RDO No. 2 - Bantay, Ilocos SurДокумент643 страницыRDO No. 2 - Bantay, Ilocos SurJennyMariedeLeonОценок пока нет

- List of Projects With License To Sell Extracted On 02132023Документ27 страницList of Projects With License To Sell Extracted On 02132023Geodel CuarteroОценок пока нет

- RDO 39 - SouthQCДокумент215 страницRDO 39 - SouthQCJ.V. Untalan100% (4)

- Annex A Locational ClearanceДокумент1 страницаAnnex A Locational Clearancemary ann carreon100% (1)

- RDO No. 114 - Mati City, Davao OrientalДокумент694 страницыRDO No. 114 - Mati City, Davao OrientalLRM0% (1)

- RDO No. 4 - Calasiao, West Pangasinan 2Документ1 416 страницRDO No. 4 - Calasiao, West Pangasinan 2Jeric Angelo Galon100% (4)

- RDO No. 53A - Las Pinas CityДокумент121 страницаRDO No. 53A - Las Pinas CityghilphilОценок пока нет

- HLURB Registration Statement Single ProprietorshipДокумент1 страницаHLURB Registration Statement Single ProprietorshipAllen HidalgoОценок пока нет

- LRA Circular No 10-2020 - Official List of Documents Required For Registration of Sale of Registerd and Unregistered LandsДокумент2 страницыLRA Circular No 10-2020 - Official List of Documents Required For Registration of Sale of Registerd and Unregistered LandsEdwin SegayaОценок пока нет

- HLURB PoultryДокумент1 страницаHLURB PoultryKonsehal Bennet PongosОценок пока нет

- 2550 MДокумент2 страницы2550 MJose Venturina Villacorta100% (3)

- Affidavit of Undertaking To Submit Transfer Certificate of Title (TCT) (For Subdivision Projects)Документ1 страницаAffidavit of Undertaking To Submit Transfer Certificate of Title (TCT) (For Subdivision Projects)yonni143Оценок пока нет

- Memorandum of Agreement: The HEIRS of - , NamelyДокумент3 страницыMemorandum of Agreement: The HEIRS of - , NamelyBetsy Maria ZalsosОценок пока нет

- QC Zonal Values - EstateДокумент1 страницаQC Zonal Values - EstateJCSОценок пока нет

- RDO No. 23A - Talavera, North Nueva EcijaДокумент782 страницыRDO No. 23A - Talavera, North Nueva EcijaJOHN GIMENOОценок пока нет

- FORM NO. 45 Affidavit of Consolidation in Deed of SaleДокумент1 страницаFORM NO. 45 Affidavit of Consolidation in Deed of SaleAlexandrius Van VailocesОценок пока нет

- Sworn Statement As To Maximum Selling PriceДокумент1 страницаSworn Statement As To Maximum Selling PriceFELSON CAPANGPANGANОценок пока нет

- Education Service Contracting: Application Form ESC Form 1Документ3 страницыEducation Service Contracting: Application Form ESC Form 1alexzandra marie posadasОценок пока нет

- RDO No. 17A - Tarlac CityДокумент814 страницRDO No. 17A - Tarlac CityHazel Pantig100% (5)

- Republic of The Philippines Land Registration Authority Register of Deeds of The Province of IsabelaДокумент2 страницыRepublic of The Philippines Land Registration Authority Register of Deeds of The Province of IsabelaAlex Respicio100% (3)

- Deed of PartitionДокумент3 страницыDeed of PartitionTauMu Academic100% (1)

- Extra Judicial Settlement of The EstateДокумент3 страницыExtra Judicial Settlement of The EstateEnerita AllegoОценок пока нет

- Lawyers ID FormДокумент1 страницаLawyers ID Formnicakyut100% (1)

- Estate Tax Amnesty ReturnДокумент2 страницыEstate Tax Amnesty ReturnCherry Chao0% (1)

- Annex B 2118-EA v2 PDFДокумент2 страницыAnnex B 2118-EA v2 PDFjencastroОценок пока нет

- 2118-Ea 0919 Encs FinalДокумент2 страницы2118-Ea 0919 Encs FinalJason YangaОценок пока нет

- 2118-EA 0919 ENCS FinalДокумент2 страницы2118-EA 0919 ENCS FinalMarkwin QuadxОценок пока нет

- 2000-OT January 2018 ENCS v3Документ2 страницы2000-OT January 2018 ENCS v3Richelle Ann RodriguezОценок пока нет

- Anti-Red Tape ActДокумент5 страницAnti-Red Tape ActMELLICENT LIANZAОценок пока нет

- R A 8371Документ4 страницыR A 8371MELLICENT LIANZAОценок пока нет

- BPO PrimerДокумент3 страницыBPO PrimerMELLICENT LIANZAОценок пока нет

- Moral Damages in Cases of Illegal DismissalДокумент2 страницыMoral Damages in Cases of Illegal DismissalMELLICENT LIANZAОценок пока нет

- Memorandum of Agreement - SunriseДокумент2 страницыMemorandum of Agreement - SunriseMELLICENT LIANZAОценок пока нет

- R. A. 8043 - InterCountry Adoption ActДокумент8 страницR. A. 8043 - InterCountry Adoption ActMELLICENT LIANZAОценок пока нет

- A. M. No. 02-11-10-SCДокумент10 страницA. M. No. 02-11-10-SCMELLICENT LIANZAОценок пока нет

- Annex D - Certificate of AvailmentДокумент1 страницаAnnex D - Certificate of AvailmentMELLICENT LIANZAОценок пока нет

- The Indigenous Peoples Rights ActДокумент5 страницThe Indigenous Peoples Rights ActmizzeloОценок пока нет

- Annex C 0621-EAДокумент1 страницаAnnex C 0621-EAMELLICENT LIANZAОценок пока нет

- Annex C 0621-EAДокумент1 страницаAnnex C 0621-EAMELLICENT LIANZAОценок пока нет

- Pain Audit ToolsДокумент10 страницPain Audit ToolsIrmela CoricОценок пока нет

- 10.isca RJCS 2015 106Документ5 страниц10.isca RJCS 2015 106Touhid IslamОценок пока нет

- Msds 77211 enДокумент13 страницMsds 77211 enJulius MwakaОценок пока нет

- Boeing 247 NotesДокумент5 страницBoeing 247 Notesalbloi100% (1)

- HAART PresentationДокумент27 страницHAART PresentationNali peterОценок пока нет

- A Packed Cultural Calendar - The Indian Music and Dance Festivals You Shouldn't Miss - The HinduДокумент6 страницA Packed Cultural Calendar - The Indian Music and Dance Festivals You Shouldn't Miss - The HindufisaОценок пока нет

- Example of Praxis TicketДокумент3 страницыExample of Praxis TicketEmily LescatreОценок пока нет

- UntitledДокумент1 страницаUntitledsai gamingОценок пока нет

- Bank Soal LettersДокумент17 страницBank Soal Lettersderoo_wahidahОценок пока нет

- GK Test-IiДокумент11 страницGK Test-IiDr Chaman Lal PTОценок пока нет

- Air Passenger Bill of RightsДокумент12 страницAir Passenger Bill of RightsAldan Subion Avila100% (1)

- 580N 580SN 580SN WT 590SN With POWERSHUTTLE ELECTRICAL SCHEMATICДокумент2 страницы580N 580SN 580SN WT 590SN With POWERSHUTTLE ELECTRICAL SCHEMATICEl Perro100% (1)

- Www.sefindia.orgДокумент372 страницыWww.sefindia.orgRahul KolateОценок пока нет

- AWS Migrate Resources To New RegionДокумент23 страницыAWS Migrate Resources To New Regionsruthi raviОценок пока нет

- BCK Test Ans (Neha)Документ3 страницыBCK Test Ans (Neha)Neha GargОценок пока нет

- Python BarchartДокумент34 страницыPython BarchartSeow Khaiwen KhaiwenОценок пока нет

- Arvind Textiles Internship ReportДокумент107 страницArvind Textiles Internship ReportDipan SahooОценок пока нет

- IllustratorДокумент27 страницIllustratorVinti MalikОценок пока нет

- Governance of Cyber Security Research ProposalДокумент1 страницаGovernance of Cyber Security Research ProposalAleksandar MaričićОценок пока нет

- Midterm Quiz 1 March 9.2021 QДокумент5 страницMidterm Quiz 1 March 9.2021 QThalia RodriguezОценок пока нет

- Branch CodeДокумент3 страницыBranch CodeAhir MukherjeeОценок пока нет

- ScriptДокумент7 страницScriptAllen Delacruz100% (1)

- Gitanjali Gems Annual Report FY2012-13Документ120 страницGitanjali Gems Annual Report FY2012-13Himanshu JainОценок пока нет

- Thematic CodingДокумент31 страницаThematic CodingLance Jazekmiel DOMINGOОценок пока нет

- Natures CandyДокумент19 страницNatures CandyFanejegОценок пока нет

- Research On The Marketing Communication Strategy of Tesla Motors in China Under The Background of New MediaДокумент5 страницResearch On The Marketing Communication Strategy of Tesla Motors in China Under The Background of New MediaSiddharth ChaudharyОценок пока нет

- Microstrip Antennas: How Do They Work?Документ2 страницыMicrostrip Antennas: How Do They Work?Tebogo SekgwamaОценок пока нет

- Leadership and Decision Making PDFДокумент34 страницыLeadership and Decision Making PDFNhi PhamОценок пока нет

- Jay Ekbote FINAL PROJECT - HDFC ERGO Health InsuranceДокумент71 страницаJay Ekbote FINAL PROJECT - HDFC ERGO Health InsuranceAditi SawantОценок пока нет

- Microsoft Software License Terms Microsoft Windows Media Player Html5 Extension For ChromeДокумент2 страницыMicrosoft Software License Terms Microsoft Windows Media Player Html5 Extension For ChromeOmar PiñaОценок пока нет