Академический Документы

Профессиональный Документы

Культура Документы

Excipients Market Analysis and Segement Forecasts To 2025

Загружено:

vikasaggarwal01Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Excipients Market Analysis and Segement Forecasts To 2025

Загружено:

vikasaggarwal01Авторское право:

Доступные форматы

MARKET ESTIMATES & TREND ANALYSIS

Excipients Market

Market, by Product (Polymers {MCC, HPMC, Ethyl Cellulose, Methyl Cellulose,

Carboxymethyl Cellulose, Croscarmellose Sodium, Povidone, Pregelatinized Starch,

Sodium Starch Glycolate, Polyethylene Glycol, Acrylic Polymers}, Alcohols {Glycerin,

Propylene Glycol, Sorbitol, Mannitol, Others}, Minerals {Calcium Phosphate, Calcium

Carbonate, Clay, Silicon Dioxide, Titanium Dioxide, Others}, Sugar & Others, {Lactose,

Sucrose, Others}, and Gelatin)

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

ABOUT US

RAND VIEW RESEARCH is a market research and consulting company that provides

G syndicated research reports, customized research reports, and consulting services. To

help clients make informed business decisions, we offer market intelligence studies

ensuring relevant and fact-based research across a range of industries including

Healthcare, Technology, Chemicals, Materials, and Energy. With a deep-seated understanding

of many business environments, Grand View Research provides strategic objective insights. We

periodically update our market research studies to ensure our clients get the most recent,

relevant, and valuable information. Grand View Research has a strong base of analysts and

consultants from assorted areas of expertise. Our industry experience and ability to zero-in on

the crux of any challenge gives you and your organization the ability to secure a competitive

advantage.

Copyright © 2016 Grand View Research Inc., USA

All Rights Reserved. This document contains highly confidential

information and is the sole property of Grand View Research. No part

of it may be circulated, copied, quoted, or otherwise reproduced

without the approval of Grand View Research.

2

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

Table of Contents

Chapter 1 Research Methodology ................................................... 11

1.1 Information Procurement ........................................................................................... 13

1.2 Data Analysis ............................................................................................................. 16

Chapter 2 Executive Summary ........................................................ 20

Chapter 3 Market Variables, Trends& Scope .................................. 22

3.1 Market Segmentation &Scope .................................................................................... 23

3.1.1 Market driver analysis ...................................................................................... 25

3.1.1.1 Growing pharmaceutical market .................................. 26

3.1.1.2 Rising demand for novel excipients .............................. 26

3.1.1.3 Patent cliffs driving the growth of excipients in the

generics market ........................................................ 27

3.1.2 Market restraint analysis .................................................................................. 30

3.1.2.1 Stringent rules by regulatory bodies ............................. 31

3.2 Penetration &Growth Prospect Mapping for Products, 2016........................................ 32

3.3 Excipients Market-Swot Analysis, By Factor (Political & Legal, Economic And

Technological) ............................................................................................................ 33

3.4 Industry Analysis – Porter’s ........................................................................................ 34

Chapter 4 Market Categorization: Product Estimates & Trend

Analysis ........................................................................... 35

4.1 Global Excipients Market: Product Movement Analysis ............................................... 36

4.2 Polymers .................................................................................................................... 38

4.2.1 Global polymers market, 2012 – 2025 (USD Million)........................................... 38

4.2.2 Methyl Crystalline Cellulose (MCC) .................................................................... 39

4.2.2.1 Global MCC market, 2012 – 2025 (USD Million) ............. 39

4.2.3 Hydroxy Propyl Methyl Cellulose (HPMC) .......................................................... 40

4.2.3.1 Global HPMC market, 2012 – 2025 (USD Million)............ 40

4.2.4 Ethyl cellulose .................................................................................................. 41

4.2.4.1 Global ethyl cellulose market, 2012 – 2025 (USD

Million) .................................................................... 41

4.2.5 Methyl cellulose ............................................................................................... 41

4.2.5.1 Global methyl cellulose market, 2012 – 2025 (USD

Million) .................................................................... 42

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

3

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

4.2.6 Carboxy Methyl Cellulose (CMC) ....................................................................... 42

4.2.6.1 Global CMC market, 2012 – 2025 (USD Million) ............. 43

4.2.7 Croscarmellose sodium ..................................................................................... 43

4.2.7.1 Global croscarmellose sodium market, 2012 – 2025

(USD Million) ............................................................ 44

4.2.8 Povidone .......................................................................................................... 44

4.2.8.1 Global povidone market, 2012 – 2025 (USD Million) ....... 45

4.2.9 Pregelatinized starch ........................................................................................ 45

4.2.9.1 Global pregelatinized starch market, 2012 – 2025

(USD Million) ............................................................ 46

4.2.10 Sodium starch glycolate .................................................................................... 46

4.2.10.1 Global sodium starch glycolate market, 2012 – 2025

(USD Million) ............................................................ 47

4.2.11 Polyethylene glycol ........................................................................................... 47

4.2.11.1 Global polyethylene glycol market, 2012 – 2025

(USD Million) ............................................................ 48

4.2.12 Acrylic polymers ............................................................................................... 48

4.2.12.1 Global acrylic polymers market, 2012 – 2025 (USD

Million) .................................................................... 49

4.3 Alcohol ...................................................................................................................... 49

4.3.1 Global alcohol market, 2012 – 2025 (USD Million).............................................. 50

4.3.2 Glycerin............................................................................................................ 50

4.3.2.1 Global glycerin market, 2012 – 2025 (USD Million) ......... 51

4.3.3 Propylene glycol ............................................................................................... 51

4.3.3.1 Global propylene glycol market, 2012 – 2025 (USD

Million) .................................................................... 52

4.3.4 Sorbitol ............................................................................................................ 52

4.3.4.1 Global sorbitol market, 2012 – 2025 (USD Million) ......... 53

4.3.5 Mannitol .......................................................................................................... 53

4.3.5.1 Global mannitol market, 2012 – 2025 (USD Million) ....... 54

4.3.6 Others .............................................................................................................. 54

4.3.6.1 Global other alcohol market, 2012 – 2025 (USD

Million) .................................................................... 55

4.4 Minerals..................................................................................................................... 55

4.4.1 Global minerals market, 2012 – 2025 (USD Million)............................................ 56

4.4.2 Calcium phosphate ........................................................................................... 56

4.4.2.1 Global calcium phosphate market, 2012 – 2025

(USD Million) ............................................................ 57

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

4

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

4.4.3 Calcium carbonate ............................................................................................ 57

4.4.3.1 Global calcium carbonate market, 2012 – 2025 (USD

Million) .................................................................... 58

4.4.4 Clay .................................................................................................................. 58

4.4.4.1 Global clay market, 2012 – 2025 (USD Million) .............. 59

4.4.5 Silicon dioxide .................................................................................................. 59

4.4.5.1 Global silicon dioxide market, 2012 – 2025 (USD

Million) .................................................................... 60

4.4.6 Titanium dioxide .............................................................................................. 60

4.4.6.1 Global titanium dioxide market, 2012 – 2025 (USD

Million) .................................................................... 61

4.4.7 Others .............................................................................................................. 62

4.4.7.1 Global other minerals market, 2012 – 2025 (USD

Million) .................................................................... 62

4.5 Sugar ......................................................................................................................... 63

4.5.1 Global sugar market, 2012 – 2025 (USD Million) ................................................ 63

4.5.2 Lactose............................................................................................................. 64

4.5.2.1 Global lactose market, 2012 – 2025 (USD Million) .......... 64

4.5.3 Sucrose ............................................................................................................ 65

4.5.3.1 Global sucrose market, 2012 – 2025 (USD Million) ......... 65

4.5.4 Others .............................................................................................................. 66

4.5.4.1 Global other excipients market, 2012 – 2025 (USD

Million) .................................................................... 66

4.6 Gelatin ....................................................................................................................... 66

4.6.1 Global gelatin market, 2012 – 2025 (USD Million) .............................................. 67

Chapter 5 Market Categorization: Regional Estimates &

Trend Analysis, by Product ............................................ 68

5.1 Global Excipients Market: Region Movement Analysis ................................................. 69

5.2 North America............................................................................................................ 71

5.2.1 North America excipients market, 2012 – 2025 (USD Million) ............................. 71

5.2.2 U.S. .................................................................................................................. 72

5.2.2.1 U.S. excipients market, 2012 – 2025 (USD Million) ........ 73

5.2.3 Canada ............................................................................................................. 73

5.2.3.1 Canada excipients market, 2012 – 2025 (USD

Million) .................................................................... 74

5.3 Europe ....................................................................................................................... 74

5.3.1 Europe excipients market, 2012 – 2025 (USD Million) ........................................ 76

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

5

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

5.3.2 Germany .......................................................................................................... 77

5.3.2.1 Germany excipients market, 2012 – 2025 (USD

Million) .................................................................... 77

5.4 Asia Pacific ................................................................................................................. 77

5.4.1 Asia Pacific excipients market, 2012 – 2025 (USD Million) .................................. 79

5.4.2 Japan ............................................................................................................... 79

5.4.2.1 Japan excipients market, 2012 – 2025 (USD Million) ...... 79

5.5 Latin America ............................................................................................................. 80

5.5.1 Latin America excipients market, 2012 – 2025 (USD Million) .............................. 81

5.5.2 Brazil ................................................................................................................ 81

5.5.2.1 Brazil excipients market, 2012 – 2025 (USD Million) ....... 82

5.6 Middle East & Africa (MEA) ........................................................................................ 82

5.6.1 Middle East & Africa excipients market, 2012 – 2025 (USD Million) .................... 83

5.6.2 South Africa ..................................................................................................... 83

5.6.2.1 South Africa excipients market, 2012 – 2025 (USD

Million) .................................................................... 84

Chapter 6 Competitive Landscape .................................................. 85

6.1 Strategy Framework ................................................................................................... 85

6.2 Market Participation Categorization ........................................................................... 86

6.3 Company Profiles ....................................................................................................... 87

6.3.1 Eastman Chemical Corporation ......................................................................... 87

6.3.1.1 Company overview .................................................... 87

6.3.1.2 Financial performance ................................................ 87

6.3.1.3 Product benchmarking................................................ 88

6.3.2 P & G................................................................................................................ 89

6.3.2.1 Company overview .................................................... 89

6.3.2.2 Financial performance ................................................ 89

6.3.2.3 Product benchmarking................................................ 90

6.3.3 Avantor Performance Materials, LLC ................................................................. 91

6.3.3.1 Company overview .................................................... 91

6.3.3.2 Financial Performance ................................................ 91

6.3.3.3 Product benchmarking................................................ 91

6.3.3.4 Strategic initiatives .................................................... 92

6.3.4 Huntsman Corporation ..................................................................................... 93

6.3.4.1 Company overview .................................................... 93

6.3.4.2 Financial performance ................................................ 93

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

6

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

6.3.4.3 Product benchmarking................................................ 93

6.3.4.4 Strategic initiatives .................................................... 94

6.3.5 BASF SE ............................................................................................................ 95

6.3.5.1 Company overview .................................................... 95

6.3.5.2 Financial performance ................................................ 95

6.3.5.3 Product benchmarking................................................ 96

6.3.5.4 Strategic initiatives .................................................... 96

6.3.6 Ashland Inc,...................................................................................................... 97

6.3.6.1 Company overview .................................................... 97

6.3.6.2 Financial performance ................................................ 97

6.3.6.3 Product benchmarking................................................ 97

6.3.6.4 Strategic initiatives .................................................... 98

6.3.7 FMC Corporation .............................................................................................. 99

6.3.7.1 Company overview .................................................... 99

6.3.7.2 Financial performance ................................................ 99

6.3.7.3 Product benchmarking.............................................. 100

6.3.7.4 Strategic initiatives .................................................. 100

6.3.8 Roquette ........................................................................................................ 101

6.3.8.1 Company overview .................................................. 101

6.3.8.2 Financial performance .............................................. 101

6.3.8.3 Product benchmarking.............................................. 101

6.3.8.4 Strategic initiatives .................................................. 102

6.3.9 Colorcon Inc., ................................................................................................. 103

6.3.9.1 Company overview .................................................. 103

6.3.9.2 Financial performance .............................................. 103

6.3.9.3 Product benchmarking.............................................. 103

6.3.9.4 Strategic initiatives .................................................. 104

6.3.10 Lubrizol Corporation ....................................................................................... 105

6.3.10.1 Company overview .................................................. 105

6.3.10.2 Financial performance .............................................. 105

6.3.10.3 Product benchmarking.............................................. 105

6.3.10.4 Strategic initiatives .................................................. 106

6.3.11 Valeant .......................................................................................................... 107

6.3.11.1 Company overview .................................................. 107

6.3.11.1.1 The Dow Chemical Company (Dow Pharma

Solutions) ..................................................... 107

6.3.11.2 Financial performance .............................................. 108

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

7

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

6.3.11.2.1 Financial performance ..................................... 108

6.3.11.3 Product benchmarking.............................................. 109

6.3.12 JRS PHARMA .................................................................................................. 110

6.3.12.1 Company overview .................................................. 110

6.3.12.2 Financial performance .............................................. 110

6.3.12.3 Product benchmarking.............................................. 111

6.3.12.4 Strategic initiatives .................................................. 112

6.3.13 Shin-Etsu Chemical Co., Ltd ............................................................................. 113

6.3.13.1 Company overview .................................................. 113

6.3.13.1.1 SE Pharma & Food Materials Distribution

GmbH .......................................................... 113

6.3.13.2 Financial performance .............................................. 114

6.3.13.3 Product benchmarking.............................................. 114

6.3.13.4 Strategic initiatives .................................................. 115

6.3.14 DFE pharma .................................................................................................... 116

6.3.14.1 Company overview .................................................. 116

6.3.14.2 Financial performance .............................................. 116

6.3.14.3 Product benchmarking.............................................. 116

6.3.14.4 Strategic initiatives .................................................. 117

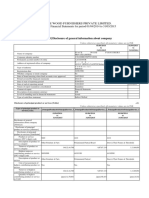

6.3.15 FINAR LIMITED ............................................................................................... 119

6.3.15.1 Company overview .................................................. 119

6.3.15.2 Financial performance .............................................. 119

6.3.15.3 Product benchmarking.............................................. 119

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

8

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

List of Tables

TABLE 1 Major drugs going off patent in 2017 29

List of Figures

FIG. 1 Market research process 12

FIG. 2 Information Procurement 13

FIG. 3 Primary research pattern 15

FIG. 4 Market research approaches 17

FIG. 5 Value chain based sizing & forecasting 17

FIG. 6 QFD modelling for market share assessment 19

FIG. 7 Market summary 21

FIG. 8 Market trends & outlook 22

FIG. 9 Market segmentation & scope 23

FIG. 10 Market driver relevance analysis (Current & future impact) 25

FIG. 11 Major drugs that lost patent protection in 2016 (Revenue in USD million) 28

FIG. 12 Market restraint relevance analysis (Current & future impact) 30

FIG. 13 Penetration & growth prospect mapping for Products, 2016 32

FIG. 14 SWOT Analysis, By Factor (political & legal, economic and technological) 33

FIG. 15 Porter’s Five Forces Analysis 34

FIG. 16 Global excipients market: Product outlook key takeaways 35

FIG. 17 Global excipients market: Product movement analysis 37

FIG. 18 Global polymers market, 2012 – 2025 (USD Million) 38

FIG. 19 Global MCC market, 2012 – 2025 (USD Million) 39

FIG. 20 Global HPMC market, 2012 – 2025 (USD Million) 40

FIG. 21 Global ethyl cellulose market, 2012 – 2025 (USD Million) 41

FIG. 22 Global methyl cellulose market, 2012 – 2025 (USD Million) 42

FIG. 23 Global CMC market, 2012 – 2025 (USD Million) 43

FIG. 24 Global croscarmellose sodium market, 2012 – 2025 (USD Million) 44

FIG. 25 Global povidone market, 2012 – 2025 (USD Million) 45

FIG. 26 Global pregelatinized starch market, 2012 – 2025 (USD Million) 46

FIG. 27 Global sodium starch glycolate market, 2012 – 2025 (USD Million) 47

FIG. 28 Global polyethylene glycol market, 2012 – 2025 (USD Million) 48

FIG. 29 Global acrylic polymers market, 2012 – 2025 (USD Million) 49

FIG. 30 Global alcohol market, 2012 – 2025 (USD Million) 50

FIG. 31 Global glycerine market, 2012 – 2025 (USD Million) 51

FIG. 32 Global propylene glycol market, 2012 – 2025 (USD Million) 52

FIG. 33 Global sorbitol market, 2012 – 2025 (USD Million) 53

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

9

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

FIG. 34 Global mannitol market, 2012 – 2025 (USD Million) 54

FIG. 35 Global other alcohol market, 2012 – 2025 (USD Million) 55

FIG. 36 Global minerals market, 2012 – 2025 (USD Million) 56

FIG. 37 Global calcium phosphate market, 2012 – 2025 (USD Million) 57

FIG. 38 Global calcium carbonate market, 2012 – 2025 (USD Million) 58

FIG. 39 Global clay market, 2012 – 2025 (USD Million) 59

FIG. 40 Global silicon dioxide market, 2012 – 2025 (USD Million) 60

FIG. 41 Global titanium dioxide market, 2012 – 2025 (USD Million) 61

FIG. 42 Global other minerals market, 2012 – 2025 (USD Million) 62

FIG. 43 Global sugar market, 2012 – 2025 (USD Million) 63

FIG. 44 Global lactose market, 2012 – 2025 (USD Million) 64

FIG. 45 Global sucrose market, 2012 – 2025 (USD Million) 65

FIG. 46 Global other excipients market, 2012 – 2025 (USD Million) 66

FIG. 47 Global gelatin market, 2012 – 2025 (USD Million) 67

FIG. 48 Regional market place: Key takeaway 68

FIG. 49 Excipients regional outlook, 2016 & 2025 70

FIG. 50 North America excipients market, 2012 – 2025 (USD Million) 71

FIG. 51 U.S. excipients market, 2012 – 2025 (USD Million) 73

FIG. 52 Canada excipients market, 2012 – 2025 (USD Million) 74

FIG. 53 Europe excipients market, 2012 – 2025 (USD Million) 76

FIG. 54 Germany excipients market, 2012 – 2025 (USD Million) 77

FIG. 55 Asia Pacific excipients market, 2012 – 2025 (USD Million) 79

FIG. 56 Japan excipients market, 2012 – 2025 (USD Million) 79

FIG. 57 Latin America excipients market, 2012 – 2025 (USD Million) 81

FIG. 58 Brazil excipients market, 2012 – 2025 (USD Million) 82

FIG. 59 Middle East & Africa excipients market, 2012 – 2025 (USD Million) 83

FIG. 60 South Africa excipients market, 2012 – 2025 (USD Million) 84

FIG. 61 Strategy framework 85

FIG. 62 Participant categorization 86

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

10

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

Chapter 1 Research Methodology

Our research methodology entails an ideal mixture of primary and secondary initiatives. Key

steps involves in the process are listed below:

Information Procurement

The stage involves the procurement of market data or related information via different

sources & methodologies.

Information Analysis

This step involves the analysis & mapping of all the information procured from the

previous step. It also encompasses the analysis of data discrepancies observed across

various data sources.

Market Formulation

The final step entails the placement of data points at appropriate market spaces in an

attempt to deduce viable conclusions. Analyst perspective & subject matter expert based

heuristic form of market sizing also plays an integral role in this step.

Validation &Publishing

Validation is the most important step in the process. Validation & re-validation via an

intricately designed process helps us finalize data-points to be used for final calculations.

The movement from step – 1 and step – 2 is bi-directional in nature. The process follows a to &

fro from both the ends. This is an integral data filtration technique used by GVR. The validation

& market formulation steps are also reversible in nature. They are run parallel to ensure data

accuracy and process flexibility.

The process of market sizing & data point identification runs throughout the report schedule.

The process moves from Step 1&2 to Step 3&4, while keeping the steps 1&2 and 3&4

reversible. The cycle of market sizing & variable identification also keeps repeating until every

data point is duly validated and is fit for publishing.

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

11

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

FIG. 1 Market research process

Information procurement Information analysis Market formulation

Validation & publishing

The stage involves the This step involves the The final step entails the

Validation is the most

procurement of market analysis & mapping of all placement of data points

important step in the

data or related the information procured at appropriate market

process. Validation & re-

information via different from the previous step. It spaces in an attempt to

validation via an

sources & methodologies. also encompasses the deduce viable conclusions.

intricately designed

analysis of data Analyst perspective &

process helps us finalize

discrepancies observed subject matter expert

data-points to be used for

across various data based heuristic form of

final calculations.

sources. market sizing also plays an

integral role in this step.

The movement from step – 1 and step – 2 is bi-directional in The validation & market formulation steps are also reversible in

nature. The process follows a to & fro from both the ends. This is nature. They are run parallel to ensure data accuracy and process

an integral data filtration technique used by GVR. flexibility.

The process of market sizing & data point identification runs throughout the report schedule. The process moves from Step 1&2

to Step 3&4, while keeping the steps 1&2 and 3&4 reversible. The cycle of market sizing & variable identification also keeps

repeating until every data point is duly validated and is fit for publishing.

12

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

1.1 Information Procurement

FIG. 2 Information Procurement

Purchased Database GVR’s Internal Database

We buy access to paid Includes historic market

databases such as Hoover’s & databases, pertinent studies,

Factiva to gain access to internal audit reports &

company financials, industry archives. Pertinent data such

information, white papers, as prevalence rates,

industry journals, SME journals prescription rates, treatment

etc. rates, usage rates etc. We have

a dedicated team of analysts

updating & maintaining these

databases.

Primary Research

Primary interviews with in-

Information Procurement house industry experts,

freelance consultants,

manufacturers, users &

distributors. Interviews are

largely based on

The stage involves the brainstorming, tele-interviews,

procurement of market data or online surveys etc.

related information via different

sources & methodologies.

Third Party Perspective Secondary Sources

Analysis of investor analyst Includes government statistics

reports, broker reports, published by organizations like

academic commentary, WHO, NGOs, World Bank etc.,

government quotes & wealth KoL publications, Company

management publications. filings, Investor documents etc.

13

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

Information procurement is one of the most extensive stages in our research process. As

illustrated in the figure above, the techniques can broadly be categorized into five sections, as

stated below:

Purchased database:

Includes company databases such as Hoover’s: This helps us identify financial

information, industry competitive landscape, and structure of the market participants. Also,

it serves as an important step in market sizing, especially, in case of commodity-flow

techniques.

Industry databases, e.g. Factiva. Helps us gain access to industry statistics, and KoL

opinions & formulate conclusions.

Other sources include SME journals, pertinent databases from third-party vendors to gain

insights into:

o Treatment rates

o Prescription/usage rates

o Line of treatment/procedure statistics

o Potential market related statistics

o Information on unmet needs

o Regional expenditure pattern

o Investment information or opportunity based statistics

GVR’s Internal Database

Includes our internal database of data points, collected as a result of previous research &

studies and information made available via our database management team

Also includes internal audit reports & archives

Secondary sources:

A list of secondary sources along with the information extracted from them will be available

in the final deliverable

Notable examples include white papers, government statistics published by organizations

like WHO, NGOs, World Bank etc., KoL publications, company filings, investor documents

etc.

14

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

Third Party Perspective:

This section includes market derivation through investor analyst reports, broker reports,

academic commentary, government quotes & wealth management publications.

Primary Research:

FIG. 3 Primary research pattern

The primary interviews and surveys derive directions from extensive secondary

research. Secondary research is a continuous process and is conducted at each

level along the value chain.

Interviews with

Interviews with

manufacturers,

Interviews with raw healthcare

distributors,

material suppliers and practitioners, industry

researchers and

manufacturers experts & independent

representatives of

consultants

regulatory bodies

Interview Scope:

• Research tools: Questionnaire based research and telephonic discussions

• Database: Paid vendors, LinkedIn, Hoover’s, Factiva, Sources extracted from

previous pertinent studies

• Regional scope: All countries within the scope of the study. Interviews of KoLs

from non-English speaking countries are conducted via our vendors and

questionnaires

Sample size for the study on Excipients Market:

Manufacturers & Raw material suppliers- Colorcon Inc., BASF SE, ELIX polymers,

S.L

©Grand View Research, Inc., USA. All Rights Reserved.

15

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

1.2 Data Analysis

Information procured from secondary and primary initiatives are then, analyzed by using

the following tools/models: (a partial list)

Identifying variables and establishing market impact

Establishing market trends

Analyzing future opportunities and market penetration rates by understanding

product commercialization, regional expansion etc.

Analyzing reimbursement trends and changes in healthcare dynamics to establish

future growth

Analyzing sustainability strategies adhered by market participants in an attempt to

determine future course of the market

Analyzing historical market trends and super-imposing them on the current and

future variables to determine year-on-year trend

Understanding disease prevalence, procedure trends and reimbursement framework

Keeping a track of technological advancements in individual segments

Base numbers are established by analyzing the following:

- Company revenues and market share (this list generally includes the analysis of

revenue published by publicly listed manufacturers)

- Derivation of market estimates via analyzing parent and ancillary markets

However, it is difficult for us to currently state the methodology or model that we would follow

while, catering to the client requirements, we propose the use of the following models (a partial

list):

Model selection: demand based bottom up approach, epidemiology and treatment rates

based approach and mixed approach (top down and bottom up)

©Grand View Research, Inc., USA. All Rights Reserved.

16

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

FIG. 4 Market research approaches

Bottom-up demand approach

Total • Demand estimation of each product across countries/regions summed

market to form the total market

Product • Variable analysis for demand forecasting

Product

• Demand estimation via analyzing paid databases, company financials

A B1

Product B either via annual reports or paid databases

Product • Primary interviews for data revalidation and insight collection

Product B B2

Top-down approach • Used extensively for new product forecasting or analyzing penetration

Prev alence levels

lev els • Tools used involve patient flow and prevalence-based models

Line of

Diagnosis therapy • Use of regression and multi-variate analyses for forecasting

Treatment

rate rate

• Involves extensive use of paid and public databases

Prescription • Primary interviews and vendor based primary research for the

Treatme rates

identification of treatment rates, prescription rates, user preferences

nt rate etc.

Combined approach

Total Prev alence

lev els

market Line of

Product Diagnosis Treatment

therapy

Product

rate rate

A Product A1 Prescription

Treatme rates

A Product

Product B A2 nt rate

FIG. 5 Value chain based sizing & forecasting

Demand side estimates

Supply side estimates

• Identifying parent

• Company revenue

markets and ancillary

estimation via

markets

referring to annual

• Segment penetration

reports, investor

analysis to obtain

presentations and

pertinent

Hoover’s

revenue/volume

• Segment revenue

• Procedure

determination via Market sizing and volumes, diagnosis

variable analysis and forecasting rates and treatment

penetration modeling simplified rates to derive market

• Competitive

size

benchmarking to

• Heuristic forecasting

identify market leaders

with the help of

and their collective

subject matter experts

revenue shares

• Forecasting via

• Forecasting via

variable

analyzing

analysis, expected

commercialization

change in diagnosis

rates, pipeline, market

and treatment rates

initiatives, distribution

and reimbursement

networks etc.

etc.

©Grand View Research, Inc., USA. All Rights Reserved.

17

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

Penetration modeling for products

o Determining and forecasting penetration via analyzing product features,

proposed pricing, availability of internal and external substitutes etc.

o Heuristic estimation of year-on-year sales by conducting primary interviews with:

Healthcare practitioners

Industry experts & KoLs

Distributors

o Product sizing and forecasting by following a diffusion model based on S-curve

growth

Analysis of current usage rates and dosage/regimen patterns to determine substitution rates

Regression and variable analysis

o Identifying variables and assigning impact to determine growth)

o QFD modeling for market share assessment (an example cited in the figure

below)

o Referring to historic data to establish base estimates

o Using exponential smoothing for forecasting

Epidemiology or user size based penetration

o Analyzing current needs and determining penetration to estimate market size or

sales

o Using unmet needs and capitalization rates to determine growth

Trend analysis (based on year on year trending models)

©Grand View Research, Inc., USA. All Rights Reserved.

18

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

FIG. 6 QFD modelling for market share assessment

Scores derived via QFD Price Efficacy rates Current penetration Future prospects Consumer preference index

Product A 10 9 7 9 6

Product B 8 9 4 6 5

Product C 10 7 1 7 9

Product D 4 8 10 9 4

Product E 8 6 6 3 1

Weightage in terms of % Market shares as calculated for initial research purposes

Avg. score Relative market share

Price 25% Product A 8.3 24.48%

Efficacy rates 25% Product B 6.6 19.47%

Current penetration 25% Product C 6.6 19.32%

Future prospects 10% Product D 7.0 20.65%

Consumer preference index 15% Product E 5.5 16.08%

100% 33.9

NOTE: THE ABOVE ILLUSTRATED FIGURE IS FOR REPRESENTATION PURPOSES ONLY. ATTRIBUTE SELECTION AND SCORE RENDERING

IS AN EXTENSIVE PROCESS INVOLVING RIGOROUS PRIMARY AND SECONDARY RESEARCH

Note in case of upcoming reports only: The above mentioned proposed techniques will

enable us with the ability to estimate and revalidate all our market estimates while

reducing error margins.

©Grand View Research, Inc., USA. All Rights Reserved.

19

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

Chapter 2 Executive Summary

The global excipient market was valued at USD 4,128.5 million in

Rising demand for 2016 and is expected to grow at a CAGR of 6.0% over the forecast

biologics due to their

period to reach an estimated value of USD 6,986.0 million by 2025.

improved efficacy

and instantaneous In recent years, pharmaceutical excipients have made a remarkable

effect is anticipated progress in quantities used and revenue captured. Gradual

to drive the market

recognition of excipients in providing better functionality and

growth in the coming

years competitive advantage in drug formulations have contributed to the

increased usage of these products by the pharmaceutical firms in the

recent years.

In addition, presence of stringent regulations and guidelines that

ensure the proper and safe use of excipients in drug development is

expected to dramatically impact the future growth of this market.

Europe captured the largest share with respect to revenue generation

Europe excipients

market is expected to

in 2016 excipients market. This market share was attributed to

reach $ 2,179.2 mn presence of regulatory agencies which are involved in enacting new

by 2025. MEA

policies in order to prevent drug adulteration in excipients.

market of excipients

is expected to emerge Europe excipients market was valued at USD 1,336.4 million in 2016

as the fastest

and is anticipated to register 5.6% CAGR over the forecast period.

growing region

However, Middle East & Africa is expected to experience the fastest

growth in the coming years as this region is receiving support from

WHO in the form of training services for local personnel. These

training services are intended to allow the local firms to comply with

the GMP standards for pharmaceutical excipients.

Currently, investigations are going on for optimization of the excipients

functioning in drug formulations and delivery. Moreover,

pharmaceutical firms are engaged in development of more

sophisticated excipients with enhanced role. These factors are

expected to have major impact on development and marketing of

excipients in the near future.

20

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

FIG. 7 Market summary

Segment Key facts

Rising adoption in different formulations

Product: Sugars(fastest) expected to fuel growth.

Market CAGR of 6.9%

High usage of polymers and sugars

Region: Europe (largest)

attributive for dominance

1,870.24

Market led by Roquette Frères, Lubrizol

Competitive landscape

Corporation, FMC Corporation

4128.55

550.49

Drivers Restraints

1,242.55 • Growing pharmaceutical market • Stringent rules by regulatory bodies

• Rising demand for novel excipients

• Patent Cliffs Driving the Growth of

175.61 Excipients in the Generics Market

289.66

Global Polymers Alcohols Sugars Minerals Gelatin

Source: WHO, U.S. CDC, FDA, Investor Presentations, Primary Interviews, Grand View Research

21

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

Chapter 3 Market Variables, Trends& Scope

FIG. 8 Market trends & outlook

Ever growing pharmaceutical market demands the need for continuous supply of

Growing pharmaceutical market excipients to process newer formulations and meet the demand for quality

medication in developing regions

Growth factor.

(Impact low to Need for newer drug delivery systems fuels the innovations in excipient technology

high along the Rising demand for novel like the nanoparticles for oncological drug delivery systems. Multifunctional

arrow

excipients excipients which can serve for more than one purpose is marketable owing to the

market scenario

Many multinational companies are on a verge of crisis due to the expiring patents of

Patent cliffs driving the growth of many blockbuster drugs they possess. This led the need for patent protection by

excipients in the generics market adding functional excipients to the drugs that can modify and make the drug more

effective such as modifying the route of administration or delayed release of drug

Restraining factor.

(Impact low to Strict regulations such as maintaining the GMP protocols, licensing of new

high along the Stringent rules by regulatory manufacturers of excipients, sign of agreement and regulations by suppliers make it

arrow bodies difficult to obtain approval of R & D sites can cause a shortage of US-FDA approved

manufacturing sites

Source: WHO, U.S. CDC, FDA, Investor Presentations, Primary Interviews, Grand View Research

22

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

3.1 Market Segmentation &Scope

FIG. 9 Market segmentation & scope

Excipients Market

Product Type Regional

Polymers Sorbitol North America

MCC Mannitol U.S.

HPMC Others Canada

Ethyl Cellulose Minerals Europe

Methyl Cellulose Calcium Phosphate Germany

Carboxymethyl Cellulose Calcium Carbonate UK

Croscarmellose Sodium Clay Asia Pacific

Povidone Silicon Dioxide China

Pregelatinized starch Titanium Dioxide Japan

Sodium starch glycolate Others Latin America

Polyethylene Glycol Sugars Brazil

Acrylic Polymers Lactose MEA

Alcohols Sucrose South Africa

Glycerin Others

Propylene Glycol Gelatin

Attribute Details

Base year used for market estimation 2016

Historic analysis Actual data from 2012 to 2015

Forecast 2017 to 2025

Source: WHO, U.S. CDC, FDA, Investor Presentations, Primary Interviews, Grand View Research

Excipients play a pivotal role in drug formulations and are expected to witness significant growth

in the coming years. Growth of excipients market is significantly driven by the the growing

demand for all-round excipients. Moreover, ongoing developments in the various categories of

excipients is expected to have positive impact on the progress of this market.

On the basis of product classes offered by this market, the overall excipients market is

segmented into polymers, alcohols, sugar & others, minerals, and gelatin. Out of which,

23

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

polymers as excipient accounted for the largest share in terms in both volume and revenue

owing to the presence of broader array of products falling into this category. In addition,

polymers are recognized to act as multifunctional excipients in drug development process,

which in turn, has attributed to the high usage rate as excipients in drug development.

On the other hand, sugar-based excipients are estimated to be the fastest growing segment.

Continuous introduction of new products in this category is the major factor driving the growth of

this segment. Moreover, ongoing studies on the use and stability effect of sugars as

pharmaceutical excipients are expected to enhance the progress of this segment.

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

24

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

3.1.1 Market driver analys is

FIG. 10 Market driver relevance analysis (Current & future impact)

Growing

High

pharmaceutic

al market

Rising

Medium

demand for

novel

excipients

Patent cliffs

driving the

growth of

Low

excipients in

the generics

market

Current impact Short-term impact Long-term impact

Source: WHO, U.S. CDC, FDA, Investor Presentations, Primary Interviews, Grand View Research

25

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

3.1.1.1 Growing pharmaceutical market

Pharmaceuticals market is being flooded with generic medicine that can be used as OTC

product to a prescribed medicine for critical illnesses. Generic medicine offers high treatment

opportunity at considerably lower prices than the branded drugs. Generic medicine market has

seen an exponential growth in recent years owing to the involvement of bigger pharmaceutical

companies in the production of generic medicines. Generic medicines are manufactured at a

higher rate than the branded drugs and to meet this demand the production of excipients has

increased in the recent years to close the demand supply gap of excipients.

Moreover, the drug formulators are relying on the blend of selected and sophisticated excipients

in order to defend against available excipient competition. Preparation of special excipient

blends that provide manufacturers with ready-made combinations of fillers, binders, disintegrant,

lubricants and other products, reducing manufacturing time and standardizing materials to be

combined with active ingredients This trend is expected to continue and prosper in the forecast

period owing to the growing generic market in the emerging regions such as Asia Pacific and

Latin America where there is a need for cheaper and effective pharmaceuticals.

3.1.1.2 Rising demand for novel excipients

As pharmaceutical industry constantly needs novel and multifunctional products to improve the

available pharmaceuticals, there exists the need for novel excipients that are multifunctional and

can aid in improvement of absorption and solubility, increase the stability of biologics and

parental formulations, enhance disintegration.

There has been a high demand for the development of novel excipients for novel drug delivery

formulations, such as liposomal and nanotechnology-enabled delivery systems. Other

requirements such as multifunctional or excipients that can co-exist and provide better excipient

functions. Market is about witness faster market approvals for the multifunctional or combined

excipients, in which two or more excipients co-exist in a specific product.

Furthermore, regulatory transition driven by rising need of high-quality excipients and rising

demand for new excipients coupled with emphasis on co-processed excipients is anticipated to

bolster growth in the global market through to 2025. Application of the functional excipients for

solving the formulation problems and contribute to simpler, more cost effective and robust drug

26

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

product manufacture, is becoming a critical component of quality-by-design projects within the

pharmaceutical industry.

Demand for an all-round excipient that enables direct compression is expected to drive market

with potential avenues. Attempts for development of a single excipient that incorporates binding,

disintegrating and lubricating properties is expected to fuel research in the sector thereby

resulting to industrial growth.

Development of nanoparticle excipients and drug delivery systems involving nanoparticles is

expected to gain popularity in the forecast years owing to increased efforts for the development

of oncological pharmaceuticals.

3.1.1.3 Patent cliffs driving the growth of excipients in the generics

market

The recent years have seen an increase in number of companies losing patents for many of

their propriety drug molecules. Companies have employed a different approach on extending

their patents on the drug molecules by including a wholly different functional excipient mixture or

composition for the drug delivery. This had worked out for many of the bigger pharmaceutical

companies in extending the patents for their molecules.

For instance, excipients help pharmaceutical companies in extending the patent life for a

molecule with innovations such as sustained release in the drug delivery. This trend is expected

to continue in the forecast period as many of the big pharmaceutical companies are in a verge

of losing patents of molecules that form a major revenue role for the companies.

Increased competition in the United States has been observed as several major drugs such as

Lipitor (atorvastatin), Plavix (clopidogrel), and Singulair (montelukast) faced patent expirations.

Patent expirations are one of the high impact rendering factors for the progress of biologics

arena as it offers ample opportunities for the pharmaceutical firms to step into this market.

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

27

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

FIG. 11 Major drugs that lost patent protection in 2016 (Revenue in USD million)

$7,000

$6,000

$5,000

$4,000

$3,000

$2,000

$1,000

$0

High revenue generating drugs going off patent in 2016

Source: WHO, U.S. CDC, FDA, Investor Presentations, Primary Interviews, Grand View Research

Figure 4 represents the highly profitable drugs that are expected to lose respective patent

protection in 2016.

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

28

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

TABLE 1 Major drugs going off patent in 2017

Drug Company Indication

Azilect Teva

Neurological disorders

Fanapt Vanda

Mepron GSK

Invanz

Cancidas Merck Infections

Cubicin

Tamiflu Roche

Treximet GSK

Relpax Pfizer Pain

Butrans Purdue Pharma

Vytorin Merck Blood pressure/ cholesterol/

heart diseases

Sandostatin LAR Novartis

Carbeglu Orphan Europe

Endocrine disorders

Somavert Pfizer

Acthar Gel Questcor

Omnaris Altana

Reyataz Bristol-Myers Squibb

Axiron

Eli Lilly

Strattera Others

Arranon GSK

Sabril Lundbeck

Macugen Valeant

Source: Industry Journals, Annual Reports, Investor Presentations, Primary Interviews, Grand View Research

Patent expiration is observed to heat up the competition amongst the pharmaceutical firms for

capitalizing the avenues present in the market space of biologics. Drugs patent expiration and

growing demand for robust biologics are anticipated to have major ramifications on the

development and marketing of biologics and thereby influencing the growth of biologics in future

market.

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

29

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

3.1.2 Market res tra int analysis

FIG. 12

High

Medium Market restraint relevance analysis (Current & future impact)

Stringent

rules by

regulatory

bodies

Low

Current impact Short-term impact Long-term impact

Source: WHO, U.S. CDC, FDA, Investor Presentations, Primary Interviews, Grand View Research

30

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

3.1.2.1 Stringent rules by regulatory bodies

Recent years have seen many adverse reactions caused by excipients added to the API’s. Due

to this the U.S.-FDA and European regulatory bodies have imposed strict regulations for the

approval of new R&D sites for excipient manufacturing.

Excipients production has been affected mainly in 3 ways; manufacturing bodies of these

excipients must comply to the standards for quality control pharmaceutical excipients which

once was just used as a reference standard. New set of rules have been laid stating that the

manufacturer must obtain pharmaceutical manufacturing license as well as pharmaceutical

excipient registration to manufacture new excipients that are considered to have a high safety

risk.

These rules are set to enhance the quality and streaming the manufacturing process right from

the selection of excipients and their use in various critical molecules. These factors led to a

shortage of FDA-approved excipient production sites, which might hamper the growth of the

market to a certain extent.

31

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

3.2 Penetration &Growth Prospect Mapping for Products, 2016

FIG. 13 Penetration & growth prospect mapping for Products, 2016

Uncharted territories Segment spearhead

Expected adoption rate (Low to High along the axis)

Polymers

Alcohols

Sugar & Others

Minerals

Gelatin

Nascent platforms Mature platforms

Penetration (Low to High along the axis)

Source: Industry Journals, Annual Reports, Investor Presentations, Primary Interviews, Grand View Research

Penetration is defined as the maturity of the segment.

Growth rate is considered as the future projected CAGR till year 2025. These growth rates are comparative in nature, with the

overall market growth rate as being the benchmark.

Polymer-based excipients held the largest share in the 2016 market and are expected to

register significant growth rate due to its high usage rate in drug formulations. This high usage

rate is mainly attributed to the wide range of polymer functionalities as excipients which is

attained with polymer chemistries and molecular weights. Sugar-based pharmaceutical

excipients are expected to gain significant ground in the future market of excipients over its

counterpart segment. This segment is expected to emerge as fastest growing segment due to

the investments made by the companies for expansion of their manufacturing facilities for

development of sugar based excipients. Moreover, researchers continue to investigate the

effectiveness of sugar based pharmaceutical excipients in drug development, thereby driving

growth of this segment. Mineral-based excipients are estimated to have lowest market share in

the 2016 market and are expected to grow with considerable CAGR over the forecast period as

this segment is at nascent stage in current excipient landscape.

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

32

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

3.3 Excipients Market-Swot Analysis, By Factor (Political & Legal, Economic And Technological)

FIG. 14 SWOT Analysis, By Factor (political & legal, economic and technological)

Strengths: Governments from the developed countries have devised strong GMP regulations to enhance the quality of excipients

used in the formulations

Weaknesses: The regulations laid have become a hurdle for the development of approved new R&D sites for newer technologies

and delivery systems

Political & Legal Opportunities: Political pressure had presented companies to come up with quality enhancements to their excipient offerings right

from selection of material to processing of final formulation

Threats: The regulations laid by the government bodies might hamper the production levels of excipients due to the closure of

manufacturing sites following a small error might lead to demand-supply gap

Strengths: Collaborations between a well established excipient manufacturer and a well-known distributor network in a particular

region is expected to increase the market penetration

Weaknesses: Pharmaceutical excipient suppliers in the emerging countries are often affected by the lack of appropriate

infrastructure for the effective transportation of the material

Economic Opportunities: Presence of well versed supplier chain and their reach to developing regions might boost the market in the forecast

period. Rising pharmaceutical manufacturing outsourcing in developing economies is expected to drive demand.

Threats: Developing regions where the technological advancements in the processing of newer excipients have to depend on

imports which is associated with high costs. This might hamper the market’s growth

Strengths : Development of newer technologies and newer excipients like the nanoparticles in the delivery of oncological drugs can

promote the market

Weaknesses: Reducing investments in excipient manufacture owing to the strict regulations and lack of resources from local players

to compete with bigger MNC’s might hamper the market in the developing regions

Technological Opportunities: Companies with newer technologies and adequate funding to expand their manufacturing capacity might help

boost the market and have an opportunity to grab major market share

Threats: Entry of newer technological might replace the existing technologies although, high costs and adoption rate might hamper

the market in the initial phase of adoption

Source: Industry Journals, Annual Reports, Investor Presentations, Primary Interviews, Grand View Research

33

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

3.4 Industry Analysis – Porter’s

FIG. 15 Porter’s Five Forces Analysis

Threat of new entrants: Moderate

Threat of new companies into the market is low as

a consequence of expensive infrastructure and

GMP compliant facilities required for the

manufacture of these products.

Bargaining power of suppliers: High Competitive rivalry: High Bargaining power of buyers: Moderate

Bargaining power of suppliers is high due to the Competitive rivalry between the companies very Buyers bargaining is power is expected to remain

presence of few GMP compliant laboratories and high owing to the highly fragmented nature of high due to the large number of manufacturers for

presence of stringent regulations. This leads to market and high demand for the excipients in the the pharmaceutical molecules. Moreover,

increase in the bargaining power of suppliers formulation of API’s. Presence of established presence of regulations for the manufacturing of

players in the chemical market space drives the excipients reduces the bargaining power, bringing

rivalry level it to moderate.

Threat of substitutes: Low

Threat of substitutes is expected to stay low in

case of excipients, as these are mandatory to

make an ideal molecule for the administration with

high acceptability from the consumer side.

Source: Industry Journals, Annual Reports, Investor Presentations, Primary Interviews, Grand View Research

34

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

Chapter 4 Market Categorization: Product Estimates & Trend Analysis

FIG. 16 Global excipients market: Product outlook key takeaways

Key product segments Key segment trends

3,500.0

•Largest Market 3,000.0

•Market growth from $ 1,870 Mn in

Polymers 2016 to $3,062 Mn in 2025 2,500.0

•CAGR 5.6% from 2017 - 2025

2,000.0

1,500.0

•Revenue estimates at $1,242.6 Mn in 1,000.0

2016

Sugars 500.0

•Highest contributor in terms of CAGR

with 6.9% from 2017-2025 0.0

2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 2023 2024 2025

Polymers Alcohols Sugars Minerals Gelatin

•Market was valued at $ 550.5 Mn in

Alcohols 2016

•CAGR 5.6% from 2017-2025

Number of times used in the Top 200

Excipient

prescription tablets

•Market was valued at $ 175.6 Mn in Polymers 269

2016

Minerals •CAGR 5.0% from 2017-2025 Alcohols 112

Sugars & Others 151

•Market was valued at $ 289.7Mn in Minerals 70

2016

Gelatin •CAGR 6.0% from 2017-2025 Gelatin 81

Source: Industry Journals, Annual Reports, Investor Presentations, Primary Interviews, Modern Medicine Journals, Grand View Research

35

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

4.1 Global Excipients Market: Product Movement Analysis

There are various types of excipients used in the pharmaceutical formulations such as solid

oral, liquid oral and other formulations administered by different routes. Amongst these,

polymers emerged as market leaders attributed to their wide usage in the formulation of tablets,

capsules and other oral formulations.

Alcohols also found their way as pharmaceutical excipients from a long time for various

enhancements such as sweeteners by sugar alcohols and are used widely in water sensitive

API’s. It had a significant share in the usage of pharmaceutical formulations in 2016.

However, sugars, gelatin are expected to have a stable market over the course of forecast

owing to the uses like capsule shell preparation and taste masking.

The quest for newer excipients has begun in the recent years which can add value to the

formulations for the delivery of oncological drugs and other critical molecules. Initiatives like

development of novel excipients that enhance drug delivery and bioavailability is expected to

drive the market in the forecast period.

36

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

FIG. 17 Global excipients market: Product movement analysis

High

Sugars: Share growth by 2.28%

272.18

2025 3,062.13 901.73 2,261.55 488.43

Medium

Low

Low

175.61

2016 1,870.24 550.49 1,242.55 289.66

Polymers: Share decline by Alcohols: Share decline by

1.47% 0.43%

Medium

0% 20% 40% 60% 80% 100%

Minerals: Share decline by

Gelatin: Share decline by 0.02%

Polymers Alcohols Sugars Minerals Gelatin 0.36%

High

Source: WHO, U.S. CDC, FDA, NIH Journals, Investor Presentations, Primary Interviews, Grand View Research

37

Back to Table of Contents

©Grand View Research, Inc., USA. All Rights Reserved.

EMISPDF in-centrum2 from 14.141.166.1 on 2019-06-04 14:23:30 BST. DownloadPDF.

Downloaded by in-centrum2 from 14.141.166.1 at 2019-06-04 14:23:30 BST. EMIS. Unauthorized Distribution Prohibited.

Excipients market analysis and segment forecasts to 2025

4.2 Polymers

Polymers have most of the ideal properties so that they can be used as an excipient in solid

pharmaceutical formulations. Polymers offer strength and improved shelf life when compared to

the other types of excipients used in the pharmaceutical preparations.

Over the past decade, pharmaceutical polymers have evolved from being used in the

preparation of simple gelatin shells to strengthen capsule to an excipient that has ideal

formulation features that include controlled/sustained release and also in delivering the drug to

specific target sites of action.

Polymers are used in higher proportions than any other excipients in pharmaceutical