Академический Документы

Профессиональный Документы

Культура Документы

Tutorial 1: 1. Included in The Cost of Sales Are

Загружено:

OrangeeeeОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tutorial 1: 1. Included in The Cost of Sales Are

Загружено:

OrangeeeeАвторское право:

Доступные форматы

Tutorial

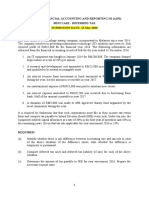

Carriage Sdn Bhd was incorporated on 1 October 2017. The company commenced

business on 1 February 2018 and made up its first set of accounts to 31 December 2018.

Its principal activities are manufacturing of motor vehicle spare parts and investment

holding.

The company’s profit and loss account for the year ended 31 December 2018 is as

follows:

Note RM’000 RM’000 Sales

3,600 Less: Cost of sales 1 (1,540)

2,060

Less Payroll costs 2 960 Directors remuneration 3 317 Freight and insurance 4 160 Legal

and professional fees 5 120 Pre-operating and incorporation expenses 6 65 Repairs and

maintenance 7 40 Entertainment 8 85 Provision of doubtful debts 9 125 Foreign exchange

differences 10 510 Interest costs 11 70 Miscellaneous expenses 12 148

2,600 (540) Add: Other income 13 60 Net loss before taxation (480)

Notes 1. Included in the cost of

sales are:

a. Depreciation of fixed assets amounting to RM120,000 b. Allowances for

stock obsolescence amounting to RM26,000 c. Royalty payment of 1% of

sales to a Taiwanese company for the right to use its

trademark. The accountant advised that the relevant withholding tax has not

been paid to the IRB.

2. Payroll costs comprises

of

a. Salaries RM720,000 b. Bonus (paid on 24

December 2018) RM80,000 c. EPF

RM160,000

3. Directors remuneration

includes

a. Non-executive directors’ fees RM12,000 b. Executive

directors’ remuneration: i. Salary RM180,000 ii. Contractual

bonus (paid on 24 December 2018) RM45,000 iii. Leave

passage RM15,000 iv. Children’s education fees RM25,000

v. EPF

RM40,000

4. Freight insurance included in the above expenditure I an amount of RM4,000 to

Reliable Insurance Bhd, a company incorporated in Malaysia, for insuring goods

imported by the company.

5. Legal and professional fees comprise

of:

a. Audit fees RM12,000 b. Legal services on

personnel matters RM8,000 c. RM60,000 d.

Valuation of land RM13,000 e. Trademark

registration RM16,000 f. Legal services on

trade debt recovery RM11,000

6. Pre-operating and incorporation expenses

comprises of

a. Pre-operating expenses

RM53,000 b. Incorporation

expenses

i. Cost of preparing and printing Memorandum and Articles of

Association

RM1,000 ii. Secretarial fees RM5,000 iii.

Stamp duty RM6,000

7. Repairs and maintenance includes furniture and fittings costing RM10,000. It is the

company’s

policy to charge to the profit and loss accounting expenditure incurred on fixed assets

costing less than RM1,000 each.

8. Entertainment comprises of staff refreshments RM8,000, opening ceremony expenses

(incurred

in January 2018) RM50,000 and distributors’ annual gathering

RM27,000.

9. Provision of doubtful debts comprises of general provision of RM40,000 and specific

provision of

RM85,00

0.

10. Foreign exchange differences

comprises of:

a. Exchange loss from translation of foreign loan at year end RM450,000 b.

Exchange loss from payment to foreign supplier of plant and machinery

RM60,000

11. Interest cost included n interest cost is an amount of RM2,000 charged by a supplier

for late

payment of cost of raw

materials.

12. Miscellaneous expenses

include:

a. Donations to State Government of RM10,000 out of which RM3,000 was in cash

and the

balance of RM7,000 in kind. b.

Scholarship of RM1,000 to a student

13. Other income comprises of profit from disposal of quoted shares RM43,000, tax

exempt

dividend RM7,000 and dividend income received from ABC Sdn Bhd

RM10,000.

14. The qualifying expenditure and the rates of annual allowances for assets qualifying

for capital

allowances for year of assessment 2018 are as

follows:

Qualifying expenditure Rate

RM’000 % Factory building

1,200 3 Plant and machinery 2,000 20 Office equipment 80 10 Furniture and

fittings 40 10

Required: a. Explain the tax treatment for note 1 to 13, with

relevant support.

b. Starting from net loss before taxation, compute the chargeable income of Carriage

Sdn Bhd

for year of assessment 2018 showing all the relevant tax adjustments. Explain your

answer

Вам также может понравиться

- ACC 4041 Tutorial - Corporate Tax 2Документ3 страницыACC 4041 Tutorial - Corporate Tax 2Atiqah DalikОценок пока нет

- MINI CASE 3-Deferred Tax - A201 - StudentДокумент3 страницыMINI CASE 3-Deferred Tax - A201 - Studentdini sofiaОценок пока нет

- Bkar3033 Financial Accounting and Reporting Iii (A192) Mini Case - Deferred Tax Submission Date: 13 May 2020Документ4 страницыBkar3033 Financial Accounting and Reporting Iii (A192) Mini Case - Deferred Tax Submission Date: 13 May 2020Rubiatul Adawiyah33% (3)

- ACC 4041 Tutorial - Investment IncentivesДокумент4 страницыACC 4041 Tutorial - Investment IncentivesAyekurikОценок пока нет

- Tutorial 5 QuestionsДокумент4 страницыTutorial 5 QuestionsChigoziem OnyekawaОценок пока нет

- Quick Quiz 1 SS 2021 B (Que)Документ3 страницыQuick Quiz 1 SS 2021 B (Que)Tiana Ling Jiunn LiОценок пока нет

- Topic 3 Practical ExampleДокумент3 страницыTopic 3 Practical Exampleszh saОценок пока нет

- Taxation: Maicsa - Icsa International Qualifying Scheme (Iqs)Документ25 страницTaxation: Maicsa - Icsa International Qualifying Scheme (Iqs)diviananaslinОценок пока нет

- June 2019 QДокумент8 страницJune 2019 Q2024786333Оценок пока нет

- F6 Pilot PaperДокумент19 страницF6 Pilot PaperSoon SiongОценок пока нет

- QuestionsДокумент7 страницQuestionsMyra RidОценок пока нет

- Service TaxДокумент2 страницыService TaxpremsuwaatiiОценок пока нет

- T 5 Business Expenses PT 2 2015Документ15 страницT 5 Business Expenses PT 2 2015DarshiniОценок пока нет

- Acca Tx-Mys 2019 JuneДокумент14 страницAcca Tx-Mys 2019 JuneChoo LeeОценок пока нет

- Uog Year 2 Taxation Paper Uog March 2013Документ9 страницUog Year 2 Taxation Paper Uog March 2013helenxiaochingОценок пока нет

- Acca Tx-Mys 2019 SeptemberДокумент13 страницAcca Tx-Mys 2019 SeptemberChoo LeeОценок пока нет

- Assignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionДокумент5 страницAssignment (20%) TRIMESTER 1, 2019/2020 BAC2674 Taxation I: % of Similarity % of Marks DeductionArjun DonОценок пока нет

- F6MYS 2014 Jun QДокумент12 страницF6MYS 2014 Jun QBeeJuОценок пока нет

- Cash Flow Statement - TutorialДокумент6 страницCash Flow Statement - TutorialChandran PachapanОценок пока нет

- Revision (CA MCQ)Документ2 страницыRevision (CA MCQ)Ee LynnОценок пока нет

- UKAF4034-ACR-Tutorial 4-Q BasicConsoДокумент7 страницUKAF4034-ACR-Tutorial 4-Q BasicConsotan JiayeeОценок пока нет

- F6mys 2007 Dec PPQДокумент19 страницF6mys 2007 Dec PPQAnslem TayОценок пока нет

- June 2021Документ82 страницыJune 2021刘宝英100% (1)

- Tax Sept2002Документ10 страницTax Sept2002Insan KerdilОценок пока нет

- Course: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 HourДокумент5 страницCourse: Taxation 2 Course Code: TAX517 Date: APRIL 2020 Time: 1 Houranis izzatiОценок пока нет

- Universiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR320Документ7 страницUniversiti Teknologi Mara Final Examination: Confidential 1 AC/FEB 2022/FAR3202021202082Оценок пока нет

- Malaysian Institute of Information Technology January 2020 SemesterДокумент4 страницыMalaysian Institute of Information Technology January 2020 SemesterEiqaa ˘˛˘Оценок пока нет

- Tutorial Questions - Week 6Документ3 страницыTutorial Questions - Week 6Arwa AhmedОценок пока нет

- Can Drinks SDN BHDДокумент3 страницыCan Drinks SDN BHDNURSABRINA BINTI ROSLI (BG)Оценок пока нет

- TAX317 TEST Q Dec2021Документ10 страницTAX317 TEST Q Dec2021sharifah nurshahira sakinaОценок пока нет

- Home Quiz No 2Документ3 страницыHome Quiz No 2Liew Chi ChiengОценок пока нет

- Answer All Questions in Part A. Answer Three Questions Only in Part BДокумент13 страницAnswer All Questions in Part A. Answer Three Questions Only in Part BHazim BadrinОценок пока нет

- Tax317 Ctmay2022Документ10 страницTax317 Ctmay2022sharifah nurshahira sakinaОценок пока нет

- Financial AccountingДокумент6 страницFinancial AccountingFernando Alcantara100% (1)

- Tutorial 4Документ8 страницTutorial 4yongjin95Оценок пока нет

- Tax Mac2002Документ8 страницTax Mac2002Insan KerdilОценок пока нет

- ACC3024 Tutorial 4 Q (Apr 2023)Документ3 страницыACC3024 Tutorial 4 Q (Apr 2023)Shermaine WanОценок пока нет

- Sunway T4 (TX4014) - Tax Computation (Business Income)Документ4 страницыSunway T4 (TX4014) - Tax Computation (Business Income)Ee LynnОценок пока нет

- Fragment M 11Документ7 страницFragment M 11sm munОценок пока нет

- BBCA3183 - Finals TaxationДокумент10 страницBBCA3183 - Finals TaxationDivesha RaviОценок пока нет

- A221 - Self-Study Chapter 3Документ8 страницA221 - Self-Study Chapter 3Shairah SaifullОценок пока нет

- Taxation - Questions Sepr 2012Документ17 страницTaxation - Questions Sepr 2012kannadhassОценок пока нет

- Chapter 3 - Sesi 1 2022 2023Документ42 страницыChapter 3 - Sesi 1 2022 2023黄勇添Оценок пока нет

- In-Class Exercise For Chapter 6-MFRS 108 and MFRS 110Документ2 страницыIn-Class Exercise For Chapter 6-MFRS 108 and MFRS 110Rubiatul AdawiyahОценок пока нет

- QUIZ 1 Deferred Taxes SolutionДокумент3 страницыQUIZ 1 Deferred Taxes SolutionMohd NuuranОценок пока нет

- Ppe ExerciseДокумент8 страницPpe ExerciseNajihah NordinОценок пока нет

- Universiti Teknologi Mara Final Examination: Confidential AC/OCT 2009/TAX370Документ11 страницUniversiti Teknologi Mara Final Examination: Confidential AC/OCT 2009/TAX370Ainnur ArifahОценок пока нет

- Pfa3163 Set G QPДокумент5 страницPfa3163 Set G QPNur hidayah putriОценок пока нет

- PTX - Past Year Set BДокумент9 страницPTX - Past Year Set BNUR ALEEYA MAISARAH BINTI MOHD NASIR (AS)Оценок пока нет

- FAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsДокумент5 страницFAR460 - JAN 2023 Group Assignment B Published Financial Statements Instructions To StudentsAmniОценок пока нет

- 2016-01 BA203 TAX1 - Assignment QДокумент7 страниц2016-01 BA203 TAX1 - Assignment QEugene WongОценок пока нет

- A181 Tutorial 2Документ9 страницA181 Tutorial 2Fatin Nur Aina Mohd Radzi33% (3)

- MASedited 2nd Pre-Board ExamsДокумент12 страницMASedited 2nd Pre-Board ExamsKim Cristian MaañoОценок пока нет

- F6 2000 Jun QДокумент11 страницF6 2000 Jun QDylan Ngu Tung HongОценок пока нет

- Impairment ExercisesДокумент3 страницыImpairment ExercisesAfif AsnawiОценок пока нет

- Dec2019 PDFДокумент12 страницDec2019 PDFArief HilmanОценок пока нет

- A211 MC 7 - StudentДокумент4 страницыA211 MC 7 - StudentWon HaОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2020 EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionОценок пока нет

- A Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionОт EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: 2018 EditionОценок пока нет

- CIB 3001 Penilaian Alternatif (Individual Assignment 20%)Документ1 страницаCIB 3001 Penilaian Alternatif (Individual Assignment 20%)OrangeeeeОценок пока нет

- CIB 3001 Penilaian Alternatif (Group Assignment 30%)Документ2 страницыCIB 3001 Penilaian Alternatif (Group Assignment 30%)OrangeeeeОценок пока нет

- Cib 3101 Tutorial #1Документ1 страницаCib 3101 Tutorial #1OrangeeeeОценок пока нет

- Topic 5 (SMA 4)Документ32 страницыTopic 5 (SMA 4)OrangeeeeОценок пока нет

- CAEA2301Lec1 introMLSДокумент26 страницCAEA2301Lec1 introMLSOrangeeeeОценок пока нет

- MSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKДокумент19 страницMSC in Healthcare Management (Top-Up) Degree From ARU - Delivered Online by LSBR, UKLSBRОценок пока нет

- APA CitationsДокумент9 страницAPA CitationsIslamОценок пока нет

- Nutrition and Metabolism: (Carbohydrates, Lipids, Protein)Документ37 страницNutrition and Metabolism: (Carbohydrates, Lipids, Protein)Trishia BonОценок пока нет

- Adverbs Before AdjectivesДокумент2 страницыAdverbs Before AdjectivesJuan Sanchez PrietoОценок пока нет

- Soal Bahasa Inggris Sastra Semester Genap KLS Xi 2023Документ3 страницыSoal Bahasa Inggris Sastra Semester Genap KLS Xi 2023Ika Endah MadyasariОценок пока нет

- Visual Images of America in The Sixteenth Century: Elaine BrennanДокумент24 страницыVisual Images of America in The Sixteenth Century: Elaine Brennanjoerg_spickerОценок пока нет

- A Professional Ethical Analysis - Mumleyr 022817 0344cst 1Документ40 страницA Professional Ethical Analysis - Mumleyr 022817 0344cst 1Syed Aquib AbbasОценок пока нет

- Diane Mediano CareerinfographicДокумент1 страницаDiane Mediano Careerinfographicapi-344393975Оценок пока нет

- L 1 One On A Page PDFДокумент128 страницL 1 One On A Page PDFNana Kwame Osei AsareОценок пока нет

- CA-2 AasthaДокумент4 страницыCA-2 AasthaJaswant SinghОценок пока нет

- KalamДокумент8 страницKalamRohitKumarSahuОценок пока нет

- Concept of HalalДокумент3 страницыConcept of HalalakОценок пока нет

- Meike SchalkДокумент212 страницMeike SchalkPetra BoulescuОценок пока нет

- 5e - Crafting - GM BinderДокумент37 страниц5e - Crafting - GM BinderadadaОценок пока нет

- Curriculum Vitae Mukhammad Fitrah Malik FINAL 2Документ1 страницаCurriculum Vitae Mukhammad Fitrah Malik FINAL 2Bill Divend SihombingОценок пока нет

- Torah Hebreo PaleoДокумент306 страницTorah Hebreo PaleocamiloОценок пока нет

- Government College of Engineering Jalgaon (M.S) : Examination Form (Approved)Документ2 страницыGovernment College of Engineering Jalgaon (M.S) : Examination Form (Approved)Sachin Yadorao BisenОценок пока нет

- Recent Cases On Minority RightsДокумент10 страницRecent Cases On Minority RightsHarsh DixitОценок пока нет

- DHBVNДокумент13 страницDHBVNnitishОценок пока нет

- Impact Grammar Book Foundation Unit 1Документ3 страницыImpact Grammar Book Foundation Unit 1Domingo Juan de LeónОценок пока нет

- Conceptual Diagram of Ways To Increase SalesДокумент1 страницаConceptual Diagram of Ways To Increase SalesO6U Pharmacy RecordingsОценок пока нет

- Theo Hermans (Cáp. 3)Документ3 страницыTheo Hermans (Cáp. 3)cookinglike100% (1)

- Maule M7 ChecklistДокумент2 страницыMaule M7 ChecklistRameez33Оценок пока нет

- Equivalence ProblemsДокумент2 страницыEquivalence ProblemsRomalyn GalinganОценок пока нет

- Organizational Behavior (Perception & Individual Decision Making)Документ23 страницыOrganizational Behavior (Perception & Individual Decision Making)Irfan ur RehmanОценок пока нет

- ITC Green Centre: Gurgaon, IndiaДокумент19 страницITC Green Centre: Gurgaon, IndiaAgastya Dasari100% (2)

- Extinct Endangered Species PDFДокумент2 страницыExtinct Endangered Species PDFTheresaОценок пока нет

- EMI - Module 1 Downloadable Packet - Fall 2021Документ34 страницыEMI - Module 1 Downloadable Packet - Fall 2021Eucarlos MartinsОценок пока нет

- Pronouns Workshop SENAДокумент7 страницPronouns Workshop SENAPaula Rodríguez PérezОценок пока нет

- Logic of English - Spelling Rules PDFДокумент3 страницыLogic of English - Spelling Rules PDFRavinder Kumar80% (15)