Академический Документы

Профессиональный Документы

Культура Документы

X.V. G.r.no. 108524, Nov. 10,1994

Загружено:

Mona LizaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

X.V. G.r.no. 108524, Nov. 10,1994

Загружено:

Mona LizaАвторское право:

Доступные форматы

G.r.no. 108524, Nov.

10, 1994

FACTS:

Petitioner is engaged in the buying and selling of copra in Misamis Oriental. The petitioner questions

Revenue Memorandum Circular 47-91 issued by the respondent, in which copra was classified as

agricultural non-food product effectively removing copra as one of the exemptions under Section 103

of the NIRC.

Section 103a of the NIRC states that the sale of agricultural non-food products in their original state

is exempt from VAT only if the sale is made by the primary producer or owner of the land from which

the same are produced and not by any other person or entity. Section 103b states the sale of

agricultural food products in their original state is exempt from VAT at all stages of production or

distribution regardless of who the seller is - which the petitioner enjoys. The reclassification had the

effect of denying to the petitioner this exemption when copra was classified as an agricultural food

product.

Petitioner filed a motion for prohibition.

ISSUE: Whether the Circular is valid.

RULING:

Yes. The Court first stated that the CIR gave the circular a strict construction consistent with the rule

that tax exemptions must be strictly construed against the taxpayer and liberally in favor of the state.

The Court also stated that the Circular is not discriminatory and in violation of the equal protection

clause. Petitioner likened copra farmers / producers, who are exempted from VAT and copra traders,

which the Court disagreed.

Lastly, petitioners argued that the Circular was counterproductive which the Court answers that it is a

question of wisdom or policy which should be addressed to respondent officials and to Congress.

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Third Party Affidavit 1Документ1 страницаThird Party Affidavit 1Mona Liza100% (1)

- Bernas PIL ReviewerДокумент42 страницыBernas PIL ReviewerDarla Grey100% (11)

- Zuno Vs CabredoДокумент2 страницыZuno Vs CabredoMona Liza100% (1)

- Intestado de Don Valentin Descals - Tax2Документ1 страницаIntestado de Don Valentin Descals - Tax2Mona LizaОценок пока нет

- Pale Cases EugeneДокумент6 страницPale Cases EugeneMona LizaОценок пока нет

- Rodolfo M. Yumang V. Atty. Edwin M. Alaestante AC. No. 10992, Jun 19, 2018Документ3 страницыRodolfo M. Yumang V. Atty. Edwin M. Alaestante AC. No. 10992, Jun 19, 2018Mona LizaОценок пока нет

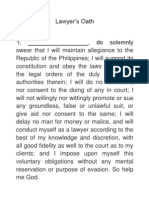

- Lawyer's OathДокумент1 страницаLawyer's OathKukoy PaktoyОценок пока нет

- Phil Acetylene V CIRДокумент1 страницаPhil Acetylene V CIRShaneBeriñaImperialОценок пока нет

- Palaganas V Palaganas Case DigestДокумент2 страницыPalaganas V Palaganas Case Digesthistab100% (3)

- Philippine Life Insurance Co vs CIR on Donor's Tax on Share SaleДокумент1 страницаPhilippine Life Insurance Co vs CIR on Donor's Tax on Share SaleMona LizaОценок пока нет

- Philippine Life Insurance Co vs CIR on Donor's Tax on Share SaleДокумент1 страницаPhilippine Life Insurance Co vs CIR on Donor's Tax on Share SaleMona LizaОценок пока нет

- De Borja Vs de BorjaДокумент2 страницыDe Borja Vs de BorjaArgel Joseph CosmeОценок пока нет

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayДокумент10 страницEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaОценок пока нет

- REДокумент2 страницыREMona LizaОценок пока нет

- VegetablesДокумент7 страницVegetablesMona LizaОценок пока нет

- Criminal Law Cases2Документ2 страницыCriminal Law Cases2Mona LizaОценок пока нет

- Civil Procedure Up BarsoftДокумент12 страницCivil Procedure Up BarsoftMona LizaОценок пока нет

- X.viii. G.R.No. 168129Документ2 страницыX.viii. G.R.No. 168129Mona LizaОценок пока нет

- Criminal Law CASEsДокумент2 страницыCriminal Law CASEsMona LizaОценок пока нет

- Tambunting PawnshopДокумент1 страницаTambunting PawnshopMona LizaОценок пока нет

- Cir Vs BF GoodrichДокумент1 страницаCir Vs BF GoodrichMona LizaОценок пока нет

- VAT Imposition on Pre-Existing Contracts UpheldДокумент1 страницаVAT Imposition on Pre-Existing Contracts UpheldMona LizaОценок пока нет

- Mary Grace Natividad S PoeДокумент4 страницыMary Grace Natividad S PoeMona LizaОценок пока нет

- Trinidad GamboaДокумент10 страницTrinidad GamboaMona LizaОценок пока нет

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Документ1 страницаEduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Mona LizaОценок пока нет

- Reaction Paper On The Principle of Jus Cogens by Mona LizaДокумент3 страницыReaction Paper On The Principle of Jus Cogens by Mona LizaMona LizaОценок пока нет

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayДокумент2 страницыEduardo R. Alicias, Jr. vs. Atty. Myrna v. MacatangayMona LizaОценок пока нет

- Eduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Документ1 страницаEduardo R. Alicias, Jr. vs. Atty. Myrna v. Macatangay, Et. Al.Mona LizaОценок пока нет

- 4Документ5 страниц4Mona LizaОценок пока нет