Академический Документы

Профессиональный Документы

Культура Документы

Sr. No. Capital Investment Cost of Industries/project Fee Amount (RS.)

Загружено:

deepali_nih9585Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Sr. No. Capital Investment Cost of Industries/project Fee Amount (RS.)

Загружено:

deepali_nih9585Авторское право:

Доступные форматы

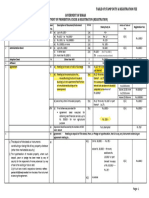

Schedule of fee prescribed by Government of Haryana,

Environment Department/HSPCB for obtaining consent to

establish/NOC & consent to operate and sampling under water

(Prevention and control of pollution), Act, 1974 & Air

(Prevention and control of pollution), Act, 1981, Authorization

under Bio Medical Waste (M & H) Rules, 1998, and public

hearing under EIA Notification, 2006.

I. Fee prescribed for obtaining consent to establish/NOC & consent to

operate under Water Act, 1974 & Air Act, 1981.

A Fees for Consent to Establish/NOC

A-I NOC/CTE Fees for highly polluting industries such fertilizers

(nitrogen/phosphate), sugar, fermentation & distillery,

petrochemical, thermal power plant, oil refinery, sulfuric acid, iron &

steel, pulp & paper, dye & dye intermediates, pesticides

manufacturing, basic drugs & pharmaceuticals etc. (Red category of

projects/industries other than specific type projects/industries

mentioned) – prescribed under Water Act, 1974.

Sr. No. Capital Investment cost of Industries/project Fee amount

(Rs.)

a. Exceeding Rs. 100 crores I,05,000

b. Exceeding Rs. 50 crores but not exceeding Rs. 100 60,000

crores

c. Exceeding Rs. 10 crores but not exceeding Rs. 50 36,000

crores

d. Exceeding Rs. 3.0 crores but not exceeding Rs. 10 24,000

crores.

e. Exceeding Rs. 1.0 crores but not exceeding Rs. 3.0 17,700

crores.

f. Exceeding Rs. 0.50 crores but not exceeding Rs. 1.0 14,500

crores.

g. Exceeding Rs. 0.25 crores but not exceeding Rs. 0.50 7,500

crores

h. Exceeding Rs. 0.10 crores but not exceeding Rs. 0.25 4,500

crores

i. Exceeding Rs. 0.02 crores but not exceeding Rs. 0.10 2,250

crores.

j. up to Rs. 0.02 crores 600

E:\Office\Fee Structure\FEE Structure.docx

Page 1 of 12

A-II For industries other than covered under heading A-I (Orange &

Green category) – (Prescribed under Water Act, 1974)

Sr. No. Industries having Capital Investment Fee amount (Rs.)

a. Exceeding Rs. 100 crores. 35,000

b. Exceeding Rs. 50 crores but not exceeding Rs. 20,000

100 crores.

c. Exceeding Rs. 10 crores but not exceeding Rs. 50 12,000

crores.

d. Exceeding Rs.3.0 crores but not exceeding Rs. 8,000

10.0 crores

e. Exceeding Rs. 1.0 crores but not exceeding Rs. 5,700

3.0 crores

f. Exceeding Rs. .50 crores but not exceeding Rs. 4,500

1.0 crores.

g. Exceeding Rs. 0.25 crores but not exceeding Rs. 2,500

0.50 crores

h. Exceeding Rs. 0.10 crores but not exceeding Rs. 1,500

0.25 crores.

i. Exceeding Rs. 0.02 crores but not exceeding Rs. 750

0.10 crores.

j. up to Rs. 0.02 crores 200

A-III For legally constituted bodies other than industrial units (Prescribed

under Water Act, 1974)

Sr. No. Local Bodies/Govt. Department/Colonizers etc. Fee amount (Rs.)

a. Municipal Corporation Faridabad 25,000

b. Class „A‟ Municipalities 5,000

c. Class „B‟ Municipalities 2,500

d. Class „C‟ Municipalities 500

e. Public Health 5,000 per each

town

f. Haryana Urban Development Authority 50,000 per each

Estate

g. Private Colonizers 50,000 per each

town

A-IV For Stone Crushers (Prescribed under Air Act, 1981)

Sr. No. Crushing capacity Fee amount (Rs.)

a. Not exceeding 100 tons/day 5,000

b. Exceeding 100 tons/day 7,500

A-V For Pulverisers (Prescribed under Air Act, 1981)

Sr. No. Pulverisers with capacity Fee amount (Rs.)

a. Not exceeding 100 tons/day 2,000

b. Exceeding 100 tons/day 3,000

E:\Office\Fee Structure\FEE Structure.docx

Page 2 of 12

A-VI For Hot Mix Plants (Prescribed under Air Act, 1981)

Sr. No. Hot Mix Plant with capacity Fee amount (Rs.)

a.

Not exceeding 40 tons/day 5,000

b.

Exceeding 40 tons/day 7, 500

A-VII For Brick Kilns (Prescribed under Air Act, 1981)

Sr. No. Units having a capital investment Fee amount (Rs.)

a. Not exceeding Rs. 30 lacs 5 ,000

b. Exceeding Rs.30 lacs but not exceeding Rs. 50 10,000

lacs

c. Exceeding Rs. 50 lacs 15,000

A-VIII For Rice Shellers (Prescribed under Water Act, 1974)

Sr. No. Units having a capital investment Fee amount (Rs.)

a. Not exceeding Rs. 30 lacs 20 ,000

b. Exceeding Rs. 30 lacs but not exceeding Rs. 30,000

50 lacs

c. Exceeding Rs. 50 lacs. 50,000

A-IX For Screening Plants (Prescribed under Water Act, 1974)

Sr. No. Units having a production capacity Fee amount (Rs.)

a. Capacity less than 100 Ton /Day 5000

b. Capacity more than 100 Ton /Day 7500

A-X For Mining Activities

1. Prescribed under Water Act, 1974 vide Notification dated

05.12.1997

Sr. No. Units paying license fee for mining Fees Amount (Rs.)

a. Not exceeding Rs. 25 lacs annually 1,00,000

b. Exceeding Rs. 25 lacs but not exceeding Rs. 50 lacs 1,50,000

c. More than Rs. 50 lacs 2,00,000

E:\Office\Fee Structure\FEE Structure.docx

Page 3 of 12

2. Prescribed under Air Act, 1981 vide Notification dated 20.09.2002

Sr. No. Units paying license fee for mining Fees Amount (Rs.)

a. For units whose dead rent as determined in the 1,00,000

auction or royalty paid whichever is higher, for

amounts Rs. 5 crores and above.

b. For units whose dead rent as determined in the 75,000

auction or royalty paid whichever is higher, for

amounts Rs. 2.5 crores to 5 crores.

c. For units whose dead rent as determined in the 60,000

auction or royalty paid whichever is higher, for

amounts Rs. 1 crores to 2.5 crores.

d. For units whose dead rent as determined in the 50,000

auction or royalty paid whichever is higher, for

amounts Rs. 75 lacs to 1 crore.

e. For units whose dead rent as determined in the 40,000

auction or royalty paid whichever is higher, for

amounts Rs. 50 lacs to 75 lacs.

f. For units whose dead rent as determined in the 30,000

auction or royalty paid whichever is higher, for

amounts Rs. 25 lacs to 50 lacs.

g. For units whose dead rent as determined in the 20,000

auction or royalty paid whichever is higher, for

amounts Rs. 10 lacs to 25 lacs.

h. For units whose dead rent as determined in the 10,000

auction or royalty paid whichever is higher, for

amounts Rs. 5 lacs to 10 lacs.

i. For units whose dead rent as determined in the 5,000

auction or royalty paid whichever is higher, for

amounts Rs. 1 lac to 5 lacs.

j. For units whose dead rent as determined in the 1,000

auction or royalty paid whichever is higher, for

amounts upto Rs. 1 lac.

A-XI Projects/units covered under Haryana Bio Energy Policy 2018.

Sr. No. Under the Act Fee Amount (Rs.)

1. Water Act, 1974 Nil

2. Air Act, 1981 Nil

E:\Office\Fee Structure\FEE Structure.docx

Page 4 of 12

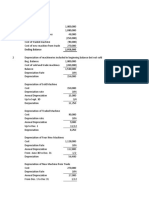

B Fees for Consent to operate under Water Act, 1974 and Air Act,

1981 to be charged annually.

B-I Consent fees for highly polluting industries such as fertilizers

(nitrogen / phosphate), sugar, cement, fermentation & distillery,

petor- chemical, thermal power plant, oil refinery, sulfuric acid,

iron & steel, pulp & paper, dye and dye intermediates, pesticides

manufacturing, basic drugs and pharmaceuticals etc.

(Red category Industries other than those specified)

Sr. Industries having Under Water Act Under Air Act

No. Capital Investment 1st Subsequent 1st Year Subsequent

Year Year Year

a. Exceeding Rs. 100 1,50,000 75,000 1,50,000 75,000

crores.

b. Exceeding Rs. 50 1,20,000 60,000 1,20,000 60,000

crores but not

exceeding Rs. 100

crores.

c. Exceeding Rs. 10 90,000 45,000 90,000 45,000

crores but not

exceeding Rs. 50

crores.

d. Exceeding Rs. 3.0 60,000 24,000 60,000 24,000

crores but not

exceeding Rs. 10

crores

e. Exceeding Rs. 1.0 30,000 11,000 30,000 11,000

crores but not

exceeding Rs. 3.0

f. Exceeding Rs. .50 15,000 4,500 15,000 4,500

crores but not

exceeding Rs. 1.0

crores

g. Exceeding Rs. 0.25 6,000 3,000 6,000 3,000

crores but not

exceeding Rs. 0.50

crores

h. Exceeding Rs. 0.10 1500 1500 1500 1500

crores but not

exceeding Rs. 0.25

crores

i. Exceeding Rs. 0.02 600 600 600 600

crores but not

exceeding Rs. 0.10

crores

j. Investment up to 300 300 300 300

Rs. 0.02

crores

E:\Office\Fee Structure\FEE Structure.docx

Page 5 of 12

B-II Consent fee for Industries other than covered under headings B-I

(Orange & Green category).

Sr. Industries having Under Water Act Under Air Act

No. Capital Investment 1st Subsequent 1st Subsequent

cost Year Years Year Years

a. Exceeding Rs. 100 50,000 25,000 50,000 25,000

crores.

b. Exceeding Rs. 50 40,000 20,000 40,000 20,000

crores but not

exceeding Rs. 100

crores.

c. Exceeding Rs. 10 30,000 15,000 30,000 15,000

crores but not

exceeding Rs. 50

crores.

d. Exceeding Rs. 3.0 20,000 8,000 20,000 8,000

crores but not

exceeding Rs. 10

crores

e. Exceeding Rs. 1.0 10,000 3,700 10,000 3,700

crores but not

exceeding Rs. 3.0

f. Exceeding Rs. .50 5,000 1,500 5,000 1,500

crores but not

exceeding Rs. 1.0

crores

g. Exceeding Rs. 0.25 2,000 1,000 2,000 1,000

crores but not

exceeding Rs. 0.50

crores

h. Exceeding Rs. 0.10 500 500 500 500

crores but not

exceeding Rs. 0.25

crores

i. Exceeding Rs. 0.02 200 500 200 200

crores but not

exceeding Rs. 0.10

crores

j. Investment up to Rs. 100 200 100 100

0.02 crores

B-III Consent fee to be charged annually for legally constituted bodies

other than industrial units (Prescribed under Water Act, 1974)

Sr. No. Local Bodies / Govt. Fees Amount (Rs.)

Department/Colonizers etc.

a. Municipal Corporation Faridabad 25,000

b. Class „A‟ Municipalities 5,000

c. Class „B‟ Municipalities 2,500

d. Class „C‟ Municipalities 500

e. Public Health 5,000 per each town

f. Haryana Urban Development Rs. 50,000 per each Estate

Authority

g. Private Colonizers Rs. 50,000 per each

township

E:\Office\Fee Structure\FEE Structure.docx

Page 6 of 12

B-IV Consent fees for Mining Activities

1. Under Water Act, 1974

Sr. Units paying license fee for 1st Years (Rs.) Subsequent Years

No. mining (Rs.)

a. Units paying license fee for 1,50,000 1,25,000

mining not exceeding Rs. 25

lacs annually

b. Units paying license fee 2,25,000 1,75,000

for mining exceeding Rs.

25 lacs but not exceeding

Rs. 50 lacs

c. Units paying license fee 3,00,000 2,25,000

for mining

more than

2. Under Air Act, 1981

Sr. Units whose dead rent as 1st Years (Rs.) Subsequent Years

No. determined in the auction (Rs.)

or royalty paid whichever is

higher

a. For amounts Rs. 5 crores 2 lacs 2 lacs

and above

b. For amounts Rs. 2.5 to 5 1.5 lacs 1.5 lacs

crores

c. For amounts Rs. 1 to 2.5 1.25 lacs 1.25 lacs

crores

d. For amounts Rs. 75 lacs to 1 1 lacs 1 lacs

crores

e. For amounts Rs. 50 lacs to 75,000 75,000

75 lacs

f. For amounts Rs. 25 lacs to 50,000 50,000

50 lacs

g. For amounts Rs. 10 lacs to 30,000 30,000

25 lacs.

h. For amounts Rs. 5 lacs to 10 10,000 10,000

lacs

i. For amounts Rs. 1 lacs to 5 1,000 1,000

lacs

j. For amounts Rs. 1 lacs 1,000 1,000

B-V Consent fee for 1st year and for subsequent years to operate

pulverizes (Prescribed under Air Act, 1981)

Sr. No. Pulverizes with capacity Fees Amount

1st Years (Rs.) Subsequent Years

(Rs.)

a. Not exceeding 100 2,000 2,000

tons/day

b. Exceeding 100 tons/day 3,000 3,000

E:\Office\Fee Structure\FEE Structure.docx

Page 7 of 12

B-VI Consent fee for stone crushers (Prescribed under Air Act, 1981)

Sr. No. Crushing unit capacity 1st Years Subsequent Years (Rs.)

(Rs.)

a. Not exceeding 100 tons/day 5,000 5,000

b. Exceeding 100 tons/day 7,500 7,500

B-VII Fee for transfer of consent to operate in case of stone crushers

(Prescribed under Air Act, 1981)

Sr. No. Crushing capacity Fees Amount (Rs.)

a. Not exceeding 100 tons/day 20,000

b. Exceeding 100 tons/day 35,000

B-VIII Consent fee for Hot Mix Plant (Prescribed under Air Act, 1981)

Sr. No. Hot Mix Plant with the capacity 1st Year Subsequent Year

(Rs.) (Rs.)

a. Not exceeding 40 tons/day 5,000 5,000

b. Hot Mix Plant with the capacity 7,500 7,500

B-IX Consent fee for brick kilns (Under Air Act, 1981)

Sr. No. Investment cost of Brick Kilns 1st Year Subsequent Year

(Rs.) (Rs.)

a. Not exceeding Rs. 30 lacs 5,000 5,000

b. Exceeding Rs. 30 lacs but not 10,000 10,000

exceeding Rs. 50 lacs

c. Exceeding Rs. 50 lacs 15,000 15,000

B-X Consent Fees for 1st Year and subsequent Year to operate Rice

Shellers.

Sr. No. Units having capital investment Under water Act Under Air Act

(Rs.) (Rs.)

a. Not exceeding Rs. 25 lacs 10,000 10,000

b. Exceeding Rs. 25 lacs but not 12,500 12,500

exceeding Rs.

c. Exceeding Rs. 50 lacs. 15,000 15,000

E:\Office\Fee Structure\FEE Structure.docx

Page 8 of 12

B-XI Consent fees to be charged annually to operate Screening Plant

(Prescribed under Water Act, 1974)

Sr. No. Screening Plant Capacity Fees amount (Rs.)

a. Screening unit with capacity not 5,000

exceeding 100 Tons/day

b. Exceeding 100 tons/day 7,500

B-XII Consent Fees to be charged for first and for subsequent year to operate

projects/units covered under Haryana Bio Energy Policy 2018.

Sr. No. Under the Act Fee Amount (Rs.)

1. Water Act, 1974 Nil

2. Air Act, 1981 Nil

Note:-

1. If the industrial units / projects fails to apply for renewal of consent to

operate (CTO) before 90 days of the expiry of previous consent and

applies 60 days before the expiry of previous consent, the unit shall have

to pay additional consent fee @ 50% of the consent fee notified under the

Rules. Subsequently, if the unit fails to apply before 60 days of the expiry

of previous consent and applies 30 days before the expiry of previous

consent, then the unit will have to pay additional consent fee @ 100% of

the consent fee applicable. If the unit fails to apply 30 days before the

expiry of the previous consent, the unit will have to pay additional

consent fee @ 200% of the consent fee applicable. Thereafter, the Board

will take closure action under the provisions of Water Act, 1974 / Air

Act, 1981 against such units for not having the valid consent to operate.

In case the unit apply for renewal of CTO after the date of expiry of

consent period or after taking the penal action as described above then

such applications will be entertained only if such units deposit consent

fees for the longer period as per the policy of the Board depending upon

the category of the unit along with the additional fees @ 300% of the

consent fees prescribed for one year along with normal consent fees for

subsequent years.

2. The industry/ project will deposit requisite NOC fees for consent to

establish for one time along with the application for auto renewal.

3. In case of the CTE applications for expansion of existing projects, the

NOC fees shall be charged on the basis of cost of the expansion project.

4. “capital investment” means the original cost invested and includes

investment on land, factory building , office building and machinery and

factory whether ownership, on rent, mortgage, or lease basis;”

5. The above fees schedule as prescribed under Water Act, 1974 and Air

Act, 1981 by Government of Haryana, Environment Department from

time to time is applicable w.e.f. 05.12.1997 except in the cases where

NOC/Consent fees has been prescribed after 05.12.1997 mentioned

against such entries above. NOC consent fees prior to 05.12.1997 is

chargeable according to fees schedule which was prescribed earlier

through various Notifications from time to time by Government of

Haryana, Environment Department and was substituted with the

schedule mentioned in the table.

E:\Office\Fee Structure\FEE Structure.docx

Page 9 of 12

II. Fees prescribed for sampling and analysis of the effluent, Air &

Noise Samples from Board Laboratories.

1. Water Sample Collection & Testing Charges

Sr. Description Ist Sample Two Samples Three

No. fees (Rs.) fees (Rs.) Samples

fees (Rs.)

a. Industries with Capital 1500 2700 3750

Investment up to Rs. 1.00

crores

b. Industries with Capital 2700 4500 6000

Investment more than Rs.

1.0 crores

2. Air Sample Collection & Testing Charges

Sr. Description Ist Sample For each

No. fees (Rs.) subsequent

sample fees (Rs.)

a. Industries with Capital Investment up 1500 1200

to Rs. 1.00 crores

b. Industries with Capital Investment 2700 2200

more than Rs. 1.0 crores

3. Noise Monitoring Fees

Sr. No. Description Fees Amount (Rs.)

a. Noise Sample Collection Charges 500

b. Noise Testing Fee (with noise level 500 per point location up to

meter) three readings

Note: Extra fee at the rate of Rs. 500/- per additional sampling point will be

charged.

E:\Office\Fee Structure\FEE Structure.docx

Page 10 of 12

III. Fees Prescribed for Conducting the Public Hearing by the Board

Under EIA, Notification No. S.O.1533 (E) dated 14.09.2006 issued by

Ministry of Environment and Forest, Govt. of India Under

Environment (Protection) Act, 1986.

Sr. No. Project Description Fee (In Rs.)

a. Projects having Capital Investment Rs. 50.00 1.50 lacs

Crore or More

b. Projects having Capital Investment more than 1.00 lacs

25 Crores and less than Rs. 50.00 crores

c. Projects having Capital Investment more than 80000.00

10 Crore s and less than 25 Crores.

d. Projects having Capital Investment more than 1 50000.00

Crore and less than 10 Crores.

e. Projects having Capital Investment more than 25000.00

50 Lacs and less than 1 Crore.

f. Projects having Capital Investment less than 50 10000.00

lacs

E:\Office\Fee Structure\FEE Structure.docx

Page 11 of 12

IV. Performance Security prescribed for obtaining the consent to

establish/expansion or refusal of CTO and failing of samples to make

over deficiencies.

a) Performance Security as per investment cost of the projects (other than

mentioned at Sr. No. b).

Sr. Capital Investment Red Category Orange Green

No. Cost of the project (in Rs.) Category (in Category

(Cost of land, building, Rs.) (in Rs.)

Plant and Machinery)

1. Upto 0.5 crore 25,000/- 12,500/- 5,000/-

2. Above 0.5 crore upto 50,000/- 25,000/- 10,000/-

1.00 crore

3. Above 1.0 crore upto 1,00,000/- 75,000/- 25,000/-

5.00 crore

4. Above 5.0 crore upto 2,00,000/- 1,50,000/- 50,000/-

10.00 crore

5. Above 10.00 crore 3,00,000/- 2,00,000/- 1,00,000/-

upto 50.00 crore

6. Above 50.00 crore 4,00,000/- 2,50,000/- 1,25,000/-

upto 100.00 crore

7. Above 100.00 crore 5,00,000/- 3,00,000/- 1,50,000/-

b) Performance Security for specific projects irrespective of investment cost

1. Hot Mix Plants/ Stone Crushers/ Screening : 50,000/-

Plants

2. Brick Kilns : 25,000/-

3. Mining Projects:-

a) More than ten Hectares : 5.0 lac

b) Five to ten Hectares : 2.5 lac

c) Less than five Hectares : 1.0 lac

*******

E:\Office\Fee Structure\FEE Structure.docx

Page 12 of 12

Вам также может понравиться

- A Consent To Establish (Noc) : Industries Having Capital InvestmentДокумент8 страницA Consent To Establish (Noc) : Industries Having Capital InvestmentAnkit GuptaОценок пока нет

- DetailsДокумент4 страницыDetailssurendra singhОценок пока нет

- Punjab Finance Act 2019Документ14 страницPunjab Finance Act 2019DETDGKHANОценок пока нет

- Department of Prohibition, Excise & Registration (Registration)Документ13 страницDepartment of Prohibition, Excise & Registration (Registration)salini jhaОценок пока нет

- Schedule of Bank Charges: (Excluding FED)Документ63 страницыSchedule of Bank Charges: (Excluding FED)Vc LhrОценок пока нет

- Bihar Stamp Duty and Registration Charges BiharДокумент1 страницаBihar Stamp Duty and Registration Charges BiharAkshansh NegiОценок пока нет

- Plant LocationДокумент2 страницыPlant Locationsujit kcОценок пока нет

- Tender Procedures 20.06.2023Документ34 страницыTender Procedures 20.06.2023Pavina MОценок пока нет

- Professional Tax Act KPKДокумент6 страницProfessional Tax Act KPKHumayunОценок пока нет

- Changes Made in Income Tax Act 2058Документ10 страницChanges Made in Income Tax Act 2058shankarОценок пока нет

- Maharashtra State Tax On Professions, Trades, Callings and Employments ActДокумент8 страницMaharashtra State Tax On Professions, Trades, Callings and Employments ActswapnilswayamОценок пока нет

- Economic Legislation II 0405Документ24 страницыEconomic Legislation II 0405api-26541915Оценок пока нет

- The Institute of Chartered Accountants of India (Icai)Документ4 страницыThe Institute of Chartered Accountants of India (Icai)Lolitambika NeumannОценок пока нет

- Recommended Rare TextДокумент6 страницRecommended Rare TextShiva MatriОценок пока нет

- KP Finance Act 2021Документ19 страницKP Finance Act 2021Arshad MahmoodОценок пока нет

- General Financial RulesДокумент9 страницGeneral Financial RulesmskОценок пока нет

- DPWH - C2016 - 03 - National Building Code of The PhilippinesДокумент23 страницыDPWH - C2016 - 03 - National Building Code of The PhilippinesRodolfo SayangОценок пока нет

- Taxation - MAR 2021Документ2 страницыTaxation - MAR 2021hemanОценок пока нет

- Demand PerformaДокумент12 страницDemand PerformaMuhammad Asif LillaОценок пока нет

- Assessment Rates Charges 2022 2023Документ2 страницыAssessment Rates Charges 2022 2023Sneha MondalОценок пока нет

- Poultry - 5 Lakhs Bank LoanДокумент11 страницPoultry - 5 Lakhs Bank LoanShyamal Dutta100% (8)

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Документ5 страницBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarОценок пока нет

- Cs Executive Taxation Solution Dec 2015 ExamsДокумент9 страницCs Executive Taxation Solution Dec 2015 ExamsBJK SIVA0% (2)

- CMA AssignmentДокумент10 страницCMA AssignmentVaibhav RajОценок пока нет

- Fin Mang 2020Документ3 страницыFin Mang 2020vinayakraj jamreОценок пока нет

- Tax Rates KPTДокумент14 страницTax Rates KPTHitheswar ReddyОценок пока нет

- Paper 4.4:cost Accounting: Time:3 HoursДокумент8 страницPaper 4.4:cost Accounting: Time:3 HoursKaran GОценок пока нет

- Dry Wall PuttyДокумент4 страницыDry Wall PuttyAnurag Agrawal100% (1)

- END Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Документ2 страницыEND Examination: Ques. L (A) (B) (8+7) Ques. 2 (A) (B)Lavi LakhotiaОценок пока нет

- 10-2017 (FA) TA, DA, Incidental Charge Revised-2017Документ2 страницы10-2017 (FA) TA, DA, Incidental Charge Revised-2017Jossymon JosephОценок пока нет

- Contractors Registration ApplicationДокумент10 страницContractors Registration ApplicationDilip Jinna0% (1)

- De Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSAДокумент11 страницDe Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSAJohn Francis RosasОценок пока нет

- Work Sheet 3 & 4 Business FinanceДокумент3 страницыWork Sheet 3 & 4 Business FinancePrateek YadavОценок пока нет

- May. 2007 Q.P.Документ4 страницыMay. 2007 Q.P.M JEEVARATHNAM NAIDUОценок пока нет

- Tax Rates KPT PDFДокумент16 страницTax Rates KPT PDFAbhishek KumarОценок пока нет

- RateДокумент13 страницRatejustndn4u6307Оценок пока нет

- Auditing ActivityДокумент4 страницыAuditing ActivityPrincessОценок пока нет

- De Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSAДокумент9 страницDe Vera Angela Kyle G. Business Taxation Prelim Task 2.1 BSAJohn Francis RosasОценок пока нет

- Accounting For PartnershipsДокумент5 страницAccounting For Partnershipsamir rabieОценок пока нет

- Final Prices Fixed For Industrial Areas-1.PDF-1Документ20 страницFinal Prices Fixed For Industrial Areas-1.PDF-1Muhammad Shihabudin AhmedОценок пока нет

- Corporate Accounting Exam Questions PaperДокумент7 страницCorporate Accounting Exam Questions PaperAmmar Bin NasirОценок пока нет

- March, 2005 Q.P.Документ5 страницMarch, 2005 Q.P.M JEEVARATHNAM NAIDUОценок пока нет

- Excise Policy 2010-11 PDFДокумент13 страницExcise Policy 2010-11 PDFSoumya TrivediОценок пока нет

- Find PBP DPBP NPV IRR PI ARRДокумент2 страницыFind PBP DPBP NPV IRR PI ARRVarad VinherkarОценок пока нет

- ZJC Tax Rates Tables - Tax Year 2023Документ11 страницZJC Tax Rates Tables - Tax Year 2023Mux ConsultantОценок пока нет

- Bcom Comp IV Apr2019 Income Tax Law and Practice-IДокумент4 страницыBcom Comp IV Apr2019 Income Tax Law and Practice-IKunal NandaОценок пока нет

- Boi Service ChargeДокумент11 страницBoi Service ChargeBharat ChatrathОценок пока нет

- Class Test: JournalДокумент5 страницClass Test: JournalHafsa AОценок пока нет

- General-Tender-gov SLДокумент46 страницGeneral-Tender-gov SLTharindu RomeshОценок пока нет

- Rat e Rs. Upto Date Quantity Quantities Paid in Last Bill: SolutionДокумент13 страницRat e Rs. Upto Date Quantity Quantities Paid in Last Bill: SolutionMoazam KhanОценок пока нет

- General Tender 2023.06.22Документ87 страницGeneral Tender 2023.06.22WHITE YETIОценок пока нет

- Group 2-Fin 6000BДокумент7 страницGroup 2-Fin 6000BBellindah wОценок пока нет

- Eligibility Criteria - CIDCOДокумент36 страницEligibility Criteria - CIDCOKiranmayi C V S PОценок пока нет

- Loyola College (Autonomous), Chennai - 600 034Документ3 страницыLoyola College (Autonomous), Chennai - 600 034Harish KapoorОценок пока нет

- Poultry Farming: Project Proposal ForДокумент8 страницPoultry Farming: Project Proposal ForShyamal Dutta100% (7)

- ACCA F6 Taxation Solved Past PapersДокумент235 страницACCA F6 Taxation Solved Past Paperssaiporg100% (1)

- Tax Card 2012Документ1 страницаTax Card 2012Ch Attique WainsОценок пока нет

- The NASI-Scopus Young Scientist of The Year Will Receive:: For Application & Nomination, Please VisitДокумент1 страницаThe NASI-Scopus Young Scientist of The Year Will Receive:: For Application & Nomination, Please Visitdeepali_nih9585Оценок пока нет

- How To Calculate Shannon Wiener Diversity Index - Definition, Formula, ExampleДокумент2 страницыHow To Calculate Shannon Wiener Diversity Index - Definition, Formula, Exampledeepali_nih9585Оценок пока нет

- Gulzar 101 - Qatra-Qatra Milti Hai (Ijaazat)Документ7 страницGulzar 101 - Qatra-Qatra Milti Hai (Ijaazat)deepali_nih9585Оценок пока нет

- Review of Happy Faces Day Care Center, Gurgaon, by A Parent - ParentingFUNdasДокумент11 страницReview of Happy Faces Day Care Center, Gurgaon, by A Parent - ParentingFUNdasdeepali_nih9585Оценок пока нет

- List of Predatory Publishers 2014 - Scholarly Open AccessДокумент208 страницList of Predatory Publishers 2014 - Scholarly Open Accessdeepali_nih9585Оценок пока нет

- Oxidative Phosphorylation - Biology (Article) - Khan AcademyДокумент16 страницOxidative Phosphorylation - Biology (Article) - Khan Academydeepali_nih9585Оценок пока нет

- Regulation of Cellular Respiration (Article) - Khan AcademyДокумент12 страницRegulation of Cellular Respiration (Article) - Khan Academydeepali_nih9585Оценок пока нет

- Sukanya's MusingsДокумент6 страницSukanya's Musingsdeepali_nih9585Оценок пока нет

- Department With Faculty - KB Women's CollegeДокумент3 страницыDepartment With Faculty - KB Women's Collegedeepali_nih9585Оценок пока нет

- OMWCJFVS21 ST EACAgendaДокумент17 страницOMWCJFVS21 ST EACAgendadeepali_nih9585Оценок пока нет

- Energy Conservation Building Code - Green BanaoДокумент4 страницыEnergy Conservation Building Code - Green Banaodeepali_nih9585Оценок пока нет

- Accreditation EIA Consultant Organizations PDFДокумент156 страницAccreditation EIA Consultant Organizations PDFdeepali_nih9585Оценок пока нет

- Vio MomДокумент36 страницVio Momdeepali_nih9585Оценок пока нет

- Welcome To The Narayana GroupДокумент2 страницыWelcome To The Narayana Groupdeepali_nih9585Оценок пока нет

- Energy Conservation Building Code 2017Документ1 страницаEnergy Conservation Building Code 2017deepali_nih9585Оценок пока нет

- List of Documents Required For CTEДокумент4 страницыList of Documents Required For CTEdeepali_nih9585Оценок пока нет

- 87th SEAC Meeting Held On 11.03.2017aДокумент39 страниц87th SEAC Meeting Held On 11.03.2017adeepali_nih9585Оценок пока нет

- Energy Conservation Building Code - Green BanaoДокумент4 страницыEnergy Conservation Building Code - Green Banaodeepali_nih9585Оценок пока нет

- IGBC Question PaperДокумент4 страницыIGBC Question Paperdeepali_nih9585Оценок пока нет

- AS Film Production Lesson.Документ13 страницAS Film Production Lesson.MsCowanОценок пока нет

- Tes - 29 October 2021 UserUploadNetДокумент120 страницTes - 29 October 2021 UserUploadNetTran Nhat QuangОценок пока нет

- Seminar ReportДокумент15 страницSeminar ReportNipesh MAHARJANОценок пока нет

- 43 Best Passive Income Streams & OpportunitiesДокумент7 страниц43 Best Passive Income Streams & OpportunitiesEri Nur Sofa50% (2)

- Acid Bases and Salts Previous Year Questiosn Class 10 ScienceДокумент5 страницAcid Bases and Salts Previous Year Questiosn Class 10 Scienceclashhunting123123Оценок пока нет

- American J Political Sci - 2023 - Eggers - Placebo Tests For Causal InferenceДокумент16 страницAmerican J Political Sci - 2023 - Eggers - Placebo Tests For Causal Inferencemarta bernardiОценок пока нет

- EASA CS-22 Certification of SailplanesДокумент120 страницEASA CS-22 Certification of SailplanessnorrigОценок пока нет

- Dacia-Group Renault - Focus To Customers Satisfact PDFДокумент7 страницDacia-Group Renault - Focus To Customers Satisfact PDFRăzvan Constantin DincăОценок пока нет

- Fulltext PDFДокумент454 страницыFulltext PDFVirmantas JuoceviciusОценок пока нет

- 3 - RA-Erecting and Dismantling of Scaffolds (WAH) (Recovered)Документ6 страниц3 - RA-Erecting and Dismantling of Scaffolds (WAH) (Recovered)hsem Al EimaraОценок пока нет

- Learning Activity Sheet Pre-Calculus: Science Technology Engineering and Mathematics (STEM) Specialized SubjectДокумент26 страницLearning Activity Sheet Pre-Calculus: Science Technology Engineering and Mathematics (STEM) Specialized SubjectJanet ComandanteОценок пока нет

- Social and Professional Issues Pf2Документ4 страницыSocial and Professional Issues Pf2DominicOrtegaОценок пока нет

- Pte Lastest QuestionsДокумент202 страницыPte Lastest QuestionsIelts Guru ReviewОценок пока нет

- Hitachi VSP Pricelist PeppmДокумент57 страницHitachi VSP Pricelist PeppmBahman MirОценок пока нет

- LCA - Bank of EnglandДокумент133 страницыLCA - Bank of EnglandJoao Paulo VazОценок пока нет

- SolutionsManual NewДокумент123 страницыSolutionsManual NewManoj SinghОценок пока нет

- PURL Questions and AnswersДокумент3 страницыPURL Questions and AnswersSHAHAN VS100% (5)

- Ecological Building: Term Project For ME 599Документ32 страницыEcological Building: Term Project For ME 599Junaid AnwarОценок пока нет

- Cutting Conics AsДокумент3 страницыCutting Conics Asbabe09Оценок пока нет

- Student Ought To Possess To Produce Clean-Up and In-Between DrawingsДокумент2 страницыStudent Ought To Possess To Produce Clean-Up and In-Between Drawingscristian friasОценок пока нет

- Semi Formal Asking To Borrow BooksДокумент75 страницSemi Formal Asking To Borrow BooksPei Cheng WuОценок пока нет

- 1623 Asm2Документ21 страница1623 Asm2Duc Anh nguyenОценок пока нет

- R820T Datasheet-Non R-20111130 UnlockedДокумент26 страницR820T Datasheet-Non R-20111130 UnlockedKonstantinos GoniadisОценок пока нет

- Standard CellДокумент53 страницыStandard CellShwethОценок пока нет

- TA35 & TA40 Articulated Dumptruck Maintenance Manual: Click Here For Table ofДокумент488 страницTA35 & TA40 Articulated Dumptruck Maintenance Manual: Click Here For Table ofKot878100% (2)

- Mechatronic ApplicationsДокумент31 страницаMechatronic ApplicationsDevice SamsungОценок пока нет

- 10 Day Penniman Chart - Literacy NarrativesДокумент5 страниц10 Day Penniman Chart - Literacy Narrativesapi-502300054Оценок пока нет

- IOQC2021 PartII Questions enДокумент13 страницIOQC2021 PartII Questions enDhamodharan SrinivasanОценок пока нет

- Punctuation WorksheetsДокумент10 страницPunctuation WorksheetsRehan Sadiq100% (2)

- Tawjihi 7Документ55 страницTawjihi 7api-3806314Оценок пока нет