Академический Документы

Профессиональный Документы

Культура Документы

Taxation: Far Eastern University - Manila

Загружено:

goerginamarquezОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Taxation: Far Eastern University - Manila

Загружено:

goerginamarquezАвторское право:

Доступные форматы

TAXATION

FAR EASTERN UNIVERSITY – MANILA

INDIVIDUAL INCOME TAX (1401)

A. Classification of Individual Taxpayers

1. Citizens Under the Philippine Constitution, citizens are:

1. Those who are citizens of the Philippines at the time of adoption of the constitution (on Feb. 2,

1987).

2. Those whose fathers or mothers are citizens of the Philippines.

3. Those born before January 17, 1973 of Filipino mothers who elect Philippine citizenship upon

reaching the age of majority.

4. Those who are naturalized in accordance law.

Resident Resident citizen - is a citizen of the Philippines who has a permanent or perpetual

Citizen home in the Philippines to which he plans or intends to return whenever he is away

or out of the country.

Nonresident Nonresident citizen

Citizen 1) A citizen of the Philippines who establishes to the satisfaction of the

Commissioner the fact of his physical presence abroad with a definite intention to

reside therein. (Sec 22(E)(1), NIRC)

2) A citizen of the Philippines who leaves the Philippines during the taxable

year to reside abroad, either as an immigrant or for employment on a permanent

basis. (Sec 22, (E)(2), NIRC)

3) A citizen of the Philippines who works and derives income from abroad

and whose employment thereat requires him to be physically present abroad most

of the time during the taxable year. (Sec 22 (E)(3), NIRC)

The phrase "most of the time" shall mean that the said citizen shall have stayed

abroad for at least 183 days in a taxable year. (Sec. (2)(c), Revenue Regulations

No. 1-79)

4) A citizen who has been previously considered as nonresident citizen and

who arrives in the Philippines at any time during the taxable year to reside

permanently in the Philippines shall likewise be treated as a nonresident citizen for

the taxable year in which he arrives in the Philippines with respect to his income

derived from sources abroad until the date of his arrival in the Philippines. (Sec

22(E)(4), NIRC)

The taxpayer shall submit proof to the Commissioner to show his intention of

leaving the Philippines to reside permanently abroad or to return to and reside in

the Philippines as the case may be for purpose of this Section. (Sec 22(E)(5), NIRC)

Overseas Contract Worker (OCW)/Overseas Filipino Workers (OFW)

RR 1-2011, defines OCWs as Filipino citizens employed in foreign

countries, commonly referred to as OFWs, who are physically present in a foreign

country as a consequence of their employment thereat.

Their salaries and wages are paid by an employer abroad and are not borne

by entities or persons in the Philippines. Hence OFWs are classified as

non-resident citizens for tax purposes.

To be considered as an OCW or OFW, they must be duly registered as

such with the Philippine Overseas Employment Administration (POEA)

with a valid Overseas Employment Certificate (OEC).

Seafares or seamen are Filipino citizens who receive compensation for

services rendered abroad as a member of the complement of a vessel

engaged exclusively for international trade. To be considered as an OCW

or OFW, they must be duly registered as such with the Philippine Overseas

Employment Administration (POEA) with a valid Overseas Employment

Certificate (OEC) with Seafarers Identification Record Book (SIRB) or

Seaman’s Book issued by the Maritime Industry Authority (MARINA).

2. Aliens Resident Resident alien - is an individual whose residence is within the Philippines and who

Alien is not a citizen thereof. (Sec. 22 (F), NIRC)

An expatriate may be considered a resident alien if:

14. INCOME TAX - INDIVIDUAL Page 1 of 18

(1) he or she is not a mere transient or sojourner***

(2) he or she has no definite intention to leave, or

(3) his or her purpose is of such a nature that an extended stay may be necessary

for its accomplishment, and to that end the alien makes his or her home temporarily

in the Philippines.

(4) An alien who has acquired residence in the Philippines retains his status as such

until he abandons the same and actually departs from the Philippines.

An intention to change his residence does not change his status as a resident alien to

that of a nonresident alien. Thus an alien who has acquired a residence in the

Philippines is taxable as a resident for the remainder of his stay in the Philippines.

(Sec 6, Revenue Regulation 2-40)

Notes:

***(Resident Alien - An alien actually present in the Philippines who is not a mere

transient or sojourner is a resident of the Philippines for purposes of income tax. Whether

he is a transient (non-resident) or not is determined by his intentions with regards to

the length and nature of his stay. One who comes to the Philippines for a definite purpose, which is

promptly accomplished, is a transient (non-resident). But if his purpose is of such a

nature that an extended stay may be necessary for its accomplishment, and to that end the alien

makes his home temporarily in the Philippines, he becomes resident, though it may be his intention

at all times to return to his domicile abroad when the purpose for which he became has been

consummated or abandoned (Sec. 5, Rev. Reg. No. 2))

***(Resident Alien – Means an individual whose residence is within the Philippines and who

is not a citizen thereof. He is one who is actually present in the Philippines and who is not a mere

transient or sojourner. But residence does not mean mere physical presence. An alien is considered

a resident or a non-resident depending on his intention with regard to the length and nature of is

stay.)

Nonresident Nonresident alien - is an individual who is not a citizen of the Philippines and

Alien whose residence is not within the Philippines. (Sec. 22 (G), NIRC)

One who comes to the Philippines for a definite purpose which in its nature may

be promptly accomplished is a transient (non-resident).

1) Nonresident alien-Engaged in trade or business- a nonresident alien who has stayed in the

Philippines for an aggregate period of more than 180 days during any calendar year.

Engaged in trade or business- includes the performance of personal services on regular basis and does

not include casual or incidental transactions.

Trade or business includes the performance of the functions of a public office. (Sec. 22 (S), NIRC)

2) Nonresident alien-not engaged in trade or business- a nonresident alien who has stayed in

the Philippines for an aggregate period of not more than 180 days (180 days or less) during any

calendar year.

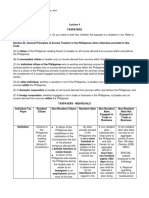

The following table summarizes the situs of taxable income to individual taxpayers:

Taxpayer Length of Stay Tax Base

Resident Citizen Taxable income – World

Non-resident citizen A citizen staying abroad for at least 183 days (365 Taxable income – Philippines

days/2)

Resident alien An alien staying in the Philippines for more than one year Taxable income – Philippines

Non-resident alien engaged in trade or An alien who stays in the Philippines for more than 180 days in any Taxable income – Philippines

business calendar year.

Non-resident alien not engaged in trade or An alien who stays in the Philippines for an aggregate period at least Gross income – Philippines

business 180 days in any calendar year. (360 days /2)

Taxable estate – estate under judicial settlement. Taxable income – World

Taxable trust – trust irrevocably designated by the grantor.

14. INCOME TAX - INDIVIDUAL Page 2 of 18

Thank you for using www.freepdfconvert.com service!

Only two pages are converted. Please Sign Up to convert all pages.

https://www.freepdfconvert.com/membership

Вам также может понравиться

- Individual Income TaxДокумент18 страницIndividual Income TaxMaeNeth GullanОценок пока нет

- Overseas Contract Workers TaxationДокумент11 страницOverseas Contract Workers TaxationShiela Jane CrismundoОценок пока нет

- Types of Individual Taxpayers Citizens Revenue Regulations No. 1-79Документ8 страницTypes of Individual Taxpayers Citizens Revenue Regulations No. 1-79James Evan I. ObnamiaОценок пока нет

- Kinds of Income Tax PayersДокумент9 страницKinds of Income Tax PayersCarra Trisha C. TitoОценок пока нет

- BAC103A-02a Income Tax For IndividualsДокумент8 страницBAC103A-02a Income Tax For IndividualsNovelyn Duyogan100% (1)

- Tax-Review-Handouts-INDV FWT CGT FBT EST PDFДокумент34 страницыTax-Review-Handouts-INDV FWT CGT FBT EST PDFMarinella Oppa100% (1)

- Taxation of IndividualsДокумент22 страницыTaxation of IndividualsTurksОценок пока нет

- Income Tax For IndividualsДокумент90 страницIncome Tax For IndividualsRubyjane KimОценок пока нет

- Tax601 Individual Itx Lecture Notes 122Документ12 страницTax601 Individual Itx Lecture Notes 122Justine JaymaОценок пока нет

- Module 2 - Individuals Estates and Trusts Without Answer-2Документ12 страницModule 2 - Individuals Estates and Trusts Without Answer-2KarenFayeBadillesОценок пока нет

- Tax Reviewer PDFДокумент6 страницTax Reviewer PDFdave excelleОценок пока нет

- Income Tax On IndividualsДокумент7 страницIncome Tax On IndividualsThe man with a Square stacheОценок пока нет

- 2 Classification of Individual TaxpayersДокумент2 страницы2 Classification of Individual TaxpayersDiana SheineОценок пока нет

- Individual Income TaxДокумент9 страницIndividual Income TaxCharmaine RosalesОценок пока нет

- TAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AДокумент12 страницTAX-601: Income TAX - Individuals, Estates AND Trusts: - T R S AVaughn TheoОценок пока нет

- Handout 3Документ51 страницаHandout 3Jilian Kate Alpapara Bustamante100% (1)

- University of St. Lasalle: Student HandoutsДокумент13 страницUniversity of St. Lasalle: Student HandoutsMae EscanillanОценок пока нет

- Individual TaxpayersДокумент3 страницыIndividual TaxpayersJoy Orena100% (2)

- Professional Review & Training Center, Inc.: Taxation Sia/Tabag TAX 2806 - Income Tax On Individuals MAY 2020Документ11 страницProfessional Review & Training Center, Inc.: Taxation Sia/Tabag TAX 2806 - Income Tax On Individuals MAY 2020Ramainne RonquilloОценок пока нет

- TAX-5.0 - Individual Income TaxДокумент65 страницTAX-5.0 - Individual Income TaxCharmaine RosalesОценок пока нет

- Tax 601Документ11 страницTax 601C.J. Clarisse FranciscoОценок пока нет

- Handout TaxationДокумент2 страницыHandout TaxationJohn Oicemen RocaОценок пока нет

- Income tax module focuses on individual taxpayersДокумент6 страницIncome tax module focuses on individual taxpayersDarwish masturaОценок пока нет

- Module 3: Income Tax On Individuals - Part 1 Learning ObjectivesДокумент8 страницModule 3: Income Tax On Individuals - Part 1 Learning ObjectivesSh1njo SantosОценок пока нет

- (TAX) Income Taxation Updated Jan 9 2022Документ133 страницы(TAX) Income Taxation Updated Jan 9 2022Reginald ValenciaОценок пока нет

- Tax Rates and Classifications for Individual Filipino TaxpayersДокумент3 страницыTax Rates and Classifications for Individual Filipino TaxpayersOdessa De JesusОценок пока нет

- Types of Income Tax PayersДокумент3 страницыTypes of Income Tax PayersAce Fati-igОценок пока нет

- Template Taxation Unit IIДокумент29 страницTemplate Taxation Unit IINacion, Jaime G.Оценок пока нет

- Income Tax Reviewer Chapter 2 Highlights Resident vs Non-Resident TaxpayersДокумент6 страницIncome Tax Reviewer Chapter 2 Highlights Resident vs Non-Resident TaxpayersKen NavarroОценок пока нет

- Income Tax Guide for IndividualsДокумент141 страницаIncome Tax Guide for Individualsrav dano100% (2)

- HO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Документ5 страницHO 1 INDIVIDUAL ESTATE AND TRUST TAXATION AND SOURCES OF INCOME Version 2.0Erine ContranoОценок пока нет

- 3 - Income Tax On IndividualsДокумент22 страницы3 - Income Tax On IndividualsRylleMatthanCorderoОценок пока нет

- What Are The Kinds of TaxpayersДокумент4 страницыWhat Are The Kinds of TaxpayersALee Bud100% (1)

- Taxation of IndividualsДокумент9 страницTaxation of IndividualsBrielle GabОценок пока нет

- Taxation Week 3Документ8 страницTaxation Week 3Jurian Jaan PeligroОценок пока нет

- Prelim Income TaxationДокумент55 страницPrelim Income TaxationclytemnestraОценок пока нет

- BSBA Financial Management Income Taxation Module OverviewДокумент3 страницыBSBA Financial Management Income Taxation Module OverviewErvin Ray FernandezОценок пока нет

- KINDS OF TAXPAYERS AND SITUS OF INCOMEДокумент2 страницыKINDS OF TAXPAYERS AND SITUS OF INCOMEMelanie SamsonaОценок пока нет

- Module TX003 Types On Income TaxpayersДокумент3 страницыModule TX003 Types On Income TaxpayersErwin TorresОценок пока нет

- TSN By: Adil, Flores, Orquina, Dura-Butaslac, Tan, Besin From The Lecture of Atty. AbrantesДокумент31 страницаTSN By: Adil, Flores, Orquina, Dura-Butaslac, Tan, Besin From The Lecture of Atty. AbrantesEmma PaglalaОценок пока нет

- Citizenship and Residency Inside RP Outside RPДокумент2 страницыCitizenship and Residency Inside RP Outside RPRhea Royce CabuhatОценок пока нет

- Chapter 2 Income TaxationДокумент31 страницаChapter 2 Income TaxationRieven BaracinasОценок пока нет

- 9) Who Are Exempt From Income Tax?Документ1 страница9) Who Are Exempt From Income Tax?Deopito BarrettОценок пока нет

- Person - Orporation: Income TaxДокумент138 страницPerson - Orporation: Income TaxMich FelloneОценок пока нет

- Person - Orporation: Income TaxДокумент223 страницыPerson - Orporation: Income TaxMich FelloneОценок пока нет

- M2u Classification Individual Taxation P1Документ30 страницM2u Classification Individual Taxation P1Xehdrickke FernandezОценок пока нет

- Income Tax ConДокумент2 страницыIncome Tax ConMaricon EstradaОценок пока нет

- Introduction to Individual Income TaxationДокумент25 страницIntroduction to Individual Income TaxationMatta, Jherrie MaeОценок пока нет

- Differences between schedular and global tax systemsДокумент18 страницDifferences between schedular and global tax systemsElaine Yap100% (1)

- Income Taxation Week 3Документ20 страницIncome Taxation Week 3Hannah Rae ChingОценок пока нет

- 2016 Tax Aid Classification of TaxpayersДокумент4 страницы2016 Tax Aid Classification of TaxpayersDewm DewmОценок пока нет

- 6 11 18 Tax Summary in The Philippines EditedДокумент117 страниц6 11 18 Tax Summary in The Philippines EditedBianca PalomaОценок пока нет

- Basergo, Lovers Mae B. General Classification of Individual TaxpayersДокумент2 страницыBasergo, Lovers Mae B. General Classification of Individual Taxpayerslavender kayeОценок пока нет

- Lesson 2 Taxation of IndividualsДокумент40 страницLesson 2 Taxation of IndividualsQuenie De la CruzОценок пока нет

- PreFi Tax PDFДокумент21 страницаPreFi Tax PDFJoesil Dianne SempronОценок пока нет

- Quickie PreFi Tax PDFДокумент12 страницQuickie PreFi Tax PDFJoesil Dianne Sempron100% (1)

- Module 2 - Income Taxes For Individuals - Lecture NotesДокумент52 страницыModule 2 - Income Taxes For Individuals - Lecture NotesRina Bico Advincula100% (1)

- A. Classification OF Individual TaxpayersДокумент7 страницA. Classification OF Individual TaxpayersShiela Marie Sta AnaОценок пока нет

- C Ae26 Module 4 Introduction To Income TaxДокумент15 страницC Ae26 Module 4 Introduction To Income TaxBaek hyunОценок пока нет

- Basiceconcepts PDFДокумент1 страницаBasiceconcepts PDFgoerginamarquezОценок пока нет

- Heirs and legitime under Philippine succession lawДокумент2 страницыHeirs and legitime under Philippine succession lawgoerginamarquezОценок пока нет

- Class Schedule: SUN MON TUE WED Thur FRI SATДокумент3 страницыClass Schedule: SUN MON TUE WED Thur FRI SATgoerginamarquezОценок пока нет

- Proof of Cash Bank StatementДокумент15 страницProof of Cash Bank StatementgoerginamarquezОценок пока нет

- VAT Law Essentials in 40 CharactersДокумент78 страницVAT Law Essentials in 40 CharactersgoerginamarquezОценок пока нет

- May 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasДокумент18 страницMay 28, 2015-CH 10-Basic Income Tax Patterns-Valencia & RoxasgoerginamarquezОценок пока нет

- DentalДокумент8 страницDentalgoerginamarquezОценок пока нет

- Essential requisites and characteristics of a contract of saleДокумент16 страницEssential requisites and characteristics of a contract of salegoerginamarquezОценок пока нет

- Government Accounting ReviewДокумент6 страницGovernment Accounting ReviewErwinPaulM.SaritaОценок пока нет

- Quizzer Cash - Solution Printed KoДокумент119 страницQuizzer Cash - Solution Printed Kogoerginamarquez80% (10)

- DonationДокумент1 страницаDonationgoerginamarquezОценок пока нет

- Local Government Tax CodeДокумент22 страницыLocal Government Tax CodeCarl AdrianОценок пока нет

- Panelist's Comment Page No. Comment/Revision/Recom Mendations Suggested Action MadeДокумент2 страницыPanelist's Comment Page No. Comment/Revision/Recom Mendations Suggested Action MadegoerginamarquezОценок пока нет

- IRR-special-provisions 9520Документ39 страницIRR-special-provisions 9520Glenn TaduranОценок пока нет

- Pocket Reference Card BlankДокумент8 страницPocket Reference Card BlankgoerginamarquezОценок пока нет

- Gower SlidesCarnivalДокумент28 страницGower SlidesCarnivalBình PhạmОценок пока нет

- Estate TaxДокумент15 страницEstate TaxDustin PascuaОценок пока нет

- DonationДокумент1 страницаDonationgoerginamarquezОценок пока нет

- Proof of Cash - Per JCD ExampleДокумент18 страницProof of Cash - Per JCD ExamplegoerginamarquezОценок пока нет

- Proof of Cash NSF and Bank ErrorДокумент2 страницыProof of Cash NSF and Bank ErrorgoerginamarquezОценок пока нет

- Reviewer TaxДокумент7 страницReviewer TaxgoerginamarquezОценок пока нет

- Once You Upload An Approved DocumentДокумент7 страницOnce You Upload An Approved DocumentgoerginamarquezОценок пока нет

- DonationДокумент1 страницаDonationgoerginamarquezОценок пока нет

- MAS Chapter 1Документ5 страницMAS Chapter 1goerginamarquezОценок пока нет

- SsssДокумент17 страницSsssgoerginamarquezОценок пока нет

- DonationДокумент1 страницаDonationgoerginamarquezОценок пока нет

- SsssДокумент17 страницSsssgoerginamarquezОценок пока нет

- SsssДокумент17 страницSsssgoerginamarquezОценок пока нет

- SsssДокумент4 страницыSsssgoerginamarquezОценок пока нет

- Vietnam's Economic Development in The Period Since Doi MoiДокумент7 страницVietnam's Economic Development in The Period Since Doi MoiNgọc LâmОценок пока нет

- SchulichДокумент20 страницSchulichSarathy Guru ShankarОценок пока нет

- Topic: Competition and Monopoly: Dominant Oligopoly Sales Seller Pure 2 25 50Документ5 страницTopic: Competition and Monopoly: Dominant Oligopoly Sales Seller Pure 2 25 50Mijwad AhmedОценок пока нет

- LET 6e-TB-Ch07Документ25 страницLET 6e-TB-Ch07sulemanОценок пока нет

- Permission MarketingДокумент35 страницPermission Marketingtattid67% (3)

- Group 4 Group AssignmentДокумент96 страницGroup 4 Group AssignmentKrutarthChaudhari0% (1)

- Inv No - 6554 PDFДокумент1 страницаInv No - 6554 PDFSunil PatelОценок пока нет

- Costing Theory & Formulas & ShortcutsДокумент58 страницCosting Theory & Formulas & ShortcutsSaibhumi100% (1)

- Qdoc - Tips - Carter Cleaning Company Case HRMДокумент7 страницQdoc - Tips - Carter Cleaning Company Case HRMYến VyОценок пока нет

- Latin American Journal of Central Banking: Andrés Arauz, Rodney Garratt, Diego F. Ramos FДокумент10 страницLatin American Journal of Central Banking: Andrés Arauz, Rodney Garratt, Diego F. Ramos FHasfi YakobОценок пока нет

- Backflu SH Costing: Yusi, Mark Lawrence - Group 4Документ19 страницBackflu SH Costing: Yusi, Mark Lawrence - Group 4Mark Lawrence YusiОценок пока нет

- Solution To Worksheet - Modified-2Документ25 страницSolution To Worksheet - Modified-2Mohammed Saber Ibrahim Ramadan ITL World KSAОценок пока нет

- Air France Case StudyДокумент7 страницAir France Case StudyKrishnaprasad ChenniyangirinathanОценок пока нет

- Mum Mineral Water-Economic Concepts and Their ApplicationsДокумент26 страницMum Mineral Water-Economic Concepts and Their Applicationsশেখ মোহাম্মদ তুহিন100% (1)

- Policy BriefДокумент2 страницыPolicy BriefEslah MatiwatОценок пока нет

- AutomotiveSectorSupplement Pilot GRIДокумент18 страницAutomotiveSectorSupplement Pilot GRIkc72Оценок пока нет

- Lecture 5 - Technology ExploitationДокумент21 страницаLecture 5 - Technology ExploitationUsmanHaiderОценок пока нет

- Fire in A Bangladesh Garment FactoryДокумент6 страницFire in A Bangladesh Garment FactoryRaquelОценок пока нет

- GST ChallanДокумент1 страницаGST ChallannavneetОценок пока нет

- Volume Spread Analysis Improved With Wyckoff 2Документ3 страницыVolume Spread Analysis Improved With Wyckoff 2ngocleasing86% (7)

- T10.10 Example: Fairways Equipment and Operating Costs: Irwin/Mcgraw-HillДокумент31 страницаT10.10 Example: Fairways Equipment and Operating Costs: Irwin/Mcgraw-HillcgrkrcglnОценок пока нет

- Table of Contents Answers: Pre-TestДокумент67 страницTable of Contents Answers: Pre-TestLachlanОценок пока нет

- Mexican Corp Accounts Receivable AdjustmentsДокумент4 страницыMexican Corp Accounts Receivable AdjustmentsA.B AmpuanОценок пока нет

- Value Chain Analysis: Primary ActivitiesДокумент3 страницыValue Chain Analysis: Primary ActivitiesPooja YamiОценок пока нет

- MFAP Performance Summary ReportДокумент17 страницMFAP Performance Summary ReportKhizar Hayat JiskaniОценок пока нет

- 22 Immutable Laws of Marketing SummaryДокумент2 страницы22 Immutable Laws of Marketing SummaryWahid T. YahyahОценок пока нет

- VRL Logistics & Navkar Corporation: Financial, Valuation, Business & Management AnalysisДокумент5 страницVRL Logistics & Navkar Corporation: Financial, Valuation, Business & Management AnalysisKaran VasheeОценок пока нет

- Using APV: Advantages Over WACCДокумент2 страницыUsing APV: Advantages Over WACCMortal_AqОценок пока нет

- Deferred TaxДокумент141 страницаDeferred TaxLorena BallaОценок пока нет

- Reviewer in MPTH 111Документ4 страницыReviewer in MPTH 111Jomari EsguerraОценок пока нет