Академический Документы

Профессиональный Документы

Культура Документы

Consolidation Theories Push-Down Account

Загружено:

aditiya mgОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Consolidation Theories Push-Down Account

Загружено:

aditiya mgАвторское право:

Доступные форматы

Find more slides, ebooks, solution manual and testbank on www.downloadslide.

com

Chapter 11

CONSOLIDATION THEORIES, PUSH-DOWN ACCOUNTING, AND

CORPORATE JOINT VENTURES

Answers to Questions

1 Parent company theory views consolidated financial statements from the viewpoint of the parent and entity

theory views consolidated financial statements from the viewpoint of the business entity under which all

resources are controlled by a single management team. By contrast, traditional theory sometimes reflects

the parent viewpoint and at other times it reflects the viewpoint of the business entity. A detailed

comparison of these theories is presented in Exhibit 11–1 of the text.

2 Only contemporary theory is changed by current pronouncements of the Financial Accounting Standards

Board. While such pronouncements can and do change the current accounting and reporting practices, they

do not change the logic or the consistency of either parent company or entity theory.

3 The valuation of subsidiary assets on the basis of the price paid for the controlling interest seems justified

conceptually when substantially all of the subsidiary stock is acquired by the parent. But the conceptual

support for this approach is less when only a slim majority of subsidiary stock is acquired. In addition, the

valuation of the noncontrolling interest based on the price paid by the parent has practical limitations

because noncontrolling interest does not represent equity ownership in the usual sense. The ability of

noncontrolling stockholders to participate in management is limited and noncontrolling shares do not

possess the usual marketability of equity securities.

4 Consolidated assets are equal to their fair values under entity theory only when the book values of parent

assets are equal to their fair values. Otherwise, consolidated assets are not equal to their fair values under

either parent company or entity theories.

5 The valuation of the noncontrolling interest at book value might overstate the equity of noncontrolling

shareholders because of the limited marketability of shares held by noncontrolling stockholders and

because of the limited ability of noncontrolling stockholders to share in management through their voting

rights. Valuation of the noncontrolling interest at book value also overstates or understates the

noncontrolling interest unless the subsidiary assets are recorded at fair values.

6 Consolidated net income under parent company theory and income to the controlling stockholders under

entity theory should be the same. This is illustrated in Exhibit 11–5, which shows different income

statement amounts for cost of sales, operating expenses, and income allocated to noncontrolling

stockholders, but the same income to controlling stockholders. Note that consolidated net income under

parent company and traditional theories reflects income to controlling stockholders.

7 Income to the parent stockholders under the equity method of accounting is the same as income to the

controlling stockholders under entity theory. But income to controlling stockholders is not identified as

consolidated net income as it would be under parent company or traditional theories.

8 Consolidated income statement amounts under entity theory are the same as under traditional theory when

subsidiary investments are made at book value because traditional theory follows entity theory in

eliminating the effects of intercompany transactions from consolidated financial statements.

© 2011 Pearson Education, Inc. publishing as Prentice Hall

11-1

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-2 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

9 Traditional theory corresponds to entity theory in matters relating to unrealized and constructive gains and

losses from intercompany transactions. In other words, unrealized and constructive gains and losses are

allocated between controlling and noncontrolling interests in the same manner under these two theories.

10 Push-down accounting simplifies the consolidation process. The push-down adjustments are recorded in

the subsidiary’s separate books at the time of the business combination; thus, it is not necessary to allocate

the unamortized fair values in the consolidation working papers.

11 A joint venture is an entity that is owned, operated, and jointly controlled by a small group of investor-

venturers to operate a business for the mutual benefit of the venturers. Some joint ventures are organized as

corporations, while others are organized as partnerships or undivided interests. Each venturer typically

participates in important decisions of a joint venture irrespective of ownership percentage.

12 Investors in corporate joint ventures use the equity method of accounting and reporting for their investment

earnings and investment balances as required by GAAP. The cost method would be used only if the

investor could not exercise significant influence over the corporate joint venture. Alternatively, investors in

unincorporated joint ventures use the equity method of accounting and reporting or proportional

consolidation for undivided interests specified as a special industry practice.

SOLUTIONS TO EXERCISES

Solution E11-1

1 A 5 B

2 A 6 C

3 C 7 D

4 A

Solution E11-2

1 B 4 D

2 B 5 C

3 D

Solution E11-3

1 c

Total value of Sit implied by purchase price $1,800,000

($1,440,000/.8)

Noncontrolling interest percentage 20%

Noncontrolling interest $360,000

2 a

Only the parent’s percentage of unrealized profits from upstream sales

is eliminated under parent company theory.

3 b

Subsidiary’s income of $400,000 10% noncontrolling $ 40,000

interest

Less: Patent amortization ($140,000/10 years 10%) (1,400)

Noncontrolling interest share $ 38,600

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-3

Solution E11-3 (continued)

4 a

Implied fair value — $1,680,000 = patents at acquisition

Book value of 100% of identifiable net assets $1,680,000

Add: Patents at acquisition ($108,000/90%) 120,000

Total implied value 1,800,000

Percent acquired 80%

Purchase price under entity theory $1,440,000

5 b

Purchase price — ($1,680,000 80%) = patents at acquisition

Book value $1,680,000 80% = underlying equity $1,344,000

Add: Patents at acquisition ($108,000/90%) 120,000

Purchase price (traditional theory) $1,464,000

Solution E11-4

1 Goodwill

Parent company theory

Cost of investment in Sad $ 500,000

Fair value acquired ($400,000 80%) 320,000

Goodwill $ 180,000

Entity theory

Implied value based on purchase price ($500,000/.8) $ 625,000

Fair value of Sad’s net assets 400,000

Goodwill $ 225,000

2 Noncontrolling interest

Parent company theory

Book value of Sad’s net assets $ 260,000

Noncontrolling interest percentage 20%

Noncontrolling interest $ 52,000

Entity theory

Total valuation of Sad $ 625,000

Noncontrolling interest percentage 20%

Noncontrolling interest $ 125,000

3 Total assets

Parent company theory

Pod Sad Adjustment Total

Current assets $520,000 $ 50,000 $ 40,000 80% $ 602,000

Plant assets — net 480,000 250,000 110,000 80% 818,000

Goodwill 180,000

$1,000,000 $300,000 $1,600,000

Entity theory

Current assets $ 520,000 $ 50,000 $ 40,000 100% $ 610,000

Plant assets — net 480,000 250,000 110,000 100% 840,000

Goodwill 225,000

$1,000,000 $300,000 $1,675,000

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-4 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution E11-5

Preliminary computations

Parent company theory

Cost of 80% interest $300,000

Fair value acquired ($350,000 80%) 280,000

Goodwill $ 20,000

Entity theory

Implied total value ($300,000 cost ÷ 80%) $375,000

Fair value of Sal’s net identifiable assets 350,000

Goodwill $ 25,000

1 Consolidated net income and noncontrolling interest share for 2011:

Entity

Theory

Combined separate incomes $550,000

Depreciation on excess allocated to

equipment:

$75,000 excess ÷ 5 years (15,000)

Total consolidated income 535,000

Less: Noncontrolling interest share

($50,000 -15,000) 20% (7,000)

Controlling interest share of NI(Income $528,000

Attributable to controlling stockholders)

Parent

Company Theory

Combined separate incomes $550,000

Depreciation on excess allocated to

equipment:

($75,000 excess x 80% acquired)/5 years (12,000)

Less: Noncontrolling interest share

($50,000 x 20%) (10,000)

Consolidated net income $528,000

2 Goodwill at December 31, 2011: $ 20,000 $ 25,000

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-5

Solution E11-6

Preliminary computation

Interest acquired in Sal: 72,000 shares 80,000 shares = 90%

1 Sal’s net assets under entity theory

Implied value from purchase price: $1,800,000/90% interest $2,000,000

2 Goodwill

a Entity theory

Implied value $2,000,000

Less: Fair value and book value of net assets 1,710,000

Goodwill $ 290,000

b Parent company theory

Cost of 90% interest $1,800,000

Fair values of net assets acquired ($1,710,000 90%) 1,539,000

Goodwill $ 261,000

c Traditional theory (same as parent theory) $ 261,000

3 Investment income from Sal

Income from Sal ($80,000 1/2 year 90% interest) $ 36,000

4 Noncontrolling interest under entity theory

Implied value of Sal at July 1, 2011 $2,000,000

Add: Income for 1/2 year 40,000

2,040,000

Noncontrolling percentage 10%

Noncontrolling interest $ 204,000

Alternatively, $200,000 noncontrolling interest at July 1, plus $4,000

share of reported income = $204,000

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-6 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution E11-7

1 Parent company theory

Combined separate incomes of Pal and Sal $800,000

Less: Pal’s share of unrealized profits from upstream

inventory sales ($30,000 80%) (24,000)

Less: Noncontrolling interest share ($300,000 20%) (60,000)

Consolidated net income $716,000

2 Entity theory

Combined separate incomes $800,000

Less: Unrealized profits from upstream sales (30,000)

Total consolidated income $770,000

Income allocated to controlling stockholders ($500,000 +

[$270,000 80%]) $716,000

Income allocated to noncontrolling stockholders

($300,000 - $30,000) 20% $ 54,000

Solution E11-8

Parent

Traditional Company Entity

Theory Theory Theory

Combined separate incomes $180,000 $180,000 $180,000

Less: Unrealized inventory profits

from downstream sales

($60,000 - $30,000) 50% (15,000) (15,000) (15,000)

Less: Unrealized profit on upstream

sale of land

($96,000 - $70,000) 100% (26,000) (26,000)

($96,000 - $70,000) 80% (20,800)

Less: Noncontrolling interest share

($60,000 - $26,000) 20% (6,800)

$60,000 20% (12,000)

Consolidated net income $132,200 $132,200

Total consolidated income $139,000

Allocated to controlling stockholders $132,200

Allocated to noncontrolling

Stockholders

($60,000 - $26,000) 20% $ 6,800

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-7

Solution E11-9 [Push-down accounting]

1 Push down under parent company theory

Retained earnings 800,000

Inventories 90,000

Land 450,000

Buildings — net 270,000

Goodwill 360,000

Equipment 180,000

Other liabilities 90,000

Push down equity 1,700,000

To record revaluation of 90% of the net assets and elimination of

retained earnings as a result of a business combination with Pin

Corporation. Push down equity = ($600,000 fair value/book value

differential 90%) + $360,000 goodwill + $800,000 retained

earnings.

2 Push down under entity theory

Retained earnings 800,000

Inventories 100,000

Land 500,000

Buildings — net 300,000

Goodwill 400,000

Equipment — net 200,000

Other liabilities 100,000

Push down equity 1,800,000

To record revaluation of 100% of the net assets and elimination of

retained earnings as a result of a business combination with Pin.

Push down equity = $600,000 fair value/book value differential +

$400,000 goodwill + $800,000 retained earnings.

Solution E11-10

Each of the investments should be accounted for by the equity method as a one-

line consolidation because the joint venture agreement requires consent of

each venturer for important decisions. Thus, each venturer is able to exercise

significant influence over its joint venture investment irrespective of

ownership interest.

The 40 percent venturer:

Income from Sun ($500,000 40%) $ 200,000

Investment in Sun ($8,500,000 40%) $3,400,000

The 15 percent venturer

Income from Sun ($500,000 15%) $ 75,000

Investment in Sun ($8,500,000 15%) $1,275,000

Solution E11-11 Field Code Changed

In general, VIE accounting follows normal consolidation principles.

Under that approach, the noncontrolling interest share would be 90% of VIE

earnings, or $900,000. However, the intercompany fees must be allocated to the

primary beneficiary, not to noncontrolling interests. Therefore, in this case,

noncontrolling interest share would be 90% of $920,000, or $828,000.

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-8 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution E11-12 Field Code Changed

As primary beneficiary, Pal must include Pot in its consolidated

financial staements. Additionally, Pal must make the following disclosures:

(a) the nature, purpose, size, and activities of the variable interest entity,

(b) the carrying amount and classification of consolidated assets that are

collateral for the variable interest entity’s obligations, and (c) lack of

recourse if creditors (or beneficial interest holders) of a consolidated

variable interest entity have no recourse to the general credit of the primary

beneficiary.

Den will not consolidate Pot, since they are not the primary beneficiary. As

in traditional consolidations, only one firm consolidates a subsidiary.

However, since Den has a significant interest in Pot, they must disclose: (a)

the nature of its involvement with the variable interest entity and when that

involvement began, (b) the nature, purpose, size, and activities of the

variable interest entity, and (c) the enterprise’s maximum exposure to loss as

a result of its involvement with the variable interest entity. Den accounts

for the investment using the equity method.

Solution E11-13 Field Code Changed

According to GAAP, if an enterprise absorbs a majority of a variable

interest entity’s expected losses and another receives a majority of expected

residual returns, the enterprise absorbing the losses is the primary

beneficiary and if condition one is also met. Laura meets condition one, since

as CEO, she had the power over economic decisions. Laura must consolidate the

variable interest entity. The contractual arrangement makes Laura the primary

beneficiary.

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-9

SOLUTION TO PROBLEMS

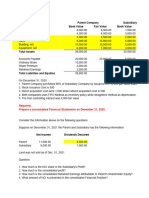

Solution P11-1

Pin Corporation and Subsidiary

Comparative Consolidated Balance Sheets

at December 31, 2012

(in thousands)

Parent

Company Theory Entity Theory

Assets

Cash $ 52 $ 52

Receivables — net 300 300

Inventories 450 450

Plant assets — neta 1,998 2,010

Patentsb 64 80

Total assets $2,864 $2,892

Liabilities

Accounts payable $ 304 $ 304

Other liabilities 500 500

Noncontrolling interestc 160

Total liabilities 964 804

Capital stock 1,000 1,000

Retained earnings 900 900

Noncontrolling interestd 0 188

Total stockholders’ equity 1,900 2,088

Total liabilities and

stockholders’ equity $2,864 $2,892

a Parent company theory: Combined plant assets of $1,950 + ($80 3/5 undepreciated

excess)

Entity theory: Combined plant assets of $1,950 + ($100 3/5 undepreciated excess)

b Parent company theory: $80 patents - $16 amortization

Entity theory: $100 patents - $20 amortization

c Parent company theory: Noncontrolling interest equals Son’s equity of $800 20%

d Entity theory: [Son’s equity of $800 + ($60 undepreciated plant assets + $80

unamortized patents)] 20%

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-10 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution P11-2

Preliminary computation

Implied value of Sip based on purchase price ($320,000/.8) $400,000

Book value 340,000

Excess to undervalued equipment $ 60,000

1 Par Corporation and Subsidiary

Consolidated Income Statement

for the year ended December 31, 2011

Sales $1,200,000

Less: Cost of sales 760,000

Gross profit 440,000

Other expenses $ 160,000

Depreciationa 159,000 319,000

Total consolidated net income $ 121,000

Allocation of income to:

Noncontrolling interestb $ 8,200

Controlling interest $ 112,800

a $150,000 depreciation - $1,000 piecemeal recognition of gain on equipment

through depreciation + ($60,000 excess 6 years) excess depreciation

b ($60,000 reported income - $10,000 unrealized gain on equipment + $1,000

piecemeal recognition of gain on equipment - $10,000 excess depreciation)

20% interest

2 Par Corporation and Subsidiary

Consolidated Balance Sheet

at December 31, 2011

Assets

Current assets $ 483,200

Plant and equipment — net

($1,190,000 - $399,000 + 50,000) 841,000

Total assets $1,324,200

Liabilities and equity

Liabilities $ 300,000

Capital stock 600,000

Retained earningsa 340,000

Noncontrolling interestb 84,200

Total liabilities and stockholders’ equity $1,324,200

a Sip beginning retained earnings $327,200 + Sip net income $112,800 - Sip

dividends of $100,000

b ($380,000 stockholders’ equity + $50,000 excess - $9,000 unrealized gain on

equipment) 20%

Check: $80,000 beginning noncontrolling interest + $8,200 noncontrolling

interest share - $4,000 noncontrolling interest dividends = $84,200

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-11

Solution P11-3

Parent company theory

1a Income from Sin for 2011 ($90,000 70%) $ 63,000

1b Goodwill at December 31, 2011 $ 70,000

($595,000 cost - $525,000 fair value)

1c Consolidated net income for 2011

Pal’s separate income $300,000

Add: Income from Sin 63,000 $363,000

1d Noncontrolling interest share for 2011

Net income of Sin of $90,000 30% $ 27,000

1e Noncontrolling interest December 31, 2011

Sin’s stockholders’ equity $790,000 30% $237,000

Entity theory

2a Income from Sin for 2011 ($90,000 70%) $ 63,000

2b Goodwill at December 31, 2011

Imputed value ($595,000/70%) $850,000

Fair value of Sin’s net assets 750,000

Goodwill $100,000

2c Total consolidated income for 2011

Income to controlling stockholders ($300,000 + $63,000) $363,000

Add: Noncontrolling interest share ($90,000 30%) 27,000

Total consolidated income $390,000

2d Noncontrolling interest share (computed in 2c above) $ 27,000

2e Noncontrolling interest at December 31, 2011

(Book equity $790,000 + $100,000 goodwill) 30% $267,000

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-12 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution P11-4

Preliminary computations

Parent company theory

Investment in Sam $224,000

Fair value of 80% interest acquired ($240,000 80%) 192,000

Goodwill $ 32,000

Entity Theory

Implied value of Sam ($224,000/.8) $280,000

Fair value of identifiable net assets 240,000

Goodwill $ 40,000

Pit used an incomplete equity method in accounting for its investment in Sam.

It ignored the intercompany upstream sales of inventory. Income from Sam on an

equity basis would be:

Share of Sam’s income ($50,000 .8) $ 40,000

Less: Unrealized profits in ending inventory from

upstream sale ($8,000 50% 80%) (3,200)

Income from Sam $ 36,800

Pit Corporation and Subsidiary

Comparative Consolidated Income Statements

for the year ended December 31, 2012

Parent

Traditional Company Entity

Theory Theory Theory

Sales $1,000,000 $1,000,000 $1,000,000

Less: Cost of sales (575,000) (575,000) (575,000)

Gross profit 425,000 425,000 425,000

Expenses (200,000) (200,000) (200,000)

Less: Unrealized profit on

upstream sale of inventory

($23,000 - $15,000) 50% 100% (4,000) (4,000)

($23,000 - $15,000) 50% 80% (3,200)

Noncontrolling interest share

($50,000 - $4,000) 20% (9,200)

$50,000 20% (10,000)

Consolidated net income $ 211,800 $ 211,800

Total consolidated income $ 221,000

Allocated to controlling

Stockholders $ 211,800

Allocated to noncontrolling

Stockholders

($50,000 - $4,000) 20% $ 9,200

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-13

Solution P11-4 (continued)

Pit Corporation and Subsidiary

Comparative Statements of Retained Earnings

for the year ended December 31, 2012

Parent

Traditional Company Entity

Theory Theory Theory

Retained earnings December 31, 2011 $360,000 $360,000 $ 360,000

Add: Consolidated net income 211,800 211,800

Add: Net income to controlling 211,800

stockholders

571,800 571,800 571,800

Less: Dividends to controlling (120,000) (120,000) (120,000)

stockholders

Retained earnings December 31, 2012 $ 451,800 $ 451,800 $ 451,800

Pit Corporation and Subsidiary

Comparative Consolidated Balance Sheets

at December 31, 2012

Parent

Traditional Company Entity

Theory Theory Theory

Assets

Cash $ 110,800 $ 110,800 $ 110,800

Accounts receivable 120,000 120,000 120,000

Inventory 196,000 196,800 196,000

Land 280,000 280,000 280,000

Buildings — net 840,000 840,000 840,000

Goodwill 32,000 32,000 40,000

Total assets $1,578,800 $1,579,600 $1,586,800

Liabilities

Accounts payable $ 275,800 $ 275,800 $ 275,800

Noncontrolling interest 52,000

Total liabilities 275,800 327,800 275,800

Stockholders’ equity

Capital stock 800,000 800,000 800,000

Retained earnings 451,800 451,800 451,800

Noncontrolling interest 51,200 59,200

Total stockholders’ equity 1,303,000 1,251,800 1,311,000

Total equities $1,578,800 $1,579,600 $1,586,800

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-14 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution P11-5

Pad Corporation and Subsidiary

Comparative Balance Sheets

at December 31, 2012

Traditional Entity

Theory Theory

Assets

Cash $ 70,000 $ 70,000

Receivables — net 110,000 110,000

Inventories 120,000 120,000

Plant assets — net 300,000 300,000

Goodwill 40,000 50,000

Total assets $640,000 $650,000

Liabilities

Accounts payable $ 95,000 $ 95,000

Other liabilities 25,000 25,000

Total liabilities 120,000 120,000

Stockholders’ equity

Capital stock 300,000 300,000

Retained earnings 194,000 194,000

Noncontrolling interest

($150,000 - $20,000) 20% 26,000

($150,000 + $50,000 - $20,000) 20% 36,000

Total stockholders’ equity 520,000 530,000

Total equities $640,000 $650,000

Supporting computations Traditional Entity

Theory Theory

Cost or imputed value $128,000 $160,000

Book value of 80% 88,000

Book value of 100% 110,000

Goodwill $ 40,000 $ 50,000

Investment cost $128,000

Add: 80% of retained earnings increase

($50,000 - $10,000) 80% 32,000

Less: 80% of $20,000 unrealized profits (16,000)

Investment balance $144,000

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-15

Solution P11-6 [AICPA adapted]

1 P carries its investment in S on a cost basis. This is evidenced by the

appearance of dividend revenue in P Company’s income statement and by

the absence of income from subsidiary.

2 P holds 1,400 shares of S. P Company’s percentage ownership is 70%, as

determined by the relationship of P Company’s dividend revenues and S

Company’s dividends paid ($11,200/$16,000). S has 2,000 outstanding

shares ($200,000/$100) and P holds 70% of these, or 1,400 shares.

3 S Company’s retained earnings at acquisition were $100,000.

Imputed value of S ($245,000 cost/70%) $ 350,000

Less: Patents (applicable to 100%) (50,000)

Book value and fair value of S’s identifiable net assets 300,000

Less: Capital stock (200,000)

Retained earnings $ 100,000

4 The nonrecurring loss is a constructive loss on the purchase of P bonds

by S Company.

Working paper entry:

Mortgage bonds payable (5%) 100,000

Loss on retirement of P bonds 3,000

P bonds owned 103,000

To eliminate intercompany bond investment and bonds payable and to

recognize a loss on the constructive retirement of P bonds.

5 Intercompany sales P to S are $240,000 computed as follows:

Combined sales ($600,000 + $400,000) $1,000,000

Less: Consolidated sales 760,000

Intercompany sales $ 240,000

6 Yes, there are other intercompany debts:

Intercompany

Combined Consolidated Balances

Cash and receivables $143,000 $97,400 $ 45,600

Current payables 93,000 53,000 40,000

Dividends payable 18,000 12,400 5,600

S Company owes P Company $40,000 on intercompany purchases and P Company

owes S Company $5,600 dividends.

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-16 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution P11-6 (continued)

7 Adjustment to determine consolidated cost of goods sold:

Consolidated Cost of Goods Sold

Combined cost of goods $640,000 $240,000 Intercompany purchases

Sold

Unrealized profit in Unrealized profit in

ending inventory 8,000 5,000 beginning inventory

403,000 To balance

$648,000 $648,000

Consolidated cost of

goods sold $403,000

Unrealized profit in ending inventory is equal to the combined less

consolidated inventories ($130,000 - $122,000).

Unrealized profit in beginning inventory is plugged as follows:

($640,000 + $8,000) - ($240,000 + $403,000) = $5,000

8 Noncontrolling interest share of $8,700 is computed as follows:

Net income of S $ 34,000

Less: Patent amortization ($50,000/10 years) 5,000

Adjusted income of S 29,000

Noncontrolling interest percentage 30%

Noncontrolling interest share $ 8,700

9 Noncontrolling interest of $117,000 at the balance sheet date is

computed:

Stockholders’ equity of S Company $360,000

Add: Unamortized patents 30,000

Equity of S plus unamortized patents 390,000

Noncontrolling interest percentage 30%

Noncontrolling interest on balance sheet date $117,000

10 Consolidated retained earnings

Retained earnings of P at end of year $200,000

Add: P’s share of increase in S’s retained earnings since

acquisition ($160,000 - $100,000) 70% 42,000

Less: Unrealized profit in S’s ending inventory (8,000)

Less: P’s patent amortization since acquisition

$20,000 70% (14,000)

Less: Loss on constructive retirement of P’s bonds (3,000)

Consolidated retained earnings — end of year $217,000

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-17

Solution P11-7

1 Entry on Sap’s books at acquisition

Inventories 20,000

Land 25,000

Buildings — net 90,000

Other liabilities 10,000

Goodwill 70,000

Retained earnings 80,000

Equipment — net 15,000

Push-down capital 280,000

To push down fair value — book value differentials.

2 Sap Corporation

Balance Sheet

at January 1, 2012

Assets

Cash $ 30,000

Accounts receivable — net 70,000

Inventories 80,000

Total current assets $180,000

Land $ 75,000

Buildings — net 190,000

Equipment — net 75,000

Total plant assets 340,000

Goodwill 70,000

Total assets $590,000

Liabilities And Stockholders’ Equity

Accounts payable $ 50,000

Other liabilities 60,000

Total liabilities $110,000

Capital stock $200,000

Push-down capital 280,000

Total stockholders’ equity 480,000

Total liabilities and stockholders’

Equity $590,000

3 If Sap reports net income of $90,000 under the new push-down system for

the calendar year 2012, Pay’s income from Sap will also be $90,000 under

a one-line consolidation.

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-18 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution P11-8

1 Parent company theory

Preliminary computation:

Cost of 80% interest in Son $3,000,000

Book value acquired ($2,000,000 80%) 1,600,000

Excess cost over book value acquired $1,400,000

Excess allocated to:

Inventories $1,600,000 80% $1,280,000

Equipment — net $(500,000) 80% (400,000)

Goodwill for the remainder 520,000

Excess fair value over book value acquired $1,400,000

Entry on Son’s books to reflect 80% push down:

Inventories 1,280,000

Goodwill 520,000

Retained earnings 1,200,000

Equipment — net 400,000

Push-down capital 2,600,000

2 Entity theory

Preliminary computation:

Implied value of net assets ($3,000,000/.8) $3,750,000

Book value of net assets 2,000,000

Total excess $1,750,000

Excess allocated to:

Inventories $1,600,000

Equipment — net (500,000)

Goodwill for remainder 650,000

Total excess $1,750,000

Entry on Son’s books to reflect 100% push down:

Inventories 1,600,000

Goodwill 650,000

Retained earnings 1,200,000

Equipment 500,000

Push-down capital 2,950,000

3 Noncontrolling interest (Parent company theory)

Son’s stockholders’ equity $2,000,000 20% $ 400,000

4 Noncontrolling interest (Entity theory)

Capital stock $ 800,000

Push-down capital 2,950,000

Stockholders’ equity 3,750,000

Noncontrolling interest percentage 20%

Noncontrolling interest $ 750,000

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-19

Solution P11-9

1 Push down under parent company theory

Buildings — net 18,000

Equipment — net 27,000

Goodwill 36,000

Retained earnings 20,000

Inventories 9,000

Push-down capital 92,000

To record revaluation of 90% of net assets and elimination of

retained earnings as a result of a business combination with Paw

Corporation.

2 Push down under entity theory

Buildings — net 20,000

Equipment — net 30,000

Goodwill 40,000

Retained earnings 20,000

Inventories 10,000

Push-down capital 100,000

To record revaluation of net assets imputed from purchase price of

90% interest acquired by Paw Corporation and eliminate retained

earnings.

3 Sun Corporation

Comparative Balance Sheets

at January 1, 2012

Parent Company Theory Entity Theory

Assets

Cash $ 20,000 $ 20,000

Accounts receivable — net 50,000 50,000

Inventories 31,000 30,000

Land 15,000 15,000

Buildings — net 48,000 50,000

Equipment — net 97,000 100,000

Goodwill 36,000 40,000

Total assets $297,000 $305,000

Liabilities and stockholders’ equity

Accounts payable $ 45,000 $ 45,000

Other liabilities 60,000 60,000

Capital stock 100,000 100,000

Push-down capital 92,000 100,000

Retained earnings 0 0

Total equities $297,000 $305,000

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-20 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution P11-10

a Paw Corporation and Subsidiary

Consolidation Working Papers

for the year ended December 31, 2012

Push down 90% — parent company theory

90% Adjustments and Consolidated

Power Sun Eliminations Statements

Income Statement

Sales $ 310,800 $ 110,000 $ 420,800

Income from Sun 37,800 b 37,800

Cost of sales 140,000* 33,000* 173,000*

Depreciation expense 29,000* 24,200* 53,200*

Other operating

expenses 45,000* 11,000* 56,000*

Consolidated NI $ 138,600

Noncontrolling share e 4,000 4,000*

Controlling share of NI $ 134,600 $ 41,800 $ 134,600

Retained Earnings

Retained earnings — Paw $ 147,000 $ 147,000

Retained earnings — Sun $ 0

Controlling share of NI 134,600 41,800 134,600

Dividends 60,000* 10,000* b 9,000

e 1,000 60,000*

Retained earnings

December 31 $ 221,600 $ 31,800 $ 221,600

Balance Sheet

Cash $ 63,800 $ 27,000 a 8,000 $ 98,800

Accounts receivable — net 90,000 40,000 a 8,000 122,000

Dividends receivable 9,000 d 9,000

Inventories 20,000 35,000 55,000

Land 40,000 15,000 55,000

Buildings — net 140,000 43,200 183,200

Equipment — net 165,000 77,600 242,600

Investment in Sun 208,800 b 28,800

c 180,000

Goodwill 36,000 36,000

$ 736,600 $ 273,800 $ 792,600

Accounts payable $ 125,000 $

20,000 $ 145,000

Dividends payable 15,000 10,000 d 9,000 16,000

Other liabilities 75,000 20,000 95,000

Capital stock 300,000 100,000 c 100,000 300,000

Push-down capital 92,000 c 92,000

Retained earnings 221,600 31,800 221,600

$ 736,600 $ 273,800

Noncontrolling interest January 1 c 12,000

Noncontrolling interest December 31 e 3,000 15,000

$ 792,600

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-21

* Deduct

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

11-22 Consolidation Theories, Push-down Accounting, and Corporate Joint Ventures

Solution P11-10 (continued)

b Paw Corporation and Subsidiary

Consolidation Working Papers

for the year ended December 31, 2012

Push down 100% — entity theory

90% Adjustments and Consolidated

Paw Sun Eliminations Statements

Income Statement

Sales $ 310,800 $ 110,000 $ 420,800

Income from Sun 37,800 b 37,800

Cost of sales 140,000* 32,000* 172,000*

Depreciation expense 29,000* 25,000* 54,000*

Other operating

expenses 45,000* 11,000* 56,000*

Consolidated NI $ 138,800

Noncontrolling share e 4,200 4,200*

Controlling share of NI $ 134,600 $ 42,000 $ 134,600

Retained Earnings

Retained earnings — Paw $ 147,000 $ 147,000

Retained earnings — Sun $ 0

Controlling share of NI 134,600 42,000 134,600

Dividends 60,000* 10,000* b 9,000

e 1,000 60,000*

Retained earnings

December 31 $ 221,600 $ 32,000 $ 221,600

Balance Sheet

Cash $ 63,800 $ 27,000 a 8,000 $ 98,800

Accounts receivable — net 90,000 40,000 a 8,000 122,000

Dividends receivable 9,000 d 9,000

Inventories 20,000 35,000 55,000

Land 40,000 15,000 55,000

Buildings — net 140,000 45,000 185,000

Equipment — net 165,000 80,000 245,000

Investment in Sun 208,800 b 28,800

c 180,000

Goodwill 40,000 40,000

$ 736,600 $ 282,000 $ 800,800

Accounts payable $ 125,000 $

20,000 $ 145,000

Dividends payable 15,000 10,000 d 9,000 16,000

Other liabilities 75,000 20,000 95,000

Capital stock 300,000 100,000 c 100,000 300,000

Push-down capital 100,000 c 100,000

Retained earnings 221,600 32,000 221,600

$ 736,600 $ 282,000

Noncontrolling interest January 1 c 20,000

Noncontrolling interest December 31 e 3,200 23,200

$ 800,800

* Deduct

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Find more slides, ebooks, solution manual and testbank on www.downloadslide.com

Chapter 11 11-23

Solution P11-11

Pep Corporation and Subsidiary

Proportionate Consolidation Working Papers

for the year ended December 31, 2011

Adjustments and Consolidated

Pep Jay 40% Eliminations Statements

Income Statement

Sales $ 800,000 $ 300,000 b 180,000 $ 920,000

Income from Jay 20,000 a 20,000

Cost of sales 400,000* 150,000* b 90,000 460,000*

Depreciation expense 100,000* 40,000* b 24,000 116,000*

Other expenses 120,000* 60,000* b 36,000 144,000*

Net income $ 200,000 $ 50,000 $ 200,000

Retained Earnings

Retained earnings — Pep $ 300,000 $ 300,000

Venture equity — Jay $ 250,000 b 250,000

Net income 200,000 50,000 200,000

Dividends 100,000* 100,000*

Retained earnings/

Venture equity $ 400,000 $ 300,000 $ 400,000

Balance Sheet

Cash $ 100,000 $ 50,000 b 30,000 $ 120,000

Receivables — net 130,000 30,000 b 18,000 142,000

Inventories 110,000 40,000 b 24,000 126,000

Land 140,000 60,000 b 36,000 164,000

Buildings — net 200,000 100,000 b 60,000 240,000

Equipment — net 300,000 180,000 b 108,000 372,000

Investment in Jay 120,000 a 20,000

b 100,000

$1,100,000 $ 460,000 $1,164,000

Accounts payable $ 120,000 $ 100,000 b 60,000 $ 160,000

Other liabilities 80,000 60,000 b 36,000 104,000

Common stock, $10 par 500,000 500,000

Retained earnings 400,000 400,000

Venture equity — Jay 300,000

$1,100,000 $ 460,000 $1,164,000

* Deduct

© 2011 Pearson Education, Inc. publishing as Prentice Hall

Вам также может понравиться

- Internal Control of Fixed Assets: A Controller and Auditor's GuideОт EverandInternal Control of Fixed Assets: A Controller and Auditor's GuideРейтинг: 4 из 5 звезд4/5 (1)

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesДокумент23 страницыConsolidation Theories, Push-Down Accounting, and Corporate Joint Venturesmd salehinОценок пока нет

- Chp11 PDFДокумент23 страницыChp11 PDFYosua SihombingОценок пока нет

- Venture Capital Valuation, + Website: Case Studies and MethodologyОт EverandVenture Capital Valuation, + Website: Case Studies and MethodologyОценок пока нет

- Ch11 Beams12ge SMДокумент28 страницCh11 Beams12ge SMKharisma Pardede33% (3)

- Consolidation Theories, Push-Down Accounting, and Corporate Joint VenturesДокумент28 страницConsolidation Theories, Push-Down Accounting, and Corporate Joint VenturesRiska Azahra NОценок пока нет

- Advanced Accounting Beams 12th Edition Solutions ManualДокумент24 страницыAdvanced Accounting Beams 12th Edition Solutions ManualMariaDaviesqrbg100% (49)

- B. Woods Chapter 11Документ24 страницыB. Woods Chapter 11Esmeraldo Ebenezer SimalangoОценок пока нет

- SMCH 11 BeamsДокумент25 страницSMCH 11 BeamsAtika DaretyОценок пока нет

- Proformaquestionspart 1Документ3 страницыProformaquestionspart 1Kevser BozoğluОценок пока нет

- Chapter 3Документ73 страницыChapter 3Mark Arceo0% (1)

- ValuationДокумент20 страницValuationNirmal ShresthaОценок пока нет

- Online Ass Advance Acc NEWДокумент6 страницOnline Ass Advance Acc NEWRara Rarara30Оценок пока нет

- ACC 113 Module 7 AnswerДокумент4 страницыACC 113 Module 7 AnswerYahlianah Lee100% (2)

- ACC2001 Lecture 10 Interco TransactionsДокумент42 страницыACC2001 Lecture 10 Interco Transactionsmichael krueseiОценок пока нет

- Slide AKT 308 AKL 1Документ92 страницыSlide AKT 308 AKL 1Steve IdnОценок пока нет

- AFA 4e PPT Chap04Документ70 страницAFA 4e PPT Chap04فهد التويجريОценок пока нет

- Chapter 2 Separate and Consolidated FS - Date of AcquisitionДокумент21 страницаChapter 2 Separate and Consolidated FS - Date of AcquisitioneiaОценок пока нет

- Direct Non ControllingДокумент24 страницыDirect Non ControllingJamie ZhangОценок пока нет

- How A Private Equity Deal WorksДокумент2 страницыHow A Private Equity Deal Worksdarthvader79Оценок пока нет

- Acquisition & Mergers ValuationДокумент18 страницAcquisition & Mergers ValuationAqeel HanjraОценок пока нет

- C. Wolken Issued New Common Stock in 2013Документ4 страницыC. Wolken Issued New Common Stock in 2013Talha JavedОценок пока нет

- Indirect and Mutual Holdings: Answers To Questions 1Документ29 страницIndirect and Mutual Holdings: Answers To Questions 1AthayaSekarNovianaОценок пока нет

- Financial Statement Analysis - RatioДокумент7 страницFinancial Statement Analysis - RatioJanelle De TorresОценок пока нет

- Consolidation of Less-than-Wholly-Owned Subsidiaries Acquired at More Than Book ValueДокумент63 страницыConsolidation of Less-than-Wholly-Owned Subsidiaries Acquired at More Than Book ValueSelena SevvinОценок пока нет

- Solution Manual For Advanced Accounting 11th Edition by Beams 3 PDF FreeДокумент14 страницSolution Manual For Advanced Accounting 11th Edition by Beams 3 PDF Freeluxion bot100% (1)

- Chapter 12: Consolidation: Non-Controlling Interest Review QuestionsДокумент35 страницChapter 12: Consolidation: Non-Controlling Interest Review QuestionsLevi LilluОценок пока нет

- Lecture-9 10 Capital-StructureДокумент32 страницыLecture-9 10 Capital-StructuremaxОценок пока нет

- IPPTChap 005Документ71 страницаIPPTChap 005Caroline Elza Brigitha ecaaОценок пока нет

- Capital Structure: Capital Structure Theories - Net Income Net Operating Income Modigliani-Miller Traditional ApproachДокумент50 страницCapital Structure: Capital Structure Theories - Net Income Net Operating Income Modigliani-Miller Traditional Approachthella deva prasadОценок пока нет

- Solution To Self-Study Exercise 1Документ5 страницSolution To Self-Study Exercise 1chanОценок пока нет

- FS Consolidation at The Date of Acquisition v2Документ16 страницFS Consolidation at The Date of Acquisition v2Pagatpat, Apple Grace C.Оценок пока нет

- Capital Structure - 1Документ25 страницCapital Structure - 1bakhtiar2014Оценок пока нет

- BKM 10e Chap014Документ8 страницBKM 10e Chap014jl123123Оценок пока нет

- Impairment of GoodwillДокумент7 страницImpairment of Goodwillalimran177Оценок пока нет

- Fundamentals of Capital StructureДокумент42 страницыFundamentals of Capital StructureSona Singh pgpmx 2017 batch-2Оценок пока нет

- Beams Aa13e SM 01Документ14 страницBeams Aa13e SM 01jiajiaОценок пока нет

- Business Combinations: Answers To Questions 1Документ14 страницBusiness Combinations: Answers To Questions 1MUFC SupporterОценок пока нет

- Risk and Capital Budgeting: © 2009 Cengage Learning/South-WesternДокумент30 страницRisk and Capital Budgeting: © 2009 Cengage Learning/South-WesternSuraj SharmaОценок пока нет

- Corporate AccountingДокумент56 страницCorporate AccountingChandrasekhar ReddypemmakaОценок пока нет

- Jones Corportion SoluationДокумент14 страницJones Corportion SoluationShakilОценок пока нет

- Chapter 4 Consolidated Financial Statements Piecemeal AcquisitionДокумент11 страницChapter 4 Consolidated Financial Statements Piecemeal AcquisitionKE XIN NGОценок пока нет

- Sale/leaseback TransactionsДокумент24 страницыSale/leaseback TransactionsNet Lease100% (2)

- 4 The Firm's Capital Structure and Degree of LeverageДокумент9 страниц4 The Firm's Capital Structure and Degree of LeverageMariel GarraОценок пока нет

- CR Par Value PC $ 1,000 $ 40: 25 SharesДокумент4 страницыCR Par Value PC $ 1,000 $ 40: 25 SharesBought By UsОценок пока нет

- Company Acc B.com Sem Iv...Документ8 страницCompany Acc B.com Sem Iv...Sarah ShelbyОценок пока нет

- Beams AdvAcc11 ChapterДокумент27 страницBeams AdvAcc11 ChapterSt Teresa AvilaОценок пока нет

- Ch7 Problems SolutionДокумент22 страницыCh7 Problems Solutionwong100% (8)

- Dividendtheorypolicy 170303055735 PDFДокумент29 страницDividendtheorypolicy 170303055735 PDFShubham AroraОценок пока нет

- Exercises of Session 11Документ8 страницExercises of Session 11MaiPhương LinhhОценок пока нет

- Dividend Policy1Документ32 страницыDividend Policy1iqbal irfaniОценок пока нет

- Impairment of Goodwill - F7 Financial Reporting - ACCA Qualification - Students - ACCA GlobalДокумент12 страницImpairment of Goodwill - F7 Financial Reporting - ACCA Qualification - Students - ACCA Globalvivsubs18Оценок пока нет

- Chương 3Документ22 страницыChương 3Mai Duong ThiОценок пока нет

- Problem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGДокумент6 страницProblem - PROFORMA BALANCE SHEET WITH CHOICE OF FINANCINGJohn Richard Bonilla100% (4)

- Bank Valuation - FE FIG TryoutДокумент5 страницBank Valuation - FE FIG Tryoutcharlotte.zibautОценок пока нет

- Applied Group Fin Reporting-Changes in Group Structure PDFДокумент25 страницApplied Group Fin Reporting-Changes in Group Structure PDFObey SitholeОценок пока нет

- Financial Planning Working Capital Management Cash ManagementДокумент22 страницыFinancial Planning Working Capital Management Cash ManagementDeniz OnalОценок пока нет

- Solutions Manual Financial Statement AnalysisДокумент14 страницSolutions Manual Financial Statement AnalysisLimОценок пока нет

- Answer Key ABM2Документ6 страницAnswer Key ABM2Elle Alorra RubenfieldОценок пока нет

- Bse, Nse, Ise, Otcei, NSDLДокумент17 страницBse, Nse, Ise, Otcei, NSDLoureducation.in100% (4)

- Protection of Minority Shareholders Rights Under Companies Act 2013Документ13 страницProtection of Minority Shareholders Rights Under Companies Act 2013Amrutha GayathriОценок пока нет

- Manajemen Keuangan - SulisytandariДокумент115 страницManajemen Keuangan - SulisytandariTrianto SatriaОценок пока нет

- Far.118 Sharholders-EquityДокумент8 страницFar.118 Sharholders-EquityMaeОценок пока нет

- Book Value Per ShareДокумент2 страницыBook Value Per ShareGlen Javellana100% (1)

- ISCA Insolvency Update 2017Документ8 страницISCA Insolvency Update 2017terencebctanОценок пока нет

- Fundamentals of Company Law PDFДокумент9 страницFundamentals of Company Law PDFSai Venkatesh RamanujamОценок пока нет

- The Impact of Audit Committee Existence and External Audit On Earnings Management Evidence From PortugalДокумент25 страницThe Impact of Audit Committee Existence and External Audit On Earnings Management Evidence From PortugalasaОценок пока нет

- SHARANNLДокумент2 страницыSHARANNLJade ChengОценок пока нет

- Dangote Sugar Refinery PLC Prospectus PDFДокумент79 страницDangote Sugar Refinery PLC Prospectus PDFBilly LeeОценок пока нет

- Corporate Books and Records Chapter 11Документ17 страницCorporate Books and Records Chapter 11NingClaudioОценок пока нет

- Clemente V CA DigestДокумент1 страницаClemente V CA DigestMarteCaronoñganОценок пока нет

- Varroc Red Hearing ProspectusДокумент722 страницыVarroc Red Hearing ProspectusankitwithyouОценок пока нет

- Edward J Nell V Pacific Farms - Philippine Legal Guide-HighligtsДокумент4 страницыEdward J Nell V Pacific Farms - Philippine Legal Guide-HighligtsQueenie SabladaОценок пока нет

- 15 - GOCC Governance ActДокумент22 страницы15 - GOCC Governance ActVincent Marius MaglanqueОценок пока нет

- Corporation Accounting - IntroductionДокумент6 страницCorporation Accounting - IntroductionGuadaMichelleGripal100% (3)

- Business Law: COMSATS University of Information Technology, Attock CampusДокумент8 страницBusiness Law: COMSATS University of Information Technology, Attock CampusRabia EmanОценок пока нет

- Phil. Trust Co. Vs RiveraДокумент1 страницаPhil. Trust Co. Vs RiveraRonan Monzon100% (1)

- Myanmar Financial Institutions LawДокумент70 страницMyanmar Financial Institutions LawNelson100% (1)

- DerivativesДокумент111 страницDerivativesMuhammad Moazzam JavaidОценок пока нет

- Instruction Kit For Eform Inc-1 (: Application For Reservation of Name)Документ29 страницInstruction Kit For Eform Inc-1 (: Application For Reservation of Name)srivenramanОценок пока нет

- RTC - 16Документ17 страницRTC - 16api-729618602Оценок пока нет

- Icofr Reference Guide For ManagementДокумент472 страницыIcofr Reference Guide For Managementgladys0% (1)

- Equity Derivatives in IndiaДокумент4 страницыEquity Derivatives in Indiarahul_garg_24Оценок пока нет

- Rules Relating To Compromises, Arrangements, Amalgamations and Capital Reduction NotifiedДокумент8 страницRules Relating To Compromises, Arrangements, Amalgamations and Capital Reduction Notifiedadarsh kumarОценок пока нет

- Usa Batch 1Документ28 страницUsa Batch 1mohanОценок пока нет

- Committees of The IIL BoardДокумент2 страницыCommittees of The IIL BoardNauman ChaudaryОценок пока нет

- AMLCFT Prakas EnglishДокумент24 страницыAMLCFT Prakas EnglishThol LynaОценок пока нет

- Comparison Chart of MOA & AOAДокумент1 страницаComparison Chart of MOA & AOAAsif HameedОценок пока нет

- Currency OptionsДокумент13 страницCurrency OptionsKaren YungОценок пока нет

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (2)

- Financial Intelligence: How to To Be Smart with Your Money and Your LifeОт EverandFinancial Intelligence: How to To Be Smart with Your Money and Your LifeРейтинг: 4.5 из 5 звезд4.5/5 (540)

- Summary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisОт EverandSummary: Trading in the Zone: Trading in the Zone: Master the Market with Confidence, Discipline, and a Winning Attitude by Mark Douglas: Key Takeaways, Summary & AnalysisРейтинг: 5 из 5 звезд5/5 (15)

- Summary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisОт EverandSummary of 10x Is Easier than 2x: How World-Class Entrepreneurs Achieve More by Doing Less by Dan Sullivan & Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisРейтинг: 4.5 из 5 звезд4.5/5 (23)

- Summary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedОт EverandSummary: The Psychology of Money: Timeless Lessons on Wealth, Greed, and Happiness by Morgan Housel: Key Takeaways, Summary & Analysis IncludedРейтинг: 5 из 5 звезд5/5 (80)

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (88)

- Baby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooОт EverandBaby Steps Millionaires: How Ordinary People Built Extraordinary Wealth--and How You Can TooРейтинг: 5 из 5 звезд5/5 (323)

- Bitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerОт EverandBitter Brew: The Rise and Fall of Anheuser-Busch and America's Kings of BeerРейтинг: 4 из 5 звезд4/5 (52)

- Broken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterОт EverandBroken Money: Why Our Financial System Is Failing Us and How We Can Make It BetterРейтинг: 5 из 5 звезд5/5 (3)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- Summary of I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works by Ramit SethiОт EverandSummary of I Will Teach You to Be Rich: No Guilt. No Excuses. Just a 6-Week Program That Works by Ramit SethiРейтинг: 4.5 из 5 звезд4.5/5 (23)

- The Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomОт EverandThe Holy Grail of Investing: The World's Greatest Investors Reveal Their Ultimate Strategies for Financial FreedomРейтинг: 5 из 5 звезд5/5 (7)

- Summary: The Gap and the Gain: The High Achievers' Guide to Happiness, Confidence, and Success by Dan Sullivan and Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisОт EverandSummary: The Gap and the Gain: The High Achievers' Guide to Happiness, Confidence, and Success by Dan Sullivan and Dr. Benjamin Hardy: Key Takeaways, Summary & AnalysisРейтинг: 5 из 5 звезд5/5 (4)

- Fluke: Chance, Chaos, and Why Everything We Do MattersОт EverandFluke: Chance, Chaos, and Why Everything We Do MattersРейтинг: 4.5 из 5 звезд4.5/5 (19)

- Rich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyОт EverandRich Bitch: A Simple 12-Step Plan for Getting Your Financial Life Together . . . FinallyРейтинг: 4 из 5 звезд4/5 (8)

- Investing for Beginners 2024: How to Achieve Financial Freedom and Grow Your Wealth Through Real Estate, The Stock Market, Cryptocurrency, Index Funds, Rental Property, Options Trading, and More.От EverandInvesting for Beginners 2024: How to Achieve Financial Freedom and Grow Your Wealth Through Real Estate, The Stock Market, Cryptocurrency, Index Funds, Rental Property, Options Trading, and More.Рейтинг: 5 из 5 звезд5/5 (99)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeОт EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeРейтинг: 4.5 из 5 звезд4.5/5 (58)

- Financial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОт EverandFinancial Literacy for All: Disrupting Struggle, Advancing Financial Freedom, and Building a New American Middle ClassОценок пока нет

- Sleep And Grow Rich: Guided Sleep Meditation with Affirmations For Wealth & AbundanceОт EverandSleep And Grow Rich: Guided Sleep Meditation with Affirmations For Wealth & AbundanceРейтинг: 4.5 из 5 звезд4.5/5 (105)

- Psychology of Money: The Essential Guide to Building Your Wealth , Discover All the Important Information And Useful Strategies in the Pursuit of WealthОт EverandPsychology of Money: The Essential Guide to Building Your Wealth , Discover All the Important Information And Useful Strategies in the Pursuit of WealthРейтинг: 4.5 из 5 звезд4.5/5 (68)

- Rich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotОт EverandRich Dad Poor Dad: What the Rich Teach Their Kids About Money That the Poor and Middle Class Do NotОценок пока нет

- The 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!От EverandThe 4 Laws of Financial Prosperity: Get Conrtol of Your Money Now!Рейтинг: 5 из 5 звезд5/5 (389)

- Rich Dad's Cashflow Quadrant: Guide to Financial FreedomОт EverandRich Dad's Cashflow Quadrant: Guide to Financial FreedomРейтинг: 4.5 из 5 звезд4.5/5 (1385)