Академический Документы

Профессиональный Документы

Культура Документы

Press Note Data Analytics

Загружено:

dinesh kasnАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Press Note Data Analytics

Загружено:

dinesh kasnАвторское право:

Доступные форматы

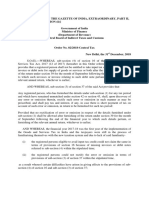

PRESS NOTE ON FILING OF RETURN IN FORM GSTR-3B FOR JULY, 2017

GST Council had earlier decided to defer the filing of return in FORM GSTR-3 and

had recommended the filing of return in FORM GSTR-3B. Accordingly, the Central

Government vide notification No. 21/2017-Central Tax dated 08.08.2017 had notified the last

date for filing of return in FORM GSTR-3B for the month of July, 2017 as 20.08.2017.

2. Concerns have been raised by the trade about whether transitional credit would be

available for discharging the tax liability for the month of July, 2017. In this regard, attention

is invited to notification No. 23/2017-Central tax dated 17.08.2017 wherein the date and

conditions for filing the return in FORM GSTR-3B have been specified. Salient points for

filing the said return are as follows:

A. Registered persons planning not to avail transitional credit for discharging the tax liability

for the month of July, 2017 or new registrants who do not have any transitional credit to avail

need to follow the steps as detailed below:

I. Calculate the tax payable as per the following formula:

Tax payable = (Output tax liability + Tax payable under reverse

charge) – input tax credit availed for the month of July, 2017;

II. Tax payable as per (i) above to be deposited in cash on or before

20.08.2017 which will get credited to electronic cash ledger;

III. File the return in FORM GSTR-3B on or before 20.08.2017 after

discharging the tax liability by debiting the electronic credit or cash

ledger.

B. Registered persons planning to avail transitional credit for discharging the tax liability for

the month of July, 2017 need to follow the steps as detailed below:

I. Calculate the tax payable as per the following formula:

Tax payable = (Output tax liability + Tax payable under reverse

charge) – (transitional credit + input tax credit availed for the

month of July, 2017);

II. Tax payable as per (i) above to be deposited in cash on or before

20.08.2017 which will get credited to electronic cash ledger;

III. File FORM GST TRAN-1 (which will be available on the common

portal from 21.08.2017) before filing the return in FORM GSTR-3B;

IV. In case the tax payable as per the return in FORM GSTR-3B is greater

than the cash amount deposited as per (ii) above, deposit the balance in

cash along with interest @18% calculated from 21.08.2017 till the date

of such deposit. This amount will also get credited to electronic cash

ledger;

V. File the return in FORM GSTR-3B on or before 28.08.2017 after

discharging the tax liability by debiting the electronic credit or cash

ledger.

******

Вам также может понравиться

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- జ్యోతిష సారము 1&2, Jyothisha-SaaramuДокумент267 страницజ్యోతిష సారము 1&2, Jyothisha-SaaramuPantula Venkata Radhakrishna83% (53)

- Excess Bank ChargesДокумент19 страницExcess Bank ChargesTRAINING WORKSHOPОценок пока нет

- News Profiter: Definte Guide To Fundemental News TRadingby Henry LiuДокумент128 страницNews Profiter: Definte Guide To Fundemental News TRadingby Henry LiuAkin OjoОценок пока нет

- Performance BondДокумент3 страницыPerformance Bondllabarda100% (1)

- FIA Paper FA1: NotesДокумент11 страницFIA Paper FA1: NotesRaeesa Khatri0% (2)

- The California Fire Chronicles First EditionДокумент109 страницThe California Fire Chronicles First EditioneskawitzОценок пока нет

- Core Areas of Corporate Strategy: Èc V ( (Èc V (ÈcvДокумент16 страницCore Areas of Corporate Strategy: Èc V ( (Èc V (ÈcvSandip NandyОценок пока нет

- ACCA Study Material 2018-19Документ2 страницыACCA Study Material 2018-19krebs38Оценок пока нет

- 01 - Amaravati Project Report Edition No4 Status Feb 2019 PDFДокумент180 страниц01 - Amaravati Project Report Edition No4 Status Feb 2019 PDFNidz ReddyОценок пока нет

- Efficio Survey Reveals Procurement ChallengesДокумент13 страницEfficio Survey Reveals Procurement ChallengesAditya JohariОценок пока нет

- Sample Complaint For EjectmentДокумент3 страницыSample Complaint For EjectmentPatrick LubatonОценок пока нет

- Treehouse Toy Library Business PlanДокумент16 страницTreehouse Toy Library Business PlanElizabeth BartleyОценок пока нет

- TDS 21-22Документ25 страницTDS 21-22dinesh kasnОценок пока нет

- Circular No 3 IGST PDFДокумент2 страницыCircular No 3 IGST PDFAnonymous SQh10rGОценок пока нет

- TDS 21-22Документ25 страницTDS 21-22dinesh kasnОценок пока нет

- Notification 02 2020 Union Territory Tax EnglishДокумент4 страницыNotification 02 2020 Union Territory Tax Englishdinesh kasnОценок пока нет

- Official Gazette Notification GST Compensation Act 2017Документ1 страницаOfficial Gazette Notification GST Compensation Act 2017dinesh kasnОценок пока нет

- Notfctn 01 2020 CGST Rate English PDFДокумент1 страницаNotfctn 01 2020 CGST Rate English PDFyogeshОценок пока нет

- Notfctn 3 2020 Igst EnglishДокумент3 страницыNotfctn 3 2020 Igst Englishdinesh kasnОценок пока нет

- Order1 CGST Central TaxДокумент1 страницаOrder1 CGST Central Taxdinesh kasnОценок пока нет

- Official Gazette Notification GST Compensation Act 2017Документ1 страницаOfficial Gazette Notification GST Compensation Act 2017dinesh kasnОценок пока нет

- Compensation Cess-2017 NT. No Date Subject Amendment To NTДокумент1 страницаCompensation Cess-2017 NT. No Date Subject Amendment To NTdinesh kasnОценок пока нет

- Notfctn 05 2020 CGST Rate EnglishДокумент1 страницаNotfctn 05 2020 CGST Rate Englishdinesh kasnОценок пока нет

- ROD - 1 of 2018 - CT - EnglishДокумент1 страницаROD - 1 of 2018 - CT - EnglishMohan AddankiОценок пока нет

- Order4 2018 CGST PDFДокумент1 страницаOrder4 2018 CGST PDFdinesh kasnОценок пока нет

- ROD - 2 of 2018 - CT - EnglishДокумент2 страницыROD - 2 of 2018 - CT - Englishdinesh kasnОценок пока нет

- Orders UTGSTДокумент1 страницаOrders UTGSTdinesh kasnОценок пока нет

- Compensation Cess CircularsДокумент1 страницаCompensation Cess Circularsdinesh kasnОценок пока нет

- ROD - 4 of 2018 - CT - EnglishДокумент1 страницаROD - 4 of 2018 - CT - Englishdinesh kasnОценок пока нет

- CBEC-20/16/15/2018-GST Government of India Ministry of Finance (Department of Revenue) Central Board of Indirect Taxes and CustomsДокумент2 страницыCBEC-20/16/15/2018-GST Government of India Ministry of Finance (Department of Revenue) Central Board of Indirect Taxes and Customsdinesh kasnОценок пока нет

- Order1 2018 CGSTДокумент1 страницаOrder1 2018 CGSTdinesh kasnОценок пока нет

- Order7-Cgst 28.10.2017Документ1 страницаOrder7-Cgst 28.10.2017dinesh kasnОценок пока нет

- Compensation Cess CircularsДокумент1 страницаCompensation Cess Circularsdinesh kasnОценок пока нет

- Compensation Cess CircularsДокумент1 страницаCompensation Cess Circularsdinesh kasnОценок пока нет

- Order3 2018 CGSTДокумент2 страницыOrder3 2018 CGSTdinesh kasnОценок пока нет

- Notification No. 13/2017-Central Tax (Rate)Документ4 страницыNotification No. 13/2017-Central Tax (Rate)giresh sbmОценок пока нет

- Compensation Cess CircularsДокумент1 страницаCompensation Cess Circularsdinesh kasnОценок пока нет

- Press Release Reduction in TDS TCS Rates Dated 14 05 2020Документ4 страницыPress Release Reduction in TDS TCS Rates Dated 14 05 2020Raghvendra ShrivastavaОценок пока нет

- Com Cess Circular No 1 2017Документ3 страницыCom Cess Circular No 1 2017sridharanОценок пока нет

- Circular No 3 IGST PDFДокумент2 страницыCircular No 3 IGST PDFAnonymous SQh10rGОценок пока нет

- Robert B SoreenДокумент2 страницыRobert B SoreenSunil SharmaОценок пока нет

- Zalando Prospectus PDFДокумент446 страницZalando Prospectus PDFVijay AnandОценок пока нет

- Project Report On Market Survey On Brand EquityДокумент44 страницыProject Report On Market Survey On Brand EquityCh Shrikanth80% (5)

- Fourosix-Reality Branding 1M SaniДокумент1 страницаFourosix-Reality Branding 1M SaniMahi AkhtarОценок пока нет

- Rosillo:61-64: 61) Pratts v. CAДокумент2 страницыRosillo:61-64: 61) Pratts v. CADiosa Mae SarillosaОценок пока нет

- Final Accounts Problems and Solutions - Final Accounts QuestionsДокумент20 страницFinal Accounts Problems and Solutions - Final Accounts QuestionshafizarameenfatimahОценок пока нет

- NBFC MCQ QuizДокумент2 страницыNBFC MCQ QuizZara KhanОценок пока нет

- Symbiosis International University: Law of ContractsДокумент9 страницSymbiosis International University: Law of ContractsSanmati RaonkaОценок пока нет

- Assignment 1 - Lecture 4 Protective Call & Covered Call Probelm Hatem Hassan ZakariaДокумент8 страницAssignment 1 - Lecture 4 Protective Call & Covered Call Probelm Hatem Hassan ZakariaHatem HassanОценок пока нет

- Nigerian Stock Exchange Performance On Economic GrowthДокумент18 страницNigerian Stock Exchange Performance On Economic GrowthsonyОценок пока нет

- Company AnalysisДокумент19 страницCompany AnalysisPashaJOОценок пока нет

- Cost and Benefit Approach To DecisionsДокумент12 страницCost and Benefit Approach To DecisionsAngie LyzОценок пока нет

- Full Committee Hearing On Food Prices and Small BusinessesДокумент105 страницFull Committee Hearing On Food Prices and Small BusinessesScribd Government DocsОценок пока нет

- CDP CDP Complaint-1Документ20 страницCDP CDP Complaint-1Scott JohnsonОценок пока нет

- Accounting EquationДокумент11 страницAccounting EquationNacelle SayaОценок пока нет

- Pledge From Atty BontosДокумент7 страницPledge From Atty BontosarielramadaОценок пока нет

- Cortazar Schwartz Naranjo 2007Документ17 страницCortazar Schwartz Naranjo 2007carreragerardoОценок пока нет

- Solution To Chapter 15Документ9 страницSolution To Chapter 15Ismail WardhanaОценок пока нет

- Fund Flow StatementДокумент16 страницFund Flow StatementRavi RajputОценок пока нет

- Assignment Fin242 Muhd Sharizan Bin MustafahДокумент16 страницAssignment Fin242 Muhd Sharizan Bin Mustafahmohd ChanОценок пока нет