Академический Документы

Профессиональный Документы

Культура Документы

Islamic Banking Chapter Explains Modes of Finance

Загружено:

Muhammad Ali Fiaz0 оценок0% нашли этот документ полезным (0 голосов)

18 просмотров4 страницыDoc

Оригинальное название

Dmc

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDoc

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

18 просмотров4 страницыIslamic Banking Chapter Explains Modes of Finance

Загружено:

Muhammad Ali FiazDoc

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 4

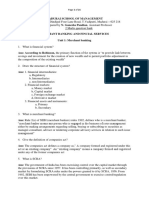

Chapter no 14.

Islamic banking system

Choose the best possible answer:

1. Shariah prohibits payment and collection of:

Demand drafts

Pay orders

Interest (Riba)

Online transfer

2. Money begets money, without being exchanged for goods and services, it is called:

Leasing

Islamic banking

Capital finance

Riba

3. Islamic banking refers to a system of banking which is consistent with:

Shariah (Islamic Law)

Commercial banks

Mark up financing

Council

4. Investment related modes of financing is:

Ijara

Bai muajjal

Qard-e- hasna

Musharka

5. Trade related modes of financing is:

Mudaraba

Murabaha

Investment auctioning

Rent sharing

6. Investment auctioning relates to:

Trade related mode of finance

Investment related mode of finance

Finance by lending

Ptc- debenture

7. Equity participation not relates to:

mudaraba

musarka

murabaha

trade related mode of finance

8. ijara-wa-iqtina means:

Buy back agreement

Leasing

Development financing

Hire purchase

9. Mark up financing also known as

Bai muajjal

Ijara

Ijara wa iqatina

Qard –e-hasna

10. Musharka means:

Sale on reciprocally agreed profit

Provides time and expertise

A joint venture on profit sharing basis

Long term financing

11. Murabaha means:

Provides time and expertise

Sale on reciprocally agreed profit

Long term financing

A joint venture on profit sharing basis

12. According to banking companies ordinance 1962,PTC can be issued to:

Public scheduled banks and financial institutions

National bank of Pakistan

Asian development bank

World bank

13. Maximum duration for the participation term certificate (PTC) is:

15 years

10 years

5 years

2 years

14. Rent sharing is Islamic mode of financing specially suited for:

Construction related business

Specialized financial institutions

Only central bank

Government

15. Qard-e-hasna relates with:

Equity participation

Finance by lending

PTC

Development financing

16. Equity participation means, participating in equity, sharing risks and rewards of ownership of

any:

Liability

Asset

Expense

Revenue

17. The legal framework of pakistan financial and corporate system was modified on _____to allow

issuance of PTC, a new interest free mode of commercial financing:

June 26,1980

June 27,1980

July 26,1980

July27,1980

18. State bank of Pakistan issued directives for elimination of interest from country in:

June 1984

June 1985

June 1986

June 1987

19. The commission for islamization of economy in Pakistan submitted a report in:

Feb 1991

Jan 1991

Jan 1992

Jan 1993

20. State bank of Pakistan issued first lslamic banking license to:

Bank al-islami

Dubai Islamic bank Pakistan ltd

Al-baraka Islamic bank

Meezan bank limited

21. The council of Islamic ideology (CII) was established in :

1960

1961

1962

1963

22. CII presented its report on elimination of interest

1980

1982

1984

1985

Answer:

1. Interest (riba)

2. Riba

3. Shariah (Islamic law)

4. Musharaka

5. Investment auction

6. Trade related mode of finance

7. Trade related mode of finance

8. Hire purchase

9. Bai muajjal

10. A joint venture on profit sharing basis

11. Sale on reciprocally agreed profit

12. Public scheduled bank and financial institution

13. 10 years

14. Construction related business

15. Finance by lending

16. Asset

17. June 26 1980

18. June 1984

19. Jan 1992

20. Meezan bank limited

21. 1962

22. 1980

Вам также может понравиться

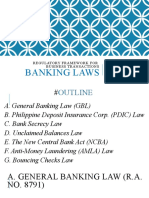

- Banking Laws: Regulatory Framework For Business TransactionsДокумент100 страницBanking Laws: Regulatory Framework For Business TransactionsMarian Roa100% (1)

- Electronic New Government Accounting SystemДокумент61 страницаElectronic New Government Accounting SystemJoseph PamaongОценок пока нет

- Financial Statement AnalysisДокумент79 страницFinancial Statement Analysissrinivas68Оценок пока нет

- 12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaДокумент2 страницы12 Swedish Match Philippines Inc. vs. The Treasurer of The City of ManilaIrene Mae GomosОценок пока нет

- Civ Pro Q&AДокумент7 страницCiv Pro Q&ASGTОценок пока нет

- Toyota QuestionnaireДокумент5 страницToyota QuestionnairePanit Poonsuwan75% (4)

- Islamic Interbank Money Market InstrumentsДокумент5 страницIslamic Interbank Money Market Instrumentsfatima humayunОценок пока нет

- Law of Banking and Security: Dr. Zulkifli HasanДокумент25 страницLaw of Banking and Security: Dr. Zulkifli HasanQuofi SeliОценок пока нет

- TreasuryДокумент23 страницыTreasuryMahyuddin Khalid100% (1)

- BF PrelimsДокумент1 страницаBF PrelimsJanah MirandaОценок пока нет

- Merchant ViruДокумент26 страницMerchant ViruVirendra JhaОценок пока нет

- Islamic Interbank Money Market InstrumentДокумент6 страницIslamic Interbank Money Market InstrumentAnaszNazriОценок пока нет

- Islamic Banking Around The World Islamic Banking in Pakistan Strategy For Eliminating Interest From The EconomyДокумент29 страницIslamic Banking Around The World Islamic Banking in Pakistan Strategy For Eliminating Interest From The EconomyMayra NiharОценок пока нет

- Guidelines Islamic Negotiable InstrumentsДокумент27 страницGuidelines Islamic Negotiable Instrumentskarim meddebОценок пока нет

- Islamic Banking Versus Commercial Banking:: Prospects & OpportunitiesДокумент37 страницIslamic Banking Versus Commercial Banking:: Prospects & OpportunitiesHanis HazwaniОценок пока нет

- Islamic Banking History and Legal FrameworkДокумент35 страницIslamic Banking History and Legal FrameworkAllauddinaghaОценок пока нет

- Overview of Islamic Banking in MalaysiaДокумент18 страницOverview of Islamic Banking in MalaysiaSarah RahimОценок пока нет

- Islamic Banking Versus Commercial Banking: Prospects & OpportunitiesДокумент42 страницыIslamic Banking Versus Commercial Banking: Prospects & OpportunitiesAbba EpicОценок пока нет

- Regulatory Framework For Islamic BankingДокумент68 страницRegulatory Framework For Islamic BankingAllauddinaghaОценок пока нет

- 03 MudharabahДокумент6 страниц03 MudharabahJinebh HanifahОценок пока нет

- Mudharabah 2Документ4 страницыMudharabah 2Hairizal HarunОценок пока нет

- Financial InstitutionsIslamic Banking Regulations2018Документ16 страницFinancial InstitutionsIslamic Banking Regulations2018nyamwenge susan priscaОценок пока нет

- Chap 1 - Islamic BankingДокумент7 страницChap 1 - Islamic BankinghanimudaОценок пока нет

- Faqs On NBFCДокумент12 страницFaqs On NBFCjeetОценок пока нет

- Banking Law (Final Draft) ON Islamic Banking: Changing Views of Banking in IndiaДокумент12 страницBanking Law (Final Draft) ON Islamic Banking: Changing Views of Banking in IndiaAnonymous Rds6k7Оценок пока нет

- Money Market InstrumentsДокумент22 страницыMoney Market Instrumentsashishp8684Оценок пока нет

- Financial ServicesДокумент120 страницFinancial ServicesBhargaviОценок пока нет

- CHAPTER I Introduction To Financial SevicesДокумент88 страницCHAPTER I Introduction To Financial SevicesMengsong NguonОценок пока нет

- Islamic Banking in Pakistan: A Growing IndustryДокумент19 страницIslamic Banking in Pakistan: A Growing IndustryHafis ShaharОценок пока нет

- Merchant Banking Financial Services Two Marks Question BankДокумент21 страницаMerchant Banking Financial Services Two Marks Question BankGanesh Pandian50% (2)

- IntershipДокумент65 страницIntershipainashaikhОценок пока нет

- Investment Banking ParadigmДокумент27 страницInvestment Banking ParadigmSharayu BavkarОценок пока нет

- Block 5Документ123 страницыBlock 5Shreya PansariОценок пока нет

- Idb Establishment Objectives, Aaoifi Objective Structure Bgiib MPBДокумент6 страницIdb Establishment Objectives, Aaoifi Objective Structure Bgiib MPBMD. ANWAR UL HAQUEОценок пока нет

- Wix Shariah and Legal Issues On Islamic Financial Products1Документ30 страницWix Shariah and Legal Issues On Islamic Financial Products1Nur IzzatiОценок пока нет

- (1) Intro. to Financial Services (cir. 14.9.2023)Документ16 страниц(1) Intro. to Financial Services (cir. 14.9.2023)Sonali MoreОценок пока нет

- Term Report: Analysis of Pakistani IndustriesДокумент18 страницTerm Report: Analysis of Pakistani IndustriesNishant SamyОценок пока нет

- Chapter1. The Investment Banking Paradigm DefinitionДокумент26 страницChapter1. The Investment Banking Paradigm DefinitionSharayu BavkarОценок пока нет

- Background: Bai' 'Inah Concept Is Used in Malaysian Islamic Banking System and Capital MarketДокумент3 страницыBackground: Bai' 'Inah Concept Is Used in Malaysian Islamic Banking System and Capital MarketNurDianaDzulkiplyОценок пока нет

- Final ShowdownДокумент26 страницFinal ShowdownSharayu BavkarОценок пока нет

- Kuliah 3 - Islamic BankДокумент42 страницыKuliah 3 - Islamic BankMusbri MohamedОценок пока нет

- 5011 Merchant Banking and Financial Services: Iii Semester/Ii Year BaДокумент18 страниц5011 Merchant Banking and Financial Services: Iii Semester/Ii Year Bas.muthuОценок пока нет

- Unit 2 Banking Innovations: Evolution of Banking in IndiaДокумент8 страницUnit 2 Banking Innovations: Evolution of Banking in IndiaAnitha RОценок пока нет

- Merchant Banking Final NotesДокумент45 страницMerchant Banking Final NotesAkash GuptaОценок пока нет

- Semi-Final Exam For Regulatory FrameworkДокумент1 страницаSemi-Final Exam For Regulatory FrameworkCindy BartolayОценок пока нет

- Law of Banking & NI ActДокумент14 страницLaw of Banking & NI Actikram4qaОценок пока нет

- Financial SystemДокумент26 страницFinancial Systemsheena guptaОценок пока нет

- 6-Banking CompaniesДокумент134 страницы6-Banking CompaniesAnilОценок пока нет

- Merchant BankingДокумент38 страницMerchant BankingBhargavKevadiyaОценок пока нет

- IBF BY DaniДокумент14 страницIBF BY DaniDaniyal AwanОценок пока нет

- Merchant Banking and Financial ServiceДокумент61 страницаMerchant Banking and Financial Servicesemi_garryОценок пока нет

- Examine The Development of Islamic Banking in UgandaДокумент6 страницExamine The Development of Islamic Banking in UgandaCOPY CARE STATIONERYОценок пока нет

- DocumentДокумент17 страницDocumentPratiksha KondaskarОценок пока нет

- Money Market AssignmentДокумент20 страницMoney Market AssignmentVijay Arjun Veeravalli100% (7)

- Islamic Banking Overview and PrinciplesДокумент19 страницIslamic Banking Overview and PrinciplesAmmad NadeemОценок пока нет

- IFS BOOK MEPL Sem 3 CUДокумент67 страницIFS BOOK MEPL Sem 3 CUkohinoor5225Оценок пока нет

- Merchandise BankingДокумент11 страницMerchandise BankingChandu SutharОценок пока нет

- Blackbook Savings and Fixed Department of BCCBДокумент44 страницыBlackbook Savings and Fixed Department of BCCBSamiksha NaikОценок пока нет

- Introduction to Methodology for Supervising Financial Institutions and AssociationsДокумент81 страницаIntroduction to Methodology for Supervising Financial Institutions and AssociationsRubina KhanОценок пока нет

- DFHILДокумент15 страницDFHILraj dhumalОценок пока нет

- Banking Sector Reforms in IndiaДокумент57 страницBanking Sector Reforms in Indiamridul agarwalОценок пока нет

- JAIIB Paper 3 Module C Banking Related Laws Download PDFДокумент42 страницыJAIIB Paper 3 Module C Banking Related Laws Download PDFstudy studyОценок пока нет

- Money MarketДокумент44 страницыMoney MarketReshma MaliОценок пока нет

- Questionnaire On Customer SatisfactionДокумент3 страницыQuestionnaire On Customer SatisfactionAmita Ojha100% (3)

- Sample Customer Satisfaction Questionnaire TemplatesДокумент4 страницыSample Customer Satisfaction Questionnaire TemplatesMuhammad Ali FiazОценок пока нет

- Central Bank: Chapter No 10Документ5 страницCentral Bank: Chapter No 10Muhammad Ali FiazОценок пока нет

- Faculty Job Application Form 130415Документ3 страницыFaculty Job Application Form 130415Muhammad Ali FiazОценок пока нет

- Wa0058Документ2 страницыWa0058Muhammad Ali FiazОценок пока нет

- Faculty Job Application FormДокумент5 страницFaculty Job Application FormMuhammad Ali FiazОценок пока нет

- Faculty Job Application FormДокумент5 страницFaculty Job Application FormMuhammad Ali FiazОценок пока нет

- My CV 153633551712916Документ2 страницыMy CV 153633551712916Muhammad Ali FiazОценок пока нет

- Wa0058Документ2 страницыWa0058Muhammad Ali FiazОценок пока нет

- Wa0059Документ4 страницыWa0059Muhammad Ali FiazОценок пока нет

- Synopsis of TargetДокумент6 страницSynopsis of TargetMuhammad Ali FiazОценок пока нет

- Synopsis of TargetДокумент6 страницSynopsis of TargetMuhammad Ali FiazОценок пока нет

- DMCДокумент1 страницаDMCMuhammad Ali FiazОценок пока нет

- MCWQS For All XamsДокумент97 страницMCWQS For All Xamsvini_anj3980Оценок пока нет

- Bank ReconciliationДокумент2 страницыBank ReconciliationPatrick BacongalloОценок пока нет

- A Study On Customer Satisfaction of Reliance Life InsuranceДокумент57 страницA Study On Customer Satisfaction of Reliance Life InsuranceRishabh PandeОценок пока нет

- IAS 33 Earnings Per Share: (Conceptual Framework and Standards)Документ8 страницIAS 33 Earnings Per Share: (Conceptual Framework and Standards)Joyce ManaloОценок пока нет

- Excel Practice SheetДокумент156 страницExcel Practice SheetLove RabbytОценок пока нет

- Crossover Rate TemplateДокумент5 страницCrossover Rate TemplatePramodJhaОценок пока нет

- Organizational Analysis: Week 4 Questions (Agency Theory)Документ5 страницOrganizational Analysis: Week 4 Questions (Agency Theory)api-25897035Оценок пока нет

- Equity Analysis of A Project: Capital Budgeting WorksheetДокумент6 страницEquity Analysis of A Project: Capital Budgeting WorksheetasaefwОценок пока нет

- Summer Internship 2013-14: Amity Business School, Amity University, Lucknow Campus 1Документ10 страницSummer Internship 2013-14: Amity Business School, Amity University, Lucknow Campus 1Deepak Singh NegiОценок пока нет

- Management Accounting: 2 Year ExaminationДокумент24 страницыManagement Accounting: 2 Year ExaminationChansa KapambweОценок пока нет

- COST ACCOUNTING HOMEWORKДокумент6 страницCOST ACCOUNTING HOMEWORKaltaОценок пока нет

- Own Mock QualiДокумент10 страницOwn Mock QualiDarwin John SantosОценок пока нет

- Financial Engineering Class Sesi 1 Ver 2.0Документ16 страницFinancial Engineering Class Sesi 1 Ver 2.0Davis FojemОценок пока нет

- Acquisition of GC by Tata ChemДокумент20 страницAcquisition of GC by Tata ChemPhalguna ReddyОценок пока нет

- FORM 10-K: United States Securities and Exchange CommissionДокумент55 страницFORM 10-K: United States Securities and Exchange CommissionJerome PadillaОценок пока нет

- Diminishing MusharakahДокумент45 страницDiminishing MusharakahIbn Bashir Ar-Raisi0% (1)

- Study On Efficacy of PSB Loan in 59 MinutesДокумент33 страницыStudy On Efficacy of PSB Loan in 59 MinutesNeeraj kumar75% (4)

- BetasДокумент7 страницBetasJulio Cesar ChavezОценок пока нет

- Error Correction (Part 2) - Suspense Accounts (Including RQS)Документ6 страницError Correction (Part 2) - Suspense Accounts (Including RQS)King JulianОценок пока нет

- 0038v2 026 PDFДокумент8 страниц0038v2 026 PDFRaluca StefanescuОценок пока нет

- Credit Rating AgenciesДокумент20 страницCredit Rating AgenciesKrishna Chandran PallippuramОценок пока нет

- Municipal BondДокумент5 страницMunicipal Bondashish_20kОценок пока нет

- The Meadow DanceДокумент22 страницыThe Meadow DancemarutishОценок пока нет

- Admission Cum Retirement DeedДокумент8 страницAdmission Cum Retirement DeedRohit Yadav50% (2)

- Accounting For Decision Making or Management AU Question Paper'sДокумент41 страницаAccounting For Decision Making or Management AU Question Paper'sAdhithiya dhanasekarОценок пока нет