Академический Документы

Профессиональный Документы

Культура Документы

SHE Equity Contributed.

Загружено:

Maketh.ManАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

SHE Equity Contributed.

Загружено:

Maketh.ManАвторское право:

Доступные форматы

PAMANTASAN NG LUNGSOD NG VALENZUELA

POBLACION II, MALINTA, VALENZULEA CITY

ACCOUNTANCY DEPARTMENT

MIDTERM DEPARTMENTAL EXAMINATION

ACADEMIC YEAR 2017-2018, 2nd SEM.

PRACTICAL AUDITING [ACCTG11]

----------------------------------

GENERAL DIRECTIONS: Use black permanent ink pen in writing your final answers

in your answer sheet. Erasure and/or superimposition of any kind is strictly not

allowed. Doing such shall automatically render your answers INCORRECT. Answers

are case sensitive. DO NOT CHEAT. GOD IS WATCHING YOU.

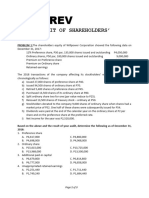

Problem I

Chonsu Corporation had the following equity account balances at December 31, 2009:

Preference Share Capital 1,800,000

Share premium- preference 90,000

Ordinary share capital 5,150,000

Share premium- ordinary 3,500,000

Retained earnings 4,000,000

Net unrealized loss on FVOCI securities 245,000

Treasury shares- ordinary 270,000

Chonsu ‘s preference and ordinary shares are traded on the over- the- counter

market. At December 31, 2009, Chonsu had 100,000 authorized shares of P 100 par,

10% cumulative preference shares and 3,000,000, no par, authorized ordinary shares

with a stated value of P 5 per share.

Transactions during 2010 and other information relating to the equity accounts were

as follows:

a. On January 10, 2010, Chonsu formally retired all the 30,000 treasury shares

and had them revert to unissued basis. The treasury shares had been acquired

on January 20, 2009. The shares were originally issued at P 10 per share.

b. Chonsu owned 10,000 ordinary shares of Benny, Inc. purchased in 2009 for

P750,000. The Benny shares were included in Chonsu ’s trading securities

portfolio. On February 15, 2010, Chonsu declared a dividend in kind of one

share of Benny for every hundred ordinary shares of Chonsu held by

stakeholders of record on February 28, 2010. The dividend in kind was

distributed on March 12, 2010.

c. On April 1, 2010, 1,000,000 share rights were issued to the ordinary

shareholders permitting the purchase of one new ordinary share in exchange

for four rights and P 11 cash. On April 25, 2010, 840,000 share rights were

exercised when the market price of Chonsu ’s ordinary share was P 13 per

share. Chonsu issued new shares to settle the transaction. The remaining

160,000 rights were not exercised and thus expired.

d. On January 1, 2007, Chonsu granted share options to employees for the

purchase of 100,000 ordinary shares of the company at P 8 per share which

GOD IS WATCHING YOU | 1

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

was also the market price. The options are exercisable within a three- year

period beginning January 1, 2009. On July 1, 2010, employees exercised 80,000

options for P 8 per share. On July 1, 2010, the market price of Chonsu ’s

ordinary share was P 8 per share. Chonsu used new shares to settle the

transaction.

e. On December 12, 2010, Chonsu declared the yearly cash dividend on

preference shares, payable on January 14, 2011, to shareholders of record on

December 31, 2010.

f. After year- end adjustment, the net unrealized loss on FVOCI securities

account had a debit balance of 135,000 at December 31, 2010.

g. On January 15, 2011, before the accounting records were closed for 2010,

Chonsu became aware that rent income for the year ended December 31, 2009

was overstated by P 500,000. The after- tax effect on the 2009 profit was

275,000. The appropriate correcting entry was recorded the same day.

h. After correcting the rent income, profit for 2010 was P 2,600,000.

Questions:

Based on the above and the result of your audit, determine the following as of

December 31, 2010:

1. Ordinary share capital?

A. 6,330,000

B. 6,450,000

C. 7,950,000

D. 8,250,000

E. None of the choices

2. Share premium- ordinary

A. 5,000,000

B. 4,880,000

C. 3,380,000

D. 4,970,000

E. None of the choices

3. Total Contributed Capital

A. 13,220,000

B. 8,250,000

C. 18,615,000

D. 16,725,000

E. None of the choices

GOD IS WATCHING YOU | 2

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

4. Retained Earnings

A. 5,275,000

B. 5,445,000

C. 5,170,000

D. 5,395,000

E. None of the choices

5. Total Shareholders’ Equity

A. 18,615,000

B. 18,255,000

C. 18,480,000

D. 18,530,000

E. None of the choices

Problem II

Penn Company began operations on January 1, 2017 by issuing at P 15 per share one-

half of the 950,000 ordinary shares of 10 par value that had been authorized for sale.

In addition, the entity has 500,000 authorized preference shares of P 5 par value.

During 2017, the entity had P 1,025,000 of net income and declared P 230,000 of

dividend. During 2018, the entity had the following transactions:

- Issued 100,000 ordinary shares for P 17 per share.

- Issued 150,000 preference shares for P 8 per share.

- Authorized the purchase of a custom- made machine to be delivered in January

2019. The entity restricted P 300,000 of retained earnings for the purchase of

the machine.

- Issued additional 50,000 preference shares for P 9 per share.

- Reported P 1,215,000 of net income and declared on December 31, 2018 a cash

dividend of P 635,000 to shareholders of record on January 15, 2019 to be paid

on February 1, 2019.

Questions:

6. What is the shareholders’ equity on December 31, 2017?

A. 7,920,000

B. 7,125,000

C. 8,150,000

D. 8,380,000

E. None of the choices

7. What is the shareholders’ equity on December 31, 2018?

A. 11,850,000

B. 11,550,000

C. 12,485,000

GOD IS WATCHING YOU | 3

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

D. 10,635,000

E. None of the choices

Problem III

On January 1, 2017, Alterra company granted 60,000 share options to employees. The

share options will vest at the end of three years, provided, the employees remain in

service until the said time. The option price is P 60 and the par value per share is P

50. At the date of grant, the entity concluded that the fair value of the share options

cannot be measured reliably.

The share options have a life of 4 years which means that the share options can be

exercised within one year after vesting.

The share prices are P 62 on December 31, 2017, P 66 on December 31, 2018, P 75

on December 31, 2019 and P 85 on December 31, 2020. All share options were

exercised on December 31, 2020.

Questions:

8. What is the compensation expense for 2019?

A. 120,000

B. 240,000

C. 200,000

D. 660,000

E. None of the choices

9. What is the compensation expense for 2020?

A. 900,000

B. 600,000

C. 660,000

D. 450,000

E. None of the choices

10. What is the share premium upon exercise of the share options on December

31, 2020?

A. 2,100,000

B. 1,500,000

C. 600,000

D. 900,000

E. None of the choices

GOD IS WATCHING YOU | 4

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

Problem IV

On January 1, 2017, Folk company changed from the average cost method to the FIFO

method to account for the inventory.

The entity provided the following ending inventory for each method:

2017 2018

Average 500,000 900,000

FIFO 700,000 1,400,000

The income statement information calculated by the average cost method was as

follows:

2017 2018

Sales 10,000,000 13,000,000

Cost of Goods sold 7,000,000 9,000,000

Operating Expense 1,500,000 2,000,000

Tax expense- 30% 450,000 600,000

Questions:

11. What amount of net income should be reported in 2017 after the change to the

FIFO inventory method?

A. 1,050,000

B. 1,500,000

C. 1,250,000

D. 1,190,000

E. None of the choices

12. What amount of net income should be reported in 2018 after the change to the

FIFO inventory method?

A. 1,610,000

B. 2,300,000

C. 1,750,000

D. 1,890,000

E. None of the choices

GOD IS WATCHING YOU | 5

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

Problem V

Lake Company had the following investments on January 1, 2017:

Share capital:

Kar Company (1,000 shares)- 100,000

Aub Company (5,000 shares)- 1,000,000

Real Estate: Parking lot (leased to Day Company) – 3,000,000

Other: Trademark- 250,000

Total investments- 4,350,000

Lake owns 1% of Kar and 30% of Aub. The Day lease, which commenced on January

1, 2017, is for 10 years at an annual rental of P 480,000. In addition, on January 1,

2017, Day Company paid a non- refundable deposit of 500,000, as well as a security

deposit of 80,000 to be refunded upon expiration of lease.

The trademark was licensed to Barr Company for royalties of 10% of sales of the

trademarked items. Royalties are payable semi- annually on March 1 for sales in July

through December of prior year, and on September 1 for sales in January through

June of the same year.

During the year ended December 31, 2017, Lake Company received cash dividend of

10,000 from Kar, and 150,000 from Aub, whose net incomes were P 750,000 and P

1,500,000, respectively.

Lake Company also received P 480,000 rent from Day Company in 2017, and the

following royalties from Barr Company:

March 1 September 1

2016 300,000 500,000

2017 400,000 700,000

Barr Company reported that sales of the trademarked items totalled 2,000,000 for the

last half of 2017.

Questions:

13. In Lake’s 2017 income statement, what amount should reported for dividend

revenue?

A. 160,000

B. 24,000

C. 10,000

D. 1,500

E. None of the choices

GOD IS WATCHING YOU | 6

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

14. In Lake’s 2017 income statement, what amount should be reported for royalty

revenue?

A. 1,400,000

B. 1,300,000

C. 1,100,000

D. 900,000

E. None of the choices

15. In Lake’s 2017 income statement, what amount should be reported for rental

revenue?

A. 430,000

B. 480,000

C. 530,000

D. 538,000

E. None of the choices

Problem VI

Shannon Company began operations on January 1, 2016. The financial statements

contained the following errors:

2016 2017

Ending Inventory 160,000 understated 150,000 overstated

Depreciation Expense 60,000 understated

Insurance expense 100,000 overstated 100,000 understated

Prepaid Insurance 100,000 understated

On December 31, 2017, fully depreciated machinery was sold for 108,000 cash but

the sale was not recorded until 2018. No corrections have been made for any of the

errors.

Questions:

Ignoring income tax, what is the total effect of the errors on

16. Net income, 2016?

A. 200,000 over

B. 200,000 under

C. 260,000 under

D. 0

E. None of the choices

GOD IS WATCHING YOU | 7

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

17. Net income, 2017?

A. 302,000 over

B. 302,000 under

C. 410,000 over

D. 410,000 under

E. None of the choices

18. Retained earnings on December 31, 2017?

A. 102,000 over

B. 102,000 under

C. 200,000 over

D. 200,000 under

E. None of the choices

19. Working Capital on December 31, 2017?

A. 42,000 over

B. 58,000 under

C. 60,000 under

D. 98,000 under

E. None of the choices

Problem VII

Mariot Company reported income before tax of P 3,700,000 for 2016 and P 5,200,000

for 2017. An audit produced the following information:

- The ending inventory for 2016 included 5,000 units erroneously priced at P 59

per unit. The correct cost was P 95 per unit.

- Merchandise costing P 175,000 was shipped to Mariot Company, FOB shipping

point, on December 26, 2016. The purchase was recorded in 2016 but the

merchandise was excluded from the ending inventory because it was not

received until January 4, 2017.

- On December 28, 2016, merchandise costing P 30,000 was sold to Deluxe

Company. Deluxe had asked Mariot in writing to keep the merchandise until

January 2, 2017. The merchandise was included in the inventory count. The

sale was correctly recorded in December 2016.

- Gray company sold merchandise costing P 15,000 to Mariot Company. The

purchase was made on December 29, 2016 and the merchandise was shipped

on December 20, 016. The terms were FOB shipping point. Because the

bookkeeper was on vacation, neither the purchase not the receipt of goods was

recorded until January 2017.

GOD IS WATCHING YOU | 8

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

20. What is the corrected income before tax for 2017?

A. 4,870,000

B. 4,815,000

C. 4,890,000

D. 5,525,000

E. None of the choices

Problem VIII

Your audit of Edu Company revealed that your client kept very limited records.

Purchases of merchandise were paid for by check, but most other items were out of

cash receipts. The company’s collections were deposited weekly. No record was kept

of cash in the bank nor was a record kept of sales. Accounts receivable were recorded

only by keeping copy of tickets, and these copies were given to the customers when

paying their accounts.

The company started its operations on January 2, 2006 and issue common stock,

216,000 shares with 100 par, for the following considerations: cash of 1,800,000,

building, useful life of 15 year, worth 16,200,000 and Land amounting to 5,400,000.

An analysis of the bank statements showed total deposits, including original cash

investment of 12,600,000. The balance in the bank statement on December 31, 2006,

was 900,000 but there were checks amounting to 180,000 dated in December but not

paid by the bank until January 2007. Cash on hand on December 31, 2006 was 450,000

including customers’ deposit of 135,000.

During the year, Edu borrowed 1,800,000 from the bank and repaid 450,000 and

90,000 interest.

Disbursements paid in cash during the year were as follows: utilities- 360,000;

salaries- 360,000; supplies 720,000; and dividends- 540,000.

An inventory of the merchandise taken on December 31, 2006 showed 2,718,000 of

merchandise.

Tickets for accounts receivable totalled 3,240,000 but 180,000 of that amount may

prove uncollectible.

Unpaid supplier invoices for merchandise amounted to 1,260,000.

Equipment with a cash price of 1,440,000 was purchased in early January on one-

year installment basis. during the year, checks for the down payment and all maturing

installments totalled 1,602,000. The equipment has a useful life of 5 years.

Based on the above data provided and the result of your audit, determine the following

information:

GOD IS WATCHING YOU | 9

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

21. Collections from customers in 2006?

A. 14,760,000

B. 11,430,000

C. 11,295,000

D. 12,960,000

E. None of the choices

22. Total sales on accrual basis in 2006?

A. 14,535,000

B. 14,670,000

C. 11,295,000

D. 11,430,000

E. None of the choices

23. Total purchases on accrual basis in 2006?

A. 10,818,000

B. 9,738,000

C. 9,558,000

D. 10,998,000

E. None of the choices

24. Cost of Goods sold in 2006?

A. 8,100,000

B. 8,280,000

C. 6,840,000

D. 7,020,000

E. None of the choices

25. Net income for the year ended December 31, 2006?

A. 4,680,000

B. 4,860,000

C. 3,015,000

D. 5,310,000

E. None of the choices

GOD IS WATCHING YOU | 10

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

Problem IX

Beans Court Tease Company was organized on January 1, 2015. On the same date,

25,000, P100 par value, ordinary share were issued in exchange for PPE valued P

3,000,000 and Cash of P 1,000,000. The following data summarize activities for 2015.

a. Profit for the year ended December 31, 2015 was P 1,000,000.

b. Raw materials on hand on December 31 were equal to 25% of raw materials

purchased.

c. Manufacturing costs were distributed as follows: Materials used- 50%; Direct

Labor- 30%; Factory Overhead- 20% (includes depreciation of building, P

100,000)

d. Work-in-process inventory remaining in the factor as of December 31 was

equal to 1/3 of the cost of goods available for sale.

e. Finished goods remaining in stock on December 31 was equal to 25% of cost

of goods sold.

f. Operating expenses were 30% of sales.

g. Cost of goods sold was 150% of the operating expenses.

h. 90% of sales were collected during 2015. The remaining balance was

considered collectible.

i. 75% of the raw materials purchased were paid for. There were no expense

accruals or prepayments at the end of the year.

Determine the balances of the following accounts at December 31, 2015.

26. Sales?

A. P 4,000,000

B. P 5,000,000

C. P 2,000,000

D. P 3,000,000

E. None of the choices

27. Total Manufacturing Costs?

A. P 4,166,667

B. P 5,000,000

C. P 666,667

D. P 2,850,000

E. None of the choices

GOD IS WATCHING YOU | 11

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

28. Cash?

A. P 1,900,000

B. P 1,150,000

C. P 650,000

D. P 500,000

E. None of the choices

29. Total Current Assets?

A. P 4,000,000

B. P 2,600,000

C. P 2,575,000

D. P 3,861,111

E. None of the choices

Problem X

You are auditing the balance sheet of the Ballares Company on December 31, 2004,

which has the following items on the equity side of the balance sheet:

Current Liabilities 2,858,000

Bonds Payable 3,000,000

Reserve for Bonds Retirement 1,600,000

6% Cumulative Preference Share, P100 par value

(entitled to P110 and accumulated dividends

per share in voluntary liquidation). Authorized,

30,000 shares; issued, 20,000 shares; in treasury,

1,500 shares 1,850,000

Ordinary share, P100 par value, authorized,

100,000 shares; issued and outstanding, 40,000

shares 4,000,000

Premium on preference share 100,000

Premium on ordinary share 673,000

Retained earnings 1,312,600

The company proposes to finance a plant expansion program by issuing an additional

20,000 shares of ordinary share.

Ordinary shareholders of record October 1, 2004 were notified that they will be

permitted to subscribe to the new issue at P150 per share up to 50% of their holdings.

The market value of the share on October 1, 2004, was P172.50. The share goes

ex-rights in the market on October 3, 2004.

GOD IS WATCHING YOU | 12

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

Questions:

30. How much is the total shareholders’ equity as of December 31, 2004?

A. 5,535,000

B. 7,500,000

C. 9,535,600

D. 2,035,000

E. None of the choices

31. The book value per share of ordinary share as of December 31, 2004 is?

A. 178.52

B. 172.50

C. 165.00

D. 203.55

E. None of the choices

Problem XI

You were engaged by Catacutan Company, a publicity held company whose shares

are traded in the Philippines Share Exchange, to conduct an examination of its 2004

financial statements. You were told by the company’s controller that there were

numerous equity transactions that took place in 2004. The shareholders’ equity

accounts at December 31, 2003, had the following balances:

Preference share, P100 par value, 6% cumulative; 15,000

shares authorized; 9,000 shares issued and outstanding P 900,000

Ordinary share, P1 par value, 900,000 shares authorized:

600,000 shares issued and outstanding 600,000

Additional paid-in capital 1,200,000

Retained earnings 3,198,000

Total shareholders’ equity P5,898,000

You summarized the following transactions during 2004 and other information relating

to the shareholders’ equity in your working papers as follows:

January 6, 2004 – issued 22,500 shares of ordinary share to Difficult Company in

exchange or land. On the date issued, the share had a market price of P16.50 per

share. The land had a carrying value of P201,000, and an assessed value for

property taxes of P135,000.

GOD IS WATCHING YOU | 13

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

January 31, 2004 – Sold 1,350, P1,000, 12% bonds due January 31, 2006, at 98

with one detachable share warrant to each bond. Interest is payable annually on

January 31. The fair value of the bonds without the share warrants is 95. The

detachable warrant entitles the holder to purchase 10 shares of ordinary share at

P10 per share.

February 22, 2004 – Purchased 7,500 shares of its own ordinary share to be held

as treasury share for P24 per share.

February 28, 2004 – Subscriptions for 21,000 shares of ordinary share were

received at P26 per share, payable 50% down and the balance by March 15.

March 15, 2004 – The balance due on 18,000 shares was received and those

shares were issued. The subscriber who defaulted on the 3,000 remaining shares

forfeited the down payment in accordance with the subscription agreement.

April 30, 2004 – Declared a dividend of inventory to ordinary shareholders. The

inventory had a carrying value of P910,000:fair value on relevant dates were:

Date of declaration (April 30, 2004) P950,000

Date of record (May 15, 2004) 900,000

Date of distribution(May 31, 2004) 920,000

August 30, 2004 – Reissued 3,000 shares of treasury share for P20 per share.

September 14, 2004 – There were 945 warrants detached from the bonds and

exercised.

November 30, 2004 – Declared a cash dividend of P2 per share to all ordinary

shareholders of record December 15, 2004. The dividend was paid on December

30, 2004.

December 15, 2004 – Declared the required annual cash dividends on preference

share for 2004. the dividend was paid on January 15, 2004.

January 8, 2005 – Before closing the accounting records for 2004. Catacutan

became aware that no amortization had been recorded for 2003 for a patent

purchased on July 2, 2003. The patent was properly capitalized at P480,000 and

had an estimated useful life of eight years when purchased. Catacutan is subject

to 32% regular corporate income tax. The appropriate correcting entry was

recorded on the same day.

Adjusted net income after tax for 2004 was P1,860,900.

Based on the given data and result of your audit investigation, answer the following:

32. Retained Earnings?

33. Total shareholders’ equity?

34. Additional paid- in capital?

GOD IS WATCHING YOU | 14

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

Problem XII

BEBE Co. was formed on July 1, 2014. It was authorized to issue 900,000 shares of

P 10 par value ordinary shares and 300,000 shares of 8 percent P 25 par value,

cumulative and non-participating preference shares. BEBE Co. has a July 1- June 30

fiscal year.

The following information relates to its shareholders’ equity:

Ordinary shares

Prior to the 2016- 2017 fiscal year, BEBE Co. had 330,000 ordinary shares issued as

follows:

1. 255,000 shares were issued for cash on July 1, 2014, at P 31 per share.

2. On July 24, 2014, 15,000 shares were exchanged for a plot of land which costs

the seller P 210,000 in 2008 and had an estimated market value of P 660,000

on July 24, 2014.

3. 60,000 shares were issued on March 1, 2015, for P 42 per share.

During 2016- 2017 fiscal year, the following transactions regarding ordinary shares

took place:

November 30, 2016- BEBE Co. purchased 6,000 of its own shares on the open market

at P 39 per share.

December 15, 2016- BEBE Co. declared a 5% stock dividend for shareholders of

record on January 15, 2017, to be issued on January 31, 2017. BEBE Co. was having

a liquidity problem and could not afford a cash dividend at the time. BEBE Co.’s

ordinary shares were selling at P 52 per share on December 15, 2016.

June 20, 2017- BEBE Co. sold 1,500 of its own ordinary shares that it had purchased

on November 30, 2016, for P 63,000.

Preference Shares

BEBE Co. issued 120,000 preference shares at P 44 per share on July 1, 2015.

Cash Dividends

BEBE Co. has followed a schedule of declaring cash dividends in December and June,

with payment being made to shareholders of record in the following month. The cash

dividends which have been declared since inception of the company through June 30,

2017, are shown below:

GOD IS WATCHING YOU | 15

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

Declaration date Share Capital- Ordinary Share Capital- Preference

12/15/15 P 0.30 per share P 1.00 per share

06/15/16 P 0.30 per share P 1.00 per share

12/15/16 - P 1.00 per share

No cash dividends were declared during June 2017 due to the company’s liquidity

problems.

Retained Earnings

As of June 30, 2016, BEBE Co’s retained earnings account had a balance of P

2,070,000. For the fiscal year ending June 30, 2017, BEBE CO. reported net income

of P 120,000.

Required:

Compute the adjusted balances of the following as of June 30, 2017:

35. Total Contributed Capital

36. Total Retained Earnings

37. Total Shareholders’ Equity

GOD IS WATCHING YOU | 16

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

Problem XIII

You were engaged by CITY Corporation, a publicly held company whose shares are

traded on the Philippine Stock Exchange, to conduct an audit of its 2017 financial

statements. You were told by the company’s controller that there were numerous

equity transactions that took place in 2017. The shareholders’ equity accounts at

December 31, 2016, had the following balances:

Share capital- preference, P 100 par value, 6% cumulative;

9,000 shares authorized; 5,400 shares issued and outstanding P 540,000

Share capital- ordinary, P 1 par value, 540,000 shares authorized;

360,000 shares issued and outstanding 360,000

Share premium 720,000

Retained Earnings 294,000

Total shareholders’ equity P 1,914,000

You summarized the following transactions during 2017 and other information relating

to the shareholders’ equity in your working papers as follows:

January 6, 2017 Issued 13,500 ordinary shares in exchange for land. On the

date issued, the shares had a market value of P 16.50 per

share. The land had a carrying value of P 126,000, and an

assessed value for property taxes of P 147,000.

January 31, 2017 Sold 720, P 1,000, 12% bonds due on January 31, 2027, at

98 with one detachable share warrant attached to each bond.

Interest is payable annually on January 31. The fair value of

the bonds without the share warrants is 95. The detachable

warrants have a fair value of P 50 each and expire on

January 31, 2018. Each warrant entitles the holder to

purchase 10 ordinary shares at P 10 per share.

February 22, 2017 Purchased 4,500 of its own ordinary shares to be held as

treasury shares for P 24 per share.

February 28, 2017 Subscriptions for 12,600 ordinary shares were received at P

26 per share, payable 50% down and the balance by March

15.

March 15, 2017 The balance due on 10,800 ordinary shares was received

and those shares were issued. The subscriber who defaulted

on the 1,800 remaining shares forfeited the down payment

in accordance with the subscription agreement.

August 30, 2017 Re- issued 1,800 treasury shares for P 20 per share.

September 14, 2017 There were 567 warrants detached from the bonds and

exercised.

November 30, 2017 Declared a cash dividend of P 0.50 per share to all ordinary

shareholders of record, December 15, 2017. The dividend

was paid on December 30, 2017.

December 15, 2017 Declared the required annual cash dividends on preference

shares for 2017. The dividend was paid on January 15, 2018.

GOD IS WATCHING YOU | 17

PAMANTASAN NG LUNGSOD NG VALENZUELA

ACCOUNTANCY DEPARTMENT

ACADEMIC YEAR 2017- 2018, SECOND SEMESTER

MIDTERM DEPARTMENTAL EXAMINATION

PRACTICAL AUDITING [ACCTG11]

January 8, 2018 Before closing the accounting records for 2017, CITY

became aware that no depreciation had been recorded for

2016 for a machine purchased on July 1, 2016. The machine

was properly capitalized at P 288,000 and had an estimated

useful life of eight years when purchased. The appropriate

correcting entry was recorded on the same date.

Adjusted net income for 2017 was P 252,000.

Based on the foregoing and result of your audit, answer the following (Ignore income

tax implications):

38. How much is the total contributed capital on December 31, 2017?

39. How much is the total shareholders’ equity on December 31, 2017?

-END OF AGONY/ EXAMINATION-

May the Lord grant you the SERENITY to ACCEPT the things you can no longer

change, the COURAGE to CHANGE what you could and the WISDOM to KNOW the

difference. <3

It’s not the loads that weights you down; it’s the way you carry it.

“You may ask me for anything in my Name, and I will do it.” – Jesus Christ

-John 14:14

GOD IS WATCHING YOU | 18

Вам также может понравиться

- Exam Company Law NotesДокумент55 страницExam Company Law Noteschau100% (2)

- 1 ST Quiz NGOДокумент5 страниц1 ST Quiz NGOfrancesОценок пока нет

- Complete Accounting For Government DisbursementsДокумент127 страницComplete Accounting For Government DisbursementsMaketh.Man100% (1)

- Introduction To Investment & SecurityДокумент38 страницIntroduction To Investment & Securitygitesh100% (1)

- Acc213 Reviewer Final QuizДокумент9 страницAcc213 Reviewer Final QuizNelson BernoloОценок пока нет

- 13 x11 Financial Management A Financial Planning & StrategiesДокумент9 страниц13 x11 Financial Management A Financial Planning & StrategiesRod Lester de GuzmanОценок пока нет

- Diluted Earnings Per ShareДокумент3 страницыDiluted Earnings Per ShareJohn Ace MadriagaОценок пока нет

- Guide To Financial MarketsДокумент44 страницыGuide To Financial MarketsTawanda B MatsokotereОценок пока нет

- 14 x11 Financial Management BДокумент10 страниц14 x11 Financial Management Balexandro_novora639671% (14)

- Responsibility Accounting FormulasДокумент2 страницыResponsibility Accounting FormulasKath SantosОценок пока нет

- FS Analysis SimulatedДокумент8 страницFS Analysis SimulatedSarah BalisacanОценок пока нет

- MSQ-02 - Variable & Absorption Costing (Final)Документ11 страницMSQ-02 - Variable & Absorption Costing (Final)Kevin James Sedurifa OledanОценок пока нет

- Variable Costing Segment ReportingДокумент7 страницVariable Costing Segment ReportingDhanylane Phole Librea SeraficaОценок пока нет

- Leases Part 2: Name: Date: Professor: Section: Score: Quiz 1Документ2 страницыLeases Part 2: Name: Date: Professor: Section: Score: Quiz 1Jamie Rose AragonesОценок пока нет

- Cost BehaviorДокумент15 страницCost BehaviorUSO CLOTHINGОценок пока нет

- Nestle Philippines Vs CA - Fariola - CDДокумент1 страницаNestle Philippines Vs CA - Fariola - CDAnonymous 1VhXp1Оценок пока нет

- Prelims Quiz 1Документ8 страницPrelims Quiz 1first una100% (1)

- Golf Coast BankДокумент2 страницыGolf Coast BankDheeya Nuruddin100% (1)

- Technical Analysis 1Документ79 страницTechnical Analysis 1jutapol100% (1)

- Agamata Chapter 6Документ18 страницAgamata Chapter 6Abigail Faye Roxas100% (1)

- Ba 194 Final Paper On Universal Robina CorpДокумент4 страницыBa 194 Final Paper On Universal Robina CorpWakei MadambaОценок пока нет

- Principles of TaxationДокумент11 страницPrinciples of TaxationJay GamboaОценок пока нет

- Capital Budgeting Problems For Fin102Документ2 страницыCapital Budgeting Problems For Fin102Marianne AgunoyОценок пока нет

- ABEJUELA - BSMA 3-5 (Assignment 1)Документ3 страницыABEJUELA - BSMA 3-5 (Assignment 1)Marlou AbejuelaОценок пока нет

- Financial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareДокумент11 страницFinancial Accounting: Share-Based Compensation Share-Based Compensation Book Value Per ShareairaОценок пока нет

- Seatwork On LeasesДокумент1 страницаSeatwork On Leasesmitakumo uwuОценок пока нет

- Q - Process Further Scarce ResourceДокумент2 страницыQ - Process Further Scarce ResourceIrahq Yarte TorrejosОценок пока нет

- TX10 - Other Percentage TaxДокумент15 страницTX10 - Other Percentage TaxKatzkie Montemayor GodinezОценок пока нет

- Finman2 Material1 MidtermsДокумент8 страницFinman2 Material1 MidtermsKimberly Laggui PonayoОценок пока нет

- AIS Tut 1Документ3 страницыAIS Tut 1HagarMahmoud0% (1)

- Chapter 13 - Tor F and MCДокумент13 страницChapter 13 - Tor F and MCAnika100% (1)

- Test Bank Chapter18 Fs AnalysisДокумент83 страницыTest Bank Chapter18 Fs Analysiskris mОценок пока нет

- MASДокумент6 страницMASIyang LopezОценок пока нет

- TB21 PDFДокумент33 страницыTB21 PDFJi WonОценок пока нет

- Case No. 1: BM2008/BM2015 - Auditing and Assurance: Concepts and Application 1 & 2Документ8 страницCase No. 1: BM2008/BM2015 - Auditing and Assurance: Concepts and Application 1 & 2Ken MateyowОценок пока нет

- Financial Management RiskДокумент11 страницFinancial Management RisknevadОценок пока нет

- Quiz Discontinued OperationДокумент2 страницыQuiz Discontinued OperationRose0% (1)

- B. Winnings Not Exceeding 10,000 D. Interest Income From Bank DepositsДокумент3 страницыB. Winnings Not Exceeding 10,000 D. Interest Income From Bank DepositsVanesa Calimag ClementeОценок пока нет

- 2011-02-03 230149 ClarkupholsteryДокумент5 страниц2011-02-03 230149 ClarkupholsteryJesus Cardenas100% (1)

- Stock ValuationДокумент5 страницStock ValuationDiana SaidОценок пока нет

- Incremental Analysis Basic ConceptsДокумент47 страницIncremental Analysis Basic ConceptsWinter SummerОценок пока нет

- Book Value Per Share Basic Earnings PerДокумент61 страницаBook Value Per Share Basic Earnings Perayagomez100% (1)

- Master Budget.9Документ3 страницыMaster Budget.9Hiraya ManawariОценок пока нет

- Dokumen PDFДокумент21 страницаDokumen PDFMark AlcazarОценок пока нет

- ExamДокумент18 страницExamLiza Roshchina100% (1)

- Advance Accounting 1 Final ExaminationДокумент13 страницAdvance Accounting 1 Final ExaminationTina LlorcaОценок пока нет

- Module 13 Regular Deductions 3Документ16 страницModule 13 Regular Deductions 3Donna Mae FernandezОценок пока нет

- File 4795281140322753513Документ10 страницFile 4795281140322753513Akako MatsumotoОценок пока нет

- MS03 09 Capital Budgeting Part 2 EncryptedДокумент6 страницMS03 09 Capital Budgeting Part 2 EncryptedKate Crystel reyesОценок пока нет

- Lanzuela, Hanzel Lapiz, Sharlene May Lee, Mei Yin Lopez, Benhur Macarembang, Hanan Cpar ObligationsДокумент22 страницыLanzuela, Hanzel Lapiz, Sharlene May Lee, Mei Yin Lopez, Benhur Macarembang, Hanan Cpar ObligationsFeizhen MaeОценок пока нет

- Capital Structure and Leverage: EasyДокумент41 страницаCapital Structure and Leverage: Easychong chojun balsaОценок пока нет

- 07 X07 A Responsibility Accounting and TP Decentralization and Performance EvaluationДокумент10 страниц07 X07 A Responsibility Accounting and TP Decentralization and Performance EvaluationabcdefgОценок пока нет

- 4 Probability AnalysisДокумент11 страниц4 Probability AnalysisLyca TudtudОценок пока нет

- Investment in Equity Securities - SeatworkДокумент2 страницыInvestment in Equity Securities - SeatworkLester ColladosОценок пока нет

- AUD 1206 Case Analysis Number 2Документ2 страницыAUD 1206 Case Analysis Number 2RОценок пока нет

- Finman Midterms Part 1Документ7 страницFinman Midterms Part 1JerichoОценок пока нет

- HO8 - Relevant Costing PDFДокумент5 страницHO8 - Relevant Costing PDFPATRICIA PEREZ100% (1)

- Leases 2Документ3 страницыLeases 2John Patrick Lazaro Andres100% (1)

- IA2 06 - Handout - 1 PDFДокумент5 страницIA2 06 - Handout - 1 PDFMelchie RepospoloОценок пока нет

- ToaДокумент5 страницToaGelyn CruzОценок пока нет

- Testbank-Quizlet RelevantCost2Документ12 страницTestbank-Quizlet RelevantCost2Lokie PlutoОценок пока нет

- SciДокумент3 страницыSciJomar VillenaОценок пока нет

- ACCO 3026 Final ExamДокумент11 страницACCO 3026 Final ExamClarisseОценок пока нет

- De La Salle Araneta UniversityДокумент7 страницDe La Salle Araneta UniversityBryent GawОценок пока нет

- Chap. 12 HomeworkДокумент14 страницChap. 12 HomeworkOmar KabeerОценок пока нет

- Sale Price of Replaced Equipment P 40,000Документ15 страницSale Price of Replaced Equipment P 40,000Jay GamboaОценок пока нет

- Moldez INT03 QUIZДокумент3 страницыMoldez INT03 QUIZVincent Larrie MoldezОценок пока нет

- Audit of SheДокумент3 страницыAudit of ShePrince PierreОценок пока нет

- Acc05 Far Handout 2Документ4 страницыAcc05 Far Handout 2Jullia Belgica0% (1)

- Quizzer 1Документ4 страницыQuizzer 1Arvin John MasuelaОценок пока нет

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetДокумент6 страницMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetYaj CruzadaОценок пока нет

- Bulacan: Mayor RS, Full Support For Mail Provincial Jamboree Meet in MarilaoДокумент12 страницBulacan: Mayor RS, Full Support For Mail Provincial Jamboree Meet in MarilaoMaketh.ManОценок пока нет

- DreamersjournalДокумент13 страницDreamersjournalMaketh.ManОценок пока нет

- Research ZXДокумент19 страницResearch ZXMaketh.ManОценок пока нет

- Our Lady of Fatima University - Valenzuela Campus Senior High School Department Accountancy, Business and Management (Abm)Документ5 страницOur Lady of Fatima University - Valenzuela Campus Senior High School Department Accountancy, Business and Management (Abm)Maketh.ManОценок пока нет

- Tba XДокумент2 страницыTba XMaketh.ManОценок пока нет

- Finals - Takehome Quizzes Problems - WithoutДокумент5 страницFinals - Takehome Quizzes Problems - WithoutMaketh.ManОценок пока нет

- Properties and ZXEquipmentДокумент4 страницыProperties and ZXEquipmentMaketh.ManОценок пока нет

- Milk Tea AaaaaДокумент2 страницыMilk Tea AaaaaMaketh.ManОценок пока нет

- At 0405 Preweek Quizzer B XXДокумент26 страницAt 0405 Preweek Quizzer B XXMaketh.ManОценок пока нет

- Lectures in GeneticsДокумент38 страницLectures in GeneticsMaketh.ManОценок пока нет

- PIZZAPHORIA - Group 7 CHAPTER 1 6Документ49 страницPIZZAPHORIA - Group 7 CHAPTER 1 6Maketh.ManОценок пока нет

- NEWSPAPERДокумент9 страницNEWSPAPERMaketh.ManОценок пока нет

- CHAPTER 1 Caselette - Accounting CycleДокумент51 страницаCHAPTER 1 Caselette - Accounting Cyclemjc24Оценок пока нет

- Chapter 3 Solutions Comm 305Документ77 страницChapter 3 Solutions Comm 305Maketh.ManОценок пока нет

- Chapter 3 Solutions Comm 305Документ77 страницChapter 3 Solutions Comm 305Maketh.ManОценок пока нет

- HHHHHДокумент4 страницыHHHHHMaketh.ManОценок пока нет

- Ch16 Receivables Management PDFДокумент4 страницыCh16 Receivables Management PDFjdiaz_646247Оценок пока нет

- Chapter 17Документ9 страницChapter 17Maketh.ManОценок пока нет

- Bir - Train - Tot - DSTДокумент14 страницBir - Train - Tot - DSTNLainie OmarОценок пока нет

- 2012 Edition: Management Advisory Services Suggested Key Answers in Multiple Choice and True-False QuestionsДокумент9 страниц2012 Edition: Management Advisory Services Suggested Key Answers in Multiple Choice and True-False QuestionsAlvin YercОценок пока нет

- Bir Train Tot Other Excise ProdДокумент23 страницыBir Train Tot Other Excise ProdGlo GanzonОценок пока нет

- Real Property TaxДокумент4 страницыReal Property TaxMaketh.ManОценок пока нет

- Omnibus Investment Code of 1987 PDFДокумент8 страницOmnibus Investment Code of 1987 PDFNympa VillanuevaОценок пока нет

- Briefing On RA 10963: Tax Reform For Acceleration and Inclusion (Train) - Transfer TaxesДокумент14 страницBriefing On RA 10963: Tax Reform For Acceleration and Inclusion (Train) - Transfer TaxesArah OpalecОценок пока нет

- Slide AKT 405 Teori Akuntansi 8 GodfreyДокумент30 страницSlide AKT 405 Teori Akuntansi 8 GodfreypietysantaОценок пока нет

- Secrets of Financial Astrology by Kenneth MinДокумент2 страницыSecrets of Financial Astrology by Kenneth MinaachineyОценок пока нет

- Bernie Madoff Scandal Mg-2Документ8 страницBernie Madoff Scandal Mg-2jeminОценок пока нет

- Tiger BrandsAnnual Financial Results November 2011Документ20 страницTiger BrandsAnnual Financial Results November 2011anon_470778742Оценок пока нет

- RR Toolkit EN New 2017 12 27 CH4 PDFДокумент18 страницRR Toolkit EN New 2017 12 27 CH4 PDFNaniОценок пока нет

- 08 Eva IntroДокумент77 страниц08 Eva Introrayhan555Оценок пока нет

- Laporan Arus KasДокумент19 страницLaporan Arus KasFuadi FadlanОценок пока нет

- Advanced Financial Reporting Supp 2018Документ8 страницAdvanced Financial Reporting Supp 2018smlingwaОценок пока нет

- Reliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment PlanДокумент24 страницыReliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment Planpuneetk20Оценок пока нет

- Can Fin Annual Report 2015-16Документ143 страницыCan Fin Annual Report 2015-16Venkat Sai Kumar KothalaОценок пока нет

- Financial Statement AnalysisДокумент12 страницFinancial Statement AnalysisGail0% (1)

- Construction of Free Cash Flows A Pedagogical Note. Part IДокумент23 страницыConstruction of Free Cash Flows A Pedagogical Note. Part IDwayne BranchОценок пока нет

- Importance of Investment PlanningДокумент18 страницImportance of Investment Planning01101988krОценок пока нет

- PT. Great River International TBK.: Summary of Financial StatementДокумент1 страницаPT. Great River International TBK.: Summary of Financial StatementroxasОценок пока нет

- SRZ PIF 2018 Permanent Capital Investment Vehicles PDFДокумент19 страницSRZ PIF 2018 Permanent Capital Investment Vehicles PDFRegis e Fabiela Vargas e AndrighiОценок пока нет

- Beta CoefficientДокумент3 страницыBeta CoefficientNahidul Islam IU100% (1)

- Buss. Valuation-Bajaj AutoДокумент19 страницBuss. Valuation-Bajaj AutoNilesh Kedia0% (1)

- Accounting Shenanigans On The Cash Flow Statement IFT NotesДокумент8 страницAccounting Shenanigans On The Cash Flow Statement IFT NoteskautiОценок пока нет

- QazДокумент9 страницQazShreeamar Singh100% (1)

- Chap 12 SolutionsДокумент4 страницыChap 12 SolutionsMiftahudin MiftahudinОценок пока нет

- How To Pick An Exit Strategy For Your Small BusinessДокумент6 страницHow To Pick An Exit Strategy For Your Small BusinessFaheem JuttОценок пока нет

- ADV2 Chapter12 QAДокумент4 страницыADV2 Chapter12 QAMa Alyssa DelmiguezОценок пока нет

- Funding of Mergers & TakeoversДокумент31 страницаFunding of Mergers & TakeoversMohit MohanОценок пока нет

- Ch03 Intermediate Accounting Ifrs Edition Vol 1 The Accpunting Information SystemДокумент107 страницCh03 Intermediate Accounting Ifrs Edition Vol 1 The Accpunting Information SystemoniОценок пока нет

- BBF 060316 816 PDFДокумент6 страницBBF 060316 816 PDFzpmellaОценок пока нет