Академический Документы

Профессиональный Документы

Культура Документы

Topic 1 - Basics of Banking Services

Загружено:

Carlos PereiraОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Topic 1 - Basics of Banking Services

Загружено:

Carlos PereiraАвторское право:

Доступные форматы

Topic 1 – Basics of Banking Services

Parts of a Check Activity (Instructor Copy)

Instructor note:

Photocopy the activity handout on the following page. Lead a discussion about the parts of a check.

A. Your name and address go here. These are preprinted on the check for your convenience and tell the

person or company to whom you’re giving the check – known as the payee – that you’re the one who

wrote it.

B. Write in today's date.

C. This is where you write the name of the person or company who will be receiving the money. If you’re

making a withdrawal for yourself, write “Cash” here.

D. The amount of the check is written here.

E. The amount in words is written on this line. You start at the left edge of the line and when you’re

finished, you will draw a line through the remaining empty space as far as the word “Dollars.”

F. The name of the bank that holds your account appears here.

G. To remember what you bought, you can write a brief description here.

H. Your signature should be the last thing you complete. It gives the bank permission, or authorization, to

release the money to the payee.

I. This is the check number. This reference number will help you keep track of your payments by check.

Each time you write a check, you should record the check number, date, payee, and amount in your

check register, and calculate your new balance.

J. This is the 10-digit account number that is unique to your account. This tells the bank which account

the money comes from.

K. This is the bank routing number. It identifies the bank that issued the check. You need this number to

set up direct deposit at work. Direct deposit allows your employer to electronically deposit your

paycheck directly into your account, without giving you a paper check.

• Write in ink.

• Write clearly.

• Record every check in your register.

Hands On Banking® • Instructor Guide • Adults • Basics Of Banking Services •

©2003, 2012 Wells Fargo Bank, N.A. All rights reserved. Member FDIC www.handsonbanking.org

Page 28 Of 539

Topic 1 – Basics of Banking Services

Parts of a Check Activity

A. Your name and address go here. These are preprinted on the check for your convenience and tell the

person or company to whom you’re giving the check – known as the payee – that you’re the one who

wrote it.

B. Write in today's date.

C. This is where you write the name of the person or company who will be receiving the money. If you’re

making a withdrawal for yourself, write “Cash” here.

D. The amount of the check is written here.

E. The amount in words is written on this line. You start at the left edge of the line and when you’re

finished, you will draw a line through the remaining empty space as far as the word “Dollars.”

F. The name of the bank that holds your account appears here.

G. To remember what you bought, you can write a brief description here.

H. Your signature should be the last thing you complete. It gives the bank permission, or authorization, to

release the money to the payee.

I. This is the check number. This reference number will help you keep track of your payments by check.

Each time you write a check, you should record the check number, date, payee, and amount in your

check register, and calculate your new balance.

J. This is the 10-digit account number that is unique to your account. This tells the bank which account

the money comes from.

K. This is the bank routing number. It identifies the bank that issued the check. You need this number to

set up direct deposit at work. Direct deposit allows your employer to electronically deposit your

paycheck directly into your account, without giving you a paper check.

• Write in ink.

• Write clearly.

• Record every check in your register.

Hands On Banking® • Instructor Guide • Adults • Basics Of Banking Services •

©2003, 2012 Wells Fargo Bank, N.A. All rights reserved. Member FDIC www.handsonbanking.org

Page 29 Of 539

Topic 1 – Basics of Banking Services

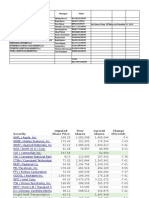

Check Writing Practice Activity (Instructor Copy)

Instructor note:

Photocopy the activity handout on the following page. Instruct your participants to fill out the sample check

using the information provided.

Instructions:

Have participants fill out the sample check below using this information:

Payee: Edgar Rodriguez

Date: April 10, 2009

Amount: $46.73

Memo: Groceries

Hands On Banking® • Instructor Guide • Adults • Basics Of Banking Services •

©2003, 2012 Wells Fargo Bank, N.A. All rights reserved. Member FDIC www.handsonbanking.org

Page 30 Of 539

Topic 1 – Basics of Banking Services

Check Writing Practice Activity

Instructions:

Fill out the sample check below using this information:

Payee: Edgar Rodriguez

Date: April 10, 2009

Amount: $46.73

Memo: Groceries

Hands On Banking® • Instructor Guide • Adults • Basics Of Banking Services •

©2003, 2012 Wells Fargo Bank, N.A. All rights reserved. Member FDIC www.handsonbanking.org

Page 31 Of 539

Topic 1 – Basics of Banking Services

How to Endorse a Check Activity (Instructor Copy)

Instructor note:

Photocopy the activity handout on the following page. Lead a discussion about endorsing a check using the

key points below, and then instruct participants to endorse the check.

Instructions:

Have participants endorse the check

• When you deposit a check, you need to let the bank know that you have personally approved the

transaction by endorsing the check.

• On the back of the check near the top, you’ll write “For deposit only,” your signature, and the number

of the account to which you want the check deposited.

Hands On Banking® • Instructor Guide • Adults • Basics Of Banking Services •

©2003, 2012 Wells Fargo Bank, N.A. All rights reserved. Member FDIC www.handsonbanking.org

Page 32 Of 539

Topic 1 – Basics of Banking Services

How to Endorse a Check Activity

Instructions:

Endorse this check with your name and the account number #279914

Hands On Banking® • Instructor Guide • Adults • Basics Of Banking Services •

©2003, 2012 Wells Fargo Bank, N.A. All rights reserved. Member FDIC www.handsonbanking.org

Page 33 Of 539

Вам также может понравиться

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- 2017 12 31 Thirteen LLC Investment SummaryДокумент437 страниц2017 12 31 Thirteen LLC Investment SummaryLarryDCurtis100% (2)

- Lucy Citra Fitriany, Se: Curriculum Vitae An AccountantДокумент2 страницыLucy Citra Fitriany, Se: Curriculum Vitae An AccountantLuchi Bee0% (1)

- SME Rating AgencyДокумент18 страницSME Rating Agencyashish_kanojia123341150% (2)

- Air Transport: Britishunitedstrike AvertedДокумент1 страницаAir Transport: Britishunitedstrike AvertedBharat TailorОценок пока нет

- James MontierДокумент12 страницJames Montierapi-26172897Оценок пока нет

- Aboitiz Vs Chiongbian G.R. No. 197530Документ12 страницAboitiz Vs Chiongbian G.R. No. 197530JetJuárezОценок пока нет

- Mcleod Vs NLRCДокумент2 страницыMcleod Vs NLRCAnonymous DCagBqFZsОценок пока нет

- Exercises For Corporate FinanceДокумент13 страницExercises For Corporate FinanceVioh NguyenОценок пока нет

- Former Citigroup Executive David James Murphy Court PapersДокумент68 страницFormer Citigroup Executive David James Murphy Court PapersNew York Post67% (3)

- Summer Internship Project Report HONDA OPSДокумент5 страницSummer Internship Project Report HONDA OPSAkshay KhannaОценок пока нет

- CEO or COO or CTO or VP or ED or MDДокумент3 страницыCEO or COO or CTO or VP or ED or MDapi-77213306Оценок пока нет

- Thesis On FarmoutДокумент322 страницыThesis On FarmoutPhạm ThaoОценок пока нет

- Duty To Retain DiscretionДокумент5 страницDuty To Retain DiscretionNotWho Youthink Iam100% (1)

- Tel Fax NoabcДокумент8 страницTel Fax NoabcNusrat KhondakerОценок пока нет

- Indigo Airlines: Prepared and Presented byДокумент6 страницIndigo Airlines: Prepared and Presented byVishakhaОценок пока нет

- Accounting DictionaryДокумент5 страницAccounting DictionaryShazad HassanОценок пока нет

- Philex Mining Vs CirДокумент2 страницыPhilex Mining Vs CirKim Lorenzo CalatravaОценок пока нет

- CLJ 2015 9 1070 Puukm1Документ27 страницCLJ 2015 9 1070 Puukm1syazwaniОценок пока нет

- Dabur Coke Case AnalysisДокумент6 страницDabur Coke Case AnalysisNiku Thali100% (1)

- TheIIA 2008 - Internal Audit Reporting Lines, Fraud Risk Decomposition, and Assessments of Fraud RiskДокумент15 страницTheIIA 2008 - Internal Audit Reporting Lines, Fraud Risk Decomposition, and Assessments of Fraud RiskHarumОценок пока нет

- Saatchi & SaatchiДокумент12 страницSaatchi & SaatchiHrushikesh Patil100% (1)

- Current Projects 2010-N°172Документ73 страницыCurrent Projects 2010-N°172Subramaniam RamasamyОценок пока нет

- Strike at Hyundai PlantДокумент6 страницStrike at Hyundai PlantHimanshu DalakotiОценок пока нет

- Atlas Copco Parts and Price Quote - Construction Equi PDFДокумент186 страницAtlas Copco Parts and Price Quote - Construction Equi PDFADELALHTBANIОценок пока нет

- Koito Case UploadДокумент11 страницKoito Case UploadJurjen van der WerfОценок пока нет

- Advanced Corporate Finance PPT About The Agency Problems and Dividends Policy Around The World. by Waqas HmaidiДокумент36 страницAdvanced Corporate Finance PPT About The Agency Problems and Dividends Policy Around The World. by Waqas HmaidiWaqas D. HamidiОценок пока нет

- Week 11 Tutorial WorkingsДокумент51 страницаWeek 11 Tutorial WorkingsKwang Yi JuinОценок пока нет

- Munjal Kiriu IndustriesДокумент15 страницMunjal Kiriu IndustriesSubhash BajajОценок пока нет

- TENAGA - Page 65-Proxy Form PDFДокумент258 страницTENAGA - Page 65-Proxy Form PDFrajoumn9Оценок пока нет

- S A 20190625Документ4 страницыS A 20190625Mary Ann Gamela IturiagaОценок пока нет