Академический Документы

Профессиональный Документы

Культура Документы

Types of Audits: Audit - An Overview

Загружено:

Ranel Clark D. TabiosОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Types of Audits: Audit - An Overview

Загружено:

Ranel Clark D. TabiosАвторское право:

Доступные форматы

Page |1

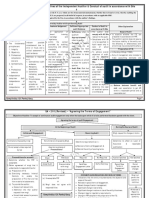

AUDIT – AN OVERVIEW 1. Audit function operates on the

TYPES OF AUDITS assumption that all financial

1. Financial Statement audit data are verifiable

2. Compliance audit 2. Auditor should always maintain

3. Operational audit independence with respect to

the fs under audit

CHARACTERISTIC IN COMMON 3. There should be no long term

1. Systematic examination and conflict between the auditor and

evaluation of evidence the client management

2. Communication of the results of 4. Effective internal control system

the examination reduces the possibility of errors

and fraud affecting fs

TYPES OF AUDITOR 5. Consistent application of GAAP

1. External Auditor or PFRS results in fair

2. Internal auditor presentation of FS

3. Government auditors 6. What was held true in the past

will continue to hold true un the

Inherent limitations future in the absence of known

1. Sampling risk conditions to the contrary

2. Non sampling risk 7. An audit benefits the public

3. Reliance on Management ASSURANCE ENGAGEMENTS

Presentation

4. Inherent limitations of the - Are intended to enhance the

client’s accounting and internal credibility of information about

control systems a subject matter by evaluating

5. Nature of evidence whether the subject matter

conforms in all material respects

GENERAL PRINCIPLES GOVERNING with a suitable criteria

THE AUDIT OF FS

ELEMENTS OF AE

1. comply with the “Code of

Professional Ethics” 1. Three party relationship

promulgated by BOA 2. Appropriate subject matter

2. conduct audit in accordance 3. Suitable/established criteria

with PSA 4. Sufficient appropriate evidence

3. plan and perform audit with an 5. A written assurance report

attitude of professional *notes:

skepticism

(1) management is responsible for

NEED FOR INDEPENDENT FS AUDIT preparing and presenting FS in

1. conflict of interest between mgt accordance with framework.

and users of fs (2) Auditor’s opinion is not a

2. expertise guarantee, it is designed to provide

3. remoteness only reasonable assurance.

4. financial consequences (3) audit evidence is generally

persuasive rather than conclusive

THEORETICAL FRAMEWORK OF in nature

AUDITING

Page |2

PROFESSIONAL STANDARDS 3. Independence

BOA – promulgated 10 GAAS 4. Acceptance and continuance of

PSA – are issued to clarify the client relationships

meaning of the 10 GAAS 5. Human Resources and

Assignment

GAAS (minimum standard of 6. Engagement Performance

performance the auditors should a. Directing

follow) b. Supervision

GENERAL c. Review

o Technical training and d. Consultation

proficiency e. Engagement Quality

o Independence Control Review

o Professional care f. Difference of Opinion

AUDITOR’S RESPONSIBILITY

FIELDWORK MATERIAL MISSTATEMENTS

o Planning

o Internal Control 1. Error

Consideration 2. Fraud

o Evidential Matter a. Fraudulent financial

REPORTING reporting (management

o GAAP fraud)

o Inconsistency b. Misappropriation of assets

o Disclosure (employee fraud)

o Opinion RESPONSIBILITY OF MGT

AASC – has been given the task to o To establish a control

promulgate auditing standards, environment and to

practices and procedures implement control policies

- Approved adoption of: (issued and procedures designed

by IAASB created by IFAC) to ensure, among others,

o ISAs the detection and

o ISAEs prevention of fraud and

o ISREs error.

o ISRS RESPONSIBILITY OF

ELEMENTS OF A SYSTEM OF QUALITY INDIVIDUALS CHARGED WITH

CONTROL GOVERNANCE

1. Leadership Responsibilities for o To ensure the integrity of

quality on audits an entity’s accounting and

2. Ethical requirements financial reporting systems

a. Integrity and that appropriate

b. Objectivity controls are in place.

c. Professional competence PLANNING PHASE

and due care

d. Confidentiality o Make inquiries

e. Professional behavior

Page |3

o Assess the risk *fraud risk counsel about

factors questions of law

COMPLETION PHASE

TESTING PHASE o Obtain a written

o Perform procedures necessary representation from the

to determine whether material client’s management that:

misstatements exist It acknowledges its

o Consider whether misstatement responsibility for the

resulted from fraud or error implementation and

If not material operations of

Refer the matter to the accounting and

appropriate level of internal control

management at least systems that are

one level above those designed to prevent

involved and detect fraud and

Be satisfied that the error

fraud has no other It believes the effects

implications for other of those uncorrected

aspects of the audit or fs misstatements are

that those implications immaterial

have been adequately It has disclose to the

considered author all significant

If material facts relating to any

Consider implication for frauds

other aspects of the It has disclosed to

audit particularly the auditor the results of

reliability of its assessment of the

management risk that the fs may

representations be materially

Discuss the matter misstated as a result

and approach to of fraud

further CONSIDER THE EFFECT OF THE

investigation with AUDITOR’S REPORT

an appropriate

level of that is at o If he believes that material

least one level error or fraud exists, he

above those should request the

involved management to revise the

Attempt to obtain fs. Otherwise, the auditor

evidence to will express a qualified or

determine adverse opinion

whether a material o If he is unable to evaluate

fraud in fact exist because of a limitation on

and, if so, their the scope of the auditor’s

effect examination, auditor

Suggest the client should either qualify or

consult with legal

Page |4

disclaim his opinion on the If there is possible

fs. instance of

*notes noncompliance,

(1) the risk of not detecting a obtain understanding

material misstatement resulting to evaluate the

from fraud is higher than the risk possible effect on the

of not detecting misstatement fs

resulting from errors If there is

noncompliance,

3. Noncompliance with laws and document the

regulations (tax evasion, findings, discuss

violation of environmental them with

protection laws, and inside management and

trading of securities) consider the

implication on other

aspects of the audit

MANAGEMENT’S

RESPONSIBILITY

o To ensure that the entity’s

operations are conducted COMPLETION PHASE

in accordance with laws

Obtain written

and regulations.

representations that

AUDITOR’S RESPONSIBILITY

management has

o To recognize that

disclosed to the

noncompliance by the

auditor all known

entity with laws and

actual or possible

regulations may materially

noncompliance with

affect the fs.

laws and regulations

PLANNING PHASE that could materially

affect the fs

Obtain a general

understanding of the CONSIDER THE EFFECT ON

legal and regulatory THE AUDITOR’S REPORT

framework

If there is

Design procedures to

noncompliance,

help identify

request the

instances of

management to

noncompliance

revise the fs

Obtain sufficient

If a scope of

appropriate audit

limitation has

evidence about

precluded the auditor

compliance with

from obtaining

those laws and

sufficient appropriate

regulations

evidence to evaluate

TESTING PHASE the effect of

noncompliance with

Page |5

laws and regulations, 4. Confirmation

5. Re-computation

the auditor should 6. Analytical Procedures

express a qualified

opinion or disclaimer

of opinion AUDIT EVIDENCE

FRAUD RISK FACTORS RELATING TO Primarily focused but not limited on:

MISSTATEMENTS RESULTING FROM

FRAUD a. Source documents

b. Accounting records

1. MANAGEMENT FRAUD underlying fs

a. Management’s c. Corroborating info from

characteristics and other sources

influence over the control

environment OVERVIEW OF AUDIT PROCESS

b. Industry conditions 1. Accepting an engagement

c. Opening characteristics 2. Planning the Audit

and financial stability 3. Considering the Internal Control

2. EMPLOYEE FRAUD 4. Performing Substantive Tests

a. Susceptibility of assets to 5. Completing the Audit

misappropriation 6. Issuing a Report

b. Controls

ACCEPTING AN ENGAGEMENT

THE AUDIT PROCESS

Firm should consider:

FS – AUDIT PROCEDURES – AUDIT

EVIDENCE – AUDIT OPINION o Competence

o Independence

FS ASSERTIONS: (subj matter of fs o Ability to serve the client properly

o Integrity of the prospective client’s

audit) management

1. About classes of transactions Preliminary planning activities:

and event for the period under

audit Performing procedures

a. Occurrence regarding the continuance of the

b. Completeness client relationship and the

c. Accuracy

d. Cut off specific audit engagement

e. Classification Evaluating compliance with

ethical requirements, including

independence

2. About account balances at the period end Establishing an understanding of

a. Existence

b. Rights and obligations

the terms of the engagement

3. About presentation and disclosure

a. Occurrence and rights and

This task would also involve

obligations

b. Completeness

1. Making inquiries of appropriate

c. Classification and understandability parties in the business

d. Accuracy and valuation community

AUDIT PROCEDURES 2. Communicating with the

1. Inspection

predecessor auditor

2. Observation Incoming auditor’s inquiry from

3. Inquiry predecessor would include:

Page |6

o The predecessor auditor’s A recent change of senior

understanding as to the reasons for

the change of auditors management, board of directors

o Any disagreement between the or ownership

predecessor auditor and client A significant change in the

o Any facts that might have a bearing

on the integrity of the prospective nature or size of the client’s

client’s management business

ENGAGEMENT LETTER Legal requirements and other

government agencies

To express an opinion on the fs pronouncements

Management’s responsibility for

AUDIT PLANNING

the fair presentation of the fs

Audit planning involves developing a

Scope of audit

general audit strategy and a detailed

Forms or any reports or other

approach for the expected conduct of

communication that the auditor

the audit.

expects to issue

The fact that because of the Auditor’s main objective: to

limitations of the audit, there is determine the scope of audit

an unavoidable risk that material procedures to be performed

misstatements may remain

undiscovered

The responsibility of the client to The extent of planning will vary

allow the auditor to have according to:

unrestricted access to whatever

a. The size of the entity

records, documentation and

b. The complexity of the audit

other information requested in

c. The auditor’s experience with

connection with the audit

the entity, and knowledge of the

Importance of the engagement letter business

Avoid misunderstandings with

respect to the engagement

Importance of Adequate Planning of

Document and confirm the the Audit Work

auditor’s acceptance of the

appointment Planning helps ensure the

appropriate attention is devoted

to important areas of the audit

The auditor does not normally send It helps identify potential

new engagement letter every year, problems

but these following factors may have It allows the work to be

caused the auditor to send a new completed expeditiously

engagement letter: It assists in the proper

assignment and coordination of

Any indication that the client

work

misunderstands the objective

It helps ensure that the audit is

and scope of the audit

conducted effectively and

Any revised or special terms of

efficiently

the engagement

Page |7

The auditor should obtain a sufficient period or, when appropriate,

level of knowledge and have been restated; and

understanding of the entity’s Appropriate accounting policies

business, which can be gathered are consistently applied or

from the following sources: changes in accounting policies

have been properly accounted

Review of prior years’ working

for and adequately disclosed

papers

Tour of client’s facilities It requires more work than a repeat

Discussion with people within engagement because of the problem

and outside the entity associated with the verification of the

Reading books, periodicals, and opening balances of the balance sheet

other publications related to the accounts,

client’s industry

Reading corporate documents

and financial reports DEVELOP AN OVERALL AUDIT

STRATEGY

Information obtained could be used

to assist the auditor in: An audit plan should be made

regarding

Assessing risks and identifying

potential problems How much evidence to

Planning and performing the accumulate

audit effectively and efficiently How and when this should be

Evaluating audit evidence as well done

as the reasonableness of client’s The auditor must consider carefully

representations and estimates the appropriate levels of materiality

Providing better service to the and audit risk, when developing an

client audit strategy

With regards to understanding, for MATERIALITY

continuing engagements, the auditor

should update and re-evaluate “Information is material if its omission

information gathered previously, or misstatement could influence the

including information in the prior economic decision of users taken on

year’s working papers. the basis of the fs.”

However, for first time audit, PSA In designing an audit plan, the auditor

510 requires the auditor to obtain should make a preliminary estimate of

sufficient appropriate audit evidence materiality for use during the

that: examination.

The opening balances do not Materiality may be viewed as:

contain misstatements that The largest amount of

materially effect the current misstatement that the auditor

year’s fs could tolerate in the fs, or

The prior period’s closing The smallest aggregate amount

balances have been correctly that could misstate the fs

brought forward to the current

Page |8

Materiality is a matter of professional Design substantive test

judgment and necessarily involves

Effect of materiality on audit risk and

quantitative factors and qualitative

planned audit procedures

factors.

- There is an inverse relationship

Importance of Materiality in Planning

between materiality and the

an Audit

level of audit risk, that is, the

There is an inverse relationship higher the materiality level, the

between materiality and lower the audit risk and vice

evidence. This means, the versa.

higher the peso amount of

materiality, the lower the

needed evidence and the lower

the peso amount of materiality,

RISK ASSESSMENT PROCEDURES

the higher the needed evidence.

These are procedures performed by

Based on PSA320, materiality should

auditors to obtain an understanding

be considered by the auditor:

of the entity and its environment

In the planning stage, to including its internal control and to

determine the scope of audit assess the risk of material

procedures; and misstatements in the fs. These

In the completion phase of the include:

audit, to evaluate the effects of

Inquiries of mgt and others

misstatements on the fs

within the entity

Analytical procedures; and

Observation and inspection

Using Materiality Levels

ANALYTICAL PROCEDURES

Determine the overall

materiality – FS level Analytical procedures involve analysis

Determine the tolerable of significant ratios and trends,

misstatement – Account Balance including the resulting investigation of

level the fluctuation and relationships that

Compare the aggregate amount are inconsistent with other relevant

of uncorrected misstatement information or deviate from predicted

with the overall materiality amounts

AUDIT RISK MODEL STEPS IN APPLYING ANALYTICAL

PROCEDURES

Audit risk = Inherent risk x Control risk

x Detection risk PSA 520 requires the auditor to use

analytical procedures in the planning

Steps in Using the Audit risk Model

and overall review stages of the audit.

Set the desired level of audit risk STEP 1: Develop expectations

Assess the level of inherent risk regarding fs using:

Assess the level of control risk

Determine the acceptable level Prior year’s fs

of detection risk

Page |9

Anticipated results such as of the audit. The overall audit

budgets or forecasts plan sets out in broad terms the

Industry averages nature, timing and extent of the

Non-financial information audit procedures to be

Typical relationships among fs performed.

account balances Audit program

STEP 2: Compare the expectations The auditor should develop and

with the fs under audit document an audit program

STEP 3: Investigate significant setting out the nature, timing

unexpected differences (unusual and extent of planned audit

fluctuations) to determine whether fs procedures required to

contain material misstatements. implement the overall audit plan.

In effect, audit program

THE USE OF ANALYTICAL executes the audit strategy. The

PROCEDURES audit program serves as a set of

Planning instructions to assistants

involved in the audit and as a

To determine the nature, timing means to control and record the

and extent of the other auditing proper execution of the work

procedures The form and content of the

o Understanding the client’s audit program may vary for each

business particular engagement but it

o Identify the areas should always include a detailed

representing specific risks. list of audit procedures that the

Substantive test auditor believes are necessary to

accomplish the audit objectives

To obtain corroborative

evidence about particular Time budget

assertions related to account A time budget is an estimate of

balance or transaction class the time that will be spent in

Completion phase executing the audit procedures

listed in the audit program. This

As an overall review of the fs provides a basis for estimating

o To identify unusual audit fees and assists the auditor

fluctuations that were not in assessing the efficiency of the

identified in the planning assistants.

and testing phases of the

audit

o To confirm conclusions CONSIDERATION OF INTERNAL CONTR

reached with respect to INTERNAL CONTROL

the fairness of the fs

Based on PSA 315, it is the

DOCUMENTING THE AUDIT PLAN process designed and effected

Audit plan by those charged with

governance, management, and

An audit plan is an overview of other personnel to provide

the expected scope and conduct reasonable assurance about the

P a g e | 10

achievement the entity’s Integrity and ethical values

objective with regard to Mgt philosophy and operating

reliability of financial reporting style

effectiveness and efficiency of Active participation of those

operations and compliance with charged with governance

applicable laws regulations Commitment to competence

FOUR ESSENTIAL CONCEPTS OF Personnel policies and

INTERNAL CONTROL procedures

Assignment of responsibility and

Based on the definition stated by PSA authority/ organizational

315: structure

Internal control is a process

Internal control is effected by 2. Risk Assessment

those charged with governance, Management should adopt policies

management and other and procedures that are designed

personnel. to identify and analyze the risk

Internal control can be expected affecting the entity’s business and

to provide reasonable assurance to take the appropriate action to

of achieving entity’s objectives manage these risks

Internal control is designed to

Business risk is the risk that the

help achieve the entity’s

entity’s business objective will not

objectives.

be attained as a result of internal

Internal control is geared towards the and external factors such as

achievement of the entity’s objectives technological developments,

in the following categories: changes in customers demand and

other economic changes.

Effectiveness and efficiency of

operations 3. Information and

Compliance with laws and Communication Systems

regulations

The information system relevant to

Reliability of financial reporting

financial reporting objectives,

COMPONENTS OF INTERNAL which includes the financial

CONTROL reporting system, consist of

procedures and records established

1. Control Environment

to initiate, record, process and

It includes the attitudes, awareness, report entity transactions and to

and actions of management and those maintain accountability for the

charged with governance concerning related assets, liabilities and equity.

the entity’s internal control and its

4. Control Activities

importance in the entity. It is the

foundation for effective internal Control activities are the policies

control, providing discipline and and procedures that help ensure

structure. that management directives are

carried out. Specific control

Factors reflected in the Control

procedures that are relevant to fs

Environment include:

audit would include:

P a g e | 11

Performance reviews Identify types of potential

Information processing misstatements that can occur

Physical controls Consider factors that affect the

Segregation of duties risk of material misstatements

Design the nature, timing, and

5. Monitoring extent audit procedures to be

performed

It is the process of assessing the

quality of internal control

2. Document the understanding of

performance over time. It involves

accounting and internal control

assessing the design and operation

systems

of controls on a timely basis and

taking necessary corrective actions. After obtaining sufficient knowledge

Monitoring is done to ensure that about the design of internal control

controls continue to operate system and verifying that the policies

effectively. and procedures are implemented, the

auditor needs to document his

understanding of accounting the

CONSIDERATION OF INTERNAL internal control systems using some of

CONTROL these commonly used forms of

documentation

Consideration of the entity’s internal

control system involves the following Narrative description

steps: Flowchart

Internal control questionnaire

1. Obtain understanding of the

internal control

3. Assess the level of control risk

This will involve evaluating the design

The auditor should make a

of the entity’s internal control by:

preliminary assessment of control risk,

Making inquiries of appropriate at the assertion level, for each

individuals material account balance or class

Inspecting documents and transactions. The auditor’s

records; and preliminary assessment of control risk

Observing of entity’s activities may be at a high level (not effective)

and operations or less than high level (effective/more

efficient to rely on)

After obtaining sufficient knowledge

about the design of the systems, the If assessed at a high level (100% / not

auditor should determine whether effective) no need to perform test of

these controls have been controls.

implemented by performing “walk-

If assessed at less than high level

through test”. Walk-through test also

(effective/more efficient to rely on)

confirms the auditor’s understanding

the auditor should

of how the accounting systems and

control procedures functions. Identify specific internal control

policies or procedures that are

The auditor uses the understanding of

likely to prevent or detect and

internal control to

P a g e | 12

correct material misstatement Using the result of test of control

relevant to fs assertion, and

As a result of this evaluation, the

Perform test of controls to

conclusion reached is called the

determine the effectiveness of

assessed level of control risk. The

such policies or procedures

auditor uses the assessed level of

control risk (together with the

4. Perform test of controls

assessed level of inherent risk) to

If preliminarily assessed at a less than determine the acceptable level of

high level, the auditor must test these detection risk. In this regard, the

controls to obtain evidence that they auditor may consider modifying:

are working effectively as the

The nature of substantive test

preliminary assessment suggests

from less effective to more

Test of controls are performed to effective procedures

obtain evidence about effectiveness The timing of substantive test by

of the design and operation of the performing them at year-end

internal controls. rather than at interim

The extent of substantive test

Test of controls generally consist of

from smaller to larger sample

one (or a combination) of the

size

following evidence gathering

techniques – inquiry, observation,

5. Document the assessed level of

inspection, and re-performance.

control risk

Timing of test of controls

If assessed at a high level, the auditor

Auditors usually perform test of should document his conclusion that

controls during an interim visit in control risk is at a high level

advance of period end. In

If assessed at less than high level, the

determining whether or not to test

auditor should document his

the remaining period, the following

conclusion that control risk is less

factors must be considered:

than high and the basis for the

The result of the interim test assessment which is actually the

The length of the remaining results of test of control. The auditor

period cannot assess control risk at less than

Whether changes have occurred high level without performing test of

in the accounting and internal control

control systems during the

AUDIT OBJECTIVES, PROCEDURES, EVIDENC

remaining period.

DOCUMENTATION

Substantive tests are audit

procedures designed to substantiate

Extent of test of control

the account balances or to detect

The auditor cannot possibly examine material misstatements in the fs.

all transactions related to certain

There are two types of substantive

control procedures. In an audit, the

tests:

auditor should determine the size of

sample sufficient to support the 1. Analytical procedures

assessed level of control risk.

P a g e | 13

When intending to perform analytical AUDIT EVIDENCE

procedures as substantive tests, the

Evidence refers to the information

auditor should focus on those

obtained by the auditor in arriving at

accounts that are predictable. The

the conclusions on which the audit

following generalizations may be

opinion is based

helpful in assessing the predictability

of the accounts. Underlying accounting data

refers to the accounting records

IS are more predictable

underlying the fs. These include

compared to BS account.

books of accounts, related

Accounts that are not subject to

accounting manuals, worksheet

management discretion are

supporting cost allocations and

generally predictable

reconciliations prepared by the

Relationships in a stable

client personnel

environment are more

Corroborating information

predictable than those in a

supporting the underlying

dynamic or unstable

accounting data obtained from

environment

client and other sources. This

includes documents such as

invoices, bank statements,

2. Test of details

purchase orders, contracts,

Test of details involves examining the checks and other information

actual detail making up the various obtained or developed by the

account balances. This approach may auditor through confirmation,

take the form of test of details of recalculation, observation, and

balances or test of details of reconciliation.

transactions.

QUALITIES OF EVIDENCE

Test of details of balances

Sufficiency refers to the amount of

involves direct testing of ending

evidence that the auditor should

balance of an account

accumulate.

Test of details of transactions

involves testing the transactions The following factors may be

which give rise to the ending considered in evaluating the

balance of an account sufficiency of evidence:

Effectiveness of substantive tests The competence of evidence

The materiality of the item

The potential effectiveness of the

being examined

auditor’s substantive test is affected

The risk involved in a particular

by its nature, timing and extent

account

Nature – high or low quality of Experience gained during

evidence to be gathered previous audit may indicate the

amount of evidence taken

Timing – substantive tests may

before and whether such

be performed at interim date or at

evidence was enough

year end

Extent – more or less extensive

P a g e | 14

Appropriateness is the measure of Assist the auditor in the planning,

performance, review and supervision of the

quality of audit evidence and its engagement.

relevance to a particular assertion and

its reliability. Secondary functions of the working

papers

Relevance relates the timeliness

of evidence and its ability to Planning future audits

satisfy the audit objective Providing information useful in

Reliability relates to the rendering other services

objectivity of evidence and is Providing adequate defense in

influenced by its source and by case of litigation

its nature Form, Content and Extent of Audit

While reliability of audit evidence is Documentation

dependent on individual circumstance, In deciding on the form, content and

the following generalizations could extent of audit documentation, the

help the auditor in assessing the auditor should consider what would

reliability of audit evidence: enable and experienced auditor,

Generated from outside sources having no previous connection with

over internally generated the audit, to understand:

If related accounting and The nature, timing, and extent,

internal control systems are of the audit procedures

effective, sources generated performed to comply with PSAs

internally are more reliable and applicable legal and

Obtained directly by the auditor regulatory requirements.

over obtained by the entity The results of the audit

Documents and written procedures and the audit

representations form over oral evidence obtained; and

representations Significant matters arising during

AUDIT DOCUMENTATION / the audit and the conclusion

WORKING PAPERS reached thereon

Working papers are records kept by Classification of working papers

the auditor that documents the audit In a continuing engagement, working

procedures applied, information papers are typically classified into

obtained and conclusions reached. permanent file or current working

PSA 30 requires the auditor to paper file:

document matters that are important

to support an opinion on fs, and 1. Permanent file – contains

evidence that the audit was information of continuing

conducted in accordance with PSA. significance to the auditor in

performing recurring audits.

Primary functions of the working 2. Current file – contains evidence

papers gathered and conclusions

Support the auditor’s opinion on fs reached relevant to the audit of

Support the auditor’s representation as to a particular year.

compliance with PSA.

P a g e | 15

Important guidelines on working control is not reliable

papers when in fact that it is

effective and can be

Owner – auditor

relied upon (risk of

Confidentiality – the auditor cannot under reliance); or

disclose confidential information to ii. In the case of

third parties unless under the substantive test, that

following circumstances: material

misstatements exists

a. When disclosure is required by

in an account balance

law or when the working papers

or transaction class

are subpoenaed by a court

when in fact such

b. When there is a professional

misstatement does

right to disclose information

not exist (risk of

such as when the auditor uses

incorrect rejection)

his working papers to defend

himself when sued by the client

b. Beta risk – is the risk the

for negligence

auditor will conclude,

Retention – 5 years (for SEC – 7 years) i. In the case of test of

control, that internal

Preparation – the auditor can use the

control is reliable

following techniques:

when in fact it is not

a. Heading effective and cannot

b. Indexing be relied upon (risk of

c. Cross-indexing / cross- over reliance)

referencing ii. In the case of

d. Tick marks substantive test, that

material

AUDIT SAMPLING AND COMPLETING THE AUDIT misstatement does

AND POST AUDIT RESPONSIBILITIES not exist when in fact

AUDIT SAMPLING material

PSA 530 defines audit sampling as misstatement does

exist (risk of incorrect

“The application of audit procedures acceptance)

to less than 100 % of the items within

an account balance or class of 2. Non – sampling risk – the risk

transactions such that all sampling that the auditor may draw

units have a chance of selection” incorrect conclusions because of

Risks in Sampling human errors such as,

application of inappropriate

1. Sampling risk – the risk that the audit procedures, failure to

sample selected for testing may recognize errors in the sample

not be truly representative of a tested, and misinterpretation of

population evidence obtained. This

a. Alpha risk – is the risk the includes all aspects of audit risk

auditor will conclude: that are not due to sampling

i. In the case of test of

control, that internal Minimizing risk in sampling

P a g e | 16

The only way to eliminate sampling

risk is to examine the entire

population but time and cost

constraints will prohibit the auditor in a. Attribute sampling

doing so, instead, auditors control A sampling plan used to

sampling risk by estimate the frequency of

occurrence of certain

Increasing the sample size; and

characteristics in a population

Using an appropriate sample

(occurrence rate)

selection method

Generally used when performing

Non-sampling risk, cannot be tests of controls to estimate the

eliminated even if the auditor rate of deviations from

examines the entire population. The prescribed internal control

risk, however, can be minimized by policies or procedures

Proper planning; and

b. Variable sampling

Adequate direction, review and

A sampling plan used to

supervision of the audit team

estimate a numerical

General Approaches to audit measurement of a population

sampling such as peso value

Generally used in performing

There are two sampling approaches

substantive tests to estimate the

that can be used by the auditor to

amount of misstatements in the

gather sufficient appropriate evidence:

fs

a. Statistical sampling – is a

Basic steps in auditing

sampling approach that

Uses random based selection of Audit procedures carried out by

sample; and means of sampling techniques require

Uses the law of probability consideration of at least the following

(mathematical formula) to basic steps:

measure sampling risk, making it 1. Define the objective of the test

quantifiable and evaluate 2. Determine the audit procedure

sample results to be performed

3. Determine the sample size

b. Non-statistical sampling – is a 4. Select the sample

sampling approach that purely 5. Apply the procedures

uses auditor’s judgment in 6. Evaluate the sample results

estimating sampling risks,

determining sample size and Sampling for test of controls

evaluating sample results.

Factors in determining the sample size

Audit Sampling Plans

1. Acceptable sampling risk – the

Audit sampling may be used when level of sampling risk the auditor

performing either tests of controls or is willing to accept. It has an

substantive tests. In instances inverse relationship with the

statistical sampling is used, it can be sample size.

either:

P a g e | 17

2. Tolerable deviation rate – the deviation rate, assess

maximum rate of deviations the control risk at a low

auditor is willing to accept, level, rely on internal

without modifying the planned control and perform less

degree of reliance on the extensive substantive

internal control. It has an tests.

inverse relationship with the 2. If the sampling deviation

sample size rate is barely lower than

3. Expected deviation rate – is the the tolerable deviation

rate of deviations the auditor rate:

expects to find in the population a. When using non-

before testing begins. It has a statistical sampling,

direct relationship with the assess control risk

sample size at a high level and

perform more

extensive

substantive tests.

PSA 530 has identified tree principal

b. When using

methods of selecting samples:

statistical sampling

1. Random number selection the auditor

2. Systematic selection determines the

3. Haphazard selection maximum

population

Other sampling applications for test

deviation rate by

of controls:

using a sampling

1. Sequential sampling (stop-or-go table or statistical

sampling) formula then

2. Discovery sampling compares vs. the

tolerable rate to

Evaluation of results

evaluate the sample

1. Determine the sample deviation results.

rate If the maximum

2. Compare the deviation rate vs deviation rate

tolerable deviation rate and exceeds the

draw an overall conclusion tolerable rate,

about the population. the auditor will

a. If sample deviation rate > assess control

the tolerable rate, assess risk at a high

control risk at a high level level and

and perform more perform more

extensive substantive tests. extensive

b. If sample deviation rate < substantive

the tolerable rate, consider tests.

allowance for sampling risk: If it does not

1. If the sampling deviation exceed, assess

rate is considerably control risk at a

lower than the tolerable low level, rely

P a g e | 18

on internal Sample Selection Methods

control and

When selecting a sample for

perform less

substantive test, the auditor may use

extensive

anyone of the sample selection

substantive

methods mentioned in earlier. In

tests.

addition, he may use:

Sampling for Substantive Tests

1. Stratified sampling – the auditor

Factors in Determining the Sample may divide or stratified the

Size population into meaningful

groups in order to decrease the

1. Acceptable sampling risk – for

effect of the variance within the

practical purposes, auditor use

population and allows the

the acceptable level of detection

auditor to give more emphasis

risk as the acceptable sampling

to those items with higher

after giving adequate

monetary value.

consideration to the risk that

2. Value weighted selection – the

analytical procedures may fail to

probability of an item to be

detect material misstatement in

selected in this method of

account balance. It has an

selection is directly proportional

inverse relationship with the

to the monetary value of such

sample size.

item.

2. Tolerable misstatement – the

maximum amount of Evaluation of results

misstatement that the auditor

1. Project the misstatements to

will permit in the population and

the population

still be willing to conclude that

Projecting misstatement can be

the account balance is fairly

accomplished using:

stated. It has an inverse

a. Ratio estimation – uses

relationship with the sample size.

the book values of the

3. Expected misstatement – the

population size and the

amount of misstatement that

sample size to project the

the auditor believes exists in the

misstatements

population. It has a direct

b. Difference estimation –

relationship with the sample size.

uses the number of

4. Variation in the population – In

customers to project

most cases, the peso amount,

misstatements to the

included in the population, tend

population

to vary significantly. When using

2. Compare the projected

statistical sampling, this

misstatement vs. the tolerable

variability is measured by the

misstatements and draw an

standard deviation. It has a

overall conclusion

direct relationship with the

a. If the projected

sample size. The auditor can

misstatement > tolerable

estimate the variation based on

misstatement, the auditor

the prior year’s tests results or

will conclude that the

pilot sample.

account balance is

P a g e | 19

materially misstated. In Subsequent Events

this case, the auditor may:

Classification:

i. Examine additional

units 1. Requiring adjustments – those

ii. Perform suitable that provide further evidence of

alternative conditions that existed at the

procedures balance sheet date

iii. Request the client to 2. Requiring disclosures – those

adjust the account that are indicative of conditions

balance that arose subsequent to the

balance sheet date

b. If the projected

Procedures to identify subsequent

misstatement < tolerable

events

misstatement, the auditor

should consider the 1. Inquire management about any

allowance for sampling risk. subsequent events

2. Review procedures management

Anomalous errors – errors or

has established to identify

misstatements arise from an isolated

subsequent events

event that has not recurred other

3. Review minutes of board of

than specifically identifiable occasions

directors and stockholder’s

and are therefore not representative

meeting

of errors in the population. Such

4. Read the latest available interim

errors should be excluded when

fs as well as management

projecting sample errors to the

reports such as budgets and

population. However, the effect of

forecasts

such errors must be considered

5. Inquire about litigation, claims

together with the projected errors in

and assessments

order to determine the combined

effect of the errors on the account Contingencies

balance or transaction class.

Litigations, claims, and assessment

COMPLETING THE AUDIT & POST

- PSA 501 requires the auditor to

AUDIT RESPONSIBILITIES

carry out procedures in order to

PROCEDURES become aware of any litigation

and claims

1. Identify subsequent events that

- Management is the primary

may affect the fs under audit

source of information about

2. Identify contingencies such as

litigation, claims, and

litigation, claims and assessment

assessment.

3. Obtain written management

- Auditor shall corroborate the

representation

information obtained from

4. Perform wrap-up procedures

management by asking the

client to send letters of audit

inquiry to lawyers

- A qualified or disclaimer of

opinion shall be issued if

management refuses to give the

P a g e | 20

auditor permission to 1. Should be addressed to the

communicate with the lawyer or auditor

if the lawyer refuses to reply 2. Date of written representations

- An unmodified opinion with shall be as near as practicable to,

emphasis if a matter paragraph but not after, the date of the

shall be issued if the lawyer is auditor’s report

unable to estimate the 3. Should be signed by the

likelihood of an unfavorable appropriate level of

outcome including the amount management who has the

of or range of potential loss primary responsibility for the fs

Wrap-up procedures

Procedures done at the end of the

audit, that generally cannot be

performed before the other audit

Management representation

work is complete. These include:

Form and Content of Written

1. Final analytical procedures

Representation

2. Evaluation of the entity’s ability

Form – representation letter to continue as a going concern

3. Evaluating audit findings and

Content

obtaining client’s approval for

1. A representation that the proposed adjusting entries

management has fulfilled its

Post audit responsibilities

responsibility for the

preparation and presentation of Auditor does not have any

the fs as set out in the terms of responsibility to perform additional

the engagement procedures after the fs are issued.

2. A representation that the fs are However, when the auditor becomes

prepared and presented in aware that the audit report issued in

accordance with the applicable connection with the fs may be

reporting framework inappropriate, he must take steps to

3. A representation that prevent future reliance on such report

management provided that

Auditing in CIS Environment

auditor with all relevant

Characteristics of CIS

information agreed in the terms

of the engagement, and that all Lack of visible transaction trails

transactions have been recorded Consistency of performance

and reflected in the fs Ease of access to Data and

4. A representation that describes Computer programs

management’s responsibilities Concentration of duties

as described in the terms of the Systems generated transactions

engagement Vulnerability of data and

5. Other representation required program storage media

by other PSAs Minimizing Risk in sampling

Basic Elements of a Written Internal Control in a CIS Environment

Management Representation

P a g e | 21

Control procedures used in manual Every computer system should

processing are also applied in a CIS have adequate security controls to

environment. When computer protect equipment, files and

processing is used in significant programs. Access to the computer

accounting applications, internal should be limited only to operators

control procedures can be classified and other authorized employees,

into two types: the use of passwords must be

adopted in order to protect data

1. General controls – are those

files and programs from

controls policies and procedures

unauthorized alteration

that relate to the overall

computer information system 4. Data recovery controls

2. Application controls – are those

A data recovery control provides

policies and procedures that

for the maintenance of back up

relate to specific use of the

files and off-site storage

system. These are designed to

procedures. Computer files should

provide reasonable assurance

be copied daily to tape or disks and

that all transactions are

secured off-site. In the event of

authorized, and that they are

disruption, reconstruction of files is

processed completely,

achieved by updating the most

accurately and on a timely basis.

recent back-up with subsequent

General Controls transaction data. When magnetic

tapes are used, a common practice

General controls include:

called Grandfather-father-son

1. Organizational controls practice requires entity to keep the

two most recent generations of

In a CIS environment, the plan of

master files and transaction files in

the organization for an entity’s

order to permit reconstruction of

computer system should include:

master files if needed.

a. Segregation between the CIS

5. Monitoring controls

department and user

departments Monitoring controls are designed

b. Segregation of duties within the to ensure that CIS controls are

CIS department working effectively as planned.

These include periodic evaluation

of the adequacy and effectiveness

of the overall CIS operations

conducted by persons within or

2. Systems development and outside the entity

documentation controls

Application Controls

Adequate systems documentation

Application controls include:

must be made in order to facilitate

the use of the programs as well as 1. Controls over input

changes that may be introduced

Input control are designed to provide

later into the system

reasonable assurance that data

3. Access controls submitted for processing are

P a g e | 22

complete, properly authorized and input documents and the CIS

accurately translated into machine output.

readable form. Some examples of It ignores the client’s data

input controls include: processing procedures

Input data are simply reconciled

Key verification

with the output to verify the

Limit check

accuracy of processing

Field check

Can only be used if there are

Control totals

visible input documents and

Validity check detailed output that will enable

Self-checking digit the auditor to trace individual

2. Controls over processing transactions back and forth

Processing controls are designed to This is also known as “block box

provide reasonable assurance that approach” because it does not permit

input data are processed accurately direct assessment of actual processing

and that data are not lost, added, of transaction.

excluded, duplicated or improperly

changed. Computer Assisted Audit Techniques

(CAATs)

3. Controls over output

It is used when computer

Output controls are designed to accounting systems perform

provide reasonable assurance that tasks for which no visible

the results of processing are evidence is available, it may be

complete, accurate and that these impracticable for the auditor to

outputs are distributed only to test manually.

authorized personnel.

CAATs are computer programs

Test of Controls in a CIS Environment and data which the auditor uses

as part of the audit procedures

Testing the reliability of general

to process data of audit

controls may include observing

significance contained in an

client’s personnel in performing their

entity’s information systems.

duties; inspecting program

documentation; and observing the This is also known as “white box

security measures in force. In testing approach” because the auditor will

application controls, the auditor may have to audit directly the client’s

either: computer program using CAATs. Some

of the commonly used CAATs include:

Audit around the computer

Use computer-assisted audit 1. TEST DATA

techniques The test data technique is primarily

Auditing Around the computer designed to test the effectiveness

of the internal control procedures

It involves examination of which are incorporated in the

documents and reports and client’s computer program. The

determine the reliability of the objective of the test data technique

system, focusing solely on the is to determine whether the

client’s computer programs can

P a g e | 23

correctly handle valid and invalid 1. Snapshots

conditions as they arise.

It involves taking a picture of

2. INTEGRATED TEST FACILITY (ITF) transaction as it flows through the

computer systems. Audit software

By using the method of processing

routines are embedded at different

test data simultaneously with

points in the processing logic to

client’s data, ITF provides

capture the images of the

assurance that the program tested

transaction as it progresses

by the auditor is the same program

through the various stages of

used by the client in processing

processing. Such a technique

transactions.

permits an auditor to track data

3. PARALLEL SIMULATION and evaluate the computer

processes applied to the data.

The simulated program is used to

reprocess transactions that were 2. Systems control audit review

previously processed by the client’s files (SCARF)

program. The auditor compares

This involves embedding audit

the results obtained from the

software modules within an

simulation with the client’s output

application system to provide

to be able to make inference about

continuous monitoring of the

the reliability of the client’s

systems transaction. The

program. Parallel simulation can

information is collected into a

be accomplished using:

special computer file that the

a. Generalized audit auditor can examine.

software

THE AUDITOR’S REPORT ON THE FS

Consist of generally available General purpose fs – FS prepared in

computer packages which accordance with a general purpose

have been designed to framework.

perform common audit tasks

General purpose framework – A

such as performing or

financial reporting framework

verifying calculations,

designed to meet the common

summarizing and totaling files,

financial information needs of a wide

and reporting in a format

range of users. The financial reporting

specified by the auditor.

framework may be a fair presentation

b. Purpose written programs framework or a compliance

framework.

These are designed to

perform audit tasks in specific Unmodified report (unqualified)

circumstances. These

The most common type of audit

programs may be developed

report contains a clear opinion or an

by the auditor, the entity

unmodified opinion. The unmodified

being audited or an outside

opinion may be issued only when the

programmer hired by the

following conditions have been met:

auditor.

CAATS for Advanced Computer

Systems

P a g e | 24

The fs are fairly stated in 3. Inappropriate or inadequate

accordance with applicable disclosure

Financial Reporting Framework.

SCOPE LIMITATION

The audit was performed in

accordance with PSA. A limitation on the scope of the

auditor’s work may be imposed by the

BASIC ELEMENTS OF UNMODIFIED

client or imposed by circumstances:

REPORT

1. Circumstances beyond the

1. Title

control of the entity such as

2. Addressee

inadequacy of accounting

3. Auditor’s opinion

records

4. Basis for opinion

2. Circumstances relating to the

5. Material uncertainty related to

nature or timing of the auditor’s

going concern

work like when the auditor is

6. Key audit matters (if listed entity)

engaged only after client’s fiscal

7. Responsibilities for the fs

year ends.

8. Auditor’s responsibilities for the

3. Limitations imposed by

audit of the fs

management like when

9. Report on other legal and

management prevents the

regulatory requirements (if

auditor from requiring external

listed entity)

confirmation of specific accounts

10. Name of the engagement

partner MATERIALITY AND PERVASIVENESS

11. Signature of the auditor CONSIDERATION

12. Auditor’s Address

If the magnitude of misstatements is

13. Date of the Auditor’s

material enough to affect the readers

Report

of the fs, but not enough to

MODIFICATION TO THE OPINION overshadow the fair presentation

taken as a whole, the auditor would

1. Material Misstatements

most likely express a qualified opinion.

a. Material but not

On the other hand, if the auditor

pervasive – qualified

believes that the effect of the

b. Material and pervasive -

misstatements is highly material and

adverse

pervasive as to render the overall fs

2. Scope Limitations

misleading, the auditor would most

a. Material but not

likely express an adverse opinion.

pervasive – qualified

b. Material and pervasive – BASIS FOR MODIFICATION OF

disclaimer of opinion PARAGRAPH

MATERIAL MISSTATEMENT This paragraph should be placed

immediately before the opinion

A material misstatement of the fs may

paragraph with appropriate heading

arise from:

such as “Basis for qualified opinion”

1. Inappropriate accounting policy “Basis for Adverse opinion” or “Basis

selected for Disclaimer of opinion”

2. Misapplication of selected

1. Material misstatement

accounting policy; or

P a g e | 25

a. Description of the nature There are instances when the auditor

of the misstatement or an considers it necessary to

explanation of how the communicate a matter other than

disclosure is misstated those that are presented or disclosed

b. Quantification of the in the fs that, in the auditor’s

financial effects of the judgment, is relevant to users’

misstatements or a understanding of the audit, the

disclosure of omitted auditor’s responsibilities or the

information, if practicable. auditor’s report.

2. Scope limitation

It is required to include another

If the modification results from

matter paragraph on the following

an inability to obtain sufficient

circumstances:

appropriate audit evidence, the

basis of the modification a. Reporting on comparative

paragraph shall only explain the information

reason for inability b. Material inconsistency between

the fs and other information

EMPHASIS OF A MATTER

c. Fs are prepared using more than

An emphasis of a matter paragraph is one financial framework

included in the report to draw the d. Limiting the use of auditor’s

reader’s attention to a matter report

presented or disclosed in the fs that, e. Subsequent discovery of facts

in the auditor’s judgment, is of such

OTHER ASSURANCE AND NON-ASSURA

importance that it is fundamental to

SERVICES

the reader’s understanding, the

SPECIAL PURPOSE AUDIT

auditor.

ENGAGEMENS

Special purpose fs – fs prepared in

It is necessary to include an Emphasis accordance with a special purpose

of a matter paragraph on the framework

following circumstances:

Special purpose framework – a

a. Uncertainty relating to the financial reporting framework

future outcome of exceptional designed to meet the financial

litigation or regulatory action information needs of specific users.

b. Early application of new The financial reporting framework

accounting standard in advance may be a fair presentation framework

of its effective date or a compliance framework.

c. Major catastrophe that has a

Examples are:

significant effect on the entity’s

fs A tax basis of accounting for a

d. A subsequent discovery of facts set of fs that accompany an

affecting the previously issued entity’s tax return

opinion The cash receipts and

e. Fs prepared using a special disbursements basis of

purpose framework accounting for cash flow

OTHER MATTER PARAGRAPH information that an entity may

P a g e | 26

be requested to prepare for difference in the information

creditors presented in the fs

The financial reporting

Special Purpose Audit Engagement

provisions established by a

Report

regulator to meet the

requirements of that regulator; The auditor’s report on special

or purpose fs shall include an emphasis

The financial reporting of a matter paragraph alerting the

provisions of a contract, such as users of the auditor’s report that the

a bond indenture, a loan fs are prepared in accordance with a

agreement, or a project grant special purpose framework and that,

as a result, the fs may not be suitable

When accepting the special purpose

for another purpose.

audit engagement the auditor should:

In an audit of special purpose fs, the

auditor shall obtain an understanding A. Non- Audit Engagements:

of: Procedures and Reports

a. The purpose for which the fs are Review

prepared

Objective: To enable the CPA to

b. The intended users; and

report whether anything has come to

c. The steps taken by management

his attention that would indicate that

to determine that the applicable

the fs are not fairly presented.

financial reporting framework is

acceptable in the circumstances. Level of assurance provided by the

CPA Moderate / limited assurance

When Planning and performing the

special purpose audit engagement Type of report issued: Negative

Assurance (Review report)

1. The auditor shall determine

whether application of the PSAs Basic Procedures performed: Inquiry

requires special consideration in and Analytical procedures

the circumstances of the

Independence required? Yes / No:

engagement

YES

2. The auditor should obtain an

understanding of the entity’s If the auditor has reason to believe

selection and application of that the information subject to review

accounting policies. In the case may be materially misstated, the

of fs prepared in accordance auditor should carry out additional or

with the provisions of a contract, more extensive procedures as are

the auditor shall obtain an necessary to be able to express

understanding of any significant negative assurance or to confirm that

interpretations of the contract a modified report is required

that management made in the

In case of:

preparation of those fs. An

interpretation is significant 1. Material misstatements

when adoption of another a. Express a qualification of

reasonable interpretation would the negative assurance

have produced a material

P a g e | 27

b. When the effect of the B. Projections – is prepared on the

matter is so material and basis of hypothetical assumptions of

pervasive to the fs that the mixture of best-estimate and

auditor concludes that a hypothetical assumptions.

qualification is not

Auditor’s Responsibility

adequate to disclose the

misleading or incomplete When examining prospective financial

nature of the fs, give an information, according to PSAE 3400,

adverse statement that the the auditor should obtain sufficient

fs are not presented fairly, appropriate evidence that:

in all, material respects, in

1. Management’s best-estimate

accordance with PFRS.

assumptions are reasonable and,

in the case of hypothetical

2. Scope limitation

assumptions, such assumptions

a. Express a qualification of

are consistent with the purpose

the negative assurance

of the information

provided regarding the

2. The prospective financial

possible adjustments to

information properly prepared

the fs that might have

on the basis of the assumptions;

been determined to be

3. The prospective financial

necessary had the

statement is properly presented

limitation not existed; or

and all material assumptions are

b. When the possible effect

adequately disclosed

of the limitation is so

4. The prospective financial

significant and pervasive

information is prepared on a

that the auditor concludes

consistent basis with historical fs

that so level of assurance

can provide, the auditor Evidence may be available to support

should not provide any the assumptions on which the

assurance. financial information is based, such

evidence is itself generally future

oriented and speculative in nature.

Examination of Prospective Financial Therefore, the auditor is not in a

Information position to express an opinion as to

whether the result shown in the

Prospective financial information

prospective financial information will

means financial information based on

be achieved

assumption about events that may

occur in the future possible actions of It may be difficult for the auditor to

the entity. There are two types of obtain a level of satisfaction sufficient

prospective financial information: to express an opinion that the

assumptions are free from material

A. Forecast – is prepared on the

misstatement, therefore, when

basis of the assumption as to future

reporting on the reasonableness of

events which management expects to

management’s assumptions, the

take as of the date the information is

auditor normally provides only a

prepared (best-estimate assumptions)

moderate level of assurance

P a g e | 28

Level of assurance provided by the

CPA: No assurance

B. Non-assurance engagements

Type of Report issued: Identification

Agreed-upon procedures

of financial information compiled

Objective: To carry out audit (Compilation Report)

procedures agreed on with the client

Basic procedures performed: Prepare

and any appropriate third parties

/ Assemble Financial Statements

identified in the report

based on client’s data

Level of assurance provided by the

Independence required? Yes/no: No

CPA: No assurance

The financial information compiled by

Type of report issued: Description of

the accountant should contain a

procedures performed and factual

reference such as “Unaudited”,

findings

“Compiled without Audit or Review”

Basic Procedures performed: or “Refer to Compilation Report” on

Procedures will be performed as each page of the financial information

agreed or on the front of the complete set of

financial statements

Independence required? Yes / No:

No. In case of:

This type of engagement may be 1. Material misstatement

accepted provided: a. The accountant should

disclose the nature of the

The client takes full

misstatement in a separate

responsibility for the adequacy

paragraph of the report,

of the procedures to be

although their effects do

performed; and

not have to be qualified

The distribution of the report is b. If the accountant feels that

limited only to those parties the modification of the

who have agreed about the report is not sufficient to

procedures to be performed describe the significant

The report is restricted to those PFRS departures and the

parties that have agreed to the client is not willing to

procedures to be performed correct these deficiencies,

the accountant, may

The auditors should ensure with withdraw from, the

representatives of the entity and, engagement

ordinarily, other specified parties who 2. Scope limitation

will receive copies of the report of - Scope limitation will normally

factual findings, that there is a clear cause the accountant to

understanding regarding the agreed withdraw from the engagement

procedures and the conditions of the

engagement SPECIAL AND OTHER RELATED TOPIC

AUDITING ACCOUNTING ESTIMATES

Compilation

Based on PSA 540, “Accounting

Objective: To assist the client in the

estimate” means an

preparation of the fs

P a g e | 29

approximation of the amounts owners, directors, officers including

of an item in the absence of a their immediate families.

precise means of measurement

The auditor needs to be aware of

The auditor must be specifically

them because:

careful in considering accounts

that are affected by accounting PFRS requires disclosures in the

estimates because the risk of fs of certain related party

material misstatement is greater relationships and transactions

when accounting estimates are A related party transaction may

involved be motivated by other than

Management is responsible for ordinary business considerations

making accounting estimates such as profit sharing or even

included in the fs fraud.

The existence of related parties

Auditor’s Responsibility

or related party transactions

The auditor’s responsibility is to may affect the financial

obtain sufficient appropriate evidence statements and the reliability of

as to whether: audit evidence

Accounting estimate is properly Management’s Responsibility

accounted for and disclosed

Management is responsible for the

Accounting estimate is

identification and disclosure of related

reasonable in the circumstances

parties and transactions with such

The auditor may use one or a parties which requires management

combination of the following to implement adequate accounting

approaches when evaluating the and internal control systems to ensure

reasonableness of accounting that transactions with related parties

estimates: are appropriately identified in the

accounting records and disclosed in

Review and test the process the fs

used by the management to

develop the estimate Auditor’s Responsibility

Make an adequate estimate The auditor should obtain and review

Review subsequent events information provided by the directors

which confirm the estimate and management identifying the

made names of all known related parties

RELATED PARTIES and related party transactions

“Related party” refers to persons or When related party transactions are

entities that may have dealings with identified, the auditor should obtain

one another in which one party has sufficient appropriate evidence that

the ability to exercise significant these are properly accounted for and

influence or control over the other disclosed in the fs. The auditor should

party in making financial and also obtain a written representation

operating decisions. These would from management concerning the

include entity’s associates, principal completeness of information provided

regarding the identification of related

P a g e | 30

parties and the adequacy of related is seeking audit

party disclosures in the fs evidence

b. The objectivity of the

USING THE WORK OF AN EXPERT

expert may be impaired if

An expert is a person or firm the expert is

possessing special skill, knowledge i. Employed by the

and experience in a particular field entity

other than accounting and auditing. ii. Related in some

other manner to the

An expert may be:

entity

Engaged by the entity 2. Evaluating the scope of the

Engaged by the auditor expert’s work

Employed by the entity; or PSA 620 requires the auditor to

Employed by the auditor obtain sufficient appropriate

evidence that the scope of the

When determining the need to use auditor’s work is adequate for

the work of an expert, the auditor the purpose of the audit. This

would consider: understanding should cover:

The materiality of the fs item The objectives and scope of the

being considered expert’s work

The risk of misstatement based Methods and assumptions to be

on the nature and complexity of used by the expert

the matter being considered; The intended use by the auditor

and of the expert’s work

The quality and quantity of other Form and content of the

audit evidence available expert’s report

Expert’s relationship to the

When the auditor concludes that the client

work of the expert is needed to

support an assertion, the auditor 3. Assessing the work of the expert

should: The auditor should assess the

1. Assessing the expert’s appropriateness of the expert’s

competence and objectivity work as audit evidence

a. The following factors must regarding the financial

be considered when statement assertion being

assessing the competence considered

of the expert: If the results of the expert’s

i. Professional work do not provide sufficient

certification or appropriate evidence or the

licensing by, or results are not consistent with

membership in, an other evidence, the auditor

appropriate should resolve the matter by

professional body discussing it with the client and

ii. Experience and the expert or performing

reputation in the field additional procedures, including

in which the auditor possibly engaging the services of

another expert

P a g e | 31

CONSIDERING THE WORK OF Audit planning

INTERNAL AUDITING Consideration of internal control

Audit objectives, procedures, evidence a

Internal auditing is an appraisal

documentation

activity established within an entity as

Audit sampling & Completing the audit a

a service to the entity. Considering

post-audit responsibilities

the work of internal auditor involves

two important phases: Auditing in CIS environment

Other assurance and non-assurance servic

1. Making a preliminary Special and other related topics

assessment of internal auditing Code of Ethics (pdf)