Академический Документы

Профессиональный Документы

Культура Документы

Index: A Study of Credit Cards in Indian Scenario

Загружено:

rohitИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Index: A Study of Credit Cards in Indian Scenario

Загружено:

rohitАвторское право:

Доступные форматы

A Study Of Credit Cards In Indian Scenario.

Index

Sr. Title Page

No. No.

01 Introduction 01

02 Importance Of The Study 01

03 Objective Of The Study 02

04 Hypothesis Of The Study 03

05 Need Of Credit Card 03

06 Limitations Of The Study 04

07 Research Methodology 05

08 Analysis And Interpretation 05

09 Conclusion 06

10 Bibliography 06

11 Chapterisation Scheme 07

Study Center - Brijlal Biyani Science Collage, Amravati (YCMOU)

Page | 1

A Study Of Credit Cards In Indian Scenario.

Introduction

What Is a Credit Card?

A credit card allows you to borrow money to buy things. There can be a cost to

borrowing that money (you might pay interest and fees), but there can also be a benefit (you

might earn rewards and build your credit.)

A credit card allows you to borrow money from a bank to make purchases, whether

you’re buying a burger or a round-trip ticket to France. As long as you pay back the money you

borrow within the “grace period” of 25-30 days, you don’t have to pay extra. If you don’t pay it

back in that time period, you’ll have to pay interest — a percentage of the money you owe the

bank — on top of what you borrowed.

Importance of the study

When used responsibly, a credit card can help you build a good credit history, allowing

you to get loans at favorable interest rates, cheaper insurance and even a new cellular plan.

Credit cards can also help you earn rewards on your everyday purchases and protect those

purchases in case of theft or damage.

Having a healthy credit profile is important for everything from opening a new credit card to

renting an apartment — even for joining a new cell phone plan.

The only way to build a healthy credit profile is to use credit responsibly, which includes holding

accounts, and paying everything off on time.

Fortunately, that doesn't mean you need to take on debt or pay interest fees — as long as you

spend within your means and pay off your cards in full each month, you'll never pay interest,

and you won't carry any debt.

A great credit card that you can open and use to help build your credit profile is the Freedom

Unlimited from Chase.

Study Center - Brijlal Biyani Science Collage, Amravati (YCMOU)

Page | 2

A Study Of Credit Cards In Indian Scenario.

Objective of the study

They encourage this by offering the consumer rewards. They do take some of the risk

due to fraud. The bank that issued the card makes money from interest and fees, in addition to

their portion of the swipe fee. The failure of the consumer to pay their balance is the

responsibility of the issuing bank.

Continue our efforts to drive a robust compliance and control culture throughout the bank

through targeted measures that take account of the changing operating environment.

Take steps to address the implications of the UK's decision to leave the EU in order to minimize

disruption to the business and to clients.

Focus on generating capital in order to return it to shareholders; our long-term objective is to

distribute around 50% of profits to shareholders for 2019 and 2020.

Develop methodologies and tools for the alignment of credit portfolios with the Paris Climate

Agreement, working with other banks.

Launch pilot phase to define internal climate risk terminology and measure certain sector

exposures against defined climate scenarios.

Review and further develop Credit Suisse's sector policies and guidelines for sensitive

industries.

Continue to engage with peers and industry groups for the development of environmental and

social (E&S) due diligence approaches and the improvement of E&S disclosure.

Study Center - Brijlal Biyani Science Collage, Amravati (YCMOU)

Page | 3

A Study Of Credit Cards In Indian Scenario.

Hypothesis of the study

The cause and effect relationship between credit cards and spending has yet to be

adequately explored.

Credit card holders are doing Extra expenses due to facility of credit received through

credit cards.

Credit card holders are increasing their monthly liabilities through credit cards.

Income of Commercial Banks from issuing credit cards is increasing day by day.

NEED OF CREDIT CARDS

Easy Access To Credit

The biggest advantage of a credit card is its easy access to credit. Credit cards function on a

deferred payment basis, which means you get to use your card now and pay for your purchases

later. The money used does not go out of your account, thus not denting your bank balance

every time you swipe.

Building A Line Of Credit

Credit cards offer you the chance to build up a line of credit. This is very important as it allows

banks to view an active credit history, based on your card repayments and card usage. Banks

and financial institutions often look to credit card usage as a way to gauge a potential loan

applicant’s creditworthiness, making your credit card important for future loan or rental

applications.

EMI Facility

If you plan on making a large purchase and don’t want to sink your savings into it, you can

choose to put it on your credit card as a way to defer payment. In addition to this, you can also

Study Center - Brijlal Biyani Science Collage, Amravati (YCMOU)

Page | 4

A Study Of Credit Cards In Indian Scenario.

choose to pay off your purchase in equated monthly installments, ensuring you aren’t paying a

lump sum for it and denting your bank balance. Paying through EMI is cheaper than taking out a

personal loan to pay for a purchase, such as a television or an expensive refrigerator.

Limitations of the study

These cards leads to overspending on the part of the holder and as such may

disorganize the organization’s cash budget and cash planning.

Limited as to the activities they can finance as they are ideal for financing working

capital items and not fixed assets in which case they are not a profitable source of finance.

They are expensive to obtain and maintain because of associated cost such as ledger

fees, registration, insurance, commission expenses, renewal fees etc.

It is a short-term source and is open only to a few establishments in which case a

company can obtain goods and services from those establishments that can accept them.

Entail a lot of formalities to obtain e.g. guarantees, presentation of bank statements and

even charging assets that are partially pledged to secure expenses that may be incurred using

these cards.

They may be misused by dishonest employees who may use them to defraud the

organization off goods and services which may not benefit such organizations.

Credit card organization may suspend the use of such cards without notice and this will

inconvenience the holder who may not meet his/her ordinary needs obtained through these

cards.

Study Center - Brijlal Biyani Science Collage, Amravati (YCMOU)

Page | 5

A Study Of Credit Cards In Indian Scenario.

Research METHODOLOGY

Research Type

A research design is a clear plan about the research. The type of the study is Exploratory.

Method of Data Collection

The task of data collection begins after a research problem has been defined and research

design chalked out. The data collected are primary and secondary data.

Sampling Methods

The sampling design of the research study consists of the following categories namely

employed persons, professionals and others. The respondents of the sample size are 100.

Sample Design

Under Non probability technique convenience sampling is being used. When the population

elements are selected for inclusion in the sample based on the ease of access, it is called

Convenience sampling. This method is also known as accidental sampling because the

respondents whom the researcher meets accidentally are included in the sample.

Data Analysis and Interpretation

The data collected will be analyzed with the help of relevant statistical tools.

CONCLUSION

The conclusion and suggestion of the will be clear after data collection and

interpretation of the statistical process in study.

Study Center - Brijlal Biyani Science Collage, Amravati (YCMOU)

Page | 6

A Study Of Credit Cards In Indian Scenario.

BIBlIOGRAPHY

1. https://www.nerdwallet.com/blog/nerdscholar/credit-card/

2. https://www.businessinsider.com/why-you-should-use-credit-cards-2018-1

3. https://www.credit-suisse.com/corporate/en/responsibility/approach-

reporting/objectives-achievements.html

4. https://www.scribd.com/document/18007997/1-Introduction-2-Objectives-3-Need-for-

the-Study-4

5. http://mtstcil.org/skills/budget-12.html

6. http://studentsrepo.um.edu.my/3437/7/chapter_3.pdf

7. http://www.ijstm.com/images/short_pdf/1422605647_432.pdf

8. https://www.academia.edu/9996970/A_Study_on_Customers_Satisfaction_Towards_Cr

edit_Card_Services_Provided_by_State_Bank_of_India_with_Special_Reference_to_Coi

mbatore_City

Study Center - Brijlal Biyani Science Collage, Amravati (YCMOU)

Page | 7

A Study Of Credit Cards In Indian Scenario.

CHAPTERISATION SCHEME

Chapter No. 1 Introduction

Chapter No. 2 Organization Profile & Review Of Literatures

Chapter No. 3 Research Methodology

Chapter No. 4 Data Analysis & Interpretation

Chapter No. 5 Conclusion, Bibliography

Research guide research student

(prof. neeta honrao madam ) (Prasad p. kale)

Date - prn no. 2018017000473382

Place - amravati

Study Center - Brijlal Biyani Science Collage, Amravati (YCMOU)

Page | 8

Вам также может понравиться

- Regional Rural Banks of India: Evolution, Performance and ManagementОт EverandRegional Rural Banks of India: Evolution, Performance and ManagementОценок пока нет

- A Synopsis On " A Study of Credit Cards in Indian Scenario."Документ11 страницA Synopsis On " A Study of Credit Cards in Indian Scenario."Wifi Internet Cafe & Multi ServicesОценок пока нет

- Research On Credit CardДокумент22 страницыResearch On Credit CardMayank Arora0% (1)

- Yogita Project 1Документ15 страницYogita Project 1Hemraj PatilОценок пока нет

- Plastic Money in IndiaДокумент46 страницPlastic Money in IndiaShrutikaKadam71% (7)

- Questionnaire On Relevance of Plastic MoneyДокумент5 страницQuestionnaire On Relevance of Plastic MoneyKayzad Madan100% (1)

- Credit Card InfoДокумент79 страницCredit Card Info888 Harshali polОценок пока нет

- A Study On Credit CardsДокумент49 страницA Study On Credit CardsSai Charan100% (1)

- Review of Literature PDFДокумент33 страницыReview of Literature PDFTanvi bhatteОценок пока нет

- 03 Liteature ReviewДокумент8 страниц03 Liteature ReviewSanjana Mitra100% (1)

- Usage of Plastic MoneyДокумент35 страницUsage of Plastic MoneyMaryam Zaidi60% (5)

- A Study On Perception of Consumer Towards Digital Payment DoneДокумент71 страницаA Study On Perception of Consumer Towards Digital Payment DoneMayur MoreОценок пока нет

- Popularity of Credit Cards Issued by Different BanksДокумент25 страницPopularity of Credit Cards Issued by Different BanksNaveed Karim Baksh75% (8)

- Literature ReviewДокумент3 страницыLiterature Reviewkumarrdv450% (1)

- Project On E-BankingДокумент64 страницыProject On E-BankingRamandeep Singh50% (2)

- Review of Literatur1Документ4 страницыReview of Literatur1anjana100% (1)

- Plastic Money in IndiaДокумент35 страницPlastic Money in IndiatarachandmaraОценок пока нет

- Plastic Money in IndiaДокумент71 страницаPlastic Money in IndiaDexter LoboОценок пока нет

- Growth of The Use of Plastic Money in IndiaДокумент46 страницGrowth of The Use of Plastic Money in IndiaHarshitGupta81% (21)

- Online Banking Services Icici BankДокумент10 страницOnline Banking Services Icici BankMohmmedKhayyumОценок пока нет

- Finance Project On Various Credit Schemes of SBIДокумент46 страницFinance Project On Various Credit Schemes of SBItaanvi00783% (6)

- Project Report On Plastic Money in IndiaДокумент44 страницыProject Report On Plastic Money in Indiayogitajadhav7984% (69)

- Project Report For MBA Named Consumer's Awareness and Perception About Credit CardДокумент2 страницыProject Report For MBA Named Consumer's Awareness and Perception About Credit Cardkeertheswaran60% (5)

- Introduction of Plastic MoneyДокумент33 страницыIntroduction of Plastic MoneyDeepali Jain87% (15)

- ProjectДокумент50 страницProjectkomalpreetdhirОценок пока нет

- A Study On Customer Awareness Towards e Banking.. B. GopichandДокумент11 страницA Study On Customer Awareness Towards e Banking.. B. Gopichandaurorashiva1Оценок пока нет

- Introduction of E CommerceДокумент2 страницыIntroduction of E CommerceAkanksha KadamОценок пока нет

- Plastic Money Word FileДокумент60 страницPlastic Money Word Fileshah sanket100% (1)

- Personal LoanДокумент31 страницаPersonal LoanAravindVenkatraman100% (1)

- Customer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)Документ10 страницCustomer Awareness and Preference Towards E-Banking Services of Banks (A Study of SBI)aurorashiva1Оценок пока нет

- It in BankingДокумент92 страницыIt in BankingRitika Tiku100% (1)

- Plastic Money IntroДокумент70 страницPlastic Money IntroParm Sidhu100% (13)

- E BankingДокумент10 страницE BankingsureshsusiОценок пока нет

- Synopsis On Education LoansДокумент10 страницSynopsis On Education Loansshriya guptaОценок пока нет

- A Study of Digital Payment in India and Perspective of Consumer AdoptionДокумент2 страницыA Study of Digital Payment in India and Perspective of Consumer Adoptionmahbobullah rahmani0% (1)

- Research Methodology On Credit Card HoldersДокумент134 страницыResearch Methodology On Credit Card Holdersaishwarya100% (4)

- Impact of Covid 19 On Digital Transaction in IndiaДокумент55 страницImpact of Covid 19 On Digital Transaction in IndiapiyushОценок пока нет

- Customer Perception Towards Internet Banking PDFДокумент17 страницCustomer Perception Towards Internet Banking PDFarpita waruleОценок пока нет

- Innovation in Banking SectorДокумент21 страницаInnovation in Banking Sectoruma2k10Оценок пока нет

- A Project Report OnДокумент109 страницA Project Report Onpiyu211sarawagigmail50% (2)

- Consumer Behaviour On Credit CardsДокумент17 страницConsumer Behaviour On Credit Cardsjonyshakya67% (3)

- Project On The Comparative Study of Debit Cards Vis - Visards Vis 2D E0 2dvis ISO-8859-1 Q Credit Cards 2edocДокумент286 страницProject On The Comparative Study of Debit Cards Vis - Visards Vis 2D E0 2dvis ISO-8859-1 Q Credit Cards 2edocgagan_benipal7265100% (4)

- PrefaceДокумент6 страницPrefaceArpit GuptaОценок пока нет

- THEJASWINI ProjectДокумент112 страницTHEJASWINI Projectswamy yashuОценок пока нет

- A Study On Electronic Payment System in IndiaДокумент67 страницA Study On Electronic Payment System in IndiaAvula Shravan Yadav50% (2)

- Credit Card Industry in IndiaДокумент28 страницCredit Card Industry in Indiashahin14372% (18)

- A Study On Lending and Recovery Project-1Документ96 страницA Study On Lending and Recovery Project-1Cenu Roman67% (3)

- Online Banking Services Icici BankДокумент51 страницаOnline Banking Services Icici BankMubeenОценок пока нет

- A Comparative Study of E-Banking in Public andДокумент10 страницA Comparative Study of E-Banking in Public andanisha mathuriaОценок пока нет

- Consumer Perception and Attitude Towards Credit Card UsageДокумент20 страницConsumer Perception and Attitude Towards Credit Card UsageSrikanthcherala67% (3)

- Credit CardДокумент80 страницCredit CardSk Mobiles100% (1)

- Dissertation On Credit CardsДокумент8 страницDissertation On Credit CardsPaperWritingServicesBestSingapore100% (1)

- Winter PRJCT SynopsisДокумент15 страницWinter PRJCT SynopsisNitu Saini100% (1)

- Analyze The Correlation Between The Credit Facilities and Buyer'S Purchasing HabitДокумент12 страницAnalyze The Correlation Between The Credit Facilities and Buyer'S Purchasing Habittacky_018Оценок пока нет

- School of Management 203Документ80 страницSchool of Management 203Monesh DemblaОценок пока нет

- Consumer Awareness On Credit CardsДокумент11 страницConsumer Awareness On Credit Cardskartik palavalasaОценок пока нет

- Customer Satisfaction and Credit Procedure Study of Citifinancial Personal LoansДокумент93 страницыCustomer Satisfaction and Credit Procedure Study of Citifinancial Personal Loansanon_103901460Оценок пока нет

- A Dissertation ON Retail BankingДокумент160 страницA Dissertation ON Retail Bankinghello2gauravОценок пока нет

- Professor, Dept. of International Business Faculty of Business Studies, University of DhakaДокумент12 страницProfessor, Dept. of International Business Faculty of Business Studies, University of DhakaOtoshi AhmedОценок пока нет

- 17 PDFДокумент12 страниц17 PDFmuqadam buttОценок пока нет

- OglalaДокумент6 страницOglalaNandu RaviОценок пока нет

- 576 1 1179 1 10 20181220Документ15 страниц576 1 1179 1 10 20181220Sana MuzaffarОценок пока нет

- Robot MecanumДокумент4 страницыRobot MecanumalienkanibalОценок пока нет

- Tugas Conditional Sentences YanneДокумент3 страницыTugas Conditional Sentences Yanneyanne nurmalitaОценок пока нет

- Term-2 - Grade 8 Science (Biology) Mock Paper-2Документ3 страницыTerm-2 - Grade 8 Science (Biology) Mock Paper-2bhagat100% (1)

- GearsДокумент14 страницGearsZulhilmi Chik TakОценок пока нет

- Applied Nutrition: Nutritional Consideration in The Prevention and Management of Renal Disease - VIIДокумент28 страницApplied Nutrition: Nutritional Consideration in The Prevention and Management of Renal Disease - VIIHira KhanОценок пока нет

- The Changeling by Thomas MiddletonДокумент47 страницThe Changeling by Thomas MiddletonPaulinaOdeth RothОценок пока нет

- Your Free Buyer Persona TemplateДокумент8 страницYour Free Buyer Persona Templateel_nakdjoОценок пока нет

- CU 8. Johnsons Roy NeumanДокумент41 страницаCU 8. Johnsons Roy NeumanPatrick MatubayОценок пока нет

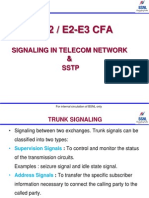

- Signalling in Telecom Network &SSTPДокумент39 страницSignalling in Telecom Network &SSTPDilan TuderОценок пока нет

- Gandhi Was A British Agent and Brought From SA by British To Sabotage IndiaДокумент6 страницGandhi Was A British Agent and Brought From SA by British To Sabotage Indiakushalmehra100% (2)

- Calendar of Cases (May 3, 2018)Документ4 страницыCalendar of Cases (May 3, 2018)Roy BacaniОценок пока нет

- GN No. 444 24 June 2022 The Public Service Regulations, 2022Документ87 страницGN No. 444 24 June 2022 The Public Service Regulations, 2022Miriam B BennieОценок пока нет

- Barangay Sindalan v. CA G.R. No. 150640, March 22, 2007Документ17 страницBarangay Sindalan v. CA G.R. No. 150640, March 22, 2007FD BalitaОценок пока нет

- Insomnii, Hipersomnii, ParasomniiДокумент26 страницInsomnii, Hipersomnii, ParasomniiSorina TatuОценок пока нет

- Theater 10 Syllabus Printed PDFДокумент7 страницTheater 10 Syllabus Printed PDFJim QuentinОценок пока нет

- Problem ManagementДокумент33 страницыProblem Managementdhirajsatyam98982285Оценок пока нет

- Focus Charting of FДокумент12 страницFocus Charting of FRobert Rivas0% (2)

- Creative Nonfiction 2 For Humss 12 Creative Nonfiction 2 For Humss 12Документ55 страницCreative Nonfiction 2 For Humss 12 Creative Nonfiction 2 For Humss 12QUINTOS, JOVINCE U. G-12 HUMSS A GROUP 8Оценок пока нет

- Biology - Solved ExamДокумент27 страницBiology - Solved ExamlyliasahiliОценок пока нет

- Long 1988Документ4 страницыLong 1988Ovirus OviОценок пока нет

- Functions & Role of Community Mental Health Nursing: Srinivasan AДокумент29 страницFunctions & Role of Community Mental Health Nursing: Srinivasan AsrinivasanaОценок пока нет

- The 5 RS:: A New Teaching Approach To Encourage Slowmations (Student-Generated Animations) of Science ConceptsДокумент7 страницThe 5 RS:: A New Teaching Approach To Encourage Slowmations (Student-Generated Animations) of Science Conceptsnmsharif66Оценок пока нет

- Atul Bisht Research Project ReportДокумент71 страницаAtul Bisht Research Project ReportAtul BishtОценок пока нет

- Ergatividad Del Vasco, Teoría Del CasoДокумент58 страницErgatividad Del Vasco, Teoría Del CasoCristian David Urueña UribeОценок пока нет

- Eternal LifeДокумент9 страницEternal LifeEcheverry MartínОценок пока нет

- Pentecostal HealingДокумент28 страницPentecostal Healinggodlvr100% (1)

- Infusion Site Selection and Infusion Set ChangeДокумент8 страницInfusion Site Selection and Infusion Set ChangegaridanОценок пока нет

- Final Presentation BANK OF BARODA 1Документ8 страницFinal Presentation BANK OF BARODA 1Pooja GoyalОценок пока нет