Академический Документы

Профессиональный Документы

Культура Документы

At Handout 3 RA 9298

Загружено:

xernathanАвторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

At Handout 3 RA 9298

Загружено:

xernathanАвторское право:

Доступные форматы

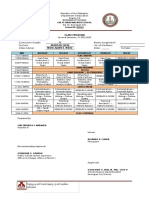

AUDITING THEORY HAND-OUT # 3

I. Fundamentals of Auditing and Assurance Services

B. Introduction to Auditing

Republic Act No. 9298 – PHILIPPINE ACCOUNTANCY ACT OF 2004

(and its Implementing Rules and Regulations)

Objectives of the Philippine Accountancy Act (Sec. 3):

a) The standardization and regulation of accounting education;

b) The examination for registration of CPAs; and

c) The supervision, control, and regulation of the practice of accountancy in the

Philippines.

Scope of Practice of Accountancy (Sec. 4):

Practice of accountancy shall include, both not limited to the following:

1. Practice of Public Accountancy – Practice of public accountancy shall constitute in a

person, be it his/her individual capacity, or as a partner or as a staff member in an

accounting or auditing firm, holding out himself/herself as one skilled in the knowledge,

science and practice of accounting, and as a qualified person to render professional

services as a certified public accountant; or offering or rendering, or both, to more than

one client on a fee basis or otherwise, services such as:

a. The audit or verification of financial transaction and accounting records

b. The preparation, signing, or certification for clients of reports of audit, balance

sheet, and other financial, accounting and related schedules, exhibits, statements

or reports which are to be used for publication or for credit purposes, or to be filed

with a court or government agency, or to be used for any other purpose

c. The design, installation, and revision of accounting system

d. The preparation of income tax returns when related to accounting procedures

e. The representation of clients before government agencies on tax and other matters

related to accounting

f. Renders professional assistance in matters relating to accounting procedures and

the recording and presentation of financial facts or data

2. Practice in Commerce and Industry – Practice in commerce and industry shall

constitute in a person:

a. Involved in decision making requiring professional knowledge in the science of

accounting, (as well as the accounting aspects of finance and taxation); or

b. When the CPA represents his employer before government agencies on tax and

other matters related to accounting

c. When such employment or position requires that the holder thereof must be a

CPA.

The IRR provides that business or company in the private sector should employ

a duly registered CPA if:

Paid-up capital is at least P5.0 million; and/or

Annual revenue is at least P10.0 million

3. Practice in Education / Academe – Practice in education or the academe shall

constitute in a person in an educational institution which involve teaching of

accounting, auditing, management advisory services, finance, business law, taxation,

and other technically related subjects.

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

A CPA is considered to be engaged in the practice of accountancy in education /

academe if he/she is employed in educational institutions as teachers of

accounting, auditing, MAS, (accounting aspects of) finance, business law,

taxation and other technically related subjects.

Members of the Integrated Bar of the Philippines (IBP) may be allowed to teach

business law and taxation subjects.

The position of either the Dean or department chairman (or its equivalent) that

supervises the BSA program of an educational institution is deemed to be in

practice of accountancy in the academic /education and therefore must be

occupied only by a duly registered CPA.

4. Practice in Government – Practice in the government shall constitute in a person who

holds, or is appointed to, a position in an accounting professional group in

government or in a government-owned and/or controlled corporation, including those

performing proprietary functions, where decision making requires professional

knowledge in the science of accounting, or where a civil service eligibility as a CPA is

a prerequisite.

Limitations of the Practice of Public Accountancy (Sec. 28):

Single practitioners (individual CPAs) and Partnership of CPAs shall be registered CPAs

in the Philippines.

The SEC shall not register any corporation organized for the practice of public

accountancy. In other words, corporation form of CPA firm is not allowed.

A certificate of accreditation issued only after showing that the registrant has acquired

the minimum 3 years meaningful experience in any of the areas of accountancy

(whether in the public accountancy, commerce and industry, education/academe and

government)

Certificate of Accreditation – a certificate under seal, issued by the PRC upon the

recommendation by the BOA, attesting that Individual CPAs, including the staff

members thereof, firms including the sole proprietors and the staff members thereof

and partnerships of CPAs including the partners and the staff members thereof, are

duly accredited to practice public accountancy in the Philippines.

Definition of Meaningful Experience:

In Public practice

Shall include:

At least 1 year as audit assistant and

At least 2 years as auditor-in-charge of audit engagements

covering full audit functions of significant clients

In Commerce and Includes significant involvement in:

Industry General accounting, budgeting and tax administration

Internal auditing and liaison officer

Representing his/her employer before government

agencies on tax and matters related to accounting or any

other related functions

In the Academe Shall include:

or Education Teaching for at least 3 trimesters or 2 semesters subjects in

either financial accounting, business law and tax, auditing

problems, auditing theory, financial management and

management services

Provided, that the accumulated teaching experience on

these subjects shall not be less than 3 school years

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

In Government Includes significant involvement in:

General accounting, budgeting, tax administration, internal

auditing, liaison with the COA, and any other related

functions

Prohibition in the Practice of Accountancy (Sec. 26):

Non-CPAs:

Are not allowed to practice accountancy in the Philippines

Cannot use the title “Certified Public Accountant” or “CPA”

Should not indicate (thru display or use any title, sign, card, advertisement, or other

device) that he practices or offers to practice accountancy or that he is a CPA

Non-Filipino professional accountants/CPAs:

Are also not allowed to practice accountancy in the Philippines, unless:

a. Through foreign reciprocity (without restriction)

b. With valid temporary/special permit duly issued by the BOA and the PRC (limited to

what was permitted)

Professional Regulatory Board of Accountancy (BOA) (Sec. 5):

The BOA is the official government agency empowered to enforce RA 9298.

BOA is under the supervision and administrative control of the Professional Regulation

Commission (PRC)

1. Composition of BOA:

a. BOA shall be composed of a chairman and 6 members (all of which are to be

appointed by the President of the Philippines)

b. BOA shall elect a vice-chairman from among its members for a term of 1 year.

According to the IRR, the 4 sectors in the practice of accountancy shall as much

as possible be equitably represented in the BOA.

2. Qualifications of BOA members (Sec. 6):

At the time of appointment, he/she must be:

a. Natural-born citizen and a resident of the Philippines;

b. Duly registered CPA with at least 10 years of work experience in any scope of

practice of accountancy

c. Of good moral character and must not have been convicted of crimes involving

moral turpitude

d. Not have any pecuniary interest, directly or indirectly, in any school, college,

university or institution conferring an academic degree necessary for admission

to the practice of accountancy (those that offer BSA degree) or where review

classes in preparation for the licensure examination are being offered or

conducted (such as RESA, PRTC and CPAR), nor shall he/she be a member of

the faculty or administration thereof at the time of his/her appointment to the

BOA, and

e. Not be a director/officer of the APO (PICPA) at the time of his/her appointment –

this is an additional requirement under the IRR

3. Term of office of BOA members (Sec. 7):

The Chairman and the members of the BOA members shall hold office for a term

of 3 years.

Any vacancy during the term of a member shall be filled up for the unexpired

portion of the term only. Appointment to fill up an unexpired term is not to be

construed as a complete term.

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

No person who has served 2 successive complete terms shall be eligible for

reappointment until the lapse of 1 year.

No person shall serve in the BOA for more than 12 years. (addition under the

IRR)

4. Powers and Functions of the BOA (Sec. 9):

The BOA shall exercise the following specific powers, functions and responsibilities:

a. To prescribe and adopt the rules and regulations necessary for carrying out the

provisions of this Act (RA 9298)

b. To supervise the registration, licensure and practice of accountancy in the

Philippines;

c. To administer oaths

d. To issue, suspend, revoke, or reinstate the Certificate of Registration for the

practice of the accountancy profession

e. To adopt its own official seal

f. To prescribe and/or adopt a Code of Ethics for the practice of accountancy

g. To monitor the conditions affecting the practice of accountancy and adopt such

measures, including promulgation of accounting and auditing standards, rules

and regulations and best practices as may be deemed proper for the

enhancement and maintenance of high professional, ethical, accounting and

auditing standards

h. To conduct an oversight into the quality of audits of financial statements through

a review of the quality control measures

i. To investigate violations of this Act as IRR, to issue summons, subpoena and

subpoena ad testificandum and subpoena duces tecum to violators or witness

thereof and compel their attendance to such investigation or hearings and the

production of documents in connection therewith

j. The Board may, motu propio in its discretion, make such investigations as it

deems necessary to determine whether any person has violated any provisions

of this law, any accounting or auditing standard or rules duly promulgated by the

BOA as part of the rules governing the practice of accountancy

k. To issue a cease or desist order to any person, association, partnership or

corporation engaged in violation of any provision of this Act, any accounting or

auditing standards or rules duly promulgated by the BOA as part of the rules

governing the practice of accountancy in the Philippines

l. To punish for contempt of the BOA, both direct and indirect, in accordance with

the pertinent provisions of and penalties prescribed by the Rules of Court

m. To prepare, adopt, issue or amend the syllabi of the subjects for examinations in

consultation with the academe, determine and prepare questions for the

licensure examination which shall strictly be within the scope of the syllabi of the

subjects for examinations as well as administer, correct and release the results

of the licensure examinations

n. To ensure, in coordination with the Commission on Higher Education (CHED) or

other authorized government offices that all higher educational instruction and

offering of accountancy comply with the policies, standards and requirements of

the course prescribed by CHED or other authorized government offices in the

areas of curriculum, faculty, library and facilities; and

o. To exercise such other powers as may be provided by law as well as those

which may be implied from, or which are necessary or incidental to the carrying

out of, the express powers granted to the BOA to achieve the objectives and

purposes of this Act.

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

5. Grounds for Suspension or Removal of BOA Members (Section 11):

The President of the Philippines, upon the recommendation of the PRC may suspend

or remove any BOA member on the following grounds:

a. Neglect of duly or incompetence

b. Violation or tolerance of any violation of RA 9298 and its IRR or the CPA Code of

Ethics and the technical and professional standards of practice for CPAs

c. Final judgment of crimes involving moral turpitude

d. Manipulation or rigging of the CPA's licensure examination results, disclosure of

secret and confidential information in the examination questions prior to the

conduct of the said examination or tampering of grades.

The President’s power to appoint carries with it the power to suspend or

removed a BOA member based on the abovementioned grounds.

When a member of the BOA has been sued of crimes involving moral turpitude,

it is not a valid ground for suspension or removal of BOA members.

FRSC and AASC (Section 9-A):

The Financial Reporting Standards Council (FRSC) shall be composed of fifteen (15)

members with a Chairman who had been or presently a senior accounting practitioner in

any of the scope of accounting practice and fourteen (14) representatives from the

following: BOA, SEC, BSP, BIR, a major organization composed of preparers and users

of financial statements, COA, PICPA-8 (2 each from public practice, commerce and

industry, academe/education, government)

The Auditing and Assurance Standards Council (AASC) shall be composed of fifteen

(15) members with a Chairman who had been or presently a senior practitioner in public

accountancy and fourteen (14) representatives from the following: BOA, SEC, BSP, an

association or organization of CPAs in active public practice of accountancy, COA,

PICPA-9 (6 from public practice, 1 each from commerce and industry,

academe/education, government)

The Chairman and members of the FRSC and AASC shall be appointed by the

Commission (PRC) upon the recommendation of the Board (BOA) in coordination with

APO (PICPA)

Education Technical Council (ETC) (Section 9-B):

Assists BOA in continuously upgrading accounting education in the Philippines

1. Functions of the ETC:

a. Determine a minimum standard curriculum for the study of accountancy to be

implemented in all schools offering accountancy as an undergraduate degree.

b. Established teaching standards, including the qualifications of members of the

faculty of schools and colleges of accountancy.

c. Monitor the progress of the program on the study of accountancy and

undertaking measures for the attainment of a high quality of accountancy

education in the country.

d. Evaluate periodically the performance of educational institution offering

accountancy education.

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

2. ETC Composition/Membership:

Seven (7) members: Chairman (had been or presently a senior accounting

practitioner in the academe/education), BOA, Accredited National Professional

Organization of CPAs – PICPA-5 (2* from academe/education and 1 each from

public practice, commerce and industry and government)

*1 private school and 1 public school offering Bachelor of Science in

Accountancy

Appointment - The Chairman and members of the ETC shall be appointed by the

PRC upon the recommendation of the BOA in connection with the APO (PICPA).

Term of office - The Chairman and the members of the ETC shall have a term of

3 years renewable for another term.

CPA Examinations (Section 13):

All applicants for registration for the practice of accountancy shall be required to undergo a

licensure examination to be given by the BOA in such places and dates as the PRC may

designate subject to compliance with the requirements prescribed by the PRC in accordance

with Republic Act No. 8981.

1. Qualifications of Applicants for CPA Examinations:

a. Must be a Filipino citizen

b. Must be of good moral character

c. Must be a holder of the degree of BSA conferred by a school, college, academy

or institute duly recognized and/or accredited by the CHED or other authorized

government offices, and

d. Has not been convicted of any criminal offense involving moral turpitude

2. Scope of Examinations (Section 15):

Revisions made by BOA:

BOA Resolution 2015-262: prescribing the six (6) new subjects of the Board

Licensure Examination for CPA (BLECPA) (see table below for the six subjects)

BOA Resolution 2015-274 for the syllabi of the 6 new subjects of BLECPA

BOA Resolution 2015-275 for the Table of Specifications (TOS) of the 6 new

subjects of BLECPA

BLECPA subjects shall be initially applied in the May 2016 schedule of licensure

examination

To include the topic Effective Communication to Stakeholders in all of the 6

subjects of BLECPA

To include the topics Code of Ethics of Professional Accountants in the

Philippines, RA 9298 or the Philippine Accountancy Act of 2004 and its

Implementing Rules and Regulations

The Board Licensure Examination for CPA (BLECPA) shall be composed of two

(2) parts with the corresponding percentage weights:

Subject Theoretical Practical/ Practice/

Competence

Financial Accounting and Reporting 30% 70%

Advanced Financial Accounting and Reporting 30% 70%

Management Advisory Services 30% 70%

Auditing 50% 50%

Taxation 30% 70%

Regulatory Framework for Business Transaction 70% 30%

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

3. Rating in the CPA Examinations (Sec. 16):

To pass the CPA exams – 75%; 65%: A candidate must obtain at least a general

average of 75%, with no grades lower than 65% in any given subject.

Conditional status: If a candidate obtains a rating of 75% and above in at least a

majority of the subjects tested, he/she will be given conditional credits for the

subjects passed.

4. Removal Examination:

The candidates with conditional status shall take an examination in the remaining

subjects within 2 years from the preceding examination.

If the candidate fails to obtain at least a general average of 75% and a rating of

at least 65% in each of the subjects reexamined, he/she shall be considered as

failed in the entire examination.

The original exam and the removal exam are counted as one exam only.

5. Candidates required to take Refresher Course (Sec. 18):

Any candidate who fails in 2 complete CPA exams shall be disqualified from

taking another set of examinations unless he/she submits evidence to the

satisfaction of the BOA that he/she enrolled in and completed a refresher course

with at least 24 units of subjects given in the CPA exams.

The examination in which the candidate was conditioned together with the

removal examination on the subject in which he/she failed shall be counted as

one complete examination.

The IRR provides that the required refresher course (whether regular or special

refresher course) shall be offered only by an educational institution granting a

degree of BSA.

Oath (Section 19):

All successful candidates in the CPA examination, prior to entering upon the practice

of the profession, shall be required to take an oath of profession before:

a. Any member of the BOA; or

b. Any government official authorized by the PRC; or

c. Any person authorized by law to administer oaths

Issuance of Certificates of Registration and Professional Identification Card (Sec. 20):

a. Certificate of Registration – a certificate under seal bearing a registration

number, issued to an individual, by the PRC, upon recommendation by the BOA,

signifying that the individual has complied with all the legal and procedural

requirements for such issuance including, in appropriate cases, having

successfully passed the CPA licensure examination

A certificate of registration shall be issued to examinees who passed the

CPA licensure examination subject to payment of fees prescribed by the

PRC.

The Certificate of Registration shall bear the signature of the chairperson of

the PRC and the chairman and members of the BOA, stamped with the

official seal of the PRC and of the BOA, indicating that the person named

therein is entitled to the practice of the profession with all the privileges

appurtenant thereto. The said certificate shall remain in full force and effect

until withdrawn, suspended or revoked.

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

b. Professional Identification Card – a card with validity of 3 years bearing the

registration number, date of issuance with an expiry date, due for periodic

renewal, duly signed by the Chairperson of the PRC issued by the PRC to a

registered CPA upon payment of the annual registration fees for 3 years

Certificate of Registration – has no expiry; shall remain in full force

until/unless withdrawn, suspended or revoked

Professional Identification Card – subject to expiry; renewable every 3 years

Grounds for Refusal to Issue Certificate of Registration and Professional ID (Sec. 23):

The BOA shall not register and issue a certificate of registration and professional

identification card to any successful examinee due to the following grounds:

a. Convicted by a court of competent jurisdiction of a criminal offense involving moral

turpitude or

b. Guilty of immoral and dishonorable conduct or

c. Of unsound mind

The BOA shall not register either, any person who has falsely sworn, or

misrepresented himself/herself in his/her application for examination.

Registration shall not be refused and a name shall not be removed from the roster of

CPAs on conviction for a political offense (or for an offense, in the opinion of the

BOA, that does not disqualify a person from practicing accountancy)

Suspension and Revocation of Certificates of Registration and Professional

Identification Card and Cancellation of Special Permit (Sec. 24):

The BOA shall have the power, upon due notice and hearing, to:

a. Suspend or revoke the practitioner’s certificate of registration and professional

identification card

b. Suspend him/her from the practice of his/her profession

c. Cancel his/her special permit

Causes or Grounds for Suspension/Revocation/Cancellation:

Convicted by a court of competent jurisdiction of a criminal offense involving moral

turpitude or

Guilty of immoral and dishonorable conduct or

Of unsound mind

Any unprofessional or unethical conduct

Malpractice

Violation of any of the provisions of this Act and its IRR

Violation of the CPA‘s Code of Ethics and the technical and professional standards of

practice for CPAs

Reinstatement, Reissuance and Replacement of Revoked or Lost Certificates (Sec.

25):

The BOA may, after the expiration of 2 years from the date of revocation of a certificate of

registration and upon application and for reasons deemed proper and sufficient, reinstate the

validity of a revoked certificate of registration and in so doing, may, in its discretion, exempt

the applicant from taking another examination.

Ownership of Working Papers (Sec. 29):

All working papers, schedules and memoranda made by a CPA and his staff in the course of

an examination, including those prepared and submitted by the client, incident to or in the

course of an examination, by such CPA, except reports submitted by a CPA to a client shall

be treated confidential and privileged and remain the property of such CPA in the absence of

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

a written agreement between the CPA and the client, to the contrary, unless such

documents are required to be produced through subpoena issued by any court, tribunal, or

government regulatory or administrative body.

Working papers – owned/property of the CPA/Practitioner

Practitioner must observe the rule on confidentiality (subject to certain exceptions

such as production of documents through subpoena issued by any court, tribunal, or

government regulatory or administrative body).

Accredited Professional Organization (APO) – PICPA (Sec. 30):

All registered CPAs whose names appear in the roster of CPAs shall be united and

integrated through their membership in a one and only registered and accredited national

professional organization of registered and licensed CPAs, which shall be registered with the

SEC as a nonprofit corporation and recognized by the BOA, subject to the approval by the

PRC.

The members in the said integrated and accredited national professional organization shall

receive benefits and privileges appurtenant thereto upon payment of required fees and dues.

Membership in the integrated organization shall not be a bar to membership in any other

association of CPA.

Continuing Professional Education (CPE) Program (Sec. 32):

Rationale: Voluntary compliance with the CPE program is an effective and credible

means of ensuring competence, integrity and global competitiveness of professional in

order to allow them to continue the practice of their profession.

CPE Objective:

a. To provide and ensure the continuous education of a registered professional with

the latest trends in the profession brought about by modernization and scientific

and technological advancements;

b. To raise and maintain the professional's capability for delivering professional

services;

c. To attain and maintain the highest standards and quality in the practice of his

profession;

d. To make the profession globally competitive; and

e. To promote the general welfare of the public.

Continuing Professional Education (CPE) – refers to the inculcation assimilation and

acquisition of knowledge, skills, proficiency and ethical and moral values, after the

initial registration of a professional that raise and enhance the professional's technical

skills and competence

CPE program – consists of properly planned and structured activities, the

implementation of which requires the participation of a determinant group of

professionals to meet the requirements of voluntarily maintaining and improving the

professional standards and ethics of the profession

All CPAs shall comply with the rules and regulations on CPE.

CPE credit units: 60 credit units for 3 years, minimum of 15 credit units shall be earned

in each year.

Exemption from CPE requirement:

Permanent exemption: Upon reaching the age of 65 years old

Temporary exemption: If the following conditions are met:

a. During their stay abroad for at least 2 years immediately prior to the date of

renewal; and

b. Working or practicing his/her profession or furthering his/her studies abroad

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

Seal and Use of Seal (Sec. 33):

All licensed CPAs shall obtain and use a seal of a design prescribed by the BOA

bearing the registrant’s name, registration number and title.

The auditor’s reports shall be stamped with said seal, indicating therein his/her current

Professional Tax Receipt (PTR) number, date/place of payment when filed with

government authorities or when used professionally.

Foreign Reciprocity (Sec. 34):

A person not a citizen of the Philippines may be allowed to practice accountancy in the

Philippines:

Where there is foreign reciprocity (in accordance with provisions of existing laws,

international treaty obligations including mutual recognition agreements entered into by

the Philippine government with other countries)

Upon presentation of proof that his country admits citizens of the Philippines to the

practice of accountancy without restriction

Coverage of Temporary or Special Permits (Sec. 35):

Special / temporary permit may be issued by the BOA subject to the approval of the PRC

and payment of the fees the latter has prescribed and charged thereof to the following

Foreign CPAs:

a. A foreign CPA called for consultation or for a specific purpose which, in the judgment

of the BOA, is essential for the development of the country: Provided, That his/her

practice shall be limited only for the particular work that he/she is being engaged:

Provided, further, That there is no Filipino CPA qualified for such consultation or

specific purposes;

b. A foreign CPA engaged as professor, lecturer or critic in fields essential to

accountancy education in the Philippines and his/her engagement is confined to

teaching only; and

c. A foreign CPA who is an internationally recognized expert or with specialization in any

branch of accountancy and his/her service is essential for the advancement of

accountancy in the Philippines.

Penal Provisions (Sec. 36):

Any person who shall violate any of the provisions of this Act or any of its IRR shall, upon

conviction, be punished by:

Fine – not less than P 50,000.00, or

Imprisonment – for a period not exceeding 2 years, or

Both

References:

Republic Act No. 9298 (Philippine Accountancy Act of 2004)

http://boa.com.ph/cpa-exam/

Prepared by: Jonathan Rex M. Quirino Date: 8/15/2016

Вам также может понравиться

- Feasibility Study VS Business PlanДокумент12 страницFeasibility Study VS Business PlanMariam Oluwatoyin Campbell100% (1)

- The Professional Practice of AccountingДокумент21 страницаThe Professional Practice of AccountingNash-tumeMacaraob50% (2)

- The Regulation and Practice of the Accountancy ProfessionДокумент14 страницThe Regulation and Practice of the Accountancy ProfessionRhia Mae Pacelo100% (1)

- MODULE 2 The Professional Practice of AccountingДокумент21 страницаMODULE 2 The Professional Practice of AccountingMary Grace Dela CruzОценок пока нет

- Audit Theory Quiz Compilation v1Документ44 страницыAudit Theory Quiz Compilation v1De Nev OelОценок пока нет

- Roque CPA Reviewer Auditing ch2 Final PDFДокумент52 страницыRoque CPA Reviewer Auditing ch2 Final PDFSherene Faith Carampatan100% (3)

- Essays Patterns and PerspectivesДокумент7 страницEssays Patterns and PerspectivestheLucky1100% (3)

- ESL Tutoring ContractДокумент1 страницаESL Tutoring ContractInternational Tutoring Association100% (4)

- Auditing Theory Schoology Quiz 01 AnswersДокумент11 страницAuditing Theory Schoology Quiz 01 AnswersMin Yoongi100% (3)

- Logo Here Auditing Theory Philippine Accountancy Act of 2004Документ35 страницLogo Here Auditing Theory Philippine Accountancy Act of 2004KathleenCusipagОценок пока нет

- Q1 - Philippine Accountancy Act of 2004, Code of EthicsДокумент10 страницQ1 - Philippine Accountancy Act of 2004, Code of EthicsPrankyJellyОценок пока нет

- 2019 Brief History and Nature of DanceДокумент21 страница2019 Brief History and Nature of DanceJovi Parani75% (4)

- CPA exam review: Key provisions of the Philippine Accountancy ActДокумент12 страницCPA exam review: Key provisions of the Philippine Accountancy ActJudy Ann ImusОценок пока нет

- Auditing in A Computer Information Systems (CIS) EnvironmentДокумент4 страницыAuditing in A Computer Information Systems (CIS) EnvironmentxernathanОценок пока нет

- RA 9298: Philippine Accountancy Act of 2004Документ12 страницRA 9298: Philippine Accountancy Act of 2004Alex OngОценок пока нет

- RPMS Portfolio Cover Page For MTsДокумент90 страницRPMS Portfolio Cover Page For MTsMarry Lee Ambrocio Ajero100% (3)

- Finance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersОт EverandFinance for Nonfinancial Managers: A Guide to Finance and Accounting Principles for Nonfinancial ManagersОценок пока нет

- Ra 9298 Accountancy Act of 2004Документ10 страницRa 9298 Accountancy Act of 2004Jerome Reyes100% (1)

- Module in Math: Place Value of 3-Digit NumbersДокумент13 страницModule in Math: Place Value of 3-Digit NumbersMarites Espino MaonОценок пока нет

- Acr Portfolio DayДокумент4 страницыAcr Portfolio DayNica Salentes100% (2)

- Phil. Accountancy Act of 2004Документ8 страницPhil. Accountancy Act of 2004emc2_mcvОценок пока нет

- At Professional Responsibilities and Other Topics With AnswersДокумент27 страницAt Professional Responsibilities and Other Topics With AnswersShielle AzonОценок пока нет

- Consideration of Internal ControlДокумент7 страницConsideration of Internal Controlemc2_mcv100% (1)

- Detailed Lesson Plan on "The StrangerДокумент3 страницыDetailed Lesson Plan on "The StrangerNhelia Mae Ebo Abaquita100% (1)

- Poverty and Inequality PDFДокумент201 страницаPoverty and Inequality PDFSílvio CarvalhoОценок пока нет

- Guthrie A History of Greek Philosophy AristotleДокумент488 страницGuthrie A History of Greek Philosophy AristotleLuiz Henrique Lopes100% (2)

- Phil Accountancy Act of 2004Документ8 страницPhil Accountancy Act of 2004Mixx MineОценок пока нет

- Republic Act NoДокумент48 страницRepublic Act NoBryzan Dela CruzОценок пока нет

- 1 - The Accountancy ProfessionДокумент3 страницы1 - The Accountancy ProfessionJames Martin ArriesgadoОценок пока нет

- Lecture Notes - RA 9298Документ3 страницыLecture Notes - RA 9298Samantha Kate NatividadОценок пока нет

- Lecture Notes - RA 9298Документ3 страницыLecture Notes - RA 9298Samantha Kate NatividadОценок пока нет

- IFRS PrelimДокумент9 страницIFRS PrelimChandria SimbulanОценок пока нет

- Lesson 4 - Professional RegulationsДокумент51 страницаLesson 4 - Professional RegulationsS RОценок пока нет

- FEU Mkti - at Lecture 2 Professional Practice of AccountingДокумент10 страницFEU Mkti - at Lecture 2 Professional Practice of AccountingmarkОценок пока нет

- Module #03 - The Professional Practice of AccountingДокумент6 страницModule #03 - The Professional Practice of AccountingRhesus UrbanoОценок пока нет

- RA 9298 Philippines Accountancy Act of 2004Документ9 страницRA 9298 Philippines Accountancy Act of 2004A BbОценок пока нет

- Auditing and AssuranceДокумент4 страницыAuditing and AssuranceSalmairah Balty AmoreОценок пока нет

- AT.3501_-_The_Professional_Practice_of_Accountancy_(2)Документ9 страницAT.3501_-_The_Professional_Practice_of_Accountancy_(2)RINCONADA ReynalynОценок пока нет

- Module 11 Section 9Документ8 страницModule 11 Section 9Donise Ronadel SantosОценок пока нет

- Lesson 5Документ27 страницLesson 5Ramon AlpitcheОценок пока нет

- Practice Test 2 - Auditing Theory 2023Документ57 страницPractice Test 2 - Auditing Theory 2023April Rose Sobrevilla DimpoОценок пока нет

- Professional Development for Future Accountants: Core Acctng 14Документ27 страницProfessional Development for Future Accountants: Core Acctng 14James FloresОценок пока нет

- 04 The Professional Practice of AccountingДокумент10 страниц04 The Professional Practice of AccountingJane DizonОценок пока нет

- Learning Objectives: at The End of The Lesson, The Learner Will Be Able ToДокумент12 страницLearning Objectives: at The End of The Lesson, The Learner Will Be Able ToBielan Fabian GrayОценок пока нет

- Accounting 1Документ4 страницыAccounting 1Maui Jean KimОценок пока нет

- RA 9298 ProposedДокумент21 страницаRA 9298 ProposedAlex OngОценок пока нет

- H2 Accounting ProfessionДокумент9 страницH2 Accounting ProfessionTrek ApostolОценок пока нет

- The Legal ContextДокумент13 страницThe Legal ContextLeny Joy DupoОценок пока нет

- Seatwork Phil Accountancy Act of 2004Документ9 страницSeatwork Phil Accountancy Act of 2004Mixx MineОценок пока нет

- Philippine Accountancy Act of 2004Документ6 страницPhilippine Accountancy Act of 2004jeromyОценок пока нет

- RA 9298 - Accountancy LawДокумент7 страницRA 9298 - Accountancy LawJen AnchetaОценок пока нет

- 01 Practice and Regulation of The Accountancy ProfessionДокумент18 страниц01 Practice and Regulation of The Accountancy Professionxara mizpahОценок пока нет

- The Accountancy ProfessionДокумент5 страницThe Accountancy ProfessionCezanne Pi-ay EckmanОценок пока нет

- Bsa 3104 - Module 1 Professional Practice of AccountingДокумент13 страницBsa 3104 - Module 1 Professional Practice of Accountingrhiz cyrelle calanoОценок пока нет

- Repealed PD 692 Known As Revised Accountancy LawДокумент8 страницRepealed PD 692 Known As Revised Accountancy LawLian RamirezОценок пока нет

- The Professional Practice of AccountingДокумент16 страницThe Professional Practice of AccountingMichiko Kyung-soonОценок пока нет

- Philippine Accountancy ActДокумент9 страницPhilippine Accountancy ActPrince DoomedОценок пока нет

- REVIEWERДокумент14 страницREVIEWERgrace bruanОценок пока нет

- The Accountancy Profession - Downloadable - 0Документ9 страницThe Accountancy Profession - Downloadable - 0Geoffer DeeОценок пока нет

- Poa 2Документ3 страницыPoa 2batistillenieОценок пока нет

- Module 1 Accountancy ProfessionДокумент39 страницModule 1 Accountancy ProfessionNicole ConcepcionОценок пока нет

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент10 страницBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledRommel PaleroОценок пока нет

- Ra 9298Документ9 страницRa 9298JessicaGonzalesОценок пока нет

- Audit Assurance MidtermДокумент8 страницAudit Assurance MidtermMohammad Farhan SafwanОценок пока нет

- PH Accountancy Act of 2004 (RA9298) - Code of EthicsДокумент8 страницPH Accountancy Act of 2004 (RA9298) - Code of EthicsHaks MashtiОценок пока нет

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsОт EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsОценок пока нет

- "The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"От Everand"The Language of Business: How Accounting Tells Your Story" "A Comprehensive Guide to Understanding, Interpreting, and Leveraging Financial Statements for Personal and Professional Success"Оценок пока нет

- Engagement Essentials: Preparation, Compilation, and Review of Financial StatementsОт EverandEngagement Essentials: Preparation, Compilation, and Review of Financial StatementsОценок пока нет

- FABM 2 Module 1Документ7 страницFABM 2 Module 1xernathanОценок пока нет

- Mas 06-03 Cost Volume Profit (CVP)Документ7 страницMas 06-03 Cost Volume Profit (CVP)xernathanОценок пока нет

- FABM 2 Module 1 p5Документ1 страницаFABM 2 Module 1 p5xernathanОценок пока нет

- FABM 2 Module 1 p4Документ2 страницыFABM 2 Module 1 p4xernathanОценок пока нет

- FABM 2 Module 1 p3Документ2 страницыFABM 2 Module 1 p3xernathanОценок пока нет

- Topic PresentationДокумент6 страницTopic PresentationxernathanОценок пока нет

- FABM 2 Module 1 p2Документ3 страницыFABM 2 Module 1 p2xernathanОценок пока нет

- FABM 2 Module 1 p1Документ1 страницаFABM 2 Module 1 p1xernathanОценок пока нет

- EQ Belt BatacДокумент1 страницаEQ Belt BatacxernathanОценок пока нет

- AT Handout 1 PDFДокумент7 страницAT Handout 1 PDFxernathanОценок пока нет

- Literary AnalysisДокумент3 страницыLiterary Analysisapi-298524875Оценок пока нет

- Tiling Long Division Puzzle FreeДокумент6 страницTiling Long Division Puzzle FreeWidya ErwinОценок пока нет

- The Master's Hand: AnecdoteДокумент6 страницThe Master's Hand: AnecdoteNiday DimalawangОценок пока нет

- Grade Sheet For Grade 10-AДокумент2 страницыGrade Sheet For Grade 10-AEarl Bryant AbonitallaОценок пока нет

- Should Kids Be Social Media InfluencerДокумент6 страницShould Kids Be Social Media Influencershawaizshahid312Оценок пока нет

- Course File Format For 2015-2016Документ37 страницCourse File Format For 2015-2016civil hodОценок пока нет

- Engaging Learners To Learn Tajweed Through Active Participation in A Multimedia Application (TaLA)Документ4 страницыEngaging Learners To Learn Tajweed Through Active Participation in A Multimedia Application (TaLA)idesajithОценок пока нет

- CV Nitin GuptaДокумент2 страницыCV Nitin GuptaNitin GuptaОценок пока нет

- Team Teaching Lesson Plan MigrationДокумент7 страницTeam Teaching Lesson Plan Migrationapi-553012998100% (1)

- Sample RizalДокумент3 страницыSample RizalFitz Gerald VergaraОценок пока нет

- Comparing Grade 12 Students' Expectations and Reality of Work ImmersionДокумент4 страницыComparing Grade 12 Students' Expectations and Reality of Work ImmersionTinОценок пока нет

- Class Program (SY 2022-2023)Документ12 страницClass Program (SY 2022-2023)Cris Fredrich AndalizaОценок пока нет

- Improving Vocabulary Mastery Through Extensive Reading For Grade X Students of Sma N 1 SewonДокумент107 страницImproving Vocabulary Mastery Through Extensive Reading For Grade X Students of Sma N 1 SewonKURNIAОценок пока нет

- CS Form No. 212 Personal Data Sheet RevisedДокумент4 страницыCS Form No. 212 Personal Data Sheet RevisedIan BarrugaОценок пока нет

- Banda Noel Assignment 1Документ5 страницBanda Noel Assignment 1noel bandaОценок пока нет

- Vectors - MediumДокумент14 страницVectors - Mediumryan.mohammed-smmОценок пока нет

- Students' Article Writing-ExampleДокумент8 страницStudents' Article Writing-ExampleRetni WidiyantiОценок пока нет

- Zuhaib Ashfaq Khan: Curriculum VitaeДокумент6 страницZuhaib Ashfaq Khan: Curriculum VitaeRanaDanishRajpootОценок пока нет

- Students' creative writing and language skills benefit more from reading books than online newspapersДокумент36 страницStudents' creative writing and language skills benefit more from reading books than online newspapersTrần NgọcОценок пока нет

- Deficient Knowledge Nursing DiagnosisДокумент3 страницыDeficient Knowledge Nursing DiagnosisCalimlim KimОценок пока нет