Академический Документы

Профессиональный Документы

Культура Документы

Newriskcare II

Загружено:

sachinthestar2007Исходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Newriskcare II

Загружено:

sachinthestar2007Авторское право:

Доступные форматы

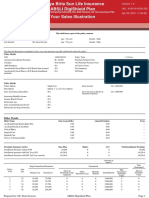

Regular Premium Contact Details

Life

Sum Assured (SA) Amount of Rebate in Gross Premium Bajaj Allianz Life Insurance Company Limited,

Individual

SA <= 10 lacs Nil G.E. Plaza, Airport Road, Yerawada, Pune - 411 006.

10 Lac < SA <= 25 lacs Rs 0.75 * (SA - 10 lacs)/1000 Tel: (020) 6602 6777. Fax: (020) 6602 6789.

25 Lac < SA <= 1 crore Rs.1125 + Rs.0.90 * (SA - 25 lacs)/1000 www.bajajallianz.com

SA > 1 Crore Rs.7875 + Rs. 1.00 * (SA - 1 Crore)/1000

SMS LIFE 56070

Single Premium

Sum Assured (SA) Amount of Rebate in Gross Premium For any queries please contact:

SA <= 10 lacs Nil

BSNL/MTNL Any Mobile & Landline Other

10 Lac < SA <= 25 lacs Rs 0.15 * y * (SA - 10 lacs)/1000 (Toll Free) (Chargeble)

(Toll Free)

25 Lac < SA <= 1 crore Rs.225*y + Rs.0.25*y* (SA - 25 lacs)/1000 1800 22 5858 <Prefix City Code> 3030 5858

1800 209 5858

SA > 1 Crore Rs.2100*y + Rs.1.00* y*(SA - 1 Crore)/1000

email: life@bajajallianz.co.in chat: bajajallianzlife.co.in/chat

Where ‘y’ is the policy term

Conditions Why Bajaj Allianz Life Insurance?

General Exclusion: Bajaj Allianz Life Insurance shall not be liable to pay Bajaj Allianz Life Insurance Company Limited is a union between Allianz SE, the

world's leading insurer and Bajaj Finserv, one of India's most respected names. Allianz

the benefits if the Life Assured commits suicide whether sane or

SE is a leading insurance conglomerate globally and one of the largest asset mangers

insane, within one year from the Policy Commencement Date or in the world. At Bajaj Allianz, we realize that you seek an insurer you can trust your

Commencement of Risk, the Company will not entertain any claim by hard earned money with. Allianz SE has more than 119 years of financial experience

virtue of this Policy except to the extent of the Installment/Single in over 70 countries and Bajaj Finserv demerged from Bajaj Auto, trusted for over 65

years in the Indian market, are committed to offering you financial solutions that

Premium paid. The actual date of death will be the basis for provide all the security you need for your family and yourself.

determining the validity of the contract of insurance. At Bajaj Allianz, customer delight is our guiding principle. Ensuring world class

solutions by offering you customized products with transparent benefits supported by

Prohibition of Rebate: Section 41 of the Insurance Act, 1938 states:

the best technology is our business philosophy.

No person shall allow or offer to allow, either directly or indirectly, as an inducement to any

person to take out or renew or continue an insurance in respect of any kind of risk relating to Disclaimer

lives or property in India, any rebate of the whole or part of the commission payable or any This product brochure gives the salient features of the plan only. The policy document

rebate of the premium shown on the policy, nor shall any person taking out or renewing or is the conclusive evidence of the contract, and provides in detail all the conditions,

continuing a policy accept any rebate, except such rebate as may be allowed in accordance exclusions related to the “Bajaj Allianz New Risk Care II ” Plan. All Charges applicable

with the published prospectuses or tables of the insurer. shall be levied.

Any person making default in complying with the provision of this section shall be punishable Please draw your cheques/ demand drafts in favour of “Bajaj Allianz Life

with a fine that may extend to five hundred rupees. Insurance Company Limited”.

SECTION 45 of the Insurance Act, 1938 states:

Bajaj Allianz New Risk Care II (UIN) : 116N063V01

No Policy of life insurance effected after the coming into force of this Act shall, after the

CAP (UIN) : 116C001V01

expiry of two years from the date on which it was effected, be called in question by an

insurer on the ground that a statement made in the proposal for insurance or in any

report of a medical officer, or referee, or friend of the insured, or in any other

CI (UIN)

HCB (UIN)

: 116C007V01

: 116C008V01 New Risk Care II

document leading to the issue of the policy, was inaccurate or false, unless the insurer

Bajaj Allianz New Risk Care II

BJAZ-B-0201/ 2-Aug-10

shows that such statement was on a material matter or suppressed facts which it was

material to disclose and that it was fraudulently made by the policy-holder and that

the policy holder knew at the time of making it that the statement was false or that it

suppressed facts which it was material to disclose.

For More Information: For more details, kindly consult our "Insurance Care

Consultant" or call us today on the numbers mentioned above.

Insurance is the subject matter of the solicitation.

Bajaj Allianz Life Insurance Company Limited

What is Bajaj Allianz New Risk Care II ? In case of unfortunate death during the term of the Policy the (i) The application for revival is made within 2 years from the

nominee will receive the full Sum Assured. due date of the first unpaid premium and before the end of the

Bajaj Allianz New Risk Care II is a non-participating term

! Maturity Benefit policy term

assurance plan which aims to provide you high insurance

(ii) The applicant being the Proposer / Life Assured furnishes, at

coverage at low premium. The key features of this plan are: Since this plan is a pure term plan, there are no maturity benefits

his own expense, satisfactory evidence of health of the Life

! Both Regular/ Single Premium payment options available Can I surrender my Policy? Assured.

! Enhanced Protection options available through Additional You have the option to surrender the Policy, provided you have (iii) The arrears of premiums together with interest

Rider Benefits chosen the single premium payment option after five years from compounded half-yearly at such rate as the company may

the date of commencement of the Policy. You would be entitled decide from time to time. The current rate is 10 % p.a. effective.

! Rebates on premium in case of high sum assured. (iv) The revival of the Policy may be on terms different from

to receive the surrender value as follows:

! In case of financial emergency, you have the option to those applicable to the Policy before it lapsed based on

Surrender Value = 0.70*(n-t)/n*Single Premium,

surrender the Policy provided you have opted for single prevailing company's underwriting norms.

where “n” is Policy Term and “t” is elapsed duration in years (v) The revival will take effect only on it being specifically

premium payment option.

from Policy Commencement Date to the Policy Anniversary communicated by the Company to the Life Assured or the

! Tax benefits on premiums paid and benefits received under following the date of surrender. Surrender value is not payable applicant.

this Policy as per the existing Income Tax Laws. on Regular Premium mode.

What are the Tax Benefits?

How does this plan work? What are the Additional Rider Benefits?

Premium paid will be eligible for tax benefit under Section 80C.

You choose your Sum Assured, Policy Term and you are required We offer you an option to choose from 3 riders to customize your The death benefit will be eligible for tax benefit under Section

to make regular premium installments or a one- time payment. plan and enhance your protection to suit your changing needs. 10(10) D as per the prevailing tax laws.

In case of any unfortunate event before the maturity of the ! Comprehensive Accident Protection : Covers against

Free Look Period

Policy, the nominee will receive the death benefit. There is no Accident and Disability - UIN : 116C001V01 .

maturity benefit in this plan ! Critical Illness Benefit (CI) : Covers you against 11 defined Within 15 days from the date of receipt of the policy, you have

critical diseases - UIN : 116C007V01. the option to review the terms and conditions and return the

Snapshot of the Plan ! Hospital Cash Benefit (HCB) : Reduces your burden against policy, if you disagree to any of the terms & conditions, stating

Parameter Details hospitalization expenses – UIN: 116C008V01. the reasons for your objections. You will be entitled to a refund of

Minimum Entry Age 18 years

(For complete details on riders, please refer to our Additional the premium paid, subject only to a deduction of a proportionate

Maximum Entry Age 60 years

Maximum Age at Maturity 65 years Rider Benefits Brochure. These additional Rider Benefits are risk premium for the period on cover and the expenses incurred

Minimum Policy Term 5 years on stamp duty and medical expenses, if any.

available on regular premium policies only and not on single

Maximum Policy Term 40 years

Premium Paying Frequency Yearly/ Half Yearly/Quarterly/Monthly/Single premium policies.) Indicative Premium

Minimum Premium Rs. 1200 per yearly installment Mr. Singh is a 30 years old healthy man and he wants to buy Bajaj

Rs. 612 per half- yearly installment What happens if I am unable to pay my premiums?

Rs. 312 per quarterly installment

Allianz New Risk Care II with a Sum Assured of Rs. 5,00,000. The

If you are unable to pay your premium on the due date you will approximate premium that he will have to pay would be:

Rs. 108 per monthly installment

Rs. 5,000 for single premium get a grace period of one month (15 days for monthly mode) to Term

Payment Mode

Maximum premium No Limit pay your premium. On expiry of the grace period the Policy 10 15 20 25

Minimum Sum Assured Rs. 2,00,000 Single Premium (Rs.) 6,740 9,940 13,335 17,405

would lapse.

Maximum Sum Assured No Limit Regular Annual Premium (Rs.) 1,210 1,340 1,390 1,490

High Sum Assured Rebate On Sum Assured above Rs. 10,00,000 Can I revive my Policy? *Above illustration is excluding Service Tax

What are the benefits available? Yes, you can revive the lapsed policy subject to following High Sum Assured Rebate:

! Death Benefit conditions: will be offered for all policies where the sum assured exceeds 10 lacs.

Вам также может понравиться

- 3m Fence DUPAДокумент4 страницы3m Fence DUPAxipotОценок пока нет

- Notary CodeДокумент36 страницNotary CodeBonnieClark100% (2)

- Digests IP Law (2004)Документ10 страницDigests IP Law (2004)Berne Guerrero100% (2)

- Subcontracting Process in Production - SAP BlogsДокумент12 страницSubcontracting Process in Production - SAP Blogsprasanna0788Оценок пока нет

- Employee Development - PPT 9Документ39 страницEmployee Development - PPT 9sachinthestar2007Оценок пока нет

- Renew Optima Restore Floater PolicyДокумент4 страницыRenew Optima Restore Floater PolicyrahulpahadeОценок пока нет

- Swift MessageДокумент29 страницSwift MessageAbinath Stuart0% (1)

- Sri Ganesh Engg - ProfileДокумент19 страницSri Ganesh Engg - Profileshikharc100% (1)

- Sanfort PreSchoolДокумент12 страницSanfort PreSchoolsachinthestar2007Оценок пока нет

- How Does FI Integrate With SD and What Is Their Account DeterminationДокумент11 страницHow Does FI Integrate With SD and What Is Their Account DeterminationBiranchi MishraОценок пока нет

- Human Resourse Management 1Документ41 страницаHuman Resourse Management 1Shakti Awasthi100% (1)

- Randy Gage Haciendo Que El Primer Circulo Funciones RG1Документ64 страницыRandy Gage Haciendo Que El Primer Circulo Funciones RG1Viviana RodriguesОценок пока нет

- Aditya Birla Sun Life Insurance SecurePlus Plan Sales IllustrationДокумент7 страницAditya Birla Sun Life Insurance SecurePlus Plan Sales Illustrationkunjal mistryОценок пока нет

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsДокумент5 страницProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsofficialavengers918Оценок пока нет

- 60048245473Документ7 страниц60048245473Mcnet WideОценок пока нет

- Here's Your Accident Insurance: You Have Made A Wise ChoiceДокумент4 страницыHere's Your Accident Insurance: You Have Made A Wise ChoiceKuppanagari TendulkarОценок пока нет

- Need Analysis Summary: Personal Details Financial DetailsДокумент17 страницNeed Analysis Summary: Personal Details Financial DetailsFemilaОценок пока нет

- Illustration Qbuh70x89xxnnДокумент2 страницыIllustration Qbuh70x89xxnnKiran JohnОценок пока нет

- Jeevan Umang: Benefits Illustration SummaryДокумент3 страницыJeevan Umang: Benefits Illustration Summarymr_anilpawarОценок пока нет

- ABSLI DigiShield Plan SummaryДокумент3 страницыABSLI DigiShield Plan Summarynita davidОценок пока нет

- Benefit Illustration 6139037238Документ6 страницBenefit Illustration 6139037238SanjeetОценок пока нет

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsДокумент7 страницProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsaman khatriОценок пока нет

- DownloadДокумент1 страницаDownloadlovep9416Оценок пока нет

- DownloadДокумент1 страницаDownloadParthiban ManiОценок пока нет

- IllustrationДокумент2 страницыIllustrationSharma RaviОценок пока нет

- Product Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life GoalsДокумент5 страницProduct Proposal For Achieving Your Life Goals Product Proposal For Achieving Your Life Goalsprachididwania13Оценок пока нет

- Arun KhurpadiДокумент5 страницArun KhurpadisengaraaradhanaОценок пока нет

- Jeevan Labh: Benefits Illustration SummaryДокумент2 страницыJeevan Labh: Benefits Illustration Summarymr_anilpawarОценок пока нет

- SBI Life Insurance Smart Shield Premium QuoteДокумент1 страницаSBI Life Insurance Smart Shield Premium QuotesanОценок пока нет

- Jeevan Umang: Benefits Illustration SummaryДокумент4 страницыJeevan Umang: Benefits Illustration SummarySelvam RamanathanОценок пока нет

- Bajaj Allianz Jana Vikas Yojana - Affordable Life Insurance PlanДокумент2 страницыBajaj Allianz Jana Vikas Yojana - Affordable Life Insurance PlanshahdevenОценок пока нет

- HDFC Life Sanchay Plus benefit illustrationДокумент2 страницыHDFC Life Sanchay Plus benefit illustrationVamsi Krishna BОценок пока нет

- SmartPlatinaPlus20022024 9624856 240220 085607Документ3 страницыSmartPlatinaPlus20022024 9624856 240220 085607k SubrahmaniamОценок пока нет

- 1N018104110 DocДокумент1 страница1N018104110 DocSudhanshu KatariyaОценок пока нет

- BenefitIllustrationДокумент5 страницBenefitIllustrationmkranrhikr93Оценок пока нет

- c549992e-cba1-4e32-9e08-7f8ff2a6d613Документ7 страницc549992e-cba1-4e32-9e08-7f8ff2a6d613vonamal985Оценок пока нет

- HDFC Health Insurance 80DДокумент1 страницаHDFC Health Insurance 80DjasjeetsОценок пока нет

- Illustration QbfadmdqynhjlДокумент2 страницыIllustration QbfadmdqynhjlAkshay ChaudhryОценок пока нет

- Umang DemoДокумент7 страницUmang DemoAvinash SinghОценок пока нет

- DetailsДокумент2 страницыDetailsmailshimmerandshineОценок пока нет

- IllustrationДокумент4 страницыIllustrationInvest Aaj for kal Life insuranceОценок пока нет

- Variable Life Insurance ProposalДокумент7 страницVariable Life Insurance ProposalAljunBaetiongDiazОценок пока нет

- IllustrationДокумент2 страницыIllustrationShashikumar RajkumarОценок пока нет

- Product Proposal For Securing Your Life Goals Product Proposal For Securing Your Life GoalsДокумент6 страницProduct Proposal For Securing Your Life Goals Product Proposal For Securing Your Life GoalsRam VОценок пока нет

- SBI Life Insurance Co. Ltd Benefit Illustration for Smart Platina Plus PolicyДокумент3 страницыSBI Life Insurance Co. Ltd Benefit Illustration for Smart Platina Plus PolicySrigandh's WealthОценок пока нет

- Features of ICICI Pru Saral Jeevan BimaДокумент2 страницыFeatures of ICICI Pru Saral Jeevan BimaAshok GОценок пока нет

- Sanchay Par Advantage Deffered IncomeДокумент3 страницыSanchay Par Advantage Deffered IncomeTamil Vanan NОценок пока нет

- 53na595066 E01 PDFДокумент15 страниц53na595066 E01 PDFRamesh ChandОценок пока нет

- IllustrationДокумент2 страницыIllustrationMayank guptaОценок пока нет

- Term PlanДокумент4 страницыTerm PlanKaushaljm PatelОценок пока нет

- IllustrationДокумент2 страницыIllustrationRajnandan shindeОценок пока нет

- Life Insurance: A Non Linked Non Participating Individual Life Savings Insurance PlanДокумент3 страницыLife Insurance: A Non Linked Non Participating Individual Life Savings Insurance Plannita davidОценок пока нет

- DownloadДокумент3 страницыDownloadKiran JohnОценок пока нет

- IllustrationДокумент2 страницыIllustrationVivek SinghalОценок пока нет

- Features of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Документ4 страницыFeatures of Icici Pru Iprotect Smart: What Are The Benefits of This Policy?Soumyaranjan SwainОценок пока нет

- EndowmentДокумент2 страницыEndowmentcryptomaxxtrade4Оценок пока нет

- 1821 - Nishchit Aayush GG 15 - Income Variant Increasing Income Lumpsum BenefitДокумент1 страница1821 - Nishchit Aayush GG 15 - Income Variant Increasing Income Lumpsum BenefitVardhiniОценок пока нет

- Personalised Proposal For Securing Your Guaranteed Income NeedsДокумент6 страницPersonalised Proposal For Securing Your Guaranteed Income NeedsSirshajit SanfuiОценок пока нет

- Aditya Birla Sun Life Insurance Vision Lifeincome Plan: Dear MR Kunjal Uin - 109N079V04Документ4 страницыAditya Birla Sun Life Insurance Vision Lifeincome Plan: Dear MR Kunjal Uin - 109N079V04kunjal mistryОценок пока нет

- SBI Life Insurance Need Analysis SummaryДокумент16 страницSBI Life Insurance Need Analysis SummaryRagavОценок пока нет

- Key Features and Benefits of ICICI Pru iProtect SmartДокумент4 страницыKey Features and Benefits of ICICI Pru iProtect SmartQualityCare InternationalОценок пока нет

- IllustrationДокумент3 страницыIllustrationsukh37949Оценок пока нет

- KFD New06012024143830079 T51Документ5 страницKFD New06012024143830079 T51Mayur NagdiveОценок пока нет

- HDFC Life Sanchay Plus Benefit IllustrationДокумент2 страницыHDFC Life Sanchay Plus Benefit Illustrationsusman paulОценок пока нет

- Ga Gig ComboДокумент2 страницыGa Gig ComboBharat19Оценок пока нет

- b464b3f8-a02f-4f47-8e63-821b81be0bb2Документ7 страницb464b3f8-a02f-4f47-8e63-821b81be0bb2vonamal985Оценок пока нет

- IllustrationДокумент2 страницыIllustrationshaan.sangram190Оценок пока нет

- Sanchy Plus - Long Term Income 1 LДокумент2 страницыSanchy Plus - Long Term Income 1 LVen NatОценок пока нет

- Insurance PolicyДокумент3 страницыInsurance Policyahmedzeeshan474Оценок пока нет

- Insurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5От EverandInsurance, regulations and loss prevention :Basic Rules for the industry Insurance: Business strategy books, #5Оценок пока нет

- Sms UssdДокумент3 страницыSms UssdAmit PaulОценок пока нет

- Indian Arny Officers AD 2014Документ2 страницыIndian Arny Officers AD 2014Kishor NagarОценок пока нет

- Financial Ratio AnalysisДокумент14 страницFinancial Ratio AnalysisPrasanga WdzОценок пока нет

- Rail Booking! Now Just A 2 Step Process: For Customers Having Bank Account With ICICI BankДокумент4 страницыRail Booking! Now Just A 2 Step Process: For Customers Having Bank Account With ICICI Banksachinthestar2007Оценок пока нет

- Resume: ObjectiveДокумент3 страницыResume: Objectivesachinthestar2007Оценок пока нет

- AdvertisementДокумент3 страницыAdvertisementSankalp KumarОценок пока нет

- Sample E-Pat QuestionsДокумент5 страницSample E-Pat Questionssachinthestar2007Оценок пока нет

- Resume: ObjectiveДокумент3 страницыResume: Objectivesachinthestar2007Оценок пока нет

- Employee Motivation Ppts Enjoy Training PPT Employee MotivationДокумент37 страницEmployee Motivation Ppts Enjoy Training PPT Employee Motivationmahesh4uОценок пока нет

- Swami VivekanandaДокумент20 страницSwami Vivekanandaapi-26231809Оценок пока нет

- AmulДокумент3 страницыAmulHardik GalaОценок пока нет

- Customs RA ManualДокумент10 страницCustoms RA ManualJitendra VernekarОценок пока нет

- GPB Rosneft Supermajor 25092013Документ86 страницGPB Rosneft Supermajor 25092013Katarina TešićОценок пока нет

- Starting A Caf or Coffee Shop BusinessДокумент11 страницStarting A Caf or Coffee Shop Businessastral05Оценок пока нет

- PEA144Документ4 страницыPEA144coffeepathОценок пока нет

- Lesson 6 Internal ControlДокумент24 страницыLesson 6 Internal ControlajithsubramanianОценок пока нет

- Child-Friendly Integrated Public Space (Ruang Publik Terpadu Ramah Anak / RPTRA)Документ14 страницChild-Friendly Integrated Public Space (Ruang Publik Terpadu Ramah Anak / RPTRA)oswar mungkasaОценок пока нет

- Wan SP - 21 JanДокумент1 страницаWan SP - 21 JanJasni PagarautomaticОценок пока нет

- GodrejДокумент4 страницыGodrejdeepaksikriОценок пока нет

- PNV-08 Employer's Claims PDFДокумент1 страницаPNV-08 Employer's Claims PDFNatarajan SaravananОценок пока нет

- IQA QuestionsДокумент8 страницIQA QuestionsProf C.S.PurushothamanОценок пока нет

- Cadbury, Nestle and Ferrero - Top Chocolate Brands in IndiaДокумент24 страницыCadbury, Nestle and Ferrero - Top Chocolate Brands in Indiaaartitomar47_8332176Оценок пока нет

- PRMG 6007 - Procurement Logistics and Contracting Uwi Exam Past Paper 2012Документ3 страницыPRMG 6007 - Procurement Logistics and Contracting Uwi Exam Past Paper 2012tilshilohОценок пока нет

- Address Styles in Oracle AppsДокумент4 страницыAddress Styles in Oracle AppskartheekbeeramjulaОценок пока нет

- Bharathi Real EstateДокумент3 страницыBharathi Real Estatekittu_sivaОценок пока нет

- Solved in A Manufacturing Plant Workers Use A Specialized Machine ToДокумент1 страницаSolved in A Manufacturing Plant Workers Use A Specialized Machine ToM Bilal SaleemОценок пока нет

- Syllabus Corporate GovernanceДокумент8 страницSyllabus Corporate GovernanceBrinda HarjanОценок пока нет

- Managing Human Resources at NWPGCLДокумент2 страницыManaging Human Resources at NWPGCLMahadi HasanОценок пока нет

- Corporate BrochureДокумент23 страницыCorporate BrochureChiculita AndreiОценок пока нет

- Business Plan For Bakery: 18) Equipment (N) 19) Working CapitalДокумент10 страницBusiness Plan For Bakery: 18) Equipment (N) 19) Working CapitalUmarSaboBabaDoguwaОценок пока нет

- Hire PurchaseДокумент16 страницHire PurchaseNaseer Sap0% (1)

- 1-Loanee Declaration PMFBYДокумент2 страницы1-Loanee Declaration PMFBYNalliah PrabakaranОценок пока нет