Академический Документы

Профессиональный Документы

Культура Документы

ch3 PDF

Загружено:

Mark GilОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

ch3 PDF

Загружено:

Mark GilАвторское право:

Доступные форматы

Solution to Chapter 3

E3‐23,24,26,28,30, E3‐38,31,33, P3‐45

EXERCISE 3-23 (10 MINUTES)

1. Process

2. Job-order

3. Job-order (contracts or projects)

4. Process

5. Process

6. Job-order

7. Process

8. Job-order (contracts or projects)

9. Process

10. Job-order

EXERCISE 3-24 (20 MINUTES)

1. Raw-material inventory, January 1......................................................................... $174,200

Add: Raw-material purchases................................................................................. 248,300

Raw material available for use................................................................................ $422,500

Deduct: Raw-material inventory, January 31 ........................................................ 161,200

Raw material used in January................................................................................. $261,300

Direct labor ............................................................................................................... 390,000

Total prime costs incurred in January ................................................................... $651,300

2. Total prime cost incurred in January ..................................................................... $651,300

Applied manufacturing overhead (70% × $390,000)............................................. 273,000

Total manufacturing cost for January.................................................................... $924,300

EXERCISE 3-24 (CONTINUED)

3. Total manufacturing cost for January....................................................................$ 924,300

Add: Work-in-process inventory, January 1.......................................................... 305,500

Subtotal.....................................................................................................................$1,229,800

Deduct: Work-in-process inventory, January 31 .................................................. 326,300

Cost of goods manufactured ..................................................................................$ 903,500

4. Finished-goods inventory, January 1 ....................................................................$ 162,500

Add: Cost of goods manufactured ......................................................................... 903,500

Cost of goods available for sale .............................................................................$1,066,000

Deduct: Finished-goods inventory, January 31 .................................................... 152,100

Cost of goods sold...................................................................................................$ 913,900

Since the company accumulates overapplied or underapplied overhead until the end of

the year, no adjustment is made to cost of goods sold until December 31.

5. Applied manufacturing overhead for January ...................................................... $273,000

Actual manufacturing overhead incurred in January........................................... 227,500

Overapplied overhead as of January 31 ................................................................ $ 45,500

The balance in the Manufacturing Overhead account on January 31 is a $45,500 credit

balance.

NOTE: Actual selling and administrative expense, although given in the exercise, is

irrelevant to the solution.

EXERCISE 3-26 (15 MINUTES)

1. Applied manufacturing overhead = total manufacturing costs 30%

= $1,250,000 30%

= $375,000

Applied manufacturing overhead = direct-labor cost 80%

Direct-labor cost = applied manufacturing overhead 80%

= $375,000 .8

= $468,750

2. Direct-material used = total manufacturing cost

– direct labor cost

– applied manufacturing overhead

= $1,250,000 – $468,750 – $375,000

= $406,250

3. Let X denote work-in-process inventory on December 31.

Total work-in-process work-in-process cost of

manufacturing + inventory, – inventory, = goods

cost Jan. 1 Dec. 31 manufactured

$1,250,000 + .75X – X = $1,212,500

.25X = $1,250,000 – $1,212,500

X = $150,000

Work-in-process inventory on December 31 amounted to $150,000.

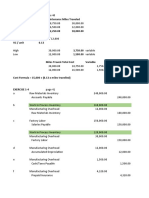

EXERCISE 3-28 (15 MINUTES)

1.

(a) At 100,000 chicken volume:

(b) At 200,000 chicken volume:

(c) At 300,000 chicken volume:

2. The predetermined overhead rate does not change in proportion to the change in

production volume. As production volume increases, the $150,000 of fixed

overhead is allocated across a larger activity base. When volume rises by 100%,

from 100,000 to 200,000 chickens, the decline in the overhead rate is 45.45%

[($1.65 – $.90)/$1.65]. When volume rises by 50%, from 200,000 to 300,000

chickens, the decline in the overhead rate is 27.78% [($.90 – $.65)/$.90].

EXERCISE 3-30 (20 MINUTES)

1. Raw-Material Inventory Work-in-Process Inventory

295,100 23,400

226,200 226,200

68,900 421,200

234,000

Wages Payable 156,000

421,200 748,800

Manufacturing Overhead Finished-Goods Inventory

234,000 39,000

156,000

Sales Revenue 171,600

253,500 23,400

Accounts Receivable Cost of Goods Sold

253,500 171,600

2. JAY SPORTS EQUIPMENT COMPANY, INC.

PARTIAL BALANCE SHEET

AS OF DECEMBER 31, 20X2

Current assets

Cash ........................................................................................................................ XXX

Accounts receivable.............................................................................................. XXX

Inventory

Raw material......................................................................................................$ 68,900

Work in process................................................................................................ 748,800

Finished goods ................................................................................................. 23,400

JAY SPORTS EQUIPMENT COMPANY, INC.

PARTIAL INCOME STATEMENT

FOR THE YEAR ENDED DECEMBER 31, 20X2

Sales revenue........................................................................................................... $253,500

Less: Cost of goods sold........................................................................................ 171,600

Gross margin ........................................................................................................... $ 81,900

EXERCISE 3-38 (15 MINUTES)

Work-in-Process Inventory: Tanning Department ..................................... 11,000a

Manufacturing Overhead ................................................................... 11,000

a11,000 = 25 sets x 110 sq. ft. x $4 per sq. ft.

Work-in-Process Inventory: Assembly Department .................................. 1,100b

Manufacturing Overhead ................................................................... 1,100

b$1,100 = 25 sets x 4 MH x $11 per MH

Work-in-Process Inventory: Saddle Department ....................................... 5,625c

Manufacturing Overhead ................................................................... 5,625

c$5,625 = 25 sets x 45 DLH x $5 per DLH

EXERCISE 3-31 (20 MINUTES)

1. Raw material:

Beginning inventory ................................................................................... $142,000

Add: Purchases .......................................................................................... ?

Deduct: Raw material used........................................................................ 652,000

Ending inventory ........................................................................................ $162,000

Therefore, purchases for the year were ................................................... $672,000

2. Direct labor:

Total manufacturing cost........................................................................... $1,372,000

Deduct: Direct material .............................................................................. 652,000

Direct labor and manufacturing overhead ............................................... $ 720,000

Direct labor + manufacturing overhead = $720,000

Direct labor + (60%) (direct labor) = $720,000

(160%) (direct labor) = $720,000

Direct labor = $720,000

1.6

Direct labor = $450,000

3. Cost of goods manufactured:

Work in process, beginning inventory ................................................. $ 160,000

Add: Total manufacturing costs............................................................ 1,372,000

Deduct: Cost of goods manufactured .................................................. ?

Work in process, ending inventory....................................................... $ 60,000

Therefore, cost of goods manufactured was ....................................... $1,472,000

EXERCISE 3-31 (CONTINUED)

4. Cost of goods sold:

Finished goods, beginning inventory....................................................... $ 180,000

Add: Cost of goods manufactured............................................................ 1,472,000

Deduct: Cost of goods sold....................................................................... ?

Finished goods, ending inventory ............................................................ $ 220,000

Therefore, cost of goods sold was ........................................................... $1,432,000

EXERCISE 3-33 (20 MINUTES)

NOTE: Budgeted sales revenue, although given in the exercise, is irrelevant to the

solution.

1. Predetermined overhead rate =

(a) = $32.50 per machine hour

(b) = $26.00 per direct-labor hour

$2.00 per direct-labor dollar or 200%

(c) =

of direct-labor cost

*Budgeted direct-labor cost = 25,000 × $13

2. Actual applied overapplied or

manufacturing – manufacturing = underapplied

overhead overhead overhead

(a) $690,000 – (22,000)($32.50) = $25,000 overapplied overhead

(b) $690,000 – (26,000)($26.00) = $14,000 underapplied overhead

(c) $690,000 – ($364,000†)(200%) = $38,000 overapplied overhead

†Actual

direct-labor cost = 26,000 × $14

PROBLEM 3-45 (25 MINUTES)

The completed T-accounts are shown below. (Missing amounts in problem are italicized.)

Raw-Material Inventory Accounts Payable

Bal. 1/1 29,400 3,500 Bal. 1/1

189,000 168,000 191,100 189,000

Bal. 12/31 50,400 1,400 Bal. 12/31

Work-in-Process Inventory Finished-Goods Inventory

Bal. 1/1 23,800 Bal. 1/1 16,800

Direct 168,000 1,005,200 994,000

material Bal. 12/31 28,000

Direct 210,000 1,005,200

labor

Mfg. 630,000

overhead

Bal. 12/31 26,600 Cost of Goods Sold

994,000

Manufacturing Overhead

633,500 630,000 Sales Revenue

1,134,000

Wages Payable

2,800 Bal. 1/1 Accounts Receivable

205,800 210,000 Bal. 1/1 15,400

7,000 Bal. 12/31 1,134,000 1,128,400

Bal. 12/31 21,000

Вам также может понравиться

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОт EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsОценок пока нет

- The Pursuit of New Product Development: The Business Development ProcessОт EverandThe Pursuit of New Product Development: The Business Development ProcessОценок пока нет

- Process Costing Test Bank SOLUTION PDFДокумент7 страницProcess Costing Test Bank SOLUTION PDFAshNor RandyОценок пока нет

- Selected Tutorial Solutions CHPT 1-5Документ22 страницыSelected Tutorial Solutions CHPT 1-5Silo KetenilagiОценок пока нет

- Chapter 1 2 SolutionsДокумент10 страницChapter 1 2 SolutionsShiv AchariОценок пока нет

- Popquizch4Au11 182nlk8Документ3 страницыPopquizch4Au11 182nlk8PrincessОценок пока нет

- Budgeted - Cogm & CogsДокумент3 страницыBudgeted - Cogm & CogsHassan TariqОценок пока нет

- Faith Job Costing ProblemsДокумент10 страницFaith Job Costing Problemsfaith olaОценок пока нет

- CH 3Документ12 страницCH 3Firas HamadОценок пока нет

- Job Costing QuestionsДокумент5 страницJob Costing Questionsfaith olaОценок пока нет

- Additonal ProblemsДокумент8 страницAdditonal ProblemsMohammed Al ArmaliОценок пока нет

- Assignment 3 Accounting PDFДокумент11 страницAssignment 3 Accounting PDFjgfjhf arwtr100% (1)

- Chapter 2 Examples OnlineДокумент13 страницChapter 2 Examples Onlinedeniz turkbayragi100% (1)

- Kunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34Документ3 страницыKunci Jawaban Lab Chapter 3: Build A Spreadsheet 03-34RantiyaniОценок пока нет

- Nama: Nabila Indri Yani No. BP: 2010931037 Tugas 1: Analisis Dan Estimasi BiayaДокумент4 страницыNama: Nabila Indri Yani No. BP: 2010931037 Tugas 1: Analisis Dan Estimasi BiayaInnabilaОценок пока нет

- Jawaban Ex 3-34 AKBB OverheadДокумент2 страницыJawaban Ex 3-34 AKBB OverheadRantiyaniОценок пока нет

- Ch3 - Batch - Exercises and SolutionДокумент9 страницCh3 - Batch - Exercises and Solution黃群睿Оценок пока нет

- Assignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR MohsinДокумент11 страницAssignment 3 Managerial Accounting: Submitted By-Ghayoor Zafar Submitted To - DR Mohsinjgfjhf arwtr100% (1)

- 1 DoneДокумент9 страниц1 DoneНикита ШтефанюкОценок пока нет

- MGT Accounting, Intermideiate-SolutionsДокумент31 страницаMGT Accounting, Intermideiate-SolutionsRONALD SSEKYANZIОценок пока нет

- Chapter 3 Job Order CostingДокумент20 страницChapter 3 Job Order Costingazam_rasheedОценок пока нет

- Solutions To Self-Study QuestionsДокумент47 страницSolutions To Self-Study QuestionsChristina ZhangОценок пока нет

- Solutions 1Документ4 страницыSolutions 1Markus H.Оценок пока нет

- Jawaban CH 3 (2) Problem 3-43 AKB ASLABДокумент5 страницJawaban CH 3 (2) Problem 3-43 AKB ASLABRantiyaniОценок пока нет

- Chapter 8 Solutions - Inclass ExercisesДокумент8 страницChapter 8 Solutions - Inclass ExercisesSummerОценок пока нет

- Busi 1002 RДокумент11 страницBusi 1002 RHarry HamiltonОценок пока нет

- MAKSI - UI - LatihanKuis - Okt 2019Документ8 страницMAKSI - UI - LatihanKuis - Okt 2019aziezoel100% (1)

- BS230 - Assignment #2Документ8 страницBS230 - Assignment #2Malcolm TumanaОценок пока нет

- Chapter 2 Selected Answers PDFДокумент16 страницChapter 2 Selected Answers PDFsadiaОценок пока нет

- Cost Accounting and Control Assignment #1Документ3 страницыCost Accounting and Control Assignment #1カリン カリンОценок пока нет

- Hilton CH 2 Select SolutionsДокумент12 страницHilton CH 2 Select SolutionsUmair AliОценок пока нет

- Sanders CompanyДокумент6 страницSanders CompanyculadiОценок пока нет

- AF2110 Management Accounting 1 Assignment 05 Suggested Solutions Exercise 6-13 (20 Minutes)Документ12 страницAF2110 Management Accounting 1 Assignment 05 Suggested Solutions Exercise 6-13 (20 Minutes)Shadow IpОценок пока нет

- BACOSTMX Module 3 Self-ReviewerДокумент5 страницBACOSTMX Module 3 Self-ReviewerlcОценок пока нет

- Solutions Chapter 3Документ10 страницSolutions Chapter 3anacristina1roОценок пока нет

- PT HIGH TECH GADGET (LAPORAN KEUANGAN) - Dikonversi-Diedit PDFДокумент1 страницаPT HIGH TECH GADGET (LAPORAN KEUANGAN) - Dikonversi-Diedit PDFBulan julpi suwellyОценок пока нет

- Acco 20073 Discussion Sy2122 (Bsma 2-4)Документ81 страницаAcco 20073 Discussion Sy2122 (Bsma 2-4)Paul BandolaОценок пока нет

- Acc 202 Exercise MyselfДокумент5 страницAcc 202 Exercise Myselfnhidiepnguyet08112004Оценок пока нет

- Chapter 8-SolutiondocxДокумент17 страницChapter 8-Solutiondocxevani1998Оценок пока нет

- Nabila Indri Yani 2010931037 Tugas AEBДокумент4 страницыNabila Indri Yani 2010931037 Tugas AEBInnabilaОценок пока нет

- Manu PracticeДокумент2 страницыManu PracticeNiro MadlusОценок пока нет

- Problem 3Документ3 страницыProblem 3Mohammed Al ArmaliОценок пока нет

- Practice Problem Set 01 - With SolutionДокумент14 страницPractice Problem Set 01 - With SolutionAntonОценок пока нет

- ABC Sample Problems 1Документ13 страницABC Sample Problems 1Mary Grace PagalanОценок пока нет

- CosthuliДокумент7 страницCosthulikmarisseeОценок пока нет

- Acc 325 Ch. 8 AnswersДокумент10 страницAcc 325 Ch. 8 AnswersMohammad WaleedОценок пока нет

- Chapter 1-2 Examples OnlineДокумент9 страницChapter 1-2 Examples Onlinedeniz turkbayragi100% (1)

- Managerial Accounting: Process CostingДокумент12 страницManagerial Accounting: Process Costingahmad bsoulОценок пока нет

- Solution To Chapter 2 E2 24,2 30, P2 40, 2 37 E2 32,28 (1 3 Parts) P2 43,2 54Документ7 страницSolution To Chapter 2 E2 24,2 30, P2 40, 2 37 E2 32,28 (1 3 Parts) P2 43,2 54ReilpeterОценок пока нет

- Quiz No. 1 Part 2 Open Ended Problems Attempt ReviewДокумент1 страницаQuiz No. 1 Part 2 Open Ended Problems Attempt ReviewEly RiveraОценок пока нет

- Accounting For FOH Part 11Документ16 страницAccounting For FOH Part 11Shania LiwanagОценок пока нет

- Hilton CH 3 Select SolutionsДокумент31 страницаHilton CH 3 Select Solutionssetiani putri100% (1)

- Budgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Документ3 страницыBudgetedmanufacturing Overhead Budgeted Machine Hours: Problem 3-43Yanwar A MerhanОценок пока нет

- Key Chapter 2 & 3Документ9 страницKey Chapter 2 & 3bxp9b56xv4Оценок пока нет

- Chap1-3 Illustration ProblemsДокумент8 страницChap1-3 Illustration ProblemscykablyatОценок пока нет

- BaenДокумент8 страницBaenBrian ChoiОценок пока нет

- Unit - Ii Cost and Management AccountingДокумент17 страницUnit - Ii Cost and Management AccountingRamakrishna RoshanОценок пока нет

- 15 Nov. PGPДокумент11 страниц15 Nov. PGPtanvi gargОценок пока нет

- Document 9Документ2 страницыDocument 9mohammedbudul18Оценок пока нет

- Tugas Akuntansi BiayaДокумент6 страницTugas Akuntansi Biayacathy pisaОценок пока нет

- ArmmДокумент12 страницArmmMark GilОценок пока нет

- The Cavite Mutiny 1872Документ10 страницThe Cavite Mutiny 1872Mark Gil100% (7)

- Cash and Cash Equivalents 1Документ22 страницыCash and Cash Equivalents 1Mark GilОценок пока нет

- Articles of Incorporation PDFДокумент10 страницArticles of Incorporation PDFMark Gil100% (1)

- Region Ii: Cagayan Valley: University of San JoseДокумент20 страницRegion Ii: Cagayan Valley: University of San JoseMark GilОценок пока нет

- Solution To Chapter 3 E3 23,24,26,28,30, E3 38,31,33, P3 45Документ7 страницSolution To Chapter 3 E3 23,24,26,28,30, E3 38,31,33, P3 45Mark GilОценок пока нет

- DFA5058 Tutorial Chapter 3 SolutionДокумент9 страницDFA5058 Tutorial Chapter 3 SolutionArabella Summer100% (1)

- Learnings From DJ SirДокумент94 страницыLearnings From DJ SirHare KrishnaОценок пока нет

- Mahindra Case StudyДокумент10 страницMahindra Case StudySahil AroraОценок пока нет

- FICO Vox Pop Report - Fine Tuning Our Financial FuturesДокумент16 страницFICO Vox Pop Report - Fine Tuning Our Financial FuturesChidera UnigweОценок пока нет

- Special Proceedings (Cases Reviewer)Документ34 страницыSpecial Proceedings (Cases Reviewer)Faith LaperalОценок пока нет

- FbsДокумент10 страницFbsPrince Matthew NatanawanОценок пока нет

- This Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesДокумент2 страницыThis Study Resource Was: Assignment 1 - Overview of Financial Markets and Interest RatesArjay Dela PenaОценок пока нет

- What Factors Influence Financial Inclusion Among Entrepreneurs in Nigeria?Документ9 страницWhat Factors Influence Financial Inclusion Among Entrepreneurs in Nigeria?International Journal of Innovative Science and Research TechnologyОценок пока нет

- Unit 6 Ratios AnalysisДокумент28 страницUnit 6 Ratios AnalysisLe TanОценок пока нет

- Entries For Various Dilutive Securities The Stockholders Equi PDFДокумент1 страницаEntries For Various Dilutive Securities The Stockholders Equi PDFAnbu jaromiaОценок пока нет

- Internship Report ON Foreign Exchange & Remittance Activities of Al-Arafah Islami Bank Limited''Документ64 страницыInternship Report ON Foreign Exchange & Remittance Activities of Al-Arafah Islami Bank Limited''Mounota MandalОценок пока нет

- Course Information BookletДокумент212 страницCourse Information BookletTang Szu ChingОценок пока нет

- Blaw Review QuizДокумент34 страницыBlaw Review QuizRichard de Leon100% (1)

- Encasa BrochureДокумент12 страницEncasa Brochuremanoj_dalalОценок пока нет

- W07 Case Study Loan AssignmentДокумент66 страницW07 Case Study Loan AssignmentArmando Aroni BacaОценок пока нет

- Banking Digest - IBPS ClerkДокумент37 страницBanking Digest - IBPS ClerkSaikrupaVempatiОценок пока нет

- Mariner QuestionnaireДокумент2 страницыMariner QuestionnaireMonique Van Kan-WierstraОценок пока нет

- Doctrine of Restitution in India and EnglandДокумент15 страницDoctrine of Restitution in India and EnglandBhart BhardwajОценок пока нет

- Mortgage (CH 9)Документ37 страницMortgage (CH 9)widya nandaОценок пока нет

- Horngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Документ111 страницHorngren'S Accounting - Tenth Edition: Chapter 2: Recording Business Transactions Page 1 of 111Sally MillerОценок пока нет

- Ravi Rao MinicaseДокумент7 страницRavi Rao MinicaseNawazish KhanОценок пока нет

- ISDA Collateral Glossary Chinese TranslationДокумент23 страницыISDA Collateral Glossary Chinese TranslationMiaОценок пока нет

- Audit Methodology FS 10 PDFДокумент114 страницAudit Methodology FS 10 PDFKelvin Lim Wei Liang0% (1)

- Rich Dad's Guide To Becoming Rich... Without Cutting Up Your Credit CardsДокумент101 страницаRich Dad's Guide To Becoming Rich... Without Cutting Up Your Credit CardsYouert RayutОценок пока нет

- NIL 77-109jhjДокумент39 страницNIL 77-109jhjBenedict AlvarezОценок пока нет

- Problems On Internal ReconstructionДокумент24 страницыProblems On Internal ReconstructionYashodhan Mithare100% (4)

- Introduction To Income TaxДокумент215 страницIntroduction To Income Taxvikashkumar657Оценок пока нет

- MRA Letter Template For WaiverДокумент2 страницыMRA Letter Template For WaiverSadiya BodhyОценок пока нет

- Iron Ore Brazil-Jiali-Soft AugustДокумент3 страницыIron Ore Brazil-Jiali-Soft Augustandrew s youngОценок пока нет

- Simple InterestДокумент24 страницыSimple InterestAgatha JenellaОценок пока нет