Академический Документы

Профессиональный Документы

Культура Документы

The Fractal Nature of Markets 11-1-10

Загружено:

KrisИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

The Fractal Nature of Markets 11-1-10

Загружено:

KrisАвторское право:

Доступные форматы

· .

't:1 +-I, Hf

Arm'strong Economics

~Jorecasting the World

The Fractal 'Nature

of' Markets

The Death of Mandelbrot

By: Martin A. Armstrong Copyright Al1 Rights R~sei:-ved ' November 1st, 2010 Please Register For Special Updates At Armst rongliconouri cs .. COM

Please send comments by mail to:

Please REGISTER for 'Special Updates

Martin A. Armstrong Fep Fort Dix Camp #12518-050

PO Box 2000

Fort Dix, NJ 08640

ArmstrongEconomics.COM

Copyright Martin A. Armstrong All Rights Reserved

This Report may be. forwarded as you like "'it~out charge to individuals or governments around the world. It is provided as a Public Service ~t this time without cost b9~ause of the critical facts that' we now faced economical1~:. The contents and'designs of the systems are in fact copyrighted.

L

ACKNOWLEDGEMENTS

I would like to thank all ~he former emp16yees, associates, sources, and contacts for "their' ongoing support and efforts to contribute to the writings I have been able to continue" through t.hed.r great efforts. I would also like. to thank those who have looked after not just myself, but my family, and shown them sUPP9tt and

". kindness. .

The purpose of these reports is to broden the understanding that is so vital to our personal survival. Government cannot save us, and will only assist·the very economic disaster we face. This is a Sovereign Debt Crisis nhat threatens our core survival. There is no plan to ever payoff debts. ·The maj ority of debt increase. is payi:~g Lrrtcrest; perpetually to rollover without any long-term plan. ~What you see

in Greece and in t.he States, we have run out 0.£ other people 'smbney. The socialists keep pointing to the rich. But to fund tile d,efidts, we need to borrow now from foreign lands. We ran out of money domestically and to support the current syst~m Lf.ke Greece, we need foreign capital. But allg0:verrunents are facj.ng the same crisis and we are on the verge of anot.her lddespread government default. Adam SiiIith warned in his 'Wealth Qf Nations that in 1776, no government paid ,6ff their debt and had always defaulted. We will have no choice either.

There is no hope that politicians will save us., for they only form committees to investigat after the shit-hits-the-fan. They will NOT risk 'their car'ee'r for a future problem that may hit on someone else's, watch. There was a pol_itician and a average man standing on top of the Sears' Tower when a gust of wiild bl.ew them off. The average man being a realistic-pessimist: t . in$edia:t.ely sees he is about to «tie and begins praying. The politicians, the ultimate optimist, (:an be heard saying "Well so far so good!" as he passes the 4th floor.

At Princeton Economics, our mission was simply to gather global data and no bring that together to create the world's largest. and most com:prehensi ve coraputer system and model that would monitor the world capitai flows. By creating that mode l, all the fallacies .of market and economic theories were revealed. 'The world is Jar more dynamic and every change even in a distant land can alter the courseQf the globale economy. Just as has been shown with the turmoil in Greece, a CONTAGION takes place and now capital begins to look around at all countries. We can no more comprehend the future but looking only at domestic issues today than we can do so

in every other area, such as disease and the spread of flus.

We live in a NEW DYNAMIC GLOBAL ECONOMY. where capital rushes around fleeing political changes and taxes just as it is at·tracted by p:rosp~rity;,. All -the peopl.e

who migrated to the United States in the 19th and 20th Centuries. came tor the ,same reasons as those still corning from Mexico - jobs and prosp,erity-. Tn the 19th Century, America was said to have so much wealth, its streets .were -pav;ed in gold. We must now look to both the past and the entire world t o uuder st.and where ve now are today,

The Fractal 'Nature

of-Markets

,- ,

The Death of

Mandelbrot'

by: Martin A. Armstrong

Former Chairman of Princeton Economics International, Ltd. and the Foundati~n For The Study of Cycles

"E conomics is a science of fashions - Keynes and 'pump-priming' at one time, Friedman and monetarism at another" wrote the Father of Chaos Theory, Benoit Mandelbrot who died last month at the age of 85 in 2004

in his book of market behavior with Richard L. Hudson. Mandelbrot was a brilliant mathematician who could see into the field of Economics while standing outside the cabin looking in from a window. He wrote that "[t]he profession burns through new theories the way a teenager

hops from one new date to another: it meets them, spends some time with them, examines them, finds what it thinks are flaws, and then drops them for a newer face." Without

a doubt, his keen observation of the field of Economics is right on the mark. Just sometimes, it takes a dispassionate observer to see the truth, but looking in from the outside. It is the story of Socrates when the Oracle at Delphi says he is the

most intelligent man in Greece and he fails to comprehend how that is possible and pretty much pisses-off just about everyone by discovering he has an ability to see into that field from the outside with a dispassionate perspective.

Mandelbrot began to 'teach at Harvard and Yale AFTER his career at IBM. He also taught at 'the Ecole Poly technique'. He is the father of Fractal Geometry. In the 1960s, he showed that Britain's coastline could never be measured in a way that would produce any cons enus regarding its actual length. The closer you zoomed in, the greater the length became. A one inch stretch was just as complicated as the whole when observed from a distance. He demonstrated that there was a repeating nature to everything from the small to the great. It is the same pattern over and over.

I myself and many others saw this same fractal element in political events and of course history. I saw in the 1970s that the intraday patterns would migrate to the daily and then the weekly, and monthly levels. I began to then chart years, decades, and centuries always seeing the same patterns appeared. While it took Mandelbrot to truly formalize this natural progression calling it fractal, his observations led him to the same conclusion but from a natural science perspective. In reality, there were many who saw the same thing in many different fields.

1

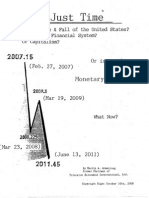

February 26th, 2007

2007.866 (11/12(071

Where in trading, I discovered that you could take the name of the object being then charted off the chart altogether, and you could take intray-day charts up to yearly and they all looked the same. Technical analysis and things like Elliot Wave all attempted to develop rules from patterns, although they crossed-over into the world of subject ~ysis of opinion that gave substance to the idea that beauty is in the eye of the beholder. It devolved into pattern recognition that to a large extent became an art form.

Mandelbrot was able to reveal that what appeared on the surface to be CHAOS, was irr all reality, high complex order. Mandelbrot reduced this to a mathematical world. From there, people without trading experience Wffe then hired as quants on Wall Street who took the world of abstract math and tried to then reduce the markets to a mathematical solution packed into a single equation.

These efforts produced the Orange County California bankruptcy where Merill got sued for $1 billion. There was the memorable Long T~rm Capital Market collapse based upon the Black-Scholes option pricing equation. The developments of Blac·k-Scholes were championed by LTOM and Goldman Sachs.

The problem that emerged was that Wall Streei turned to quants, but those quants had no trading experience. It became like going to a trader to consul on physics. The whole world of trying to figure out markets and the

2009.3

2009

2010.2915 April 16th,. 2010

200!).298 .(YWQ9)

economy went off on the wrong road from the very start. Everyone seemed to begin with a false premise

and garbage in gives garbage out. The Capital Asset Pricing Model of the 1960s became a joke. The Efficient Market Theory pro-

. duced nothing that was in anyway even worthwhile. All of

these various theo- 2011 ries an variations that had:indeed led to the Black-Scholes

.'

2011.45

2011.446 (6/12~13/111

.Ttme 13th,

attempt to create an equation were driving the markets and the economy off a cliff and the latest was the formula used to create the mortgage backed securities used by the main credit rating firms who strolled down that same path to oblivion.

All of these models were created by people who had no such idea about trading nor global capital flows. The idea that markets are efficient insofar as they are always a reflection of fair value is absurd. The swing between two extremes always exists.

Edward Dewey who founded the Foundation For the Study of Cycles, had worked for President Hoover and carne away from the Great Depression feeling,there was something there on a collective basis. The Dust Bowl carne

and no matter what laws were passed, Congress could not make it rain.

2

Corning from a trading background and watching things rise and collapse ever since the 1966 Stock Market Crash, I observed the same pattern appeared in all investments. It was this very "fractal" behaviour that had attracted me to studying the field, although I carne at it from a different direction than Mandelbrot.

I kind-of backed into the "fractal" na~ ture of markets. My first observation was that the PANIC was not confined to a single market, but appeared in all from stocks, the real estate, and bonds, as well as the more movable tangible objects such as art. All had risen and all had fallen. There were no such exceptions. I saw the same in history and in politics.

As I began to trade in the 197m~, there were no computer screens with chart-so I had a _pa'p_er t.ape iand I plotted tick-by-tick. I oe'ganto observe 'the "ftract.a l," behaviour in the market from one Leve I to. the next. What I had observed BETWEEN-markets, was taking place withi~ the same market graduating from one level to the next in time. I began to experiment with time, making charts in 15 minute, 30 minute, hourly, and two-hour intervals. The same patterns emerged.

We use to provide daily trading recomend at ions and in 1983, it had been worked to, such a science, we had 96 winning trades in'a row. The Wall Street Journal had called me the highest paid analyst in the world and things got even crazier by the day.

Yet through ~ll the chaos, many then began to tty to copy what we: accomp.Lf.saed by creating computer mode'Ls., My wri,tings about Chaos Theory back then perhaps misled sOl.l1e int-o thinking that the model was simply a math based 0bJect reducing the complex world down to a few lines of computer code. But those who began to try to mimic Princeton Economics merely hired quants. That was not the answer.

Those who followed us for years will recall that we always had the PANIC CYCLES!

I never revealed the formula behind them and perhaps I never really fully explained why they existed. They were to a large extent Ufractal" representations of a Great Depression on a scaleable event horizon. In other words, 98% of the time a market trades in what' people would call a ,"normal" pattern. Then comes the tsunami that wipes out everyone. The death toll is tremendous. The Great DePression first wipes out the real estate in the Florida Land Boom. Then comes stocks, and this is followed by the bond defaults in '31, and then weather wipes out agriculture. No one was left standing.

In other words, the PANIC CYCLE was

the chaos event that wipes out the traditional analytical models that map the 98% of the normal market movements. So where models cannot see the event such as 2007 or 1929

or the DOT-COM Bubble and the Crash of '89

in Tokyo, the PANIC CYCLE did what other standard models did not. It was ONLY concerned with those wild events of pure chaos.

These were what I came to explain as P~ASE TRANSITION. Those extremely volatile events. This was what I had warned President Reagan about when they created G5 in 1985

to manipulate the dollar lower by 40% that manifested itself into the 1987 Crash. This was what Mr. Sprinkle wrote and said that Princeton Economics was the only firm who had such a model and until someone else had such a model, they could not rely on just one.

This was the essence of coping with

the reality of markets and the g Loba Loeconrmy, Predicting the normal course of markets is not difficult. Trying to figure out WHEN that PHASE TRANSITION is going to hit is a completely different thing altogether.

While Mandelbrot was not a trader and was looking from the outside in, he did not understand the global economy for he never had the opportunity to witness international action. ~e wrote that "I agree with the orthodox economists that stock prices are probably not predictable in any useful sense of the term." I could not disgree more. Yet Mandelbrot came close to defining the problem where he distinguished between what he had called a "Joseph" event in biblical terms of 7 years of the good life and 7 years of the lean times, from what he called a "Noah" event such as the Great Depression or 911.

He wrongly assumed that these events would

be unpredictable and cause the models to fail. Yes, they do cause the models to fail when the model is based only on the 98% normal trending events. Mandelbrot came close to

at least identifying that there is what I have called a PHASE TRANSITION and developed a PANIC CYCLE MODEL.

There is indeed FRACTAL self-similarity with one market from every division of time from great to small. There is also the same similarity among varied markets. But then there

3

is the PANIC CYCLE that runs through absolute':: ly everything around us. These are the truly great events of alignment from many different segments both instinctively within human behavior as well as within nature.

It is often a mystery why nature seems to kick-in when the economy takes a hit. Just as there was the Dust Bowl of the late 1930s that resulted from a 7 year drought that was of a Biblical frequency, there was the Black Death that hit following the Sovereign Debt defaults of England and Naples in 1342.

Mandelbrot's proof of a new geometry that has had a significant impact not merely upon the mathematics field, but also on such diverse fields as physical chemistry, fluid mechanics, physiology, and then people tried to apply it to markets without understanding the nature of markets to begin with.

Like the medical care in federal prison, they will do absolutely nothing unless they see blood. They investigate nothing and a witch-doctor would be a huge improvement for at least they would pray over you instead of cursing you. There is no respect for illMAN RIGHTS at all. Adopting the same approach, those who latched on to Mandelbrot's "fractals" understood nothing, and applied it to only their limited mind's view of a market. They did not investigate the dynamic structure

of the economy or the global CONTAGIONS and interconnectivity. This is why the models they created failed and there is a higher probability of death in prisons because

they do nothing unless they see blood.

Both illustrate the dangers of no testing.

Fractal geometry is quite distinct from the simple figures of classical, or Euclidean geometry - the square, circle, sphere for example. Fractals are capable of then describing the many irregularly shaped objects or spatially nonuniform phenomena in nature that simply cannot be accommodated

by the components of Euclidean geomtry.

Most fractals are self-similar, but not all in nature are precise. A self-similar object is one where its component parts do in fact resemble the whole. This attribute is inherent in economics and market behavior because it can be witnessed on all levels of time.

The mere fact that history repeats is also an example of the self-similar nature of the behavior of man. As Machiavelli said, the one thing that never changes is man's passions. This is why history is fractal at its core.

A self-similar fractal object remains invariant under changes of scale, so a chart

.intraday cannot be distringuished from a daily, weekly, monthly, or yearly chart.

This is scaling symmetry. This inherent trait can be seen in objects like a snowflake. This fractal phenomenon can be readily seen in such objects in nature and in the plain collective behavior of man. They are indeed stochastic meaning there is a randomness

to a variable. This allows them to scale in a statistical sense. Hence, markets are very fractal in nature making them much more com-

,plex to understand. The fractal phenomenon is a proof of this complexity.

There is also a FRACTAL DIMENSION

no matter how much we magnified the object, or even if we change the view. However, the fractal dimension is express as a fraction whereas an Eucliden dimension is expressed by a whole number. If we constructed a curve using fractals, the length of the perimeter of such a curve incre~ses in the ratio of

4 to 3. (D) is the fractal dimension and this is the power to which 3 must be raised to produce 4 - i.e. 3D = 4. The fractal curve is thus log 4/log 3, or roughly 1.26. This illustrates both the complexity and the nuances of the shape.

-Fractals have been used to reveal the distribution of galaxy clusters throughout the universe. However, applying fractals

to the economy produces a coherent and neat distribution of wealth, but the models that have been adopted by Wall Street that have blown up everything from Long-Term Capital Management to the latest mortgage debacle, failure because they are being applied on the cheap to limited snap-shots of the economy, wi thout any comprehension of the true scope and complexity with which they are dealing. It is going to take someone with EXPERIENCE to understand the world economy·to solve

the problems and it is going to take a true budget not limited by immediate profits as has been the case on Wall Street.

4

Вам также может понравиться

- The Cycle of War and the Coronavirus: The New Threat to World Peace & Battle of the BillionairesОт EverandThe Cycle of War and the Coronavirus: The New Threat to World Peace & Battle of the BillionairesРейтинг: 5 из 5 звезд5/5 (3)

- Manipulating the World Economy: The Rise of Modern Monetary Theory & the Inevitable Fall of Classical Economics — Is there an Alternative?От EverandManipulating the World Economy: The Rise of Modern Monetary Theory & the Inevitable Fall of Classical Economics — Is there an Alternative?Рейтинг: 5 из 5 звезд5/5 (2)

- Armstrong The End of TimeДокумент40 страницArmstrong The End of TimecantusОценок пока нет

- The Dog Bone Portfolio: A Personal Odyssey into the First Kondratieff Winter of the Twenty-First CenturyОт EverandThe Dog Bone Portfolio: A Personal Odyssey into the First Kondratieff Winter of the Twenty-First CenturyОценок пока нет

- Armstrong On GoldДокумент5 страницArmstrong On GoldNathan MartinОценок пока нет

- Armstrong Economics Manual ModelsДокумент93 страницыArmstrong Economics Manual ModelsLotus NagaОценок пока нет

- Kris' Integrity Regarding Martin Armstrong and BookДокумент1 страницаKris' Integrity Regarding Martin Armstrong and BookKristy Doty ZuurОценок пока нет

- The 17.6 Year Stock Market Cycle: Connecting the Panics of 1929, 1987, 2000 and 2007От EverandThe 17.6 Year Stock Market Cycle: Connecting the Panics of 1929, 1987, 2000 and 2007Рейтинг: 4 из 5 звезд4/5 (8)

- Martin Armstrong - Tipping Point 2-3-2011Документ10 страницMartin Armstrong - Tipping Point 2-3-2011Ragnar DanneskjoldОценок пока нет

- The 8.6 Year Cycle and The Forces of Mother Nature 91509Документ4 страницыThe 8.6 Year Cycle and The Forces of Mother Nature 91509Kris100% (7)

- Martin Armstrong - It's Just Time (2008)Документ77 страницMartin Armstrong - It's Just Time (2008)Ragnar DanneskjoldОценок пока нет

- Behind The Curtain - The Full Monty (Part One)Документ24 страницыBehind The Curtain - The Full Monty (Part One)Kris83% (6)

- Capital Flight - The USA Has Lost It's Stature As The Financial Capital of The WorldДокумент14 страницCapital Flight - The USA Has Lost It's Stature As The Financial Capital of The WorldKris100% (1)

- Martin Armstrong On FractalsДокумент6 страницMartin Armstrong On Fractalsxear818Оценок пока нет

- Other Side of Inflation Martin Armstrong 04-13-2011Документ11 страницOther Side of Inflation Martin Armstrong 04-13-2011Kris100% (1)

- Martin Armstrong - A Total Eclipse of The Economy 12-22-2010Документ7 страницMartin Armstrong - A Total Eclipse of The Economy 12-22-2010Ragnar DanneskjoldОценок пока нет

- The 224 Year Cycle Turns On March 22, 2013 by Martin ArmstrongДокумент4 страницыThe 224 Year Cycle Turns On March 22, 2013 by Martin ArmstrongmomentumtraderОценок пока нет

- March 22nd, Just Amazing by Martin ArmstrongДокумент4 страницыMarch 22nd, Just Amazing by Martin ArmstrongmomentumtraderОценок пока нет

- Answering Your Questions 06-09-2011Документ2 страницыAnswering Your Questions 06-09-2011Kris100% (1)

- 1 Martin Armstrong Biography May 2011Документ63 страницы1 Martin Armstrong Biography May 2011Sidewinder747Оценок пока нет

- June13th 14th Turning Point 06-14-2011Документ8 страницJune13th 14th Turning Point 06-14-2011Kris100% (1)

- Armstrong ShillДокумент32 страницыArmstrong ShilljfriedmОценок пока нет

- Martin Armstrong - Pi Number NotesДокумент8 страницMartin Armstrong - Pi Number Notesreggaemusic100% (1)

- Nihon Jishin (Japanese Earthquakes) 04-25-2011Документ10 страницNihon Jishin (Japanese Earthquakes) 04-25-2011KrisОценок пока нет

- Hyperinflation - Armstrong EconomicsДокумент4 страницыHyperinflation - Armstrong EconomicscantusОценок пока нет

- Martin Armstrong ArticleДокумент28 страницMartin Armstrong ArticleJames WarrenОценок пока нет

- Writing From 'The Hole'-Phase II of This Debt Crisis 31310Документ1 страницаWriting From 'The Hole'-Phase II of This Debt Crisis 31310Kris100% (1)

- From 'The Hole' #6 - GeniusДокумент3 страницыFrom 'The Hole' #6 - GeniusKris100% (2)

- Cycles & Pattern Projections 8/09Документ7 страницCycles & Pattern Projections 8/09Kris100% (13)

- Armstrong Economics: Forecasting The WorldДокумент5 страницArmstrong Economics: Forecasting The WorldKris100% (3)

- Armstrong Testimony To Congress - 1996Документ8 страницArmstrong Testimony To Congress - 1996KrisОценок пока нет

- 2010-07-20 The-New-Securities-Reality-7202010 PDFДокумент10 страниц2010-07-20 The-New-Securities-Reality-7202010 PDFicemanmelbОценок пока нет

- Armstrong Report 10-23-1987Документ17 страницArmstrong Report 10-23-1987david_binto100% (1)

- Manipulating The World Economy or Just Understanding How It Really Functions?Документ7 страницManipulating The World Economy or Just Understanding How It Really Functions?Tom BaccoОценок пока нет

- Electronic Money: The Real ConspiracyДокумент5 страницElectronic Money: The Real ConspiracyoverqualifiedОценок пока нет

- Coming Commodity BoomДокумент8 страницComing Commodity BoompuretrustОценок пока нет

- Martin Armstrong On The Sovereign Debt CrisisДокумент7 страницMartin Armstrong On The Sovereign Debt CrisisRon HeraОценок пока нет

- India - The ExceptionДокумент3 страницыIndia - The ExceptionvinayvparthasarathyОценок пока нет

- Martin Armstrong Biography May 2011Документ63 страницыMartin Armstrong Biography May 2011Kris100% (1)

- Martin Armstrong - The Next WaveДокумент15 страницMartin Armstrong - The Next WaveNathan MartinОценок пока нет

- Armstrong Economics "The Unattainable Illusion Never Changed" 09 25 11Документ10 страницArmstrong Economics "The Unattainable Illusion Never Changed" 09 25 11valeriobrlОценок пока нет

- Its Just Time Martin ArmstrongДокумент77 страницIts Just Time Martin ArmstrongMarty MahОценок пока нет

- The Dow & The Future - Theory & Myth 12-6-09Документ30 страницThe Dow & The Future - Theory & Myth 12-6-09Kris100% (3)

- On Martin Armstrong's 'It's Just Time' - Seeking AlphaДокумент4 страницыOn Martin Armstrong's 'It's Just Time' - Seeking AlphakennerhkОценок пока нет

- Cycles In Our History Predict A (Nuclear?) World War: History Cycles, Time FractualsОт EverandCycles In Our History Predict A (Nuclear?) World War: History Cycles, Time FractualsОценок пока нет

- 45 Years In Wall Street (Rediscovered Books): A Review of the 1937 Panic and 1942 Panic, 1946 Bull Market with New Time Rules and Percentage Rules with Charts for Determining the Trend on StocksОт Everand45 Years In Wall Street (Rediscovered Books): A Review of the 1937 Panic and 1942 Panic, 1946 Bull Market with New Time Rules and Percentage Rules with Charts for Determining the Trend on StocksОценок пока нет

- Stock Cycles: Why Stocks Won't Beat Money Markets over the Next Twenty YearsОт EverandStock Cycles: Why Stocks Won't Beat Money Markets over the Next Twenty YearsРейтинг: 4.5 из 5 звезд4.5/5 (3)

- The Breaking Point: Profit from the Coming Money CataclysmОт EverandThe Breaking Point: Profit from the Coming Money CataclysmОценок пока нет

- The Production of Money - Ann Pettifor's LSE LectureДокумент20 страницThe Production of Money - Ann Pettifor's LSE LectureemontesaОценок пока нет

- Wall StreetДокумент382 страницыWall StreetDoug HenwoodОценок пока нет

- It Didn't Have to Be This Way: Why Boom and Bust Is Unnecessary—and How the Austrian School of Economics Breaks the CycleОт EverandIt Didn't Have to Be This Way: Why Boom and Bust Is Unnecessary—and How the Austrian School of Economics Breaks the CycleРейтинг: 4 из 5 звезд4/5 (4)

- The Enigma of Capital and The Crisis This Time: David HarveyДокумент14 страницThe Enigma of Capital and The Crisis This Time: David HarveydaladaldalaОценок пока нет

- Cyril Smith - Marx at The MillenniumДокумент28 страницCyril Smith - Marx at The MillenniumMarijan KraljevićОценок пока нет

- An Idiot's Overview of Why Western Capitalism Is Crashing: Alan HartДокумент4 страницыAn Idiot's Overview of Why Western Capitalism Is Crashing: Alan HartSimply Debt SolutionsОценок пока нет

- June13th 14th Turning Point 06-14-2011Документ8 страницJune13th 14th Turning Point 06-14-2011Kris100% (1)

- Martin Armstrong Biography May 2011Документ63 страницыMartin Armstrong Biography May 2011Kris100% (1)

- Answering Your Questions 06-09-2011Документ2 страницыAnswering Your Questions 06-09-2011Kris100% (1)

- Nihon Jishin (Japanese Earthquakes) 04-25-2011Документ10 страницNihon Jishin (Japanese Earthquakes) 04-25-2011KrisОценок пока нет

- So You Thought The Sovereign Debt Crisis Was Over 05-10-2011Документ9 страницSo You Thought The Sovereign Debt Crisis Was Over 05-10-2011rmullisОценок пока нет

- Other Side of Inflation Martin Armstrong 04-13-2011Документ11 страницOther Side of Inflation Martin Armstrong 04-13-2011Kris100% (1)

- Martin Armstrong - The Next WaveДокумент15 страницMartin Armstrong - The Next WaveNathan MartinОценок пока нет

- Armstrong Testimony To Congress - 1996Документ8 страницArmstrong Testimony To Congress - 1996KrisОценок пока нет

- Princeton Economics Archive Crisis-In-Democracy1987Документ9 страницPrinceton Economics Archive Crisis-In-Democracy1987KrisОценок пока нет

- The Assent of China The New Face of China 1-25-2011Документ11 страницThe Assent of China The New Face of China 1-25-2011Daniele TurrettiОценок пока нет

- Nice Try But No Cigar 10-9-2010Документ13 страницNice Try But No Cigar 10-9-2010mdesign1984Оценок пока нет