Академический Документы

Профессиональный Документы

Культура Документы

Digest RR 14-2018

Загружено:

Carlota Nicolas Villaroman0 оценок0% нашли этот документ полезным (0 голосов)

45 просмотров1 страницаDigest RR 14-2018

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документDigest RR 14-2018

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

45 просмотров1 страницаDigest RR 14-2018

Загружено:

Carlota Nicolas VillaromanDigest RR 14-2018

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

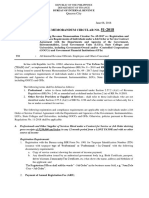

REVENUE REGULATIONS NO.

14-2018 issued on April 5, 2018 amends the provisions of

Revenue Regulations No. 11-2018, particularly Sections 2 and 14.

There shall be withheld a creditable Income Tax at the rates herein specified on the

gross professional, promotional, and talent fees or any other form of remuneration for the

services rendered by the following:

Individual payee:

If gross income for the current year did not exceed - Five percent (5%)

₱3M

If gross income is more than ₱3M or VAT Registered

regardless of amount - Ten percent (10%)

Non-individual payee:

If gross income for the current year did not exceed

₱720,000 - Ten percent (10%)

If gross income exceeds ₱720,000 - Fifteen percent (15%)

Income recipient/payee subject to withholding tax under Section 2 (Section 2.57.2 of

RR No. 11-2018) and availing to be exempt from the prescribed withholding tax rates shall

submit on or before April 20, 2018 a duly accomplished “Income Payee’s Sworn Declaration of

Gross Receipts/Sales”, together with a copy of the Certificate of Registration (COR) to his/her

income payor/withholding agent.

The income payor/withholding agent who/which received the “Income Payee’s Sworn

Declaration of Gross Receipts/Sales” and the copy of the payee’s COR shall submit on or before

April 30, 2018 a duly accomplished “Income Payor/Withholding Agent’s Sworn Declaration”,

together with the List of Payees who have submitted “Income Payee’s Sworn Declaration of

Gross Receipts/Sales” and copies of CORs.

Any Income Tax withheld by the income payor/withholding agent in excess of what is

prescribed in these regulations shall be refunded to the payee by the said income

payor/withholding agent. The income payor/withholding agent shall reflect the amount refunded

as adjustment to the remittable withholding tax due for the first quarter withholding tax return.

The adjusted amount of tax withheld shall also be reflected in the Alphabetical List of Payees to

be attached in the said first (1st) quarter return. The said list of payees, who are subject to refund

either due to the change of rates of withholding or due to the qualification to avail of exemption

from withholding tax shall likewise be attached in the said return, which shall be filed on or

before April 30, 2018.

In case the Certificate of Tax Withheld at Source (BIR Form No. 2307) has already

been given to the payee, the same shall be returned by the payee to the payor upon receipt of the

amount refunded by the income payor/withholding agent, together with the corrected BIR Form

No. 2307, if still applicable. Otherwise, the said certificate to be given to the payee on or before

the twentieth (20th) day after the close of the first (1st) quarter must reflect the corrected amount

of tax withheld.

In no case shall income payee use BIR Form No. 2307 twice for the same amount of

income payment from the same income payor/withholding agent and for the same period.

Вам также может понравиться

- Rangel Taxes 2019Документ38 страницRangel Taxes 2019Josue Perez VelezОценок пока нет

- Form - 1040 - ES PDFДокумент12 страницForm - 1040 - ES PDFAnonymous JqimV1EОценок пока нет

- Basic TaxationДокумент45 страницBasic TaxationTessa De Claro89% (9)

- Corpo CasesДокумент2 страницыCorpo CasesGela Bea BarriosОценок пока нет

- Taxation Bar Questions (Multiple Choice Questions and Answers)Документ81 страницаTaxation Bar Questions (Multiple Choice Questions and Answers)Anonymous Mickey Mouse100% (1)

- 2307Документ2 страницы2307Nephy Bersales Taberara67% (3)

- 36 - PILIPINAS TOTAL GAS vs. CIRДокумент2 страницы36 - PILIPINAS TOTAL GAS vs. CIRLEIGH TARITZ GANANCIALОценок пока нет

- Sps Decena Vs PiqueroДокумент2 страницыSps Decena Vs PiqueroCarlota Nicolas VillaromanОценок пока нет

- Silverio v. RepublicДокумент1 страницаSilverio v. RepublicCarlota Nicolas Villaroman100% (1)

- Philippine Products Co. v. Primateria SocieteДокумент3 страницыPhilippine Products Co. v. Primateria SocieteJNMGОценок пока нет

- DPWH v. City Advertising Ventures Corp. - INjUNCTIONДокумент4 страницыDPWH v. City Advertising Ventures Corp. - INjUNCTIONCarlota Nicolas VillaromanОценок пока нет

- SAP FICO Project - Part 1Документ132 страницыSAP FICO Project - Part 1anand chawanОценок пока нет

- Taxation I - PreFinals - Corporation Income TaxationДокумент91 страницаTaxation I - PreFinals - Corporation Income TaxationMicha Chernobyl Malana-CabatinganОценок пока нет

- Conflict of LawsДокумент50 страницConflict of LawsCarlota Nicolas VillaromanОценок пока нет

- QuestionsДокумент9 страницQuestionsOlivia Jane100% (1)

- CIR v. P&G Philippine tax credit deniedДокумент2 страницыCIR v. P&G Philippine tax credit deniedNaomi QuimpoОценок пока нет

- Hall v. PiccioДокумент4 страницыHall v. PiccioApipah Datudacula-MacabangkitОценок пока нет

- Galindez v. FirmalanДокумент1 страницаGalindez v. FirmalanCarlota Nicolas VillaromanОценок пока нет

- Supreme Court Rules on Taxation of Airlines Under FranchiseДокумент18 страницSupreme Court Rules on Taxation of Airlines Under Franchisemceline19Оценок пока нет

- Ona v. CIRДокумент2 страницыOna v. CIRCarlota Nicolas Villaroman100% (1)

- Republic v. CagandahanДокумент1 страницаRepublic v. CagandahanCarlota Nicolas VillaromanОценок пока нет

- Philamcare vs CA health care agreementДокумент1 страницаPhilamcare vs CA health care agreementADОценок пока нет

- Jardine Davies Insurance Brokers vs. AliposaДокумент2 страницыJardine Davies Insurance Brokers vs. AliposaCarlota Nicolas Villaroman100% (1)

- Republic v. Spouses NovalДокумент1 страницаRepublic v. Spouses NovalCarlota Nicolas Villaroman100% (1)

- Uy v. CAДокумент3 страницыUy v. CACarlota Nicolas Villaroman100% (1)

- Recent Supreme Court and CTA Tax DecisionsДокумент144 страницыRecent Supreme Court and CTA Tax DecisionsFender Boyang100% (1)

- TIO KHE CHIO vs. CA PDFДокумент2 страницыTIO KHE CHIO vs. CA PDFCarlota Nicolas VillaromanОценок пока нет

- Makati Tuscany Condominium Corp. v. Multi-Realty Development CorpДокумент1 страницаMakati Tuscany Condominium Corp. v. Multi-Realty Development CorpCarlota Nicolas Villaroman100% (1)

- Steampship Mutual Underwriting Association (Bermuda) Limited v. Sulpicio Lines, Inc.Документ3 страницыSteampship Mutual Underwriting Association (Bermuda) Limited v. Sulpicio Lines, Inc.Carlota Nicolas VillaromanОценок пока нет

- Latest Jurisprudence and Landmark Doctrines On DepreciationДокумент2 страницыLatest Jurisprudence and Landmark Doctrines On DepreciationCarlota Nicolas VillaromanОценок пока нет

- Documentary Evidence Rule 130b No. 2 Imani Vs MetrobankДокумент2 страницыDocumentary Evidence Rule 130b No. 2 Imani Vs MetrobankRepolyo Ket CabbageОценок пока нет

- Eversley Childs Sanitarium v. Spouses BarbaronaДокумент1 страницаEversley Childs Sanitarium v. Spouses BarbaronaCarlota Nicolas VillaromanОценок пока нет

- RA 8291 GSIS ActДокумент19 страницRA 8291 GSIS ActAicing Namingit-VelascoОценок пока нет

- Guevarra vs Eala: Lawyer Disbarred for Adulterous AffairДокумент18 страницGuevarra vs Eala: Lawyer Disbarred for Adulterous Affairafro yowОценок пока нет

- Heirs of Maramag v. Maramag G.R. No. 181132, June 5, 2009 FactsДокумент2 страницыHeirs of Maramag v. Maramag G.R. No. 181132, June 5, 2009 FactsFrancis PunoОценок пока нет

- DPWH v. City Advertising Ventures Corp. - NUISANCEДокумент2 страницыDPWH v. City Advertising Ventures Corp. - NUISANCECarlota Nicolas VillaromanОценок пока нет

- CIR v. Magsaysay Lines, Inc.Документ1 страницаCIR v. Magsaysay Lines, Inc.Joe CuraОценок пока нет

- Chapter 1 - STI College Vigan Paperless Document Mangement System - Jayson ViernesДокумент15 страницChapter 1 - STI College Vigan Paperless Document Mangement System - Jayson ViernesJayson ViernesОценок пока нет

- Reynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodeДокумент35 страницReynaldo S. Nicolas - Devices Affecting Control Under The Corporation CodesaverjaneОценок пока нет

- Intestate Estate of San Pedro v. CAДокумент2 страницыIntestate Estate of San Pedro v. CACarlota Nicolas VillaromanОценок пока нет

- BIR Rulings On Change of Useful LifeДокумент6 страницBIR Rulings On Change of Useful LifeCarlota Nicolas VillaromanОценок пока нет

- Compania Maritima Vs Insurance CompanyДокумент7 страницCompania Maritima Vs Insurance Companylovekimsohyun89Оценок пока нет

- Insurance law bar exam questionsДокумент5 страницInsurance law bar exam questionsMayroseTAquinoОценок пока нет

- Spouses Yulo v. Bank of The Philippine IslandsДокумент2 страницыSpouses Yulo v. Bank of The Philippine IslandsCarlota Nicolas VillaromanОценок пока нет

- Banco Filipino Savings and Mortgage Bank vs. Central Bank G.R. No. 70054, December 11, 1991Документ14 страницBanco Filipino Savings and Mortgage Bank vs. Central Bank G.R. No. 70054, December 11, 1991Ronald LasinОценок пока нет

- Heirs of Zoleta v. Land Bank of The PhilippinesДокумент1 страницаHeirs of Zoleta v. Land Bank of The PhilippinesCarlota Nicolas VillaromanОценок пока нет

- Special Proceedings Doctrine - Loti NotesДокумент38 страницSpecial Proceedings Doctrine - Loti NotesCarlota Nicolas VillaromanОценок пока нет

- Part H 2 - CIR vs. Procter GambleДокумент2 страницыPart H 2 - CIR vs. Procter GambleCyruz TuppalОценок пока нет

- 8 Florido V Atty FloridoДокумент1 страница8 Florido V Atty Floridoralph_atmosferaОценок пока нет

- 9th WeekДокумент6 страниц9th WeekStephanie GriarОценок пока нет

- July 18 - SPIT NotesДокумент8 страницJuly 18 - SPIT NotesMiggy CardenasОценок пока нет

- RR 12-01Документ6 страницRR 12-01matinikkiОценок пока нет

- Bagayas v. BagayasДокумент3 страницыBagayas v. BagayasCarlota Nicolas Villaroman100% (1)

- Page 584 Cir Vs KepcoДокумент2 страницыPage 584 Cir Vs KepcoDaniel GalzoteОценок пока нет

- Abacus v. Manila BankingДокумент3 страницыAbacus v. Manila BankingSean GalvezОценок пока нет

- 1.2 CIR V Aichi Forging Company of Asia, Inc.Документ11 страниц1.2 CIR V Aichi Forging Company of Asia, Inc.Gloria Diana DulnuanОценок пока нет

- San Miguel Corp vs. AvelinoДокумент1 страницаSan Miguel Corp vs. AvelinoCarlota Nicolas VillaromanОценок пока нет

- Dumaguete Cathedral Credit Cooperative (Dccco) V. Commissioner of Internal RevenueДокумент2 страницыDumaguete Cathedral Credit Cooperative (Dccco) V. Commissioner of Internal RevenuepaobnyОценок пока нет

- Civil Pro ReviewДокумент23 страницыCivil Pro ReviewjamesОценок пока нет

- Pena Vs AparicioДокумент8 страницPena Vs AparicioShari ThompsonОценок пока нет

- Vda de Biascan v. Biascan DigestДокумент3 страницыVda de Biascan v. Biascan Digestautumn moonОценок пока нет

- Sps Franco Vs IAC Case DigestДокумент3 страницыSps Franco Vs IAC Case DigestYeb CedulloОценок пока нет

- Pagcor vs. Bir - December 10, 2014Документ6 страницPagcor vs. Bir - December 10, 2014Cyruss Xavier Maronilla NepomucenoОценок пока нет

- Tax Digests Remaining CasesДокумент15 страницTax Digests Remaining CasesAdrian FranzingisОценок пока нет

- Regulating Philippine Stevedoring Companies as Public UtilitiesДокумент6 страницRegulating Philippine Stevedoring Companies as Public Utilitiesmarie janОценок пока нет

- First Planters Pawnshop v. CIR, G.R. No. 174134, July 30, 2008Документ8 страницFirst Planters Pawnshop v. CIR, G.R. No. 174134, July 30, 2008Emerson NunezОценок пока нет

- Hazegawa Vs KitamuraДокумент1 страницаHazegawa Vs Kitamurapja_14Оценок пока нет

- PNR vs. CA G.R. No. 157658Документ8 страницPNR vs. CA G.R. No. 157658Jam LentejasОценок пока нет

- Negotiable Instruments Reviewer For FinalsДокумент10 страницNegotiable Instruments Reviewer For FinalsAireen Villahermosa PiniliОценок пока нет

- Firestone Tire Wins Collection Suit Against Ines Chaves for Unpaid InvoicesДокумент2 страницыFirestone Tire Wins Collection Suit Against Ines Chaves for Unpaid InvoicesSharon Padaoan RuedasОценок пока нет

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAДокумент2 страницыBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloОценок пока нет

- SSS V CAДокумент2 страницыSSS V CARZ ZamoraОценок пока нет

- ICC jurisdiction and non-surrender agreementsДокумент16 страницICC jurisdiction and non-surrender agreementsJOJI ROBEDILLOОценок пока нет

- RP Vs Fncbny DigestДокумент2 страницыRP Vs Fncbny Digestjim jimОценок пока нет

- Rohm Apollo vs. CIRДокумент6 страницRohm Apollo vs. CIRnikkisalsОценок пока нет

- Loan Agreement Interest DisputeДокумент100 страницLoan Agreement Interest Dispute2CОценок пока нет

- 20 Traders Royal Bank Vs Radio Philippines NetworkДокумент6 страниц20 Traders Royal Bank Vs Radio Philippines NetworktheresagriggsОценок пока нет

- Torts and DamagesДокумент63 страницыTorts and DamagesStevensonYuОценок пока нет

- 3.G.R. No. 103092Документ5 страниц3.G.R. No. 103092Lord AumarОценок пока нет

- 2nd Half Cases-Rulings OnlyДокумент39 страниц2nd Half Cases-Rulings OnlyalyssamaesanaОценок пока нет

- Republic of The Philippines Manila First Division: Supreme CourtДокумент4 страницыRepublic of The Philippines Manila First Division: Supreme CourtJil Mei IV100% (1)

- Republic V Mambulao Lumber: A Claim For Taxes Is Not Such A Debt, Demand, Contract or Judgment As IsДокумент1 страницаRepublic V Mambulao Lumber: A Claim For Taxes Is Not Such A Debt, Demand, Contract or Judgment As IsiptrinidadОценок пока нет

- PADISCOR vs Nievarez - Temporary lay-off requires proof of financial lossesДокумент2 страницыPADISCOR vs Nievarez - Temporary lay-off requires proof of financial lossesRalph Christian Lusanta FuentesОценок пока нет

- Duavit Vs Ca PDFДокумент3 страницыDuavit Vs Ca PDFSheena PagoОценок пока нет

- Subpoena AbbyДокумент2 страницыSubpoena AbbyAbby EvangelistaОценок пока нет

- Undergrad Review in Income TaxationДокумент17 страницUndergrad Review in Income TaxationJamesОценок пока нет

- CIR Vs Commonwealth ManagementДокумент3 страницыCIR Vs Commonwealth ManagementGoody100% (1)

- Agra (Group 3) - GsisДокумент43 страницыAgra (Group 3) - GsisPatatas SayoteОценок пока нет

- Unclaimed Bank Deposits Escheated to PhilippinesДокумент2 страницыUnclaimed Bank Deposits Escheated to PhilippinesChristopher Jan DotimasОценок пока нет

- Philippine Long Distance Telephone Company vs. National Telecommunications Commission PDFДокумент16 страницPhilippine Long Distance Telephone Company vs. National Telecommunications Commission PDFXtine CampuPotОценок пока нет

- FPIC EXEMPT FROM LOCAL TAX AS COMMON CARRIERДокумент2 страницыFPIC EXEMPT FROM LOCAL TAX AS COMMON CARRIERDavid CameronОценок пока нет

- When to Apply 10% or 15% EWT for Professional FeesДокумент2 страницыWhen to Apply 10% or 15% EWT for Professional FeesRegs AccexОценок пока нет

- RMC No 51-2008Документ7 страницRMC No 51-2008Yasser MangadangОценок пока нет

- BIR Tax Briefing - RR 11-2018Документ3 страницыBIR Tax Briefing - RR 11-2018Jeff BulasaОценок пока нет

- Conflict of Law - Case DoctrinesДокумент4 страницыConflict of Law - Case DoctrinesCarlota Nicolas VillaromanОценок пока нет

- Quick Doctrines On Classess of EmployeesДокумент2 страницыQuick Doctrines On Classess of EmployeesCarlota Nicolas VillaromanОценок пока нет

- Principle of Forum Non ConveniensДокумент5 страницPrinciple of Forum Non ConveniensCarlota Nicolas VillaromanОценок пока нет

- Limlingan v. Asian Institute of Management, Inc.Документ3 страницыLimlingan v. Asian Institute of Management, Inc.Carlota Nicolas Villaroman100% (1)

- VAT - Northwind Power Development Corporation v. CIR PDFДокумент4 страницыVAT - Northwind Power Development Corporation v. CIR PDFCarlota Nicolas VillaromanОценок пока нет

- Loti Notes - Wills FormalitiesДокумент49 страницLoti Notes - Wills FormalitiesCarlota Nicolas VillaromanОценок пока нет

- Commrev - Insurance - Loti NotesДокумент99 страницCommrev - Insurance - Loti NotesCarlota Nicolas VillaromanОценок пока нет

- Quezon City Foundation Tax Exemption RulingДокумент8 страницQuezon City Foundation Tax Exemption RulingKem FajardoОценок пока нет

- RMC No. 73-2019 - Annex CДокумент2 страницыRMC No. 73-2019 - Annex CLeo R.Оценок пока нет

- Administrative Provisions - Estate Tax (Presentation Slides)Документ9 страницAdministrative Provisions - Estate Tax (Presentation Slides)KezОценок пока нет

- SIGTAS & New IRC Forms - AmДокумент24 страницыSIGTAS & New IRC Forms - AmAnnahMaso100% (2)

- Both Statements Are False (4) The First Statement Is True and The Second Is FalseДокумент4 страницыBoth Statements Are False (4) The First Statement Is True and The Second Is FalseNoreen NombsОценок пока нет

- BIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated OutДокумент4 страницыBIR Ruling No. 453-2018 Interest Income On Individual Loans Obtained From Banks That Are Not Securitized, Assigned or Participated Outliz kawiОценок пока нет

- Bir05 PDFДокумент3 страницыBir05 PDFBarangay LumbangОценок пока нет

- ADM 016 ACRS Certification Agreement (Version 3.1) WebДокумент23 страницыADM 016 ACRS Certification Agreement (Version 3.1) WebMonica SinghОценок пока нет

- Weekly Tax TableДокумент12 страницWeekly Tax TableLianna HendyОценок пока нет

- Singapore Withholding Tax Presented by Tax Accountants Pte LTDДокумент2 страницыSingapore Withholding Tax Presented by Tax Accountants Pte LTDTax AccountantsОценок пока нет

- Duyag Vs InciongДокумент8 страницDuyag Vs InciongAngela P. SenoraОценок пока нет

- Annual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesДокумент6 страницAnnual Information Return of Income Taxes Withheld On: Compensation and Final Withholding TaxesStanly OrtizОценок пока нет

- RR 03-98Документ5 страницRR 03-98Ayvee BlanchОценок пока нет

- Final Income Taxation: Catch-All For Item of Gross Income Not Subject To Final Tax and Capital Gains TaxДокумент2 страницыFinal Income Taxation: Catch-All For Item of Gross Income Not Subject To Final Tax and Capital Gains Taxdaenielle reyesОценок пока нет

- Ascap P A: Ublisher PplicationДокумент12 страницAscap P A: Ublisher Pplicationtytewriter1Оценок пока нет

- TRAIN Briefing – Income TaxДокумент34 страницыTRAIN Briefing – Income TaxJemma SaponОценок пока нет

- SCRC 3 CorporationДокумент18 страницSCRC 3 CorporationChristine Yedda Marie AlbaОценок пока нет

- FATCA Non Individual FormДокумент6 страницFATCA Non Individual FormV RОценок пока нет

- Income tax payment receipt detailsДокумент1 страницаIncome tax payment receipt detailsM Naveed SultanОценок пока нет