Академический Документы

Профессиональный Документы

Культура Документы

Name: - Grade & Section

Загружено:

Techh SavvyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Name: - Grade & Section

Загружено:

Techh SavvyАвторское право:

Доступные форматы

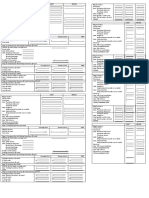

NAME: ___________________________________________________________________ GRADE & SECTION: ____________________________

ADJUSTING ENTRIES 02

Problem 1 – The company purchased equipment at a cost of 7,200. The estimated salvage value of this equipment was 600, and estimated useful life is 10 years.

The annual depreciation is:

Computation: (Annual) Computation: (Monthly Depreciation)

Journal Entry: (for monthly depreciation report)

Book Value Balance Sheet entry

Cost ____ Equipment ____

Less: Accumulated Depreciation ____ Less: Accumulated Depreciation: ____

Book Value ____ _______

Problem 2 - A delivery truck was purchased for P25,000. It is estimated to last 10 years after which it shall have a value of P5,000. Compute for the depreciation.

Computation: (Annual) Computation: (Monthly Depreciation)

Journal Entry: (for monthly depreciation report)

Book Value Balance Sheet entry

Cost ____ Delivery Truck ____

Less: Accumulated Depreciation ____ Less: Accumulated Depreciation: ____

Book Value ____ _______

Problem 3 – The company purchased a building on April 1, 2011. The building cost 870,000 has an estimated 25-year life, and is not expected to have any salvage

value at the end of that time.

Computation: (Annual) Computation: (Monthly Depreciation)

Journal Entry: (for monthly depreciation report)

Book Value Balance Sheet entry

Cost ____ Building ____

Less: Accumulated Depreciation ____ Less: Accumulated Depreciation: ____

Book Value ____ _______

Вам также может понравиться

- Appendix 70 PPELCДокумент3 страницыAppendix 70 PPELCJo Ellaine TorresОценок пока нет

- PartnershipДокумент10 страницPartnershipMark Joseph Urmeneta Fernando80% (5)

- Retail Formula .2Документ1 страницаRetail Formula .2C/PVT DAET, SHAINA JOYОценок пока нет

- Variable and Absorption Costing ActivityДокумент4 страницыVariable and Absorption Costing ActivityRendyel PagariganОценок пока нет

- Appendix 9 - SLCДокумент1 страницаAppendix 9 - SLCrocky CadizОценок пока нет

- Chapter 3/unit 4 Review Sheet 4/preparing The Income StatementДокумент2 страницыChapter 3/unit 4 Review Sheet 4/preparing The Income Statementkamaljeet kaurОценок пока нет

- For Quiz - Product CostingДокумент3 страницыFor Quiz - Product CostingBetchang AquinoОценок пока нет

- Dressny Inc FormsДокумент10 страницDressny Inc Formsancla.theaalenaОценок пока нет

- PowerPoint FA1 C5 EngДокумент38 страницPowerPoint FA1 C5 EngNG AshleyОценок пока нет

- CKSIAN-Accounting Cycle Hacks pt3Документ4 страницыCKSIAN-Accounting Cycle Hacks pt3fhfdhОценок пока нет

- IAS 2 Inventory Costing and ValuationДокумент41 страницаIAS 2 Inventory Costing and ValuationReyad Al-WeshahОценок пока нет

- ReviewerДокумент2 страницыReviewerKristine De JoyaОценок пока нет

- المحاضرة التاسعة والعاشرةДокумент6 страницالمحاضرة التاسعة والعاشرةAly SaadОценок пока нет

- Income Statement Vertical Full PDFДокумент1 страницаIncome Statement Vertical Full PDFRainbow Construction LtdОценок пока нет

- Fins5514 L04 2023 PDFДокумент78 страницFins5514 L04 2023 PDFwilliam YuОценок пока нет

- Trial Balance & Financial StatementsДокумент4 страницыTrial Balance & Financial StatementsJuan FrivaldoОценок пока нет

- Appendix 70 PPELCДокумент3 страницыAppendix 70 PPELCjeromeОценок пока нет

- Activity Sheet in Business Enterprise SimulationДокумент7 страницActivity Sheet in Business Enterprise SimulationAimee LasacaОценок пока нет

- Business Plan Booklet 1Документ3 страницыBusiness Plan Booklet 1Amr AbdelMoneimОценок пока нет

- Appropriation Request: Major Elements of Estimate Estimated ExpendituresДокумент1 страницаAppropriation Request: Major Elements of Estimate Estimated ExpendituresRendra SyamОценок пока нет

- Week 3 - Non-Current AssetsДокумент55 страницWeek 3 - Non-Current AssetsAishath Nisfa MohamedОценок пока нет

- Taxation and DepreciationДокумент62 страницыTaxation and Depreciationrobel popОценок пока нет

- FABM1 11 Quarter 4 Week 1 Las 1Документ1 страницаFABM1 11 Quarter 4 Week 1 Las 1Janna PleteОценок пока нет

- ACCTG1 Chapter 6Документ2 страницыACCTG1 Chapter 6Mark Kevin JavierОценок пока нет

- Week 7 HWMДокумент8 страницWeek 7 HWMJarongchai Keng HaemaprasertsukОценок пока нет

- AS-2: Accounting for InventoriesДокумент18 страницAS-2: Accounting for InventoriesTushar Gauba0% (1)

- Fsa End SemДокумент5 страницFsa End SemCharles MarkeyОценок пока нет

- 9Документ16 страниц9Asal IslamОценок пока нет

- THREE BASIC FINANCIAL STATEMENTSДокумент12 страницTHREE BASIC FINANCIAL STATEMENTSJayvee TasaneОценок пока нет

- 2010-05-29 174457 XaiverДокумент2 страницы2010-05-29 174457 XaiverShaoPuYuОценок пока нет

- ML10 Xadd 05 - Rep3 FiscalPaperFormsДокумент5 страницML10 Xadd 05 - Rep3 FiscalPaperFormsmalox25677Оценок пока нет

- ACTG 3151 Test #1 (Converted)Документ2 страницыACTG 3151 Test #1 (Converted)Ermine BonnellОценок пока нет

- 5.03 - NOTES: 6311 Accounting I Summer 2010, Version 2Документ15 страниц5.03 - NOTES: 6311 Accounting I Summer 2010, Version 2api-262218593Оценок пока нет

- FA2 - Sem04 ImpairmentДокумент5 страницFA2 - Sem04 Impairmenttitu patriciuОценок пока нет

- CP Accounting MIdterm Review 15-16Документ11 страницCP Accounting MIdterm Review 15-16jhouvanОценок пока нет

- Global supply chain integrationДокумент3 страницыGlobal supply chain integrationEchoОценок пока нет

- Small Scale IndustriesДокумент15 страницSmall Scale IndustriesSumit KumarОценок пока нет

- PC2 AnswerSheetДокумент3 страницыPC2 AnswerSheetLuWiz DiazОценок пока нет

- Basic accounting test transactionsДокумент1 страницаBasic accounting test transactionsJeremy CabilloОценок пока нет

- E3 - Depreciation of Non-Current AssetsДокумент17 страницE3 - Depreciation of Non-Current Assetsanson100% (1)

- Evaluate methods to increase profit margins and liquidityДокумент2 страницыEvaluate methods to increase profit margins and liquidityKrrishna Rajesh TOKARAWATОценок пока нет

- Quiz 03Документ2 страницыQuiz 03Vincent CapulongОценок пока нет

- Excel functions and formulas for financial analysisДокумент17 страницExcel functions and formulas for financial analysisakhilsai peddiОценок пока нет

- Advanced Financial Accounting and Reporting G.P. Costa Installment SalesДокумент6 страницAdvanced Financial Accounting and Reporting G.P. Costa Installment SalesmkОценок пока нет

- PPE QUIZ MAY 2 ProblemsДокумент3 страницыPPE QUIZ MAY 2 ProblemsGenivy SalidoОценок пока нет

- Lesson Title: Home Office, Branch and Agency: AccountingДокумент14 страницLesson Title: Home Office, Branch and Agency: AccountingFeedback Or BawiОценок пока нет

- Topic 7 OF ACCONTINGДокумент11 страницTopic 7 OF ACCONTINGCharlesОценок пока нет

- Book KeepingДокумент13 страницBook KeepingWisdom Lawal (Wizywise)Оценок пока нет

- 9.form Comprehensive Income CapitalДокумент1 страница9.form Comprehensive Income CapitalAlvin AsanzaОценок пока нет

- 2013 June Management Accounting L2 PDFДокумент21 страница2013 June Management Accounting L2 PDFDixie CheeloОценок пока нет

- Acc308 Prelim Exam Name: - Date: - Score: - Permit No. - I. True/FalseДокумент3 страницыAcc308 Prelim Exam Name: - Date: - Score: - Permit No. - I. True/FalseJamhel MarquezОценок пока нет

- Philippine Education Department Summative TestДокумент3 страницыPhilippine Education Department Summative TestAlvin Echano AsanzaОценок пока нет

- EN - 2022-2023 Spring - Final Exam 15.06.2023 (Solved)Документ13 страницEN - 2022-2023 Spring - Final Exam 15.06.2023 (Solved)tomasslrsОценок пока нет

- Activity 15Документ17 страницActivity 15Babylonia San AgustinОценок пока нет

- Xid-47773026 1Документ4 страницыXid-47773026 1Chung AliciaОценок пока нет

- Inventory Valuation Methods and StandardsДокумент36 страницInventory Valuation Methods and StandardsAnkita SinghОценок пока нет

- IAS 2 Inventories: Costing Methods and ValuationДокумент7 страницIAS 2 Inventories: Costing Methods and ValuationHikmət RüstəmovОценок пока нет

- Engineering Eco NotesДокумент59 страницEngineering Eco NotesBilal AhmadОценок пока нет

- Part 2Документ1 страницаPart 2Techh SavvyОценок пока нет

- Steps in Client ConfigДокумент1 страницаSteps in Client ConfigTechh SavvyОценок пока нет

- Part 5 HahahahaДокумент2 страницыPart 5 HahahahaTechh SavvyОценок пока нет

- Wala LaaaДокумент2 страницыWala LaaaTechh SavvyОценок пока нет

- Part 4 PokkkkkДокумент2 страницыPart 4 PokkkkkTechh SavvyОценок пока нет

- Edi WowДокумент2 страницыEdi WowTechh SavvyОценок пока нет

- Part 2Документ1 страницаPart 2Techh SavvyОценок пока нет

- Part 3 Npo IrtoДокумент1 страницаPart 3 Npo IrtoTechh SavvyОценок пока нет

- Wehhhh AhahaДокумент1 страницаWehhhh AhahaTechh SavvyОценок пока нет

- CantinДокумент2 страницыCantinTechh SavvyОценок пока нет

- Java Scanner Class - Read Input and Parse ValuesДокумент6 страницJava Scanner Class - Read Input and Parse ValuesTechh SavvyОценок пока нет

- 2019 Nfot Guidelines ConsolidatedДокумент62 страницы2019 Nfot Guidelines ConsolidatedTechh SavvyОценок пока нет

- Classes of AccountsДокумент3 страницыClasses of AccountsTechh SavvyОценок пока нет

- Actt1 SFPДокумент1 страницаActt1 SFPRyan San JuanОценок пока нет

- WTFДокумент4 страницыWTFTechh SavvyОценок пока нет

- ICTДокумент2 страницыICTTechh SavvyОценок пока нет

- June 2Документ3 страницыJune 2Techh SavvyОценок пока нет

- Aa RtesДокумент17 страницAa RtesTechh SavvyОценок пока нет

- FSBДокумент2 страницыFSBTechh SavvyОценок пока нет

- La LangДокумент2 страницыLa LangTechh SavvyОценок пока нет

- KhaiДокумент2 страницыKhaiTechh SavvyОценок пока нет

- AsusДокумент2 страницыAsusTechh SavvyОценок пока нет

- 222Документ3 страницы222Techh SavvyОценок пока нет

- DLL CssДокумент1 страницаDLL CssTechh SavvyОценок пока нет

- OmniДокумент2 страницыOmniTechh SavvyОценок пока нет

- Lesson PlannnДокумент2 страницыLesson PlannnTechh SavvyОценок пока нет

- PlsssДокумент8 страницPlsssTechh SavvyОценок пока нет

- LangДокумент3 страницыLangTechh SavvyОценок пока нет

- RoleДокумент4 страницыRoleTechh SavvyОценок пока нет

- CH 4 Zakat and Tax PlanningДокумент48 страницCH 4 Zakat and Tax Planningabdihakimmohamed628Оценок пока нет

- Lec1 ProblemsДокумент16 страницLec1 Problems김가영 / 학생 / 경제학부Оценок пока нет

- Chapter 4 MДокумент39 страницChapter 4 MAhmed El KhateebОценок пока нет

- FPAC1014 Business Accounting: Lecture WorkbookДокумент107 страницFPAC1014 Business Accounting: Lecture WorkbookTay Kai XianОценок пока нет

- Chapter One Overview of Financial Management: 1.1. Finance As An Area of StrudyДокумент33 страницыChapter One Overview of Financial Management: 1.1. Finance As An Area of Strudysamuel kebedeОценок пока нет

- Half year FY21 results overviewДокумент35 страницHalf year FY21 results overviewNima MoaddeliОценок пока нет

- Functional AccountingДокумент85 страницFunctional AccountingUzair AhmadОценок пока нет

- F7.2 - Mock Test 1Документ5 страницF7.2 - Mock Test 1huusinh2402Оценок пока нет

- Marcelo Transport Services Income Statement and Balance SheetДокумент3 страницыMarcelo Transport Services Income Statement and Balance SheetPaulene Abegail MatiasОценок пока нет

- Colgate Palmolive 22Документ33 страницыColgate Palmolive 22shubhanshuОценок пока нет

- 1.1 Assignment Personal Net Worth & Accounting EquationДокумент2 страницы1.1 Assignment Personal Net Worth & Accounting EquationOrkun OzkanОценок пока нет

- Abbott FINAL REPORTДокумент42 страницыAbbott FINAL REPORTTaha NoorullahОценок пока нет

- Arun ReportДокумент60 страницArun ReportSumit SuriОценок пока нет

- Provisions and Contingencies SlidesДокумент28 страницProvisions and Contingencies SlidesAinnur Arifah100% (1)

- Chapter 01 Introduction To The Management of Working CapitalДокумент32 страницыChapter 01 Introduction To The Management of Working CapitalMahin100% (1)

- ACCA Advanced Corporate Reporting 2005Документ763 страницыACCA Advanced Corporate Reporting 2005Platonic100% (2)

- Corporate Insolvency Law Exam NotesДокумент167 страницCorporate Insolvency Law Exam NotesEmily TanОценок пока нет

- Contractor Audited Financial StatementДокумент1 страницаContractor Audited Financial StatementAbigail EjiroОценок пока нет

- Working Capital ManagementДокумент10 страницWorking Capital ManagementHarshit GoyalОценок пока нет

- Problem BankДокумент10 страницProblem BankSimona NistorОценок пока нет

- Valuatioin of GoodwillДокумент44 страницыValuatioin of GoodwillNeerja KaushikОценок пока нет

- 10 Element of FRДокумент12 страниц10 Element of FRIloОценок пока нет

- Proforma of Trading AДокумент11 страницProforma of Trading ASneha AgrawalОценок пока нет

- @canotes - Ipcc AS BookДокумент160 страниц@canotes - Ipcc AS Booksamartha umbare100% (1)

- Fecto Sugar Mills Annual ReportДокумент30 страницFecto Sugar Mills Annual ReportSyeda Kainat AqeelОценок пока нет

- 10 Years Financial Data For AirtelДокумент18 страниц10 Years Financial Data For AirtelSudipta ChatterjeeОценок пока нет

- R15 PDFДокумент119 страницR15 PDFIndonesian ProОценок пока нет

- PARTNERSHIP2Документ13 страницPARTNERSHIP2Anne Marielle UyОценок пока нет

- Lesson 4Документ114 страницLesson 4Quyen Thanh NguyenОценок пока нет