Академический Документы

Профессиональный Документы

Культура Документы

Payroll and Contribution Rates Employers PDF

Загружено:

NicquainCTОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Payroll and Contribution Rates Employers PDF

Загружено:

NicquainCTАвторское право:

Доступные форматы

Taxes & Contributions

(Rates)

Employee Employer Basis of

Calculation

2.5% 2.5%

NIS* Gross

Emoluments

2% 3%

NHT Gross

Emoluments

ED 2.25% 3.5% **Statutory

Income

TAX

Statutory Income

PAYE/

INCOME 25% N/A Less

Income Tax

TAX Threshold

Gross Taxable

HEART 3% Payroll if the

N/A Employer’s payroll

costs exceeds

$173,328 per

annum

2013

* NIS Ceiling: 2.5% o f $1,500,000.00 = $37,500

**Statutory Income = Gross Income Less Allowable Deductions

such as contributions for NIS, Approved Pension and Employees

Share Ownership Plan (ESOP).

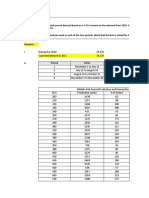

HOW TO CALCULATE AN EMPLOYEE’S PAYROLL TAXES & CONTRIBUTIONS

An employee is earning $60,000 per month as gross pay. The company has an approved

pension scheme for which the employee contributes $1,000 per month. Below is an

illustration of the calculation of the statutory and taxable income to arrive at Net Pay:

2012 DEDUCTIONS 2013 DEDUCTIONS

Gross Pay $60,000 $60,000

Less Pension Contribution ($1,000) $1,000 ($1,000) $1,000

Less NIS (2.5% of $60,000) ($1,500) $1,500 ($1,500) $1,500

Statutory Income $57,500 $57,500

($60,000 - $1,000 - $1,500)

Education Tax $1,150 $1,150 $1,293.75 $1,293.75

( 2/2.25% of Statutory Income)

( 2/2.25% × $57,500)

NHT (2% of Gross Pay ) $1,200 $1,200 $1,200 $1,200

(2% × $60,000)

Less Income Tax Threshold $36,764 $42,276

Taxable Income ($57,500 - $20,736.00 $15,224.00

$36,764) ($57,500 - $42,276)

Income Tax (25% of $20,736) $5,184.00 $ 5,184 $3,806 $3,806

(25% of $15,224)

Net Pay $49,966 $10,034 $51,200.25 $8,799.75

(Gross Pay less Total Deductions:

$60,000 - $ 10,034)(Gross Pay less

Total Deductions:

$60,000 - $8,799.75)

NIS is calculated at 2½% of Gross Pay up to a ceiling of $1,500,000( per year).

The maximum amount an employee pays for NIS is $37,500 yearly or $3,125 monthly.

Income Tax Threshold

½ Year Per Year Weekly Fortnightly Monthly

Total Threshold for 2012 $441,168 $8,484 $16,968 $36,764

Total Threshold for 2013 $507,312 $9,756 $19,512 $42,276

Threshold means the tax-free portion of your taxable pay and which is used for

Income Tax computation only. If your pay is below the threshold NO Income Tax will

be deducted.

FOR MORE INFORMATION: Call 1- 888 - TAX - HELP (829- 4357) or 1- 888 - GO-JA-TAX (465-2829)

Website: www.jamaicatax.gov.jm or www.jamaicatax-online.gov.jm

Facebook:www.facebook.com/jamaicatax I Twitter: @jamaicatax or

visit the Tax Office nearest you.

MAY 2013

Вам также может понравиться

- Make Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformОт EverandMake Taxes Great Again: The Good, the Bad and the Ugly About Tax ReformОценок пока нет

- Payroll TaxesДокумент2 страницыPayroll Taxesforevapure_bar88162Оценок пока нет

- Financial Management For Decision MakersДокумент3 страницыFinancial Management For Decision MakerssgdrgsfОценок пока нет

- Income Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Документ5 страницIncome Tax Fundamentals (Assignment 1 - FIN 4017 Questions Summer 2022) (11339)Maria PatinoОценок пока нет

- S Corp vs. Sole Prop - LLC Tax Savings CalculatorДокумент1 страницаS Corp vs. Sole Prop - LLC Tax Savings CalculatorsomdivaОценок пока нет

- Tax Foundation FF6241Документ5 страницTax Foundation FF6241muhammad mudassarОценок пока нет

- Self Employed Tax ContributionДокумент4 страницыSelf Employed Tax ContributionLe-Noi AndersonОценок пока нет

- Department of Finance and Administration: Withholding TaxДокумент3 страницыDepartment of Finance and Administration: Withholding TaxJuan Daniel Garcia VeigaОценок пока нет

- Impact of Proposed 2009 Tax IncreaseДокумент1 страницаImpact of Proposed 2009 Tax IncreaseNathan Benefield100% (1)

- Annual Compensation and Business TaxesДокумент21 страницаAnnual Compensation and Business TaxesRyDОценок пока нет

- Tabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Документ3 страницыTabl2751 - Business Taxation Tax Rates and Example Calculation TAX RATES (2017-18)Benjamin PangОценок пока нет

- Individual Taxation 2013 Pratt 7th Edition Test BankДокумент19 страницIndividual Taxation 2013 Pratt 7th Edition Test BankCharles Davis100% (34)

- Net Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!Документ7 страницNet Pay Calculator: The "NIC" and "Income Tax" Tabs Are For Calculation Purposes Only - You Do Not Need To Look at These!abhi1648665Оценок пока нет

- $87,000 Income Tax Calculator 2023 - Ontario - Salary After TaxДокумент5 страниц$87,000 Income Tax Calculator 2023 - Ontario - Salary After TaxEdward Dale LiwanagОценок пока нет

- Free Australia Personal Income Tax Calculator v1.0.2017Документ7 страницFree Australia Personal Income Tax Calculator v1.0.2017Minh Nguyen Vo NhatОценок пока нет

- Info Card 2016-17Документ12 страницInfo Card 2016-17Nick KОценок пока нет

- Manning Burden - Assumption-Jan2020Документ14 страницManning Burden - Assumption-Jan2020shaifullahОценок пока нет

- Tax Data Card 30 June 2014Документ9 страницTax Data Card 30 June 2014api-300877373Оценок пока нет

- LECTURE - 9 - TAX - COMPUTATION Year 2024 RateДокумент14 страницLECTURE - 9 - TAX - COMPUTATION Year 2024 RateArnold BucudОценок пока нет

- Salary Break Down and Invoicing ProjectionДокумент6 страницSalary Break Down and Invoicing ProjectionShu'l Gz MrtinzОценок пока нет

- ExtraTaxProblem-TY2020 Student - SUSANДокумент6 страницExtraTaxProblem-TY2020 Student - SUSANhhunter530Оценок пока нет

- Individual Taxation 2013 Pratt 7th Edition Test BankДокумент19 страницIndividual Taxation 2013 Pratt 7th Edition Test Bankbrianbradyogztekbndm100% (42)

- Tax Credit Certificate - 2018 : PPS No: 1793106MAДокумент4 страницыTax Credit Certificate - 2018 : PPS No: 1793106MAAlexandru CiobanuОценок пока нет

- TABL 2751 Tax Rates 2022Документ4 страницыTABL 2751 Tax Rates 2022Crystal CheahОценок пока нет

- Payroll Deductions: Pay. These Deductions May Include, Among Others, The FollowingДокумент11 страницPayroll Deductions: Pay. These Deductions May Include, Among Others, The FollowingheenimОценок пока нет

- TDS On SalaryДокумент5 страницTDS On SalaryAato AatoОценок пока нет

- IRS Notice 1036 - January 2018Документ4 страницыIRS Notice 1036 - January 2018FedSmith Inc.100% (1)

- 2021 Gr12 Maths Literacy WKBKДокумент20 страниц2021 Gr12 Maths Literacy WKBKtinashe chirukaОценок пока нет

- Notice 1036: Early Release Copies of The 2019 Percentage Method Tables For Income Tax Withholding Future DevelopmentsДокумент4 страницыNotice 1036: Early Release Copies of The 2019 Percentage Method Tables For Income Tax Withholding Future DevelopmentsAgr AgrОценок пока нет

- RG146 Pocket GuideДокумент30 страницRG146 Pocket GuideMentor RG146Оценок пока нет

- Mathematical Literacy Grade 12 Term 3Документ24 страницыMathematical Literacy Grade 12 Term 3Thato Moratuwa MoloantoaОценок пока нет

- Econ Math ProjectДокумент14 страницEcon Math ProjectAndy ChiuОценок пока нет

- Cpa Australia Tax and Social Security Guide: 2016-2017Документ5 страницCpa Australia Tax and Social Security Guide: 2016-2017Lupo AlbertoОценок пока нет

- Annual Gross IncomeДокумент4 страницыAnnual Gross IncomeMarilyn Perez OlañoОценок пока нет

- Chapter 3Документ22 страницыChapter 3Steve CouncilОценок пока нет

- Taxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerДокумент21 страницаTaxes Individuals Pay: Citizen's Guide To Economics Dr. Katie SauerKatherine SauerОценок пока нет

- Income Tax Schedules For Australian Residents 2019-2020: CalculatorДокумент5 страницIncome Tax Schedules For Australian Residents 2019-2020: CalculatorAkshay GargОценок пока нет

- Payroll Taxes 2002-2019Документ19 страницPayroll Taxes 2002-2019Charles HopeОценок пока нет

- Ten Tax Mistakes - Part 1Документ17 страницTen Tax Mistakes - Part 1bomseriesОценок пока нет

- Financial StatementДокумент6 страницFinancial Statementrhiscel cereligiaОценок пока нет

- Income Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeДокумент4 страницыIncome Tax Calculator FY 2015-16 (AY 2016-17) : Particulars Details TypeKamlesh ChauhanОценок пока нет

- US Master Tax Guide (PDFDrive)Документ1 258 страницUS Master Tax Guide (PDFDrive)sutan mОценок пока нет

- MnDOR LetterДокумент3 страницыMnDOR LetterTim NelsonОценок пока нет

- Chap 007Документ6 страницChap 007nasmoe321Оценок пока нет

- ManjithMeal Delivery - Group1Документ19 страницManjithMeal Delivery - Group1Reem AlyОценок пока нет

- Assignment 01, HRM 412Документ3 страницыAssignment 01, HRM 412Nur Nahar LimaОценок пока нет

- Your EPF Account Will Now Show Taxable and Non-Taxable BalanceДокумент1 страницаYour EPF Account Will Now Show Taxable and Non-Taxable Balancedrrmm2sОценок пока нет

- Ey Tax Rates Alberta 2023 01 15 v1Документ2 страницыEy Tax Rates Alberta 2023 01 15 v1AltafОценок пока нет

- The Direct Tax CodeДокумент10 страницThe Direct Tax CodeHemant SharmaОценок пока нет

- Chapter 8Документ22 страницыChapter 8Steve CouncilОценок пока нет

- United States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018Документ2 страницыUnited States Government Other Information (Unaudited) For The Years Ended September 30, 2019, and 2018LokiОценок пока нет

- TXZWE 2018 Dec QДокумент15 страницTXZWE 2018 Dec QKAH MENG KAMОценок пока нет

- (Q2) BS MATH Mod 3Документ3 страницы(Q2) BS MATH Mod 3Duhreen Kate CastroОценок пока нет

- (SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)Документ6 страниц(SINGLE TEMPLATE) Federal Tax Analysis - Last Name, First Name (2021)MD RAKIBОценок пока нет

- Income Taxation PPT - pptx-1Документ28 страницIncome Taxation PPT - pptx-1Irfan AhmedОценок пока нет

- Chapter 2Документ28 страницChapter 2Steve CouncilОценок пока нет

- Salary Sacrifice Arrangements What Is Salary Sacrifice?Документ4 страницыSalary Sacrifice Arrangements What Is Salary Sacrifice?alanОценок пока нет

- US Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesОт EverandUS Taxation of International Startups and Inbound Individuals: For Founders and Executives, Updated for 2023 rulesОценок пока нет

- Form 4A - GCT Returns PDFДокумент2 страницыForm 4A - GCT Returns PDFNicquainCTОценок пока нет

- Technical Note: DisclaimerДокумент13 страницTechnical Note: DisclaimerNicquainCTОценок пока нет

- Payroll TaxesДокумент40 страницPayroll TaxesNicquainCT0% (1)

- Market Conduct For Insurance Companies and Intermediaries Ir Consul 18-07-0016Документ13 страницMarket Conduct For Insurance Companies and Intermediaries Ir Consul 18-07-0016NicquainCTОценок пока нет

- Capital Allowance RegimeДокумент2 страницыCapital Allowance RegimeNicquainCTОценок пока нет

- The General Consumption Tax Act PDFДокумент107 страницThe General Consumption Tax Act PDFNicquainCTОценок пока нет

- Proposed ISA 701 (Revised) - FinalДокумент15 страницProposed ISA 701 (Revised) - FinalMahediОценок пока нет

- IAS 12 Income TaxДокумент40 страницIAS 12 Income TaxfurqanОценок пока нет

- 300hours Study PlanДокумент13 страниц300hours Study PlanNicquainCTОценок пока нет

- IFRS For SMEs at A Glance PDFДокумент54 страницыIFRS For SMEs at A Glance PDFNicquainCTОценок пока нет

- IAS 26 - Retirement PlansДокумент12 страницIAS 26 - Retirement PlansJanelle SentinaОценок пока нет

- IAS 24 Related Party DisclosuresДокумент14 страницIAS 24 Related Party DisclosuresChristian Blanza LlevaОценок пока нет

- Agriculture: International Accounting Standard 41Документ16 страницAgriculture: International Accounting Standard 41NicquainCTОценок пока нет

- 2015 - Amendments To IFRS For SMEs - StandardДокумент76 страниц2015 - Amendments To IFRS For SMEs - StandardChamba CNОценок пока нет

- Ias 21Документ22 страницыIas 21Cryptic LollОценок пока нет

- Ias41 PDFДокумент34 страницыIas41 PDFNicquainCTОценок пока нет

- Sweet River Abattoir 2015 Annual ReportДокумент60 страницSweet River Abattoir 2015 Annual ReportNicquainCT100% (1)

- Classification of LiabilitiesДокумент49 страницClassification of Liabilitiesasachdeva17Оценок пока нет

- IAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFДокумент20 страницIAS 8 Accounting Policies - Changes in Accounting Estimates and Errors PDFMichelle TanОценок пока нет

- P6 SyllabusДокумент36 страницP6 SyllabusNicquainCTОценок пока нет

- Classification of LiabilitiesДокумент49 страницClassification of Liabilitiesasachdeva17Оценок пока нет

- ("Valstybės Žinios" (Official Gazette), 2004, No. 180-6694)Документ5 страниц("Valstybės Žinios" (Official Gazette), 2004, No. 180-6694)andihaxhillariОценок пока нет

- OBU RAP Project Mentor NotesДокумент3 страницыOBU RAP Project Mentor NotesTuguldur Gan-OchirОценок пока нет

- Pass Professional PapersДокумент10 страницPass Professional PapersNicquainCTОценок пока нет

- International Standard On Auditing 220 Quality Control For An Audit of Financial StatementsДокумент19 страницInternational Standard On Auditing 220 Quality Control For An Audit of Financial StatementsNicquainCTОценок пока нет

- f6 p6 Uk Examdocs 2014Документ4 страницыf6 p6 Uk Examdocs 2014Pranesh RamalingamОценок пока нет

- f6 p6 Uk Examdocs 2014Документ4 страницыf6 p6 Uk Examdocs 2014Pranesh RamalingamОценок пока нет

- P5 SyllabusДокумент14 страницP5 SyllabusNicquainCTОценок пока нет

- A Framework For Audit QualityДокумент72 страницыA Framework For Audit QualityNicquainCTОценок пока нет

- SJK (T) Ladang Renchong, PagohДокумент2 страницыSJK (T) Ladang Renchong, PagohAinHazwanОценок пока нет

- War: Causation of War, Total War, Limited War, Strategic Culture: Determinants of Strategic Culture Deterrence: Theory and Practice With SpecialДокумент52 страницыWar: Causation of War, Total War, Limited War, Strategic Culture: Determinants of Strategic Culture Deterrence: Theory and Practice With SpecialMazhar HussainОценок пока нет

- Republic of The Philippines Legal Education BoardДокумент25 страницRepublic of The Philippines Legal Education BoardPam NolascoОценок пока нет

- Hop Movie WorksheetДокумент3 страницыHop Movie WorksheetMARIA RIERA PRATSОценок пока нет

- SPECIAL POWER OF ATTORNEY To JeffДокумент2 страницыSPECIAL POWER OF ATTORNEY To JeffTom SumawayОценок пока нет

- Unit 2 Lab Manual ChemistryДокумент9 страницUnit 2 Lab Manual ChemistryAldayne ParkesОценок пока нет

- CHAPTER 2-3 LipidДокумент20 страницCHAPTER 2-3 LipidDaniel IsmailОценок пока нет

- Catibog Approval Sheet EditedДокумент10 страницCatibog Approval Sheet EditedCarla ZanteОценок пока нет

- The Old Rugged Cross - George Bennard: RefrainДокумент5 страницThe Old Rugged Cross - George Bennard: RefrainwilsonОценок пока нет

- Created by EDGAR Online, Inc. Dow Chemical Co /de/ Table - of - Contents Form Type: 10-K Period End: Dec 31, 2020 Date Filed: Feb 05, 2021Документ286 страницCreated by EDGAR Online, Inc. Dow Chemical Co /de/ Table - of - Contents Form Type: 10-K Period End: Dec 31, 2020 Date Filed: Feb 05, 2021Udit GuptaОценок пока нет

- 12c. Theophile - de Divers ArtibusДокумент427 страниц12c. Theophile - de Divers Artibuserik7621Оценок пока нет

- Gothic Fiction Oliver TwistДокумент3 страницыGothic Fiction Oliver TwistTaibur RahamanОценок пока нет

- Apforest Act 1967Документ28 страницApforest Act 1967Dgk RajuОценок пока нет

- Community Based Nutrition CMNPДокумент38 страницCommunity Based Nutrition CMNPHamid Wafa100% (4)

- Athletic KnitДокумент31 страницаAthletic KnitNish A0% (1)

- Tu 05Документ23 страницыTu 05Yang ElvisQUОценок пока нет

- IO RE 04 Distance Learning Module and WorksheetДокумент21 страницаIO RE 04 Distance Learning Module and WorksheetVince Bryan San PabloОценок пока нет

- Yamaha TW 125 Service Manual - 1999Документ275 страницYamaha TW 125 Service Manual - 1999slawkomax100% (11)

- Martin Vs MalcolmДокумент17 страницMartin Vs Malcolmronnda100% (2)

- Portfolio Assignment MaternityДокумент2 страницыPortfolio Assignment Maternityapi-319339803100% (1)

- Peace Corps Samoa Medical Assistant Office of The Public Service of SamoaДокумент10 страницPeace Corps Samoa Medical Assistant Office of The Public Service of SamoaAccessible Journal Media: Peace Corps DocumentsОценок пока нет

- ICFR Presentation - Ernst and YoungДокумент40 страницICFR Presentation - Ernst and YoungUTIE ELISA RAMADHANI67% (3)

- Yds Deneme Sinavi PDFДокумент16 страницYds Deneme Sinavi PDFodysseyyyОценок пока нет

- MYPNA SE G11 U1 WebДокумент136 страницMYPNA SE G11 U1 WebKokiesuga12 TaeОценок пока нет

- Communication & Soft Skills: Deepak and Arvind Kumar Pgppe + Mba (Feb'11)Документ19 страницCommunication & Soft Skills: Deepak and Arvind Kumar Pgppe + Mba (Feb'11)deepaksingh16100% (1)

- Daily Mail 2022-10-25Документ74 страницыDaily Mail 2022-10-25mohsen gharbiОценок пока нет

- Creole LanguagesДокумент2 страницыCreole LanguagesClaire AlexisОценок пока нет

- CEO - CaninesДокумент17 страницCEO - CaninesAlina EsanuОценок пока нет

- Recollections From Pine Gulch QuestionsДокумент2 страницыRecollections From Pine Gulch Questionsoliver abramsОценок пока нет

- Timothy L. Mccandless, Esq. (SBN 147715) : Pre-Trial Documents - Jury InstructionsДокумент3 страницыTimothy L. Mccandless, Esq. (SBN 147715) : Pre-Trial Documents - Jury Instructionstmccand100% (1)