Академический Документы

Профессиональный Документы

Культура Документы

Securtization and Corporate Valuation

Загружено:

SADAF FAIZIИсходное описание:

Оригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Securtization and Corporate Valuation

Загружено:

SADAF FAIZIАвторское право:

Доступные форматы

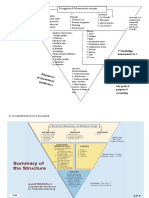

9 Securitization Corporate Valuation

New

Syllabus

1 2 3 4 5

Need for Corporate Valuation 1

Meaning Features Participants Mechanism Problems 1. Information for its internal stakeholders,

2 Important Terms

2. Comparison with similar enterprises for understanding

1. P ro c e s s o f s e c u r i t i z a t i o n 1. Creation of Financial Primary Participant 1. Creation of Pool of Assets

1. Stamp Duty

management efficiency, 1. Present Value of Cash Flows

typically involves the creation of

Instruments

1. Originator

2. Taxation

3. Future public listing of the enterprise, 2. Internal Rate of Return

pool of assets from the illiquid 2. Transfer to SPV

fi n a n c i a l a s s e t s , s u c h a s 2. Bundling and 2. Special Purpose Vehicle

3. Accounting

4. Strategic planning, for e.g. finding out the value driver of the 3. Return on Investment

receivables or loans which are 3. The Investors

3. Sale of Securitized Papers

Unbundling

4. Lack of enterprise, or for a correct deployment of surplus cash,

marketable.

Secondary Participant 4. Perpetual Growth Rate

2. It is the process of repackaging 3. Tools of Risk standardization

1. Obligors

4. Administration of assets

5. Ball park price (i.e. an approximate price) for acquisition, 3

or rebounding of illiquid assets 5. Terminal Value

Management

5. Inadequate Debt etc.

into marketable securities.

2. Rating Agency

5. Recourse to Originator

3. T h e s e a s s e t s c a n b e 4. Structured Finance

3. Receiving and paying agent

Market

automobile loans, credit card Methods of Valuation

5. Trenching

4. Agent or Trustee

6. Repayment of funds

6. Ineffective

receivables, residential

mortgages or any other form of 6. Homogeneity 5. Credit Enhancer

Foreclosure laws 1 2 3

7. Credit Rating to Instruments

future receivables. 6. Structurer

Asset Based Earnings Based Cash Flow Based

Book Value = Total Assets - Long Term

Instruments

There are essentially five

6 Debt steps in performing DCF

based valuation:

Total Assets = Fixed Assets + Intangible Assets +

Current Assets – Current Liabilities 1. Arriving at the ‘Free Cash

Flow’

Pass Through Certificates (PTCs) Pay Through Securities (PTS) Stripped Securities This can also be equated to share capital plus free

reserves. 2. Forecasting of future cash

1. Originator (seller of the assets) transfers the 1. In PTCs all cash flows are passed to the 1. Stripped Securities are created by dividing the cash flows associated flows (also called

entire receipt of cash in the form of interest or

principal repayment from the assets sold.

performance of the securitized assets. To

overcome this limitation there is another

with underlying securities into two or more new securities. Those two

securities are as follows:

4 Enterprise Value Based projected future cash

flows)

2. These securities represent direct claim of the structure i.e. PTS.

(1) Interest Only (IO) Securities

investors on all the assets that has been 2. In contrast to PTC in PTS, SPV debt (2) Principle Only (PO) Securities

Enterprise

Market Value Market Value Market Value Minority Cash & Cash 3. Determining the discount

CA Mayank Kothari

securitized through SPV.

securities backed by the assets and hence it 1. Accordingly, the holder of IO securities receives only interest while PO Value = of Equity + of Preference + of Debt + Interest - Equivalent rate based on the cost of

3. Since all cash flows are transferred the capital

can restructure different tranches from security holder receives only principal. Being highly volatile in nature

investors carry proportional beneficial interest varying maturities of receivables.

these securities are less preferred by investors.

1. The Enterprise Value, or EV for short, is a measure of a company's total 4. Finding out the Terminal

in the asset held in the trust by SPV.

3. In other words, this structure permits 2. In case yield to maturity in market rises, PO price tends to fall as Value (TV) of the

4. Since it is a direct route any prepayment of desynchronization of servicing of securities borrower prefers to postpone the payment on cheaper loans. Whereas value, often used as a more comprehensive alternative to equity market enterprise

principal is also proportionately distributed issued from cash flow generating from the if interest rate in market falls, the borrower tends to repay the loans as capitalization.

among the securities holders.

asset.

they prefer to borrow fresh at lower rate of interest.

5. Finding out the present

5. Further due to these characteristics on 4. Further, this structure also permits the SPV to 3. In contrast, value of IO’s securities increases when interest rate goes up 2. Enterprise value (EV) can be thought of as the theoretical takeover price if a values of both the free

completion of securitization by the final reinvest surplus funds for short term as per in the market as more interest is calculated on borrowings.

company were to be bought. cash flows and the TV,

payment of assets, all the securities are their requirement.

4. However, when interest rate due to prepayments of principals, IO’s and interpretation of the

terminated Simultaneously. 5. This structure also provides the freedom to tends to fall.

3. The value of a firm's debt, for example, would need to be paid off by the results.

issue several debt tranches with varying 5. Thus, from the above, it is clear that it is mainly perception of investors buyer when taking over a company, thus, enterprise value provides a much

maturities. that determines the prices of IOs and POs

more accurate takeover valuation because it includes debt in its value

calculation.

9 8 7

4. Why doesn't market capitalization properly represent a firm's value? It leaves

a lot of important factors out, such as a company's debt on the one hand and

its cash reserves on the other.

Securitization in India Benefits Pricing of Instruments

I Relative Valuation

5 Other Methods

1. It is the Citi Bank who pioneered the concept of securitization in India by

bundling of auto loans in securitized instruments.

From the angle of Originator The Relative valuation, also referred to as ‘Valuation by

Economic Value Added II multiples,’ uses financial ratios to derive at the desired

2. Thereafter many organizations securitized their receivables. Although 1. Off- Balance Sheet Financing

metric (referred to as the ‘multiple’) and then compares the

started with securitization of auto loans it moved to other types of From Originator’s

receivables such as sales tax deferrals, aircraft receivable etc.

2. More specialisation in main From Investor’s Angle same to that of comparable firms.

Angle

3. In order to encourage securitization, the Government has come out with business

In the process, there may be extrapolations set to the

Securitization and Reconstruction of Financial Assets and Enforcement of The instruments Security price can be

3. Helps to improve financial desired range to achieve the target set. To elaborate –

Security Interest (SARFAESI) Act, 2002, to tackle menace of Non can be priced at a determined by

Performing Assets (NPAs) without approaching to Court.

ratios

1. Find out the ‘drivers’ that will be the best representative

rate at which discounting best Market Value Added III

4. It has become an important source of funding for micro finance companies 4. Reduced borrowing Cost

for deriving at the multiple. Drivers can be

and NBFCs and even now a days commercial mortgage backed securities originator has to estimate of expected

are also emerging.

From the angle of Investor incur an outflow future cash flows using 1. Enterprise value based multiples, which would

5. Securitization in Indian Market is that it is dominated by a few players e.g. 1. Diversification of Risk

rate of yield to maturity of Shareholders Value Analysis IV

consist primarily of EV/EBITDA, EV/Invested

ICICI Bank, HDFC Bank, NHB etc.

Capital, and EV/Sales.

a security of comparable

6. As per a report of CRISIL, securitization transactions in India scored to the 2. Regulatory requirement

Steps involved in SVA computation:

security with respect to 2. Equity value based multiples, which would comprise

highest level of approximately Rs.70000 crores, in Financial Year 2016. 3. Protection against default

(Business Line, 15th June, 2016)

credit quality and a. Arrive at the Future Cash Flows (FCFs) of P/E ratio and PEG.

by using mix of the ‘value drivers’

7. In order to further enhance the investor base in securitized debts, SEBI average life of the 2. Determine the results based on the chosen driver(s)

allowed FPIs to invest in securitized debt of unlisted companies upto a securities. b. Discount these FCF using WACC

through financial ratios

certain limit. c. Add the terminal value to the present

values computed in step (b) 3. Find out the comparable firms, and perform the

comparative analysis, and

d. Add market value of non-core assets

e. Reduce the value of debt from the result 4. Iterate the value of the firm obtained to smoothen out

in step (d) to arrive at value of equity the deviations

The only way to do great work is to love what you do. —Steve Jobs |The question isn’t who is going to let me; it’s who is going to stop me. |You can’t connect the dots looking forward; you can only connect them looking backwards. So you have to trust that the dots will somehow connect in your future. You have to trust in something—your gut, destiny, life, karma,

whatever. This approach has never let me down, and it has made all the difference in my life.

Вам также может понравиться

- 1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistДокумент8 страниц1 Mile.: # Speed Last Race # Prime Power # Class Rating # Best Speed at DistNick RamboОценок пока нет

- Balance Sheet StructuresОт EverandBalance Sheet StructuresAnthony N BirtsОценок пока нет

- Deed of Sale of Large CattleДокумент3 страницыDeed of Sale of Large CattleSean Arcilla100% (3)

- Chapter 4 - Controls: External Audit EngagementДокумент9 страницChapter 4 - Controls: External Audit EngagementSanjeev JayaratnaОценок пока нет

- State vs. Johnny Church (Drew Blahnik)Документ15 страницState vs. Johnny Church (Drew Blahnik)Michael Howell100% (1)

- Cfas Chapter 2Документ55 страницCfas Chapter 2Lance Lenard Divinagracia Calimpos100% (1)

- A Critical Analysis of Arguments (Most Recent)Документ3 страницыA Critical Analysis of Arguments (Most Recent)diddy_8514Оценок пока нет

- Gakondo: Images of Royal Rwanda From The Colonial PeriodДокумент116 страницGakondo: Images of Royal Rwanda From The Colonial Periodchevalier63100% (1)

- Investment Pricing Methods: A Guide for Accounting and Financial ProfessionalsОт EverandInvestment Pricing Methods: A Guide for Accounting and Financial ProfessionalsОценок пока нет

- Accounting 1Документ146 страницAccounting 1Touhidul IslamОценок пока нет

- Chapter 16 - Due Diligence, Investigation and Forensic AuditДокумент8 страницChapter 16 - Due Diligence, Investigation and Forensic Auditsathya_41095Оценок пока нет

- Conceptual Framework and Accounting Standards: OutlineДокумент6 страницConceptual Framework and Accounting Standards: OutlineMichael TorresОценок пока нет

- Observations On Poverty and Poor in Plato and Aristotle, Cicero and SenecaДокумент26 страницObservations On Poverty and Poor in Plato and Aristotle, Cicero and SenecaJuanОценок пока нет

- The Unbecoming of Mara DyerДокумент6 страницThe Unbecoming of Mara DyerKasshika Nigam75% (4)

- DEED OF ABSOLUTE SALE OF MEMORIAL LOT'bienvenido SanchezДокумент2 страницыDEED OF ABSOLUTE SALE OF MEMORIAL LOT'bienvenido SanchezJaime Gonzales73% (15)

- Deal Flow ModelДокумент1 страницаDeal Flow ModelSoumya KesharwaniОценок пока нет

- Module 2 Quiz ReviewerДокумент2 страницыModule 2 Quiz Reviewerangelo austriaОценок пока нет

- ErdДокумент6 страницErdRoshan KhetadeОценок пока нет

- From 28.11.21 Power Point AccountingДокумент191 страницаFrom 28.11.21 Power Point AccountingAbdul AzizОценок пока нет

- Standards and The Conceptual Framework Underlying Financial AccountingДокумент26 страницStandards and The Conceptual Framework Underlying Financial AccountingLodovicus LasdiОценок пока нет

- Corporate Finance Mind Map PDFДокумент1 страницаCorporate Finance Mind Map PDFKanyabwira Aime Jean ClaudeОценок пока нет

- Chapter 21 - Audit of The Capital Acquisition and Repayment CycleДокумент5 страницChapter 21 - Audit of The Capital Acquisition and Repayment CycleRaymond GuillartesОценок пока нет

- ACCTG ReviewerДокумент13 страницACCTG ReviewerAnn Christine C. ChuaОценок пока нет

- Corporate Governance Challenges and FailuresДокумент5 страницCorporate Governance Challenges and FailuresLalaine De JesusОценок пока нет

- CombinepdfДокумент83 страницыCombinepdfA PОценок пока нет

- Audit of The Capital Acquisition and Repayment Cycle: Auditing Ii - Chapter 22Документ31 страницаAudit of The Capital Acquisition and Repayment Cycle: Auditing Ii - Chapter 22Ratu ShaviraОценок пока нет

- Lecture 20 BFДокумент19 страницLecture 20 BFmuhibОценок пока нет

- Finance For Non-Financial ExecutivesДокумент8 страницFinance For Non-Financial ExecutivesImran ZahidОценок пока нет

- Introduction To Financial Management: Juraz-Enhance Your Commerce Skills With UsДокумент4 страницыIntroduction To Financial Management: Juraz-Enhance Your Commerce Skills With Uskoppilanshaheen738Оценок пока нет

- Work Program: Company Section Year: Risks Audit Objectives Audit Steps/Tests Working Paper RefДокумент2 страницыWork Program: Company Section Year: Risks Audit Objectives Audit Steps/Tests Working Paper RefChinh Le DinhОценок пока нет

- IFRS 3 Business Combinations - IFRS 10 Consolidated Financial Statements - UrFU - 2019Документ36 страницIFRS 3 Business Combinations - IFRS 10 Consolidated Financial Statements - UrFU - 2019Дарья ГоршковаОценок пока нет

- Managing The Finance FunctionДокумент12 страницManaging The Finance FunctionDumplings DumborОценок пока нет

- Charles H. Gibson Financial Reporting A-25-27Документ3 страницыCharles H. Gibson Financial Reporting A-25-27Arisha KhanОценок пока нет

- BF Reviewer LastДокумент4 страницыBF Reviewer LastKarl JardinОценок пока нет

- Acc 1Документ3 страницыAcc 1Nitish YadavОценок пока нет

- Acct TransДокумент4 страницыAcct TransStephanieОценок пока нет

- 112 Financial Accounting IДокумент4 страницы112 Financial Accounting IPratik KanchanОценок пока нет

- Kieso, Weygandt, WarfieldДокумент56 страницKieso, Weygandt, WarfieldShevina Maghari shsnohsОценок пока нет

- 419 Reviewer MIDTERMSДокумент12 страниц419 Reviewer MIDTERMSGatungay JanessaОценок пока нет

- 5 - Lesson 4 LIQUIDATION BASED VALUATION - Unit 1 Liquidation ValueДокумент2 страницы5 - Lesson 4 LIQUIDATION BASED VALUATION - Unit 1 Liquidation ValueKarla Mae GammadОценок пока нет

- 2.0 Practical Lessons On Dos and Donts For Internal Auditors A Case Study of A Listed Company CPA Denish OsodoДокумент15 страниц2.0 Practical Lessons On Dos and Donts For Internal Auditors A Case Study of A Listed Company CPA Denish Osododaniel geevargheseОценок пока нет

- Zurita (Block C) - Summary Table For Audit and Other ServicesДокумент2 страницыZurita (Block C) - Summary Table For Audit and Other ServicesNove Jane ZuritaОценок пока нет

- Chapter 2 - Conceptual Framework For Financial Accounting: Study Online atДокумент4 страницыChapter 2 - Conceptual Framework For Financial Accounting: Study Online atKris TineОценок пока нет

- Chapter 3Документ8 страницChapter 3subeyr963Оценок пока нет

- Peta SintesisДокумент3 страницыPeta SintesisHotmauly RikaОценок пока нет

- Auditing & Corporate Governance (BCOM)Документ4 страницыAuditing & Corporate Governance (BCOM)Soumya LathaОценок пока нет

- Lesson 4 - LIQUIDATION BASED VALUATION - Unit 1 - Liquidation Value - Fb2ca0cd5f0a68Документ2 страницыLesson 4 - LIQUIDATION BASED VALUATION - Unit 1 - Liquidation Value - Fb2ca0cd5f0a68Jessica PaludipanОценок пока нет

- Lesson 4 - LIQUIDATION BASED VALUATION - Unit 1 - Liquidation ValueДокумент2 страницыLesson 4 - LIQUIDATION BASED VALUATION - Unit 1 - Liquidation ValueGevilyn M. GomezОценок пока нет

- GoalДокумент2 страницыGoalVarun JainОценок пока нет

- Coby Harmon: Prepared by University of California, Santa Barbara Westmont CollegeДокумент46 страницCoby Harmon: Prepared by University of California, Santa Barbara Westmont CollegeDeeb. DeebОценок пока нет

- McframeéVtraining Purchasing, Inspection, Inventory (L) 7.0.3.0 R00-EnДокумент106 страницMcframeéVtraining Purchasing, Inspection, Inventory (L) 7.0.3.0 R00-EnKerr PalaranОценок пока нет

- Santosh Sharma PPT IBCДокумент15 страницSantosh Sharma PPT IBCmoney honeyОценок пока нет

- Day 33Документ11 страницDay 33Reem JavedОценок пока нет

- Internal External: Prepared by M.T. SacramedДокумент2 страницыInternal External: Prepared by M.T. SacramedLawrence CasullaОценок пока нет

- Sept Dec 2018 Darjeeling CoДокумент6 страницSept Dec 2018 Darjeeling Conajihah zakariaОценок пока нет

- Position of The Bank - Rene, YifredewДокумент11 страницPosition of The Bank - Rene, YifredewYifredew AdamuОценок пока нет

- Chapter 02 AnsДокумент9 страницChapter 02 AnsDave Manalo100% (1)

- Why Should We Be Concerned About Ethics in The Business World?Документ5 страницWhy Should We Be Concerned About Ethics in The Business World?Orange BunsieОценок пока нет

- GGSR ReviewerДокумент5 страницGGSR ReviewerTrisha mae CruzОценок пока нет

- (C2) Basic Accounting ConceptsДокумент3 страницы(C2) Basic Accounting ConceptsVenus LacambraОценок пока нет

- CIS SynthesisДокумент10 страницCIS SynthesisChristian AribasОценок пока нет

- Lesson 6 - Internal ControlsДокумент5 страницLesson 6 - Internal ControlsAllaina Uy BerbanoОценок пока нет

- C.O.Capital - Capital Budgeting (OK Na!)Документ8 страницC.O.Capital - Capital Budgeting (OK Na!)Eunice BernalОценок пока нет

- Management Accounting IIДокумент7 страницManagement Accounting IIKendrick PajarinОценок пока нет

- Analysis of FSДокумент10 страницAnalysis of FSJhondel RabinoОценок пока нет

- Finac Final Handouts 1 PDFДокумент2 страницыFinac Final Handouts 1 PDFRamm Raven CastilloОценок пока нет

- 1.2 Ch8 Risk Return 2020Документ6 страниц1.2 Ch8 Risk Return 2020bobhamilton3489Оценок пока нет

- Recent Trends in Valuation: From Strategy to ValueОт EverandRecent Trends in Valuation: From Strategy to ValueLuc KeuleneerОценок пока нет

- Scripbox Reg FormДокумент6 страницScripbox Reg FormRohan SinghОценок пока нет

- Handling Order: To-Write-Acknowledgement-Letter - Htm. DownloadДокумент15 страницHandling Order: To-Write-Acknowledgement-Letter - Htm. DownloadNomica Eka PutriОценок пока нет

- TLLR 2007 To 2012Документ342 страницыTLLR 2007 To 2012rose suleimanОценок пока нет

- SOP Regulation Rate Charges and Terms&ConditionДокумент12 страницSOP Regulation Rate Charges and Terms&ConditionSPIgroupОценок пока нет

- Larry James Gamble v. State of Oklahoma, 583 F.2d 1161, 10th Cir. (1978)Документ7 страницLarry James Gamble v. State of Oklahoma, 583 F.2d 1161, 10th Cir. (1978)Scribd Government DocsОценок пока нет

- Havells India LTD: Actuals Key Financials (Rs. in CRS.)Документ159 страницHavells India LTD: Actuals Key Financials (Rs. in CRS.)milan kakkadОценок пока нет

- MALAYSIA The Nightmare of Indian IT ProfessionalsДокумент3 страницыMALAYSIA The Nightmare of Indian IT ProfessionalspenangОценок пока нет

- South Delhi Municipal Corporation Tax Payment Checklist For The Year (2021-2022)Документ1 страницаSouth Delhi Municipal Corporation Tax Payment Checklist For The Year (2021-2022)QwerОценок пока нет

- Defensible Space ZoneДокумент2 страницыDefensible Space ZoneVentura County StarОценок пока нет

- Agael Et - Al vs. Mega-Matrix (Motion For Reconsideration)Документ5 страницAgael Et - Al vs. Mega-Matrix (Motion For Reconsideration)John TorreОценок пока нет

- Dist. Level Police Training KandhmalДокумент9 страницDist. Level Police Training Kandhmalsankalp mohantyОценок пока нет

- 4ATДокумент3 страницы4ATPaula Mae DacanayОценок пока нет

- Timetable - 42389 - X6, 7, 7A, N7, X7 & 8Документ4 страницыTimetable - 42389 - X6, 7, 7A, N7, X7 & 8geo32Оценок пока нет

- CPR Ar 28Документ44 страницыCPR Ar 28kkОценок пока нет

- Subsection B12 - Discharge Value and Width of Required Staircase Clause B12.1Документ3 страницыSubsection B12 - Discharge Value and Width of Required Staircase Clause B12.1Yk YkkОценок пока нет

- Case Study: TEAM-2Документ5 страницCase Study: TEAM-2APARNA SENTHILОценок пока нет

- Outline-Bare Unit: DWN by CK'D by Third Angle ProjectionДокумент1 страницаOutline-Bare Unit: DWN by CK'D by Third Angle ProjectionHelder ChavezОценок пока нет

- 01 Baguio Country Club Corp. v. National Labor Relations CommissionДокумент4 страницы01 Baguio Country Club Corp. v. National Labor Relations CommissionGina RothОценок пока нет

- SOP (Client Arrival) - 2Документ2 страницыSOP (Client Arrival) - 2arishinewatiaОценок пока нет

- Efects of Globlization On SovereigntyДокумент3 страницыEfects of Globlization On SovereigntyirfanaliОценок пока нет

- Lift Plan v2Документ3 страницыLift Plan v2Hussain YahyaОценок пока нет

- Schwab One Account Signature CardДокумент2 страницыSchwab One Account Signature CardJimario SullivanОценок пока нет