Академический Документы

Профессиональный Документы

Культура Документы

Value Value Value Volume Value Volume Value Volume Value Volume Value Volume Value Volume Value Value Volume (In Thousand) Value (In Rs. Thousand)

Загружено:

Soham BanerjeeОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Value Value Value Volume Value Volume Value Volume Value Volume Value Volume Value Volume Value Value Volume (In Thousand) Value (In Rs. Thousand)

Загружено:

Soham BanerjeeАвторское право:

Доступные форматы

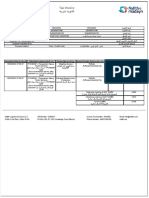

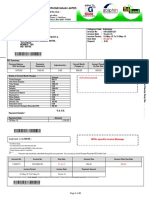

Electronic Payment Systems - Representative Data (Updated as on March 06, 2018)

Volume in million, Value in Rs. billion

Debit and

RTGS NEFT CTS* IMPS* NACH* UPI* USSD** Credit Cards at PPI # Mobile Banking Total

Data for the POS &

period

value (in

volume (in

volume value volume value volume value volume value volume value volume value Rs. volume value volume value volume value volume value

thousand)

thousand)

Nov-16 7.9 78479.2 123.0 8807.8 87.1 5419.2 36.2 324.8 152.5 606.6 0.3 0.9 7.0 7302.6 205.5 352.4 59.0 13.2 72.3 1244.9 671.5 94004.2

Dec-16 8.8 84096.5 166.3 11537.6 130.0 6811.9 52.8 431.9 198.7 626.8 2.0 7.0 102.2 103718.4 311.0 522.2 87.8 21.3 70.2 1365.9 957.5 104055.3

Jan-17 9.3 77486.1 164.2 11355.1 118.5 6618.4 62.4 491.2 158.7 541.4 4.2 16.6 314.3 381760.2 265.5 481.2 87.3 21.0 64.9 1206.7 870.4 97011.4

Feb-17 9.1 74218.8 148.2 10877.9 100.4 5993.9 59.7 482.2 150.5 592.0 4.2 19.0 224.8 357055.2 212.3 391.5 78.4 18.7 56.2 1080.0 763.0 92594.5

Mar-17 12.5 123375.8 186.7 16294.5 119.2 8062.8 67.4 564.7 182.1 829.4 6.2 23.9 211.2 337962.4 229.7 416.2 90.0 21.5 60.8 1499.9 893.9 149589.1

Apr-17 9.5 88512.2 143.2 12156.2 95.3 6990.6 65.1 562.1 212.6 905.2 6.9 22.0 188.9 301650.5 231.1 431.4 89.2 22.3 61.0 1443.8 853.1 109602.2

May-17 10.4 90170.5 155.8 12410.8 97.1 6745.9 66.7 585.6 194.4 692.4 9.2 27.7 192.6 316723.7 233.4 450.8 91.3 25.3 64.9 1940.7 858.5 111109.3

Jun-17 9.8 92812.6 152.3 12694.2 91.9 6409.9 65.8 596.5 197.3 708.6 10.2 30.7 198.9 313277.0 232.4 468.2 84.7 24.1 77.1 1584.7 844.7 113745.2

Jul-17 9.4 87149.3 148.1 12011.6 92.2 6342.5 69.1 604.8 204.3 771.7 11.4 33.8 190.7 302097.8 237.6 439.3 88.7 25.1 69.5 1019.2 861.1 107378.4

Aug-17 9.5 89163.4 151.6 12500.4 92.1 6224.3 75.7 651.5 205.2 752.4 16.6 41.3 191.8 294239.4 243.0 457.1 89.7 27.2 70.8 1033.0 883.4 109817.9

Sep-17 9.6 102348.1 157.7 14182.1 92.2 6271.5 82.9 717.6 176.0 628.4 30.8 52.9 202.7 323578.5 240.3 478.2 87.5 27.6 86.3 1121.6 877.0 124706.8

Oct-17 10.0 92056.1 158.8 13851.3 94.4 6340.2 88.1 750.4 187.0 900.5 76.8 70.3 184.6 299071.8 255.7 530.5 96.2 32.7 130.9 1168.7 967.3 114532.2

Nov-17 10.8 98410.5 162.0 13884.0 96.3 6633.9 89.5 782.6 197.5 724.1 104.8 96.4 182.4 287309.6 244.6 483.3 92.8 32.0 122.8 848.4 998.5 121047.1

Dec-17 10.9 100907.8 169.0 15779.2 94.6 6564.0 98.0 871.1 183.0 714.0 145.5 131.4 179.9 299367.3 263.9 528.7 99.1 35.1 113.3 921.5 1064.2 125531.5

Jan-18 11.2 107488.4 170.2 15374.1 96.7 6792.6 99.6 882.1 208.1 727.7 151.7 155.4 172.8 290020.0 271.1 521.9 113.6 38.3 106.3 928.7 1122.3 131980.8

Average 9.9 92445.0 157.1 12914.5 99.9 6548.1 71.9 619.9 187.2 714.7 38.7 48.6 183.0 281009.0 245.2 463.5 89.0 25.7 81.8 1227.2 899.1 113780.4

Feb-18

1 0.5 4689.0 12.5 782.7 4.0 319.0 4.4 45.1 14.4 61.9 5.8 9.7 7.0 13220.0 8.6 15.5 4.2 1.5 5.4 52.9 54.4 5924.5

2 0.4 4918.6 7.9 697.0 3.8 295.9 4.1 40.4 9.8 23.4 5.8 9.3 6.3 12500.0 9.3 18.4 4.1 1.4 4.9 46.3 45.1 6004.5

3 0.4 993.2 6.8 377.5 4.0 272.0 3.7 35.1 9.4 20.5 6.6 8.2 6.3 11900.0 9.0 17.1 3.9 1.3 4.3 44.1 43.9 1724.8

4 h h h h h h 2.9 20.7 0.0 0.0 5.7 5.7 5.4 10190.0 8.7 15.1 3.7 1.1 3.3 17.8 20.9 42.6

5 0.5 4515.5 8.5 634.3 4.1 281.3 4.3 40.0 14.8 79.9 7.3 8.4 6.2 11830.0 10.6 19.9 3.9 1.3 4.7 44.9 54.1 5580.6

6 0.5 4429.6 7.6 618.3 4.3 290.5 3.8 36.7 5.7 22.0 7.4 8.0 5.8 10850.0 8.6 16.7 4.0 1.4 4.2 42.2 41.9 5423.1

7 0.5 4231.0 8.3 653.6 4.2 290.7 3.7 35.3 11.5 42.0 5.5 7.6 6.1 11630.0 8.5 16.4 4.2 1.4 4.1 40.8 46.3 5278.0

8 0.5 4015.8 7.8 582.3 3.9 270.1 3.7 34.7 9.1 37.0 5.8 7.5 6.5 11970.0 8.7 17.6 4.1 1.4 4.0 38.1 43.6 4966.4

9 0.5 4619.1 8.0 693.5 4.0 278.8 3.7 35.4 5.4 18.4 6.3 7.9 6.8 12510.0 9.0 19.2 4.1 1.3 4.1 40.3 41.1 5673.5

10 h h h h h h 3.5 28.3 h h 5.2 6.0 5.5 10050.0 8.4 15.0 4.1 1.3 3.2 19.6 21.2 50.6

11 h h h h h h 2.5 15.4 h h 5.5 4.3 4.8 8250.0 8.7 15.1 3.7 1.1 2.5 11.6 20.4 35.9

12 0.6 4784.2 9.3 818.4 5.8 364.2 4.2 37.0 16.8 88.6 7.0 7.7 6.0 10350.0 11.2 21.1 4.1 1.3 4.3 43.1 59.0 6122.6

13 0.3 611.9 5.3 356.1 2.7 168.6 3.6 28.6 7.1 16.6 6.9 6.1 5.4 9430.0 8.1 15.0 4.1 1.2 3.5 28.5 38.0 1204.0

14 0.4 4503.9 5.8 566.4 4.6 299.2 3.7 32.6 5.1 36.2 6.7 6.7 5.5 9280.0 9.3 18.0 4.2 1.3 3.6 34.1 39.7 5464.2

15 0.5 4942.4 6.3 729.8 4.8 322.2 3.8 34.2 9.6 57.3 6.1 6.6 5.6 9410.0 8.7 16.9 4.3 1.4 3.4 37.3 44.3 6110.8

16 0.5 4959.9 6.5 716.9 4.3 297.4 3.6 31.6 5.4 21.7 6.9 6.8 5.6 9420.0 8.0 16.5 4.3 1.4 3.6 35.5 39.4 6052.2

17 0.4 974.2 5.2 389.0 3.7 258.5 3.2 27.7 6.3 26.0 5.2 6.1 5.3 8740.0 7.9 16.5 3.4 1.1 3.0 33.0 35.2 1699.1

18 h h h h h h 2.4 14.5 h h 4.8 4.1 4.4 7160.0 8.8 15.3 3.9 1.2 2.4 11.1 19.9 35.0

19 0.4 829.0 5.7 450.5 3.1 218.1 3.6 30.1 6.8 24.1 6.4 6.5 5.2 8620.0 9.9 17.7 4.1 1.4 3.8 33.6 40.1 1577.4

20 0.5 4925.2 6.3 756.5 4.4 306.4 3.5 31.9 8.3 29.6 6.3 6.7 5.4 8480.0 8.3 15.5 4.2 1.4 3.8 36.5 41.8 6073.2

21 0.5 4552.0 6.0 584.9 4.1 285.5 3.3 30.2 7.2 18.8 5.8 6.1 5.4 7650.0 7.6 14.6 4.2 1.3 3.4 34.2 38.7 5493.4

22 0.5 4747.7 5.7 659.3 3.9 272.5 3.2 29.3 7.4 27.0 6.1 6.4 5.2 7990.0 8.6 16.5 4.2 1.3 3.5 33.8 39.5 5760.0

23 0.5 5067.6 6.7 746.7 3.8 284.5 3.4 32.4 5.9 32.3 6.6 6.6 5.3 8030.0 8.4 15.9 4.2 1.3 3.6 36.9 39.5 6187.4

24 h h h h h h 3.1 24.1 h h 5.7 5.2 4.6 7330.0 7.5 11.6 4.1 1.2 2.9 17.0 20.5 42.0

25 h h h h h h 2.3 13.1 h h 4.3 3.7 4.1 6150.0 9.0 16.3 3.7 1.0 2.4 10.4 19.3 34.2

26 0.6 5450.0 8.2 946.7 5.6 398.7 3.8 34.8 12.4 59.1 6.5 6.9 5.2 7980.0 10.8 19.4 4.1 1.3 3.9 41.4 52.0 6917.0

27 0.6 5658.2 8.0 940.8 4.7 348.3 3.7 35.5 6.8 39.5 6.5 6.9 5.2 8410.0 7.6 14.3 4.0 1.3 3.6 40.0 41.9 7044.9

28 0.6 7347.5 13.1 1142.5 4.3 331.3 4.5 48.2 14.0 68.9 6.5 9.7 5.9 10930.0 9.3 18.7 4.1 1.3 3.4 39.9 56.3 8968.1

Feb-2018 Total 10.6 91765.6 165.6 14843.9 91.8 6453.6 99.2 882.7 199.1 850.9 171.2 191.0 156.1 270260.0 247.1 465.9 113.1 36.5 102.5 945.0 1098.0 115490.3

Note 1:

1. Data is provisional.

2. *: Source is NPCI.

3. **:Figures Negligible, Source is NPCI

4. &: Card transactions of four banks.

5. #: PPI issued by 8 issuers for goods and services transactions only.

6. h: Holiday

7. Mobile Banking figures are taken from 5 banks. The total volume & value of electronic payment systems does not include mobile banking.

8. NACH figures are for approved transactions only

RTGS – Real time gross settlement

NEFT – National electronic funds transfer

CTS – Cheque truncation system

IMPS – Immediate payment service

NACH – National automated clearing house

UPI - Unified Payments Interface

USSD - Unstructured Supplementary Service Data

POS – Point of sale

PPI – Prepaid payment instrument

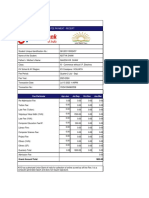

Preferred Payment Modes

Cards 56.48%

Netbanking 23.80%

UPI 17.00%

Wallets 18.70%

AGS Credit Card rates

Standard Credit Card 1.30%

Premium Credit Card 2.00%

Super Premium Credit Card 2.20%

International Cards 2.50%

RBI Debit Card rates

Small merchants (<20 LPA) 0.40%

Other merchants (>20 LPA) 0.90%

Below INR 2000 0.00%

Wallets

Paytm 1.50%

Mobikwik 1.90%

Freecharge 1.75%

PayZapp 1.90%

Oxigen 1.90%

ItzCash 1.90%

UPI

<INR 2000 0.25%

>INR 2000 0.65%

Вам также может понравиться

- United States Census Figures Back to 1630От EverandUnited States Census Figures Back to 1630Оценок пока нет

- CURVAS IDF ConcayoДокумент15 страницCURVAS IDF ConcayoFlorentino Alberto Sanchez VilelaОценок пока нет

- Actual Paid Out Costs Incurred by Owned Land Operators A1 Pulses Gram India 1996 97 To 2018 19Документ2 страницыActual Paid Out Costs Incurred by Owned Land Operators A1 Pulses Gram India 1996 97 To 2018 19gourav_gogoОценок пока нет

- IUnits ChartДокумент1 страницаIUnits ChartThomas EntersОценок пока нет

- SolarДокумент11 страницSolarCarlos Tadeo CapistranОценок пока нет

- Ncoli Up To February 2021Документ1 страницаNcoli Up To February 2021Onalenna MdongoОценок пока нет

- Forex ArchДокумент18 страницForex ArchعبداللہОценок пока нет

- Time Series Data Rainfall by Seasons in Tamilnadu 2010Документ2 страницыTime Series Data Rainfall by Seasons in Tamilnadu 2010Praveen BhalajiОценок пока нет

- Export FiguresДокумент1 страницаExport FiguresNael ChiraghОценок пока нет

- Chap5 Money Annual 07 AanexДокумент20 страницChap5 Money Annual 07 AanexowltbigОценок пока нет

- Number of Cards and Users of Payment Instruments (End of Period)Документ1 страницаNumber of Cards and Users of Payment Instruments (End of Period)Vaibhav guptaОценок пока нет

- Tourism Statistics: Kingdom of CambodiaДокумент8 страницTourism Statistics: Kingdom of CambodiaAubrey LabardaОценок пока нет

- Domestic Markets & Monetary Management Department: R: RevisedДокумент17 страницDomestic Markets & Monetary Management Department: R: RevisedAli RazaОценок пока нет

- BYU Stat 121 Statistical TablesДокумент1 страницаBYU Stat 121 Statistical TablesGreg KnappОценок пока нет

- Katalog BONT-Full Lift Safety ValveДокумент8 страницKatalog BONT-Full Lift Safety ValveAnwar MohammadОценок пока нет

- Noi-Amort - Inter / R.F para Tat - Tat / Ean Shp. Amr VL - Nd/vite Ose Vl+inv/vite I Borxh I, (Brxh-Princ) IДокумент2 страницыNoi-Amort - Inter / R.F para Tat - Tat / Ean Shp. Amr VL - Nd/vite Ose Vl+inv/vite I Borxh I, (Brxh-Princ) IXhoiZekajОценок пока нет

- Sachaeffler India Ltd.Документ63 страницыSachaeffler India Ltd.shivam vermaОценок пока нет

- NPV Calculation of Euro DisneylandДокумент5 страницNPV Calculation of Euro DisneylandRama SubramanianОценок пока нет

- Production Monthly Report 2020Документ42 страницыProduction Monthly Report 2020Adaro WaterОценок пока нет

- IS: 4984 Wall Thickness & Weight Chart of Pipes For Material Grade PE-63Документ1 страницаIS: 4984 Wall Thickness & Weight Chart of Pipes For Material Grade PE-63Deputy Executive Engineeer RWS & S Nrpm100% (2)

- Year 2019Документ5 страницYear 2019Master SearОценок пока нет

- Rainfall Database PT XXX: CH Hujan Tahun 2008-2017Документ74 страницыRainfall Database PT XXX: CH Hujan Tahun 2008-2017junirahmadhasibuanОценок пока нет

- Financial Management: Academy of AccountsДокумент10 страницFinancial Management: Academy of AccountsAshishОценок пока нет

- Consumer Price Index (February 2019 100)Документ8 страницConsumer Price Index (February 2019 100)rzvendiya-1Оценок пока нет

- K Pvif: Tabel PV Dari RP 1 Pada Akhir Periode Ke-N (Tabel Pvif)Документ4 страницыK Pvif: Tabel PV Dari RP 1 Pada Akhir Periode Ke-N (Tabel Pvif)Valentina AlenОценок пока нет

- IS: 4984 Wall Thickness & Weight Chart of Pipes For Material Grade PE-100Документ1 страницаIS: 4984 Wall Thickness & Weight Chart of Pipes For Material Grade PE-100Deputy Executive Engineeer RWS & S Nrpm100% (2)

- Astrology Levels Stock SetupДокумент222 страницыAstrology Levels Stock SetupasathОценок пока нет

- Present Value of Annuity TableДокумент1 страницаPresent Value of Annuity TableAntonette CastilloОценок пока нет

- Q (X) e DT Q (X) : Complementary Error FunctionДокумент2 страницыQ (X) e DT Q (X) : Complementary Error FunctionMohamed DakheelОценок пока нет

- Inflation Data - 176 Countries: Long-Term Time Series of Economic Data For Most Countries in The WorldДокумент4 страницыInflation Data - 176 Countries: Long-Term Time Series of Economic Data For Most Countries in The WorldAnkur Sharda100% (1)

- US Corporate Bond Issuance: All Data Are Subject To RevisionДокумент5 страницUS Corporate Bond Issuance: All Data Are Subject To RevisionÂn TrầnОценок пока нет

- Year 2018-1Документ5 страницYear 2018-1Vũ Ngọc BíchОценок пока нет

- Basic Lowry Model: by Dr. Jean-Paul RodrigueДокумент14 страницBasic Lowry Model: by Dr. Jean-Paul RodrigueirpanОценок пока нет

- RMT 559 Final Exam Answer Sheet Index Number: Expected Profit Intial Cost Annual Maintenance 25000 75000 5000 35000 110000 10000 92435.1314Документ3 страницыRMT 559 Final Exam Answer Sheet Index Number: Expected Profit Intial Cost Annual Maintenance 25000 75000 5000 35000 110000 10000 92435.1314Aulia Putri ElzaОценок пока нет

- 4 Selangor PDFДокумент14 страниц4 Selangor PDFJoo LimОценок пока нет

- Statistical TableДокумент100 страницStatistical TablesmanisuzzamanОценок пока нет

- Financial TableДокумент4 страницыFinancial TablePule JackobОценок пока нет

- KEQ FV and PV TablesДокумент4 страницыKEQ FV and PV TablesRaj ShravanthiОценок пока нет

- KEQ FV and PV TablesДокумент4 страницыKEQ FV and PV TablesDennis AleaОценок пока нет

- FV and PV TablesДокумент4 страницыFV and PV TablesTanya SinghОценок пока нет

- Statista Outlook Key Market IndicatorsДокумент25 страницStatista Outlook Key Market Indicatorsvishesh jainОценок пока нет

- PVIF FVIF TableДокумент2 страницыPVIF FVIF TableYaga Kangga0% (1)

- Financial Tables PDFДокумент2 страницыFinancial Tables PDFomer1299Оценок пока нет

- Future Value Tables PDFДокумент2 страницыFuture Value Tables PDFToniОценок пока нет

- Tabel BungaДокумент2 страницыTabel BungaAnonymous 6bKfDkJmKeОценок пока нет

- Present Value TablesДокумент2 страницыPresent Value TablesFreelansir100% (1)

- Tables PvifaДокумент2 страницыTables PvifaDdy Lee60% (5)

- Full Lift Safety Valve AritaДокумент8 страницFull Lift Safety Valve Aritahairul firdausОценок пока нет

- Lượng Mưa Trung Bình Tháng Thực Đo Sóc Trăng Số Liệu Từ Năm 1978 - 2015Документ1 страницаLượng Mưa Trung Bình Tháng Thực Đo Sóc Trăng Số Liệu Từ Năm 1978 - 2015Tam DoОценок пока нет

- Conversion: Milliamps - PLC Raw Counts - 1 To 5 VDC - PercentageДокумент1 страницаConversion: Milliamps - PLC Raw Counts - 1 To 5 VDC - PercentagedeepakОценок пока нет

- Financial Tables - Present and Future Value TablesДокумент7 страницFinancial Tables - Present and Future Value TablesN Rakesh86% (7)

- Present Value of A $1Документ3 страницыPresent Value of A $1anonimussttОценок пока нет

- Present Value of A $1Документ3 страницыPresent Value of A $1Aah SonaahОценок пока нет

- Reporte ProyeccionДокумент5 страницReporte ProyeccionPaolo FloresОценок пока нет

- Drug Overdose Deaths in The United States, 1999-2016Документ4 страницыDrug Overdose Deaths in The United States, 1999-2016KUER NewsОценок пока нет

- Cambodia Tourism Statistics 2017Документ5 страницCambodia Tourism Statistics 2017Thông NguyễnОценок пока нет

- Professional Windows Phone 7 Application Development: Building Applications and Games Using Visual Studio, Silverlight, and XNAОт EverandProfessional Windows Phone 7 Application Development: Building Applications and Games Using Visual Studio, Silverlight, and XNAОценок пока нет

- Spoolify Ai F6S PDFДокумент1 страницаSpoolify Ai F6S PDFSoham BanerjeeОценок пока нет

- Neotec Hub - Compliance Calendar For Pvt. Ltd. CompaniesДокумент2 страницыNeotec Hub - Compliance Calendar For Pvt. Ltd. CompaniesSoham BanerjeeОценок пока нет

- Uat of SWM - Nkda - 20 March 2020 - v1.2Документ6 страницUat of SWM - Nkda - 20 March 2020 - v1.2Soham BanerjeeОценок пока нет

- Cracking The Coding Interview-Gayle McDowellДокумент1 страницаCracking The Coding Interview-Gayle McDowellSoham BanerjeeОценок пока нет

- Investorpitchdecktemplatefromnewhaircut 150516093021 Lva1 App6892Документ17 страницInvestorpitchdecktemplatefromnewhaircut 150516093021 Lva1 App6892Soham BanerjeeОценок пока нет

- Question Papers - WB-JEE Sample PaperДокумент3 страницыQuestion Papers - WB-JEE Sample PaperSoham BanerjeeОценок пока нет

- ACCA July 2010 Intake KLДокумент2 страницыACCA July 2010 Intake KLjalan1989Оценок пока нет

- Income Tax Payment Challan: PSID #: 148473407Документ1 страницаIncome Tax Payment Challan: PSID #: 148473407Haseeb RazaОценок пока нет

- A Project Report On TaxationДокумент68 страницA Project Report On TaxationDinesh ChahalОценок пока нет

- Subledger Accounting Program ReportДокумент2 страницыSubledger Accounting Program ReportLinh Dang Thi ThuyОценок пока нет

- Sworn DeclarationДокумент1 страницаSworn DeclarationGilden Joy CequenaОценок пока нет

- Contoh - BL Coo Phyto IspmДокумент4 страницыContoh - BL Coo Phyto IspmHeru Dwi Setiawan0% (1)

- Negotin Bar Exam QuestionsДокумент13 страницNegotin Bar Exam QuestionsVenz LacreОценок пока нет

- Pan Asia LineДокумент12 страницPan Asia LineRAJVIJIAMALОценок пока нет

- Draft Text MT 700 LCДокумент3 страницыDraft Text MT 700 LCalfares171260% (5)

- HSBC v. CIRДокумент11 страницHSBC v. CIRArvin Antonio OrtizОценок пока нет

- Ibs Kelana Jaya 1 31/03/21Документ4 страницыIbs Kelana Jaya 1 31/03/21flawlessОценок пока нет

- Unilab Inv PDFДокумент1 страницаUnilab Inv PDFMithun Mathew KottaramkunnelОценок пока нет

- Transaction TableДокумент1 страницаTransaction TableASHIQ HUSSAINОценок пока нет

- IDFC FASTag Summary1694338464880Документ2 страницыIDFC FASTag Summary1694338464880fayiz0358Оценок пока нет

- Payment Processing - UserGuide - v1.5Документ39 страницPayment Processing - UserGuide - v1.5ashu guptaОценок пока нет

- Credit Card Assignment PDF WeeblyДокумент2 страницыCredit Card Assignment PDF Weeblyapi-371069146Оценок пока нет

- B.ing HotelsДокумент4 страницыB.ing HotelsAgung RamadhanОценок пока нет

- YES Bank & RBL Bank - BenefitДокумент2 страницыYES Bank & RBL Bank - BenefitBikash SaoОценок пока нет

- 2Документ172 страницы2Tharuman IvanОценок пока нет

- Taxation - Procedural Due ProcessДокумент3 страницыTaxation - Procedural Due ProcessjorgОценок пока нет

- Trial Balance PD Mitra Des 16 Rev 2018Документ1 страницаTrial Balance PD Mitra Des 16 Rev 2018Faie RifaiОценок пока нет

- Nafith Logistics Services LLC Tax InvoiceДокумент1 страницаNafith Logistics Services LLC Tax InvoiceMaan JuttОценок пока нет

- BinatuДокумент6 страницBinatuhandri yosephОценок пока нет

- Receipt - 7 - 15 - 2023 12 - 00 - 00 AMДокумент1 страницаReceipt - 7 - 15 - 2023 12 - 00 - 00 AMAditya ShawОценок пока нет

- Philippine Credit Card Authorization FormДокумент1 страницаPhilippine Credit Card Authorization FormJack Roquid RodriguezОценок пока нет

- Biznext Agent Proposal 2020-NewДокумент10 страницBiznext Agent Proposal 2020-NewWilson ThomasОценок пока нет

- Discharge Voucher ULIP End V6.1 RevisedДокумент3 страницыDischarge Voucher ULIP End V6.1 Revisedsunny0908Оценок пока нет

- OutputДокумент31 страницаOutputvenkatachalapathy.thОценок пока нет

- Human Rights Defense Center v. MCCA Self-Funded Risk Management PoolДокумент18 страницHuman Rights Defense Center v. MCCA Self-Funded Risk Management PoolMaine Trust For Local NewsОценок пока нет

- Statement of Axis Account No:911010036952533 For The Period (From: 13-05-2020 To: 11-06-2021)Документ2 страницыStatement of Axis Account No:911010036952533 For The Period (From: 13-05-2020 To: 11-06-2021)srinu katamsОценок пока нет