Академический Документы

Профессиональный Документы

Культура Документы

Manila V Alegar

Загружено:

yzarvelascoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Manila V Alegar

Загружено:

yzarvelascoАвторское право:

Доступные форматы

CITY OF MANILA vs.

Alegar Corporation

G.R. No. 187604 June 25, 2012

Ponente: Abad, J.

Doctrine:

Two stages of an action for expropriation: An expropriation proceeding of private lands has two stages: first,

the determination of plaintiffs authority to exercise the power of eminent domain in the context of the facts of

the case and, second, if there be such authority, the determination of just compensation. The first phase ends

with either an order of dismissal or a determination that the property is to be acquired for a public purpose.

Facts: The City of Manila issued ordinance 8012 which authorizes the Mayor to acquire certain lots belonging

to the respondents for use in the socialized housing project of the former. The respondents refused as the offer

given by the petitioner was too low. As such, petitioner filed an expropriation suit in the RTC against

respondents. In the RTC, respondents did not submit their memorandum.

RTC ruling: RTC dismissed the suit as the expropriation did not comply with RA 7279 section 10 which

required that private properties are considered last for expropriation. Petitioner moved for reconsideration but

did not wait for the RTC’s decision and filed their appeal with the CA.

CA ruling: CA affirmed the ruling of the RTC and denied petitioner from submitting evidence to support its

claim.

Issue: Whether or not the RTC denied petitioner its right to due process when it did not allow it to present

evidence in its behalf? Whether or not the expropriation was proper?

Ruling: No, the RTC did not deny the city its right to due process. An expropriation proceeding of private lands

has two stages: first, the determination of plaintiffs authority to exercise the power of eminent domain in the

context of the facts of the case and, second, if there be such authority, the determination of just

compensation. The first phase ends with either an order of dismissal or a determination that the property is to be

acquired for a public purpose. Here, the City’s action was still in the first stage when the RTC called the parties

to a pre-trial conference where, essentially, their task was to determine how the court may resolve the issue

involved in the first stage: the City’s authority to acquire by expropriation the particular lots for its intended

purpose. As it happened, the parties opted to simultaneously submit their memoranda on that issue. There was

nothing infirm in this agreement since it may be assumed that the parties knew what they were doing and since

such agreement would facilitate early disposal of the case. Unfortunately, the agreement implied that the City

was waiving its right to present evidence that it was acquiring the subject lots by expropriation for a proper

public purpose. Counsel for the City may have been confident that its allegations in the complaint can stand on

their own, ignoring the owners challenge to its right to expropriate their lots for the stated purpose.

Parenthetically, the City moved for the reconsideration of the RTCs order of dismissal but withdrew this

remedy by filing a notice of appeal from that order to the CA. Evidently, the City cannot claim that it had been

denied the opportunity of a hearing.

The expropriation did not comply with RA 7279. Admittedly, the City alleged in its amended complaint that it

wanted to acquire the subject lots in connection with its land-for-the-landless program and that this was in

accord with its Ordinance 8012. But the City misses the point. The owners directly challenged the validity of

the objective of its action. They alleged that the taking in this particular case of their lots is not for public use or

purpose since its action would benefit only a few. Whether this is the case or not, the owners answer tendered a

factual issue that called for evidence on the Citys part to prove the affirmative of its allegations. As already

stated, the City submitted the issue for the RTCs resolution without presenting evidence.

Dispositive portion: CA ruling affirmed. Deposited amount to be returned to city of manila less expenses for

attorney’s fees amounting to 50,000 pesos.

Вам также может понравиться

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- Internal Quality Audit ReportДокумент4 страницыInternal Quality Audit ReportyzarvelascoОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5794)

- Customer Complaint Form: CCF NoДокумент1 страницаCustomer Complaint Form: CCF NoyzarvelascoОценок пока нет

- Internal Quality Audit Nonconformance ReportДокумент1 страницаInternal Quality Audit Nonconformance ReportyzarvelascoОценок пока нет

- Oxychem Vendor ScorecardДокумент6 страницOxychem Vendor ScorecardyzarvelascoОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- Corrective Action Form: Quality Assurance DepartmentДокумент2 страницыCorrective Action Form: Quality Assurance DepartmentyzarvelascoОценок пока нет

- Scorecard Dimension: Costs/PricingДокумент6 страницScorecard Dimension: Costs/PricingyzarvelascoОценок пока нет

- Internal Quality Auditor Qualification RecordДокумент1 страницаInternal Quality Auditor Qualification RecordyzarvelascoОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

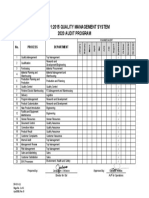

- Iso 9001:2015 Quality Management System 2020 Audit Program: No. Process DepartmentДокумент1 страницаIso 9001:2015 Quality Management System 2020 Audit Program: No. Process DepartmentyzarvelascoОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- Iso 9001:2015 Quality Management System 2018 Audit Plan: No. Process DepartmentДокумент1 страницаIso 9001:2015 Quality Management System 2018 Audit Plan: No. Process DepartmentyzarvelascoОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Product Road Map Form 111Документ1 страницаProduct Road Map Form 111yzarvelascoОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- QC Self Inspection Checklist 111Документ14 страницQC Self Inspection Checklist 111yzarvelascoОценок пока нет

- 183 - 221697 & 221698-700 (Concurring Opinion) - Poe-Llamanzares v. Commission On ElectionsДокумент6 страниц183 - 221697 & 221698-700 (Concurring Opinion) - Poe-Llamanzares v. Commission On ElectionsyzarvelascoОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Lina V PanoДокумент7 страницLina V PanoyzarvelascoОценок пока нет

- Complaint KathrineДокумент6 страницComplaint KathrineyzarvelascoОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- Nocum V TanДокумент2 страницыNocum V TanyzarvelascoОценок пока нет

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- 29 Rosario Maneja V NLRC and Manila Midtown HotelДокумент2 страницы29 Rosario Maneja V NLRC and Manila Midtown HotelyzarvelascoОценок пока нет

- Kisajiro Okamoto CaseДокумент6 страницKisajiro Okamoto CaseyzarvelascoОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- Judicial Affidavit SampleДокумент9 страницJudicial Affidavit SampleyzarvelascoОценок пока нет

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- DANGWA TRANSPO V CA DigestДокумент4 страницыDANGWA TRANSPO V CA DigestyzarvelascoОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Taule CaseДокумент9 страницTaule CaseyzarvelascoОценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Lina vs. PanoДокумент7 страницLina vs. PanoyzarvelascoОценок пока нет

- Lee V CaДокумент1 страницаLee V CayzarvelascoОценок пока нет

- Labor Standards - Prescribes The Terms and ConditionsДокумент7 страницLabor Standards - Prescribes The Terms and ConditionsyzarvelascoОценок пока нет

- Aldaba V Comelec, Robles V Hret, Trillianes V PimentelДокумент4 страницыAldaba V Comelec, Robles V Hret, Trillianes V PimentelyzarvelascoОценок пока нет

- TSA Response To GoodenДокумент6 страницTSA Response To GoodenHayden SparksОценок пока нет

- An Interview With Adib Khan - Bali AdvertiserДокумент3 страницыAn Interview With Adib Khan - Bali AdvertiserPratap DattaОценок пока нет

- Bpop Plan - DanahaoДокумент3 страницыBpop Plan - DanahaoJessica CindyОценок пока нет

- El Alamein - Operazione SuperchargeДокумент2 страницыEl Alamein - Operazione SuperchargeAndrea MatteuzziОценок пока нет

- Tribiana VS TribianaДокумент1 страницаTribiana VS Tribianakrystine joy sitjarОценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Company Liquidation Process and ProcedureДокумент2 страницыCompany Liquidation Process and ProcedureandrewОценок пока нет

- Acuzar vs. JorolanДокумент5 страницAcuzar vs. JorolanedmarkarcolОценок пока нет

- Strengths and Weaknesses of MusharrafДокумент10 страницStrengths and Weaknesses of MusharrafMariumHafeez100% (3)

- Island of Las Palmas CaseДокумент3 страницыIsland of Las Palmas CaseNicole BlancheОценок пока нет

- Llses: Federal Register! Vol. 64, No. 231/ Thursday, December 2, 1999/ Notices 67585Документ1 страницаLlses: Federal Register! Vol. 64, No. 231/ Thursday, December 2, 1999/ Notices 67585H.I.M Dr. Lawiy Zodok100% (2)

- Elmer Duarte v. Atty Gen USA, 3rd Cir. (2010)Документ6 страницElmer Duarte v. Atty Gen USA, 3rd Cir. (2010)Scribd Government DocsОценок пока нет

- Wa0005Документ8 страницWa0005rida zulquarnainОценок пока нет

- Obat Yang Tersedia Di PuskesmasДокумент4 страницыObat Yang Tersedia Di PuskesmasHas minaОценок пока нет

- NSTP Module 2Документ76 страницNSTP Module 2Niña Baltazar100% (3)

- Racism and Rhetoric, From Ferguson To PalestineДокумент5 страницRacism and Rhetoric, From Ferguson To PalestineThavam RatnaОценок пока нет

- Ayala Investment and Development Corporation vs. CA, G.R. No. 118305Документ10 страницAyala Investment and Development Corporation vs. CA, G.R. No. 118305graceОценок пока нет

- Synopsis of Clinical Diagnostic Interview QuestionsДокумент2 страницыSynopsis of Clinical Diagnostic Interview QuestionsRoxanne ForbesОценок пока нет

- Ascending The Mountain of The LordДокумент9 страницAscending The Mountain of The Lordjuan pozasОценок пока нет

- 3-Palay Inc Vs ClaveДокумент7 страниц3-Palay Inc Vs ClaveRen A EleponioОценок пока нет

- Certificate of Inventory: Republic of The Philippines Philippine National PoliceДокумент1 страницаCertificate of Inventory: Republic of The Philippines Philippine National PoliceNobrien HernandezОценок пока нет

- Kheamhuat Holdings V The Indian Association of PenangДокумент22 страницыKheamhuat Holdings V The Indian Association of PenangCalan EskandarОценок пока нет

- Text Di Bawah Ini Digunakan Untuk Menjawab Nomor 1 Dan 2.: Rahmat and Wati JumintenДокумент3 страницыText Di Bawah Ini Digunakan Untuk Menjawab Nomor 1 Dan 2.: Rahmat and Wati JumintenKiddy Care TegalОценок пока нет

- The Face of Intimate PartnerДокумент9 страницThe Face of Intimate PartnerhsnemonОценок пока нет

- Rex Education REX Book Store Law Books Pricelist As of 13 June 2022Документ10 страницRex Education REX Book Store Law Books Pricelist As of 13 June 2022AndreaОценок пока нет

- Mcveyead536-Safety Calendar 1Документ12 страницMcveyead536-Safety Calendar 1api-529486237Оценок пока нет

- Africa NeocolonialismoДокумент198 страницAfrica NeocolonialismoIsis VioletaОценок пока нет

- Small Deeds, Great Rewards by Hadhrat Moulana Abdur Rauf Sahib D.BДокумент68 страницSmall Deeds, Great Rewards by Hadhrat Moulana Abdur Rauf Sahib D.BibnturabОценок пока нет

- Ching v. Salinas, Sr. (G.r. No. 161295)Документ3 страницыChing v. Salinas, Sr. (G.r. No. 161295)Rizal Daujr Tingkahan IIIОценок пока нет

- NCERT Class 7 Geography PDFДокумент81 страницаNCERT Class 7 Geography PDFJayant OjhaОценок пока нет

- Compiled Case Digests For Articles 1015-1023, 1041-1057, New Civil Code of The PhilippinesДокумент134 страницыCompiled Case Digests For Articles 1015-1023, 1041-1057, New Civil Code of The PhilippinesMichy De Guzman100% (1)