Академический Документы

Профессиональный Документы

Культура Документы

GHHHVVT

Загружено:

JajajaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

GHHHVVT

Загружено:

JajajaАвторское право:

Доступные форматы

Chapter 7

Business Taxes

Onerous transfers

“in the course of trade or business” – regular conduct or pursuit of a commercial or an

economic activity except isolated transactions

Services rendered by a nonresident foreign person in the Phil is considered being

rendered in the course of trade or business

If for subsistence or livelihood with receipts not exceeding 100k for any 12-month

aggregated is not subject to business taxes (marginal income earners)

Based on gross sales or receipts irrespective of the result of the operation

Types of Business Taxes

VAT

OPT

Excise Tax

VAT

Tax on the value added by every seller to the purchase price or cost in the sale or lease of

goods, property or services in the ordinary course o trade or business as well as on importation

of goods into the Philippines, whether for persona or business use.

Sale, barter, exchange or lease of goods or properties and services in the Philippines

“Cross border doctrine” no VAT, only those consumed in the Phil

VAT on sales of goods or properties

VAT on importation of goods

VAT on sales of services and use or lease of properties

Goods or properties are tangible and intangible objects capable of pecuniary estimation

Sale of Services

Sale of Real Properties

Characteristics of VAT

1. Indirect tax where tax shifting is always presumes

Statutory liable to pay

Tax burden is on the final consumers

In case of importation, importer is liable for vat

2. It is consumption based

3. Imposed on the value added in each stage of production and distribution process

Credit Invoice Method- adopted in computing VAT payable

Output vat-Input Vat

If the input tax inclusive of input tax carried over from the previous quarter exceeds the output

tax, the excess input tax shall be carried over to the succeeding quarter or quarters, provided

however, that any input tax attributable to zero-rated sales by a VAT registered person may at

his option be refunded or applied for a tax credit certificate which may be used in the payment

of internal revenue taxes

Basis

VAT reform act RA9337 passed by congress in May 2015 amended by RA 9361 implemented on

November 1, 2005.

Sales of goods or properties Gross selling price (Gross sales less any SDRA)

Sale of services Gross receipts

Importation Total landed cost

Dealers in securities Gross Income

Deductions from gross selling price

a. Discounts determined and granted at the time of sale, expressly indicated in the invoice

that form part of the gross sales, should not be dependent upon the happening of a

future event

b. SRA with proper credit or refund, or with issued credit memo

Gross Selling Price

The total amount of money or its equivalent which the purchaser pays or is obligated to pay to

the seller in consideration of the sale, barter or exchange of the goods or properties, excluding

VAT.

Real property sales subject to VAT, GSP is consideration stated in the sales document or

the FMV (higher between determined by commissioner or provincial and city assessors),

whichever is higher. If the gross selling price is based on the zonal or market value of the

property, the zonal or market value shall be deemed exclusive of VAT.

Gross Receipts

Constructive receipts occur when the money consideration or its equivalent is placed at the

control of the person who rendered the service without restrictions by the payor.

Advance Payment

registration

A. Mandatory Registration

January 1, 2018 (TRAIN Law)

a. Aggregate amount of actual gross sales or receipts exceed 3,000,000 (previously

1,919,500) or there are reasons to believe that it will happen.

In case of non-registration, liable to VAT but cannot avail input tax credit

b. Radio and/or broadcasting companies, gross receipts of the preceding year

exceed 10M

c. Taxpayer required to register but failed to.

B. Optional registration

Those elect themselves as VAT registered

Any person who elects to register under optional registration shall not be

allowed to cancel his registration for the next three years.

VAT registered entered into exempt transactions

Franchise grantees of radio and/or television broadcasting with GR of 10M may elect to

be VAT registered, once exercised shall be irrevocable.

May apply not later than 10 days before the beginning of the calendar quarter

Shall pay the registration fee

Once registered, liable to output tax and be entitled to input tax credit beginning on the

first day of the month following the registration.

C. Cancellation or registration

1. Written application with demonstration of GR/GS for the following 12 months will

not exceed 3M

2. If he has ceased to carry on his business.

Beginning on the first day of the following month the cancellation was approved.

Power of Commissioner to suspend business operations

Not less than 5 days

1. Failure to issue receipts or invoices

2. Failure to file vat return

3. Understatement of taxable sales or receipts, 30%

4. Failure to register

VAT is an ad valorem tax payable by the customer

Advance payment of VAT is required with raw and refined sugar.

Applicabl base price of 1,400 per 50 kg bag

Вам также может понравиться

- Theory of Accounts ExamДокумент6 страницTheory of Accounts ExamAlbert Delos SantosОценок пока нет

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeОт EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeРейтинг: 4 из 5 звезд4/5 (5795)

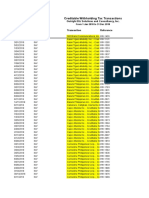

- Creditable Withholding Tax Transactions: Outright Biz Solutions and Consultancy, IncДокумент30 страницCreditable Withholding Tax Transactions: Outright Biz Solutions and Consultancy, IncJajajaОценок пока нет

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceОт EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceРейтинг: 4 из 5 звезд4/5 (895)

- BIR-Payment For DST 2000 For New Lease Contract 2018 To 2019Документ3 страницыBIR-Payment For DST 2000 For New Lease Contract 2018 To 2019JajajaОценок пока нет

- The Yellow House: A Memoir (2019 National Book Award Winner)От EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Рейтинг: 4 из 5 звезд4/5 (98)

- RMC No 50-2018Документ18 страницRMC No 50-2018JajajaОценок пока нет

- Reflective DiaryДокумент34 страницыReflective DiaryJajajaОценок пока нет

- The Little Book of Hygge: Danish Secrets to Happy LivingОт EverandThe Little Book of Hygge: Danish Secrets to Happy LivingРейтинг: 3.5 из 5 звезд3.5/5 (400)

- Welcome To Our Presentation Welcome To Our Presentation: Marketing Management PhilosophyДокумент13 страницWelcome To Our Presentation Welcome To Our Presentation: Marketing Management PhilosophyLayes AhmedОценок пока нет

- The Emperor of All Maladies: A Biography of CancerОт EverandThe Emperor of All Maladies: A Biography of CancerРейтинг: 4.5 из 5 звезд4.5/5 (271)

- Sky Blue FRP Canopy, Rs 55 - Piece, Sri Lakshmi Fibers - ID - 13701496633Документ6 страницSky Blue FRP Canopy, Rs 55 - Piece, Sri Lakshmi Fibers - ID - 13701496633Manish PandeyОценок пока нет

- Never Split the Difference: Negotiating As If Your Life Depended On ItОт EverandNever Split the Difference: Negotiating As If Your Life Depended On ItРейтинг: 4.5 из 5 звезд4.5/5 (838)

- ProjectДокумент115 страницProjectchaluvadiinОценок пока нет

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyОт EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyРейтинг: 3.5 из 5 звезд3.5/5 (2259)

- DominosДокумент36 страницDominosYadav PriyankaaОценок пока нет

- Concept Map CHapter 9Документ1 страницаConcept Map CHapter 9MarieОценок пока нет

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureОт EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureРейтинг: 4.5 из 5 звезд4.5/5 (474)

- Suraj Lamp and Industries PVT LTD Vs State of Harys111126COM937521 PDFДокумент10 страницSuraj Lamp and Industries PVT LTD Vs State of Harys111126COM937521 PDFyashoОценок пока нет

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryОт EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryРейтинг: 3.5 из 5 звезд3.5/5 (231)

- Bir Comparison SLSPДокумент5 страницBir Comparison SLSPchris cardino100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnОт EverandTeam of Rivals: The Political Genius of Abraham LincolnРейтинг: 4.5 из 5 звезд4.5/5 (234)

- Case Study of Avon - Case 2Документ2 страницыCase Study of Avon - Case 2gregbaccayОценок пока нет

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaОт EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaРейтинг: 4.5 из 5 звезд4.5/5 (266)

- 40 Strategic Questions To Ask To Evaluate Company DirectionДокумент7 страниц40 Strategic Questions To Ask To Evaluate Company DirectionShailendra Kelani100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersОт EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersРейтинг: 4.5 из 5 звезд4.5/5 (345)

- Orvis OCДокумент6 страницOrvis OCpooja jaiswalОценок пока нет

- Introducing CPFR 2.0 WebinarДокумент40 страницIntroducing CPFR 2.0 WebinarRonaldo Real PerezОценок пока нет

- The Unwinding: An Inner History of the New AmericaОт EverandThe Unwinding: An Inner History of the New AmericaРейтинг: 4 из 5 звезд4/5 (45)

- Research PlanДокумент23 страницыResearch PlanArsh MaanОценок пока нет

- Kristen Konishi ResumeДокумент2 страницыKristen Konishi Resumeapi-301803766Оценок пока нет

- Principles of Marketing (Introduction)Документ17 страницPrinciples of Marketing (Introduction)Charlene Joy RodriguezОценок пока нет

- Brief of Dtls of Direct Selling and PlanДокумент2 страницыBrief of Dtls of Direct Selling and PlanKangen WaterОценок пока нет

- FinalДокумент60 страницFinalSANKET BANDYOPADHYAYОценок пока нет

- International Product DecisionsДокумент38 страницInternational Product Decisionsreena sharmaОценок пока нет

- IC Restaurant Balanced Scorecard ExampleДокумент1 страницаIC Restaurant Balanced Scorecard ExampleClint Jan Salvaña75% (4)

- Nonprofit Organizations: Publication 18 - April 2013Документ45 страницNonprofit Organizations: Publication 18 - April 2013psawant77Оценок пока нет

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreОт EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreРейтинг: 4 из 5 звезд4/5 (1090)

- Case StudyДокумент2 страницыCase StudyErine ConcepcionОценок пока нет

- Deed of Sale and Deed of Assignment - SampleДокумент17 страницDeed of Sale and Deed of Assignment - SampleHoney Mae de LeonОценок пока нет

- Exclusive Authority To Sell Agreement PDFДокумент4 страницыExclusive Authority To Sell Agreement PDFjohn milo67% (3)

- 7 ElevenДокумент3 страницы7 ElevenButch kevin adovasОценок пока нет

- Elasticity of DemandДокумент7 страницElasticity of Demandsujeet_kumar_nandan7984Оценок пока нет

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)От EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Рейтинг: 4.5 из 5 звезд4.5/5 (121)

- Marketing Information SystemДокумент9 страницMarketing Information SystemTwinkleDewaniОценок пока нет

- October 2015Документ17 страницOctober 2015Pumper TraderОценок пока нет

- Decathlon Sourcing Project To Identify The Logistics Potential in Accordance To The Needs of Decathlon's ProcessesДокумент53 страницыDecathlon Sourcing Project To Identify The Logistics Potential in Accordance To The Needs of Decathlon's ProcessesQenОценок пока нет

- Scale-Up Business Game ENДокумент129 страницScale-Up Business Game ENHermesOrestes0% (1)

- Retail CommunicationsДокумент47 страницRetail CommunicationsArshiya JabeenОценок пока нет

- 45 CD South African Airways Vs CirДокумент1 страница45 CD South African Airways Vs CirMaribeth G. TumaliuanОценок пока нет