Академический Документы

Профессиональный Документы

Культура Документы

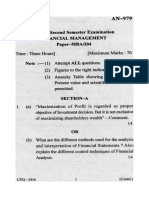

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Загружено:

Sushmanth ReddyОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The Answer

Загружено:

Sushmanth ReddyАвторское право:

Доступные форматы

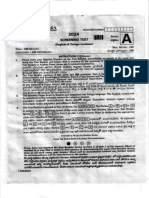

Test Series: April, 2019

MOCK TEST PAPER – II

INTERMEDIATE (NEW): GROUP – II

PAPER – 8: FINANCIAL MANAGEMENT& ECONOMICS FOR FINANCE

PAPER 8A : FINANICAL MANAGEMENT

Answers are to be given only in English except in the case of the candidates who have opted for Hindi medium.

If a candidate has not opted for Hindi medium his/ her answers in Hindi will not be valued .

Question No. 1 is compulsory.

Attempt any four questions from the remaining five questions.

Working notes should form part of the answer.

Time Allowed – 3 Hours (Total time for 8A and 8B) Maximum Marks – 60

1. Answer the following:

(a) The proportion and required return of debt and equity was recorded for a company with its

increased financial leverage as below:

Debt (%) Required return Equity Required Return (Ke) Weighted Average Cost of

(Kd ) (%) (%) (%) Capital (WACC) (K o )(%)

0 5 100 15 15

20 6 80 16 ?

40 7 60 18 ?

60 10 40 23 ?

80 15 20 35 ?

You are required to complete the table and IDENTIFY which capital structure is most beneficial for

this company. (Based on traditional theory, i.e., capital structure is relevant).

(b) Annova Ltd is considering raising of funds of about Rs.250 lakhs by any of two alternative methods,

viz., 14% institutional term loan and 13% non-convertible debentures. The term loan option would

attract no major incidental cost and can be ignored. The debentures would have to be issued at a

discount of 2.5% and would involve cost of issue of 2% on face value.

ADVISE the company as to the better option based on the effective cost of capital in each case.

Assume a tax rate of 50%.

(c) Probabilities for net cash flows for 3 years of a project of Ganesh Ltd are as follows:

Year 1 Year 2 Year 3

Cash Flow Probability Cash Flow Probability Cash Flow Probability

(Rs.) (Rs.) (Rs.)

2,000 0.1 2,000 0.2 2,000 0.3

4,000 0.2 4,000 0.3 4,000 0.4

6,000 0.3 6,000 0.4 6,000 0.2

8,000 0.4 8,000 0.1 8,000 0.1

CALCULATE the expected net cash flows and the present value of the expected cash flow, using

10 per cent discount rate. Initial Investment is Rs. 10,000

© The Institute of Chartered Accountants of India

(d) With the help of the following information ANALYSE and complete the Balance Sheet of Anup Ltd.:

Equity share capital Rs. 1,00,000

The relevant ratios of the company are as follows:

Current debt to total debt 0.40

Total debt to Equity share capital 0.60

Fixed assets to Equity share capital 0.60

Total assets turnover 2 Times

Inventory turnover 8 Times

(4 × 5 = 20 Marks)

2. (a) The capital structure of Anshu Ltd. as at 31.3.2019 consisted of ordinary share capital of

Rs. 5,00,000 (face value Rs. 100 each) and 10% debentures of Rs. 5,00,000 (Rs. 100 each). In

the year ended with March 2019, sales decreased from 60,000 units to 50,000 units. During this

year and in the previous year, the selling price was Rs. 12 per unit; variable cost stood at Rs. 8 per

unit and fixed expenses were at Rs. 1,00,000 p.a. The income tax rate was 30%.

You are required to CALCULATE the following:

(i) The percentage of decrease in earnings per share.

(ii) The degree of operating leverage at 60,000 units and 50,000 units.

(iii) The degree of financial leverage at 60,000 units and 50,000 units. (6 Marks)

(b) EXPLAIN the limitations of Leasing? (4 Marks)

3. (a) Navya Ltd has annual credit sales of Rs. 45 lakhs. Credit terms are 30 days, but its management

of receivables has been poor and the average collection period is 50 days, Bad debt is 0.4 per cent

of sales. A factor has offered to take over the task of debt administration and credit checking, at

an annual fee of 1 per cent of credit sales. Navya Ltd. estimates that it would save Rs. 35,000 per

year in administration costs as a result. Due to the efficiency of the factor, the average collection

period would reduce to 30 days and bad debts would be zero. The factor would advance 80 per

cent of invoiced debts at an annual interest rate of 11 per cent. Navya Ltd. is currently financing

receivables from an overdraft costing 10 per cent per year.

If occurrence of credit sales is throughout the year, COMPUTE whether the factor’s services should

be accepted or rejected. Assume 365 days in a year. (6 Marks)

(b) EXPLAIN the principles of “Trading on equity”. (4 Marks)

4. (a) Prem Ltd has a maximum of Rs. 8,00,000 available to invest in new projects. Three possibilities

have emerged and the business finance manager has calculated Net present Value (NPVs) for

each of the projects as follows :

Investment Initial cash outlay NPV

Rs. Rs.

Alfa (α) 5,40,000 1,00,000

Beta(β) 6,00,000 1,50,000

Gama (γ) 2,60,000 58,000

DETERMINE which investment/combination of investments should the company invest in, if we

assume that the projects can be divided? (6 Marks)

© The Institute of Chartered Accountants of India

(b) Invest Corporation Ltd. adjusts risk through discount rates by adding various risk premiums to the

risk free rate. Depending on the resultant rate, the proposed project is judged to be a low, medium

or high risk project.

Risk level Risk free rate Risk Premium

(%) (%)

Low 8 4

Medium 8 7

High 8 10

DEMONSTRATE the acceptability of the project on the basis of Risk Adjusted rate. (4 Marks)

5. The following information is supplied to you:

Rs.

Total Earnings 2,00,000

No. of equity shares (of Rs. 100 each) 20,000

Dividend paid 1,50,000

Price/ Earnings ratio 12.5

Applying Walter’s Model

(i) DETERMINE whether the company is following an optimal dividend policy.

(ii) IDENTIFY, what should be the P/E ratio at which the dividend policy will have no effect on the

value of the share.

(iii) Will your decision change, if the P/E ratio is 8 instead of 12.5? ANALYSE. (10 Marks)

6. (a) DESCRIBE Bridge Finance.

(b) STATE Virtual Banking? DISCUSS its advantages.

(c) EXPLAIN Concentration Banking (4 + 4 + 2 = 10 Marks)

© The Institute of Chartered Accountants of India

PAPER – 8B: ECONOMICS FOR FINANCE

Time Allowed – 1:15 Hours Maximum Marks - 40

Answers are to be given only in English except in the case of the candidates who have opted for Hindi medium. If

a candidate has not opted for Hindi medium his/ her answers in Hindi will not be valued.

Question 7 is compulsory question.

Attempt any three from the remaining four questions

In case, any candidate answers extra questions(s)/sub-question(s)/sub-question(s) over and above the

required number, then only the requisite number of questions first answered will be the evaluated the rest

answer shall be ignored

Working Notes should form part of the answer.

7. (a) Suppose in an economy:

Consumption Function (C) = 100 + 0.9 Yd, where Yd = Y-T

Autonomous Investment (I) = Rs. 100 crores

Government Expenditure G = Rs. 120 crores

Taxes (T) = Rs.50 crores

Exports (X) = Rs.200 crores

Import Function (M) = 100 + 0.15Y

Where Y and Yd National Income and Personal Disposable Income respectively. All the figures are

in Rupees. Find the Equilibrium level of GDP? (3 Marks)

(b) Define permanent income and state its relationship to demand for real money balances?

(3 Marks)

(c) Explain why government imposes price ceilings? (2 Marks)

(d) What is meant by trade distortion? (2 Marks)

8. (a) (i) Explain how decline in interest rates influence economic activity by changing the incentives

for households and businesses to save or invest? (3 Marks)

(ii) Define Information Failure (3 Marks)

(b) (i) What is meant by nominal GDP-growth? (2 Marks)

(ii) Define optimal output from the point of view of social welfare? (2 Marks)

9. (a) (i) Explain the effects of monetary policy through balance sheet channel (3 Marks)

(ii) What is the major determinant of the economic functions of a government? (2 Marks)

(b) Calculate (a) GDPMP and (b) NNPFC from the following data: (5 Marks)

Particulars (Rs) In Crore

(i) Net indirect tax 208

(ii) Consumption of fixed capital 42

(iii) Net factor income from abroad -40

(iv) Rent 311

(v) Profits 892

© The Institute of Chartered Accountants of India

(vi) Interest 81

(vii) Royalty 6

(viii) Wages and salary 489

(ix) Employer's contribution to Social Security Scheme 50

10. (a) (i) How do foreign direct investments enhance human capital in recipient countries? (3 Marks)

(ii) Distinguish between domestic subsidy and export subsidy? (2 Marks)

(b) (i) What do you understand by the term ‘final good”? (2 Marks)

(ii) Explain the different types of Externalities? How Externalities lead to welfare loss of markets?

(3 Marks)

11. (a) (i) What is the rationale for government intervention in allocation of resources? (3 Marks)

(ii) Distinguish between ‘non tariff measures’ and ‘non tariff barriers’ (3 Marks)

(b) (i) What do you understand by the term ‘cross rate’? (2 Marks)

(ii) What is the objective of policies requiring foreign entities to procure local contents? (2 Marks)

OR

What is meant by open market operations?

© The Institute of Chartered Accountants of India

Вам также может понравиться

- Finding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesОт EverandFinding Balance 2016: Benchmarking the Performance of State-Owned Enterprise in Island CountriesОценок пока нет

- 8) FM EcoДокумент19 страниц8) FM EcoKrushna MateОценок пока нет

- MTP Oct. 2018 FM and Eco QuestionДокумент6 страницMTP Oct. 2018 FM and Eco QuestionAisha MalhotraОценок пока нет

- FM MTP Question Paper Nov 19Документ6 страницFM MTP Question Paper Nov 19sriramakrishnajayamОценок пока нет

- UntitledДокумент18 страницUntitledAlok TiwariОценок пока нет

- Set AДокумент3 страницыSet AManish KumarОценок пока нет

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionДокумент6 страницCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayОценок пока нет

- 202 - FM Question PaperДокумент5 страниц202 - FM Question Papersumedh narwadeОценок пока нет

- Previous Year Question Paper (F.M)Документ10 страницPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerДокумент17 страницQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidОценок пока нет

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Документ15 страниц6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverОценок пока нет

- Dayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankДокумент9 страницDayalbagh Educational Institute Faculty of Commerce Abm 801: Financial Management & Analysis Question BankneetamoniОценок пока нет

- FABVДокумент10 страницFABVdivyayella024Оценок пока нет

- 71888bos57845 Inter p8qДокумент6 страниц71888bos57845 Inter p8qMayank RajputОценок пока нет

- 73153bos58999 p8Документ27 страниц73153bos58999 p8Sagar GuptaОценок пока нет

- FM MTP MergedДокумент330 страницFM MTP MergedAritra BanerjeeОценок пока нет

- Paper 8 Financial Management & Economics For Finance PDFДокумент5 страницPaper 8 Financial Management & Economics For Finance PDFShivam MittalОценок пока нет

- Techniques For Risk AnalysisДокумент7 страницTechniques For Risk AnalysisshahiankitОценок пока нет

- 7 Corporate Finance - Prof. Gagan SharmaДокумент4 страницы7 Corporate Finance - Prof. Gagan SharmaVampireОценок пока нет

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementДокумент34 страницыLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementSimon JosephОценок пока нет

- Corporate Financial ManagementДокумент3 страницыCorporate Financial ManagementRamu KhandaleОценок пока нет

- Ii Semester Endterm Examination March 2016Документ2 страницыIi Semester Endterm Examination March 2016Nithyananda PatelОценок пока нет

- 48 17228rtp Ipcc Nov09 Paper3bДокумент33 страницы48 17228rtp Ipcc Nov09 Paper3bemmanuel JohnyОценок пока нет

- An 979 MBA Sem II Financial Management14Документ4 страницыAn 979 MBA Sem II Financial Management14Riya AgrawalОценок пока нет

- FMECO M.test EM 30.03.2021 QuestionДокумент6 страницFMECO M.test EM 30.03.2021 Questionsujalrathi04Оценок пока нет

- Question No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerДокумент7 страницQuestion No. 1 Is Compulsory. Attempt Any Four Questions From The Remaining Five Questions. Working Notes Should Form Part of The AnswerHarsh KumarОценок пока нет

- Ca Inter May 2023 ImpДокумент23 страницыCa Inter May 2023 ImpAlok TiwariОценок пока нет

- Unit - I: Section - AДокумент22 страницыUnit - I: Section - AskirubaarunОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент6 страниц© The Institute of Chartered Accountants of IndiatilokiОценок пока нет

- J8. CAPII - RTP - June - 2023 - Group-IIДокумент162 страницыJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalОценок пока нет

- 7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BДокумент15 страниц7680 PEIIPaper 4 Financial Managementyearmay 2005 Section BManish MishraОценок пока нет

- Loyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementДокумент3 страницыLoyola College (Autonomous), Chennai - 600 034: APRIL 2016 Co 6608 - Financial ManagementvivekОценок пока нет

- MTP 19 53 Questions 1713430127Документ12 страницMTP 19 53 Questions 1713430127Murugesh MuruОценок пока нет

- FM (2nd) May2019 PDFДокумент2 страницыFM (2nd) May2019 PDFJohnОценок пока нет

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementДокумент27 страницPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalОценок пока нет

- Numericals On Financial ManagementДокумент4 страницыNumericals On Financial ManagementDhruv100% (1)

- MTP1 May2022 - Paper 8 FM EcoДокумент19 страницMTP1 May2022 - Paper 8 FM EcoYash YashwantОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент6 страниц© The Institute of Chartered Accountants of IndiaShrwan SinghОценок пока нет

- 78735bos63031 p6Документ44 страницы78735bos63031 p6dileepkarumuri93Оценок пока нет

- Capital Rationing 0u9sbal38rДокумент3 страницыCapital Rationing 0u9sbal38rRising ThunderОценок пока нет

- Financial ManagementДокумент3 страницыFinancial ManagementMRRYNIMAVATОценок пока нет

- SFM - 1Документ3 страницыSFM - 1ketulОценок пока нет

- FM QB New NewДокумент22 страницыFM QB New NewskirubaarunОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент24 страницы© The Institute of Chartered Accountants of IndiaAniketОценок пока нет

- FM & Eco - Test 1Документ3 страницыFM & Eco - Test 1Ritam chaturvediОценок пока нет

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementДокумент23 страницыPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementZrake 24Оценок пока нет

- CRV - Valuation - ExerciseДокумент15 страницCRV - Valuation - ExerciseVrutika ShahОценок пока нет

- Financial-Planning-and-Budgeting-S-22 PaperДокумент3 страницыFinancial-Planning-and-Budgeting-S-22 Paperrjyasir1985Оценок пока нет

- Gujarat Technological UniversityДокумент3 страницыGujarat Technological UniversityAmul PatelОценок пока нет

- Paper14 SolutionДокумент15 страницPaper14 Solutionharshrathore17579Оценок пока нет

- Ca-Ii May 2022Документ6 страницCa-Ii May 2022Gayathri V GОценок пока нет

- PRM41 - FM - End Term Question PaperДокумент2 страницыPRM41 - FM - End Term Question PapershravaniОценок пока нет

- Project Planning and Capital BudgetingДокумент16 страницProject Planning and Capital BudgetingtoabhishekpalОценок пока нет

- CF Paper Summer 2015Документ4 страницыCF Paper Summer 2015Vicky ThakkarОценок пока нет

- Capital Budgeting-ProblemsДокумент5 страницCapital Budgeting-ProblemsUday Gowda0% (1)

- 01 LeveragesДокумент11 страниц01 LeveragesZerefОценок пока нет

- SFM New Sums AddedДокумент78 страницSFM New Sums AddedRohit KhatriОценок пока нет

- BBA 4th 2012 Financial Management-204Документ2 страницыBBA 4th 2012 Financial Management-204Ríshãbh JåíñОценок пока нет

- FM IiДокумент5 страницFM IiDarshan GandhiОценок пока нет

- FM Eco 100 Marks Test 1Документ6 страницFM Eco 100 Marks Test 1AnuragОценок пока нет

- Formula BookletДокумент2 страницыFormula BookletOm PatelОценок пока нет

- The Community Reinvestment Act in The Age of Fintech and Bank CompetitionДокумент28 страницThe Community Reinvestment Act in The Age of Fintech and Bank CompetitionHyder AliОценок пока нет

- Cuerpos Extraños Origen FDAДокумент30 страницCuerpos Extraños Origen FDALuis GallegosОценок пока нет

- 10.ULABs Presentation Camiguin FinalДокумент55 страниц10.ULABs Presentation Camiguin FinalKaren Feyt MallariОценок пока нет

- Ojt HRMДокумент7 страницOjt HRMArlyn Joy NacinoОценок пока нет

- APPSC GR I Initial Key Paper IIДокумент52 страницыAPPSC GR I Initial Key Paper IIdarimaduguОценок пока нет

- Design and Implementation of Hotel Management SystemДокумент36 страницDesign and Implementation of Hotel Management Systemaziz primbetov100% (2)

- 2062 TSSR Site Sharing - Rev02Документ44 страницы2062 TSSR Site Sharing - Rev02Rio DefragОценок пока нет

- OpenGL in JitterДокумент19 страницOpenGL in JitterjcpsimmonsОценок пока нет

- GlobalДокумент24 страницыGloballaleye_olumideОценок пока нет

- DGA Furan AnalysisДокумент42 страницыDGA Furan AnalysisShefian Md Dom100% (10)

- Dbe Bes100 ZZ XXXX YyyДокумент3 страницыDbe Bes100 ZZ XXXX Yyyjavierdb2012Оценок пока нет

- Annual Presentation 18 19 EILДокумент41 страницаAnnual Presentation 18 19 EILPartha Pratim GhoshОценок пока нет

- 033 - Flight Planning Monitoring - QuestionsДокумент126 страниц033 - Flight Planning Monitoring - QuestionsEASA ATPL Question Bank100% (4)

- Calculating Measures of Position Quartiles Deciles and Percentiles of Ungrouped DataДокумент43 страницыCalculating Measures of Position Quartiles Deciles and Percentiles of Ungrouped DataRea Ann ManaloОценок пока нет

- Role of ACT, S & WHO Guidlines For The Treatment of MalariaДокумент34 страницыRole of ACT, S & WHO Guidlines For The Treatment of MalariasalmanОценок пока нет

- CCBA Exam: Questions & Answers (Demo Version - Limited Content)Документ11 страницCCBA Exam: Questions & Answers (Demo Version - Limited Content)begisep202Оценок пока нет

- ROBONIK - Prietest EasylabДокумент2 страницыROBONIK - Prietest EasylabAlexis Armando Ramos C.Оценок пока нет

- Biology Concepts and Applications 9th Edition Starr Solutions ManualДокумент9 страницBiology Concepts and Applications 9th Edition Starr Solutions Manualscarletwilliamnfz100% (31)

- Med Error PaperДокумент4 страницыMed Error Paperapi-314062228100% (1)

- AXIOM75 50 25 1B - Rev.6 10.000MHzДокумент4 страницыAXIOM75 50 25 1B - Rev.6 10.000MHzTürkay PektürkОценок пока нет

- Making Sense of The Future of Libraries: Dan Dorner, Jennifer Campbell-Meier and Iva SetoДокумент14 страницMaking Sense of The Future of Libraries: Dan Dorner, Jennifer Campbell-Meier and Iva SetoBiblioteca IICEОценок пока нет

- Understand Fox Behaviour - Discover WildlifeДокумент1 страницаUnderstand Fox Behaviour - Discover WildlifeChris V.Оценок пока нет

- Article On Role of Cyberspace in Geopolitics-PegasusДокумент5 страницArticle On Role of Cyberspace in Geopolitics-PegasusIJRASETPublicationsОценок пока нет

- Personal ComputerДокумент3 страницыPersonal ComputerDan Mark IsidroОценок пока нет

- Portfolio Sandwich Game Lesson PlanДокумент2 страницыPortfolio Sandwich Game Lesson Planapi-252005239Оценок пока нет

- ALA - Assignment 3 2Документ2 страницыALA - Assignment 3 2Ravi VedicОценок пока нет

- Put Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsДокумент2 страницыPut Them Into A Big Bowl. Serve The Salad in Small Bowls. Squeeze Some Lemon Juice. Cut The Fruits Into Small Pieces. Wash The Fruits. Mix The FruitsNithya SweetieОценок пока нет

- Grade 10 LP Thin LensДокумент6 страницGrade 10 LP Thin LensBrena PearlОценок пока нет

- What Are The Challenges and Opportunities of ResearchingДокумент5 страницWhat Are The Challenges and Opportunities of ResearchingmelkyОценок пока нет

- Getting to Yes: How to Negotiate Agreement Without Giving InОт EverandGetting to Yes: How to Negotiate Agreement Without Giving InРейтинг: 4 из 5 звезд4/5 (652)

- The Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingОт EverandThe Masters of Private Equity and Venture Capital: Management Lessons from the Pioneers of Private InvestingРейтинг: 4.5 из 5 звезд4.5/5 (17)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)От EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindОт EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindРейтинг: 5 из 5 звезд5/5 (231)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)От EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (13)

- These are the Plunderers: How Private Equity Runs—and Wrecks—AmericaОт EverandThese are the Plunderers: How Private Equity Runs—and Wrecks—AmericaРейтинг: 4.5 из 5 звезд4.5/5 (14)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyОт EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyРейтинг: 4.5 из 5 звезд4.5/5 (37)

- 2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNОт Everand2019 Business Credit with no Personal Guarantee: Get over 200K in Business Credit without using your SSNРейтинг: 4.5 из 5 звезд4.5/5 (3)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyОт EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyРейтинг: 5 из 5 звезд5/5 (1)

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОт Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelОценок пока нет

- Finance Basics (HBR 20-Minute Manager Series)От EverandFinance Basics (HBR 20-Minute Manager Series)Рейтинг: 4.5 из 5 звезд4.5/5 (32)

- Ready, Set, Growth hack:: A beginners guide to growth hacking successОт EverandReady, Set, Growth hack:: A beginners guide to growth hacking successРейтинг: 4.5 из 5 звезд4.5/5 (93)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditОт EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditРейтинг: 5 из 5 звезд5/5 (1)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageОт EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageРейтинг: 4.5 из 5 звезд4.5/5 (109)

- Summary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisОт EverandSummary of The Black Swan: by Nassim Nicholas Taleb | Includes AnalysisРейтинг: 5 из 5 звезд5/5 (6)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantОт EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantРейтинг: 4.5 из 5 звезд4.5/5 (146)

- The Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetОт EverandThe Caesars Palace Coup: How a Billionaire Brawl Over the Famous Casino Exposed the Power and Greed of Wall StreetРейтинг: 5 из 5 звезд5/5 (2)

- The Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursОт EverandThe Six Secrets of Raising Capital: An Insider's Guide for EntrepreneursРейтинг: 4.5 из 5 звезд4.5/5 (8)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsОт EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsРейтинг: 5 из 5 звезд5/5 (1)

- Joy of Agility: How to Solve Problems and Succeed SoonerОт EverandJoy of Agility: How to Solve Problems and Succeed SoonerРейтинг: 4 из 5 звезд4/5 (1)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceОт EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceОценок пока нет

- Burn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialОт EverandBurn the Boats: Toss Plan B Overboard and Unleash Your Full PotentialРейтинг: 4.5 из 5 звезд4.5/5 (32)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)От EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Рейтинг: 4.5 из 5 звезд4.5/5 (24)