Академический Документы

Профессиональный Документы

Культура Документы

Tax Invoice, Debit and Credit Note

Загружено:

Kunika BachhasОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Tax Invoice, Debit and Credit Note

Загружено:

Kunika BachhasАвторское право:

Доступные форматы

TAX INVOICE, DEBIT AND CREDIT NOTE

Q1. Do I have to issue an invoice even if I remove goods for ‘sale on approval basis’?

Q2. I have a registration as an Input Service Distributor. Am I required to raise invoices

even though no taxable supplies are made from this registration number?

Q3. What are the circumstances in which a Credit Note is to be issued?

Q4. What are the special requirements of a supplementary or revised invoice?

Q5. Is it compulsory to mention HSN Codes? State the no. of digits of HSN code for

goods or services that a class of registered persons shall be required to mention, as

notified by the Board?

Q6. Are the requirements of tax invoice the same for both registered and unregistered

recipients?

Q7. Can I start a fresh series of serial number for my ‘invoice’ or ‘bill of supply’ every day,

e.g., 20160401-001 for April 1st and 20160402-001 for 2nd April?

Q8. How many copies of an invoice is required for supply of services?

Q9. Who can issue Invoice-cum-bill of supply ?

Q10. Are there any relaxations available for banking companies or a financial institutions

including NBFC?

Q11. Is it necessary e to issue receipt for advances?

Q12. Can a consolidated ‘revised invoice’ be issued to every recipient for supplies made

during the period before registration is granted?

Q13. I became liable to pay tax on 1st April,2017. I have applied for registration on 15 th

April, 2017 which is within the 30 days’ window given to me. My registration is granted

on 29th April, 2017. What document can I issue to collect tax from 1st April to 28th April,

2017?

Вам также может понравиться

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Does Exemption From IGST Automatically Apply As Exemption From CGST?Документ1 страницаDoes Exemption From IGST Automatically Apply As Exemption From CGST?Kunika BachhasОценок пока нет

- Invoicing Under GSTДокумент5 страницInvoicing Under GSTpuru1292Оценок пока нет

- FAQ Invoice 2Документ4 страницыFAQ Invoice 2Niki MilaОценок пока нет

- RMC 42-03 PEZA Claim For VAT Refund or TCCДокумент8 страницRMC 42-03 PEZA Claim For VAT Refund or TCCMatthew TiuОценок пока нет

- FAQ's EmployeeДокумент3 страницыFAQ's Employeeak.xar16Оценок пока нет

- GST and It Ppt. GRP.6Документ32 страницыGST and It Ppt. GRP.6BANANI DASОценок пока нет

- Guide ITProof SubmissionДокумент9 страницGuide ITProof SubmissionSrikanthОценок пока нет

- BOA FAQ On CompilationДокумент8 страницBOA FAQ On CompilationArchie LazaroОценок пока нет

- Basic Concepts of Transition & Invoice I20177804Документ28 страницBasic Concepts of Transition & Invoice I20177804vishalОценок пока нет

- Payment Basis (Revised As at 30 January 2014) PDFДокумент29 страницPayment Basis (Revised As at 30 January 2014) PDFNasTikОценок пока нет

- Maharashtra Profession Tax FaqsДокумент5 страницMaharashtra Profession Tax FaqsPrashant BedaseОценок пока нет

- General Knowledge Income Tax Series One 12011789619702 2Документ6 страницGeneral Knowledge Income Tax Series One 12011789619702 2Amit MaisuriyaОценок пока нет

- 2015 11 01 VAT Guidance On Invoices Sales Receipts Credit Notes and Debit NotesДокумент26 страниц2015 11 01 VAT Guidance On Invoices Sales Receipts Credit Notes and Debit NotesRoseОценок пока нет

- 10 1355 MoF Guide For Vendors CoverДокумент25 страниц10 1355 MoF Guide For Vendors CoverntombiponchОценок пока нет

- Tax Law Changes As A Result of The CoronavirusДокумент7 страницTax Law Changes As A Result of The CoronavirusGraceОценок пока нет

- Procure To Pay: Perfect Invoice Guidelines 2017Документ7 страницProcure To Pay: Perfect Invoice Guidelines 2017Ese FregeneОценок пока нет

- Chapter 22Документ25 страницChapter 22Rachel Pepito BaladjayОценок пока нет

- Tax Com Review Program - Expanded Withholding Tax Program.v.2018 082018Документ7 страницTax Com Review Program - Expanded Withholding Tax Program.v.2018 082018bulasa.jefferson16Оценок пока нет

- Processing Fiscal 2015 RequisitionsДокумент2 страницыProcessing Fiscal 2015 RequisitionsAldo CatalanОценок пока нет

- Direct Deposit Form EUДокумент2 страницыDirect Deposit Form EUOprea EmiliaОценок пока нет

- Income Tax ComplianceДокумент4 страницыIncome Tax ComplianceJusefОценок пока нет

- Tanzania Revenue Authority - VAT RefundДокумент1 страницаTanzania Revenue Authority - VAT RefundMICHAEL MBILINYIОценок пока нет

- Unit 2:Gst Procedures Topic: Tax InvoiceДокумент29 страницUnit 2:Gst Procedures Topic: Tax InvoiceManada SachdevaОценок пока нет

- Business Tax Ans3Документ18 страницBusiness Tax Ans3Lars FriasОценок пока нет

- Oracle AP Interview QuestionsДокумент23 страницыOracle AP Interview QuestionsDinesh Kumar100% (1)

- Analysis of Section 43B (H)Документ21 страницаAnalysis of Section 43B (H)gavandarpita02Оценок пока нет

- Bizmates Trainers' Briefing On BIR ComplianceДокумент8 страницBizmates Trainers' Briefing On BIR Compliancejoahnabulanadi100% (2)

- Tax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Документ16 страницTax Invoice, Credit and Debit Notes (Section 31-34 of CGST Act)Nikhil PahariaОценок пока нет

- Persona Fizike 0-2 MilioneДокумент10 страницPersona Fizike 0-2 MilionesuelahutiОценок пока нет

- Abk Ltd. - Korean Etax Invoices 2 PDFДокумент6 страницAbk Ltd. - Korean Etax Invoices 2 PDFэкспресс сервисОценок пока нет

- Appeal Tax Procedure (Malaysia)Документ2 страницыAppeal Tax Procedure (Malaysia)Zati TyОценок пока нет

- Reminder-I: Modern IndustriesДокумент3 страницыReminder-I: Modern IndustriesManoj Kumar TanwarОценок пока нет

- Advance Payment of TaxДокумент15 страницAdvance Payment of Taxsurbhi baisОценок пока нет

- 16 Income Tax Important Question BankДокумент25 страниц16 Income Tax Important Question Bankakshay_rockstarОценок пока нет

- How & When To Raise A GST InvoiceДокумент6 страницHow & When To Raise A GST InvoiceRabin DebnathОценок пока нет

- Some Questions Regarding E-Filling and Income Tax Return: 1. What Is E-Filing?Документ8 страницSome Questions Regarding E-Filling and Income Tax Return: 1. What Is E-Filing?omar_msОценок пока нет

- VAT Booklet F.Y.2012-13Документ20 страницVAT Booklet F.Y.2012-13ankur2706Оценок пока нет

- RCL How To Pass The Bir Compliance TestДокумент26 страницRCL How To Pass The Bir Compliance TestAzenithAlmoradieОценок пока нет

- Year End FAQs - 2021-2022Документ39 страницYear End FAQs - 2021-2022pradeep nareОценок пока нет

- Form 24QДокумент10 страницForm 24QNIKHILОценок пока нет

- A. Sales Order and Financial ReportingДокумент2 страницыA. Sales Order and Financial ReportingBianca CabintoyОценок пока нет

- Clinical Registration FAQДокумент5 страницClinical Registration FAQRahul KirkОценок пока нет

- Interview PresentationДокумент2 страницыInterview PresentationellyОценок пока нет

- Tax Clearance FormДокумент1 страницаTax Clearance FormJhen FigueroaОценок пока нет

- Tax. 23Документ18 страницTax. 23RahulОценок пока нет

- Allama Iqbal Open University: Assignment # 2Документ13 страницAllama Iqbal Open University: Assignment # 2Irfan AslamОценок пока нет

- PGDTP ParnaДокумент73 страницыPGDTP ParnaRi ChОценок пока нет

- Audit Project TAX AUDIT PDFДокумент38 страницAudit Project TAX AUDIT PDFYogesh Sahani100% (3)

- Legal Formalities and DocumentationДокумент20 страницLegal Formalities and DocumentationSarada NagОценок пока нет

- GST Registration ProcessДокумент24 страницыGST Registration Processbharat2goodОценок пока нет

- How To Claim GST Refund If No Specific Refund Application Available in Refunds Section - Taxguru - inДокумент11 страницHow To Claim GST Refund If No Specific Refund Application Available in Refunds Section - Taxguru - inKaushal DidwaniaОценок пока нет

- Accounting, Tax and Payroll Services - Lani-Rose Shipping PDFДокумент6 страницAccounting, Tax and Payroll Services - Lani-Rose Shipping PDFjohnkurt catipayОценок пока нет

- WT IT - Declarations - Guidelines - FY - 2019-20 PDFДокумент11 страницWT IT - Declarations - Guidelines - FY - 2019-20 PDFGautham ReddyОценок пока нет

- Vat Returns Manual 2021Документ25 страницVat Returns Manual 2021mactechОценок пока нет

- GST Faq PDFДокумент18 страницGST Faq PDFsiva moorthyОценок пока нет

- Faqs On GSTДокумент18 страницFaqs On GSTmsanrxlОценок пока нет

- Questions and Answers On Boa Resolution Feb 3Документ9 страницQuestions and Answers On Boa Resolution Feb 3Danilo Pasana Jr.Оценок пока нет

- GST Word 7Документ62 страницыGST Word 7aparna aravamudhanОценок пока нет

- Office of The Comptroller Sindh House Islamabad, DATED: - / /2016Документ337 страницOffice of The Comptroller Sindh House Islamabad, DATED: - / /2016Muhammad MehrbanОценок пока нет

- Interview Questions On Practicum 1 Subject FINALДокумент3 страницыInterview Questions On Practicum 1 Subject FINALSapphireОценок пока нет

- Group 5-Decommissioning CostДокумент2 страницыGroup 5-Decommissioning CostMarieJoiaОценок пока нет

- Islamic Political Parties and ElectionДокумент14 страницIslamic Political Parties and ElectionMouliza Kristhopher Donna SweinstaniОценок пока нет

- Confidentiality - 2021Документ20 страницConfidentiality - 2021patrixiaОценок пока нет

- Islamic Culture & CivilizationДокумент2 страницыIslamic Culture & Civilizationhifza99100% (1)

- Compiled Sec12 19Документ172 страницыCompiled Sec12 19anjisy100% (1)

- Popular CultureДокумент2 страницыPopular CultureChloe GuiaoОценок пока нет

- COBIT-2019-Implementation-Guide Res Eng 1218 PDFДокумент78 страницCOBIT-2019-Implementation-Guide Res Eng 1218 PDFAchmad Arzal Fariz100% (1)

- Test American History I Chapter 4 QuizletДокумент4 страницыTest American History I Chapter 4 Quizletapi-278808798Оценок пока нет

- Procure To PayДокумент2 страницыProcure To PaySanjeewa PrasadОценок пока нет

- MU Contract TemplateДокумент3 страницыMU Contract TemplateTim BeattieОценок пока нет

- The Deep State Encyclopedia Exposing The Cabal's Playbook GraceДокумент537 страницThe Deep State Encyclopedia Exposing The Cabal's Playbook GracePaulo Ricardo Portella Pietschmann100% (2)

- The Social Construction of Race: Some Observations On Illusion, Fabrication, and ChoiceДокумент103 страницыThe Social Construction of Race: Some Observations On Illusion, Fabrication, and Choicenssabah8Оценок пока нет

- Pil - T16Документ96 страницPil - T16harsh jainОценок пока нет

- The Kashmir QuestionДокумент2 страницыThe Kashmir QuestionNeil DevОценок пока нет

- Converging Criminal Justice Systems - Guilty Pleas and The PublicДокумент13 страницConverging Criminal Justice Systems - Guilty Pleas and The PublicSAMRIDDH SHARMAОценок пока нет

- Culminating ActivityДокумент5 страницCulminating ActivitymerlindaОценок пока нет

- Lesson 2 Reading in Phil HistoryДокумент23 страницыLesson 2 Reading in Phil HistoryIrishkaye AguacitoОценок пока нет

- 0-ISO 26000-2020 (Changed)Документ4 страницы0-ISO 26000-2020 (Changed)Sugeng RiyadiОценок пока нет

- Regulation No 184 2010 Public Procurement and Property Disposal Service EstablishmentДокумент5 страницRegulation No 184 2010 Public Procurement and Property Disposal Service EstablishmentAbrahamОценок пока нет

- Define Permanent Account Number (PAN) - Who Are Liable To Apply For Allotment of PANДокумент6 страницDefine Permanent Account Number (PAN) - Who Are Liable To Apply For Allotment of PANDebasis MisraОценок пока нет

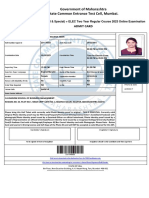

- Government of Maharashtra State Common Entrance Test Cell, MumbaiДокумент2 страницыGovernment of Maharashtra State Common Entrance Test Cell, MumbaiRahul R.Оценок пока нет

- THE NON CUSTODIAL MEASURE AS AN ALTERNATIVE NORM FOR CUSTODIAL PUNISHMENT in India, US and UKДокумент17 страницTHE NON CUSTODIAL MEASURE AS AN ALTERNATIVE NORM FOR CUSTODIAL PUNISHMENT in India, US and UKmunmun kadamОценок пока нет

- The Atlantic - May 2024Документ108 страницThe Atlantic - May 2024fede.mgoОценок пока нет

- tugas1BhsInggris 043049971Документ5 страницtugas1BhsInggris 043049971ArdiaОценок пока нет

- Complaint Jamestown 12 - 16 - 2022 Final With ExhibitsДокумент67 страницComplaint Jamestown 12 - 16 - 2022 Final With ExhibitsWebbie HeraldОценок пока нет

- 2023-02-17 0.20 FIDIC - Red - Conditions of Contract For Construction - 2nd Edition 2017Документ118 страниц2023-02-17 0.20 FIDIC - Red - Conditions of Contract For Construction - 2nd Edition 2017Carlos Ferreira CaetanoОценок пока нет

- Area of "My Space" ProjectДокумент1 страницаArea of "My Space" Projectjnewman85100% (4)

- Sia Vs PeopleДокумент1 страницаSia Vs PeopleEJ SantosОценок пока нет