Академический Документы

Профессиональный Документы

Культура Документы

BG121436

Загружено:

Eng Venance MasanjaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

BG121436

Загружено:

Eng Venance MasanjaАвторское право:

Доступные форматы

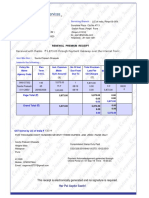

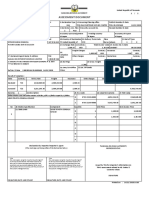

Tanzania Revenue Authority United Republic of Tanzania

1 / 2

ASSESSMENT DOCUMENT

2.Exporter/Consigner Name & Address TIN:

1.Declaration Type A.Processing/Clearing office TANSAD Number & Date

BE FORWARD CO.,LTD IM4 TZDL DAR CUSTOMS SERVICE CENTRE TZDL-19-1098032 21/03/2019

JAPAN 3.No Items 4.CL. Plan 5.Security Account No. Receipt Number & Date

1 PAD

6.Country Last Consignment 7.Trading Country 8.Country of Export

JP Japan JP Japan JP Japan

9.Importer/Consignee Name & Address TIN: 10.Country of Destination 11.Delivery Term Code Place 12.Nat of Trans

VENANCE MASANJA OGESA 138-708-071 TZ United Republic of CFR Dar es Salaam 1 9

P.O.BOX 999 DAR ES SALAAM 13.Exchange Rate 14.Currency Total Invoice Value 15.Invoice No. & Date

2,300.87 USD 1,000.00 1541895 15/02/2019

Freight Charges Currency Insurance Currency

16. 570.00 USD 2.00 USD

Valuation

17.Declarant/Agent Name & Address TIN: Note Other charges Currency Deductions Currency

JAMAAP CO LTD 100-597-780

45-46 CHIMARA ROAD BLOCK C CHIMARA ROAD-NEAR OCEAN 18.No Pckgs 19.Gross Weight 20.Net Weight

ROAD HOSPITAL DSM P. O. BOX 104784 DAR ES SALAAM Ilala 1 (NE) 1,275 (Kgs) 1,000 (Kgs)

Dar es Salaam

21.Entry/Exit Office 22.Loc. Of Goods 23.AWB/BL/RCN/Shipping Order

Ref.No. & Date 100597780-19-0600335 21/03/2019 TZDW BFTP01214239

Result of Valuation :

State Currency TOTAL FOB Freight Insurance Othe charges Deductions Total Customs Value

Declared TZS 2,300,870.00 1,311,495.90 4,601.74 3,616,967.64

Assessed TZS 2,300,870.00 1,311,495.90 4,601.74 3,616,967.64

Item No. 1 24.Description 25.H.S. Code 26.Value for Customs 27.FOB Value

Other:Motor cars and other motor vehicles p:Of a cylinder capacity>1,000cc

D 8703.22.90.0000 3,616,967.64 2,300,870.00

USED HONDA FIT

A 8703.22.90.0000 3,616,967.64 2,300,870.00

No 28.Model, Specification Component Quantity Unit Price Item invoice Price

WAGON, 1330 CC, YEAR 2005

D 1 1,000.00 1,000.00

1

A 1 1,000.00 1,000.00

Declaration by Importer/Importer's Agent TANZANIA REVENUE AUTHORITY

(Who must sign and stamp either of the declaration below) REPRESENTATIVE

I/We I/We

the undersigned, being the Importer/Exporter/Agent* the undersigned, being the Importer/Exporter/Agent*

do hereby declare that the information declared on do hereby declare that the information declared on

this entry is true and complete and accept fully the this entry is true and complete and accept fully the

conditions and requirements attached to the use of conditions and requirements attached to the use of issued by TRA for importer's information on

CPC declared therein, and comply with the provision of CPC declared therein, and comply with the provision of TRA's assessment related to HS. Codes &

the Customs Management Act. the Customs Management Act.

Customs Values

SIGNATURE

SIGNATURE,DATE AND STAMP SIGNATURE,DATE AND STAMP

Printed on : 25/03/2019 11:04

Tanzania Revenue Authority United Republic of Tanzania

2 / 2

ASSESSMENT DOCUMENT

29. Taxes

Tax Type Duty / Tax Base Rate Amount Relief Amount Relief Code MOP

IMP 3,616,967.64 25.00 904,242.00 1

EXA 4,521,209.64 30.00 1,356,363.00 1

EX 4,521,209.64 5.00 226,061.00 1

VEH 450,000.00 100.00 450,000.00 1

CPF 2,300,870.00 0.60 13,806.00 1

RDL 3,616,967.64 1.50 54,255.00 1

VAT 6,621,694.64 18.00 1,191,906.00 1

Total taxes for item 1 4,196,633.00

Вам также может понравиться

- The Ultimate Credit Loophole by WIZCREDITGURUДокумент97 страницThe Ultimate Credit Loophole by WIZCREDITGURUrodney96% (56)

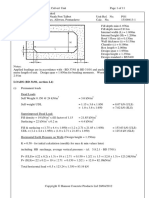

- BS ABUTMENT DESIGNДокумент17 страницBS ABUTMENT DESIGNEng Venance Masanja100% (1)

- Barrandey BlsДокумент1 страницаBarrandey Blsapi-534373531Оценок пока нет

- F 1099 AДокумент6 страницF 1099 AIRS100% (1)

- Installation ChargesVДокумент1 страницаInstallation ChargesVbaby yodaОценок пока нет

- Design of Slab CulvertДокумент16 страницDesign of Slab CulvertRaju Ranjan SinghОценок пока нет

- Money LionДокумент4 страницыMoney LionhumleОценок пока нет

- Address of Buisness PremisesДокумент1 страницаAddress of Buisness PremisesAkash ManojОценок пока нет

- Ajwpr6707nsd002 06 05 2011 PDFДокумент1 страницаAjwpr6707nsd002 06 05 2011 PDFGlobal Law FirmОценок пока нет

- Application No: RegularДокумент2 страницыApplication No: RegularBussiness EmpireОценок пока нет

- Board of Secondary Education:: Andhra Pradesh SSC Public Examinations April / May - 2022Документ1 страницаBoard of Secondary Education:: Andhra Pradesh SSC Public Examinations April / May - 2022ZPHS KollikullaОценок пока нет

- JsjsjsjsДокумент1 страницаJsjsjsjsSagar RautОценок пока нет

- Aulps1966qsd002 02 12 2011Документ1 страницаAulps1966qsd002 02 12 2011lalita_sharma_14Оценок пока нет

- Application No: RegularДокумент2 страницыApplication No: RegularBussiness EmpireОценок пока нет

- Billing Address: Tax InvoiceДокумент1 страницаBilling Address: Tax InvoiceSatish ValaОценок пока нет

- Culvert Design ManualДокумент54 страницыCulvert Design ManualMahmoud Al NoussОценок пока нет

- FirstaidcertificateДокумент1 страницаFirstaidcertificateapi-491895687Оценок пока нет

- LIC policy renewal receiptsДокумент10 страницLIC policy renewal receiptstarunkumarcladОценок пока нет

- 1306 Sales - Invoice 00003444Документ1 страница1306 Sales - Invoice 00003444Ana Luisa Alcala MartinezОценок пока нет

- Bcfpa2280jsd001 06 11 2015Документ2 страницыBcfpa2280jsd001 06 11 2015Azam PashaОценок пока нет

- Analysis of Box Culvert, Results & DesignДокумент16 страницAnalysis of Box Culvert, Results & DesignEng Venance MasanjaОценок пока нет

- Merged TDL Files 20200808101932Документ1 страницаMerged TDL Files 20200808101932api-549489233Оценок пока нет

- CPR Bls 2021Документ1 страницаCPR Bls 2021api-548066065Оценок пока нет

- GR Infra Inv-12, DT26-03-2022Документ1 страницаGR Infra Inv-12, DT26-03-2022aditya sharmaОценок пока нет

- Acvpg9128n 2021Документ4 страницыAcvpg9128n 2021SRI KALALAYA CHARITABLE TRUSTОценок пока нет

- Tax Invoice SummaryДокумент1 страницаTax Invoice SummaryAtut BieОценок пока нет

- CPR Certificate - HarrisДокумент1 страницаCPR Certificate - Harrisapi-621459006Оценок пока нет

- Tax Invoice: Mr. Creator Graphics StudioДокумент1 страницаTax Invoice: Mr. Creator Graphics StudioKinjal VasavaОценок пока нет

- Billing Address: Tax InvoiceДокумент1 страницаBilling Address: Tax InvoiceShivani SinghОценок пока нет

- Mohamed Hafees Aa 22 Jul 2020 Sonovision Aetos Technical Services Private LTD MEMBER128Документ1 страницаMohamed Hafees Aa 22 Jul 2020 Sonovision Aetos Technical Services Private LTD MEMBER128AkbardeenОценок пока нет

- Booking Confirmation for D&G Villas Nusa DuaДокумент2 страницыBooking Confirmation for D&G Villas Nusa DuaAgung Yudha Adiputera MakawimbangОценок пока нет

- Letter of CreditДокумент7 страницLetter of CreditprasadbpotdarОценок пока нет

- Ma-Id Name Relation Pribeneficiary Polhldr Emp. No.: 4023721080: Suhas Lokesh: Self: Suhas Lokesh: Gallagher Service Center LLP: G3496Документ2 страницыMa-Id Name Relation Pribeneficiary Polhldr Emp. No.: 4023721080: Suhas Lokesh: Self: Suhas Lokesh: Gallagher Service Center LLP: G3496SuhasSuОценок пока нет

- CPR StudentcertificateДокумент1 страницаCPR Studentcertificateapi-368265694Оценок пока нет

- Billing Address: Tax InvoiceДокумент1 страницаBilling Address: Tax InvoiceGame FreakОценок пока нет

- Tax Invoice for MyGlamm LipsticksДокумент1 страницаTax Invoice for MyGlamm LipsticksNEHA BHARTIОценок пока нет

- Student EcardДокумент1 страницаStudent Ecardapi-479463487Оценок пока нет

- Road Design With Autocad Civil 3d 0912 enДокумент26 страницRoad Design With Autocad Civil 3d 0912 enAMTRIS33% (3)

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Документ1 страницаTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)P SinghОценок пока нет

- Tanzania Revenue Authority assesses used car importДокумент2 страницыTanzania Revenue Authority assesses used car importMwenda Mongwe0% (1)

- Online Application Form For Admission - 2022: (Undergraduate Professional Programmes (BCA & BBA) )Документ1 страницаOnline Application Form For Admission - 2022: (Undergraduate Professional Programmes (BCA & BBA) )Ayush DubeyОценок пока нет

- Student EcardДокумент1 страницаStudent Ecardapi-408570044Оценок пока нет

- Invoice PDFДокумент1 страницаInvoice PDFPatrycja CieplińskaОценок пока нет

- Medical FormДокумент2 страницыMedical FormPushpendra KumarОценок пока нет

- Agent Name, License No & IRDA URN ListДокумент20 страницAgent Name, License No & IRDA URN ListHarshad BhirudОценок пока нет

- BG121436Документ2 страницыBG121436Eng Venance MasanjaОценок пока нет

- BG121436Документ2 страницыBG121436Eng Venance MasanjaОценок пока нет

- Price 1,533.46: Booking ConfirmationДокумент2 страницыPrice 1,533.46: Booking ConfirmationHimanshu DangwalОценок пока нет

- 515, Udyog Vihar, Phase 5, Gurgaon, Haryana Pin C Ode: 122 016 Phones: 0124-4699600,4833900 Fax No: 0124-2438276,4699611-12 4308211Документ1 страница515, Udyog Vihar, Phase 5, Gurgaon, Haryana Pin C Ode: 122 016 Phones: 0124-4699600,4833900 Fax No: 0124-2438276,4699611-12 4308211PREETOMDEB7Оценок пока нет

- Billing Address: Tax InvoiceДокумент1 страницаBilling Address: Tax InvoiceAkash VermaОценок пока нет

- Garai HardwareДокумент3 страницыGarai Hardwaresubhajit mondalОценок пока нет

- Tax - Exams 2Документ6 страницTax - Exams 2Renalyn ParasОценок пока нет

- Internship Report Bank Alfalah Islamic Ltd. by AZEEM JAFFERY CompletedДокумент69 страницInternship Report Bank Alfalah Islamic Ltd. by AZEEM JAFFERY CompletedAzeem Jafri83% (6)

- This E-Card Is Valid Only If It Is Supported by Any Alternative Photo ID Proof Like Driving License/Passport/PAN Card/Election ID Card/Ration CardДокумент1 страницаThis E-Card Is Valid Only If It Is Supported by Any Alternative Photo ID Proof Like Driving License/Passport/PAN Card/Election ID Card/Ration CardGayatry Prakash JaiswalОценок пока нет

- Please Supply Lens As Per Following DetailsДокумент2 страницыPlease Supply Lens As Per Following DetailsSanthosh DuraisamyОценок пока нет

- Faculty Recruitment at NIT JalandharДокумент7 страницFaculty Recruitment at NIT JalandharKumar gsОценок пока нет

- Ma-Id Name Relation Pribenef Polhldr Emp. No.: 5039695822: Harsh Tyagi: Self: Harsh Tyagi: Bundl Technologies PVT LTD: 155522Документ1 страницаMa-Id Name Relation Pribenef Polhldr Emp. No.: 5039695822: Harsh Tyagi: Self: Harsh Tyagi: Bundl Technologies PVT LTD: 155522Karan WasanОценок пока нет

- The Economics of Money Banking and Financial Markets 6th Canadian Edition by Mishkin - Test BankДокумент34 страницыThe Economics of Money Banking and Financial Markets 6th Canadian Edition by Mishkin - Test BankerisalogicОценок пока нет

- CPR CardДокумент1 страницаCPR Cardapi-380833341Оценок пока нет

- Result Sheet Sl. No. Subject Name Max. Marks Sec. Marks Credit Hrs Grade Points Credit Points RemarksДокумент2 страницыResult Sheet Sl. No. Subject Name Max. Marks Sec. Marks Credit Hrs Grade Points Credit Points RemarksVinay GowdruОценок пока нет

- Harding v. Commercial Union Assurance CompanyДокумент3 страницыHarding v. Commercial Union Assurance CompanyIldefonso HernaezОценок пока нет

- Invoice No.1197Документ2 страницыInvoice No.1197LL Lawwise Consultech India Pvt LtdОценок пока нет

- Registered Engineering Consulting Firms TanzaniaДокумент10 страницRegistered Engineering Consulting Firms TanzaniaEng Venance MasanjaОценок пока нет

- Invoice: 226A Commerce St. Altec AIR, LLCДокумент1 страницаInvoice: 226A Commerce St. Altec AIR, LLCFrio EspecializadoОценок пока нет

- (University of Technology of Madhya Pradesh) : Examination Admit Card (Eac) May-June-2022Документ1 страница(University of Technology of Madhya Pradesh) : Examination Admit Card (Eac) May-June-2022ASHU KОценок пока нет

- Summer Internship Project at ICICI BankДокумент81 страницаSummer Internship Project at ICICI BankNeha Vora100% (3)

- Tax InvoiceДокумент1 страницаTax InvoiceᴘᴇᴀᴄᴏᴄᴋОценок пока нет

- ST 2 PDFДокумент2 страницыST 2 PDFEbenezer SamedwinОценок пока нет

- Price 1,142.86: Booking ConfirmationДокумент2 страницыPrice 1,142.86: Booking ConfirmationHimanshu DangwalОценок пока нет

- CandidateHallTicket PDFДокумент2 страницыCandidateHallTicket PDFRavi ManiОценок пока нет

- PriceДокумент3 страницыPriceBalakrishna VadlamudiОценок пока нет

- For The Post of Assistant Engineer (Trainee) ElectricalДокумент2 страницыFor The Post of Assistant Engineer (Trainee) ElectricalPiyush SinghОценок пока нет

- Original For Recipient Duplicate For Transporter Triplicate For SupplierДокумент1 страницаOriginal For Recipient Duplicate For Transporter Triplicate For Suppliernitin agrawalОценок пока нет

- Od 126242273247807000Документ1 страницаOd 126242273247807000Prince SharmaОценок пока нет

- Acls CertificationДокумент1 страницаAcls Certificationapi-534220533Оценок пока нет

- CandidateHallTicket UPPCL PDFДокумент2 страницыCandidateHallTicket UPPCL PDFmahesh dubeyОценок пока нет

- Form 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961Документ8 страницForm 26AS: Annual Tax Statement Under Section 203AA of The Income Tax Act, 1961heenaОценок пока нет

- SettlementReportДокумент1 страницаSettlementReportSarath KumarОценок пока нет

- Statement 0152308223100 18 Nov 2019 - 13 11 07 PDFДокумент2 страницыStatement 0152308223100 18 Nov 2019 - 13 11 07 PDFEng Venance MasanjaОценок пока нет

- Ch5 FlowДокумент29 страницCh5 FlowPriyanka BasuОценок пока нет

- BS 5400 References for Steel Bridge DesignДокумент30 страницBS 5400 References for Steel Bridge DesignEng Venance MasanjaОценок пока нет

- LOADS (BD 31/01, Section 2.4)Документ11 страницLOADS (BD 31/01, Section 2.4)Eng Venance MasanjaОценок пока нет

- BS 5400 References for Steel Bridge DesignДокумент30 страницBS 5400 References for Steel Bridge DesignEng Venance MasanjaОценок пока нет

- Regulations2013 PDFДокумент301 страницаRegulations2013 PDFEng Venance MasanjaОценок пока нет

- Stochastic Analysis of Seepage Under Water-Retaining StructuresДокумент8 страницStochastic Analysis of Seepage Under Water-Retaining StructuresEng Venance MasanjaОценок пока нет

- Design of Outfall and Culvert Details: StandardsДокумент36 страницDesign of Outfall and Culvert Details: StandardsEng Venance MasanjaОценок пока нет

- Chapter 11Документ9 страницChapter 11Samudrala JayaPrakash NarayanaОценок пока нет

- Ultra Rib Corrugated Metal PanelsДокумент1 страницаUltra Rib Corrugated Metal PanelsEng Venance MasanjaОценок пока нет

- Wisdot Bridge Manual: Chapter 12 - AbutmentsДокумент38 страницWisdot Bridge Manual: Chapter 12 - AbutmentsamitОценок пока нет

- CRS 60 Emulsified BitumenДокумент1 страницаCRS 60 Emulsified BitumenEng Venance MasanjaОценок пока нет

- Emulsified BitumenДокумент5 страницEmulsified BitumenEng Venance MasanjaОценок пока нет

- Test Description Test Method: Sub-Grade/ Alignment SamplesДокумент2 страницыTest Description Test Method: Sub-Grade/ Alignment SamplesEng Venance MasanjaОценок пока нет

- Expanded Training SteelДокумент20 страницExpanded Training SteelBen AnimОценок пока нет

- Test Description Test Method: Sub-Grade/ Alignment SamplesДокумент2 страницыTest Description Test Method: Sub-Grade/ Alignment SamplesEng Venance MasanjaОценок пока нет

- CV of Indonesian Economist with International ExperienceДокумент4 страницыCV of Indonesian Economist with International ExperienceEng Venance MasanjaОценок пока нет

- WingfieldДокумент40 страницWingfieldAbdirahmanОценок пока нет

- Spam Alert PDFДокумент8 страницSpam Alert PDFEng Venance MasanjaОценок пока нет

- Design Rainfall Distributions Based On Noaa 14 Volumes 1 and 2 DataДокумент1 страницаDesign Rainfall Distributions Based On Noaa 14 Volumes 1 and 2 DataEng Venance MasanjaОценок пока нет

- Impact Severity IndexДокумент1 страницаImpact Severity IndexEng Venance MasanjaОценок пока нет

- Vehicle Accidental Impacts On Bridges: StatybaДокумент9 страницVehicle Accidental Impacts On Bridges: StatybaEng Venance MasanjaОценок пока нет

- Basis For Conclusions IsaeДокумент18 страницBasis For Conclusions Isaebwann77Оценок пока нет

- E-Bulletin Foundation Sept 2019Документ45 страницE-Bulletin Foundation Sept 2019Vijay SharmaОценок пока нет

- Banking Case DigestДокумент6 страницBanking Case DigestIsaac David GatchalianОценок пока нет

- UCPB v. MasaganaДокумент5 страницUCPB v. MasaganajrfbalamientoОценок пока нет

- From Import Import From Import From Import Try From Import Except PassДокумент2 страницыFrom Import Import From Import From Import Try From Import Except PassriteshОценок пока нет

- New Microsoft PowerPoint PresentationДокумент48 страницNew Microsoft PowerPoint PresentationIryne Kim PalatanОценок пока нет

- Successful Transactions PDFДокумент1 страницаSuccessful Transactions PDFQhairin BaharudinОценок пока нет

- Edi - 20689603 - 20689603-Broker-Mrs Febylyn Rodrigue-07 - 04 - 2018-pdx35439512 PDFДокумент6 страницEdi - 20689603 - 20689603-Broker-Mrs Febylyn Rodrigue-07 - 04 - 2018-pdx35439512 PDFVenis ManahanОценок пока нет

- Shippers Letter of InstructionДокумент2 страницыShippers Letter of InstructionWilliam LooОценок пока нет

- Account Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceДокумент2 страницыAccount Statement From 1 Dec 2016 To 31 Dec 2016: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceENDLURI DEEPAK KUMARОценок пока нет

- GK CAPSULE FOR SBI ASSOCIATE ASSISTANT EXAM 2015Документ56 страницGK CAPSULE FOR SBI ASSOCIATE ASSISTANT EXAM 2015Nilay VatsОценок пока нет

- IRCTC travel insurance coverДокумент3 страницыIRCTC travel insurance coverAbhinav TayadeОценок пока нет

- CP A-FДокумент230 страницCP A-FRupesh GuravОценок пока нет

- Banking Law Short QuestionsДокумент4 страницыBanking Law Short QuestionsDEEPAKОценок пока нет

- ADJUSTMENTS SUMMARYДокумент28 страницADJUSTMENTS SUMMARYshanu17889Оценок пока нет

- Incoterms, Export Process Guide for Importers & ExportersДокумент2 страницыIncoterms, Export Process Guide for Importers & ExporterskanzulimanОценок пока нет

- Daily Cashier Report SummaryДокумент1 страницаDaily Cashier Report SummaryIbox MagОценок пока нет

- Truth About Imperial RussiaДокумент3 страницыTruth About Imperial RussiaareliabijahОценок пока нет

- Guide To The Top Banking Employers, Asia Pacific EditionДокумент291 страницаGuide To The Top Banking Employers, Asia Pacific EditionVinh PhamОценок пока нет

- BillДокумент11 страницBillRahul SharmaОценок пока нет