Академический Документы

Профессиональный Документы

Культура Документы

Chapter 6: Corporate-Level Strategy Diversification: Pooled Negotiating Power: Improvement

Загружено:

caicaii0 оценок0% нашли этот документ полезным (0 голосов)

600 просмотров2 страницыStrategic Management- Outlined Notes from Dess et al

Оригинальное название

Chapter 6

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документStrategic Management- Outlined Notes from Dess et al

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

600 просмотров2 страницыChapter 6: Corporate-Level Strategy Diversification: Pooled Negotiating Power: Improvement

Загружено:

caicaiiStrategic Management- Outlined Notes from Dess et al

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Chapter 6: Corporate-Level Strategy Pooled Negotiating Power: improvement

in bargaining position relative to suppliers

Diversification and customers

- Process of firms expanding their operations by Vertical Integration: expansion or

entering new businesses extension of the firm by integrating

- Companies bother with diversification initiatives preceding or successive production

because of synergy (Gk. Synergos; working processes

together) Benefits and Risks

Diversify into related businesses or BENEFITS RISKS

horizontal relationships: business sharing Secure source of raw Costs and expenses are

intangible and tangible resources materials increased

Diversify into unrelated businesses or Protection of and control Loss of flexibility

hierarchical relationships: value creation over valuable assets

from corporate office Proprietary access to new Unbalanced capacities

technologies

RELATED Diversification Simplifies procurement and Additional administrative

- Firm entering a different business in which it can administrative procedures costs

benefit from leveraging core competencies,

sharing activities or building market power Transaction Cost Perspective:

- Benefit from economies of scope perspective that the choice of a

Cost savings from transaction’s governance

leveraging core structure is influenced by

competencies or sharing transaction costs (search,

related activities among negotiating, contracting,

businesses in a monitoring and enforcement

corporation costs) associated with each

- Leveraging Core Competencies choice

Firm’s strategic resources that

reflect the collective learning in UNRELATED Diversification

the organization - Firm entering a different business that has little

Viewed as “glue” that binds existing horizontal interaction with other businesses of a

businesses together firm

Three criteria TWO SOURCES OF SYNERGIES

1. Core competence must enhance competitive 1. Corporate Parenting and Restructuring

advantage by creating superior customer Parenting Advantage: positive

value contributions of the corporate office to a

2. Different businesses in the corporation must new business as a result of expertise and

be similar in at least one important way support provided and not as a result of

related to the core competence substantial changes in assets, capital

3. The core competencies must be difficult for structure, or management

competitors to imitate or find substitutes for it Restructuring: intervention of the

corporate office in a new business that

- Sharing activities substantially changes the assets, capital

Having activities of two or more structure and management

businesses’ value chains done by one Asset Restructuring: sale of

value of the businesses unproductive assets

Capital Restructuring: changing

Two primary pay-offs the debt-equity mix

1. Devising Cost Savings Management Restructuring:

- Most common type of synergy and easiest to changes in composition of the top

estimate management team,

- Hard synergies organizational structure and

reporting relationships

2. Revenue Enhancements 2. Portfolio Management

Method of:

- Market Power Assessing the competitive

Firm’s ability to profit through restricting or position of a portfolio of

controlling supply to a market or businesses within a corporation

coordinating with other firms to reduce Suggesting strategic alternatives

investment for each business

Identifying priorities for the Internal Development: entering a new

allocation of resources across the business through investment in new

businesses facilities, often called corporate

KEY PURPOSE: assist a firm in achieving entrepreneurship and new venture

a balanced portfolio of businesses development

Means to achieve diversification 3. Diversify

1. Mergers and Acquisitions

Mergers: combination or consolidation of How managerial motives can erode value creation

two firms to form a new legal entity Managerial Motives: managers acting in their own self-

Acquisitions: incorporation of one firm into interest rather than to maximize log-term shareholder

another through purchase value

Benefits

Obtain valuable resources that Growth for growth’s Sake

help an organization expand its Managers’ actions to grow the size of

product offerings their firms not to increase long-term

Provide the opportunity for firms profitability but to serve managerial self-

to attain three bases of synergy ( interest

leveraging core competencies,

sharing activities and building Egotism

market power) Manager’s actions to shape their firm’s

Lead to consolidation within an strategies to serve their selfish interests

industry and force other players to rather than maximize lone-term

merge shareholder value

Enter new market segments

Limitations Antitakeover Tactics

Takeover premiums paid for Managers’ actions to avoid losing wealth

acquisitions are high or power as a result of hostile takeover

Competing firms often can imitate Greenmail: payment by a firm to a

any advantages or copy hostile party for the firm’s stock at

synergies that result from M&A a premium, made when the firm’s

Managers’ ego sometimes get in management feels that the hostile

the way of sound business party is about to make a tender

decisions offer

Cultural issues may doom Golden parachute: prearranged

intended benefits from M&A contract with managers specifying

endeavors that, in an event of a hostile

Divestment: exit of a business from a takeover, the target firm’s

firm’s portfolio; help a firm reverse an managers will be paid a

earlier acquisition that didn’t work out as significant severance package

planned Poison pill: used by a company to

Seven principles for successful give shareholders certain rights in

divestiture the event of takeover by another

a. Remove emotion from decision firm; shareholder rights plans

b. Know the value of the business you

are selling

c. Time the deal right

d. Maintain a sizable pool of potential

buyers

e. Tell a story about the deal

f. Run divestitures systematically

through a project office

g. Communicate clearly and frequently

2. Joint Venture or Strategic Alliance

Strategic Alliance: cooperative

relationship between two or more firms

Joint Venture: new entities formed within

a strategic alliance in which two or more

firms contribute equity to form a new legal

entity

Вам также может понравиться

- Petition For Voluntary Dissolution - AVIДокумент2 страницыPetition For Voluntary Dissolution - AVIcaicaii75% (4)

- Winning From Within - SummaryДокумент4 страницыWinning From Within - SummaryShraddha Surendra100% (3)

- Schonberg, Harold - The Lives of The Great Composers (1997)Документ662 страницыSchonberg, Harold - The Lives of The Great Composers (1997)Inés SuárezОценок пока нет

- Product Market StakeholdersДокумент3 страницыProduct Market Stakeholdersqaqapataqa100% (1)

- The Internal Organization: Resources, Capabilities, Core Competencies, and Competitive AdvantagesДокумент47 страницThe Internal Organization: Resources, Capabilities, Core Competencies, and Competitive AdvantagesHananie NanieОценок пока нет

- Mapping Compensation StrategiesДокумент4 страницыMapping Compensation StrategiesMarc Allan100% (1)

- Internal Analysis: Resources, Capabilities, and Core CompetenciesДокумент8 страницInternal Analysis: Resources, Capabilities, and Core CompetenciesNadineОценок пока нет

- Chapter 5 - (PART 2) Strategy FormulationДокумент22 страницыChapter 5 - (PART 2) Strategy FormulationAila Marie PastorОценок пока нет

- Week 13 Exercise With AnswersДокумент10 страницWeek 13 Exercise With Answersmaria fernОценок пока нет

- Chap 011Документ44 страницыChap 011Jessica Cola50% (2)

- ADMS4900 3.0 - Midterm Notes StudentДокумент19 страницADMS4900 3.0 - Midterm Notes Studentvjmtran4Оценок пока нет

- Quizlet Test Dividend PDFДокумент3 страницыQuizlet Test Dividend PDFAPRATIM BHUIYANОценок пока нет

- Krispy Kreme Doughnuts, Inc.: Statement of The ProblemДокумент4 страницыKrispy Kreme Doughnuts, Inc.: Statement of The Problemmeann colinaОценок пока нет

- Opinion Letter For CoДокумент5 страницOpinion Letter For CocaicaiiОценок пока нет

- JA of Janice Psychologist DraftДокумент11 страницJA of Janice Psychologist DraftcaicaiiОценок пока нет

- Suffolk County Substance Abuse ProgramsДокумент44 страницыSuffolk County Substance Abuse ProgramsGrant ParpanОценок пока нет

- Relativity of ContractsДокумент7 страницRelativity of ContractsCristy C. Bangayan100% (1)

- Corporate Strategy: Diversification and The Multibusiness CompanyДокумент38 страницCorporate Strategy: Diversification and The Multibusiness CompanyAmirah Rahmat0% (1)

- Strategy - Chapter 11Документ9 страницStrategy - Chapter 1132_one_two_threeОценок пока нет

- Video ReflectionДокумент4 страницыVideo ReflectionXuan LimОценок пока нет

- Chapter 14 EthicДокумент36 страницChapter 14 Ethicike4546100% (1)

- OM TQM Case StudyДокумент3 страницыOM TQM Case StudyPaulynn OlpocОценок пока нет

- Internal Factor Evaluation MatrixДокумент13 страницInternal Factor Evaluation MatrixAlexis SyОценок пока нет

- PPTДокумент50 страницPPTShaik ShabeerОценок пока нет

- The Internal Environment Resources, Capabilities, and Core CompetenciesДокумент41 страницаThe Internal Environment Resources, Capabilities, and Core CompetenciesMahmudur Rahman50% (4)

- Chapter 2 - PlanningДокумент15 страницChapter 2 - PlanningHidayu AfiqahОценок пока нет

- Homework 2Документ2 страницыHomework 2Jutt SmithОценок пока нет

- Chapter 4 - Strategies in ActionДокумент64 страницыChapter 4 - Strategies in ActionNetsanet Workineh ነፃነት ወርቅነህ0% (1)

- The External Audit: Chapter SevenДокумент37 страницThe External Audit: Chapter SevenAbdullahОценок пока нет

- Strategic Performance ManagementДокумент34 страницыStrategic Performance ManagementParamjit SharmaОценок пока нет

- Lecture 1 - The Concept of StrategyДокумент10 страницLecture 1 - The Concept of StrategyAbhishekОценок пока нет

- StratMan-Outside USAДокумент23 страницыStratMan-Outside USAoceansОценок пока нет

- Chapter 8 - Managing ChangeДокумент6 страницChapter 8 - Managing ChangeMeera MenonОценок пока нет

- GovernanceДокумент3 страницыGovernanceAndrea Marie CalmaОценок пока нет

- Module 1 (Strategic Management)Документ51 страницаModule 1 (Strategic Management)The Brain Dump PHОценок пока нет

- Master in Business Administration: Managerial Economics (MPME 7113) Assignment 1Документ20 страницMaster in Business Administration: Managerial Economics (MPME 7113) Assignment 1sasha100% (1)

- Characteristics of Strategic DecisionsДокумент2 страницыCharacteristics of Strategic DecisionsMufaddal Hussain100% (2)

- Bayan Group Strategic Audit - Case StudyДокумент11 страницBayan Group Strategic Audit - Case Studymfadel110Оценок пока нет

- Operations ManagementДокумент4 страницыOperations ManagementFarel Abdia HarfyОценок пока нет

- Chapter-04 Evaluating A Company's Resources & Competitive PositionДокумент25 страницChapter-04 Evaluating A Company's Resources & Competitive PositionShahariar RiasatОценок пока нет

- Organisational Culture Compliance and Stakeholder Management PDFДокумент18 страницOrganisational Culture Compliance and Stakeholder Management PDFjoannakamОценок пока нет

- Chapter 09Документ20 страницChapter 09salmanmushtaqОценок пока нет

- Building An Organization Capable of Good Strategy Execution: People, Capabilities, and StructureДокумент31 страницаBuilding An Organization Capable of Good Strategy Execution: People, Capabilities, and Structuremrt8888100% (1)

- OB7e GE IMChap001 PDFДокумент20 страницOB7e GE IMChap001 PDFHemant Huzooree0% (1)

- AIG Case StudyДокумент8 страницAIG Case StudyKaushik JackОценок пока нет

- Puregold Strategic Management PaperДокумент11 страницPuregold Strategic Management PapermahilomferОценок пока нет

- Business Ethics Case AnalysisДокумент10 страницBusiness Ethics Case AnalysisMarielle Taryao Padilla50% (2)

- Finance Quiz 2Документ2 страницыFinance Quiz 2brnycОценок пока нет

- Module3 - The Internal OrganizationДокумент24 страницыModule3 - The Internal OrganizationLysss Epssss100% (3)

- Chapter 6 Organizational SystemsДокумент13 страницChapter 6 Organizational SystemsLee Jeon KimОценок пока нет

- Assignment 7 FinanceДокумент3 страницыAssignment 7 FinanceAhmedОценок пока нет

- Chapter 7 - Strategy ImplementationДокумент35 страницChapter 7 - Strategy ImplementationKalkidanОценок пока нет

- Chapter 4 - Internal AssessmentДокумент43 страницыChapter 4 - Internal AssessmentKristine Esplana ToraldeОценок пока нет

- Strategy Formulation Situational Analysis and Business StrategyДокумент70 страницStrategy Formulation Situational Analysis and Business StrategyKimberly Claire AtienzaОценок пока нет

- Ch09 Resource Allocation CrashcostДокумент25 страницCh09 Resource Allocation Crashcostndc6105058Оценок пока нет

- Module 2 Stakeholders RelationshipДокумент7 страницModule 2 Stakeholders RelationshipkenОценок пока нет

- BCG Susan BistaДокумент1 страницаBCG Susan BistasusanОценок пока нет

- Unit 10 - STMДокумент3 страницыUnit 10 - STMchristine tabanaoОценок пока нет

- Finding True North Corporate Governance PhilippinesДокумент58 страницFinding True North Corporate Governance PhilippinesNathan De La CruzОценок пока нет

- Contemporary Strategy Analysis Ch2 Study QuestionsДокумент3 страницыContemporary Strategy Analysis Ch2 Study QuestionsBeta Acc100% (1)

- Module 3 - Social Responsibility and Ethics in ManagementДокумент18 страницModule 3 - Social Responsibility and Ethics in ManagementAaron Christopher SungaОценок пока нет

- Decentralization and Segment ReportingДокумент3 страницыDecentralization and Segment ReportingYousuf SoortyОценок пока нет

- Selected Ratios For Three Different Companies That Operate inДокумент1 страницаSelected Ratios For Three Different Companies That Operate indhanya1995Оценок пока нет

- Value Chain Management Capability A Complete Guide - 2020 EditionОт EverandValue Chain Management Capability A Complete Guide - 2020 EditionОценок пока нет

- Chapter 6Документ4 страницыChapter 6Atasha FilipinaОценок пока нет

- Cbmec 2 (Chapter 7 Reviewer)Документ35 страницCbmec 2 (Chapter 7 Reviewer)Shiella marie VillaОценок пока нет

- Corporate Strategy - 2Документ51 страницаCorporate Strategy - 2anon_938204859Оценок пока нет

- Memorandum of Agreement (Pineridge)Документ2 страницыMemorandum of Agreement (Pineridge)caicaiiОценок пока нет

- Affidavit of Oath-Taking-: Country Club Village, Baguio Country, Benguet, Philippines, HavingДокумент1 страницаAffidavit of Oath-Taking-: Country Club Village, Baguio Country, Benguet, Philippines, HavingcaicaiiОценок пока нет

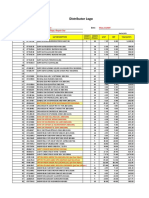

- Distributor Logo: Henrietta's Store May 23,2020 Country Club Village, Baguio CityДокумент4 страницыDistributor Logo: Henrietta's Store May 23,2020 Country Club Village, Baguio CitycaicaiiОценок пока нет

- Quilacio - PsychologistДокумент1 страницаQuilacio - PsychologistcaicaiiОценок пока нет

- Tracking Number: Date of Last Status Transaction StatusДокумент1 страницаTracking Number: Date of Last Status Transaction StatuscaicaiiОценок пока нет

- Janice Katrina O. Castelo: 488074801.docx, Page 1 of 4Документ4 страницыJanice Katrina O. Castelo: 488074801.docx, Page 1 of 4caicaiiОценок пока нет

- Crim. Case No: 43504-R NPS Docket No.: I-17-INV-19-0238 For: Violation of Sec. 5 (I) of R.A. 9262Документ10 страницCrim. Case No: 43504-R NPS Docket No.: I-17-INV-19-0238 For: Violation of Sec. 5 (I) of R.A. 9262caicaiiОценок пока нет

- Tracking Number: Date of Last Status Transaction StatusДокумент1 страницаTracking Number: Date of Last Status Transaction StatuscaicaiiОценок пока нет

- Republic of The Philippines Department of Justice State Regional Prosecutor San Fernando, La Union Marielle QuilacioДокумент20 страницRepublic of The Philippines Department of Justice State Regional Prosecutor San Fernando, La Union Marielle QuilaciocaicaiiОценок пока нет

- Deed of DonationДокумент2 страницыDeed of Donationkentclark03Оценок пока нет

- JA Marielle Anne DraftДокумент13 страницJA Marielle Anne DraftcaicaiiОценок пока нет

- Deed of Assignment Pamela To BoniccaДокумент1 страницаDeed of Assignment Pamela To BoniccacaicaiiОценок пока нет

- Secretary'S Certificate: Republic of The Philippines) City of Baguio .) S.SДокумент1 страницаSecretary'S Certificate: Republic of The Philippines) City of Baguio .) S.ScaicaiiОценок пока нет

- Steps Amendment at SECДокумент1 страницаSteps Amendment at SECcaicaiiОценок пока нет

- Deed of DonationДокумент2 страницыDeed of Donationkentclark03Оценок пока нет

- Secretary's Certificate Get GISДокумент1 страницаSecretary's Certificate Get GIScaicaiiОценок пока нет

- Directors' Certificate: TIN: 253-645-025-000 TIN: 270-596-035-00Документ3 страницыDirectors' Certificate: TIN: 253-645-025-000 TIN: 270-596-035-00caicaiiОценок пока нет

- Affidavit Legaspi 2Документ1 страницаAffidavit Legaspi 2caicaiiОценок пока нет

- Secretary's Certificate Get GISДокумент1 страницаSecretary's Certificate Get GIScaicaiiОценок пока нет

- Affidavit: Council, IDP: IELTS Australia and Cambridge Assessment English, Doha, QatarДокумент1 страницаAffidavit: Council, IDP: IELTS Australia and Cambridge Assessment English, Doha, QatarcaicaiiОценок пока нет

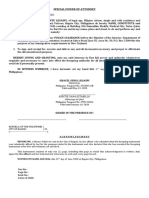

- Special Power of Attorney: Know All Men by These PresentsДокумент1 страницаSpecial Power of Attorney: Know All Men by These PresentscaicaiiОценок пока нет

- Motion To Set Case For Family ConferenceДокумент3 страницыMotion To Set Case For Family ConferencecaicaiiОценок пока нет

- Affidavit: Republic of The Philippines) Province of Benguet) S.S. City of Baguio)Документ1 страницаAffidavit: Republic of The Philippines) Province of Benguet) S.S. City of Baguio)caicaiiОценок пока нет

- GPA - Geoffrey WoodДокумент4 страницыGPA - Geoffrey WoodcaicaiiОценок пока нет

- Chap 2 Human Resource Strategy and PerformanceДокумент35 страницChap 2 Human Resource Strategy and PerformanceĐinh HiệpОценок пока нет

- 504 Loan Refinancing ProgramДокумент5 страниц504 Loan Refinancing ProgramPropertywizzОценок пока нет

- Deed OfAdjudication Cresencio Abuluyan BasilioДокумент4 страницыDeed OfAdjudication Cresencio Abuluyan BasilioJose BonifacioОценок пока нет

- Adv Tariq Writ of Land Survey Tribunal (Alomgir ALo) Final 05.06.2023Документ18 страницAdv Tariq Writ of Land Survey Tribunal (Alomgir ALo) Final 05.06.2023senorislamОценок пока нет

- A#2 8612 SehrishДокумент16 страницA#2 8612 SehrishMehvish raniОценок пока нет

- Research ProposalДокумент21 страницаResearch Proposalkecy casamayorОценок пока нет

- Part I Chapter 1 Marketing Channel NOTESДокумент25 страницPart I Chapter 1 Marketing Channel NOTESEriberto100% (1)

- Role of A ManagerДокумент8 страницRole of A ManagerMandyIrestenОценок пока нет

- Posh TTTДокумент17 страницPosh TTTKannanОценок пока нет

- DESIGNATIONДокумент16 страницDESIGNATIONSan Roque ES (R IV-A - Quezon)Оценок пока нет

- Warhammer Armies: The Army of The NorseДокумент39 страницWarhammer Armies: The Army of The NorseAndy Kirkwood100% (2)

- WHO in The Philippines-Brochure-EngДокумент12 страницWHO in The Philippines-Brochure-EnghОценок пока нет

- Organizational Behavior: L. Jeff Seaton, Phd. Murray State UniversityДокумент15 страницOrganizational Behavior: L. Jeff Seaton, Phd. Murray State UniversitySatish ChandraОценок пока нет

- Surviving Hetzers G13Документ42 страницыSurviving Hetzers G13Mercedes Gomez Martinez100% (2)

- Be It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledДокумент7 страницBe It Enacted by The Senate and House of Representatives of The Philippines in Congress AssembledYanna ManuelОценок пока нет

- Mock 10 Econ PPR 2Документ4 страницыMock 10 Econ PPR 2binoОценок пока нет

- International Law Detailed Notes For Css 2018Документ95 страницInternational Law Detailed Notes For Css 2018Tooba Hassan Zaidi100% (1)

- Usaid/Oas Caribbean Disaster Mitigation Project: Planning To Mitigate The Impacts of Natural Hazards in The CaribbeanДокумент40 страницUsaid/Oas Caribbean Disaster Mitigation Project: Planning To Mitigate The Impacts of Natural Hazards in The CaribbeanKevin Nyasongo NamandaОценок пока нет

- Spiritual Fitness Assessment: Your Name: - Date: - InstructionsДокумент2 страницыSpiritual Fitness Assessment: Your Name: - Date: - InstructionsLeann Kate MartinezОценок пока нет

- Slavfile: in This IssueДокумент34 страницыSlavfile: in This IssueNora FavorovОценок пока нет

- Environmental Management Plan GuidelinesДокумент23 страницыEnvironmental Management Plan GuidelinesMianОценок пока нет

- Henry Garrett Ranking TechniquesДокумент3 страницыHenry Garrett Ranking TechniquesSyed Zia-ur Rahman100% (1)

- Ocampo - v. - Arcaya-ChuaДокумент42 страницыOcampo - v. - Arcaya-ChuaChristie Joy BuctonОценок пока нет

- 240 Marilag v. MartinezДокумент21 страница240 Marilag v. Martinezdos2reqjОценок пока нет

- Louis I Kahn Trophy 2021-22 BriefДокумент7 страницLouis I Kahn Trophy 2021-22 BriefMadhav D NairОценок пока нет

- Barrier Solution: SituationДокумент2 страницыBarrier Solution: SituationIrish DionisioОценок пока нет