Академический Документы

Профессиональный Документы

Культура Документы

Budget of Lessons Accounting

Загружено:

rhio amorИсходное описание:

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Budget of Lessons Accounting

Загружено:

rhio amorАвторское право:

Доступные форматы

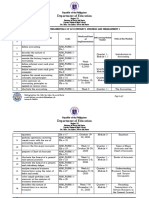

BUDGET OF LESSONS

FUNDAMENTALS OF ABM 1

(ACCOUNTING PRINCIPLES)

S.Y. 2019 - 2020

First Quarter

Subject Matter Skills & Competencies Code No. of Remarks Signature of the

Days School Head

1. Introduction to Accounting The learners …

1. define accounting GAS_FABM12-Ia-1

2. describe the nature of accounting GAS_FABM12-Ia-2 4

3. explain the functions of accounting in business GAS_FABM12-Ia-3

4. narrate the history/origin of accounting GAS_FABM12-Ia-4

2. Branches of Accounting 1. differentiate the branches of accounting GAS_FABM12-Ia-5

2. explain the kind/type of services rendered in each of GAS_FABM12-Ia-6 2

these branches

3. Users of Accounting Information 1. define external users and gives examples GAS_FABM12-Ia-7

2. define internal users and give examples GAS_FABM12-Ia-8

3. identify the type of decisions made by each group of GAS_FABM12-Ia-9 4

users

4. describe the type of information needed by each group GAS_FABM12-Ia-10

of users

4. Forms of Business Organizations 1. differentiate the forms of business organization in terms GAS_FABM12-Ib-11

of nature of ownership 2

2. identify the advantages and disadvantages of each form GAS_FABM12-Ib-12

5. Types of Business According to Activities 1. compare and contrast the types of business according to GAS_FABM12-Ib-13

activities

2. identify the advantages, disadvantages, and business GAS_FABM12-Ib-14 2

requirements of each type

6. Accounting Concepts and Principles 1. explain the varied accounting concepts and principles GAS_FABM12- Ib-c-15

2. solve exercises on accounting principles as applied in GAS_FABM12- Ib-c-16 2

various cases

7. The Accounting Equation 1. illustrate the accounting equation GAS_FABM12- Ib-c-17

2. perform operations involving simple cases with the use GAS_FABM12- Ib-c-18 2

of accounting equation

8. Types of Major Account 1. discuss the five major accounts GAS_FABM12- Id-e-19

2. cite examples of each type of account GAS_FABM12- Id-e-20 3

3. prepare a Chart of Accounts GAS_FABM12- Id-e-21

9. Books of Accounts 1. identify the uses of the two books of accounts GAS_FABM12- If-22

2. illustrate the format of a general and special GAS_FABM12- If-23

journals 3

3. illustrate the format of a general and subsidiary GAS_FABM12- If-24

ledger

10. Business Transactions and Their Analysis As 1. describe the nature and gives examples of business GAS_FABM12- Ig-j-25

Applied to the Accounting Cycle of a Service transactions

Business a. Rules of Debits and Credits 2. identify the different types of business documents GAS_FABM12- Ig-j-26 4

b. Journalizing 3. analyze common business transactions using the rules of GAS_FABM12- Ig-j-27

c. Posting debit and credit GAS_FABM12- Ig-j-28

d. Preparation of a Trial Balance 4. solve simple problems and exercises in the analyses of

business transaction

11. Business Transactions and Their Analysis As 1. describes the nature of transactions in a service business GAS_FABM12- IIa-d-29

Applied to the Accounting Cycle of a Service 2. records transactions of a service business in the general GAS_FABM12- IIa-d-30

Business a. Adjusting Entries journal

b. Adjusted Trial Balance 3. posts transactions in the ledger GAS_FABM12- IIa-d-31 6

c. Preparation of Basic Financial Statements 4. prepares a trial balance GAS_FABM12- IIa-d-32

(Income Statement) 5. prepares adjusting entries GAS_FABM12- IIa-d-33

6. complete the accounting cycle GAS_FABM12- IIa-d-34

12. Accounting Cycle of a Merchandising Business 1. describes the nature of transactions in a merchandising GAS_FABM12- IIe-j-35

business

2. records transactions of a merchandising business in the GAS_FABM12- IIe-j-36

general and special journals

3. post transactions in the general and subsidiary ledgers GAS_FABM12- IIe-j-37

4. prepares a trial balance GAS_FABM12- IIe-j-38 7

5. prepares adjusting entries GAS_FABM12- IIe-j-39

6. completes the accounting cycles of a merchandising GAS_FABM12- IIe-j-40

business

7. prepares the statement of Cost of Goods Sold and Gross GAS_FABM12- IIe-j-41

Profit.

TOTAL 41

Вам также может понравиться

- Department of Education: Republic of The PhilippinesДокумент2 страницыDepartment of Education: Republic of The PhilippinesCharly Mint Atamosa IsraelОценок пока нет

- 3FABM1 DLL Nov 20-23Документ5 страниц3FABM1 DLL Nov 20-23Marilyn Nelmida TamayoОценок пока нет

- DLL Fabm1 Week 7Документ4 страницыDLL Fabm1 Week 7Joey AgnasОценок пока нет

- ABM1 Week 3Документ54 страницыABM1 Week 3Gladzangel LoricabvОценок пока нет

- DLL FABM Week17Документ3 страницыDLL FABM Week17sweetzelОценок пока нет

- DLL Fabm1 Week 4Документ4 страницыDLL Fabm1 Week 4reverewh ouyОценок пока нет

- A. Review Activity: B. Springboard/MotivationДокумент3 страницыA. Review Activity: B. Springboard/MotivationsweetzelОценок пока нет

- DLL Apecon FS Week6Документ4 страницыDLL Apecon FS Week6Hubert S. BantingОценок пока нет

- 1FABM1 DLL Nov 6-9Документ3 страницы1FABM1 DLL Nov 6-9Marilyn Nelmida TamayoОценок пока нет

- Fabm1 LPДокумент2 страницыFabm1 LPRaul Soriano CabantingОценок пока нет

- DLP Fundamentals of Accounting 1 - Q3 - W5Документ10 страницDLP Fundamentals of Accounting 1 - Q3 - W5Daisy PaoОценок пока нет

- History of Accounting: Fundamentals of Accountancy, Business and Management 1 (FABM 1)Документ10 страницHistory of Accounting: Fundamentals of Accountancy, Business and Management 1 (FABM 1)trek boiОценок пока нет

- Grade11 Org. & Mgt. - Week 2 Sept. 18 - 22Документ4 страницыGrade11 Org. & Mgt. - Week 2 Sept. 18 - 22Kramoel AgapОценок пока нет

- Tos in FABM2 Second QuarterДокумент2 страницыTos in FABM2 Second QuarterLAARNI REBONGОценок пока нет

- FABM1 Q4 Module 15Документ17 страницFABM1 Q4 Module 15Earl Christian BonaobraОценок пока нет

- DLL FABM Week15Документ3 страницыDLL FABM Week15sweetzel100% (1)

- DLL #9 ACCTG. - Trial BalanceДокумент3 страницыDLL #9 ACCTG. - Trial BalanceCab Vic100% (1)

- Week 3 DLL Jan 15-19 XXXДокумент7 страницWeek 3 DLL Jan 15-19 XXXChristian TonogbanuaОценок пока нет

- Lanado, Shiela R. DLL Week 8.fabm1.recentДокумент3 страницыLanado, Shiela R. DLL Week 8.fabm1.recentDorothyОценок пока нет

- DLL FabmДокумент4 страницыDLL FabmjoanОценок пока нет

- DLL FABM Week11Документ3 страницыDLL FABM Week11sweetzel67% (3)

- DLL Fabm2Документ2 страницыDLL Fabm2Dimple Grace AstorgaОценок пока нет

- Week 2Документ5 страницWeek 2Jemar Alipio100% (1)

- Organization and ManagementДокумент5 страницOrganization and ManagementElla Q. EngcoОценок пока нет

- Learning Activity Sheets Week 2: Applied EconomicsДокумент8 страницLearning Activity Sheets Week 2: Applied EconomicsRodj Eli Mikael Viernes-IncognitoОценок пока нет

- Fundamentals of Accountancy, Business and Management 2 2: Elements of The Statement of Comprehensive IncomeДокумент16 страницFundamentals of Accountancy, Business and Management 2 2: Elements of The Statement of Comprehensive IncomeGladys Angela ValdemoroОценок пока нет

- TG #01 - ABM 006Документ9 страницTG #01 - ABM 006Cyrill Paghangaan VitorОценок пока нет

- Five Major Accounts 666: Fundamentals of Accountancy, Business and Management 1 (FABM 1)Документ10 страницFive Major Accounts 666: Fundamentals of Accountancy, Business and Management 1 (FABM 1)Angelica ParasОценок пока нет

- A. Review Activity: B. Springboard/MotivationДокумент3 страницыA. Review Activity: B. Springboard/MotivationsweetzelОценок пока нет

- DLL Fabm2Документ2 страницыDLL Fabm2Dimple Grace AstorgaОценок пока нет

- Weekly Home Learning Plan Fabm1Документ2 страницыWeekly Home Learning Plan Fabm1Charly Mint Atamosa Israel100% (2)

- Lesson Guide in Fundamentals of Accountancy, Business and Management June 19, 2019 I. ObjectivesДокумент3 страницыLesson Guide in Fundamentals of Accountancy, Business and Management June 19, 2019 I. ObjectivesGlaiza Dalayoan FloresОценок пока нет

- Abm Aom11 Iic e 28 AgcopraДокумент5 страницAbm Aom11 Iic e 28 AgcopraJarven SaguinОценок пока нет

- DLL Applied Economics - March 12-16, 2018Документ10 страницDLL Applied Economics - March 12-16, 2018Babylyn ImperioОценок пока нет

- Dll. Business Finance Week 1Документ9 страницDll. Business Finance Week 1Mariz Bolongaita AñiroОценок пока нет

- A. Review Activity: Reviewing Previous Lesson or RelatingДокумент4 страницыA. Review Activity: Reviewing Previous Lesson or RelatingsweetzelОценок пока нет

- Week 5 SCEДокумент4 страницыWeek 5 SCEAngelicaHermoParas100% (1)

- DLP Demo-Bank StatementДокумент5 страницDLP Demo-Bank StatementPhegiel Honculada MagamayОценок пока нет

- FABM1 Module 4 Types of Major AccountsДокумент26 страницFABM1 Module 4 Types of Major AccountsKISHAОценок пока нет

- DLL - Abm July3-7Документ2 страницыDLL - Abm July3-7Michelle Vinoray PascualОценок пока нет

- Identifying Money Management Philosophy: LearningДокумент2 страницыIdentifying Money Management Philosophy: LearningDe Nev Oel100% (1)

- 4th FABM 2Документ2 страницы4th FABM 2Keisha MarieОценок пока нет

- FABM1 Q4 Module 16Документ20 страницFABM1 Q4 Module 16Earl Christian BonaobraОценок пока нет

- Bus Ethics and Responsbility Dll1Документ18 страницBus Ethics and Responsbility Dll1ClaireSobredilla-Juarez100% (3)

- ABM - FABM11-IIIg - J - 28Документ2 страницыABM - FABM11-IIIg - J - 28Mary Grace Pagalan Ladaran0% (1)

- Abm PPT Week 1 and 2Документ50 страницAbm PPT Week 1 and 2Robertojr sembranoОценок пока нет

- LeaP-ABM-FABM1-Week 1 To 5Документ4 страницыLeaP-ABM-FABM1-Week 1 To 5Paulo Amposta Carpio100% (1)

- Lessonm Plan For COTДокумент6 страницLessonm Plan For COTGizellen Guibone100% (1)

- Cayambanan National High School: Republic of The Philippines Region 1 Division of City Schools Urdaneta CityДокумент3 страницыCayambanan National High School: Republic of The Philippines Region 1 Division of City Schools Urdaneta CityJessie Rose Tamayo100% (1)

- Fundamentals of Accountancy, Business and Management 1 (FABM 1)Документ12 страницFundamentals of Accountancy, Business and Management 1 (FABM 1)trek boiОценок пока нет

- DLL - Abm Aug 21 - 25Документ2 страницыDLL - Abm Aug 21 - 25Michelle Vinoray PascualОценок пока нет

- A Detailed Lesson Plan in FABM 1Документ6 страницA Detailed Lesson Plan in FABM 1Rey Kian Miguel Mengullo100% (1)

- ABM 1 LP COT Aug 29Документ6 страницABM 1 LP COT Aug 29ßella DC Reponoya100% (1)

- Business Finance - 12 - Third - Week 4Документ10 страницBusiness Finance - 12 - Third - Week 4AngelicaHermoParasОценок пока нет

- DLL FABM Week8Документ4 страницыDLL FABM Week8sweetzel100% (1)

- Abm-Enterprenuership 12 q1 w1 Mod1Документ18 страницAbm-Enterprenuership 12 q1 w1 Mod1Charliemane ColladoОценок пока нет

- Accounting Cycle - Transactions: Fundamentals of Accountancy Business and Management 1 11 3 QuarterДокумент4 страницыAccounting Cycle - Transactions: Fundamentals of Accountancy Business and Management 1 11 3 QuarterPaulo Amposta CarpioОценок пока нет

- Citations From Curriculum Guides Eng 8, Talosig, Cherry L. Sy 19-20Документ4 страницыCitations From Curriculum Guides Eng 8, Talosig, Cherry L. Sy 19-20LORAINE LACERNA GAMMADОценок пока нет

- K To 12 Basic Education CurriculumДокумент7 страницK To 12 Basic Education CurriculumJeremiah NayosanОценок пока нет

- Mount Carmel School of Infanta, Inc.: Senior High School DepartmentДокумент3 страницыMount Carmel School of Infanta, Inc.: Senior High School DepartmentKaye VillaflorОценок пока нет

- Career Comparison ChartДокумент2 страницыCareer Comparison Chartapi-255605088Оценок пока нет

- Chapter - 4 MineДокумент23 страницыChapter - 4 MineBereket MinaleОценок пока нет

- Rini Mam NotesДокумент15 страницRini Mam NotesasbroadwayОценок пока нет

- EASA Modules Price List Dubai Rev4Документ2 страницыEASA Modules Price List Dubai Rev4Parush guptaОценок пока нет

- Car Lease Policy MyntraДокумент11 страницCar Lease Policy MyntraertytrythytyОценок пока нет

- Electronic Funds Transfer and The Internationalisation of The Banking and Finance Industry - 1985Документ13 страницElectronic Funds Transfer and The Internationalisation of The Banking and Finance Industry - 1985Moh SaadОценок пока нет

- TP Link TD w8968 TD w8968 It Manual de UsuarioДокумент4 страницыTP Link TD w8968 TD w8968 It Manual de UsuarioVeraОценок пока нет

- C 03Документ52 страницыC 03Lạc LốiОценок пока нет

- 7340 FTTU AP FG2 6 XДокумент17 страниц7340 FTTU AP FG2 6 Xmuhammad farooqОценок пока нет

- The Nilson Report - Aug 2016 IssueДокумент11 страницThe Nilson Report - Aug 2016 IssueFidel100% (1)

- Barangay Forms 3Документ26 страницBarangay Forms 3Yel RahОценок пока нет

- The Accounting CycleДокумент98 страницThe Accounting CycleEhsan Sarparah100% (2)

- E StatementДокумент3 страницыE StatementEvin JoyОценок пока нет

- RFP - NBSP For All ESCOMs of Karnataka 09-11-2023Документ141 страницаRFP - NBSP For All ESCOMs of Karnataka 09-11-2023davidglitsОценок пока нет

- Client Acceptance, Main Concept Audit and Planning AuditДокумент25 страницClient Acceptance, Main Concept Audit and Planning AuditchristintjoaОценок пока нет

- BBAW2103 Financial AccountingДокумент336 страницBBAW2103 Financial AccountingJohn JamesОценок пока нет

- Esi & PF inДокумент30 страницEsi & PF inkuttyboyОценок пока нет

- Madura14e Ch07 FinalДокумент33 страницыMadura14e Ch07 FinalfabianngxinlongОценок пока нет

- Huge Collection of Finacle MenuДокумент26 страницHuge Collection of Finacle MenurajsundarsОценок пока нет

- List of IFRS and IASДокумент3 страницыList of IFRS and IASmit0039287767% (6)

- XXXXXXXXXX0009 20240128150640302188 UnlockedДокумент6 страницXXXXXXXXXX0009 20240128150640302188 Unlockedr6540073Оценок пока нет

- The Workmen's Compensation Act 1923Документ21 страницаThe Workmen's Compensation Act 1923aman26kaurОценок пока нет

- TalentPop Questions PDFДокумент3 страницыTalentPop Questions PDFlizzawambo9Оценок пока нет

- SOLUTION BRIEF - Siemens & ZscalerДокумент4 страницыSOLUTION BRIEF - Siemens & ZscalerAkhilesh SoniОценок пока нет

- PRINCIPLES OF MARKETING PPДокумент77 страницPRINCIPLES OF MARKETING PPAvegail Ocampo TorresОценок пока нет

- Thesis 2nd Review PDFДокумент4 страницыThesis 2nd Review PDFnavjyoth reddyОценок пока нет

- Ye Olde Book Store Opened Its Doors For Business OnДокумент2 страницыYe Olde Book Store Opened Its Doors For Business OnAmit PandeyОценок пока нет

- A Reliable System Integration Study Using Open Source Voip SoftwareДокумент9 страницA Reliable System Integration Study Using Open Source Voip SoftwareRay ErsnОценок пока нет

- Smart Banking For Business Price ListДокумент3 страницыSmart Banking For Business Price ListcrownicleОценок пока нет

- Mexican Grocery ProductsДокумент8 страницMexican Grocery ProductsCrevel EuropeОценок пока нет