Академический Документы

Профессиональный Документы

Культура Документы

EMNACE V CA

Загружено:

bfar cebuОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

EMNACE V CA

Загружено:

bfar cebuАвторское право:

Доступные форматы

EMILIO EMNACE v. COURT OF APPEALS, G.R. No. 126334.

November 23, 2001

Facts:

Petitioner Emilio Emnace, Vicente Tabanao and Jacinto Divinagracia were partners in a business

concern known as Ma. Nelma Fishing Industry. Sometime in January of 1986, they decided to

dissolve their partnership and executed an agreement of partition and distribution of the

partnership properties among them, consequent to Jacinto Divinagracia’s withdrawal from the

partnership.

Throughout the existence of the partnership, and even after Vicente Tabanao’s untimely demise

in 1994, petitioner failed to submit to Tabanao’s heirs any statement of assets and liabilities of

the partnership, and to render an accounting of the partnership’s finances. Petitioner also

reneged on his promise to turn over to Tabanao’s heirs the deceased’s 1/3 share in the total

assets of the partnership, amounting to P30,000,000.00, or the sum of P10,000,000.00, despite

formal demand for payment thereof.

Consequently, Tabanao’s heirs, respondents herein, filed against petitioner an action for

accounting, payment of shares, division of assets and damages.

The following day, respondents filed an amended complaint, incorporating the additional prayer

that petitioner be ordered to "sell all (the partnership’s) assets and thereafter

pay/remit/deliver/surrender/yield to the plaintiffs" their corresponding share in the proceeds

thereof. In due time, petitioner filed a manifestation and motion to dismiss but was denied.

The motion to dismiss and the petition for certiorari filed before the Court of Appeals were

denied.

Hence, this petition.

Issue:

Whether or not the court should have dismissed the complaint on the ground of prescription?

Held:

No.

The three (3) final stages of a partnership are: (1) dissolution; (2) winding-up; and (3)

termination. The partnership, although dissolved, continues to exist and its legal personality is

retained, at which time it completes the winding up of its affairs, including the partitioning and

distribution of the net partnership assets to the partners. For as long as the partnership exists,

any of the partners may demand an accounting of the partnership’s business. Prescription of the

said right starts to run only upon the dissolution of the partnership when the final accounting is

done.

Contrary to petitioner’s protestations that respondents’ right to inquire into the business affairs

of the partnership accrued in 1986, prescribing four (4) years thereafter, prescription had not

even begun to run in the absence of a final accounting. Article 1842 of the Civil Code provides:

virtua l 1aw lib rary

chan rob1e s

The right to an account of his interest shall accrue to any partner, or his legal representative as

against the winding up partners or the surviving partners or the person or partnership

continuing the business, at the date of dissolution, in the absence of any agreement to the

contrary.

Applied in relation to Articles 1807 and 1809, which also deal with the duty to account, the

above-cited provision states that the right to demand an accounting accrues at the date of

dissolution in the absence of any agreement to the contrary. When a final accounting is made, it

is only then that prescription begins to run. In the case at bar, no final accounting has been

made, and that is precisely what respondents are seeking in their action before the trial court,

since petitioner has failed or refused to render an accounting of the partnership’s business and

assets. Hence, the said action is not barred by prescription.

Вам также может понравиться

- Emnace v. CA - DigestДокумент2 страницыEmnace v. CA - Digestkathrynmaydeveza100% (4)

- Santos entitled to accounting as industrial partnerДокумент3 страницыSantos entitled to accounting as industrial partnermichelle zatarainОценок пока нет

- SSS Case DigestДокумент8 страницSSS Case DigestJaycebelОценок пока нет

- 1 - 9 - International Academy of Management and Economics VsДокумент3 страницы1 - 9 - International Academy of Management and Economics VsJan Re Espina CadeleñaОценок пока нет

- BANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Документ2 страницыBANCO FILIPINO SAVINGS AND MORTGAGE BANK vs. HON. FIDEL PURISIMA, Etc., and HON. VICENTE ERICTA and JOSE DEL FIERO, Etc.Dave Lumasag CanumhayОценок пока нет

- Partnership dissolution caseДокумент2 страницыPartnership dissolution casemaggiОценок пока нет

- GR No. 126881Документ2 страницыGR No. 126881ElleОценок пока нет

- Worcester v. OcampoДокумент27 страницWorcester v. OcampoJerickson A. ReyesОценок пока нет

- Willex and Inter-Resin Joint Liability Under Continuing GuarantyДокумент2 страницыWillex and Inter-Resin Joint Liability Under Continuing GuarantykkkОценок пока нет

- Mod1 - 7 - GR No. 127405 - Tacao vs. CA.Документ3 страницыMod1 - 7 - GR No. 127405 - Tacao vs. CA.Ojie SantillanОценок пока нет

- Lim Tong Lim vs. Philippine Fishing Gear IndustriesДокумент1 страницаLim Tong Lim vs. Philippine Fishing Gear IndustriesValora France Miral AranasОценок пока нет

- Arias - Atp DigestsДокумент5 страницArias - Atp DigestsPolaОценок пока нет

- Cyanimid Phils vs. CAДокумент2 страницыCyanimid Phils vs. CAlorenbeatulalianОценок пока нет

- Evangelista, Et Al. v. CIR, GR No. L-9996, October 15, 1957Документ3 страницыEvangelista, Et Al. v. CIR, GR No. L-9996, October 15, 1957Marianne Hope VillasОценок пока нет

- Supreme Court Ruling on Locus Standi of Taxpayers Challenging Gov't ContractДокумент2 страницыSupreme Court Ruling on Locus Standi of Taxpayers Challenging Gov't ContractLv Escartin0% (1)

- Narra Nickel Mining and Development CorpДокумент1 страницаNarra Nickel Mining and Development CorpDianne YcoОценок пока нет

- Partnership dissolution case upheld due to lack of evidence disproving lossesДокумент1 страницаPartnership dissolution case upheld due to lack of evidence disproving lossesAndrea TiuОценок пока нет

- Ona Vs CIRДокумент2 страницыOna Vs CIRFlorence UdaОценок пока нет

- Z. Valley Trading Co. vs. CFI of Isabela, 171 SCRA 501 SДокумент2 страницыZ. Valley Trading Co. vs. CFI of Isabela, 171 SCRA 501 SRhenee Rose Reas SugboОценок пока нет

- Phil. National Construction Corp. Vs Pabion G.R. No. 131715, December 8, 1999Документ29 страницPhil. National Construction Corp. Vs Pabion G.R. No. 131715, December 8, 1999Juni VegaОценок пока нет

- Dan Fue Leung Vs IacДокумент11 страницDan Fue Leung Vs IacCMGОценок пока нет

- Commissioner v. Goodyear Philippines tax treaty governs redemptionДокумент2 страницыCommissioner v. Goodyear Philippines tax treaty governs redemptionAnn QuebecОценок пока нет

- Compañia Maritima v. MunozДокумент15 страницCompañia Maritima v. MunozTris Lee100% (1)

- Idos vs. CAДокумент3 страницыIdos vs. CAGia DimayugaОценок пока нет

- Liwanag Vs CAДокумент1 страницаLiwanag Vs CAposh cbОценок пока нет

- 02) Ortega Vs Court of AppealsДокумент2 страницы02) Ortega Vs Court of AppealsjjjzosaОценок пока нет

- Alfafara V Acebedo Optical CompanyДокумент1 страницаAlfafara V Acebedo Optical CompanyMaria Cristina MartinezОценок пока нет

- Villareal vs. RamirezДокумент1 страницаVillareal vs. RamirezJillie Bean DomingoОценок пока нет

- G.R. No. 143340Документ1 страницаG.R. No. 143340ElleОценок пока нет

- Partnership Continues Business After DissolutionДокумент8 страницPartnership Continues Business After Dissolutionnina armadaОценок пока нет

- CA Ruling on Motion for SubstitutionДокумент2 страницыCA Ruling on Motion for SubstitutionKaira CarlosОценок пока нет

- Pleading - Case DigestДокумент30 страницPleading - Case DigestQuennieОценок пока нет

- Liwanag Vs Workmen's (Case Digest)Документ3 страницыLiwanag Vs Workmen's (Case Digest)jhammyОценок пока нет

- Saguid Vs CAДокумент3 страницыSaguid Vs CACarolyn Clarin-BaternaОценок пока нет

- PV CДокумент1 страницаPV CRM DGОценок пока нет

- 143 Martinez V Ong Pong CoДокумент2 страницы143 Martinez V Ong Pong Co01123813Оценок пока нет

- Ching vs. Secretary of JusticeДокумент3 страницыChing vs. Secretary of JusticeAderose SalazarОценок пока нет

- 113 Montelibano V Bacolod-Murcia Milling (Tiglao)Документ1 страница113 Montelibano V Bacolod-Murcia Milling (Tiglao)ASGarcia24Оценок пока нет

- PATДокумент2 страницыPATCat VGОценок пока нет

- Notes 17 - Law On Sales Assignment of CreditsДокумент7 страницNotes 17 - Law On Sales Assignment of CreditsChristine Daine BaccayОценок пока нет

- Fue Leung v. IACДокумент2 страницыFue Leung v. IAClealdeosaОценок пока нет

- 03 Pacific Commercial Company v. AboitizДокумент1 страница03 Pacific Commercial Company v. AboitizMark Anthony Javellana SicadОценок пока нет

- Tai Tong Chuache V Insurance CommissionДокумент1 страницаTai Tong Chuache V Insurance CommissionWILLAMОценок пока нет

- Herrera V Quezon City Board of Assessment GR No L-15270Документ8 страницHerrera V Quezon City Board of Assessment GR No L-15270KidMonkey2299Оценок пока нет

- Ang Pue v. Secretary of Commerce and IndustryДокумент2 страницыAng Pue v. Secretary of Commerce and IndustryJamie BerryОценок пока нет

- Corpo DigestsДокумент38 страницCorpo DigestsJai KaОценок пока нет

- Angeles v. Sec. of Justice (2005)Документ2 страницыAngeles v. Sec. of Justice (2005)ueppi67% (3)

- Realubit V JasoДокумент1 страницаRealubit V JasoMarieal InotОценок пока нет

- Primelink Properties vs. Ma. Clariza Lazatin-MagatДокумент1 страницаPrimelink Properties vs. Ma. Clariza Lazatin-MagatValora France Miral AranasОценок пока нет

- Torres v. CA, 320 S 428Документ1 страницаTorres v. CA, 320 S 428Aphrobit CloОценок пока нет

- 004 RAYOS China Banking Corp V CAДокумент3 страницы004 RAYOS China Banking Corp V CATelle MarieОценок пока нет

- University of Mindanao, Inc. Versus Bangko Sentral NG Pilipinas - G.R. No. 194964-65 - F. PALOMO (Digest)Документ3 страницыUniversity of Mindanao, Inc. Versus Bangko Sentral NG Pilipinas - G.R. No. 194964-65 - F. PALOMO (Digest)FRANCOIS AMOS PALOMOОценок пока нет

- Land Dispute Intervention DeniedДокумент1 страницаLand Dispute Intervention DeniedEdgar Jino BartolataОценок пока нет

- Island Sales Vs United Pioneers 65 SCRA 554Документ1 страницаIsland Sales Vs United Pioneers 65 SCRA 554Alleine TupazОценок пока нет

- Marjorie Tacao and Wiliiam Velo Vs CA & Nenita AnayДокумент10 страницMarjorie Tacao and Wiliiam Velo Vs CA & Nenita Anaycris baligodОценок пока нет

- Emnace Vs CAДокумент2 страницыEmnace Vs CAPACОценок пока нет

- 1809 - Right To Formal Accounting 1842 - Right To An Account by A Partner Upon DissolutionДокумент2 страницы1809 - Right To Formal Accounting 1842 - Right To An Account by A Partner Upon DissolutionZengardenОценок пока нет

- Emnace v. CA DigestsДокумент3 страницыEmnace v. CA DigestsJulian100% (1)

- Emnace vs. CA DigestedДокумент1 страницаEmnace vs. CA Digestedgregoriomanueldon.patrocinioОценок пока нет

- Emilio EmnaceДокумент2 страницыEmilio EmnaceboybilisОценок пока нет

- Sapm AssingnmentДокумент8 страницSapm Assingnmentamit98765Оценок пока нет

- GT Capital: Up To P12B Bond IssueДокумент457 страницGT Capital: Up To P12B Bond IssueBusinessWorldОценок пока нет

- Organizational PlanДокумент1 страницаOrganizational PlanCarla Jamina IbeОценок пока нет

- More Notarzed SigsДокумент44 страницыMore Notarzed SigsHarold Hewell100% (1)

- Jaiib Questions and Model Question PaperДокумент52 страницыJaiib Questions and Model Question Paperவன்னியராஜாОценок пока нет

- Starbucks' external opportunities and threats analysisДокумент3 страницыStarbucks' external opportunities and threats analysisJoan LaroyaОценок пока нет

- Combining Home Office and Branch Financial StatementsДокумент34 страницыCombining Home Office and Branch Financial Statementskiki dwiОценок пока нет

- Project Vishal Mega MartДокумент41 страницаProject Vishal Mega MartSalman RazaОценок пока нет

- OSD Siemens Case StudyДокумент15 страницOSD Siemens Case StudyAnurag SatpathyОценок пока нет

- ACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationДокумент21 страницаACC803 Advanced Financial Reporting: Week 2: Financial Statement Preparation and PresentationRavinesh PrasadОценок пока нет

- 004A - Supplier Qualification Questionnaire 2Документ6 страниц004A - Supplier Qualification Questionnaire 2Jephthah BalogunОценок пока нет

- Salcon Berhad PDFДокумент9 страницSalcon Berhad PDFRachmatt RossОценок пока нет

- 09 Chapter 1Документ113 страниц09 Chapter 1Sami ZamaОценок пока нет

- Accounting Theory FinalДокумент552 страницыAccounting Theory FinalYazlin Yusof80% (5)

- Admission of A PartnerДокумент5 страницAdmission of A PartnerTimothy BrownОценок пока нет

- VC PRIVATE EQUITY SESSIONДокумент25 страницVC PRIVATE EQUITY SESSIONMary Williams100% (1)

- Complete Fico ManualДокумент374 страницыComplete Fico ManualJigar Shah96% (23)

- Ojt 2018-2019Документ1 страницаOjt 2018-2019Bane BarrionОценок пока нет

- Ias 12Документ10 страницIas 12ImrahОценок пока нет

- RFI On Conflict of Interest SupplierДокумент5 страницRFI On Conflict of Interest Supplierabelardo65Оценок пока нет

- W GC Final 00139Документ31 страницаW GC Final 00139Pawan Chaturvedi0% (1)

- Delpher Trades Corporation vs. IACДокумент1 страницаDelpher Trades Corporation vs. IACGeoanne Battad Beringuela100% (1)

- WikiLeaks SpiДокумент26 страницWikiLeaks SpiПетар ВучинићОценок пока нет

- IOCL Tender for Support Services at Panipat RefineryДокумент13 страницIOCL Tender for Support Services at Panipat Refinerypmcmbharat264Оценок пока нет

- Digital Booklet - Mobile OrchestraДокумент12 страницDigital Booklet - Mobile Orchestrachayan_mondal29Оценок пока нет

- PDFДокумент14 страницPDFKamal RajОценок пока нет

- VI.4 - Bases Conversion v. DMCIДокумент13 страницVI.4 - Bases Conversion v. DMCIFrank AnaОценок пока нет

- Form 2307Документ2 страницыForm 2307Dino Garzon OcinoОценок пока нет

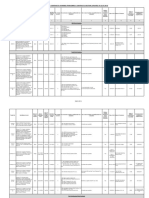

- List of Contracts AwardedДокумент21 страницаList of Contracts AwardedShailesh GangОценок пока нет

- Relationship Between Doctrines of Indoor Management and Constuctive NoticeДокумент19 страницRelationship Between Doctrines of Indoor Management and Constuctive NoticeShashwat Dubey100% (1)