Академический Документы

Профессиональный Документы

Культура Документы

Trading Breakouts: How to Find and Trade Explosive Moves Outside Key Price Levels

Загружено:

Kiran KrishnaОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Trading Breakouts: How to Find and Trade Explosive Moves Outside Key Price Levels

Загружено:

Kiran KrishnaАвторское право:

Доступные форматы

Chapter 22

Trading Breakouts

"We must remove the emotional element as quickly as possible in trading. If you can do it before you put on a position, you have

a good start."

As we move forward in the trading course, it is important to address actual strategies to apply to your trading

approach. Most active traders spend countless hours looking for trading strategies or opportunities that offer the

highest returns, without exposing their account to unnecessary risk. As option traders, it becomes even more

difficult to do this. Let’s face it; option buying is a low-probability strategy. To compensate for this, we highly

recommend focusing your efforts on a common technical strategy that offers explosive price swings in most

financial instruments – trading breakouts.

Breakout trading is used by many active investors to take a position within a trend’s early stages. Generally

speaking, this strategy can be the starting point for major price moves, expansions in volatility, and when managed

properly, can offer limited downside risk. Throughout this chapter we will walk through the anatomy of this trade

from start to finish and offer a few ideas to better manage this trading style.

What Is a Breakout?

A breakout occurs when a stock moves outside a defined support or resistance level on its price chart with

increased volume. An investor enters a bullish position after the stock price breaks above resistance or enters a

bearish position after the stock breaks below support. Once the stock trades into the new price level, volatility

tends to increase and prices usually trend in the breakout’s direction. The reason breakouts are such an important

trading strategy is because these setups are the starting point for future volatility increases and large price swings.

In many circumstances, breakouts are the starting point for most major price trends.

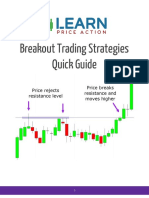

Figure 1: A Breakout in RIMM and a Breakdown in AAPL

Trading Breakouts Page 1

Breakouts occur from many environments. Typically, the most explosive price movements are a result of channel

breakouts and price pattern breakouts such as triangles, flags or head and shoulders patterns (see Figure 1). The

pattern is not necessarily as important as the fact that the stock has paused and consolidated ahead of a potential

breakout. Note: as volatility contracts during these time frames, it will typically expand after prices move beyond

these ranges.

As we discuss trading breakouts as a trading strategy, it is important to discuss from start to finish, how to manage

this type of approach. We will highlight entry points, exit points, trade management, and profit targets. At the end

of this chapter, you should be able to develop a complete plan on how to successfully trade breakouts.

Important Points to Consider

Breakouts generate explosive price swings because they trigger supply/demand imbalances that occur outside of

these obvious price barriers. For example, traders that are bullish on a stock will set buy stop orders at or above

resistance to execute a buy order once prices trade through resistance. Traders that are short the stock during this

event will likely have their stop orders in this area as well, to cover a short position as prices trade above

resistance. This event sends a tremendous amount of demand to the market as the bulls enter buy orders to buy

stock, and the bears enter buy orders to cover their short positions to prevent further loss. This excess of demand

sends prices sharply higher.

The opposite would be true for traders that are bearish on a stock. They would set sell stop orders at or beneath

support to short shares of stock as prices break beneath support. Any traders that are long shares of stock at this

time would likely have sell stop orders at or beneath support as well, to take them out of a long position in the

event that the stock broke support. This event sends a tremendous amount of supply to the market as the bears

enter sell orders to short stock, and the bulls enter sell orders to sell their shares to prevent further loss. This

excess of supply sends prices sharply lower.

As you can see, breakouts trigger significant order flow and price action. Traders know that once a stock is done

consolidating, as it moves away from a range, one side of the market will be wrong while the other will be right.

The general public will notice this move as well and will enter the market based on the idea that the stock is

getting ready to trend; similar to the examples in Figure 1. Once prices moved outside the highlighted support and

resistance levels, prices continued to trend for multiple weeks. These moves are more significant than most typical

market fluctuations. This is why we will always be keeping an eye out for these types of situations. We want to

trade stocks that are moving with purpose, not stocks that are just fluctuating randomly with the broad market.

When looking for opportunities to trade, here are a few key points to consider:

A prior trend must exist – This will help you determine direction as prices get set to leave a point of

consolidation. If continuation or reversal patterns show up after trending move in price, this will help you

better anticipate a new directional price move for aggressive trade timing and entries.

Watch for the first sign of strength/weakness – The ultimate goal is to get good at reading and

Trading Breakouts Page 2

anticipating price swings. Many stocks will give clues as to when they will leave a range, and whether they

will move up or down. By constantly watching prices, you can see whether prices are strengthening or

deteriorating in their respective ranges, which will help you in taking anticipatory entries.

Prices fall faster than they rise – It’s important to remember that stocks “take the stairs up and the

elevator down.” Since downward price movements trigger anxiety, emotion, and eventually sell orders,

the market falls much faster than it rises. Knowing this is important as prices trend beyond their

breakouts.

The larger the pattern, the bigger the potential move – As it pertains to measuring breakouts from price

patterns, the bigger and more dynamic the pattern is, the more significant the outcome will be. If a

continuation pattern measures 10 points wide at its widest point, then you can anticipate setting a profit

target 10 points beyond the point of the breakout.

Volume is a confirming indicator – Volume levels should increase as prices break beyond a support or

resistance level. This confirms the execution of order flow, and if the stock remains outside its prior range,

than it is said that the stock is “accepting” these new prices. Volume should always confirm a breakout.

Time frames - Regardless of the time frame, breakout trading is a great strategy. Whether you use

intraday, daily or weekly charts, the concepts are universal. You can apply this strategy to day trading,

swing trading or any style of trading.

Finding a Good Candidate

When trading breakouts, it is important to consider the underlying stock’s characteristics aside from just its price

pattern or support and resistance levels. Most traders develop preferences of the types of stocks they like to trade.

Every stock has particular characteristics that make it good to trade, or not good to trade based on each individuals

preferential biases. For example, Trader A prefers stocks that move fast and in large percentages, while Trader B

prefers highly liquid stocks that are not quite so volatile. These qualities can be used to dial down the large number

of available stocks out there to a smaller, more manageable list. As we’ve discussed in prior chapters, this is why

tracking a watchlist is so important.

A few simple characteristics you’ll want to define are:

Volatility – Stocks that are more volatile can generate bigger returns, but also bigger losses.

Liquidity – Liquid stocks will typically offer liquid options, and are more actively traded in general.

Options – Always double check to see that the options are liquid enough to trade.

Aside from the stocks characteristics, the next thing to check will be the technical set-up. Support and resistance

levels should be inspected, as should the price pattern before entering a trade. The more times a stock price has

touched these support/resistance areas, the more valid they are and the important they become. At the same

time, the longer these support and resistance levels have been in play, the better the outcome when the stock

price finally breaks out (see Figure 2).

Trading Breakouts Page 3

Figure 2: A Triangle Breakout in BIDU

Looking at the chart above, what defines this as a “price pattern” is the consistent touch points that form the

shape of a triangle.

As prices consolidate, various price patterns will occur on the price chart. Formations such as channels, triangles

and flags are valuable vehicles when looking for stocks to trade. Aside from patterns, consistency and length of

time a stock price has adhered to its support or resistance levels are important factors to consider when finding a

good candidate to trade. All of these elements were discussed in greater detail in our Price Patterns module.

Entry Points

After finding a good instrument to trade, it is time to plan the trade. The easiest consideration is the entry point.

Entry points are fairly black and white when it comes to establishing positions upon a breakout. Once prices are set

to close above a resistance level, an investor will establish a bullish position. When prices are set to close below a

support level, an investor will take on a bearish position. This is where many traders will use buy stop orders to put

them into a long position once a particular price is reached. For example, in Figure 2 the resistance level at the

apex of the triangle pattern was $140. A trader can simply issue a buy stop order to put them into shares of BIDU

once prices hit $140.

Anticipatory Entry Points

Trading Breakouts Page 4

If a stock is in a consolidation pattern, or a trading range, there is no guarantee as to which direction it will break.

This is why many traders opt to wait for the breakout to occur and take on a position immediately as prices start to

break either up or down. However, anticipating a price move can be a very rewarding task, if done correctly.

Going back to Figure 2, let’s assume you were bullish on BIDU. The stock had been in an upward trend, the market

had been bullish, and with the triangle pattern being a continuation pattern, you were anticipating a breakout to

the upside.

Knowing where support and resistance are located on the chart, you simply look for opportunities to buy at

support if you are anticipating a bullish breakout. Conversely, if you were anticipating a bearish breakdown, you

would look to short shares or buy puts when the stock reaches resistance.

Figure 3: Anticipatory Entry Points

One of the reasons we aim to trade at support or resistance levels is because risk is easy to define, and easier to

manage. Going back to our example of BIDU, the apex of this consolidation pattern illustrates resistance at $140,

and support at $135. If you are able to enter a trade at support, you could set a stop just beneath support, in case

prices were to break down. For example, if you entered the trade at $135, you could set a stop at $134 knowing

that if the stock traded down to that price, then the outcome of this price consolidation would be a breakdown,

which would result in much lower prices.

At times you will run across situations where a stock attempts to make a move outside a support or resistance

level, only to fail and trade back into their trading ranges. This is commonly referred to as a “fake-out.” As it

pertains to trading breakouts, always remember “from failed moves come fast moves.” This means that in a fake-

out situation, once a breakout fails, you will see a fast move in the opposite direction. This is why many traders

Trading Breakouts Page 5

choose to wait for confirmation, as opposed to anticipating movements. Many investors look for above-average

volume as confirmation or wait towards the close of a trading period to determine whether or not prices will

sustain the levels they’ve broken out of.

Planning Exits

Predetermined exits are an essential ingredient to a successful trading approach. When trading breakouts, there

are three exits plans to arrange prior to establishing a position.

1. Where to Exit with a Profit

When planning target prices, look at the stock’s recent behavior to determine a reasonable objective. When

trading price patterns, it is easy to use the recent price action to establish a price target. For example, if the range

of a recent channel or price pattern is 12 points, then that amount should be used as a price target to forward

project once the stock breaks out (see Figure 4).

Figure 4: Measuring a Price Target

Trading Breakouts Page 6

As you can see, the range in Figure 4 is roughly $12 points wide (142 – 130 = 12). That means that once prices

break resistance at $140, you would anticipate a $12 point move, or would look to book gains at $152 (140 = 12 =

152).

Another idea is to calculate recent price swings and average them out to get a relative price target. If the stock has

made an average price swing of four points over the last few price swings, this would be a reasonable objective.

These are a few ideas of how to set price targets as the trade objective. This should be your goal for the trade.

After the goal is reached, an investor can exit the position, exit a portion of the position to let the rest run or raise

a stop-loss order to lock in profits.

2. Where to Exit with a Loss

It is important to know when a trade has failed. Breakout trading offers this insight in a fairly clear manner. After a

breakout, old resistance levels should act as new support and old support levels should act as new resistance. This

is an important consideration because it is an objective way to determine when a trade has failed and an easy way

to determine where to set your stop-loss order. After a position has been taken, use the old support or resistance

level as a line in the sand to close out a losing trade. As an example, study the CHK chart in Figure 5.

Figure 5: A Failed Breakout in CHK

Trading Breakouts Page 7

After a trade fails, it is important to exit the trade quickly. Never give a loss too much rope. Remember; from failed

moves come fast moves. As you can see in Figure 5, a low volume breakout in CHK quickly unravels into a 25%

decline!

3. Where to Set a Stop Order

When considering where to exit a position with a loss, use the prior support or resistance level that prices have

broken out of. Placing a stop comfortably within these parameters is a safe way to protect a position without

giving the trade too much downside risk. Setting a stop higher than this will likely trigger an exit prematurely

because it is common for prices to re-test price levels they’ve just broken out of.

Figure 6: A Breakout in RIMM

Looking at the chart in Figure 6, you can see the initial consolidation of prices, the breakout, the re-test and then

the price objective reached. The process is fairly mechanical. When considering where to set a stop-loss order, had

it been set above the old resistance level, prices wouldn’t have been able to re-test these levels and the investor

would have been stopped out prematurely. Setting the stop below this level allows prices to re-test and catch the

trade quickly if it fails.

Summary

Breakout trading can be a packaged trading system by itself. As discussed in this chapter, so long as you are able to

consistently identify opportunities, if is very straight forward on how to enter a trade, set a profit target, and set a

stop order. At that point, the only thing left to do is to let the trade work.

Trading Breakouts Page 8

Trading these set-ups can offer significant returns, but they also bring about riskier trading conditions. Prices are

moving fast and there can be a considerable amount of volatility. As with all trading systems, the most important

element is understanding what risks are involved and properly managing those risks.

Trading Breakouts Page 9

Вам также может понравиться

- For Ex Box ProfitДокумент29 страницFor Ex Box Profitnhar15Оценок пока нет

- Double Top and Double Bottom Pattern Quick GuideДокумент9 страницDouble Top and Double Bottom Pattern Quick GuidejeevandranОценок пока нет

- Range Breakouts and Trading Tactics GuideДокумент12 страницRange Breakouts and Trading Tactics GuideNibbleTraderОценок пока нет

- At 11 06 21 Candlestick Charting - LoganДокумент18 страницAt 11 06 21 Candlestick Charting - LoganJoseph MarshallОценок пока нет

- 02-Forex Price Action Explained-Svetlin MinevДокумент153 страницы02-Forex Price Action Explained-Svetlin MinevJorgeLm100% (1)

- Breakout Trading Pt1Документ4 страницыBreakout Trading Pt1Surya NayakОценок пока нет

- Price Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)Документ22 страницыPrice Action Trading Strategies - 6 Patterns That Work (Plus Free Video Tutorial)kalpesh kathar100% (1)

- 8 Price ActionДокумент16 страниц8 Price Actiondinesh lalwani67% (3)

- PRICE SWINGS & MARKET CONTEXTДокумент243 страницыPRICE SWINGS & MARKET CONTEXTAteeque Mohd83% (6)

- Setup Trading SBRДокумент93 страницыSetup Trading SBRImron100% (7)

- The Most Comprehensive Guide To Volume Price Analysis In Forex Trading: Learn The Hidden Secret Of Highly Profitable Forex TradersОт EverandThe Most Comprehensive Guide To Volume Price Analysis In Forex Trading: Learn The Hidden Secret Of Highly Profitable Forex TradersРейтинг: 1 из 5 звезд1/5 (1)

- Trading Strategies Explained: A selection of strategies traders could use on the LMAX platformОт EverandTrading Strategies Explained: A selection of strategies traders could use on the LMAX platformОценок пока нет

- Summary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthОт EverandSummary of Rubén Villahermosa Chaves's The Wyckoff Methodology in DepthОценок пока нет

- Adam Lemon - Trading Higher Lows Lower HighsДокумент5 страницAdam Lemon - Trading Higher Lows Lower HighsRameshKumarMurali0% (1)

- FMS New Final DraftДокумент89 страницFMS New Final DraftJunior Ex IntrovetОценок пока нет

- 2 Advanced Candlestick Techniques and AnalysisДокумент30 страниц2 Advanced Candlestick Techniques and AnalysisAmit MaityОценок пока нет

- Momentum Trading Strategies Free PDFДокумент11 страницMomentum Trading Strategies Free PDFRajendra Singh100% (1)

- 7 Things About Support and Resistance That Nobody Tells YouДокумент6 страниц7 Things About Support and Resistance That Nobody Tells YouAli Abdelfatah Mahmoud100% (1)

- Forex M SystemДокумент16 страницForex M SystemBảo KhánhОценок пока нет

- Ebook Basic TradesmartfxДокумент47 страницEbook Basic TradesmartfxDanny P100% (1)

- Moving Average Indicator Checklist: Tradingwithrayner PresentsДокумент8 страницMoving Average Indicator Checklist: Tradingwithrayner PresentsHimanshu Singh RajputОценок пока нет

- E-Book GaryДокумент19 страницE-Book GaryRenganathan VenkatavaradhanОценок пока нет

- Price Action Part 2Документ41 страницаPrice Action Part 2imad ali100% (1)

- 9 Forex Systems PDFДокумент35 страниц9 Forex Systems PDFFGHFGH100% (1)

- BRV S+R Trading 210808Документ50 страницBRV S+R Trading 210808Simon Zhong100% (1)

- My Waves UpdateДокумент9 страницMy Waves Updateboyboy228100% (1)

- Cut Losses Ride Winners v1Документ8 страницCut Losses Ride Winners v1jjaypowerОценок пока нет

- Read The Market - SNDДокумент34 страницыRead The Market - SNDNabinChhetriОценок пока нет

- The Profit Picture: AnalysisДокумент7 страницThe Profit Picture: Analysisrtkiyous2947Оценок пока нет

- Price Action Trading - 6 Things To Look For Before You Place A TradeДокумент20 страницPrice Action Trading - 6 Things To Look For Before You Place A TradeSalman Munir100% (7)

- First Hour of Trading - How To Trade Like A Pro - TradingSimДокумент21 страницаFirst Hour of Trading - How To Trade Like A Pro - TradingSimAbhishek2009GWUОценок пока нет

- Stock Selection For Trading - UnencryptedДокумент2 страницыStock Selection For Trading - UnencryptedRamesh KutadiОценок пока нет

- The Complete Trading SystemДокумент5 страницThe Complete Trading SystemMariafra AntonioОценок пока нет

- USD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James FournierДокумент5 страницUSD/JPY - Long Trade Called at 27/09/2011. HIGH RISK TRADE! James Fournierapi-100874888Оценок пока нет

- Time Tested Classic Trading Rules For The Modern Trader To FollowДокумент19 страницTime Tested Classic Trading Rules For The Modern Trader To FollowArt James100% (1)

- Lesson 1 - Trading Tactics 1Документ1 страницаLesson 1 - Trading Tactics 1KOF.ETIENNE KOUMAОценок пока нет

- HOW I TRADE @boomcrashsignal @anggavisca666Документ17 страницHOW I TRADE @boomcrashsignal @anggavisca666OuattaraОценок пока нет

- Price Action Reversal StrategiesДокумент7 страницPrice Action Reversal Strategiesmanoj tomer100% (1)

- Multiple Timeframe Analysis 2Документ3 страницыMultiple Timeframe Analysis 2santanu_13100% (1)

- Major KeyДокумент4 страницыMajor KeyBursa ValutaraОценок пока нет

- True Support Resistance LinesДокумент12 страницTrue Support Resistance LineschajimОценок пока нет

- 200 TRADING PSYCHOLOGY TRUTHSДокумент32 страницы200 TRADING PSYCHOLOGY TRUTHSVarun Vasurendran100% (2)

- 05 - Market Structure - Trend, Range and VolatilityДокумент9 страниц05 - Market Structure - Trend, Range and VolatilityRamachandra Dhar100% (3)

- 01 - Pullback - How To Enter Your Trades at A Discounted PriceДокумент12 страниц01 - Pullback - How To Enter Your Trades at A Discounted Priceramu100% (2)

- LFB London Open Trade Plan: Taming the BeastДокумент3 страницыLFB London Open Trade Plan: Taming the BeastmdufauОценок пока нет

- RSI Trade Settings Explained 4 Unique Trading Strategies - TradingSimДокумент25 страницRSI Trade Settings Explained 4 Unique Trading Strategies - TradingSimgiberamu790Оценок пока нет

- 7 Step Blueprint: Key Steps High Probability Price Action TradingДокумент11 страниц7 Step Blueprint: Key Steps High Probability Price Action TradingNureka Rahayu50% (2)

- Advanced Candlestick Analysis - Trading With Smart MoneyДокумент8 страницAdvanced Candlestick Analysis - Trading With Smart Moneyhiteshnp100% (1)

- TP The Double Edged Trader ReportДокумент18 страницTP The Double Edged Trader ReportAdil BensellamОценок пока нет

- 04 D Money Management & Market PsychologyДокумент9 страниц04 D Money Management & Market PsychologyBudi MulyonoОценок пока нет

- Trading Strategy v.1 PDFДокумент3 страницыTrading Strategy v.1 PDFSanju GoelОценок пока нет

- Finding Entry Opportunity Using Volume Spread Analysis in TradingДокумент13 страницFinding Entry Opportunity Using Volume Spread Analysis in TradingKindabul Abd100% (3)

- Demand and Supply zones explainedДокумент247 страницDemand and Supply zones explainedNông Dân100% (3)

- The Trend Reversal Trading Strategy GuideДокумент18 страницThe Trend Reversal Trading Strategy GuideBede Stephen100% (1)

- Breakout Trading Explanatory NotesДокумент47 страницBreakout Trading Explanatory NotesMfxMazprofxОценок пока нет

- Technique CorrectionДокумент9 страницTechnique CorrectionRajatОценок пока нет

- Day Trading StrategyДокумент4 страницыDay Trading StrategyJoel FrankОценок пока нет

- Candlesticks For Support and Resistance PDF (PDFDrive)Документ40 страницCandlesticks For Support and Resistance PDF (PDFDrive)Raja100% (2)

- ST Sir Swing Trade With Smaller StoplossДокумент6 страницST Sir Swing Trade With Smaller StoplossUsha JagtapОценок пока нет

- Gap Trading Strategies Quick GuideДокумент9 страницGap Trading Strategies Quick GuideFauzi BОценок пока нет

- More Info On Rahu-Deva and D.I.Y. Rahu Graha Shanti PujaДокумент10 страницMore Info On Rahu-Deva and D.I.Y. Rahu Graha Shanti PujaKiran KrishnaОценок пока нет

- Nifty Open Interest Analysis - Page 21Документ6 страницNifty Open Interest Analysis - Page 21Kiran KrishnaОценок пока нет

- Inside Bar Trading StrategiesДокумент8 страницInside Bar Trading StrategiesKiran Krishna100% (1)

- Winning at Day Trading System Full Download-Html PDFДокумент6 страницWinning at Day Trading System Full Download-Html PDFKiran KrishnaОценок пока нет

- Cryptocurrency Trading Guide for BeginnersДокумент16 страницCryptocurrency Trading Guide for BeginnersAngel AngiaОценок пока нет

- Forex Terminology Free PDFДокумент7 страницForex Terminology Free PDFKiran Krishna100% (1)

- What Is Heikin Ashi and How You Use ItДокумент10 страницWhat Is Heikin Ashi and How You Use ItFauzi BОценок пока нет

- Breakout Trading Strategies Quick GuideДокумент10 страницBreakout Trading Strategies Quick GuideKiran KrishnaОценок пока нет

- Candlestick Patterns PDF Free Guide DownloadДокумент11 страницCandlestick Patterns PDF Free Guide DownloadGreg Mavhunga88% (8)

- How To Use Moving Average PDF GuideДокумент13 страницHow To Use Moving Average PDF GuideNephiAlmarasDecaycoОценок пока нет

- Winning at Day Trading System Full Download-Html PDFДокумент6 страницWinning at Day Trading System Full Download-Html PDFKiran KrishnaОценок пока нет

- Trading Psychology: How To Master Your Trading MindДокумент9 страницTrading Psychology: How To Master Your Trading MindKiran KrishnaОценок пока нет

- Gap Trading Strategies Quick GuideДокумент9 страницGap Trading Strategies Quick GuideFauzi BОценок пока нет

- Bollinger Bands Explained: A Complete Trading GuideДокумент12 страницBollinger Bands Explained: A Complete Trading GuideKouzino KouzinteОценок пока нет

- Breakout Trading Strategies Quick GuideДокумент10 страницBreakout Trading Strategies Quick GuideKiran KrishnaОценок пока нет

- YouTube Marketing Handbook by Marc Bullard PDFДокумент59 страницYouTube Marketing Handbook by Marc Bullard PDFKiran KrishnaОценок пока нет

- More Info On Brihaspatideva Remedies and DIY Brihaspati Graha Shanti Puja... 1 PDFДокумент10 страницMore Info On Brihaspatideva Remedies and DIY Brihaspati Graha Shanti Puja... 1 PDFKiran KrishnaОценок пока нет

- YouTube Marketing Strategies - How To Get Thousands of YouTube Channel Subscribers and Millions of Video Views With David Walsh PDFДокумент40 страницYouTube Marketing Strategies - How To Get Thousands of YouTube Channel Subscribers and Millions of Video Views With David Walsh PDFKiran Krishna100% (2)

- YouTube Marketing Handbook by Marc Bullard PDFДокумент59 страницYouTube Marketing Handbook by Marc Bullard PDFKiran KrishnaОценок пока нет

- Faster Reading by The Princeton Language InstituteДокумент249 страницFaster Reading by The Princeton Language Institutescorpiac100% (6)

- 5 Reasons Why Price Action ISN'T The Holy GrailДокумент25 страниц5 Reasons Why Price Action ISN'T The Holy GrailKiran KrishnaОценок пока нет

- Jyotish-KP - Reader 4-Marriage-Married Life & ChildrenДокумент283 страницыJyotish-KP - Reader 4-Marriage-Married Life & ChildrenJyotish Freedom100% (16)

- Youtube Marketing TutorialДокумент53 страницыYoutube Marketing TutorialAnto Padaunan67% (3)

- More Info On Budha-Deva and D.I.Y. Budha Graha Shanti PujaДокумент10 страницMore Info On Budha-Deva and D.I.Y. Budha Graha Shanti PujaKiran KrishnaОценок пока нет

- Jyotish-KP - Reader 4-Marriage-Married Life & ChildrenДокумент283 страницыJyotish-KP - Reader 4-Marriage-Married Life & ChildrenJyotish Freedom100% (16)

- Best Candlestik 2019 Strategy Book PDFДокумент205 страницBest Candlestik 2019 Strategy Book PDFKiran KrishnaОценок пока нет

- Ebook Occult Hitt Robert AstroEcon Financial Astrology and Technical AnalysisДокумент107 страницEbook Occult Hitt Robert AstroEcon Financial Astrology and Technical Analysisceres709Оценок пока нет

- Trade Pattern Tutorial PDFДокумент24 страницыTrade Pattern Tutorial PDFKiran Krishna33% (3)

- 3 Intro To Ozone LaundryДокумент5 страниц3 Intro To Ozone LaundrynavnaОценок пока нет

- "60 Tips On Object Oriented Programming" BrochureДокумент1 страница"60 Tips On Object Oriented Programming" BrochuresgganeshОценок пока нет

- Fundamentals of Real Estate ManagementДокумент1 страницаFundamentals of Real Estate ManagementCharles Jiang100% (4)

- Geneva IntrotoBankDebt172Документ66 страницGeneva IntrotoBankDebt172satishlad1288Оценок пока нет

- Material Properties L2 Slides and NotesДокумент41 страницаMaterial Properties L2 Slides and NotesjohnОценок пока нет

- Computers As Components 2nd Edi - Wayne WolfДокумент815 страницComputers As Components 2nd Edi - Wayne WolfShubham RajОценок пока нет

- Ata 36 PDFДокумент149 страницAta 36 PDFAyan Acharya100% (2)

- Part E EvaluationДокумент9 страницPart E EvaluationManny VasquezОценок пока нет

- Green Management: Nestlé's Approach To Green Management 1. Research and DevelopmentДокумент6 страницGreen Management: Nestlé's Approach To Green Management 1. Research and DevelopmentAbaidullah TanveerОценок пока нет

- CTS experiments comparisonДокумент2 страницыCTS experiments comparisonmanojkumarОценок пока нет

- Logistic Regression to Predict Airline Customer Satisfaction (LRCSДокумент20 страницLogistic Regression to Predict Airline Customer Satisfaction (LRCSJenishОценок пока нет

- Top Brand Story Bar Supervisor Jobs Chennai Apply Now Latest Fresher Experienced Bar Supervisor Jobs in Various Location July 18 2021Документ1 страницаTop Brand Story Bar Supervisor Jobs Chennai Apply Now Latest Fresher Experienced Bar Supervisor Jobs in Various Location July 18 2021Surya JamesОценок пока нет

- Empowerment Technologies Learning ActivitiesДокумент7 страницEmpowerment Technologies Learning ActivitiesedzОценок пока нет

- Chapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationДокумент16 страницChapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationSarmila MahendranОценок пока нет

- International Convention Center, BanesworДокумент18 страницInternational Convention Center, BanesworSreeniketh ChikuОценок пока нет

- Banas Dairy ETP Training ReportДокумент38 страницBanas Dairy ETP Training ReportEagle eye0% (2)

- 50TS Operators Manual 1551000 Rev CДокумент184 страницы50TS Operators Manual 1551000 Rev CraymondОценок пока нет

- 1LE1503-2AA43-4AA4 Datasheet enДокумент1 страница1LE1503-2AA43-4AA4 Datasheet enAndrei LupuОценок пока нет

- Civil Aeronautics BoardДокумент2 страницыCivil Aeronautics BoardJayson AlvaОценок пока нет

- Yamaha Nmax 155 - To Turn The Vehicle Power OffДокумент1 страницаYamaha Nmax 155 - To Turn The Vehicle Power Offmotley crewzОценок пока нет

- Ju Complete Face Recovery GAN Unsupervised Joint Face Rotation and De-Occlusion WACV 2022 PaperДокумент11 страницJu Complete Face Recovery GAN Unsupervised Joint Face Rotation and De-Occlusion WACV 2022 PaperBiponjot KaurОценок пока нет

- Bank Statement AnalysisДокумент26 страницBank Statement AnalysisAishwarya ManoharОценок пока нет

- UKIERI Result Announcement-1Документ2 страницыUKIERI Result Announcement-1kozhiiiОценок пока нет

- Information Pack For Indonesian Candidate 23.06.2023Документ6 страницInformation Pack For Indonesian Candidate 23.06.2023Serevinna DewitaОценок пока нет

- COVID-19's Impact on Business PresentationsДокумент2 страницыCOVID-19's Impact on Business PresentationsRetmo NandoОценок пока нет

- Applicants at Huye Campus SiteДокумент4 страницыApplicants at Huye Campus SiteHIRWA Cyuzuzo CedricОценок пока нет

- Short Term Training Curriculum Handbook: General Duty AssistantДокумент49 страницShort Term Training Curriculum Handbook: General Duty AssistantASHISH BARAWALОценок пока нет

- Take Private Profit Out of Medicine: Bethune Calls for Socialized HealthcareДокумент5 страницTake Private Profit Out of Medicine: Bethune Calls for Socialized HealthcareDoroteo Jose Station100% (1)

- UW Computational-Finance & Risk Management Brochure Final 080613Документ2 страницыUW Computational-Finance & Risk Management Brochure Final 080613Rajel MokОценок пока нет

- NAC Case Study AnalysisДокумент25 страницNAC Case Study AnalysisSushma chhetriОценок пока нет