Академический Документы

Профессиональный Документы

Культура Документы

Q3. Analyse The Situation Qualitatively and Recommend Any Future Action

Загружено:

HEM BANSALОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Q3. Analyse The Situation Qualitatively and Recommend Any Future Action

Загружено:

HEM BANSALАвторское право:

Доступные форматы

Q3.

Analyse the situation qualitatively and recommend any future action

Deluxe Corporation which was one of the largest players in printed paper checks industry in

USA, is now facing declining growth because of alternative payment options like credit cards,

debit cards etc. Because of easy availability and accessibility of Internet, the popularity of these

alternative modes of payment have been increasing rapidly, which has led to declining market

share for printed checks industry. There has been a decline of around 1-3%. Due to this decline,

they had diversified from their core business but not shut it completely. In order to mitigate from

the revenue growth decline, complete reorganization was done to reduce operating expenses.

The company had had many rounds of share repurchase, so the only option now left with them

was that of debt financing. The current debt level calculated with debt ratio (operating

income/debt service) was approximately 1.87, which indicates that Deluxe was below required

level for any rating category. The market was matured that was indicated by intense price

competition. The market decline may also be a result of consolidation of banking sector.

Following financing requirements are recommended- working capital, capital asset repurchases,

acquisitions, repayment of outstanding debt, constant payment of dividends, securities

repurchase.

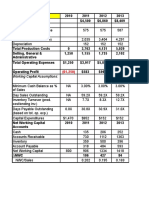

2001 2002 2003 2004 2005 2006

EBIT Margin 0.2659878 0.2669704 0.2670091 0.267026 0.2670176

Net Profit Margin 0.146433 0.1630024 0.1636295 0.1636891 0.163741 0.1638097

Operating Leverage 1.6132479 1.6318031 1.6315545 1.631196 1.6307829 1.6300478

CASH/T ASSETS 0.0346195 0.3158028 0.4726813 0.5720988 0.6408423 0.6912789

$ $ $ $ $ $

DEBT 161.50 161.50 161.50 161.50 161.50 161.50

$ $ $ $ $ $

EQUITY 78.70 195.20 315.80 440.90 570.80 706.20

D/E 2.0520966 0.8273566 0.5113996 0.3662962 0.2829362 0.2286888

$ $ $ $ $

Interest Coverage $ - 86.20 87.90 89.68 91.65 93.85

Roe Five Factor

Asset/Equity 3.523507 2.0163934 1.6285624 1.4502155 1.3477575 1.2810818

Sales/Assets 4.6101695 3.2934451 2.5607622 2.1010322 1.7846094 1.5539958

$ $ $ $ $

PBIT/Sales $ - 0.27 0.27 0.27 0.27 0.27

PBT/PBIT 0 1 2 3 4 5

PAT/PBT 0.6198675 0.612819 0.6129124 0.6130471 0.6132024 0.613479

ROE based on above 0 1.0824795 1.3647878 1.4962577 1.5753329 1.6305579

ROE Check -Direct formula 2.3786531 1.0824795 0.6823939 0.4987526 0.3938332 0.3261116

2001 $2,000.00

Total Cost/Sales 0.7637672 0.7791241

Variable Cost/Sales 0.354975 0.358755

Fixed Cost/Sales 0.4072278 0.4145086

Based on the 5-step DuPont Analysis the ROE is increasing, which is a positive factor. This is

not reflected in the calculation of ROE using the direct formula. Debt to Equity is decreasing

while the equity is increasing and the total debt (long- and short-term) is constant.

Income statement 2001 2002 2003 2004 2005 2006 CAGR

Net sales $1,278.40 $1,296.30 $1,317.00 $1,343.40 $1,372.90 $1,405.90 1.92%

Operating profit $ 302.00 $ 344.80 $ 351.60 $ 358.70 $ 366.60 $ 375.40 4.45%

Interest expense, net $ 3.20 $ 4.00 $ 4.00 $ 4.00 $ 4.00 $ 4.00 4.56%

Pretax income $ 298.80 $ 340.80 $ 347.60 $ 354.70 $ 362.60 $ 371.40 4.45%

Tax expense $ 111.60 $ 129.50 $ 132.10 $ 134.80 $ 137.80 $ 141.10 4.80%

Net income $ 187.20 $ 211.30 $ 215.50 $ 219.90 $ 224.80 $ 230.30 4.23%

Dividends $ 94.90 $ 94.90 $ 94.90 $ 94.90 $ 94.90 $ 94.90 0.00%

Retentions to earnings $ 92.30 $ 116.40 $ 120.60 $ 125.00 $ 129.90 $ 135.40 7.97%

Balance sheet

Cash $ 9.60 $ 124.30 $ 243.10 $ 365.80 $ 493.00 $ 625.40 130.56%

Working capital $ 116.60 $ 118.20 $ 120.10 $ 122.50 $ 125.20 $ 128.20 1.91%

Net fixed assets $ 151.10 $ 151.10 $ 151.10 $ 151.10 $ 151.10 $ 151.10 0.00%

Total assets $ 277.30 $ 393.60 $ 514.30 $ 639.40 $ 769.30 $ 904.70 26.68%

Debt (long and short-term) $ 161.50 $ 161.50 $ 161.50 $ 161.50 $ 161.50 $ 161.50 0.00%

Other long-term liabilities $ 37.00 $ 37.00 $ 37.00 $ 37.00 $ 37.00 $ 37.00 0.00%

Equity $ 78.70 $ 195.20 $ 315.80 $ 440.90 $ 570.80 $ 706.20 55.09%

Total capital $ 277.20 $ 393.60 $ 514.30 $ 639.30 $ 769.30 $ 904.60 26.69%

Вам также может понравиться

- Sbux, Peet, and Pro-Forma Pete-DdrxДокумент12 страницSbux, Peet, and Pro-Forma Pete-DdrxfcfroicОценок пока нет

- Common Size Income StatementДокумент7 страницCommon Size Income StatementUSD 654Оценок пока нет

- McDonald's Data and Arby's DataДокумент23 страницыMcDonald's Data and Arby's DataRahil VermaОценок пока нет

- Amazon ValuationДокумент22 страницыAmazon ValuationDr Sakshi SharmaОценок пока нет

- Applications 2Документ7 страницApplications 2jaОценок пока нет

- Axisbank Financial Statements Summary AJ WorksДокумент12 страницAxisbank Financial Statements Summary AJ WorksSoorajKrishnanОценок пока нет

- Netflix Financial StatementsДокумент2 страницыNetflix Financial StatementsGoutham RaoОценок пока нет

- Trabajo Final de Ingeniería EconomicaДокумент30 страницTrabajo Final de Ingeniería EconomicaSergio HernandezОценок пока нет

- Stryker Corporation - Assignment 22 March 17Документ4 страницыStryker Corporation - Assignment 22 March 17Venkatesh K67% (6)

- Bbby 4Q2014Документ3 страницыBbby 4Q2014RahulBakshiОценок пока нет

- Ejercicio Proyecto FinalДокумент3 страницыEjercicio Proyecto FinalCortez Rodríguez Karen YanethОценок пока нет

- Harley-Davidson Motor Co.: Enterprise Software SelectionДокумент4 страницыHarley-Davidson Motor Co.: Enterprise Software Selectionjuan guerreroОценок пока нет

- Tire City Case AnalysisДокумент10 страницTire City Case AnalysisVASANTADA SRIKANTH (PGP 2016-18)Оценок пока нет

- I. Income StatementДокумент27 страницI. Income StatementNidhi KaushikОценок пока нет

- Apple TTMДокумент25 страницApple TTMQuofi SeliОценок пока нет

- Genzyme DCF PDFДокумент5 страницGenzyme DCF PDFAbinashОценок пока нет

- Varun BeveragesДокумент16 страницVarun BeveragesPuneet GirdharОценок пока нет

- Chapter Iv - Data Analysis and Interpretation: Property #1Документ32 страницыChapter Iv - Data Analysis and Interpretation: Property #1karthiga312Оценок пока нет

- Chapter Iv - Data Analysis and Interpretation: Property #1Документ12 страницChapter Iv - Data Analysis and Interpretation: Property #1karthiga312Оценок пока нет

- Investment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsДокумент8 страницInvestment Banking: Valuation, Leveraged Buyouts, and Mergers & AcquisitionsMarta RodriguesОценок пока нет

- Cover Sheet: General InputsДокумент10 страницCover Sheet: General InputsBobby ChristiantoОценок пока нет

- Exhibit 1: Income StatementДокумент16 страницExhibit 1: Income StatementAbhishek GuptaОценок пока нет

- Financial PlanДокумент5 страницFinancial PlanVivian CorpuzОценок пока нет

- Lady M DCF TemplateДокумент4 страницыLady M DCF Templatednesudhudh100% (1)

- Valuation AssignmentДокумент20 страницValuation AssignmentHw SolutionОценок пока нет

- Financial Statement Analysis On APEX and Bata Shoe CompanyДокумент12 страницFinancial Statement Analysis On APEX and Bata Shoe CompanyLabiba Farah 190042118Оценок пока нет

- Meerut Adventure Company CV1Документ9 страницMeerut Adventure Company CV1Ayushi GuptaОценок пока нет

- Fabricycle FinancialsДокумент3 страницыFabricycle FinancialsRahul AchaяyaОценок пока нет

- Ejercicio Estados Financieros Vertical y Horizontal 22 SepДокумент5 страницEjercicio Estados Financieros Vertical y Horizontal 22 Sepgracy yamileth vasquez garayОценок пока нет

- Restructuring at Neiman Marcus Group (A) Bankruptcy ValuationДокумент66 страницRestructuring at Neiman Marcus Group (A) Bankruptcy ValuationShaikh Saifullah KhalidОценок пока нет

- BNI 111709 v2Документ2 страницыBNI 111709 v2fcfroicОценок пока нет

- Operating Lease Converter: InputsДокумент44 страницыOperating Lease Converter: InputsJosé Manuel EstebanОценок пока нет

- Gyaan SessionДокумент25 страницGyaan SessionVanshGuptaОценок пока нет

- TATA Steel Financial ModelДокумент19 страницTATA Steel Financial ModelAkshayОценок пока нет

- Ambuja Cements: Profit & Loss AccountДокумент15 страницAmbuja Cements: Profit & Loss Accountwritik sahaОценок пока нет

- Shree Cement DCF ValuationДокумент71 страницаShree Cement DCF ValuationPrabhdeep DadyalОценок пока нет

- Polaroid 1996 CalculationДокумент8 страницPolaroid 1996 CalculationDev AnandОценок пока нет

- UST Debt Policy Spreadsheet (Reduced)Документ9 страницUST Debt Policy Spreadsheet (Reduced)Björn Auðunn ÓlafssonОценок пока нет

- Bcel 2019Документ1 страницаBcel 2019Dương NguyễnОценок пока нет

- New Heritage DollДокумент8 страницNew Heritage DollJITESH GUPTAОценок пока нет

- Sample Business Plan Excel TemplateДокумент27 страницSample Business Plan Excel TemplateAndriyadi MardinОценок пока нет

- Harley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementДокумент5 страницHarley-Davidson, Inc. (HOG) Stock Financials - Annual Income StatementThe Baby BossОценок пока нет

- Solucion Caso Lady MДокумент13 страницSolucion Caso Lady Mjohana irma ore pizarroОценок пока нет

- AirThread ConnectionsДокумент10 страницAirThread ConnectionsGuru Charan ChitikenaОценок пока нет

- Mercury CaseДокумент23 страницыMercury Caseuygh gОценок пока нет

- Ejer 7 EvaДокумент17 страницEjer 7 EvavaleОценок пока нет

- Profitability Test: Profit/Net Sales Pat-Pref Div/ No of Eq Shares (Pat-Pref Div) / Eqty FundДокумент7 страницProfitability Test: Profit/Net Sales Pat-Pref Div/ No of Eq Shares (Pat-Pref Div) / Eqty FundJatin AroraОценок пока нет

- High GrowthДокумент30 страницHigh GrowthAbhinav PandeyОценок пока нет

- 2 Million / 40%) + $5 Million Post-Money Valuation $7 MillionДокумент1 страница2 Million / 40%) + $5 Million Post-Money Valuation $7 MillionShabnam ShahОценок пока нет

- Sum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Документ6 страницSum of PV $ 95,315: Netflix Base Year 1 2 3 4 5Laura Fonseca SarmientoОценок пока нет

- CLW Analysis 6-1-21Документ5 страницCLW Analysis 6-1-21HunterОценок пока нет

- Company Name Most Recent Fiscal Year Date of Coverage AnalystДокумент79 страницCompany Name Most Recent Fiscal Year Date of Coverage AnalystPassmore DubeОценок пока нет

- AVIS CarsДокумент10 страницAVIS CarsSheikhFaizanUl-HaqueОценок пока нет

- 61 10 Shares Dividends AfterДокумент10 страниц61 10 Shares Dividends Aftermerag76668Оценок пока нет

- Pacific Grove Spice CompanyДокумент3 страницыPacific Grove Spice CompanyLaura JavelaОценок пока нет

- Proyecto Final Eq. 3Документ25 страницProyecto Final Eq. 3Arath Eduardo Balcazar AntonioОценок пока нет

- Polaroid Corporation ENGLISHДокумент14 страницPolaroid Corporation ENGLISHAtul AnandОценок пока нет

- Mini Case Chapter 3 Final VersionДокумент14 страницMini Case Chapter 3 Final VersionAlberto MariñoОценок пока нет

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОт EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineОценок пока нет

- TeamExport A95152 Paris R Period 2Документ71 страницаTeamExport A95152 Paris R Period 2HEM BANSALОценок пока нет

- OPEC Oil Market Report - September, 2019 PDFДокумент113 страницOPEC Oil Market Report - September, 2019 PDFHEM BANSALОценок пока нет

- NASREEN RAHAT - 39516 - Assignsubmission - File - SecC - Group6 - ProjectДокумент18 страницNASREEN RAHAT - 39516 - Assignsubmission - File - SecC - Group6 - ProjectHEM BANSALОценок пока нет

- India - India Inc Trends and OutlookДокумент49 страницIndia - India Inc Trends and OutlookHEM BANSALОценок пока нет

- Mahindra CIE What Is Holding Back MHCIE StockДокумент11 страницMahindra CIE What Is Holding Back MHCIE StockHEM BANSALОценок пока нет

- TeamExport - A95152 - Paris - R - Period 0Документ68 страницTeamExport - A95152 - Paris - R - Period 0HEM BANSALОценок пока нет

- Siddharth Sharma - Siddharth - Sharma - PGP10174 SCCДокумент2 страницыSiddharth Sharma - Siddharth - Sharma - PGP10174 SCCHEM BANSALОценок пока нет

- SANKALP TIGGA - 39498 - Assignsubmission - File - SecC - Group7 - Final - ProjectДокумент15 страницSANKALP TIGGA - 39498 - Assignsubmission - File - SecC - Group7 - Final - ProjectHEM BANSALОценок пока нет

- SANKALP TIGGA - 39498 Assignsubmission File SecC Group7 Final ProjectДокумент15 страницSANKALP TIGGA - 39498 Assignsubmission File SecC Group7 Final ProjectHEM BANSALОценок пока нет

- Global Industry Forecast - Motor Vehicles Q3 2019Документ27 страницGlobal Industry Forecast - Motor Vehicles Q3 2019HEM BANSALОценок пока нет

- RAHUL ARORA - 39497 Assignsubmission File SecC Group8 Project FinalДокумент17 страницRAHUL ARORA - 39497 Assignsubmission File SecC Group8 Project FinalHEM BANSALОценок пока нет

- Blockchain - Adoption in Automotive IndustryДокумент85 страницBlockchain - Adoption in Automotive IndustryHEM BANSALОценок пока нет

- SectionC Nokia BNaturalДокумент17 страницSectionC Nokia BNaturalHEM BANSALОценок пока нет

- Marksrat: Company Name:-R Industry Name: - ParisДокумент10 страницMarksrat: Company Name:-R Industry Name: - ParisHEM BANSALОценок пока нет

- Group8 SDM SecCДокумент33 страницыGroup8 SDM SecCHEM BANSALОценок пока нет

- India Auto Industry Update August 2019Документ8 страницIndia Auto Industry Update August 2019HEM BANSALОценок пока нет

- ReNew Power BL 17jan2019Документ5 страницReNew Power BL 17jan2019HEM BANSALОценок пока нет

- SecC Group5 Sales&WilkinsДокумент3 страницыSecC Group5 Sales&WilkinsHEM BANSALОценок пока нет

- SecC Group 4 WilkinsДокумент8 страницSecC Group 4 WilkinsHEM BANSALОценок пока нет

- Building A Social Media Culture at Dell: Submitted By: Group 1Документ2 страницыBuilding A Social Media Culture at Dell: Submitted By: Group 1HEM BANSALОценок пока нет

- Turning Customer Information Into Sales KnowledgeДокумент1 страницаTurning Customer Information Into Sales KnowledgeHEM BANSALОценок пока нет

- Group8 SDM SecC 1Документ5 страницGroup8 SDM SecC 1HEM BANSALОценок пока нет

- Setting Goals and Managing The Sales Force's PerformanceДокумент2 страницыSetting Goals and Managing The Sales Force's PerformanceHEM BANSALОценок пока нет

- Wilkins, A Zurn Company: Demand Forecasting: Submitted By: Group-8 Section-CДокумент6 страницWilkins, A Zurn Company: Demand Forecasting: Submitted By: Group-8 Section-CHEM BANSALОценок пока нет

- Summary Chapter - 11Документ2 страницыSummary Chapter - 11HEM BANSALОценок пока нет

- Sales & Wilkins, A Zurn Company Demand Forecasting: Group 7Документ8 страницSales & Wilkins, A Zurn Company Demand Forecasting: Group 7HEM BANSALОценок пока нет

- Wilkins, A Zurn CompanyДокумент8 страницWilkins, A Zurn CompanyHEM BANSALОценок пока нет

- Wilkins Group6Документ21 страницаWilkins Group6HEM BANSALОценок пока нет

- Turning Customer Information Into Sales KnowledgeДокумент2 страницыTurning Customer Information Into Sales KnowledgeHEM BANSALОценок пока нет

- Turning Customer Information Into Sales KnowledgeДокумент2 страницыTurning Customer Information Into Sales KnowledgeHEM BANSALОценок пока нет

- Wolfx Signals ®Документ9 страницWolfx Signals ®Fale MensОценок пока нет

- ACT3110 - Accounting For Revenue and Expenses - Accounting Process Part II (S)Документ34 страницыACT3110 - Accounting For Revenue and Expenses - Accounting Process Part II (S)amirah1999Оценок пока нет

- Stuy Town CW CapitalДокумент50 страницStuy Town CW CapitalrahОценок пока нет

- CVP Solution PDFДокумент1 страницаCVP Solution PDFFerdausОценок пока нет

- Ratio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosДокумент4 страницыRatio Analysis: Interpretation of Financial Statements: 1) Profitability RatiosCollen MahamboОценок пока нет

- Foreign Direct InvestmentДокумент16 страницForeign Direct InvestmentKuz StifflerОценок пока нет

- Lease Finance and Investment Banking PDFДокумент105 страницLease Finance and Investment Banking PDFnayanОценок пока нет

- Angelo - Chapter 10 Operating LeaseДокумент8 страницAngelo - Chapter 10 Operating LeaseAngelo Andro Suan100% (1)

- 14 - Simple Interest MODULE 6Документ16 страниц14 - Simple Interest MODULE 6Mabel LynОценок пока нет

- Economics 12, 2 SolutionsДокумент48 страницEconomics 12, 2 Solutionssantpreetkaur659Оценок пока нет

- Class NotesДокумент24 страницыClass NotesRajat tiwariОценок пока нет

- BAFACR16 01 Problem IllustrationsДокумент2 страницыBAFACR16 01 Problem Illustrationsmisssunshine112Оценок пока нет

- Mba General Model QPДокумент134 страницыMba General Model QPshanvenkyОценок пока нет

- Debt Collector Disclosure StatementДокумент8 страницDebt Collector Disclosure StatementGreg WilderОценок пока нет

- Sole Proprietorship Quiz Bee1Документ5 страницSole Proprietorship Quiz Bee1Dethzaida AsebuqueОценок пока нет

- Outcome Based SHG Lending 3 by Dr.N.JeyaseelanДокумент7 страницOutcome Based SHG Lending 3 by Dr.N.JeyaseelanJeyaseelanОценок пока нет

- Accounting Cycle Requirement 1: Journal Entries T-AccountsДокумент5 страницAccounting Cycle Requirement 1: Journal Entries T-Accountsnerissa belloОценок пока нет

- Schroder GAIA Egerton Equity: Quarterly Fund UpdateДокумент8 страницSchroder GAIA Egerton Equity: Quarterly Fund UpdatejackefellerОценок пока нет

- Simple Deed of Mortgage - Cenotaph Road Land-ITSL ENear Final VersionДокумент37 страницSimple Deed of Mortgage - Cenotaph Road Land-ITSL ENear Final VersionSELMA G.SОценок пока нет

- Lecture-3 & 4 - Common Size and Comparative AnalysisДокумент28 страницLecture-3 & 4 - Common Size and Comparative AnalysissanyaОценок пока нет

- LECTURE/ TUTORIAL 5, 6, 7 - Examples of Present Worth Methods Example-1Документ8 страницLECTURE/ TUTORIAL 5, 6, 7 - Examples of Present Worth Methods Example-1Veejay SalazarОценок пока нет

- Long Problems For Prelim'S Product: Case 1Документ7 страницLong Problems For Prelim'S Product: Case 1Mae AstovezaОценок пока нет

- Do The Math WorkbookДокумент38 страницDo The Math WorkbookJustin CoОценок пока нет

- Muhammad Alfarizi - 142200278 - Ea-J - Tugas 2 Ap2Документ4 страницыMuhammad Alfarizi - 142200278 - Ea-J - Tugas 2 Ap2Muhammad AlfariziОценок пока нет

- Global Economy-Cheat SheetДокумент3 страницыGlobal Economy-Cheat SheetjakeОценок пока нет

- Calculating Contractors MarkupДокумент3 страницыCalculating Contractors MarkupHorace Prophetic DavisОценок пока нет

- Hindu Review January 2024Документ57 страницHindu Review January 2024AshutoshPathakОценок пока нет

- DeliveryHeroSE Annual Financial Statement FinalДокумент108 страницDeliveryHeroSE Annual Financial Statement FinalimranОценок пока нет

- Ali HaiderДокумент68 страницAli HaiderManamОценок пока нет

- Activity of Credit Intermediation and Factoring Companies in PolandДокумент5 страницActivity of Credit Intermediation and Factoring Companies in PolandjournalОценок пока нет