Академический Документы

Профессиональный Документы

Культура Документы

Far 103 - Accounting For Receivables and Notes Receivable PDF

Загружено:

Reyn Saplad PeralesОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Far 103 - Accounting For Receivables and Notes Receivable PDF

Загружено:

Reyn Saplad PeralesАвторское право:

Доступные форматы

ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE – FINANCIAL ACCOUNTING AND

REPORTING

1. On May 1, 2019, Kelly Company sold to Bryer Company merchandise having a list

price of P12,000,000 on account. Kelly Company allowed trade discounts of 20%,

10% and 10%. Terms were 8/10; n/30, FOB shipping point. Kelly Company engages

On-Time Company to deliver the goods.

On May 3, 2019, Bryer Company notified Kelly Company that merchandise with a

selling price of P800,000 contained flaws that rendered it worthless.

Subsequently, Kelly Company issued a credit memo covering the worthless

merchandise.

On May 11, 2019, Kelly Company received a check for the balance due from Byer

Company

A. Prepare all the related journal entries to record the above-mentioned

transactions under the following methods of recording the sale:

a. Gross Method b. Net Method

B. Assuming that the receivables were collected on May 12, 2019. Prepare the

journal entries under the following methods of recording the sale.

a. Gross Method b. Net Method

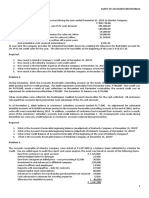

2. On December 31, 2019 the accounts receivable control account of Belle Company

had a balance of P6,150,000. An analysis of the accounts receivable account

showed the following:

Accounts receivable deemed to be worthless P75,000

Advance payments to creditors on purchase orders 300,000

Advances to affiliated companies 750,000

Customer’s credit balance arising from sales return (450,000)

Interest receivable on bond investment 300,000

Other trade receivable – unassigned 1,500,000

Subscription receivable – ordinary share due in 30 1,650,000

days

Trade accounts receivable – assigned 1,125,000

Trade instalment receivable due 1 – 18 months, 637,500

(including unearned finance charges, P37,500)

Trade receivables from officers, due currently 112,500

Trade accounts on which post – dated checks are

held (no entries were made on receipts of checks) 150,000

TOTAL 6,150,000

The correct balance of trade receivables on December 31, 2019 is

3. Willow Company sells products for P650,000 during the amount of February

2019. During 2019 receivables collected totalled P320,000. P8,000 were

written – off as uncollectible and a P1,000 account previously written off

was collected.

Prepare the journal entries necessary to record the preceding information

if:

a. Bad debts are estimated at b. Bad debts are recorded as

3% of sales at the time of sale they actually occur

Source: CRC – ACE Review School

1|Page

ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE – FINANCIAL ACCOUNTING AND

REPORTING

4. The following were abstracted from the records of Hannah Company:

Accounts Receivable, December 31, 2019 P760,000

Allowance for bad debts (before adjustment), Dec 31, 2019 3,500

Sales, 2019 2,500,000

Sales discounts, 2019 20,000

Sales returns, 2019 30,000

Determine the bad debt expense and allowance for bad debts

Bad debt Allowance for

expense bad debts

a. Bad debts based on 0.4% of net

sales

b. Bad debts based on 2.5% of

outstanding accounts receivable

c. Aging analysis of which P18,000 of

the accounts are uncollectible

5. On December 31, 2019, before any adjustments, the balances in Mack Company’s

Accounts Receivable account has a debit balance of P1,300,000 and allowance

for bad debts had a credit balance of P50,000.

The year end balance reported in the balance sheet for the Allowance for bad

debts will be based on the aging of schedule shown below:

Days Outstanding Amount % of Collectability

1-30 days past due P850,000 .98

31-60 days past due 260,000 .95

61-90 days past due 100,000 .90

91-120 days past due 50,000 .80

Over 120 days past due 40,000 .50

Total receivables written-off during the year totalled P30,000; while total

recoveries of previously written-off accounts during the year totalled P9,000.

a. The adjusted Allowance for bad debts on December 31, 2019

b. The amount to be reported as bad debts expense for 2019

6. The following was made available about Luke Company’s receivables:

Accounts Receivable January 1 350,000

Allowance for uncollectible accounts, Jan 1 35,000

Sales – all on credit 2,195,000

Sales returns and allowances 5,000

Cash collected from customers’ current accounts,

net of sales discounts of P5,000 2,110,000

Accounts written off during the year 30,000

Recoveries of accounts written off in the

previous year 7,000

Actual credit sales and uncollectible accounts for the previous years:

Year Net Credit Sales Uncollectible Accounts

2016 P1,100,000 32,000

2017 1,200,000 40,000

2018 1,350,000 55,750

An aging of he receivables at December 31, 2019 indicated the following:

Age % AR end Probability of Collection

Current 80% 90%

31-60 days 12% 85%

61-89 7% 50%

Over 90 days 1% 1%

Source: CRC – ACE Review School

2|Page

ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE – FINANCIAL ACCOUNTING AND

REPORTING

Determine the bad debt expense for 2019 and the related allowance at December

31, 2019 under

Bad debt Allowance for

expense bad debts

a. Percentage of net credit sales

b. Aging of the receivables

7. On January 1, 2019, DC Company sold land costing P850,000 and received in

exchange a four year note with a face amount of P1,300,000 bearing a rate of

19% which approximates the current interest rate in the market. DC Company

uses the calendar year for reporting purposes.

a. Gain on sale of the land is

b. Carrying value of the note in December 31, 2019

c. Interest income for 2020

8. On October 1, 2019, Marvel Company sold land costing P3,000,000 and received

in exchange a note with face amount of P4,250,000 and a maturity date of

October 1, 2024. It bears an interest rate of 8% which approximates the current

interest rates in the market. Marvel Company uses the calendar year for

reporting purposes

a. Selling price of the land

b. Note receivable amount reported in the current section of the 2019

statement of financial position

c. Interest income to be reported in 2020

9. On August 1, 2016, Superman Company sold an equipment with a carrying amount

of P750,000 and received as payment a 9% 1,000,000 face value note. Equal

principal payments plus interest are due every August 1, from 2017 to 2020.

The first principal payment was made on August 1, 2017. Superman Company uses

the calendar year for reporting purposes.

a. Gain or loss on the sale of equipment

b. Interest income for 2017

c. Carrying value of the notes receivable account on December 31, 2017

10. Captain America sold an equipment on January 2, 2019. The agreed price was

P3,000,000. A P1,000,000 down payment was received, and Captain America Company

accepted a mortgage note for the balance. The note shall carry a 10% rate of

interest (computed on the unpaid balance) for 5-year period. Equal payments

are to be made at the end of each year beginning December 31, 2019. Captain

America Company’s accounting period ends on December 31.

a. Annual collection

b. Interest income 2016 and 2017

c. Notes receivable reported in the current section of the December 31, 2017

statement of financial position.

11. On April 1, 2016, Batman Company sold a merchandise to Bruce Enterprises in

exchange for a P525,000 non-interest bearing note due on April 1, 2020. There

was no established exchange price for the equipment and the note has no ready

market. The prevailing rate of interest for a note of this type at April 1,

2016 was 12%. The equipment had a carrying value of P170,000 at the time of

sale. The collection of the note from Bruce Enterprises is reasonably assured.

Batman Company uses calendar year for reporting purposes.

a. Initial measurement of the notes receivable

b. Interest income for 2017

c. Unearned interest at December 31, 2018

12. On January 1, 2016, Iron Man Company sold a parcel of land which it has

acquired previously for P300,000 and received in exchange a non-interest

bearing note whose face value amounted to P900,000. The note shall be collected

every December 31, as follows P200,000 in 2016; P300,000 in 2017; and P400,000

in 2018. The effective interest rate for a similar note was 6%. Iron Man

Company uses calendar the calendar year for reporting purposes.

a. Gain or loss on the sale of land

b. Notes receivable reported in the non-current portion in the December 31,

2016 statement of financial position

c. Interest income for 2018

Source: CRC – ACE Review School

3|Page

ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE – FINANCIAL ACCOUNTING AND

REPORTING

13. On January 1, 2016, Flash Company sold used equipment to Barry Company and

received a non-interest bearing note requiring payment of P40,000 annually

for 8 years. The first payment is due on December 31, 2016 and the prevailing

rate of interest for this type of note at date of issuance was 8%. The

equipment’s carrying amount on January 1, 2016 was P185,000. Flash uses

calendar the calendar year for reporting purposes.

a. The gain or loss on the sale of the equipment is

b. The amount credited to notes receivable account to record the collection

on December 31, 2016

c. Interest income for 2018

14. On January 1, 2016, Thor Company sold Asgard Company goods costing P110,000

and received a note having a face amount of P250,000. The note requires Asgard

Company, the buyer to pay five equal annual instalment starting January 1,

2016. No interest rate was stipulated in the note. A note of a similar

characteristic would bear a market rate of 8%. Collection of the note is

reasonably assured. Thor Company uses calendar the calendar year for reporting

purposes.

a. Initial recording to notes receivable on January 1, 2016

b. Interest income for 2017

15. On January 1, 2016, Aqua Man Company sold goods costing P275,000 to Atlantis

Company. As payment, Atlantis Company gave Aqua Man Company a P700,000 face

value note. The note bears an interest rate of 4% and shall be repaid in 4

annual instalments of P175,000, plus interest based on the outstanding

balance. The first payment is due on December 31, 2016. The market price of

the land is not reliably determinable. Prevailing interest rate for a note of

this type is 12%

a. Amount recorded as sales

b. Interest income for 2017

Source: CRC – ACE Review School

4|Page

Вам также может понравиться

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)От EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Рейтинг: 4.5 из 5 звезд4.5/5 (5)

- Outline of NESARA GESARA - 2023Документ14 страницOutline of NESARA GESARA - 2023jpes100% (4)

- Calculate Long-Term Receivables for NGO CorporationДокумент8 страницCalculate Long-Term Receivables for NGO CorporationCindy CrausОценок пока нет

- Financial Accounting and ReportingДокумент26 страницFinancial Accounting and ReportingJanaela89% (45)

- FAR-01 Trade & Other PayableДокумент3 страницыFAR-01 Trade & Other PayablehIgh QuaLIty SVT100% (1)

- Required Ending Allowance For Doubtful AccountsДокумент4 страницыRequired Ending Allowance For Doubtful AccountsAngelica SamonteОценок пока нет

- Central Corp 2019 Financial PositionДокумент3 страницыCentral Corp 2019 Financial PositionGlen Javellana50% (2)

- FAR First Pre BoardДокумент18 страницFAR First Pre BoardKIM RAGAОценок пока нет

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОт EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionОценок пока нет

- Intermediate Accounting 1Документ12 страницIntermediate Accounting 1Walter Peralta100% (1)

- 10, Intengan Vs CAДокумент2 страницы10, Intengan Vs CABOEN YATORОценок пока нет

- BSE StAR MF USER MANUAL FOR MFD PDFДокумент23 страницыBSE StAR MF USER MANUAL FOR MFD PDFssddnОценок пока нет

- Quiz AP Receivables 2ndsetДокумент7 страницQuiz AP Receivables 2ndsetMaritessОценок пока нет

- Practice Problems Account ReceivableДокумент14 страницPractice Problems Account ReceivableDonna Zandueta-TumalaОценок пока нет

- Receivables ProblemsДокумент13 страницReceivables ProblemsIris Mnemosyne0% (1)

- Quiz - Cash and AccrualДокумент2 страницыQuiz - Cash and AccrualJamaica SaquilabonОценок пока нет

- Electronic Payment Systems Security and Protocols ExplainedДокумент36 страницElectronic Payment Systems Security and Protocols ExplainedPaksmilerОценок пока нет

- Boscalt Hospitality Fund PitchbookДокумент71 страницаBoscalt Hospitality Fund PitchbookrenatafornilloОценок пока нет

- Seatwork 3-Liabilities 22Aug2019JMДокумент3 страницыSeatwork 3-Liabilities 22Aug2019JMJoseph II MendozaОценок пока нет

- Proof of Cash: Irene Mae C. Guerra, CPAДокумент17 страницProof of Cash: Irene Mae C. Guerra, CPAjeams vidalОценок пока нет

- ReSA CPA Review Batch 41 Audit Problems Weeks 1-3Документ4 страницыReSA CPA Review Batch 41 Audit Problems Weeks 1-3Angela AlejandroОценок пока нет

- Chapter-4 Homework ReceivablesДокумент3 страницыChapter-4 Homework ReceivablesKenneth Christian WilburОценок пока нет

- FAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFДокумент4 страницыFAR 103 ACCOUNTING FOR RECEIVABLES AND NOTES RECEIVABLE PDF PDFvhhhОценок пока нет

- HO 2 Receivables PDFДокумент4 страницыHO 2 Receivables PDFIzzy BОценок пока нет

- Cash To InventoryДокумент6 страницCash To InventoryEdmar HalogОценок пока нет

- Accounts Receivable Aging AnalysisДокумент5 страницAccounts Receivable Aging AnalysisFurtunato LepornioОценок пока нет

- Receivables Problem 5Документ2 страницыReceivables Problem 5Ken Ashton NombradoОценок пока нет

- Practice Problems AR and NotesДокумент7 страницPractice Problems AR and NotesDonna Zandueta-TumalaОценок пока нет

- ReceivableДокумент3 страницыReceivableBellaОценок пока нет

- Far FPBДокумент16 страницFar FPBMae Marcos SaguipedОценок пока нет

- Audit ReviewДокумент9 страницAudit ReviewephraimОценок пока нет

- Assignment No. 2 Audit of ReceivablesДокумент5 страницAssignment No. 2 Audit of ReceivablesMa Tiffany Gura RobleОценок пока нет

- Compre 2 - Far1Документ5 страницCompre 2 - Far1Mary Alyssa Claire Capate IIОценок пока нет

- Problems - Docx 1Документ25 страницProblems - Docx 1You Knock On My DoorОценок пока нет

- Local Media271226407970108268Документ17 страницLocal Media271226407970108268Jana Rose PaladaОценок пока нет

- HW On Receivables CДокумент5 страницHW On Receivables CAmjad Rian MangondatoОценок пока нет

- Soal P 7.2, 7.3, 7.5Документ3 страницыSoal P 7.2, 7.3, 7.5boba milkОценок пока нет

- Receivables Mock QuizДокумент5 страницReceivables Mock QuizChester CariitОценок пока нет

- Audit of Accounts ReceivablesДокумент5 страницAudit of Accounts ReceivablesIzza Mae Rivera KarimОценок пока нет

- Chapter 3Документ6 страницChapter 3You Knock On My DoorОценок пока нет

- Statement of Financial PositionДокумент3 страницыStatement of Financial PositionDJ NicartОценок пока нет

- Chapter 3Документ7 страницChapter 3Coursehero PremiumОценок пока нет

- ACC 122 Intermediate Accounting I Dean's Exam ReviewДокумент11 страницACC 122 Intermediate Accounting I Dean's Exam ReviewJaselle SanchezОценок пока нет

- Far 6660Документ2 страницыFar 6660Glessy Anne Marie FernandezОценок пока нет

- Current Liabilities GuideДокумент3 страницыCurrent Liabilities GuideKim Cristian MaañoОценок пока нет

- UNIT 1 Discussion ProblemsДокумент13 страницUNIT 1 Discussion ProblemsMarynelle Labrador SevillaОценок пока нет

- Assessment Part 1Документ5 страницAssessment Part 1RoNnie RonNieОценок пока нет

- D. Discounted - YES Pledged - NOДокумент9 страницD. Discounted - YES Pledged - NOJasper LuagueОценок пока нет

- 7293 - Accrual BasisДокумент2 страницы7293 - Accrual BasisJulia MirhanОценок пока нет

- ACCTG102 Midterm ExaminationДокумент9 страницACCTG102 Midterm ExaminationJimbo Manalastas100% (1)

- Quizzer 1Документ4 страницыQuizzer 1Arvin John MasuelaОценок пока нет

- Midterm Examination Suggested AnswersДокумент9 страницMidterm Examination Suggested AnswersJoshua CaraldeОценок пока нет

- Riyadh Final PB Far 2019Документ17 страницRiyadh Final PB Far 2019jhaizonОценок пока нет

- Au Ia1 Midterm ExamДокумент4 страницыAu Ia1 Midterm ExamCherrylane EdicaОценок пока нет

- AP Receivables PSBAДокумент17 страницAP Receivables PSBAephraimОценок пока нет

- Quiz on LiabilitiesДокумент5 страницQuiz on LiabilitiesDewdrop Mae RafananОценок пока нет

- MidtermsДокумент8 страницMidtermsRhea BadanaОценок пока нет

- Midterm ExaminationДокумент6 страницMidterm ExaminationJamie Rose Aragones100% (1)

- Sabina Company Quiz #1 Questions and SolutionsДокумент6 страницSabina Company Quiz #1 Questions and SolutionsJames Daniel SwintonОценок пока нет

- Receivables QuizДокумент3 страницыReceivables QuizAshianna KimОценок пока нет

- Audit of Other Income Statement ComponentsДокумент6 страницAudit of Other Income Statement ComponentsVip BigbangОценок пока нет

- Financial LiabilitiesДокумент4 страницыFinancial LiabilitiesNicah AcojonОценок пока нет

- Mock Board Exam QuestionsДокумент7 страницMock Board Exam QuestionsKenneth Christian WilburОценок пока нет

- FAR Practice ProblemsДокумент34 страницыFAR Practice ProblemsJhon Eljun Yuto EnopiaОценок пока нет

- INTACCTG2 Assignment Statement of Comprehensive Income Financial Position Final Revised PDFДокумент2 страницыINTACCTG2 Assignment Statement of Comprehensive Income Financial Position Final Revised PDFUnnamed homosapienОценок пока нет

- One Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020От EverandOne Year of Living with COVID-19: An Assessment of How ADB Members Fought the Pandemic in 2020Оценок пока нет

- Syllabus Math InvestmentДокумент8 страницSyllabus Math InvestmentMphilipTОценок пока нет

- LKG 2022-23 Fee Declaration FormДокумент1 страницаLKG 2022-23 Fee Declaration Formnayan mulkiОценок пока нет

- Accounting IQ TestДокумент12 страницAccounting IQ TestHarichandra Patil100% (3)

- Debt Invetment: Summary: InvestmentДокумент3 страницыDebt Invetment: Summary: InvestmentEphine PutriОценок пока нет

- Set A Merchandising Vat QuizДокумент6 страницSet A Merchandising Vat QuizJan Allyson BiagОценок пока нет

- BPO Frequently Asked Questions Corporates May2018 FinalДокумент10 страницBPO Frequently Asked Questions Corporates May2018 FinalMuthu SelvanОценок пока нет

- FINANCE 481 Group 2 10-19Документ5 страницFINANCE 481 Group 2 10-19JerodОценок пока нет

- Mini Centrale Electrique Autonome Hybride PV Diesel Master MHPV Ed1Документ2 страницыMini Centrale Electrique Autonome Hybride PV Diesel Master MHPV Ed1Faly RalisonОценок пока нет

- Annual Report 2020 - PT MDS TBKДокумент306 страницAnnual Report 2020 - PT MDS TBKyanuar buanaОценок пока нет

- Applying CAPM to Capital BudgetingДокумент3 страницыApplying CAPM to Capital BudgetingMohamed Al-WakilОценок пока нет

- TVMДокумент1 страницаTVMrabiaОценок пока нет

- Purchase Order Sheet: Unico Global IncДокумент1 страницаPurchase Order Sheet: Unico Global IncSang HàОценок пока нет

- FINA2010 Financial Management: Lecture 2: Financial Statement AnalysisДокумент68 страницFINA2010 Financial Management: Lecture 2: Financial Statement AnalysismoonОценок пока нет

- Toa Valix Vol 1Документ451 страницаToa Valix Vol 1Joseph Andrei BunadoОценок пока нет

- Calculate WACC to Evaluate New ProjectsДокумент52 страницыCalculate WACC to Evaluate New ProjectsksachchuОценок пока нет

- MCB Bank InformationДокумент26 страницMCB Bank Informationatifatanvir1758Оценок пока нет

- Econ Unit Vecab Crossword AnswersДокумент2 страницыEcon Unit Vecab Crossword Answersapi-242800256100% (1)

- E-Payment in GhanaДокумент32 страницыE-Payment in GhanaSammy AcquahОценок пока нет

- CH-5 Business CombinationsДокумент52 страницыCH-5 Business CombinationsRam KumarОценок пока нет

- 18.1 P4 - LEMBAR KERJA-AkuntansiДокумент40 страниц18.1 P4 - LEMBAR KERJA-Akuntansisiwi tri utamiОценок пока нет

- FIN 6060 Module 2 WorksheetДокумент2 страницыFIN 6060 Module 2 WorksheetemoshokemehgraceОценок пока нет

- Finance Management HW Week 5Документ8 страницFinance Management HW Week 5arwa_mukadam03Оценок пока нет

- Regulation of Currency in IndiaДокумент9 страницRegulation of Currency in Indiaindiangamer18Оценок пока нет

- Horizon Kinetics: Q4-2021-Quarterly-Review - FINALДокумент32 страницыHorizon Kinetics: Q4-2021-Quarterly-Review - FINALTBoone0Оценок пока нет