Академический Документы

Профессиональный Документы

Культура Документы

IAS-27: Conceptual Test

Загружено:

Babu babu0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров1 страницаA Ltd acquired 45% of shares in B Ltd for Tk 5 lakhs. B Ltd's balance sheet as of 31.3.2010 shows total equity of Tk 10 lakhs from share capital and reserves. In 2011, A Ltd received dividend from B Ltd's reserves from 2010, and B Ltd made a profit of Tk 7 lakhs and declared a dividend of 50% for 2011. A Ltd must prepare consolidated financial statements according to IAS-27 and determine any goodwill from acquiring B Ltd, how to reflect the value of its investment in B Ltd, and how to show the dividend received from B Ltd.

Исходное описание:

Оригинальное название

A Ltd.docx

Авторское право

© © All Rights Reserved

Доступные форматы

DOCX, PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документA Ltd acquired 45% of shares in B Ltd for Tk 5 lakhs. B Ltd's balance sheet as of 31.3.2010 shows total equity of Tk 10 lakhs from share capital and reserves. In 2011, A Ltd received dividend from B Ltd's reserves from 2010, and B Ltd made a profit of Tk 7 lakhs and declared a dividend of 50% for 2011. A Ltd must prepare consolidated financial statements according to IAS-27 and determine any goodwill from acquiring B Ltd, how to reflect the value of its investment in B Ltd, and how to show the dividend received from B Ltd.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров1 страницаIAS-27: Conceptual Test

Загружено:

Babu babuA Ltd acquired 45% of shares in B Ltd for Tk 5 lakhs. B Ltd's balance sheet as of 31.3.2010 shows total equity of Tk 10 lakhs from share capital and reserves. In 2011, A Ltd received dividend from B Ltd's reserves from 2010, and B Ltd made a profit of Tk 7 lakhs and declared a dividend of 50% for 2011. A Ltd must prepare consolidated financial statements according to IAS-27 and determine any goodwill from acquiring B Ltd, how to reflect the value of its investment in B Ltd, and how to show the dividend received from B Ltd.

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате DOCX, PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 1

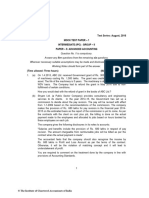

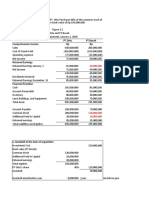

IAS-27: Conceptual Test

A Ltd. acquired 45% of shares in B Ltd. as on 31.3.2010 for Tk.5 lakhs. The Balance Sheet

of B Ltd. as on 31.3.2010 is given below :

Taka

Share Capital 5,00,000

Reserves and Surplus 5,00,000

Total Equity 10,00,000

Fixed Assets 5,00,000

Investments 2,00,000

Current Assets 3,00,000

Total Assets 10,00,000

During the year ended 31.3.2011 the following are the additional information available:

1. A Ltd. received dividend from B Ltd., for the year ended 31.3.2010 at 40% from the

Reserves.

2. B Ltd. made a profit after tax of Tk.7 lakhs for the year ended 31.3.2011.

3. B Ltd. declared a dividend @ 50% for the year ended 31.3.2011 on 30.4.2011.

A Ltd. is preparing Consolidated Financial Statements in accordance with IAS-27 for its

various subsidiaries.

Required:

a) Goodwill if any on acquisition of B Ltd.’s shares.

b) How A Ltd., will reflect the value of investment in B Ltd., in the Consolidated Financial

Statements?

c) How the dividend received from B Ltd. will be shown in the Consolidated Financial

Statements?

Вам также может понравиться

- Handout 2 - Introduction To Auditing and Assurance of Specialized IndustriesДокумент2 страницыHandout 2 - Introduction To Auditing and Assurance of Specialized IndustriesPotato CommissionerОценок пока нет

- HKICPA QP Exam (Module A) Sep2006 Question PaperДокумент7 страницHKICPA QP Exam (Module A) Sep2006 Question Papercynthia tsuiОценок пока нет

- Factors Affecting Exchange RatesДокумент2 страницыFactors Affecting Exchange Ratesanish-kc-8151Оценок пока нет

- Consolidation Notes Complex Group StructuresДокумент6 страницConsolidation Notes Complex Group StructuresRobert MunyaradziОценок пока нет

- Documentary Stampt Tax: Prepared By: Nelia I. Tomas, CPA, LPTДокумент44 страницыDocumentary Stampt Tax: Prepared By: Nelia I. Tomas, CPA, LPTTokis Saba100% (1)

- Accounting For Special Transactions Partnership AccountingДокумент15 страницAccounting For Special Transactions Partnership AccountingJessaОценок пока нет

- Report TimkenДокумент45 страницReport TimkenVubon Minu50% (4)

- Financial Performance Analysis Mba Project Report DownloadДокумент3 страницыFinancial Performance Analysis Mba Project Report DownloadAhamed Ibrahim100% (3)

- Audit of Shareholder's EquityДокумент4 страницыAudit of Shareholder's EquityRosalie Colarte LangbayОценок пока нет

- HKICPA QP Exam (Module A) May2007 Question PaperДокумент7 страницHKICPA QP Exam (Module A) May2007 Question Papercynthia tsuiОценок пока нет

- Audit of Shareholder's EquityДокумент6 страницAudit of Shareholder's EquityRosalie Colarte LangbayОценок пока нет

- Consolidation TutorialДокумент8 страницConsolidation TutorialPrageeth Roshan WeerathungaОценок пока нет

- Corporate Financial Accounting Chapter - I Corporate Financial ReportingДокумент35 страницCorporate Financial Accounting Chapter - I Corporate Financial ReportingSWAPNIL JADHAVОценок пока нет

- Adv Acc Q.P 2Документ7 страницAdv Acc Q.P 2Swetha ReddyОценок пока нет

- Advanced FA I - Individual Assignment 1Документ4 страницыAdvanced FA I - Individual Assignment 1Hawultu AsresieОценок пока нет

- Simple Problems On NCIДокумент8 страницSimple Problems On NCIKiran Kumar KBОценок пока нет

- Consolidation Part 1Документ11 страницConsolidation Part 1Benita BijuОценок пока нет

- Consolidation Question PaperДокумент42 страницыConsolidation Question PaperNick VincikОценок пока нет

- Orion Academy: Class Test - TYBCOM - 2018-19 Marks: 30Документ2 страницыOrion Academy: Class Test - TYBCOM - 2018-19 Marks: 30Amarjeet GuptaОценок пока нет

- Consolidated Financial StatementsДокумент29 страницConsolidated Financial StatementsPramad BhattacharjeeОценок пока нет

- Paper18 Solution PDFДокумент24 страницыPaper18 Solution PDFI'm Just FunnyОценок пока нет

- CASH FLOW Revision-1 PDFДокумент12 страницCASH FLOW Revision-1 PDFBHUMIKA JAINОценок пока нет

- HD Book 5Документ4 страницыHD Book 5humphrey daimonОценок пока нет

- Unit-2 Sums SheetДокумент8 страницUnit-2 Sums SheetAstha ParmanandkaОценок пока нет

- 12 Acs (S) - Set A 19.7.2021Документ3 страницы12 Acs (S) - Set A 19.7.2021Sakshi NagotkarОценок пока нет

- Sums On Consolidation 2020 PDFДокумент3 страницыSums On Consolidation 2020 PDFRohan DharneОценок пока нет

- MTP Nov 16 Grp-2 (Series - I)Документ58 страницMTP Nov 16 Grp-2 (Series - I)keshav rakhejaОценок пока нет

- BB0017 - Financial Reporting - Fall-10Документ2 страницыBB0017 - Financial Reporting - Fall-10Safa ShafiqОценок пока нет

- 2017 MJДокумент4 страницы2017 MJRasel AshrafulОценок пока нет

- F2 Questions November 2010Документ20 страницF2 Questions November 2010Robert MunyaradziОценок пока нет

- 3526 - 25114 - Textbooksolution - PDF 3Документ108 страниц3526 - 25114 - Textbooksolution - PDF 3dhanuka jiОценок пока нет

- Paper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Документ52 страницыPaper - 1: Financial Reporting Questions Consolidated Balance Sheet (Chain Holding)Anonymous duzV27Mx3Оценок пока нет

- Q1 From The Following Particulars of XYZ Ltd. Prepare The Cash Flow StatementДокумент2 страницыQ1 From The Following Particulars of XYZ Ltd. Prepare The Cash Flow StatementSuvam PatelОценок пока нет

- Corporate Accounting - IIДокумент2 страницыCorporate Accounting - IISiva KumarОценок пока нет

- Accounting Redemption of Debentures 1642416359Документ19 страницAccounting Redemption of Debentures 1642416359Shashank SikarwarОценок пока нет

- Introduction To Group Statements - FASSET Class - 15 May 2021Документ22 страницыIntroduction To Group Statements - FASSET Class - 15 May 2021Mike NdunaОценок пока нет

- EXERCISE Cashflow of The CompanyДокумент41 страницаEXERCISE Cashflow of The CompanyDev lakhaniОценок пока нет

- Advanced Financial Accounting Group A SolutionДокумент6 страницAdvanced Financial Accounting Group A SolutionNajmul IslamОценок пока нет

- PQ - Covnersion Partnership To CompanyДокумент8 страницPQ - Covnersion Partnership To CompanyAnshul BiyaniОценок пока нет

- Important Que Advanced Cor AccДокумент18 страницImportant Que Advanced Cor Accvineethaj2004Оценок пока нет

- Xii AccДокумент3 страницыXii Accantonytreesa8Оценок пока нет

- B4 IfaДокумент4 страницыB4 IfaadnanОценок пока нет

- Business Combination Illustration 3Документ57 страницBusiness Combination Illustration 3Ash CastroОценок пока нет

- Financial & Corporate Reporting: RequirementДокумент6 страницFinancial & Corporate Reporting: RequirementTawsif HasanОценок пока нет

- Chapter 4 - Financial Statements of CompaniesДокумент198 страницChapter 4 - Financial Statements of CompaniesVaidehee MishraОценок пока нет

- 3-Company - Formation Final Account and DividendДокумент26 страниц3-Company - Formation Final Account and DividendSudipta MallickОценок пока нет

- Holding Company ProblemsДокумент22 страницыHolding Company ProblemsYashodhan MithareОценок пока нет

- CA Inter Adv. Accounting Top 50 Question May 2021Документ117 страницCA Inter Adv. Accounting Top 50 Question May 2021Sumitra yadavОценок пока нет

- DK Goal 4Документ147 страницDK Goal 4sahiltiwariii225Оценок пока нет

- AccountancyДокумент32 страницыAccountancysunil kumarОценок пока нет

- Financial Statement of CompaniesДокумент35 страницFinancial Statement of CompaniesTanyaОценок пока нет

- Chương 3Документ22 страницыChương 3Mai Duong ThiОценок пока нет

- PT Ortu PT Bocah Comprehensive Income RP RPДокумент8 страницPT Ortu PT Bocah Comprehensive Income RP RPNcim PoОценок пока нет

- Paper 33Документ6 страницPaper 33AVS InfraОценок пока нет

- CRV - Valuation - ExerciseДокумент15 страницCRV - Valuation - ExerciseVrutika ShahОценок пока нет

- AFM-Assignment-2021: Trial Balance As On 31 March 2015Документ1 страницаAFM-Assignment-2021: Trial Balance As On 31 March 2015SILLA SAIKUMARОценок пока нет

- Crash MysoreДокумент40 страницCrash MysoreyashbhardwajОценок пока нет

- Quiz 4 Ch7 Questions SentДокумент2 страницыQuiz 4 Ch7 Questions SentLiandra AmorОценок пока нет

- Cma December-2018 Examination Management Level Subject: F2. Financial ManagementДокумент11 страницCma December-2018 Examination Management Level Subject: F2. Financial ManagementRashed AliОценок пока нет

- © The Institute of Chartered Accountants of IndiaДокумент56 страниц© The Institute of Chartered Accountants of IndiaTejaОценок пока нет

- Principles of Consolidated Financial Statements Test Your Understanding 1Документ17 страницPrinciples of Consolidated Financial Statements Test Your Understanding 1sandeep gyawaliОценок пока нет

- Practice - Exercise Consolidated - Balance - Sheet 17 06 2014Документ7 страницPractice - Exercise Consolidated - Balance - Sheet 17 06 2014Deepika PadukoneОценок пока нет

- Paper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Документ56 страницPaper - 5: Advanced Accounting Questions Answer The Following (Give Adequate Working Notes in Support of Your Answer)Basant OjhaОценок пока нет

- Example 7Документ1 страницаExample 7Babu babuОценок пока нет

- IAS-33: Earnings Per ShareДокумент1 страницаIAS-33: Earnings Per ShareBabu babuОценок пока нет

- ExampleДокумент1 страницаExampleBabu babuОценок пока нет

- Eps 33Документ1 страницаEps 33Babu babuОценок пока нет

- XYZ Limited Is A Public Company Listed With Dhaka Stock Exchange. The Paid Up Capital of TheДокумент2 страницыXYZ Limited Is A Public Company Listed With Dhaka Stock Exchange. The Paid Up Capital of TheBabu babuОценок пока нет

- Earnings Per Share (IAS-33) : Examples of Potential Ordinary SharesДокумент1 страницаEarnings Per Share (IAS-33) : Examples of Potential Ordinary SharesBabu babuОценок пока нет

- Eps 33Документ1 страницаEps 33Babu babuОценок пока нет

- Afa-I: Advanced Financial Accounting - IДокумент1 страницаAfa-I: Advanced Financial Accounting - IBabu babuОценок пока нет

- IAS-33: Earnings Per ShareДокумент1 страницаIAS-33: Earnings Per ShareBabu babuОценок пока нет

- Earnings Per ShareДокумент1 страницаEarnings Per ShareBabu babuОценок пока нет

- IAS-33: Earnings Per ShareДокумент1 страницаIAS-33: Earnings Per ShareBabu babuОценок пока нет

- Earnings Per Share (IAS-33) : Common Examples of Potential Ordinary SharesДокумент1 страницаEarnings Per Share (IAS-33) : Common Examples of Potential Ordinary SharesBabu babuОценок пока нет

- IAS-33: Earnings Per ShareДокумент1 страницаIAS-33: Earnings Per ShareBabu babuОценок пока нет

- Important Sections of Companies Act-1994:, Schedule-IДокумент12 страницImportant Sections of Companies Act-1994:, Schedule-IBabu babuОценок пока нет

- During 2002 Peerless Company Started A Construction Job WithДокумент2 страницыDuring 2002 Peerless Company Started A Construction Job WithBabu babuОценок пока нет

- Résumé Of: Career VisionДокумент4 страницыRésumé Of: Career VisionBabu babuОценок пока нет

- DiscloДокумент3 страницыDiscloBabu babuОценок пока нет

- Consolidated Balance Sheet: RequiredДокумент1 страницаConsolidated Balance Sheet: RequiredBabu babuОценок пока нет

- Disclosure of Construction Contact (IAS-11) : For Contracts in Progress at Balance Sheet DateДокумент1 страницаDisclosure of Construction Contact (IAS-11) : For Contracts in Progress at Balance Sheet DateBabu babuОценок пока нет

- Share Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessДокумент17 страницShare Premium: Shill # 18c-4 Sheet # 20 1 Income From Business or Profession (U/s-28) : Taka Taka LessBabu babuОценок пока нет

- Net Profit Attributable To Ordinary Shareholders:: Page 1 of 4Документ4 страницыNet Profit Attributable To Ordinary Shareholders:: Page 1 of 4Babu babuОценок пока нет

- ClasДокумент1 страницаClasBabu babuОценок пока нет

- Contingent - LiabilityДокумент5 страницContingent - LiabilityBabu babuОценок пока нет

- DiscloДокумент3 страницыDiscloBabu babuОценок пока нет

- Disclosure of Construction Contact (IAS-11) : For Contracts in Progress at Balance Sheet DateДокумент1 страницаDisclosure of Construction Contact (IAS-11) : For Contracts in Progress at Balance Sheet DateBabu babuОценок пока нет

- A Firm of Contractors Obtained A Contract For Construction of Bridges Across A RiverДокумент1 страницаA Firm of Contractors Obtained A Contract For Construction of Bridges Across A RiverBabu babuОценок пока нет

- A Firm of Contractors Obtained A Contract For Construction of Bridges Across A RiverДокумент1 страницаA Firm of Contractors Obtained A Contract For Construction of Bridges Across A RiverBabu babuОценок пока нет

- Module-1 Fundamentals: New Syllabus (Effective From January-2011)Документ2 страницыModule-1 Fundamentals: New Syllabus (Effective From January-2011)Babu babuОценок пока нет

- Net Profit Attributable To Ordinary Shareholders:: Page 1 of 4Документ4 страницыNet Profit Attributable To Ordinary Shareholders:: Page 1 of 4Babu babuОценок пока нет

- Construction Contracts: International Accounting Standard 11Документ5 страницConstruction Contracts: International Accounting Standard 11Babu babuОценок пока нет

- Manhattan Resources 3Q15 Press ReleaseДокумент3 страницыManhattan Resources 3Q15 Press ReleaseTony LeongОценок пока нет

- What Is Insurance and Why You Need It!Документ2 страницыWhat Is Insurance and Why You Need It!FACTS- WORLDОценок пока нет

- Freight Out or Delivery Expenses or TransportationДокумент4 страницыFreight Out or Delivery Expenses or TransportationMichelle GoОценок пока нет

- Date Narration Chq/Ref No Withdrawal (DR) Balance Deposit (CR)Документ23 страницыDate Narration Chq/Ref No Withdrawal (DR) Balance Deposit (CR)Vinay TataОценок пока нет

- How To Write A Financial PlanДокумент6 страницHow To Write A Financial PlanGokul SoodОценок пока нет

- Vitthal Mandir Audit ReportДокумент4 страницыVitthal Mandir Audit ReportHindu Janajagruti SamitiОценок пока нет

- Level I R08 Probability Concepts: Test Code: L1 R08 PRCO Q-Bank 2020Документ11 страницLevel I R08 Probability Concepts: Test Code: L1 R08 PRCO Q-Bank 2020Tsaone FoxОценок пока нет

- Study CarrefourДокумент2 страницыStudy CarrefourTriyono AeОценок пока нет

- Chap 02-Analyzing TransactionsДокумент51 страницаChap 02-Analyzing TransactionsJean Coul100% (1)

- Chapter 31Документ9 страницChapter 31narasimhaОценок пока нет

- Charrie Mae MДокумент2 страницыCharrie Mae MRaymond GanОценок пока нет

- The Indian Capital Market - An Overview: Chapter-1 Gagandeep SinghДокумент45 страницThe Indian Capital Market - An Overview: Chapter-1 Gagandeep SinghgaganОценок пока нет

- 184733Документ2 страницы184733Rosemarie AgcaoiliОценок пока нет

- Đề thi thử Deloitte-ACE Intern 2021Документ60 страницĐề thi thử Deloitte-ACE Intern 2021Đặng Trần Huyền TrâmОценок пока нет

- 2022 Term 2 JC 2 H1 Economics SOW (Final) - Students'Документ5 страниц2022 Term 2 JC 2 H1 Economics SOW (Final) - Students'PROgamer GTОценок пока нет

- Handbook Iberico 2018 WebДокумент329 страницHandbook Iberico 2018 WebspachecofdzОценок пока нет

- Deed of Sale of Motor Vehicle With Assumption of Mortgage 1Документ3 страницыDeed of Sale of Motor Vehicle With Assumption of Mortgage 1Richelle TanОценок пока нет

- Chapter 22Документ8 страницChapter 22GONZALES, MICA ANGEL A.Оценок пока нет

- Abm Act 3 FinalДокумент6 страницAbm Act 3 FinalJasper Briones IIОценок пока нет

- IfsДокумент23 страницыIfsRahul Kumar JainОценок пока нет

- Basic Information: Guide in Filling Out Saln 2021 ObjectivesДокумент4 страницыBasic Information: Guide in Filling Out Saln 2021 ObjectivesArjay DioknoОценок пока нет

- Time Value of Money TVMДокумент48 страницTime Value of Money TVMNikita KumariОценок пока нет

- Individual Account ApplicationДокумент5 страницIndividual Account ApplicationZaineb AbbadОценок пока нет

- Company Master Data: ChargesДокумент2 страницыCompany Master Data: ChargesNaresh KarmakarОценок пока нет

- A Study On Retail Loans, at UTI Bank Retail Asset CentreДокумент74 страницыA Study On Retail Loans, at UTI Bank Retail Asset CentreBilal Ahmad LoneОценок пока нет