Академический Документы

Профессиональный Документы

Культура Документы

Shs - Acctg. 1 Fundamentals of Accountancy Reviewer: "Try Not To Become A Man of Success. Rather Become A Man of Value."

Загружено:

louisa sabalbarinoОригинальное название

Авторское право

Доступные форматы

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документАвторское право:

Доступные форматы

Shs - Acctg. 1 Fundamentals of Accountancy Reviewer: "Try Not To Become A Man of Success. Rather Become A Man of Value."

Загружено:

louisa sabalbarinoАвторское право:

Доступные форматы

14.

Companies can prepare the income

statement and the statement of financial

SHS – ACCTG. 1 FUNDAMENTALS OF position directly from the adjusted trial

ACCOUNTANCY balance.TRUE

15. The accrual basis recognizes revenue

REVIEWER when earned and expenses in the period

_____________________________________________ when cash is paid.FALSE

__ 16. Accounting provides quantitative

information. TRUE

“Try not to become a man of success. Rather become a 17. The GAAP stands for Generally Accepted

man of value.” Accounting Principles. TRUE

-Albert Einstein 18. Classifying is writing down the business

transactions chronologically.FALSE

19. An increase in income is on the credit side

TRUE OR FALSE hence a decrease in expense is also on

1. A ledger is where the company initially the credit side.TRUE

records transactions and selected other 20. If the revenues are equal to or more than

events. FALSE the expenses for a given period, there is a

2. Under International Financial Reporting net income.TRUE

Standards (IFRS) the "book of original

entry" is also known as the journal. TRUE

3. On the income statement, debits are used

to increase account balances, whereas on

the statement of financial position, credits

are used to increase account RULES OF DEBIT AND CREDIT

balances.FALSE 21. Asset accounts normally have DEBIT

4. The rules for debit and credit and the balances.

normal balance of owner’s equity are the 22. An increase in asset is recorded as a

same as for liabilities.TRUE DEBIT.

5. Both a corporation and a proprietorship 23. A decrease in asset is recorded as a

commonly use the share capital CREDIT.

account.FALSE 24. Liability accounts normally have a

6. All liability and equity accounts are CREDIT balances.

increased on the credit side and 25. An increase in liability is recorded as a

decreased on the debit side.TRUE CREDIT.

7. The first step in the accounting cycle is 26. A decrease in liability is recorded as a

the journalizing of transactions and DEBIT.

selected other events.FALSE 27. The owner’s equity accounts normally

8. The trial balance uncovers any errors in have a CREDIT balances.

journalizing and posting prior to 28. An increase in owner’s equity is recorded

preparation of the statement of financial as a CREDIT.

position.FALSE 29. A decrease in owner’s equity is recorded

9. The trial balance will not balance when a as a DEBIT.

company debits two statements of 30. Income accounts normally have a

financial position accounts and no income CREDIT balances.

statement accounts.TRUE 31. An increase in income account is recorded

10. Posting is done for income statement as CREDIT.

activity; activity related to statement of 32. A decrease in income account is recorded

financial position does not require as DEBIT.

posting.FALSE 33. Expense accounts normally have DEBIT

11. The trial balance is a listing of all the balances.

accounts and their balances in the order 34. An increase in expense account is

the accounts appear on the statement of recorded as DEBIT

financial position.TRUE 35. A decrease in expense account is recorded

12. An adjustment for salaries and wages as CREDIT.

expense, incurred but unpaid at year end,

is an example of an accrued

expense.TRUE

13. A company must make adjusting entries

each time it prepares an income

statement and a statement of financial

position.TRUE

ELEMENTS OF FINANCIAL STATEMENTS G. CASH 19,300

Direction: Fill in the missing amount in each SERVICE REVENUE 19,300

accounting equation.

H. ACCOUNTS PAYABLE 4,000

Accounting equation: A=L+OE CASH 4,000

OWNER’S I. DIAZ, CAPITAL 9,000

ASSETS LIABILITIES EQUITY CASH 9,000

36. P257,000 P72,000 P185,000

37. P565,000 210,000 355,000 LEDGER ACCOUNTS:

38. P125,000 200,000 (75,000)

CASH STORE SUPPLIES

39. 430,000 (156,000) P586,000

40. 85,000 P190,000 (105,000)

RECORDING BUSINESS TRANSACTIONS

INSTRUCTION: Identify the normal balance of

the following account titles. STORE EQUIPMENT ACCOUNTS PAYABLE

41. Dividend Income CREDIT

42. Merchandise Inventory DEBIT

43. Office Supplies DEBIT DIAZ, CAPITAL SERVICE REVENUE

44. Diaz, Capital CREDIT

45. Purchases DEBIT

46. Sales CREDIT

47. Interest Expense DEBIT

48. Interest Income CREDIT

49. Professional Fees CREDIT SALARIES EXPENSE RENT EXPENSE

50. Equipment DEBIT

51. Cost of Sales DEBIT

52. Accounts Receivable DEBIT

53. Rent Expense DEBIT

54. Notes Payable CREDIT

What are the balances of the following accounts:

55. Land DEBIT

A B C D

POSTING TO THE LEDGER

8,000 7,000 5,000 6,000

INSTRUCTIONS: Analyze the following Journal

21,250 22,300 27,550 6,250

Entries. Post the following journal entries in the 12,000 10,520 11,000 1,250

ledger accounts and answer the following 45,300 40,300 42,500 41,150

questions.

56. Cash A. 45,300

JOURNAL ENTRIES: 57. Store Supplies D. 6,000

A. CASH 20,000 58. Store Equipment A. 12,000

DIAZ, CAPITAL 20,000 59. Accounts Payable A. 8,000

60. Diaz, Capital C. 11,000

B. STORE SUPPLIES 6,000

61. Service Revenue C. 27,550

CASH 6,000

62. Salaries Expense D. 1,250

63. Rent Expense C. 5,000

C. RENT EXPENSE 5,000

CASH 5,000 64. Total Assets is equal to B. 40,300

65. Total expense amounts to D. 6,250

D. STORE EQUIPMENT 12,000

ACCOUNTS PAYABLE 12,000

E. CASH 8,250

SERVICE REVENUE 8,250

F. SALARIES EXPENSE 1,250

CASH 1,250

Вам также может понравиться

- Accounting CycleДокумент15 страницAccounting Cyclearubera2010Оценок пока нет

- ACC 250 Exam 1 Flashcards - QuizletДокумент4 страницыACC 250 Exam 1 Flashcards - QuizletIslam SamirОценок пока нет

- A Review of The Accounting CycleДокумент46 страницA Review of The Accounting CycleLiezl MaigueОценок пока нет

- Course Structure SlidesДокумент80 страницCourse Structure SlidesVân Anh Lê PhạmОценок пока нет

- Intermediate Accounting Solutions ch1Документ62 страницыIntermediate Accounting Solutions ch1laminuОценок пока нет

- Xi Acts Ca (2022 23)Документ197 страницXi Acts Ca (2022 23)sara VermaОценок пока нет

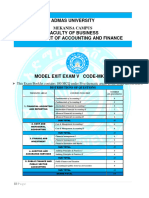

- Model Exit Exam 7Документ23 страницыModel Exit Exam 7tame kibruОценок пока нет

- Ans: AnsДокумент7 страницAns: AnsRomelie M. NopreОценок пока нет

- Review Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020Документ20 страницReview Materials: Prepared By: Junior Philippine Institute of Accountants UC-Banilad Chapter F.Y. 2019-2020AB Cloyd100% (1)

- Chapter01 2Документ10 страницChapter01 2Subhankar PatraОценок пока нет

- Igcse Accounting Short Answer Questions: Prepared by D. El-HossДокумент28 страницIgcse Accounting Short Answer Questions: Prepared by D. El-HossGodfreyFrankMwakalinga100% (1)

- Chapter 2 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Документ103 страницыChapter 2 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi44% (9)

- Chapter 02 - Basic Financial StatementsДокумент139 страницChapter 02 - Basic Financial StatementsElio BazОценок пока нет

- A Review of The Accounting CycleДокумент44 страницыA Review of The Accounting CycleBelle PenneОценок пока нет

- CPChap 2Документ79 страницCPChap 2Quang Võ MinhОценок пока нет

- Course Outline: Accounting BasicsДокумент2 страницыCourse Outline: Accounting BasicsLudwig DieterОценок пока нет

- QUIZ 2. MC - Before Chap5Документ9 страницQUIZ 2. MC - Before Chap5minhhquyetОценок пока нет

- Journal Entries and Trial BalanceДокумент12 страницJournal Entries and Trial BalanceKathlene JaoОценок пока нет

- Fin slides warn not subДокумент79 страницFin slides warn not subK59 Hoang Gia HuyОценок пока нет

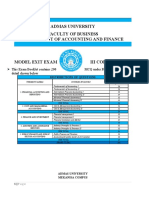

- Model Exit Exam 6Документ19 страницModel Exit Exam 6tame kibruОценок пока нет

- Financial statement analysisДокумент77 страницFinancial statement analysisUyên BùiОценок пока нет

- Financial Accounting - 1Документ38 страницFinancial Accounting - 1dany2884bcОценок пока нет

- Accounting ReviewДокумент24 страницыAccounting ReviewChris Tian FlorendoОценок пока нет

- Adjusting Entries GuideДокумент71 страницаAdjusting Entries Guidecherri blos59Оценок пока нет

- Fabm2 Law q1 Week 1 To 9Документ21 страницаFabm2 Law q1 Week 1 To 9Karen, Togeno CabusОценок пока нет

- Bookkeeping Group 1 KainaДокумент20 страницBookkeeping Group 1 KainaRhodge BustilloОценок пока нет

- Financial AccountingДокумент72 страницыFinancial AccountingChitta LeeОценок пока нет

- FAR Review For Accounting Process Step 5Документ23 страницыFAR Review For Accounting Process Step 5Marian GodinezОценок пока нет

- QUIZ 3 for Weeken . quesДокумент10 страницQUIZ 3 for Weeken . quesminhhquyetОценок пока нет

- Chapter 02 - Basic Financial StatementsДокумент111 страницChapter 02 - Basic Financial Statementsyujia ZhaiОценок пока нет

- Answer and Question Financial Accounting Chapter 6 InventoryДокумент7 страницAnswer and Question Financial Accounting Chapter 6 Inventoryukandi rukmanaОценок пока нет

- A Review of The Accounting CycleДокумент46 страницA Review of The Accounting CycleRОценок пока нет

- Basic Accounting Concepts and Financial Statements ExplainedДокумент8 страницBasic Accounting Concepts and Financial Statements ExplainedLouiseОценок пока нет

- Accounting 3 Done !Документ24 страницыAccounting 3 Done !Kiminosunoo LelОценок пока нет

- M8-Correcting-Closing-Reversing-Entries-and-Financial-StatementsДокумент10 страницM8-Correcting-Closing-Reversing-Entries-and-Financial-StatementsMicha AlcainОценок пока нет

- Dry RunДокумент5 страницDry RunMarc MagbalonОценок пока нет

- Class 11 Accountancy SolutionsДокумент5 страницClass 11 Accountancy SolutionsNisha SeksariaОценок пока нет

- Mock Quiz Bee: Basic AccountingДокумент121 страницаMock Quiz Bee: Basic AccountingHedi mar NecorОценок пока нет

- Our Lady of The Pillar College Cauayan: Prelim Examination Accounting 1 &2Документ8 страницOur Lady of The Pillar College Cauayan: Prelim Examination Accounting 1 &2John Lloyd LlananОценок пока нет

- Chapter 7 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Документ152 страницыChapter 7 Solution of Fundamental of Financial Accouting by EDMONDS (4th Edition)Awais Azeemi50% (4)

- Chapter 11 Bookkeeping EntrepДокумент37 страницChapter 11 Bookkeeping EntrepJacel GadonОценок пока нет

- Financial Statements and Business Decisions: True / False QuestionsДокумент104 страницыFinancial Statements and Business Decisions: True / False Questionssara.elsayed3325Оценок пока нет

- Fabm1 Preparing Adjusting EntriesДокумент19 страницFabm1 Preparing Adjusting EntriesVenice0% (1)

- Practical Exercises: AccountingДокумент7 страницPractical Exercises: AccountingHira SialОценок пока нет

- Bookkeeping NCIII Lecture 3.1Документ59 страницBookkeeping NCIII Lecture 3.1jvtg994Оценок пока нет

- 67178bos54090 Cp7u1Документ59 страниц67178bos54090 Cp7u1Hansika ChawlaОценок пока нет

- 67178bos54090 Cp7u1Документ59 страниц67178bos54090 Cp7u1ashifОценок пока нет

- Accounting Chapter SolutionsДокумент52 страницыAccounting Chapter SolutionsBayan Al-MrayatОценок пока нет

- Financial AccountingДокумент2 страницыFinancial AccountingAndrea Padilla MoralesОценок пока нет

- Abm 1 Midterm Marlowne Brialle T. GalaponДокумент9 страницAbm 1 Midterm Marlowne Brialle T. GalaponCharles Elquime GalaponОценок пока нет

- All QuestionДокумент37 страницAll QuestionOUSMAN SEIDОценок пока нет

- Merchandise: Periodic Inventory MethodДокумент10 страницMerchandise: Periodic Inventory MethodRhena GasatanОценок пока нет

- lvl1 Sem1 Rev1Документ12 страницlvl1 Sem1 Rev1amir rabieОценок пока нет

- CH 4 - End of Chapter Exercises SolutionsДокумент80 страницCH 4 - End of Chapter Exercises SolutionsPatrick AlphonseОценок пока нет

- 61809bos50279 cp7 U1Документ61 страница61809bos50279 cp7 U1Sukhmeet Singh100% (1)

- Sample Question - Not ArrangedДокумент7 страницSample Question - Not ArrangedJonh Paul SantosОценок пока нет

- Basic AccountingДокумент32 страницыBasic AccountinghectorbaladingОценок пока нет

- Fundamentals of Accountancy Business and Management 1: Learning Activity Sheet Posting To The LedgerДокумент18 страницFundamentals of Accountancy Business and Management 1: Learning Activity Sheet Posting To The Ledgerwhat's up mga kaibiganОценок пока нет

- Key formulas for introductory statisticsДокумент8 страницKey formulas for introductory statisticsimam awaluddinОценок пока нет

- HistoryДокумент144 страницыHistoryranju.lakkidiОценок пока нет

- Report Daftar Penerima Kuota Telkomsel Dan Indosat 2021 FSEIДокумент26 страницReport Daftar Penerima Kuota Telkomsel Dan Indosat 2021 FSEIHafizh ZuhdaОценок пока нет

- Module - No. 3 CGP G12. - Subong - BalucaДокумент21 страницаModule - No. 3 CGP G12. - Subong - BalucaVoome Lurche100% (2)

- Furnace ITV Color Camera: Series FK-CF-3712Документ2 страницыFurnace ITV Color Camera: Series FK-CF-3712Italo Rodrigues100% (1)

- The Singular Mind of Terry Tao - The New York TimesДокумент13 страницThe Singular Mind of Terry Tao - The New York TimesX FlaneurОценок пока нет

- National Advisory Committee For AeronauticsДокумент36 страницNational Advisory Committee For AeronauticsSamuel ChristioОценок пока нет

- The Learners Demonstrate An Understanding Of: The Learners Should Be Able To: The Learners Should Be Able ToДокумент21 страницаThe Learners Demonstrate An Understanding Of: The Learners Should Be Able To: The Learners Should Be Able ToBik Bok50% (2)

- VEGA MX CMP12HP Data SheetДокумент2 страницыVEGA MX CMP12HP Data SheetLuis Diaz ArroyoОценок пока нет

- Microsoft Word 2000 IntroductionДокумент72 страницыMicrosoft Word 2000 IntroductionYsmech SalazarОценок пока нет

- EE290 Practice 3Документ4 страницыEE290 Practice 3olgaОценок пока нет

- Modern Indian HistoryДокумент146 страницModern Indian HistoryJohn BoscoОценок пока нет

- Covey - Moral CompassingДокумент5 страницCovey - Moral CompassingAsimОценок пока нет

- Corn MillingДокумент4 страницыCorn Millingonetwoone s50% (1)

- Digital Communication Quantization OverviewДокумент5 страницDigital Communication Quantization OverviewNiharika KorukondaОценок пока нет

- Computer Portfolio (Aashi Singh)Документ18 страницComputer Portfolio (Aashi Singh)aashisingh9315Оценок пока нет

- Fiera Foods - Production SupervisorДокумент1 страницаFiera Foods - Production SupervisorRutul PatelОценок пока нет

- Laws of MotionДокумент64 страницыLaws of MotionArnel A. JulatonОценок пока нет

- MSDS FluorouracilДокумент3 страницыMSDS FluorouracilRita NascimentoОценок пока нет

- Machine Spindle Noses: 6 Bison - Bial S. AДокумент2 страницыMachine Spindle Noses: 6 Bison - Bial S. AshanehatfieldОценок пока нет

- Product CycleДокумент2 страницыProduct CycleoldinaОценок пока нет

- Term Sheet: Original Borrowers) Material Subsidiaries/jurisdiction) )Документ16 страницTerm Sheet: Original Borrowers) Material Subsidiaries/jurisdiction) )spachecofdz0% (1)

- Deluxe Force Gauge: Instruction ManualДокумент12 страницDeluxe Force Gauge: Instruction ManualThomas Ramirez CastilloОценок пока нет

- Childrens Ideas Science0Документ7 страницChildrens Ideas Science0Kurtis HarperОценок пока нет

- SYNOPSIS - Impact of GST On Small Traders!Документ21 страницаSYNOPSIS - Impact of GST On Small Traders!Laxmi PriyaОценок пока нет

- Learning Stations Lesson PlanДокумент3 страницыLearning Stations Lesson Planapi-310100553Оценок пока нет

- Self Team Assessment Form - Revised 5-2-20Документ6 страницSelf Team Assessment Form - Revised 5-2-20api-630312626Оценок пока нет

- Course: Citizenship Education and Community Engagement: (8604) Assignment # 1Документ16 страницCourse: Citizenship Education and Community Engagement: (8604) Assignment # 1Amyna Rafy AwanОценок пока нет

- Ca. Rajani Mathur: 09718286332, EmailДокумент2 страницыCa. Rajani Mathur: 09718286332, EmailSanket KohliОценок пока нет

- 14 15 XII Chem Organic ChaptДокумент2 страницы14 15 XII Chem Organic ChaptsubiОценок пока нет