Академический Документы

Профессиональный Документы

Культура Документы

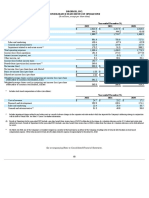

Financial Highlights: Profit and Loss Account

Загружено:

Saad Zia0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров2 страницыFinancial highlights for forecasting

Оригинальное название

Financial Highlights

Авторское право

© © All Rights Reserved

Доступные форматы

PDF, TXT или читайте онлайн в Scribd

Поделиться этим документом

Поделиться или встроить документ

Этот документ был вам полезен?

Это неприемлемый материал?

Пожаловаться на этот документFinancial highlights for forecasting

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

0 оценок0% нашли этот документ полезным (0 голосов)

11 просмотров2 страницыFinancial Highlights: Profit and Loss Account

Загружено:

Saad ZiaFinancial highlights for forecasting

Авторское право:

© All Rights Reserved

Доступные форматы

Скачайте в формате PDF, TXT или читайте онлайн в Scribd

Вы находитесь на странице: 1из 2

Financial Highlights

2015 2014 2013 2012

PROFIT AND LOSS ACCOUNT

Sales 37,764 39,153 30,275 16,600

Gross profit / (loss) 4,773 2,857 1,447 (44)

Operating profit / (loss) 3,786 2,135 716 (347)

Profit / (loss) before tax 3,767 2,097 525 (499)

Profit / (loss) after tax 3,162 1,074 244 (532)

Proposed dividend 714 428 43 -

BALANCE SHEET

Share capital 1,428 1,428 1,428 1,428

Shareholders’ equity 5,120 2,391 1,365 1,128

Capital expenditure 662 239 466 397

Fixed assets - at cost 8,531 8,150 7,957 8,202

Fixed assets - net 2,933 3,041 3,503 3,668

Non current liabilities 64 56 43 110

Total assets 13,926 12,317 15,146 9,489

Working capital 1,806 (1,043) (3,180) (3,622)

Capital employed 5,120 2,391 1,365 1,294

SIGNIFICANT RATIOS

Profitability

Gross profit / (loss) margin % 12.6 7.3 4.8 (0.3)

Operating profit / (loss) margin % 10.0 5.5 2.4 (2.1)

Profit / (loss) before tax % 10.0 5.4 1.7 (3.0)

Profit / (loss) after tax % 8.4 2.7 0.8 (3.2)

Liquidity

Current ratio Times 1.2 0.9 0.8 0.6

Quick ratio Times 0.6 0.5 0.4 0.2

Long term debt to equity Times - - - 0.2

Total liabilities to equity Times 2.7 5.2 11.1 8.4

Activity

Total assets turnover Times 2.7 3.2 2.0 1.7

Fixed assets turnover Times 12.9 12.9 8.6 4.5

Stock turnover ratio Times 7.0 8.9 8.0 5.3

Interest cover (BT) Times 202.8 56.1 3.7 (2.3)

Interest cover (AT) Times 170.4 29.2 2.3 (2.5)

Number of days stock Days 52 41 46 69

Earning

Return on capital employed % 84.2 57.2 18.4 (28.0)

Return on equity (BT) % 100.3 111.7 42.1 (35.6)

Return on equity (AT) % 84.2 57.2 19.6 (37.9)

Earning / (loss) per share (BT) Rs. 26.4 14.7 3.7 (3.5)

Earning / (loss) per share (AT) Rs. 22.1 7.5 1.7 (3.7)

Price earning ratio (AT) Times 8.3 7.3 17.1 (3.0)

Dividend per ordinary share Rs. 5.00 3.00 0.30 -

OTHER INFORMATION

Break up value per share Rs. 36 17 10 8

Market value per share Rs. 183 55 29 11

Contribution to national exchequer Rs in M 11,758 13,750 10,664 6,281

Units produced Units 23,320 23,223 19,387 11,040

Units sold Units 23,311 23,310 18,915 11,406

Manpower (Permanent + Contractual) Nos. 1,160 1,122 1,003 934

Honda Atlas Cars (Pakistan) Limited

Exchange rates at year end date

¥ to $ ¥ 120 104 94 82

Rs to $ Rs. 101.94 98.53 98.57 90.75

Rs to ¥ Rs. 0.85 0.95 1.05 1.11

# Issue of 100% right shares

* Bonus shares

40

2011 2010 2009 2008 2007 2006

(Rupees in million)

22,026 15,854 14,150 14,715 17,055 25,639

199 (240) 177 627 100 1,168

(93) (533) (400) 297 (176) 1,180

(245) (988) (622) 64 (482) 1,134

(298) (852) (402) 75 (265) 705

- - - - - 294 *

(Rupees in million)

1,428 1,428 1,428 1,428 # 714 420

1,677 1,976 2,828 3,230 2,441 2,705

55 29 2,129 188 2,521 1,833

7,821 7,786 7,783 5,979 5,832 3,535

3,945 4,594 5,406 4,010 4,341 2,359

417 1,333 1,500 500 1,958 672

10,573 8,946 9,942 6,817 8,305 9,174

(2,816) (2,125) (1,685) (652) (225) 473

2,511 3,476 4,328 3,730 4,982 3,705

0.9 (1.5) 1.3 4.3 0.6 4.6

(0.4) (3.4) (2.8) 2.0 (1.0) 4.6

(1.1) (6.2) (4.4) 0.4 (2.8) 4.4

(1.4) (5.4) (2.8) 0.5 (1.6) 2.7

0.7 0.6 0.7 0.8 0.9 1.1

0.2 0.2 0.2 0.2 0.2 0.4

0.5 0.8 0.5 0.2 1.0 0.4

6.3 4.5 3.5 2.1 3.4 3.4

2.1 1.8 1.4 2.2 2.1 2.8

5.6 3.5 2.6 3.7 3.9 10.9

7.6 6.1 6.1 6.5 4.9 6.7

(0.6) (1.2) (1.8) 1.3 (0.6) 25.5

(1.0) (0.9) (0.8) 1.3 0.1 16.2

48 60 60 56 74 54

(10.0) (21.8) (10.0) 1.7 (6.1) 24.3

(13.4) (41.1) (20.5) 2.3 (18.7) 47.3

(16.3) (35.5) (13.3) 2.6 (10.3) 29.4

(1.7) (6.9) (4.4) 0.5 (6.8) 27.0

(2.1) (6.0) (2.8) 0.5 (3.7) 16.8

(4.8) (2.7) (4.3) 88.0 (15.7) 6.7

- - - - - 7.0

12 14 20 23 34 64

10 16 12 44 58 112

Annual Report for the year ended March 31, 2015

8,229 6,316 6,452 4,958 6,213 8,481

16,440 11,980 12,780 15,080 18,240 31,476

16,467 12,344 12,502 15,604 18,709 30,719

975 857 955 946 1,034 1,198

83 94 98 100 117 118

85.50 84.18 80.45 62.77 60.85 60.10

1.03 0.90 0.82 0.63 0.52 0.51

41

Вам также может понравиться

- 16 Financial HighlightsДокумент2 страницы16 Financial HighlightswasiumОценок пока нет

- Consolidated 11-Year Summary: Financial / Data SectionДокумент60 страницConsolidated 11-Year Summary: Financial / Data SectionMUHAMMAD ISMAILОценок пока нет

- Consolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)Документ62 страницыConsolidated 11-Year Summary: ANA HOLDINGS INC. and Its Consolidated Subsidiaries (Note 1)MUHAMMAD ISMAILОценок пока нет

- Ping An 2009 EnglishДокумент230 страницPing An 2009 Englishjinzhang2020Оценок пока нет

- Baskin RobbinsДокумент2 страницыBaskin RobbinsArshad MohammedОценок пока нет

- NIKE Inc Ten Year Financial History FY19Документ1 страницаNIKE Inc Ten Year Financial History FY19Moisés Ríos RamosОценок пока нет

- Performance AGlanceДокумент1 страницаPerformance AGlanceHarshal SawaleОценок пока нет

- Summary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Документ4 страницыSummary of Cooper Tire & Rubber Company's Financial and Operating Performance, 2009$2013 (Dollar Amounts in Millions, Except Per Share Data)Sanjaya WijesekareОценок пока нет

- Dows ExcelДокумент18 страницDows ExcelJaydeep SheteОценок пока нет

- Financial Highlights: Revenues and Income (IFRS) Financial Position (IFRS)Документ2 страницыFinancial Highlights: Revenues and Income (IFRS) Financial Position (IFRS)renytereОценок пока нет

- Tar2016e FRДокумент84 страницыTar2016e FRAchmad Rifaie de JongОценок пока нет

- Group 2 employee detailsДокумент20 страницGroup 2 employee detailsReeja Mariam MathewОценок пока нет

- Annual Report 2015 EN 2 PDFДокумент132 страницыAnnual Report 2015 EN 2 PDFQusai BassamОценок пока нет

- Investor FajarPaper AR 2015 2Документ180 страницInvestor FajarPaper AR 2015 2Shehilda SeptianaОценок пока нет

- Consolidated Q4Документ6 страницConsolidated Q4Qazi MudasirОценок пока нет

- Jollibee Foods Corporation: Consolidated Statements of IncomeДокумент9 страницJollibee Foods Corporation: Consolidated Statements of Incomearvin cleinОценок пока нет

- Fujita Kanko Financial SummaryДокумент5 страницFujita Kanko Financial SummaryDamTokyoОценок пока нет

- DLF Announces Annual Results For FY10: HistoryДокумент7 страницDLF Announces Annual Results For FY10: HistoryShalinee SinghОценок пока нет

- Marel q3 2019 Condensed Consolidated Interim Financial Statements ExcelДокумент5 страницMarel q3 2019 Condensed Consolidated Interim Financial Statements ExcelAndre Laine AndreОценок пока нет

- Five-Year Performance OverviewДокумент2 страницыFive-Year Performance OverviewAjees AhammedОценок пока нет

- OMV Annual Report 2016 enДокумент240 страницOMV Annual Report 2016 enAhmed Ben HmidaОценок пока нет

- Financial HighlightsДокумент4 страницыFinancial HighlightsmomОценок пока нет

- Lloyds Banking Group PLC 2017 Q1 RESULTSДокумент33 страницыLloyds Banking Group PLC 2017 Q1 RESULTSsaxobobОценок пока нет

- Lbo W DCF Model SampleДокумент33 страницыLbo W DCF Model Samplejulita rachmadewiОценок пока нет

- India Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008Документ6 страницIndia Cements Limited: Latest Quarterly/Halfyearly Detailed Quarterly As On (Months) 31-Dec-200931-Dec-2008amitkr91Оценок пока нет

- Ringkasan Laporan Keuangan / Financial HighlightsДокумент2 страницыRingkasan Laporan Keuangan / Financial HighlightsNur RahmahОценок пока нет

- Prospective Analysis - FinalДокумент7 страницProspective Analysis - FinalMAYANK JAINОценок пока нет

- Bestbuy Income StatementДокумент1 страницаBestbuy Income Statementmeverick_leeОценок пока нет

- Income StatementДокумент1 страницаIncome StatementImran HusainiОценок пока нет

- Also Annual Report Gb2022 enДокумент198 страницAlso Annual Report Gb2022 enmihirbhojani603Оценок пока нет

- ANJ AR 2014 English - dT8RRA20170321164537Документ232 страницыANJ AR 2014 English - dT8RRA20170321164537baktikaryaditoОценок пока нет

- 14-10 Years HighlightsДокумент1 страница14-10 Years HighlightsJigar PatelОценок пока нет

- Narration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18Документ38 страницNarration Mar-13 Mar-14 Mar-15 Mar-16 Mar-17 Mar-18AbhijitChandraОценок пока нет

- Financial Section - Annual2019-08Документ11 страницFinancial Section - Annual2019-08AbhinavHarshalОценок пока нет

- Prospective Analysis - FinalДокумент7 страницProspective Analysis - Finalsanjana jainОценок пока нет

- Prospective Analysis 1Документ5 страницProspective Analysis 1MAYANK JAINОценок пока нет

- Intellipharmaceutics International Inc. q2 2021Документ31 страницаIntellipharmaceutics International Inc. q2 2021Sandesh PatilОценок пока нет

- Adidas Chartgenerator ArДокумент2 страницыAdidas Chartgenerator ArTrần Thuỳ NgânОценок пока нет

- Annual Report of Acs Group PDFДокумент458 страницAnnual Report of Acs Group PDFManyОценок пока нет

- Stanley Black & Decker Q4 and Full Year 2015 Financial ResultsДокумент4 страницыStanley Black & Decker Q4 and Full Year 2015 Financial Resultspedro_noiretОценок пока нет

- Financial Ratios of Home Depot and Lowe'sДокумент30 страницFinancial Ratios of Home Depot and Lowe'sM UmarОценок пока нет

- Condensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Документ10 страницCondensed Consolidated Statements of Income: Weighted-Average Shares Outstanding (In Millions) 4,201 4,141 4,201 4,141Annemiek BlezerОценок пока нет

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementДокумент12 страницBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneОценок пока нет

- Prospective Analysis 2Документ7 страницProspective Analysis 2MAYANK JAINОценок пока нет

- Profitability: 31-Dec Sales Ebitda Net Income EPS Euro M Euro M Euro M EuroДокумент21 страницаProfitability: 31-Dec Sales Ebitda Net Income EPS Euro M Euro M Euro M Euroapi-19513024Оценок пока нет

- Nasdaq Aaon 2018Документ92 страницыNasdaq Aaon 2018gaja babaОценок пока нет

- Excel Workings ITE ValuationДокумент19 страницExcel Workings ITE Valuationalka murarka100% (1)

- 10-Year Consolidated Financial Statements Summary (2001-2010Документ12 страниц10-Year Consolidated Financial Statements Summary (2001-2010anshu sinhaОценок пока нет

- Mercury Athletic Footwear Answer Key FinalДокумент41 страницаMercury Athletic Footwear Answer Key FinalFatima ToapantaОценок пока нет

- BSRM PresentationДокумент4 страницыBSRM PresentationMostafa Noman DeepОценок пока нет

- 1 Walmart and Macy S Case StudyДокумент3 страницы1 Walmart and Macy S Case StudyMihir JainОценок пока нет

- Caso HertzДокумент32 страницыCaso HertzJORGE PUENTESОценок пока нет

- Ferozsons Annual Report 2018Документ191 страницаFerozsons Annual Report 2018Muhammad YamanОценок пока нет

- Pidilite Industries Income StatementДокумент4 страницыPidilite Industries Income StatementRehan TyagiОценок пока нет

- ANJ Annual Report Highlights Sustainable GrowthДокумент216 страницANJ Annual Report Highlights Sustainable GrowthAry PandeОценок пока нет

- PNX Income Statement AnalysisДокумент12 страницPNX Income Statement AnalysisDave Emmanuel SadunanОценок пока нет

- TML q4 Fy 21 Consolidated ResultsДокумент6 страницTML q4 Fy 21 Consolidated ResultsGyanendra AryaОценок пока нет

- Schaum's Outline of Bookkeeping and Accounting, Fourth EditionОт EverandSchaum's Outline of Bookkeeping and Accounting, Fourth EditionРейтинг: 5 из 5 звезд5/5 (1)

- Honda Atlas: Vision StatementДокумент3 страницыHonda Atlas: Vision StatementSaad ZiaОценок пока нет

- Organizational Architecture: A Dynamic FrameworkДокумент5 страницOrganizational Architecture: A Dynamic FrameworkSaad ZiaОценок пока нет

- Personal Hygiene ProcedureДокумент6 страницPersonal Hygiene ProcedureSaad Zia100% (1)

- Store Issuance Daily SheetДокумент1 страницаStore Issuance Daily SheetSaad ZiaОценок пока нет

- Personal Hygiene ProcedureДокумент6 страницPersonal Hygiene ProcedureSaad Zia100% (1)

- Drinking Water Process Flow DiagramДокумент2 страницыDrinking Water Process Flow DiagramSaad Zia0% (1)

- Daily Production Sheet For Bottled WaterДокумент1 страницаDaily Production Sheet For Bottled WaterSaad Zia100% (1)

- Apple Goes GlobalДокумент2 страницыApple Goes GlobalSaad ZiaОценок пока нет

- Quality Control ManualДокумент3 страницыQuality Control ManualSaad ZiaОценок пока нет

- Mcgraw-Hill/Irwin: Operations Management, Eighth Edition, by William J. StevensonДокумент52 страницыMcgraw-Hill/Irwin: Operations Management, Eighth Edition, by William J. StevensonAsadvirkОценок пока нет

- The Practice of HRMДокумент23 страницыThe Practice of HRMGagan Gupta0% (1)

- 6th Central Pay Commission Salary CalculatorДокумент15 страниц6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Neraca Lajur 12 KolomДокумент1 страницаNeraca Lajur 12 KolomSiti NuraeniОценок пока нет

- Financial Ratio AnalysisДокумент5 страницFinancial Ratio AnalysisIrin HaОценок пока нет

- ACC 102 Chapter 6 Review QuestionsДокумент2 страницыACC 102 Chapter 6 Review QuestionsKaitlyn MakiОценок пока нет

- Assignment 2 (PJ)Документ2 страницыAssignment 2 (PJ)Nabila Abu BakarОценок пока нет

- Choose Your Smallcase Explore Smallcase On Zerodha PDFДокумент1 страницаChoose Your Smallcase Explore Smallcase On Zerodha PDFhsrahdnОценок пока нет

- Bri AgustusДокумент3 страницыBri AgustusdinoОценок пока нет

- Q2 Describe The Features and Benefits of THREE ProductДокумент1 страницаQ2 Describe The Features and Benefits of THREE ProductYEOH SENG WEI NICKLAUSОценок пока нет

- Gitman 12e 525314 IM ch11rДокумент22 страницыGitman 12e 525314 IM ch11rAnn!3100% (1)

- Taxi Business Plan ExampleДокумент36 страницTaxi Business Plan ExampleARIF100% (1)

- Complete) Fundamentals of Accounting Theory and Practice 1B: Sheet1Документ16 страницComplete) Fundamentals of Accounting Theory and Practice 1B: Sheet1Wendelyn JimenezОценок пока нет

- Cost of Debt Redeemable in Instalments:-: + I +P + I +P + + I +P (1+K) 1 (1+K) 2 (1+K) 3 (1+K) NДокумент4 страницыCost of Debt Redeemable in Instalments:-: + I +P + I +P + + I +P (1+K) 1 (1+K) 2 (1+K) 3 (1+K) Napi-19824242Оценок пока нет

- Government GrantsДокумент2 страницыGovernment GrantsGerrelle Cap-atanОценок пока нет

- Financials Infosys Last 5 Years Annual Revenue History and Growth RateДокумент7 страницFinancials Infosys Last 5 Years Annual Revenue History and Growth RateDivyavadan MateОценок пока нет

- PWC Income Tax 2013 PDFДокумент668 страницPWC Income Tax 2013 PDFKoffee Farmer100% (1)

- 2020 03 19 PH D PDFДокумент4 страницы2020 03 19 PH D PDFRaquel LaorenoОценок пока нет

- ACC 401week 8 QuizДокумент17 страницACC 401week 8 QuizEMLОценок пока нет

- EASY ROUND INCOME TAXESДокумент13 страницEASY ROUND INCOME TAXESCamila Mae AlduezaОценок пока нет

- CH 2 Accounting 2Документ45 страницCH 2 Accounting 2EmadОценок пока нет

- Solutions Manual: 1st EditionДокумент21 страницаSolutions Manual: 1st EditionJunior Waqairasari100% (1)

- Orascom Construction PLC Corporate Presentation September 2022Документ27 страницOrascom Construction PLC Corporate Presentation September 2022Mira HoutОценок пока нет

- Chapter 1 (Structure of Malaysian Financial System)Документ13 страницChapter 1 (Structure of Malaysian Financial System)niena ZLОценок пока нет

- Understanding the Definition and Types of BondsДокумент1 страницаUnderstanding the Definition and Types of BondsjayubaradОценок пока нет

- Mini Case Chapter 8Документ8 страницMini Case Chapter 8William Y. OspinaОценок пока нет

- Valuation & Fin Moduling PDFДокумент14 страницValuation & Fin Moduling PDFTohidul Anwar ChyОценок пока нет

- IBCC Attestation Fee Deposit SlipДокумент1 страницаIBCC Attestation Fee Deposit SlipAsif RazaОценок пока нет

- 02 - Balance Sheet Definition - Formula & ExamplesДокумент13 страниц02 - Balance Sheet Definition - Formula & ExamplesPasha Shaikh MehboobОценок пока нет

- Group 5Документ35 страницGroup 5Sameer GopalОценок пока нет

- Types of Financial Decisions in Financial ManagementДокумент20 страницTypes of Financial Decisions in Financial ManagementRahul Upadhayaya100% (1)

- Assumptions: DCF ModelДокумент3 страницыAssumptions: DCF Modelniraj kumarОценок пока нет

- Financial Analysis and Industrial FinancingДокумент150 страницFinancial Analysis and Industrial FinancingSM FriendОценок пока нет